Annual Report and Accounts 2018 01 Overview Performance Highlights for the Year to 31 March 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Chronology, 1963–89

Chronology, 1963–89 This chronology covers key political and economic developments in the quarter century that saw the transformation of the Euromarkets into the world’s foremost financial markets. It also identifies milestones in the evolu- tion of Orion; transactions mentioned are those which were the first or the largest of their type or otherwise noteworthy. The tables and graphs present key financial and economic data of the era. Details of Orion’s financial his- tory are to be found in Appendix IV. Abbreviations: Chase (Chase Manhattan Bank), Royal (Royal Bank of Canada), NatPro (National Provincial Bank), Westminster (Westminster Bank), NatWest (National Westminster Bank), WestLB (Westdeutsche Landesbank Girozentrale), Mitsubishi (Mitsubishi Bank) and Orion (for Orion Bank, Orion Termbank, Orion Royal Bank and subsidiaries). Under Orion financings: ‘loans’ are syndicated loans, NIFs, RUFs etc.; ‘bonds’ are public issues, private placements, FRNs, FRCDs and other secu- rities, lead managed, co-managed, managed or advised by Orion. New loan transactions and new bond transactions are intended to show the range of Orion’s client base and refer to clients not previously mentioned. The word ‘subsequently’ in brackets indicates subsequent transactions of the same type and for the same client. Transaction amounts expressed in US dollars some- times include non-dollar transactions, converted at the prevailing rates of exchange. 1963 Global events Feb Canadian Conservative government falls. Apr Lester Pearson Premier. Mar China and Pakistan settle border dispute. May Jomo Kenyatta Premier of Kenya. Organization of African Unity formed, after widespread decolonization. Jun Election of Pope Paul VI. Aug Test Ban Take Your Partners Treaty. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Morningstar Report

Report as of 02 Oct 2021 Threadneedle Monthly Extra Income Fund Retail Income GBP Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ Category_EUCA000916 Morningstar UK Moderately 20% ICE BofA Sterling Corp&Coll TR QQQ Adventurous Target Allocation NR GBP EUR, 80% FTSE AllSh TR GBP Used throughout report Investment Objective Performance The Fund aims to provide a monthly income with prospects 172 for capital growth over the long term. It looks to provide 154 an income yield higher than the FTSE All-Share Index over 136 rolling 3-year periods, after the deduction of charges. The 118 Fund is actively managed, and invests in a combination of 100 company shares and bonds; typically, between 70-80% in 82 UK company shares and 20%-30% in bonds. 2016 2017 2018 2019 2020 2021-08 12.39 6.59 -5.45 19.10 -5.17 11.72 Fund - - - - 4.52 9.96 Benchmark 13.23 10.00 -6.37 15.67 5.25 9.54 Category Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha -4.50 3Y Sharpe Ratio 0.33 3 Months 1.16 0.35 0.46 2021 2.78 4.59 - - 3Y Beta 1.30 3Y Std Dev 14.34 6 Months 6.14 5.16 5.16 2020 -20.71 10.08 -0.11 8.77 3Y R-Squared 89.79 3Y Risk abv avg 1 Year 17.92 15.22 15.32 2019 6.46 2.75 4.10 4.59 3Y Info Ratio -0.54 5Y Risk abv avg 3 Years Annualised 3.80 6.62 6.12 2018 -4.05 8.69 -0.28 -9.09 3Y Tracking Error 5.57 10Y Risk abv avg 5 Years Annualised 4.71 7.20 6.49 2017 3.91 2.73 -0.15 0.01 Calculations use Morningstar UK Moderately Adventurous Target Allocation NR GBP 10 Years Annualised 8.86 8.92 8.05 -

