Pbfixedincomedailyjan1716.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dubai Review 2020 – 2021 Outlook

Dubai Review Outlook www.valustrat.com ValuStrat Price Index – VPI Dubai Residential Base: January 2014=100 ValuStrat Price Index – VPI Dubai Office Base: January 2015=100 All prices are quoted in UAE Dirhams unless otherwise stated Sales and Rent performance are measured on a quarterly basis while hotel performance are on yearly basis 2020 Review FIRST QUARTER REVIEW 2020 VPI Residential VPI Residential VPI Office Capital Values Rental Values Capital Values 73.3 69.6 63.1 -10.1% -8.9% -14.7% Y-o-Y Y-o-Y Y-o-Y Residential Ready Residential Ready Ticket Size Sales Volume 1.71m 3,491 AED Transactions 0.6% -0.3% Q-o-Q Q-o-Q Residential Off-Plan Residential Off-Plan Ticket Size Sales Volume 1.45m 5,224 AED Transactions -8.6% -26.3% Q-o-Q Q-o-Q Office Sales Office Sales Office Ticket Size Volume Rent 0.92m 269 863 per sq m AED Transactions AED -17.9% 11.2% -5.2% Q-o-Q Q-o-Q Q-o-Q Jan COVID - 19 PANDEMIC • The VPI – residential capital values for Dubai as of March 2020 stood at 73.3 points, dipping 0.9% since February, -10% annually. 1W • First confirmed case in the UAE recorded on 29th January • The Dubai VPI for residential rental values during Q1 2020 stood at 69.6 points, • Suspension of all flights except cargo, halting operation of major public mass declining 1.7% quarterly and 8.9% annually. On an annual basis, apartment and transport (Dubai Metro and Tram) villa asking rents fell 9.4% and 8% respectively • Countrywide curfew and disinfection drive started • VPI for Dubai’s office capital values stood at 63.1 points, suggesting that -

SPEAKER BIOS | in SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi Tasked Video Journalist &

SPEAKER BIOS | IN SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi tasked Video Journalist & Business Communications Expert with a wealth of experience in the UK, Australia, Europe & MENA region. Bringing a warm, personable, informative and friendly approach to presenting, interviewing and drawing out the best of people in many diverse fields. Fully experienced in a live studio environment and on location. Specialties: Facilitating business programming for both TV and Radio stations. Managing teams within a broadcast unit. Presenting, producing, directing, filming and editing live and recorded TV & Radio content. Experience of anchoring in a live environment. Specialist in media training and presentation on-air delivery. Moderator at events. Magazine and newspaper features writer. Voice Over artist and Voice imaging. Experienced in using AVID inews, Final Cut Pro X, Adobe Premiere, audio editing software including soundtrack pro and Twisted Wave. His Excellency Hani Al Hamli Secretary General Dubai Economic Council (DEC) H.E. Hani Rashid Al Hamli is the Secretary General of the Dubai Economic Council (DEC) since 2006. The Council envisioned acting as the strategic partner for the Government of Dubai in economic-decision making. It provides policy recommendations and initiatives that enhance the sustainable economic development in the Emirate of Dubai. Prior to his service at DEC, Mr. Al Hamli held a number of senior positions in various government and private entities in Dubai such as the Executive Council-Government of Dubai, Dubai Chamber of Commerce and Industry, Investment & Development Authority, and Emirates Bank Group. Under his management of the DEC Secretariat, Mr. Al Hamli has realized many achievements for the DEC, notably the establishment of Dubai Competitiveness Center (DCC) in 2008, and the DEC has embraced the stated center from 2008-2013. -

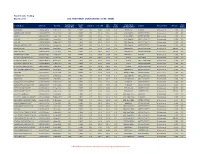

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM)

