Mashreq Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SPEAKER BIOS | in SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi Tasked Video Journalist &

SPEAKER BIOS | IN SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi tasked Video Journalist & Business Communications Expert with a wealth of experience in the UK, Australia, Europe & MENA region. Bringing a warm, personable, informative and friendly approach to presenting, interviewing and drawing out the best of people in many diverse fields. Fully experienced in a live studio environment and on location. Specialties: Facilitating business programming for both TV and Radio stations. Managing teams within a broadcast unit. Presenting, producing, directing, filming and editing live and recorded TV & Radio content. Experience of anchoring in a live environment. Specialist in media training and presentation on-air delivery. Moderator at events. Magazine and newspaper features writer. Voice Over artist and Voice imaging. Experienced in using AVID inews, Final Cut Pro X, Adobe Premiere, audio editing software including soundtrack pro and Twisted Wave. His Excellency Hani Al Hamli Secretary General Dubai Economic Council (DEC) H.E. Hani Rashid Al Hamli is the Secretary General of the Dubai Economic Council (DEC) since 2006. The Council envisioned acting as the strategic partner for the Government of Dubai in economic-decision making. It provides policy recommendations and initiatives that enhance the sustainable economic development in the Emirate of Dubai. Prior to his service at DEC, Mr. Al Hamli held a number of senior positions in various government and private entities in Dubai such as the Executive Council-Government of Dubai, Dubai Chamber of Commerce and Industry, Investment & Development Authority, and Emirates Bank Group. Under his management of the DEC Secretariat, Mr. Al Hamli has realized many achievements for the DEC, notably the establishment of Dubai Competitiveness Center (DCC) in 2008, and the DEC has embraced the stated center from 2008-2013. -

Pbfixedincomedailyjan1716.Pdf

mashreq Fixed Income Trading Daily Market Update Sunday, January 17, 2015 Quote of the Day "Wealth consists not in having great possessions, but in having few wants." (Epictetus) Market Update Iran sanctions lifted after IAEA confirms compliance with the nuclear deal, US firms set to miss out as US sanctions remain International sanctions on Iran have been lifted after IAEA, the UN nuclear watchdog confirmed the country had complied with a deal designed to prevent it developing nuclear weapons. The International Atomic Energy Agency concluded that the Islamic Republic had curbed its ability to develop an atomic weapon as required under an accord with world powers. The US and five other nations agreed in July’s accord to lift sanctions on Iran “simultaneously with the IAEA-verified implementation” of the deal. “Iran has undertaken significant steps that many people doubted would ever come to pass,” clearing the way for sanctions to end, US Secretary of State John Kerry said in Vienna late on Saturday after Iran’s compliance with the agreement was certified. Still, he said the accord “doesn’t wipe away all of the concerns” of the international community, and “verification remains, as it always has been, the backbone of this agreement." The EU foreign policy chief, Federica Mogherini, said the deal would contribute to improved regional and international peace and security. “Relations between Iran and the IAEA now enter a new phase. It is an important day for the international community,” Yukiya Amano, director general of the agency, said in a statement. “This paves the way for the IAEA to begin verifying and monitoring Iran’s nuclear-related commitments.” Ahead of the announcement Iran freed four Iranian-Americans as part of a prisoner exchange with the US that had been negotiated in secret for more than a year. -

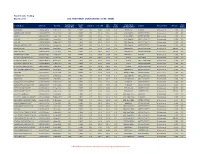

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM)

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM) Outstanding Coupon Indic. Offer Credit Rating Risk Security Name ISIN Code Maturity Coupon % Indic. Bid Country Payment Rank Min. Size Amount (Mio) Type Offer Yield % S&P/Moody/Fitch Rating AGRIUM INC US008916AP31 15-Mar-2025 550 FIXED 3.38 99.08 99.08 3.50 BBB/Baa2/- CANADA Sr Unsecured 2,000 P3 AMERICAN INTL GROUP US026874DD67 10-Jul-2025 1250 FIXED 3.75 101.42 101.42 3.56 A-/Baa1/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AON PLC US00185AAF12 14-Jun-2024 600 FIXED 3.50 101.66 101.66 3.26 A-/Baa2/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RBN17 1-Dec-2022 1500 FIXED 2.63 99.33 99.33 2.74 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RCN08 15-May-2025 5000 FIXED 3.40 101.43 101.43 3.21 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 BANK OF AMERICA CORP US06051GEU94 11-Jan-2023 4250 FIXED 3.30 102.16 102.16 2.94 BBB+/Baa1/A UNITED STATES Sr Unsecured 2,000 P3 BARCLAYS PLC US06738EAE59 16-Mar-2025 2000 FIXED 3.65 97.62 97.62 3.97 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARCLAYS PLC US06738EAN58 12-Jan-2026 2500 FIXED 4.38 100.83 100.83 4.27 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARRICK GOLD CORP US067901AQ17 1-May-2023 730 FIXED 4.10 103.55 103.55 3.52 BBB-/Baa3/- CANADA Sr Unsecured 2,000 P3 BHP BILLITON FIN USA LTD US055451AQ16 24-Feb-2022 1000 FIXED 2.88 100.95 101.92 2.52 A/A3/A+ AUSTRALIA Sr Unsecured 2,000 P3 BP CAPITAL MARKETS PLC US05565QCB23 6-Nov-2022 1000 FIXED 2.50 98.26 98.26 2.80 A-/A2/A UNITED KINGDOM -

