SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549 ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Special Advertising Section

2 Special Advertising Section shop MERLE HAY MALL GRAND OPENING, SUNDAY, JULY 24 AT 8 AM Soon! The world’s largest and most respected gourmet coff ee company will soon call Merle Hay Mall home! Starbucks, Inc. is currently Just opened! Fun and funky fashion-forward private label constructing an 1,836 square-foot store at the sportswear and accessories for “tweens” ages 7 to 14. east entrance to the mall, across from Applebees. This store will be the fi rst stand-alone store in the Des Moines area. Enjoy tasty beverages, food and merchandise in the comfortable indoor seating area or at the outdoor umbrella tables. In a hurry? Swing through the drive-up window! Opening mid-August. In the Target hallway across from Old Navy shopshop MERLE HAY MALL SpecialSpecial AdvertisingAdvertising Section 3 ISSUE NO. 6: AUGUST/SEPTEMBER/OCTOBER, 2005 Mall Events 4 There’s always something going on at Merle Hay Mall! Look Smart 6 AUGUST 5–31 Get the skinny on the latest fall fashions. Shop Savvy 7 Check out these tips for the back-to-school shopper. Otis’s Fun Forest 8 will be given away to area schools! Ready for a challenge? Try this wordpuzzle! Raising money for your school while you shop at Merle Hay Mall is easy! Here’s how: 1) Shop any store in Merle Hay Mall. VISIT US ONLINE! WWW.MERLEHAYMALL.COM 2) Bring your receipt(s) to Customer Service. All receipts must be from purchases made at Merle Hay Mall from August 5–31, 2005. Each receipt can only be submitted once. -

L BRANDS, INC. (Exact Name of Registrant As Specified in Its Charter) (Formerly Known As Limited Brands, Inc.) ______

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 ______________________________________________________ FORM 10-K ______________________________________________________ (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 1, 2014 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] For the transition period from to Commission file number 1-8344 ______________________________________________________ L BRANDS, INC. (Exact name of registrant as specified in its charter) (Formerly known as Limited Brands, Inc.) _________________________________________________ Delaware (State or other jurisdiction 31-1029810 of incorporation or organization) (I.R.S. Employer Identification No.) Three Limited Parkway, Columbus, Ohio 43230 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (614) 415-7000 ______________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $.50 Par Value The New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Copyrighted Material

15_787434 bindex.qxp 6/13/06 6:45 PM Page 314 INDEX A Alexander McQueen, 108, 140 Aaron Faber, 192–193 Alfred Dunhill, 199 Aaron’s, 289–290 Allan & Suzi, 87 ABC Carpet & Home, 12, 16, 21–22, American Express, 49 105, 108, 244, 249 American Girl Place, 93–94 Abercrombie & Fitch, 167 Amish Market, 173 About.com, 35 Amore Pacific, 117, 238–239 Accessories, 131–135 Amsterdam Avenue, 87 Accommodations, 67–77 Andy’s Chee-Pees, 216 chains, 76–77 An Earnest Cut & Sew, 189–190 dining deals, 57–58 Ann Ahn, 149 four-star, 73 Anna Sui, 137 luxury, 71–73 Anne Fontaine, 155 promotions, 53 The Annex/Hell’s Kitchen Flea Market, promotions and discounts, 69–71 267–268 tax, 70 Ann Taylor, 86, 167 unusual locations, 75–76 Ann Taylor LOFT, 90, 168 Active sportswear, 135–136 Anthropologie, 105, 117 Add, 131 Antiques, 275–278 Adidas, 21, 135 Anya Hindmarch, 184 Adrien Linford, 102, 255 AOL CityGuide New York, 35 Adriennes, 151 The Apartment, 255, 263 Aerosoles, 207 APC, 186–187 AfternoonCOPYRIGHTED tea, 18, 66–67 A Pea In The MATERIAL Pod, 198 Agatha Ruiz de la Prada, 255 Apple Core Hotels, 76 Airport duty-free stores, 55–56 Apple Store, 116, 264 Akris, 139 April Cornell, 22, 88 Alcone Company, 109–110, 224–225 Arcade Auctions, Sotheby’s, 275 314 15_787434 bindex.qxp 6/13/06 6:45 PM Page 315 Index 315 Armani Casa, 245 Barneys Co-Op, 12, 110, 159 Arriving in New York, 44–45 Barneys New York, 160, 198, 199, Ascot Chang, 85, 199 212, 256 A Second Chance, 307 cafe, 63 Atlantic Avenue (Brooklyn), antiques Barneys Warehouse Sale, 110 shops, 277 Barolo, 67 Au Chat Botte, 156–157 Bathroom accessories, 263 Auctions for art and antiques, 269–275 Bauman Rare Books, 147 Auto, 187, 255–256 Beacon’s Closet (Brooklyn), 128 Aveda, 100, 219–220 Beauty products, 218–240 Aveda Institute, 220, 239 bath and body stores, 228–230 Avon Salon & Spa, 220, 239 big names, 219–223 A. -