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM) Outstanding Coupon Indic. Offer Credit Rating Risk Security Name ISIN Code Maturity Coupon % Indic. Bid Country Payment Rank Min. Size Amount (Mio) Type Offer Yield % S&P/Moody/Fitch Rating AGRIUM INC US008916AP31 15-Mar-2025 550 FIXED 3.38 99.08 99.08 3.50 BBB/Baa2/- CANADA Sr Unsecured 2,000 P3 AMERICAN INTL GROUP US026874DD67 10-Jul-2025 1250 FIXED 3.75 101.42 101.42 3.56 A-/Baa1/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AON PLC US00185AAF12 14-Jun-2024 600 FIXED 3.50 101.66 101.66 3.26 A-/Baa2/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RBN17 1-Dec-2022 1500 FIXED 2.63 99.33 99.33 2.74 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RCN08 15-May-2025 5000 FIXED 3.40 101.43 101.43 3.21 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 BANK OF AMERICA CORP US06051GEU94 11-Jan-2023 4250 FIXED 3.30 102.16 102.16 2.94 BBB+/Baa1/A UNITED STATES Sr Unsecured 2,000 P3 BARCLAYS PLC US06738EAE59 16-Mar-2025 2000 FIXED 3.65 97.62 97.62 3.97 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARCLAYS PLC US06738EAN58 12-Jan-2026 2500 FIXED 4.38 100.83 100.83 4.27 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARRICK GOLD CORP US067901AQ17 1-May-2023 730 FIXED 4.10 103.55 103.55 3.52 BBB-/Baa3/- CANADA Sr Unsecured 2,000 P3 BHP BILLITON FIN USA LTD US055451AQ16 24-Feb-2022 1000 FIXED 2.88 100.95 101.92 2.52 A/A3/A+ AUSTRALIA Sr Unsecured 2,000 P3 BP CAPITAL MARKETS PLC US05565QCB23 6-Nov-2022 1000 FIXED 2.50 98.26 98.26 2.80 A-/A2/A UNITED KINGDOM -

Download Brochure

H.E ABDUL AZIZ AL GHURAIR FOR ALMOST HALF A CENTURY, MASHREQ BANK HAS BEEN A LEADING FINANCIAL INSTITUTION IN THE UAE. We have a long and proud heritage and we are looked up to as pioneers in the banking world. Innovation is at the heart of everything we do and while we celebrate our rich history, we do so with one eye always on the future. Burj Al Shams is the embodiment of that pioneering spirit. This visionary architectural construct is a masterpiece of innovation, a brilliant example of what can be achieved when you think and dream big. Its fitting name (the Sun Tower) was chosen because it symbolises endless possibilities and an optimistic view of the future. This striking building represents all the values to which we aspire and which have made possible the successes achieved on our journey thus far. Now we want to share Burj Al Shams with the wider business community, offering a rare opportunity to become part of something truly unique. A BUSINESS HOME TO INSPIRE BRILLIANCE WITH A TOTAL LEASABLE AREA OF 330,000 SQUARE FEET, BURJ AL SHAMS IS AN IMPRESSIVE HOME FOR ANY BUSINESS. Ideally situated in the heart of Downtown Dubai, Burj Al Shams enjoys all the benefits of a prime city centre location with an outstanding array of world famous landmarks close at hand. Iconic destinations such as the Burj Khalifa, Dubai Mall, and Dubai Opera are all within easy reach, alongside multiple high-end hotels and a wide selection of top-quality restaurants within walking distance. With an international nursery, supermarket and shopping facilities close at hand, all your practical needs are conveniently catered for. -

SWIFT Gpi Delivering the Future of Cross-Border Payments, Today SWIFT Gpi SWIFT Gpi

