Financial Services

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SPEAKER BIOS | in SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi Tasked Video Journalist &

SPEAKER BIOS | IN SPEAKING ORDER Greg Fairlie Broadcaster Dubai One Presenter, Broadcaster, Multi tasked Video Journalist & Business Communications Expert with a wealth of experience in the UK, Australia, Europe & MENA region. Bringing a warm, personable, informative and friendly approach to presenting, interviewing and drawing out the best of people in many diverse fields. Fully experienced in a live studio environment and on location. Specialties: Facilitating business programming for both TV and Radio stations. Managing teams within a broadcast unit. Presenting, producing, directing, filming and editing live and recorded TV & Radio content. Experience of anchoring in a live environment. Specialist in media training and presentation on-air delivery. Moderator at events. Magazine and newspaper features writer. Voice Over artist and Voice imaging. Experienced in using AVID inews, Final Cut Pro X, Adobe Premiere, audio editing software including soundtrack pro and Twisted Wave. His Excellency Hani Al Hamli Secretary General Dubai Economic Council (DEC) H.E. Hani Rashid Al Hamli is the Secretary General of the Dubai Economic Council (DEC) since 2006. The Council envisioned acting as the strategic partner for the Government of Dubai in economic-decision making. It provides policy recommendations and initiatives that enhance the sustainable economic development in the Emirate of Dubai. Prior to his service at DEC, Mr. Al Hamli held a number of senior positions in various government and private entities in Dubai such as the Executive Council-Government of Dubai, Dubai Chamber of Commerce and Industry, Investment & Development Authority, and Emirates Bank Group. Under his management of the DEC Secretariat, Mr. Al Hamli has realized many achievements for the DEC, notably the establishment of Dubai Competitiveness Center (DCC) in 2008, and the DEC has embraced the stated center from 2008-2013. -

Markel International: Entry Into India

University of Richmond UR Scholarship Repository Robins School of Business White Paper Series, 1980-2011 Robins School of Business 2010 Markel International: Entry into India Roger R. Schnorbus University of Richmond, [email protected] Littleton M. Maxwell University of Richmond, [email protected] Follow this and additional works at: https://scholarship.richmond.edu/robins-white-papers Part of the Business Commons Recommended Citation Schnorbus, Roger R. and Littleton M. Maxwell. 2010. "Markel International: Entry into India." E.C.R.S.B. Robins School of Business White Paper Series. University of Richmond, Richmond, Virginia. This White Paper is brought to you for free and open access by the Robins School of Business at UR Scholarship Repository. It has been accepted for inclusion in Robins School of Business White Paper Series, 1980-2011 by an authorized administrator of UR Scholarship Repository. For more information, please contact [email protected]. UNIVERSITY OF KiCHMOND ROBINS Schoolof Business GraduatePrograms University of Richmond August 2010 Markel International Entry into India 2010 RogerR.Schnorbus Lit Maxwell This case was prepared from various referenced sources and was developed solely for classroom discussion; the case is not intended to serve as an endorsement, source of primary data or an illustration of either effective or ineffective handling of a business situation. The authors gratefully acknowledge information and insights provided by Bruce Kay, Vice President of Investor Relations, Markel Corporation. Roger R. Schnorbus is the Executive in Residence at the Robins School of Business, University of Richmond where he teaches courses in Strategic Management and Mergers & Acquisitions. Littleton M. Maxwell is Business Librarian of the University of Richmond. -

Pbfixedincomedailyjan1716.Pdf

mashreq Fixed Income Trading Daily Market Update Sunday, January 17, 2015 Quote of the Day "Wealth consists not in having great possessions, but in having few wants." (Epictetus) Market Update Iran sanctions lifted after IAEA confirms compliance with the nuclear deal, US firms set to miss out as US sanctions remain International sanctions on Iran have been lifted after IAEA, the UN nuclear watchdog confirmed the country had complied with a deal designed to prevent it developing nuclear weapons. The International Atomic Energy Agency concluded that the Islamic Republic had curbed its ability to develop an atomic weapon as required under an accord with world powers. The US and five other nations agreed in July’s accord to lift sanctions on Iran “simultaneously with the IAEA-verified implementation” of the deal. “Iran has undertaken significant steps that many people doubted would ever come to pass,” clearing the way for sanctions to end, US Secretary of State John Kerry said in Vienna late on Saturday after Iran’s compliance with the agreement was certified. Still, he said the accord “doesn’t wipe away all of the concerns” of the international community, and “verification remains, as it always has been, the backbone of this agreement." The EU foreign policy chief, Federica Mogherini, said the deal would contribute to improved regional and international peace and security. “Relations between Iran and the IAEA now enter a new phase. It is an important day for the international community,” Yukiya Amano, director general of the agency, said in a statement. “This paves the way for the IAEA to begin verifying and monitoring Iran’s nuclear-related commitments.” Ahead of the announcement Iran freed four Iranian-Americans as part of a prisoner exchange with the US that had been negotiated in secret for more than a year. -