Black Magic NEW YORK — Carolina Herrera Is out to Prove That Men Can Be Every Bit As Stylish As Women with Chic for Men, Her Third Men’S Scent

PRADA’S DEBT PLAN/2 GAP CEDES GERMANY TO H&M/2 WWWDomen’s Wear Daily • The Retailers’FRIDAY Daily Newspaper • February 6, 2004 • $2.00 Beauty Black Magic NEW YORK — Carolina Herrera is out to prove that men can be every bit as stylish as women with Chic for Men, her third men’s scent. The fragrance, which also borrowed inspiration from the simplicity of classic black-and-white photography, will roll out in Saks Fifth Avenue doors at the end of this month, and enter the rest of its 200-door distribution in September. It could do $3.5 million at retail in its first year. For more, see page 13. Luxury on a Roll: Double-Digit Gains for Third Straight Month By Jennifer Weitzman arrival of new spring lines. Chilly Comparable-Store Sales Index and Ross Tucker weather and gift-card redemptions came in with a 5.9 percent increase BY BRYN KENNY NEW YORK — Luxury’s momentum also drove traffic. for the month, its highest gain since continued in January while In turn, retailers reported strong September 2003 when it also consumers were also lured into comparable-store gains. The showed a 5.9 percent increase. stores by clearance sales and the Goldman Sachs Retail Composite See Strong, Page 20 PHOTO BY GEORGE CHINSEE; STYLED 2 WWD, FRIDAY, FEBRUARY 6, 2004 WWDFRIDAY Prada Plans to Halve Debt Beauty By Courtney Colavita Patrizio lion euro, or $82 million, tax re- Patrizio bate from the Italian government BEAUTY Bertelli MILAN — This may or may not Bertelli would enable Prada to cut its Coty Beauty is hoping for back-to-back hits with the launch of a second be the year of Prada’s long- debt to 290 million euros, or 12 Celine Dion fragrance this spring called Celine Dion Parfum Notes. -

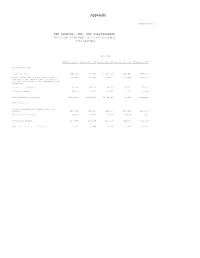

Appendix Limitedbran

Appendix EXHIBIT 12 ---------- THE LIMITED, INC. AND SUBSIDIARIES RATIO OF EARNINGS TO FIXED CHARGES (Thousands) Year Ended ------------------------------------------------------------------------------------ February 3, 2001 January 29, 2000 January 30, 1999 January 31, 1998 February 1, 1997 ---------------- ---------------- ---------------- ---------------- ---------------- Adjusted Earnings ----------------- Pretax earnings $758,905 $831,759 $2,351,494 $390,653 $675,088 Portion of minimum rent ($653,820 in 2000, 217,940 223,987 229,747 246,162 237,419 $671,960 in 1999, $689,240 in 1998, $738,487 in 1997, and $712,258 in 1996) representative of interest Interest on indebtedness 58,244 78,297 68,528 68,728 75,363 Minority interest 69,345 72,623 63,616 55,610 45,466 ------------ ------------ ------------ ------------ ------------ Total earnings as adjusted $1,104,434 $1,206,666 $2,713,385 $761,153 $1,033,336 ============ ============ ============ ============ ============ Fixed Charges ------------- Portion of minimum rent representative of interest $217,940 $223,987 $229,747 $246,162 $237,419 Interest on indebtedness 58,244 78,297 68,528 68,728 75,363 ------------ ------------ ------------ ------------ ------------ Total fixed charges $276,184 $302,284 $298,275 $314,890 $312,782 ============ ============ ============ ============ ============ Ratio of earnings to fixed charges 4.00x 3.99x 9.10x 2.42x 3.30x ============ ============ ============ ============ ============ Exhibit 13 6 FINANCIAL SUMMARY (Millions except per share amounts, -

THE DRESS BARN, INC. (Exact Name of Registrant As Specified in Its Charter) Connecticut 06-0812960 (State Or Other Jurisdiction of (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K/A (Amendment No. 1) ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended July 31, 2010 Commission file number 0-11736 THE DRESS BARN, INC. (Exact name of registrant as specified in its charter) Connecticut 06-0812960 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 30 Dunnigan Drive, Suffern, New York 10901 (Address of principal executive offices) (Zip Code) (845) 369-4500 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.05 par value The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