SWIFT Gpi Delivering the Future of Cross-Border Payments, Today SWIFT Gpi SWIFT Gpi

SWIFT gpi Delivering the future of cross-border payments, today SWIFT gpi SWIFT gpi SWIFT gpi 4 SWIFT is an innovative The Concept 8 technology company. As an industry cooperative, we listen The Tracker 10 Delivering and respond to the evolving The Observer 12 needs of our Community. The Directory 14 Part of our core mission is to Market infrastructures 16 the future of bring the financial community The Roadmap 18 together to work collaboratively to shape market practice, Enable digital transformation 22 define standards and debate Explore new technology 24 cross-border issues of mutual interest. payments, Innovation is an ongoing process, and through our R&D programmes and initiatives such as SWIFTLab, Innotribe, today and the SWIFT Institute, SWIFT is ideally placed to offer insights into the future of global financial technology and work with our Community to make real world change really happen. 2 3 SWIFT gpi SWIFT gpi SWIFT gpi SWIFT global payments innovation (gpi) In its first phase, SWIFT gpi focuses on business-to-business At Citi, we welcome the launch of As an early member of SWIFT dramatically improves the customer payments. It is designed to help corporates grow their international SWIFT gpi – we see this as a key gpi, Bank of China successfully experience in cross-border payments business, improve supplier initiative in evolving how cross- completed the gpi pilot and by increasing the speed, transparency relationships, and achieve greater border payments are transacted. was one of the first banks to treasury efficiencies. Thanks to SWIFT The time is right for the industry to go live. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Visibility of Incoming Payments

SWIFT Report July 2019 Visibility of incoming payments – Proof of Value (PoV) Can visibility on all incoming cross-border payments help corporates achieve greater efficiency? In this report: Solution investigated Can end-to-end visibility Approach Results of the PoV and transparency on all Next steps Benefits at a glance incoming cross-border payments help corporates on the seller side? We presented this question to six gpi member banks and corporate customers1 as we launched the visibility of incoming payments PoV explored with AccessPay. 1 Participating banks: BNP Paribas, Natixis, Citi, Deutsche Bank, Mashreq Bank, Societe Generale, UBS, Yapi Kredi Participating corporate customers: ITV and Eversheds Sutherland 2 Solution investigated Building on the unique capabilities of SWIFT gpi, a visibility of incoming payments initiative would leverage the existing gpi Tracker to help corporates with the management of working capital as well as payment reconciliation operations. With SWIFT gpi, member banks benefit from visibility over As a result, banks would have the capacity to offer all incoming payments before reception of the payment incoming payment notification, tracking and search message. However, the information presented does not services to their corporate customers. today include the details on the buyer, the seller and any remittance details. Would SWIFT made this information available to gpi banks, the solution examined would utilise the transaction information that the buyer bank puts in the SWIFT network to enable the beneficiary bank to present these transaction details to the corporate beneficiary, ahead of payment delivery. gpi Tracker Incoming! Incoming Payments 3 Approach Throughout the PoV, participating banks and corporates were invited to validate the proposed solution in the context of their institution, and provide input on possible use cases and perceived value. -

Mashreq Bank

mashreq Fixed Income Trading Daily Market Update Sunday, July 05, 2015 Market Update • Abu Dhabi lenders’ earnings grow 11% in Q1 The total net earnings of Islamic and commercial banks in Abu Dhabi climbed 11.2% in the first quarter of 2015 in year-on-year period, showing the strengthens of the flourishing banking sector. Total earnings rose 1.5% in quarter-on-quarter comparison, said Statistics Centre Abu Dhabi complied, “Abu Dhabi-Based Banks Statistics Report”, for Q1 2015. (Khaleej Times) • Gulf Finance House planning acquisition GFH is planning to make an acquisition this year and sell a unit in an initial public offering. The expected moves are part of efforts to reshape GFH, which was hit hard by the 2008-2009 global financial crisis. “The new strategy of GFH is primarily focused on creation of a financial group rather than just an investment bank which it used to be before,” said Hisham Alrayes, the chief executive. “From the five pillars, we would like to have an equal participation of income, ideally.” Currently the Bahrain-based Islamic investment bank has four units: investment banking, commercial banking, real estate and industry. GFH, which is talking to one firm in Bahrain and two in Dubai, is banking on closing this year with at least one leveraged acquisition valued at about USD200 million. The firm is seeking to finance the acquisition through 30 to 40% equity and the remainder in debt. (Bloomberg) • Qatar National Bank and Bahrain's Arab Bank Corp more interested in acquiring Finansbank QNB and ABC did not follow up early interest in acquiring HSBC's Turkish business because they were more interested in National Bank of Greece's Turkish arm Finansbank, two people familiar with the matter said. -