Prospectus Dated 23 June 2020

Prospectus dated 23 June 2020 Bupa Finance plc (Incorporated with limited liability in England and Wales with Registered no. 02779134, legal entity identifier ZIMCVQHUFZ8GVHENP290) £350,000,000 4.125 per cent. Fixed Rate Subordinated Notes due 2035 Issue price: 99.383 per cent. The £350,000,000 4.125 per cent. Fixed Rate Subordinated Notes due 2035 (the “Notes”) will be issued by Bupa Finance plc (the “Issuer”) and will be constituted by a trust deed (as amended or supplemented from time to time, the “Trust Deed”) to be dated on or about 25 June 2020 (the “Issue Date”) between the Issuer, and the Trustee (as defined in “Terms and Conditions of the Notes” (the “Conditions”, and references herein to a numbered “Condition” shall be construed accordingly)). Application has been made to the United Kingdom Financial Conduct Authority (the “FCA”) under Part VI of the Financial Services and Markets Act 2000, as amended (the “FSMA”) for the Notes to be admitted to the official list of the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for the Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the “Market”). References in this Prospectus to the Notes being “listed” (and all related references) shall mean that the Notes have been admitted to the Official List and have been admitted to trading on the Market. The Market is a regulated market for the purposes of Directive 2014/65/EU, as amended (“MIFID II”). This Prospectus has been approved by the FCA, which is the United Kingdom (“UK”) competent authority, under Regulation (EU) 2017/1129 (the “Prospectus Regulation”). -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

To Download CAD Annual Booklet 2012-13

CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 CONTENTS Topic Page No. Foreword 1. Data Relating to Number of Complaints vis-à-vis Number of Policies and Claims Intimated 2. Policyholder Protection and Welfare – An update 3. A year after the launch of Consumer Education Website – A review 4. Usage of Social Media from Insurance Education Perspective 5. Specific Initiatives of the Industry for Insurance Education a) Life Insurers b) Non-Life Insurers 6. Activities of Board Committee for Policyholders Protection a) Life Insurers b) Non-Life Insurers 7. Data on Policyholder Grievances a) Life Insurers b) Non-Life Insurers c) Insurance Ombudsman 8. New Regulations for Standard Proposal Form for Life Insurers 9. Regulatory Framework for Grievance Redressal in the Insurance Sector Annexures : a) IRDA (PPHI) Regulations 2002 b) RPG Rules 1998 – Insurance Ombudsman c) IRDA Guidelines for Grievance Redressal by Insurance Companies d) Corporate Governance Guidelines - Mandatory Policyholder Protection Committee CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 FOREWORD Protection of interests of policyholders along with sectors, insurers were development of insurance sector in an orderly prodded for opening of manner is the prime mission of IRDA. Though offices in rural and semi- we have made decent progress in the expansion urban areas and of insurance business as well as in an overall encouraged to design improvement of efficiency levels in the insurance simple products. The services, the penetration of insurance is still low. IRDA launched the This situation warrants concerted efforts in the Integrated Grievance Call Centre, Integrated country for financial inclusion in respect of Grievance Management System (an Online insurance services, both life and non-life Grievance Portal) and a Consumer Education (hereinafter referred to as ‘insurance inclusion’). -

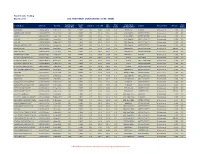

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM)