View Annual Report

“WE KNOW THAT THE PATH TO CREATING VALUE FOR OUR SHAREHOLDERS IS BY CREATING VALUE FOR OUR CUSTOMERS. ACROSS ALMOST 4,000 STORES, OUR NEARLY 50,000 ASSOCIATES KNOW THAT CUSTOMER SERVICE MAKES THE DIFFERENCE.” 2013 has been an evolutionary year for our business. We made significant progress in a number of areas, particularly with respect to the integration of our acquisition of the Charming Shoppes businesses. We have embarked on a transformation of our operating platform. This is a wide-ranging effort designed to create a strong shared services platform that centralizes our operations, unlocks synergy and efficiency, improves our financial performance and positions us for continued growth and value creation. Over the past year, we’ve continued to build an experienced executive team that will achieve our vision. Key hires have included Dirk Montgomery, who joined us as our new Chief Financial Officer in January, and Linda Heasley, our new CEO of Lane Bryant, who will help us write the next chapter for that brand. We have attracted talent for key positions across the company, including new senior merchandising leaders. This is a world- class team with high aspirations and expectations. Our fiscal 2013 results, particularly in the early part of the year, This focus is increasingly important because today’s consumer has reflect the transition in the business, including our pre-integration reduced discretionary expenditures, demands greater value for cost structure and some merchandising challenges at Lane Bryant her dollar, and has become smarter and more educated with every and dressbarn. We finished the year with operational strength passing season. -

Limited Brands Reports June Sales

Limited Brands Reports June Sales July 11, 2002 COLUMBUS, Ohio, July 11 /PRNewswire-FirstCall/ -- Limited Brands (NYSE: LTD) reported a comparable store sales increase of 5% for the five weeks ended July 6, 2002 compared to the five weeks ended July 7, 2001. Net sales were $858.7 million, an increase of 8% compared to adjusted sales of $793.3 million last year. Adjusted sales in 2001 exclude sales from Lane Bryant, which was sold to Charming Shoppes, Inc. (Nasdaq: CHRS) in August 2001. Net sales for the five weeks ended July 7, 2001 including Lane Bryant were $878.1 million. (Photo: http://www.newscom.com/cgi-bin/prnh/20020520/CLM001LOGO ) The Company reported a comparable store sales increase of 4% for the twenty-two weeks ended July 6, 2002 compared to the twenty-two weeks ended July 7, 2001. Net sales were $3.557 billion, an increase of 8% compared to adjusted sales of $3.302 billion last year. Net sales for the twenty-two weeks ended July 7, 2001 including Lane Bryant were $3.707 billion. To hear Limited Brands' prerecorded June sales message, call 1-800-337- 6551, followed by the passcode LTD (583), or log onto www.Limitedbrands.com for an audio replay. ABOUT LIMITED BRANDS: Limited Brands, through Victoria's Secret, Bath & Body Works, Express, Express Men's (Structure), Lerner New York, Limited Stores, White Barn Candle Co. and Henri Bendel, presently operates 4,564 specialty stores. Victoria's Secret products are also available through the catalogue and www.VictoriasSecret.com . THE LIMITED, INC. June 2002 Comparable Store Sales -

State of North Carolina Before the Tax Review Board County of Wake

STATE OF NORTH CAROLINA BEFORE THE TAX REVIEW BOARD COUNTY OF WAKE IN THE MATTER OF: The Proposed Corporate ) Franchise and Income Tax ) Assessments for the Fiscal ) Years of January 31, 1992 ) through January 31, 1994 ) by the Secretary of Revenue ) of North Carolina ) ) ADMINISTRATIVE DECISION vs. ) Number: 381 A&F Trademark, Inc., ) Caciqueco, Inc., ) Expressco, Inc., ) Lanco, Inc., ) Lernco, Inc., ) Limco Investments, Inc., ) Limtoo, Inc., ) Structureco, Inc. ) V. Secret Stores, Inc. ) This matter was heard before the Tax Review Board (hereinafter “Board”) in the City of Raleigh, Wake County, North Carolina, in the office of the State Treasurer on Thursday, February 14, 2002, upon the Petition of A&F Trademark, Inc., Caciqueco, Inc., Expressco, Inc., Lanco, Inc., Lernco, Inc., Limco Investments, Inc., Limtoo, Inc., Structureco, Inc., and V. Secret Stores, Inc. (“hereinafter Taxpayers”) for administrative review of the Final Decision of Michael A. Hannah, Assistant Secretary of the North Carolina Department of Revenue, entered on September 19, 2000, sustaining the Department’s proposed assessment of corporate franchise and income taxes for fiscal year ended January 31, 1994. Chairman Richard H. Moore, State Treasurer, presided over the hearing with Jo Anne Sanford, Chair, Utilities Commission and duly appointed member, Noel L. Allen, Attorney at Law participating. Paul H. Frankel, Hollis L. Hyans, and Craig B. Fields of Morrison & Foerster, LLP, and Jasper L. Cummings, Jr., of Alston & Bird, LLP represented the Taxpayers at the hearing. Kay Miller Hobart, Assistant Attorney General, represented the Secretary of Revenue at the hearing. STATEMENT OF FACTS The Taxpayers are nine wholly-owned subsidiaries of the Limited Stores, Inc. -