SWIFT gpi Delivering the future of cross-border payments, today SWIFT gpi SWIFT gpi SWIFT gpi 4 SWIFT is an innovative The Concept 8 technology company. As an industry cooperative, we listen The Tracker 10 Delivering and respond to the evolving The Observer 12 needs of our Community. The Directory 14 Part of our core mission is to Market infrastructures 16 the future of bring the financial community The Roadmap 18 together to work collaboratively to shape market practice, Enable digital transformation 22 define standards and debate Explore new technology 24 cross-border issues of mutual interest. payments, Innovation is an ongoing process, and through our R&D programmes and initiatives such as SWIFTLab, Innotribe, today and the SWIFT Institute, SWIFT is ideally placed to offer insights into the future of global financial technology and work with our Community to make real world change really happen. 2 3 SWIFT gpi SWIFT gpi SWIFT gpi SWIFT global payments innovation (gpi) In its first phase, SWIFT gpi focuses on business-to-business At Citi, we welcome the launch of As an early member of SWIFT dramatically improves the customer payments. It is designed to help corporates grow their international SWIFT gpi – we see this as a key gpi, Bank of China successfully experience in cross-border payments business, improve supplier initiative in evolving how cross- completed the gpi pilot and by increasing the speed, transparency relationships, and achieve greater border payments are transacted. was one of the first banks to treasury efficiencies. Thanks to SWIFT The time is right for the industry to go live. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Mashreq Wealth Gauge

Exceptional. Individual. The banking sector is expected to benefit from the With the outstanding success of the Initial Public UAE continues to benefit with influx of private strong economic growth and ample liquidity in the Offering of the Emaar Malls Group, the IPO Market capital on account of political unrest in addition to cash market. However the growth in the retail has shown traction. More number of companies are influx of wealth from emerging markets like India, Mashreq segment will be nicely balanced by the launch of expected to take this route to listing. Such listings Russia and China. The Institute of International Al Etihad Credit Bureau. The Sector is expected to will add further depth and liquidity to the bourses. Finance (IIF) confirms that Foreign Direct do well with earnings more than the market Amanat holding, Al Habtoor Group, Ithmar Capital Investments (FDI) have doubled to USD 12 billion expectations. The profitability will be primarily and Damac are a few companies who have lined up which now accounts to 3% of the 2013 GDP. The driven by growth in fee income and decline in their IPOs. Listings will ease out cash liquidity issues, fiscal balance is at a surplus of 10.2% of GDP of Property provisioning. The compression in margins is however the challenge will be to make good use of 2013. All indicators have led to an improvement Wealth Gauge. expected to continue which will be over funds raised and to meet working capital in credit conditions for the economy. shadowed by strong growth in lending book size. -

Visibility of Incoming Payments

SWIFT Report July 2019 Visibility of incoming payments – Proof of Value (PoV) Can visibility on all incoming cross-border payments help corporates achieve greater efficiency? In this report: Solution investigated Can end-to-end visibility Approach Results of the PoV and transparency on all Next steps Benefits at a glance incoming cross-border payments help corporates on the seller side? We presented this question to six gpi member banks and corporate customers1 as we launched the visibility of incoming payments PoV explored with AccessPay. 1 Participating banks: BNP Paribas, Natixis, Citi, Deutsche Bank, Mashreq Bank, Societe Generale, UBS, Yapi Kredi Participating corporate customers: ITV and Eversheds Sutherland 2 Solution investigated Building on the unique capabilities of SWIFT gpi, a visibility of incoming payments initiative would leverage the existing gpi Tracker to help corporates with the management of working capital as well as payment reconciliation operations. With SWIFT gpi, member banks benefit from visibility over As a result, banks would have the capacity to offer all incoming payments before reception of the payment incoming payment notification, tracking and search message. However, the information presented does not services to their corporate customers. today include the details on the buyer, the seller and any remittance details. Would SWIFT made this information available to gpi banks, the solution examined would utilise the transaction information that the buyer bank puts in the SWIFT network to enable the beneficiary bank to present these transaction details to the corporate beneficiary, ahead of payment delivery. gpi Tracker Incoming! Incoming Payments 3 Approach Throughout the PoV, participating banks and corporates were invited to validate the proposed solution in the context of their institution, and provide input on possible use cases and perceived value. -

