Healthcare Real Estate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Major Office Specialty (Area 280) 2015 Revaluation

Major Office Specialty (Area 280) 2015 Revaluation Department of Assessments Commercial Appraisal Office Specialty 280- 20 DENNY REGRADE - LAKE UNION - FREMONT 280- 10 SEATTLE CBD 280- 40 WATERFRONT - PILL HILL 280- 30 PIONEER SQUARE - SOUTH SEATTLE 280- 50 BELLEVUE - EASTSIDE 20 40 10 30 50 280- 60 NORTH-EAST-SOUTH 280- 60 NORTH-EAST-SOUTHC COOUNNTYTY The information included on this map has been compiled by King County staff from a variety of sources and is subject to change without notice. King County makes no representations or warranties, express or implied, as to accuracy, completeness, timeliness, or rights to the use of such information. This document is not intended for use as a survey product. King County shall not be liable for any general, special, indirect, incidental, or consequential damages including, but not limited to, lost revenues or lost profits resulting from the use or misuse of the information contained on this map. King County Any sale of this map or information on this map is prohibited except by written permission of King County. Dept. of Assessments C:\Data\data\Commercial\Commercial_Areas\Specialtyedits.mxd King County Department of Assessments King County Administration Bldg. Lloyd Hara 500 Fourth Avenue, ADM-AS-0708 Seattle, WA 98104-2384 Assessor (206) 296-5195 FAX (206) 296-0595 Email: [email protected] As we start preparations for the 2015 property assessments, it is helpful to remember that the mission and work of the Assessor’s Office sets the foundation for efficient and effective government and is vital to ensure adequate funding for services in our communities. -

Healthcare Transactions: Year in Review

HEALTHCARE TRANSACTIONS: YEAR IN REVIEW JANUARY 2019 bassberry.com OVERVIEW 2018 marked a year of continued robust healthcare merger and acquisition activity, with deal volume surpassing that of 2017. The dollar volume of healthcare deals also exceeded 2017, highlighted by CVS Health Corp. (NYSE: CVS) surviving regulatory scrutiny and finalizing its purchase of Aetna for $69 billion, and Cigna (NYSE: CI) closing its $67 billion merger with pharmacy benefit manager Express Scripts (Nasdaq: ESRX). Private equity firm KKR & Co. Inc. (NYSE: KKR) acquired Envision Healthcare Corporation (NYSE: EVHC) in a going private transaction for $9.9 billion; and in November, LifePoint Health, Inc. (Nasdaq: LPNT) merged with Apollo Global Management-owned RCCH HealthCare Partners for an estimated $5.6 billion. Not only do these deals show the energy of the industry, but they also represent a seismic shift in healthcare. Cross-sector transactions, such as the CVS-Aetna and Cigna-Express Scripts transactions, are becoming more frequent and disrupt traditional industry models. By seeking alliances across industry lines, healthcare companies aim both to reduce costs and improve care coordination as well as realign incentives to better meet consumer demands. As providers fight to stay profitable in the wake of value-based reimbursement, these cross-sector combinations may foreshadow the future of the healthcare industry. Many of these same drivers also have led to increasing private equity investment in the industry. The need for innovation and disruption via consolidation adds further appeal to investors. The injection of capital by private equity firms allows healthcare providers to cut costs and increase efficiencies, and the shift in reimbursement presents a unique opportunity for firms to help providers and systems reposition. -

50The 50 Largest U.S. Seniors Housing Real Estate Owners and Operators

2020 ASHA The 50 largest U.S. 50seniors housing real estate owners and operators The Hacienda at the River in Tucson, Arizona, operated by Watermark Retirement Communities. Special supplement to n Seniors Housing Business n Heartland Real Estate Business n Northeast Real Estate Business An exclusive n Southeast Real Estate Business report from the n Texas Real Estate Business American Seniors n Western Real Estate Business Housing Association Excellence. Sustained. Strong relationships with true industry leaders are more vital than ever in these unprecedented times. For more than 20 years, Ventas has been a proud partner and investor supporting best-in-class senior living operators and providers. We continue to be inspired by their tireless work in helping to keep seniors safe and well. As one of the world’s premier capital providers, Ventas remains deeply committed to the success of our shareholders and business partners, and to the individuals and families they serve. ventasreit.com SENIOR HOUSING | MEDICAL OFFICE BUILDINGS | RESEARCH & INNOVATION HEALTH SYSTEMS | POST ACUTE CARE TRUSTED SENIORS HOUSING ADVISORS FOR ALL YOUR Excellence. INVESTMENT NEEDS Sustained. Our nationally-recognized platform has expertise Strong relationships with true industry leaders are more vital in projects of all sizes and scopes than ever in these unprecedented times. For more than 20 years, Ventas has been a proud partner and investor supporting best-in-class senior living operators and providers. We continue to be inspired by their tireless work in helping to keep seniors safe and well. As one of the world’s premier capital providers, Ventas remains deeply committed to the success of our shareholders and business partners, and to the individuals and families they serve. -