The Limited, Inc. Announces Fourth Quarter Earnings and Additional Initiatives to Increase Shareholder Value

The Limited, Inc. Announces Fourth Quarter Earnings and Additional Initiatives to Increase Shareholder Value February 28, 2001 -- Pursuing Strategic or Financial Buyer for Lane Bryant -- -- Integrating Structure into the Express Brand under the Leadership of Michael Weiss -- -- Other Organizational Changes Announced -- COLUMBUS, Ohio, Feb. 28 /PRNewswire/ -- The Limited, Inc. (NYSE: LTD; London) today announced a number of initiatives designed to further the creation of shareholder value. The Company also announced adjusted fourth quarter earnings per share, excluding special items, of $0.55, in line with current Wall Street estimates. The initiatives include: * The intention to sell Lane Bryant to a strategic or financial buyer; * The integration of Structure into the Express brand as Express Men's, under the leadership of Express President and CEO Michael Weiss; and, * Key organizational changes at the Company. "These initiatives are a continuation of our focus on offering our customers the best shopping experience, our associates the best career opportunities, and our shareholders maximum value," said Leslie H. Wexner, Chairman and CEO of The Limited. Sale of Lane Bryant The Company announced its intent to pursue a strategic or financial buyer for Lane Bryant and has retained Lazard Freres to represent it in this transaction. "Lane Bryant has established itself as the leading women's plus- size business. It is well positioned and now is an ideal time to pursue future growth opportunities with a strategic or financial buyer," Mr. Wexner said. Ken Gilman will join Lane Bryant as CEO. Jill Dean will retain her position as President of Lane Bryant. "I want to thank Ken for his more than 25 years of dedicated service to The Limited, most recently as Vice-Chairman and Chief Administrative Officer. -

Abercrombie & Fitch: Values, Culture and Business Ethics in Fashion

Abercrombie & Fitch: Values, Culture and Business Ethics in Fashion Verónica Arribas Barreras ISEM Fashion Business School, Spain [email protected] Isabel García Hiljding ISEM Fashion Business School, Spain [email protected] Lourdes Susaeta Erburu ISEM Fashion Business School and IESE Business School, Spain [email protected] José Ramón Pin Arboledas IESE Business School, Spain [email protected] Abstract Purpose – The aim of this article is to discuss some ethical issues in the fashion industry and start a debate about business ethics from a stakeholder perspective. It analyzes the implications of fashion companies for employees, with policies and practices, and for customers, with the messages and the lifestyles they communicate, especially when targeting adolescents. It also aims to highlight how company leaders can influence the corporate culture and values. The paper ends with an open discussion of the impact this is having on society and how it can affect a company’s sustainability and performance. Design/Methodology/Approach – The methodology used in this paper is the case study. We have chosen the fashion company Abercrombie & Fitch (A&F) as it offers a fascinating example of how businesses – in the fashion industry overall – can promote or destroy ethical behavior through their cultural values and lifestyle as well as through management practices. Findings – The values communicated and promoted by the company – both internally and externally – have a real impact on society and this may have negative consequences for brand perception and company performance. Research Limitations – We are aware of the existence of limitations when analyzing a single case study due to the multiple interpretations it may have and the limited access to the company and to people directly involved in the case. -

LIMITED BRANDS, INC. (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] For the fiscal year ended January 31, 2004 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] For the transition period from to Commission file number 1-8344 LIMITED BRANDS, INC. (Exact name of registrant as specified in its charter) Delaware 31-1029810 (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) Three Limited Parkway, P.O. Box 16000, Columbus, Ohio 43216 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (614) 415-7000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $.50 Par Value The New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to the filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10- K.