Pbfixedincomedailyjun21.Pdf

mashreq Fixed Income Trading Daily Market Update Sunday, June 21, 2015 Market Update • Emaar Misr IPO offer price set at 3.8 Egyptian Pounds Following the completion of the Institutional Offering Emaar Misr for Development S.A.E. has announced that the offer price has been set at EGP 3.8 per Share, after the Institutional Offering tranche was over 11 times oversubscribed at the offer price. At this price Emaar Misr’s market capitalisation at listing will be approximately EGP 17.6 billion (USD2.3 billion). Emaar Properties PJSC, the parent company of Emaar Misr, will retain its current holdings in Emaar Misr, which will represent 87.01% of Emaar Misr’s post-offer share capital. • Non-oil industries accounted for 69% of economic output last year, state-run news agency reports, citing Prime Minister Mohammed Bin Rashid Al Maktoum. Sheikh Mohammed said the government would spend on large infrastructure projects this year to maintain growth after last year’s robust rate of expansion, when inflation-adjusted GDP grew 4.6%. Projects include 100billion dirham airport expansions, 40billion dirham rail lines, roads and transport projects, tourist facilities, electronic infrastructure, real estate, financial service. The sharp decline in the price of oil since last summer has triggered a renewed focus on diversification. The contribution of the non-oil sector to the economy has already reached almost 70% with a target of up to 80% by 2021. The call for greater economic integration comes ahead of the release of new economic statistics expected this week. The government plans to triple spending on research and development over the next six years and boost the national workforce by 185,000. -

Making Blockchain a Reality Contents Summary

Making Blockchain a Reality Contents Summary Summary 03 Until recently, the world of finance was seen as a highly technical, highly regulated industry dominated by giant banks that resisted disruption (other than the occasional global meltdown). However, the finance industry No Responsibility, No Progress 04 is now riding an entrepreneurial wave, with blockchain at the helm. The Remittance Revolution 05 Fear of the Unknown? 06 Demand for start-up services is now stronger than ever, piqued by widespread frustration with historically cumbersome big banks that Collaboration at the Core 07 were unable to move at the speed or direction that was needed to Access the Infrastructure, Access the Opportunity 08 meet market need. However, as financial institutions realise that their only way to ride this wave is to embrace (and often partner) Getting Ready 10 with these new start-ups, we are set to see a perfect marriage never before witnessed. So, why have financial institutions been so slow to embrace technology, and in particular, blockchain? | 02 | 03 No Responsibility, The Remittance No Progress Revolution Blockchain could represent the next big Patrick Laurent, Partner at Deloitte comments that “these results One factor that is driving this market disruption is the movement of the costs structures are too high. If banks wants to retain their are not surprising, but give a clear indication of the immediate money from a period of high dollar amount and low transaction customers and earn extra revenues, they must adopt a lower shift in technology over the next five need to begin learning courses, workshops and develop Proof of volumes to low dollar amounts and high transaction volume. -

Financial Services

Financial Services Change Making Simplified 1 TechnoVision 2020 I Financial Services Contents Foreword 03 Introduction 04 FS TechnoVision and COVID-19 05 Sponsorship & Executive Leadership Team 06 TechnoVision in a Nutshell 07 Design for Digital 12 Invisible Infostructure 17 Applications Unleashed 22 Thriving on Data 27 Process on the Fly 32 You Experience 37 We Collaborate 42 FS Technovision Contacts 47 2 TechnoVision 2020 I Financial Services Foreword We introduce TechnoVision 2020, now in its twelfth year, with pride in reaching a second decade of providing a proven and relevant source of technology guidance and thought leadership to help enterprises navigate the compelling and yet complex opportunities for business. In this Financial Services edition of TechnoVision 2020, we have scanned the industry to find suitable examples that illustrate how some of the Banks and Insurers have embraced upcoming technology trends articulated through TechnoVision building blocks. I am proud to present to you the 2020 edition of FS for curating and applying innovation from problem TechnoVision, a playful and engaging, but we believe to statement to business outcome. A key asset here is be deep and important, guide to technology business our Applied Innovation Exchanges (AIEs), which is a transformation. The theme of this edition is ‘Simplify’; global innovation platform that is leveraged by our a recognition that a key goal of technology is to make clients for Change Making. For Technology we have the lives of consumers, colleagues and citizens easier ‘TechnoVision’; our holistic approach to technology, to in a world where we can be easily inundated by data. enable organizations anticipate the new trends, assess Those enterprises that achieve this goal will be the their potential, validate their enterprise readiness and business winners, but to do this requires mastery of exploit them. -