Analyzing the Alignment of Incentives, Control, and Economics in Development Agreements Between Private Developers and Mission-Driven Institutions

Analyzing the Alignment of Incentives, Control, and Economics in Development Agreements between Private Developers and Mission-Driven Institutions by F. Samuel Reiche B.A. Economics, 2007 Trinity College Submitted to the Center for Real Estate in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development at the Massachusetts Institute of Technology September 2013 ©2013 F. Samuel Reiche All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Author ___________________________________________________________ Center for Real Estate August 1, 2013 Certified by_____________________________________________________________________ Peter Roth Lecturer, Center for Real Estate Thesis Supervisor Accepted by____________________________________________________________________ David Geltner Chair, MSRED Committee, Interdepartmental Degree Program in Real Estate Development 2 Analyzing the Alignment of Incentives, Control, and Economics in Development Agreements between Private Developers and Mission-Driven Institutions by F. Samuel Reiche Submitted to the Center for Real Estate on August 1, 2013 in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development ABSTRACT This thesis examines and analyzes the alignment of incentives, project control, and economics in development agreements between -

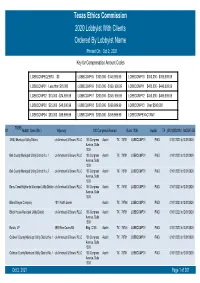

Texas Ethics Commission 2020 Lobbyist with Clients Ordered by Lobbyist Name Printed on Oct 2, 2021 Key for Compensation Amount Codes

Texas Ethics Commission 2020 Lobbyist With Clients Ordered By Lobbyist Name Printed On Oct 2, 2021 Key for Compensation Amount Codes LOBBCOMPEQZERO $0 LOBBCOMP05 $100,000 - $149,999.99 LOBBCOMP10 $350,000 - $399,999.99 LOBBCOMP01 Less than $10,000 LOBBCOMP06 $150,000 - $199, 999.99 LOBBCOMP11 $400,000 - $449,999.99 LOBBCOMP02 $10,000 - $24,999.99 LOBBCOMP07 $200,000 - $249, 999.99 LOBBCOMP12 $450,000 - $499,999.99 LOBBCOMP03 $25,000 - $49,000.99 LOBBCOMP08 $250,000 - $299,999.99 LOBBCOMP13 Over $500,000 LOBBCOMP04 $50,000 - $99,999.99 LOBBCOMP09 $300,000 - $349,999.99 LOBBCOMPEXACTAMT 70358 #1 Abbott, Sean (Mr.) Attorney 100 Congress Avenue Suite 1300 Austin TX (512)4352334 MODIFIED 3 B&J Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bell County Municipal Utility District No. 1 c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bell County Municipal Utility District No. 2 c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Berry Creek Highlands Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Blake Magee Company 1011 North Lamar Austin TX 78704 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Block House Municipal Utility District c/o Armbrust & Brown, PLLC 100 Congress Austin TX 78701 LOBBCOMP01 PAID 01/01/2020 to12/31/2020 Avenue, Suite 1300 Bonzo, LP 3939 Bee Caves Rd. -

Private Equity Buyouts in Healthcare: Who Wins, Who Loses? Eileen Appelbaum and Rosemary Batt Working Paper No

