Reporting 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CORSIA Aeroplane Operator to State Attributions

CORSIA Aeroplane Operator to State Attributions This is a preliminary version of the ICAO document “CORSIA Aeroplane Operator to State Attributions” that has been prepared to support the timely implementation of CORSIA from 1 January 2019. It contains aeroplane operators with international flights, and to which State they are attributed, based on information reported by States by 30 November 2018 in accordance with the Environmental Technical Manual (Doc 9501), Volume IV – Procedures for Demonstrating Compliance with the CORSIA, Chapter 3, Table 3-1. Terms used in the tables on the following pages are: • Aeroplane Operator Name is the full name of the aeroplane operator as reported by the State; • Attribution Method is one of three options as selected by the State: "ICAO Designator", "Air Operator Certificate" or "Place of Juridical Registration" in accordance with Annex 16 – Environmental Protection, Volume IV – Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), Part II, Chapter 1, 1.2.4; and • Identifier is associated with each Attribution Method as reported by the State: o If the Attribution Method is "ICAO Designator", the Identifier is the aeroplane operator's three-letter designator according to ICAO Doc 8585; o If the Attribution Method is "Air Operator Certificate", the Identifier is the number of the AOC (or equivalent) of the aeroplane operator; o If the Attribution Method is "Place of Juridical Registration", the Identifier is the name of the State where the aeroplane operator is registered as juridical person. Disclaimer: The designations employed and the presentation of the material presented herein do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

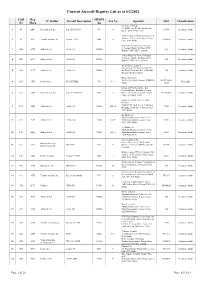

To Access the List of Registered Aircraft As on 2Nd August

Current Aircraft Registry List as at 8/2/2021 CofR Reg MTOM TC Holder Aircraft Description Pax No Operator MSN Classification No Mark /kg Cherokee 160 Ltd. 24, Id-Dwejra, De La Cruz Avenue, 1 41 ABW Piper Aircraft Inc. Piper PA-28-160 998 4 28-586 Aeroplane (land) Qormi QRM 2456, Malta Malta School of Flying Company Ltd. Aurora, 18, Triq Santa Marija, Luqa, 2 62 ACL Textron Aviation Inc. Cessna 172M 1043 4 17260955 Aeroplane (land) LQA 1643, Malta Airbus Financial Services Limited 6, George's Dock, 5th Floor, IFSC, 3 1584 ACX Airbus S.A.S. A340-313 275000 544 Aeroplane (land) Dublin 1, D01 K5C7,, Ireland Airbus Financial Services Limited 6, George's Dock, 5th Floor, IFSC, 4 1583 ACY Airbus S.A.S. A340-313 275000 582 Aeroplane (land) Dublin 1, D01 K5C7,, Ireland Air X Charter Limited SmartCity Malta, Building SCM 01, 5 1589 ACZ Airbus S.A.S. A340-313 275000 4th Floor, Units 401 403, SCM 1001, 590 Aeroplane (land) Ricasoli, Kalkara, Malta Nazzareno Psaila 40, Triq Is-Sejjieh, Naxxar, NXR1930, 001-PFA262- 6 105 ADX Reno Psaila RP-KESTREL 703 1+1 Microlight Malta 12665 European Pilot Academy Ltd. Falcon Alliance Building, Security 7 107 AEB Piper Aircraft Inc. Piper PA-34-200T 1999 6 Gate 1, Malta International Airport, 34-7870066 Aeroplane (land) Luqa LQA 4000, Malta Malta Air Travel Ltd. dba 'Malta MedAir' Camilleri Preziosi, Level 3, Valletta 8 134 AEO Airbus S.A.S. A320-214 75500 168+10 2768 Aeroplane (land) Building, South Street, Valletta VLT 1103, Malta Air Malta p.l.c. -