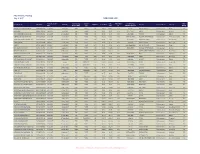

Fixed Income Trading July 2, 2017 NEW ISSUE LOG

Fixed Income Trading July 2, 2017 NEW ISSUE LOG Announcement Outstanding Coupon Indic. Offer Yield Credit Rating Risk Security Name ISIN Code Maturity Coupon % Indic. Bid Country Payment Rank Industry Date Amount (Mio) Type Offer % S&P/Moody/Fitch Rating MYRIAD INTL HOLDINGS BV USN5946FAD98 6/29/2017 6-Jul-2027 1000 FIXED 4.85 100.44 100.52 4.78 -/Baa3e/- SOUTH AFRICA Sr Unsecured Media P5 BAIDU INC US056752AJ76 6/27/2017 6-Jul-2027 600 FIXED 3.63 98.59 98.81 3.77 -/A3e /*-/Ae /*- CHINA Sr Unsecured Internet P5 YAPI VE KREDI BANKASI AS XS1634372954 6/14/2017 21-Jun-2024 500 FIXED 5.85 98.88 99.33 5.97 -/Ba1/BBB- TURKEY Sr Unsecured Banks P5 VIMPELCOM HOLDINGS BV XS1625994618 6/13/2017 16-Jun-2024 900 FIXED 4.95 100.31 100.31 4.90 BB/(P)Ba2/BB+ RUSSIAN FEDERATION Sr Unsecured Telecommunications P5 AFRICAN EXPORT-IMPORT BA XS1633896813 6/13/2017 20-Jun-2024 750 FIXED 4.13 99.04 99.51 4.21 -/Baa1/BBB-e SUPRANATIONAL Sr Unsecured Multi-National P4 IVORY COAST XS1631415400 6/8/2017 15-Jun-2033 1250 FIXED 6.13 96.24 97.11 6.43 -/Ba3/B+ COTE D’IVOIRE Sr Unsecured Sovereign P5 COACH US189754AC88 6/6/2017 15-Jul-2027 600 FIXED 4.13 98.79 99.46 4.19 BBB-/Baa2/BBB UNITED STATES Sr Unsecured Retail P4 MMC NORILSK NICKEL XS1622146758 6/1/2017 8-Apr-2022 500 FIXED 3.85 99.76 100.09 3.83 BBB-/-/BBB- RUSSIAN FEDERATION Sr Unsecured Mining P3 MERAAS SUKUK (S) XS1622425806 5/25/2017 31-May-2022 400 FIXED 5.11 100.83 101.51 4.76 -/-/- UNITED ARAB EMIRATES Sr Unsecured Real Estate P5 RURAL ELECTRIFICATION XS1641477119 5/24/2017 7-Jul-2027 450 FIXED 3.88 99.43 -

Processor Names

Processor Names Reference Guide © 2021. Cybersource Corporation. All rights reserved. Cybersource Corporation (Cybersource) furnishes this document and the software described in this document under the applicable agreement between the reader of this document (You) and Cybersource (Agreement). You may use this document and/or software only in accordance with the terms of the Agreement. Except as expressly set forth in the Agreement, the information contained in this document is subject to change without notice and therefore should not be interpreted in any way as a guarantee or warranty by Cybersource. Cybersource assumes no responsibility or liability for any errors that may appear in this document. The copyrighted software that accompanies this document is licensed to You for use only in strict accordance with the Agreement. You should read the Agreement carefully before using the software. Except as permitted by the Agreement, You may not reproduce any part of this document, store this document in a retrieval system, or transmit this document, in any form or by any means, electronic, mechanical, recording, or otherwise, without the prior written consent of Cybersource. Restricted Rights Legends For Government or defense agencies: Use, duplication, or disclosure by the Government or defense agencies is subject to restrictions as set forth the Rights in Technical Data and Computer Software clause at DFARS 252.227-7013 and in similar clauses in the FAR and NASA FAR Supplement. For civilian agencies: Use, reproduction, or disclosure is subject to restrictions set forth in subparagraphs (a) through (d) of the Commercial Computer Software Restricted Rights clause at 52.227-19 and the limitations set forth in Cybersource Corporation's standard commercial agreement for this software.