Hampton-Alexander Review Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

KPMG Equity Capital Markets Review H1 2018

Equity Capital Markets Half Year Review H1 2018 kpmg.com/uk/equitycapitalmarkets 1 Equity Capital Markets review – H1 2018 H1 2018: Equity Capital Markets review H1 2018 snapshot The first half of 2018 ended strongly generating positive momentum in equity issuance especially in the UK where volumes were up. Overall, however, global ECM volumes were slightly lower versus H2 2017, continuing a trend seen since H1 2017 Overall, global equity issuance was slightly lower in H1 2018 versus H2 2017 Global Europe UK Funds raised Funds raised Funds raised (£000m) (£000m) (£000m) 25 400 125 20 issuance 100 300 15 75 200 10 50 100 5 25 0 Total ECM 0 0 H1 H2 H1 H2 H1 H1 H2 H1 H2 H1 H1 H2 H1 H2 H1 2016 2016 2017 2017 2018 2016 2016 2017 2017 2018 2016 2016 2017 2017 2018 IPOs Right Issues Placings Germany and the UK lead European ECM in H1 Largest 3 European and UK IPOs £20.1bn Siemens Healthineers AG £3.7bn highlights DWS Group GmbH £19.2bn & Co. KGaA £1.2bn Adyen BV European ECM European ECM £4.4bn £834m A very active half year for AIM IPOs beating H1 2017 and offsetting lower Main Market volumes Main Market AIM Funds raised Funds raised (£000m) No. deals (£000m) No. deals 41 IPOs 8 40 1.5 50 16% decrease on H1 2017 6 30 1.2 40 0.9 30 4 20 0.6 20 2 10 0.3 10 £4.3bn Funds Raised 0 0 0.0 0 H1 H2 H1 H2 H1 H1 H2 H1 H2 H1 44% decrease on H1 2017 2016 2016 2017 2017 2018 2016 2016 2017 2017 2018 Deal value Focus # Deals IPO UK IPO Key sectors Strong aftermarket performance of UK IPOs in H1 2018 Financial Services Main Market AIM £1,409m raised (13 deals) -

Herbert Smith Freehills Boosts London Corporate Capability with Ecm Partner Hire

HERBERT SMITH FREEHILLS BOOSTS LONDON CORPORATE CAPABILITY WITH ECM PARTNER HIRE 23 June 2020 | London Firm news Leading global law firm Herbert Smith Freehills has hired Michael Jacobs to join its market leading Global Corporate practice as an Equity Capital Markets partner in London. Michael joins the firm from Allen & Overy where he was a partner. He returns to London from Hong Kong, where he has spent the last three years. Michael is an equity capital markets specialist and has represented listed companies, underwriters and investors on initial public offerings, secondary offerings and other strategic equity transactions. He also regularly advises listed corporates on the equity capital markets implications of public and private M&A transactions and restructurings. Prior to relocating to Hong Kong, Michael acted on the initial public offerings of Worldpay, Virgin Money, Hastings Insurance, Neinor Homes and The Gym Group and secondary capital raises by companies including Great Portland Estates, Sirius Minerals, Ophir Energy, Capitec Bank, GKN, Vedanta Energy and the recapitalisation and consensual bail in of the Co- operative Bank. Michael is recommended by Legal 500 for equity capital markets transactions. Michael also has considerable experience across mainstream corporate finance transactions, including public and private M&A, board-level corporate advisory work, restructurings and regulatory advice for clients including advising on cross-border deals which span a wide range of sectors, including financial institutions, fintech and growth capital. His M&A experience includes advising on Banco de Sabadell’s takeover of TSB Banking Group and the acquisition of Northern Rock by Virgin Money, as well as on transactions for Ping An, Go-Jek, Discovery Capital and Roivant Sciences during his time in Hong Kong. -

Annual Report and Accounts 2018 01 Overview Performance Highlights for the Year to 31 March 2018

3i Group plc Overview Governance Introduction 01 Chairman’s introduction 58 Performance highlights 02 Board of Directors and Executive Committee 60 Chairman’s statement 02 Nominations Committee report 65 Chief Executive’s statement 04 Audit and Compliance Committee report 66 Action 08 Valuations Committee report 70 Directors’ remuneration report 73 Our business Relations with shareholders 83 Our business at a glance 10 Additional statutory and corporate governance information 84 Our business model 12 Our strategic objectives 14 Audited financial statements Key performance indicators 16 Private Equity 18 Consolidated statement of comprehensive income 92 Infrastructure 25 Consolidated statement of financial position 93 Performance, risk and sustainability Consolidated statement of changes in equity 94 Consolidated cash flow statement 95 Financial review 29 Company statement of financial position 96 Investment basis 35 Company statement of changes in equity 97 Reconciliation of Investment basis and IFRS 39 Company cash flow statement 98 Alternative Performance Measures 43 Significant accounting policies 99 Risk management 44 Notes to the accounts 104 Principal risks and mitigations 47 Independent Auditor’s report 139 Sustainability 52 Portfolio and other information 20 Large investments 148 Strategic report: Portfolio valuation – an explanation 150 pages 2 to 56. Information for shareholders 152 Directors’ report: pages Glossary 154 58 to 72 and 83 to 90. For definitions of our financial terms, used throughout this report, please see Directors’ remuneration our glossary on pages 154 to 156. report: pages 73 to 82. Consistent with our approach since the introduction of IFRS 10 in 2014, the financial data presented in the Overview and Strategic report is taken from the Investment basis financial statements. -