Ryanair Buys Malta Air Startup to Target African Markets 11 June 2019

Ryanair buys Malta Air startup to target African markets 11 June 2019 DAC overseeing the Irish group's main operations, Lauda for its Austrian-based business and Buzz, or Polish unit. Malta Air will now be the fourth division. "Ryanair is pleased to welcome Malta Air to the Ryanair Group of airlines which now includes Buzz (Poland), Lauda (Austria), Malta Air, and Ryanair (Ireland)," O'Leary added on Tuesday. "Malta Air will proudly fly the Maltese name and flag to over 60 destinations across Europe and North Africa as we look to grow our Maltese based fleet, routes, traffic and jobs over the next three years." © 2019 AFP Air Malta is Ryanair's ticket into more African markets Irish no-frills airline Ryanair said Tuesday that it will buy Maltese startup Malta Air, forming a new division that reaches more markets in north Africa from the Mediterranean island. "Ryanair Holdings ... today announced it has agreed to purchase Malta Air," the Dublin-based company said in a statement. The Dublin-based company will move its Malta- based fleet of six Boeing 737 aircraft into the new subsidiary. Ryanair will seek to increase the division's total fleet to ten aircraft over the next three years, creating some 350 jobs. The deal, whose value was not disclosed, is expected to complete at the end of June. The news comes as Ryanair overhauls its operations into distinct operations, mirroring a set- up by British Airways owner IAG. Under group boss Michael O'Leary will be Ryanair 1 / 2 APA citation: Ryanair buys Malta Air startup to target African markets (2019, June 11) retrieved 26 September 2021 from https://phys.org/news/2019-06-ryanair-malta-air-startup-african.html This document is subject to copyright. -

DHL and Leipzig Now Lead ATM Stats 3 European Airline Operations in April According to Eurocontrol

Issue 56 Monday 20 April 2020 www.anker-report.com Contents C-19 wipes out 95% of April air traffic; 1 C-19 wipes out 95% of April air traffic; DHL and Leipzig now lead movements statistics in Europe. DHL and Leipzig now lead ATM stats 3 European airline operations in April according to Eurocontrol. The coronavirus pandemic has managed in the space of a According to the airline’s website, Avinor has temporarily month to reduce European air passenger travel from roughly its closed nine Norwegian airports to commercial traffic and 4 Alitalia rescued (yet again) by Italian normal level (at the beginning of March) to being virtually non- Widerøe has identified alternatives for all of them, with bus government; most international existent (at the end of March). Aircraft movement figures from transport provided to get the passengers to their required routes from Rome face intense Eurocontrol show the rapid decrease in operations during the destination. competition; dominant at Milan LIN. month. By the end of the month, flights were down around Ryanair still connecting Ireland and the UK 5 Round-up of over 300 new routes 90%, but many of those still operating were either pure cargo flights (from the likes of DHL and FedEx), or all-cargo flights Ryanair’s current operating network comprises 13 routes from from over 60 airlines that were being operated by scheduled airlines. Ireland, eight of which are to the UK (from Dublin to supposed to have launched during Birmingham, Bristol, Edinburgh, Glasgow, London LGW, London the last five weeks involving Leipzig/Halle is now Europe’s busiest airport STN and Manchester as well as Cork to London STN). -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

(UE) 2018/336 De La Comisión, De 8 De Marzo De 2018

13.3.2018 ES Diario Oficial de la Unión Europea L 70/1 II (Actos no legislativos) REGLAMENTOS REGLAMENTO (UE) 2018/336 DE LA COMISIÓN de 8 de marzo de 2018 que modifica el Reglamento (CE) n.o 748/2009, sobre la lista de operadores de aeronaves que han realizado una actividad de aviación enumerada en el anexo I de la Directiva 2003/87/CE el 1 de enero de 2006 o a partir de esta fecha, en la que se especifica el Estado miembro responsable de la gestión de cada operador (Texto pertinente a efectos del EEE) LA COMISIÓN EUROPEA, Visto el Tratado de Funcionamiento de la Unión Europea, Vista la Directiva 2003/87/CE del Parlamento Europeo y del Consejo, de 13 de octubre de 2003, por la que se establece un régimen para el comercio de derechos de emisión de gases de efecto invernadero en la Comunidad y por la que se modifica la Directiva 96/61/CE del Consejo (1), y en particular su artículo 18 bis, apartado 3, letra b), Considerando lo siguiente: (1) La Directiva 2008/101/CE del Parlamento Europeo y del Consejo (2) modificó la Directiva 2003/87/CE para incluir las actividades de aviación en el régimen que regula el comercio de derechos de emisión de gases de efecto invernadero en la Unión. (2) El Reglamento (CE) n.o 748/2009 de la Comisión (3) establece una lista de los operadores de aeronaves que han realizado una actividad de aviación enumerada en el anexo I de la Directiva 2003/87/CE el 1 de enero de 2006 o a partir de esta fecha. -