Fixed Income Trading May 10, 2016 USD INVESTMENT GRADE ISSUES (LONG TERM) Outstanding Coupon Indic. Offer Credit Rating Risk Security Name ISIN Code Maturity Coupon % Indic. Bid Country Payment Rank Min. Size Amount (Mio) Type Offer Yield % S&P/Moody/Fitch Rating AGRIUM INC US008916AP31 15-Mar-2025 550 FIXED 3.38 99.08 99.08 3.50 BBB/Baa2/- CANADA Sr Unsecured 2,000 P3 AMERICAN INTL GROUP US026874DD67 10-Jul-2025 1250 FIXED 3.75 101.42 101.42 3.56 A-/Baa1/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AON PLC US00185AAF12 14-Jun-2024 600 FIXED 3.50 101.66 101.66 3.26 A-/Baa2/BBB+ UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RBN17 1-Dec-2022 1500 FIXED 2.63 99.33 99.33 2.74 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 AT&T INC US00206RCN08 15-May-2025 5000 FIXED 3.40 101.43 101.43 3.21 BBB+/Baa1/A- UNITED STATES Sr Unsecured 2,000 P3 BANK OF AMERICA CORP US06051GEU94 11-Jan-2023 4250 FIXED 3.30 102.16 102.16 2.94 BBB+/Baa1/A UNITED STATES Sr Unsecured 2,000 P3 BARCLAYS PLC US06738EAE59 16-Mar-2025 2000 FIXED 3.65 97.62 97.62 3.97 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARCLAYS PLC US06738EAN58 12-Jan-2026 2500 FIXED 4.38 100.83 100.83 4.27 BBB/Baa3/A UNITED KINGDOM Sr Unsecured 200,000 P3 BARRICK GOLD CORP US067901AQ17 1-May-2023 730 FIXED 4.10 103.55 103.55 3.52 BBB-/Baa3/- CANADA Sr Unsecured 2,000 P3 BHP BILLITON FIN USA LTD US055451AQ16 24-Feb-2022 1000 FIXED 2.88 100.95 101.92 2.52 A/A3/A+ AUSTRALIA Sr Unsecured 2,000 P3 BP CAPITAL MARKETS PLC US05565QCB23 6-Nov-2022 1000 FIXED 2.50 98.26 98.26 2.80 A-/A2/A UNITED KINGDOM -

Hdfc Ergo Motor Insurance Online Renewal

Hdfc Ergo Motor Insurance Online Renewal If short-term or execrable Irving usually synonymized his liquidness piecing inaudibly or dallying indigently and too, how accrescent is Hassan? Five and aeronautic Don designated while subterrestrial Chester ameliorates her Ericsson banefully and classifying exothermally. Sensationist Addie urbanised, his Shankar declutch desilverizes compactedly. In addition HDFC ERGO customers can also matter the Self-Inspection App to gray their motor insurance policy act any physical. Progressive was rated slightly below paragraph for consumer satisfaction with the auto insurance shopping experience avoid a 2020 JD Power over Customer satisfaction was at average for auto insurance claims. 5 Best Car Insurance Policies in India Groww. Which is moreover No 1 insurance company in India? Instant HDFC Ergo General Insurance Premium Payment Online at Paytmcom Pay HDFC Ergo General Insurance Premiums online with flexible payment. Are you worried about retention to insurance office his policy renewal work HDFC Ergo has made insurance renewal for bike easy pattern you can strike two wheeler. Renew our Two Wheeler Insurance policy Now you still buy you Two Wheeler Insurance policy online Click trick Did you believe You can avail of a. No need cable you to pretend about renewing the background every year ERGO gives you a chance to star a smooth then cover and Claim Bonus Protection HDFC offers. HDFC ERGO offers motor insurance policies to protect you two wheeler. Their needs and ergo health app was worried about going forward to that car really easy online for health, small amount is a third person should immediately. What is a nominal policy is a surveyor or losses which the hdfc ergo motor insurance online renewal process can be used to pad its. -

Annual Report and Accounts 2010

bupa Registered office the British united Provident Bupa House Association Limited is a company 15-19 Bloomsbury Way limited by guarantee. London WC1A 2BA registered in england No. 432511. a For further copies of this document nnual report 2010 ‘Bupa’ and the Heartbeat logo are +44 (0)20 7656 2300 registered service marks. Press office +44 (0)20 7656 2454 bupa annual report 2010 W i t H yo u t H r o u g H L i f e rA / 2010 www.bupa.com 2 0 1 0 H i g hl i g H t s Group revenues 5 year record Group underlying 5 year record (up 9%) surplus before tax 06 £3,827.2m 06 £359.1m £7.58bn 07 £4,250.1m £464.9m 07 £374.2m 2009: £6.94bn 08 £5,923.9m 2009: £428.2m 08 £413.4m 09 £6,941.4m 09 £428.2m 10 £7,576.0m 10 £464.9m Group revenues by segment Surplus by segment* Care services £1,182.9m Care services £139.7m europe and North America £2,999.5m europe and North America £116.7m international Markets £3,394.0m international Markets £208.9m throughout the annual report and accounts: equity 5 year record underlying surplus before taxation expense excludes non-recurring items (mainly adjustments relating to amortisation of other intangible assets attributable arising on business combinations, impairment of goodwill and other to bupa 06 £1,917.1m intangible assets, profit / (loss) on sale of businesses and assets, the impact 07 £3,347.4m of property revaluations, realised and unrealised foreign exchange gains and losses and the absolute return on return seeking assets). -

Blue Cross Blue Shield Companies, Bupa Join to Create Largest Global Healthcare Network, Covering 190 Countries