Annual Report & Accounts Report Ferrexpo Plc 2018 Annual

FERREXPO PLC ANNUAL REPORT 2018 ANNUAL REPORT & ACCOUNTS for over 40 years SINCE 1977, FERREXPO HAS SUPPLIED HIGH QUALITY IRON ORE PELLETS TO THE WORLD’S STEEL INDUSTRY. WE HAVE BEEN LISTED ON THE LONDON STOCK EXCHANGE FOR OVER 10 YEARS. The Group has had a premium listing on Ferrexpo is the largest exporter of iron ore the Main Market of the London Stock pellets in the Former Soviet Union (the Exchange since its IPO in June 2007 and it “FSU”) and currently the third largest is currently a constituent of the FTSE 250 supplier of blast furnace pellets to the Index and the FTSE4Good Index. global steel industry. For more information See pages 20-23 BUT IT’S THE FUTURE THAT INSPIRES US. OUR VISION IS TO KEEP ON GROWING BY DEVELOPING OUR PLENTIFUL RESOURCES AND ENABLING OUR PEOPLE TO PERFORM TO THEIR BEST. 01 Ferrexpo plc Annual Report & Accounts 2018 GROUP PERFORMANCE 2018 STRATEGIC REPORT LOST TIME INJURY FREQUENCY RATE TOTAL PRODUCTION Welcome to Ferrexpo IFC STRATEGIC REPORT STRATEGIC Group Performance 2018 01 Ferrexpo at a Glance 02 High Value Sector 03 x MT Long-Life Resource Base 04 1.18 10.6 Group LTIFR in line with 2017 (2017: 1.17x) 94% of production of 65% Fe pellets (2017: Low Cost and Well Invested Production 1 fatality during the year (2017: 1) total production 10.4Mt, 95% of production Process 05 of 65% Fe pellets) High Quality Product 06 Established Logistics 07 World Class Customer Base 08 REVENUE Sustainable Future 09 Business Model 10 Production Process 12 Chairman’s Statement 16 GOVERNANCECORPORATE Market Review 20 US$1.3BN -

Weekend News Summary

Weekend News Summary THE SUNDAY TIMES INDICES THIS MORNING Current (%) 1W% Change Cabi, the Avon for fashion, hits the U.K.’s doorsteps: Cabi, which has Value Change* more than 3,000 stylists selling personalised services to clients, has FTSE 100 7,329.7 -0.7% -0.8% become one of the world’s biggest direct-selling companies. It is set DAX 30 12,278.9 -0.07% -0.3% for a U.K. launch. CAC 40 5,471.2 -0.2% -1.7% Ferrexpo hit with tax bill in fresh setback: The embattled iron ore DJIA** 26,438.5 - -0.4% producer, Ferrexpo has been hit with a $16.2 million (£12.3 million) S&P 500** 2,932.5 - -0.4% demand by the authorities in Kiev following a government audit into NASDAQ Comp.** 8,123.3 - -0.5% how the company priced iron ore pellets sold to a Swiss subsidiary. Nikkei 225 21,923.7 -1.5% 0.0% Hang Seng 40 29,363.0 0.5% -2.3% BT, led by Philip Jansen, sees chance to charge more for rural Shanghai Comp 2,926.4 0.7% broadband: BT could be given licence to charge more for internet -5.1% Kospi 2,177.0 -0.9% connections in the countryside under proposals by the regulator to -0.9% encourage bolder investment in broadband. Ofcom may allow BT to BSE Sensex 38,550.4 -0.3% -1.2% hit broadband providers using its Openreach network with an S&P/ASX 200 6,295.7 0.2% -1.2% upfront cost to help fund the roll out of high-speed fibre in rural Current Values as at 10:15 BST, *%Chg from Monday Close, ** As on Monday Close areas where it is too expensive to invest. -