Private Equity Buyouts in Healthcare: Who Wins, Who Loses? Eileen Appelbaum* and Rosemary Batt† Working Paper No. 118 March 15, 2020 ABSTRACT Private equity firms have become major players in the healthcare industry. How has this happened and what are the results? What is private equity’s ‘value proposition’ to the industry and to the American people -- at a time when healthcare is under constant pressure to cut costs and prices? How can PE firms use their classic leveraged buyout model to ‘save healthcare’ while delivering ‘outsized returns’ to investors? In this paper, we bring together a wide range of sources and empirical evidence to answer these questions. Given the complexity of the sector, we focus on four segments where private equity firms have been particularly active: hospitals, outpatient care (urgent care and ambulatory surgery centers), physician staffing and emergency * Co-Director and Senior Economist, Center for Economic and Policy Research. [email protected] † Alice H. Cook Professor of Women and Work, HR Studies and Intl. & Comparative Labor ILR School, Cornell University. [email protected]. We thank Andrea Beaty, Aimee La France, and Kellie Franzblau for able research assistance. room services (surprise medical billing), and revenue cycle management (medical debt collecting). In each of these segments, private equity has taken the lead in consolidating small providers, loading them with debt, and rolling them up into large powerhouses with substantial market power before exiting with handsome returns. https://doi.org/10.36687/inetwp118 JEL Codes: I11 G23 G34 Keywords: Private Equity, Leveraged Buyouts, health care industry, financial engineering, surprise medical billing revenue cycle management, urgent care, ambulatory care. -

Investor Update February 2020

Investor Update February 2020 Investor Update February 2020 0 Important Notice This presentation contains forward-looking statements within the meaning of applicable federal securities laws that are based upon our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “will,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward-looking statements. All statements contained in this presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking statements that involve certain risks and uncertainties. In particular, any projections or expectations regarding the acquisition by CIT Bank of Mutual of Omaha Bank, our future revenues, expenses, earnings, capital expenditures, deposits or stock price, as well as the assumptions on which such expectations are based, are such forward-looking statements reflecting only our current judgment and are not guarantees of future performance or results. While these statements represent our current judgment -

Legal News Alert Is a Publication for Distribution Without Charge to Our Clients and Friends

SENIORS’ HOUSING LEGAL January 2008 NEWS ALERT Ruskin Moscou Faltischek’s The Industry Today Seniors’ Housing Capabilities The seniors' housing market has become soft, the gap between buyer and seller expectations has grown wider • Licensing Applications and Regulatory making it hard to get deals done, valuations have con- Matters tracted and will be driven by fundamentals instead of • Real Estate, Construction and Financing by cheap capital, cap rates are rising, the debt markets have become very conservative, and some lenders have • Contract Drafting and Reviews been changing their terms or just getting cold feet. • Counsel and Advice on Third Party Wayne L. Kaplan These factors combined or separately, are impacting Deals participants on both sides of the table. • Project Related Litigation Proceed with Caution • Compliance Audits The troubles in the subprime mortgage sector have sparked concerns about credit quality. However, some industry professionals are saying that the chang- • Fostering Alliances Between Housing and Healthcare Providers ing climate is not necessarily a bad thing. The seniors' housing market was get- ting far too overheated, with easy money spiking up the price of assets and • Exit Strategies lenders going higher and higher up the risk spectrum in order to put their dol- • Facility Sales and Refinancing lars into play. A fast adjustment was needed. This meant that on the debt side, borrowers could forget about high loan to values and lengthy interest-only peri- • Evaluating Model Types for Developers ods. The capital has become more expensive and harder to come by. As a • Federal and State Legislation result, an increasing number of deals are being re-priced or scrapped altogether. -

Hta-2019-12-31-10-K.Pdf

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the year ended December 31, 2019 Commission File Number: 001-35568 (Healthcare Trust of America, Inc.) Commission File Number: 333-190916 (Healthcare Trust of America Holdings, LP) HEALTHCARE TRUST OF AMERICA, INC. HEALTHCARE TRUST OF AMERICA HOLDINGS, LP (Exact name of registrant as specified in its charter) Maryland (Healthcare Trust of America, Inc.) 20-4738467 Delaware (Healthcare Trust of America Holdings, LP) 20-4738347 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 16435 N. Scottsdale Road, Suite 320, Scottsdale, Arizona 85254 (480) 998-3478 http://www.htareit.com (Address of principal executive office and zip code) (Registrant's telephone (Internet address) number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange on which registered Common stock, $0.01 par value HTA New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Healthcare Trust of America, Inc. Yes No Healthcare Trust of America Holdings, LP Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Healthcare Trust of America, Inc. Yes No Healthcare Trust of America Holdings, LP Yes No Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