Aviation Week Aviation Daily, Thursday, July 30, 2020

The Business Daily of the Global Scheduled Airline Industry Since 1939 July 30, 2020 AIRFRAMERS Boeing Deepens Production Cuts, Inside: Delays 777X GUY NORRIS, [email protected] AIRLINES JetBlue Tests Honeywell UV Facing another heavy quarterly loss of $2.4 billion, the COVID-19-triggered market Cabin Disinfection System PAGE 3 downturn, and continued uncertainty over the timing of the return-to-service of the 737 Wizz Air Has Been ‘Waiting For This MAX, Boeing is making further cutbacks to its commercial aircraft production rates, Moment For 10 Years,’ CEO Says PAGE 5 studying additional layoffs and delaying deliveries of the 777X until 2022. Laudamotion To Shut, Become Announcing new steps in its aggressive retrenchment plan as part of the company’s Malta-Based Lauda Europe PAGE 6 2020 second-quarter results, Boeing also confirmed production of the 747 will end in SUPPLIERS 2022 and said it is evaluating whether to consolidate in one location its two 787 produc- GE Aviation Finances Battered tion facilities in Everett, Washington and Charleston, South Carolina. By Production, Services Slowdowns PAGE 4 The company’s priority remains fixed on returning the 737 to service, but with 450 REGULATORY/LEGISLATIVE aircraft already built and in storage awaiting delivery, Boeing is slowing plans to ramp up Majority Of U.S. House Urge Payroll production to 31 per month from 2021 to early 2022 amid on-going market softness and Support Extension PAGE 6 the prolonged process of recertification. Boeing now believes deliveries will restart in the fourth quarter of 2020 pending clearance of the MAX, which was grounded in March 2019 after two fatal accidents. -

List of EU Air Carriers Holding an Active Operating Licence

Active Licenses Operating licences granted Member State: Austria Decision Name of air carrier Address of air carrier Permitted to carry Category (1) effective since ABC Bedarfsflug GmbH 6020 Innsbruck - Fürstenweg 176, Tyrolean Center passengers, cargo, mail B 16/04/2003 AFS Alpine Flightservice GmbH Wallenmahd 23, 6850 Dornbirn passengers, cargo, mail B 20/08/2015 Air Independence GmbH 5020 Salzburg, Airport, Innsbrucker Bundesstraße 95 passengers, cargo, mail A 22/01/2009 Airlink Luftverkehrsgesellschaft m.b.H. 5035 Salzburg-Flughafen - Innsbrucker Bundesstraße 95 passengers, cargo, mail A 31/03/2005 Alpenflug Gesellschaft m.b.H.& Co.KG. 5700 Zell am See passengers, cargo, mail B 14/08/2008 Altenrhein Luftfahrt GmbH Office Park 3, Top 312, 1300 Wien-Flughafen passengers, cargo, mail A 24/03/2011 Amira Air GmbH Wipplingerstraße 35/5. OG, 1010 Wien passengers, cargo, mail A 12/09/2019 Anisec Luftfahrt GmbH Office Park 1, Top B04, 1300 Wien Flughafen passengers, cargo, mail A 09/07/2018 ARA Flugrettung gemeinnützige GmbH 9020 Klagenfurt - Grete-Bittner-Straße 9 passengers, cargo, mail A 03/11/2005 ART Aviation Flugbetriebs GmbH Porzellangasse 7/Top 2, 1090 Wien passengers, cargo, mail A 14/11/2012 Austrian Airlines AG 1300 Wien-Flughafen - Office Park 2 passengers, cargo, mail A 10/09/2007 Disclaimer: The table reflects the data available in ACOL-database on 16/10/2020. The data is provided by the Member States. The Commission does not guarantee the accuracy or the completeness of the data included in this document nor does it accept responsibility for any use made thereof. 1 Active Licenses Decision Name of air carrier Address of air carrier Permitted to carry Category (1) effective since 5020 Salzburg-Flughafen - Innsbrucker Bundesstraße AVAG AIR GmbH für Luftfahrt passengers, cargo, mail B 02/11/2006 111 Avcon Jet AG Wohllebengasse 12-14, 1040 Wien passengers, cargo, mail A 03/04/2008 B.A.C.H. -