Al Saraya Buses Rental Llc Delhi Private School, Dubai Bus Routes for the Academic Year 2021-2022

AL SARAYA BUSES RENTAL LLC DELHI PRIVATE SCHOOL, DUBAI BUS ROUTES FOR THE ACADEMIC YEAR 2021-2022 AREA AREA ROUTE NAME BUS NUMBERS CODE Gardens 58,76,78,89 1 DUBAI Discovery Gardens 34,35,36,39,42,43,44,45,46,49,51,52,53,56,60,84,88,108 Al Furjan 32, 66 ,68,111 JLT 48,53,59 Marina, Media city, Jumeirah Beach Residency 44,85 2 DUBAI Springs, Meadows, Jumeirah Island,Jumeirah park, 88,99 Barsha 47,74 Greens, Tecom, Knowledge Village 50,57,91 DIP, GREEN COMMUNITY, 54,96,106, 3 DUBAI Jumeirah village circle, Motor city, Remraam & Mudon, 95,101,107,110 Arabian Ranches, Sports City, IMPZ Deira 92,109 Downtown,Business Bay,Satwa,Jafiliya,Diafaa 73,97,105 Jumeirah Al Quoz, Al Khail Gate, Jumeirah Village Triangle 64,94 4 DUBAI Burdubai 55,61,71,72,80,86,93,103 Karama, Oud Metha 69,70,83 Qusais 65,67,98 International City, DSO, Skycourts, Liwan 40,63,112 Sharjah - STAFF ACCOMMODATION DPS-1 5 SHARJAH SHARJAH 75,82,102 TOTAL BUS ROUTES AL SARAYA BUSES RENTAL L.L.C DELHI PRIVATE SCHOOL, DUBAI ROUTE NUMBER 32 ROUTE NAME AL FURJAN DRIVER NAME ABDUL KADIR KHAN CONTACT NUMBER 971552299871 PICK UP ORDER PICK UP CODE BUS STOP AREA CODE PICK UP TIME DROP OFF TIME 1 32-1 AVENUE BLDG 1 06:50 14:10 2 32-2 VILLA 17 B 1 06:50 14:10 3 32-3 AZIZI MONTRELL BLDG 1 06:55 14:15 4 32-4 MURANO RESIDENCES 1 1 06:55 14:15 5 32-5 STARZ BY DANUBE 1 07:00 14:20 6 32-6 AZZIZE YASMEN RESIDENCE 1 07:00 14:20 7 32-7 AZZIZE FEIROUZ RESIDENCES 1 07:05 14:22 Note:- All students should be at the bus stop 5 minutes before the bus is scheduled to arrive. -

Mashreq Bank

mashreq Fixed Income Trading Daily Market Update Sunday, July 05, 2015 Market Update • Abu Dhabi lenders’ earnings grow 11% in Q1 The total net earnings of Islamic and commercial banks in Abu Dhabi climbed 11.2% in the first quarter of 2015 in year-on-year period, showing the strengthens of the flourishing banking sector. Total earnings rose 1.5% in quarter-on-quarter comparison, said Statistics Centre Abu Dhabi complied, “Abu Dhabi-Based Banks Statistics Report”, for Q1 2015. (Khaleej Times) • Gulf Finance House planning acquisition GFH is planning to make an acquisition this year and sell a unit in an initial public offering. The expected moves are part of efforts to reshape GFH, which was hit hard by the 2008-2009 global financial crisis. “The new strategy of GFH is primarily focused on creation of a financial group rather than just an investment bank which it used to be before,” said Hisham Alrayes, the chief executive. “From the five pillars, we would like to have an equal participation of income, ideally.” Currently the Bahrain-based Islamic investment bank has four units: investment banking, commercial banking, real estate and industry. GFH, which is talking to one firm in Bahrain and two in Dubai, is banking on closing this year with at least one leveraged acquisition valued at about USD200 million. The firm is seeking to finance the acquisition through 30 to 40% equity and the remainder in debt. (Bloomberg) • Qatar National Bank and Bahrain's Arab Bank Corp more interested in acquiring Finansbank QNB and ABC did not follow up early interest in acquiring HSBC's Turkish business because they were more interested in National Bank of Greece's Turkish arm Finansbank, two people familiar with the matter said. -