HEALTHCARE REALTY TRUST INCORPORATED (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: December 31, 2010 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period to Commission File Number: 1-11852 HEALTHCARE REALTY TRUST INCORPORATED (Exact name of Registrant as specified in its charter) Maryland 62 -1507028 (State or other jurisdiction of (I.R.S. Employer Incorporation or organization) Identification No.) 3310 West End Avenue Suite 700 Nashville, Tennessee 37203 (Address of principal executive offices) (615) 269-8175 (Registrant’s telephone number, including area code) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common stock, $0.01 par value per share New York Stock Exchange Securities Registered Pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the Registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Kansas Board of Regents Mandatory Retirement Plan Semi-Annual Investment Review As of 12/31/2018

The Kansas Board of Regents Mandatory Retirement Plan Semi-Annual Investment Review As of 12/31/2018 Brad Tollander Bernie Heffernon [email protected] [email protected] Advanced Capital Group | 50 South 6th Street, Suite 975 | Minneapolis, MN 55402 | 612.230.3000 | 866.225.5224 Table of Contents Industry Trends 1 Recap of Markets and Economy 9 Executive Summary 17 TIAA Summary 30 Voya Summary 56 TIAA Detailed Analysis 81 Voya Detailed Analysis 148 TIAA Investment Manager Searches 203 • Core Plus Bond 204 • International Bond 217 • A Case for Foreign Small Cap Equity 229 • Foreign Small Cap 233 • Mid Cap Index 247 • Large Cap Growth Evaluation 255 Voya Investment Manager Searches 266 • Core Bond Index 267 • Treasury Inflation-Protected (TIPS) 273 • Foreign Equity Index Comparison 291 • Vanguard vs. Fidelity Tracking Charts 298 DFA Target Date Fund Analysis 302 The Kansas Board of Regents Mandatory Retirement Plan Industry Trends Update Page 1 of 333 Industry Trends Update ➢ Higher Education Litigation • Approximately 25 Colleges and Universities have faced lawsuits from groups of 403(b) retirement plan participants since 2016. • Since the September 2018 RPC meeting, 5 Universities have experienced activity related to lawsuits. • University of Rochester (NY) – Participants Voluntarily dropped complaint – January, 2019 • University of Long Island – Participants Voluntarily dropped complaint – February, 2019 • Washington University (St. Louis) – Complaints dismissed – September, 2018 • Duke University – Settled lawsuit for $10.65 million – December, 2018 • Georgetown University – Complaints dismissed – January, 2019 ➢ Behavioral Finance and Retirement Readiness • Behavioral Finance is the study of “How” participants make investment decisions based on specific behaviors supported by specific data elements. -

Healthcare Real Estate Bulletin

Brackett Flagship Properties HEALTHCARE REAL ESTATE BULLETIN Fourth Quarter 2015 BFP TO PARTNER WITH CAROMONT HEALTH FOR NEW 50,000 SF CORPORATE OPERATIONS CENTER INSIDE In today’s competitive environment, leading within the healthcare/hospital culture”. THIS ISSUE: healthcare systems are increasingly looking CaroMont Health is a regional health for ways to improve operational efficiencies. system based in Gastonia, NC that provides USAA Venture Continues to Optimizing the use of space to realize the innovative medical and wellness services. Grow Portfolio with Fourth highest and best use of a system’s real estate Their vast network of care locations includes Quarter Acquisitions ....................2 assets presents a huge opportunity for many CaroMont Regional Medical Center, a hospital systems as they continue to evolve nationally recognized, not-for-profit, 435-bed News from the Office .................2 and realign under the Affordable Care Act. acute care hospital. “We couldn’t be more The Brackett Flagship team is excited excited about the opportunity to work with New Hires, Promotions, and to be working with CaroMont Health to CaroMont” said Thorn Baccich, Vice President Professional Recognition ...........3 provide space planning, development and of Development. “At the end of the day, our construction management services for a value to a healthcare system is really only Flagship HealthCare Real Estate new corporate operations center. The new measured in terms of our ability to help Fund Finishes Year Strong .........3 building is planned for the corner of New the system improve patient care. Working Hope Road and Court drive near CaroMont with CaroMont to put multiple service lines CHS Inks Lease at Eastover Regional Medical Center.