Introducing the CAPA Interiors Database Tap Into Rich and Unrivalled Insights on All Aspects of Global Commercial Fleet Interiors

NEWLY LAUNCHED DATA TOOL Introducing the CAPA Interiors Database Tap into rich and unrivalled insights on all aspects of global commercial fleet interiors. Discover your new comprehensive resource. centreforaviation.com Rebooted and ready to serve Our aim is to make a difference 2020 is a year like no other. The challenge is greater than anything we’ve experienced in our careers and enormous changes are coming to our industry. The pace of adaptation and evolution is dizzying. In keeping with this paradigm, we are more committed than ever to create and deliver new tools that will arm our Members with the right intelligence and strategic insights to weather this storm. The CAPA Interiors Database is aimed at capturing all commercial cabin components in the current and future aviation market. This data will allow clients and analysts to better understand trends behind the ever- changing dynamics of the industry. Our aim is to make a difference and we’re ready to work with you in a new way to access the data and information you need to flourish in this new world. CAPA has rebooted our data offerings and we invite you to join us on this new journey! Derek Sadubin, Managing Director CAPA - Centre for Aviation Meet the CAPA Interiors Database Providing rich and unrivalled insights into the fleet interiors market. Product overview CAPA’s new Interiors Database is designed to be your resource for all things aircraft interiors. Allowing you to quickly see trends and spot new business opportunities. Encapsulating all aspects of this market such as seat models, inflight entertainment (IFE), and inflight connectivity (IFC), it’s the most extensive data source of its kind. -

Annual Statistical Summary

2015 Annual Statistical Summary 2015 2014 Passenger Movements (Scheduled & non-Scheduled) 4,618,640 4,290,304 Quick Reference Aircraft Movements (Scheduled & non-Scheduled) 34,242 32,247 Cargo & Mail (Scheduled, non-Scheduled & General Aviation), in kilos 16,413,756 15,546,540 report 1 Monthly Summary of Pax, Movement, Cargo 2 International Monthly Totals for the last five years 3 Peaks 4 By the Hour 5 Monthly Totals by Main Countries / Regions 6 Monthly Totals by Country Passenger Movements 7 Monthly Totals by Airport of Destination / Origin 8 Airlines operating to/from Malta 9 Monthly Totals by Main Countries / Regions 10 Monthly Totals by Country Aircraft Movements 11 Monthly Totals by Airport of Destination / Origin 12 Airlines operating to/from Malta 13 Monthly Totals by Main Countries / Regions Cargo Movements 14 Monthly Totals by Airport of Destination / Origin 15 Airlines operating to/from Malta report 1 Monthly Summary of Pax, Movement, Cargo Passenger Movements Scheduled & Non-Scheduled Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2015 Total 2014 Arrivals 104,941 106,882 141,405 201,908 225,271 232,752 282,628 282,289 249,467 226,759 133,820 122,026 2,310,148 2,144,193 Departures 103,935 102,014 133,929 191,284 216,648 226,546 265,479 302,929 253,429 237,798 149,676 124,825 2,308,492 2,146,111 Total [Scheduled & Non- 208,876 208,896 275,334 393,192 441,919 459,298 548,107 585,218 502,896 464,557 283,496 246,851 4,618,640 4,290,304 Scheduled] Transit [counted only on departure] 200 435 83 77 281 806 335 738 662 198 178