Inside Micro Market Prices City Indices Dubai Real Estate Cycle What's Driving Dubai Real Estate

DR E A L E S T AuT E M A R K EbT S N A P SaH O T i Inside Micro Market prices City Indices Dubai Real Estate Cycle What's driving Dubai Real Estate A S Q U A R E G L O B A L R E S E A R C H P U B L I C A T I O N w w w . s q u a r e y a r d s . c o m D U B A I Real Estate Cycle Dubai Real Estate Outlook in 2017 Dubai’s real estate industry is set Traditionally, Britons along with Bullish Sentiments in for a turn-around in 2017. After Indians & Pakistanis are major Anticipation rallying ahead in 2013-14, real international investor community in estate prices started softening in Dubai. However, after BREXIT, in H1 In 2017, real estate market in 2015 & 16 with average prices 2016; the total amount of British Dubai is expected to accelerate. being corrected by around 5% investment has been in tune of UAE’s economy will ramp up & this annually. Slowdown also persisted USD 1 billion, down from USD 1.3 will fuel demand for more in the rental markets. billion in H1, 2015. residential units through added job creation. Real Estate Market Sentiments Micro markets in Dubai such as in 2016 Dubai Silicon Oasis (DSO), Dubai The tourism industry in Dubai, will International City & Dubai Sports add more mileage to the real estate Real estate market sentiments City continued to show capital demand dynamics. -

Wholesale Banking

Wholesale Banking Table of Contents CEO’s Message ..….………. 04 3.8 Healthcare …….……..…. 32 3.9 Education …….……..…. 33 1 Introduction to Mashreq ..….………. 05 3.10 Energy …….…..……. 34 1.1 Banking with us .....….………. 07 1.2 Our Values ..…….………. 08 4 Offering …….………. 35 1.3 Our Journey ….……..……. 09 4.1 Investment Banking ……….………. 37 1.4 Our Network ……….….……. 11 4.2 Global Transaction Banking …….………... 41 Corporate & Investment Banking 4.3 Mashreq Al Islami …….…..……. 43 Group Head’s Message …….………. 13 5 International Presence …….………. 45 International Banking Group 5.1 Egypt …….…………. 47 Head’s Message …….………. 14 5.2 Qatar …….…………. 49 5.3 India ……….………. 51 2 Introduction to Corporate & 5.4 Bahrain ……….………. 53 Investment Banking Group …….………. 15 5.5 United States of America ……….………. 55 2.1 Corporate & Investment Banking Group ……….………. 17 5.6 Kuwait .……..………. 57 2.2 Our Proposition ..……..………. 18 5.7 Hong Kong …..….….……. 59 2.3 Leadership Team …….…………. 19 5.8 United Kingdom ……...………. 61 Corporate Origination and Business 3 Industry Expertise …….………. 22 6 Development …….………. 63 3.1 Real Estate …….………... 23 3.2 Services & Manufacturing …….……..…. 24 7 Research & Knowledge Partnerships …….………. 67 3.3 Contracting Finance …….…..……. 25 8 Business Transformation, Strategy 3.4 Non-Banking Financial Institutions …….…..……. 27 & Intelligence …….………. 73 3.5 Financial Institutions …….…………. 28 3.6 Trading Companies …….…………. 30 9 Client Endorsements …….………. 77 3.7 Public Sector, Aviation & Utilities ………………. 31 10 Our Achievements …….………. 81 CEO‘s Message Mashreq’s rich legacy of over 50 years and commitment to deliver customer-centric banking solutions puts the bank in a leadership position when serving businesses with a global vision. We aim to become a true growth partner for all our clients, enabling innovation across key financial & business touch points.