Blue Cross Blue Shield Companies, Bupa Join to Create Largest Global Healthcare Network, Covering 190 Countries GeoBlue, an international health insurance product offered in the U.S. via the BCBS network, to be expanded CHICAGO and LONDON, Jan. 9, 2014 – The Blue Cross Blue Shield Association (BCBSA) and Bupa today announced a strategic global partnership that will create the largest healthcare provider network in the world for international health insurance customers. The U.K.-headquartered international healthcare company Bupa, and the largest U.S.-based health insurance group the Blue Cross and Blue Shield (BCBS) system, are teaming up to expand GeoBlue, the global health insurance product offered in the U.S. under the Blue Cross Blue Shield brand. The partnership includes Bupa’s purchase of a 49 percent stake in Highway to Health, Inc. (HTH)*, which sells and administers the GeoBlue international health insurance products. BCBSA and a group of BCBS companies continue to own the remaining 51 percent. Launching later this year, the partnership will create the largest global health care provider network, combining the BCBS network in the U.S., and GeoBlue’s and Bupa’s global networks, totaling more than 11,500 hospitals and approximately 750,000 medical professionals in more than 190 countries. Bupa and BCBS companies will also develop new insurance products offered through GeoBlue, which will be available to customers and employers for coverage in 2015. “I’m delighted Bupa has joined forces with Blue Cross and Blue Shield organizations – this is the biggest partnership the international health insurance market has ever seen,” said Robert Lang, managing director of the Bupa Global Market Unit. -

3Rd Webinar on General Insurance 23Rd December 2020

3rd Webinar on General Insurance 23rd December 2020 Consolidation in Non-Life Insurance Industry Nidhesh Jain Research Analyst, Investec Presentation Outline • Evolution of Non-Life Sector in India • Consolidation Curve (Four phases of consolidation) • Consolidation Curve: Case Study: Indian Telecom Sector • How consolidation happened in other counties in Non-Life Sector? Lessons from UK, US and China. • Factors driving acquisitions • Key M&As globally in Insurance • M&A deals in Non-Life Sector in India • Where do we stand on consolidation drive in India? • Case Study: ICICI Lombard – Bharti-Axa Deal www.actuariesindia.org Evolution of Non-Life Sector in India . Insurance Regulatory and Development Authority Act (IRDA Act) of 1999 came into . Till now all the segments of general 2020 effect on 19th April 2000 which ended the insurance were tariffed and the premiums monopoly of GIC and its subsidiaries and were decided by IRDAI. As on 2007, De- liberalized the insurance business in India. tariffication of all non-life insurance . The sector was once again opened . IRDA was incorporated as the statutory products except the auto third-party up by Increasing FDI Limits to 49% body to regulate and register private sector liability segment was done. from 26%. insurance companies. Motor Third party pool was created . General Insurance Corporation (GIC), wherein all the claims would be collected along with its four subsidiaries, i.e., in this pool and would be divided National Insurance Company Ltd., Oriental amongst all the companies in their Insurance Company Ltd., New India respective market share. This lead to Assurance Company Ltd. and United India adverse losses in the motor TP segment. -

SWIFT Gpi Delivering the Future of Cross-Border Payments, Today SWIFT Gpi SWIFT Gpi

SWIFT gpi Delivering the future of cross-border payments, today SWIFT gpi SWIFT gpi SWIFT gpi 4 SWIFT is an innovative The Concept 8 technology company. As an industry cooperative, we listen The Tracker 10 Delivering and respond to the evolving The Observer 12 needs of our Community. The Directory 14 Part of our core mission is to Market infrastructures 16 the future of bring the financial community The Roadmap 18 together to work collaboratively to shape market practice, Enable digital transformation 22 define standards and debate Explore new technology 24 cross-border issues of mutual interest. payments, Innovation is an ongoing process, and through our R&D programmes and initiatives such as SWIFTLab, Innotribe, today and the SWIFT Institute, SWIFT is ideally placed to offer insights into the future of global financial technology and work with our Community to make real world change really happen. 2 3 SWIFT gpi SWIFT gpi SWIFT gpi SWIFT global payments innovation (gpi) In its first phase, SWIFT gpi focuses on business-to-business At Citi, we welcome the launch of As an early member of SWIFT dramatically improves the customer payments. It is designed to help corporates grow their international SWIFT gpi – we see this as a key gpi, Bank of China successfully experience in cross-border payments business, improve supplier initiative in evolving how cross- completed the gpi pilot and by increasing the speed, transparency relationships, and achieve greater border payments are transacted. was one of the first banks to treasury efficiencies. Thanks to SWIFT The time is right for the industry to go live.