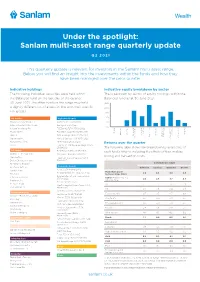

Sanlam Multi-Asset Range Quarterly Update

Under the spotlight: Sanlam multi-asset range quarterly update Q2 2021 This quarterly update is relevant for investors in the Sanlam multi-asset range. Below you will find an insight into the investments within the funds and how they have been managed over the prior quarter. Indicative holdings Indicative equity breakdown by sector The following individual securities were held within The breakdown by sector of equity holdings within the the Balanced fund on the last day of the quarter, Balanced fund as at 30 June 2021. 30 June 2021. The other funds in the range may hold 25% a slightly different list of assets, in line with their specific 20% risk grades. 15% 10% UK equity High yield bonds Howden Joinery Group Plc AA Bond 6.5% 31/01/2026 5% Intercontinental Hotels Group Barclays 6.375% Perp 0% s s s s s e y re Integrafin Holdings Plc FCE Bank 2.727% 03/06/2022 ty gy on ion ti rial rial Ca vice umer umer aple onar Prudential Plc Fidelidade SA 4.25% 04/09/2031 te oper ti Ener ructur St rmat Ser Ma alth Pr re chnology fo Financial Indust Cons Relx Plc GKN Holdings 4.625% 12/05/2032 Cons sc In He Te frast Di Rightmove Plc Marks & Spencer 4.5% 10/07/2027 In Communica Taylor Wimpey Plc MPT 3.692% 05/06/2028 Returns over the quarter Unilever Plc Permanent TSB Group Holdings 2.125% 26/09/2024 The following table shows the breakdown by asset class of US equity Rolls-Royce 3.375% 18/06/2026 each fund’s returns, including the effects of fees, midday Akamai Technologies Inc Sainsbury’s Bank 6% 23/11/2027 pricing and transaction costs. -

Asset Allocation

1 ASSET ALLOCATION May 2021 VAM CAUTIOUS FUND – A LOWER RISK PORTFOLIO 2 Corporate Bonds 23.76% Phoenix Group Holdings Plc 4.125% 20/07/2022 1.31% Bp Capital Markets Plc 4.25% Perp 2.01% Daimler International Finance Bv 1.25% Cautious Asset Allocation 1.55% Pension Insurance Corp Plc 7.375% Perp 2.05% 05/09/2022 Hiscox Ltd 2% 14/12/2022 1.10% Koninklijke Kpn Nv 5.75% 17/09/2029 1.14% Tesco Plc 3.322% 05/11/2025 1.98% Just Group Plc 8.125% 26/10/2029 2.20% Intercontinental Hotels Group Plc 3.75% 1.02% Natwest Group Plc 3.622% 14/08/2030 0.67% 14/08/2025 Corporate Bonds, 23.76% Whitbread Group Plc 3.375% 16/10/2025 1.48% Aviva Plc 5.125% 04/06/2050 0.94% Just Group Plc 9% 26/10/2026 0.82% Legal & General Group Plc 5.625% Perp 1.53% Rothesay Life Plc 3.375% 12/07/2026 1.17% M&G Plc 5.625% 20/10/2051 1.82% High Yield Bonds, 15.31% Sse Plc 3.74% Perp 0.97% High Yield Bonds 15.31% Fce Bank Plc 2.727% 03/06/2022 1.55% Barclays Plc 6.375% Perp 2.41% Permanent Tsb Group Holdings Plc 2.125% 1.26% Rolls-Royce Plc 3.375% 18/06/2026 1.41% Global Equity, 30.92% 26/09/2024 Mpt Operating Partnership Lp / Mpt Finance Sainsbury'S Bank Plc 6% 23/11/2027 1.60% 1.00% Corp 3.692% 05/06/2028 Aa Bond Co Ltd 6.5% 31/01/2026 1.78% Marks & Spencer Plc 4.5% 10/07/2027 2.03% UK Equity, 12.19% Jerrold Finco Plc 5.25% 15/01/2027 1.61% Gkn Holdings Ltd 4.625% 12/05/2032 0.66% Global Equity 30.92% Heineken Nv 1.23% Facebook Inc 1.78% Anheuser-Busch Inbev Sa/Nv 1.19% Microsoft Corp 1.52% Listed Property, 4.08% Bayer Ag 1.39% Akamai Technologies Inc 2.23% Koninklijke Philips -

Q2 Sustainable Investment Report US.Indd

Sustainable Investment Report Q2 2017 For Financial Intermediary, Institutional and Consultant use only. Not for redistribution under any circumstances. Contents 1 6 Introduction INfl uence With great power comes great responsibility: shareholders have a vital role to play Unaoil case study: managing the changing risk 2 INsight 8 Managing corporate controversies: the role of ESG ratings Second quarter 2017 We’ll always have Paris: our view of climate Total company engagement change remains unchanged Engagement in numbers ESG and Sovereign Bonds: our new framework for ESG integration Shareholder voting Engagement progress In an ideal world, our work on sustainability and Environmental, Social and Governance (ESG) integration combined with our focus on active fund management would mean that we are never exposed to controversies. The reality of managing $500 billion of assets is more complex. Jessica Ground Global Head of Stewardship, Schroders This quarter we explore corporate controversies. Meanwhile, despite policymakers around the world We have analysed third party ESG scores and concluded stressing the importance of corporate governance, that they are of little help in identifying companies that engaged asset managers and asset owners, and new will face them. We have always viewed such ratings as Stewardship Codes being introduced almost monthly, a starting point, rather than the defi nitive view on a we are seeing more companies fl oat with fewer company, and this work confi rms that our proprietorial shareholder rights. In recent consultations with index approach is correct. We also highlight the engagement providers and exchanges, we have emphasised the work that we did with our holdings following revelations need to preserve existing governance standards.