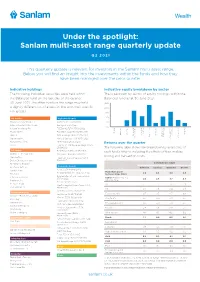

Sanlam Multi-Asset Range Quarterly Update

Under the spotlight: Sanlam multi-asset range quarterly update Q2 2021 This quarterly update is relevant for investors in the Sanlam multi-asset range. Below you will find an insight into the investments within the funds and how they have been managed over the prior quarter. Indicative holdings Indicative equity breakdown by sector The following individual securities were held within The breakdown by sector of equity holdings within the the Balanced fund on the last day of the quarter, Balanced fund as at 30 June 2021. 30 June 2021. The other funds in the range may hold 25% a slightly different list of assets, in line with their specific 20% risk grades. 15% 10% UK equity High yield bonds Howden Joinery Group Plc AA Bond 6.5% 31/01/2026 5% Intercontinental Hotels Group Barclays 6.375% Perp 0% s s s s s e y re Integrafin Holdings Plc FCE Bank 2.727% 03/06/2022 ty gy on ion ti rial rial Ca vice umer umer aple onar Prudential Plc Fidelidade SA 4.25% 04/09/2031 te oper ti Ener ructur St rmat Ser Ma alth Pr re chnology fo Financial Indust Cons Relx Plc GKN Holdings 4.625% 12/05/2032 Cons sc In He Te frast Di Rightmove Plc Marks & Spencer 4.5% 10/07/2027 In Communica Taylor Wimpey Plc MPT 3.692% 05/06/2028 Returns over the quarter Unilever Plc Permanent TSB Group Holdings 2.125% 26/09/2024 The following table shows the breakdown by asset class of US equity Rolls-Royce 3.375% 18/06/2026 each fund’s returns, including the effects of fees, midday Akamai Technologies Inc Sainsbury’s Bank 6% 23/11/2027 pricing and transaction costs. -

Annual Report and Accounts 2019 Introduction

Annual report and accounts 2019 Introduction Our purpose is to deliver a long-term sustainable return to shareholders from investing in infrastructure. Our strategy is to maintain a balanced portfolio of infrastructure investments delivering an attractive mix of income yield and capital appreciation for shareholders. 15.4% Total return for the year 13.4% In the 12 years since the initial public offering (‘IPO’) the Company has delivered an annualised total shareholder return of 13.4% per annum For further information, Cover image: Attero see our website Page 37 www.3i-infrastructure.com Inside this report Overview Financial review, 1 Performance highlights Risk and Sustainability 2 Chair’s statement 42 Financial review 4 At a glance 50 Risk report 6 Our markets 58 Sustainability report 8 Our business model 12 Our objectives and strategic priorities 13 How we measure our performance Governance and KPIs 64 Introduction to Governance 14 2019 realisation 66 Leadership 72 Division of responsibilities Investment Manager’s review 76 Relations with shareholders 77 Composition, succession and evaluation 18 Review from the Managing Partner 80 Audit, Risk and Internal Control 20 Investment activity 84 Remuneration 22 Portfolio 85 Directors’ statement 24 Movements in portfolio value Accounts and Review of investments other information 30 Tampnet 92 Independent auditor’s report 32 Infinis to the members of 3i Infrastructure plc 33 Wireless Infrastructure Group (‘WIG’) 99 Consolidated statement 34 TCR of comprehensive income 35 ESVAGT 100 Consolidated statement of changes 36 Oystercatcher in equity 37 Attero 101 Consolidated balance sheet 38 Valorem 102 Consolidated cash flow statement 39 Projects portfolio 103 Reconciliation of net cash flow to movement in net debt 104 Significant accounting policies 110 Notes to the accounts 126 Investment policy 127 Portfolio valuation methodology 128 Information for shareholders Chair’s statement At a glance 2 4 Review from the Financial Managing Partner review 18 42 The Strategic report comprises pages 1 to 61. -

Asset Allocation

1 ASSET ALLOCATION May 2021 VAM CAUTIOUS FUND – A LOWER RISK PORTFOLIO 2 Corporate Bonds 23.76% Phoenix Group Holdings Plc 4.125% 20/07/2022 1.31% Bp Capital Markets Plc 4.25% Perp 2.01% Daimler International Finance Bv 1.25% Cautious Asset Allocation 1.55% Pension Insurance Corp Plc 7.375% Perp 2.05% 05/09/2022 Hiscox Ltd 2% 14/12/2022 1.10% Koninklijke Kpn Nv 5.75% 17/09/2029 1.14% Tesco Plc 3.322% 05/11/2025 1.98% Just Group Plc 8.125% 26/10/2029 2.20% Intercontinental Hotels Group Plc 3.75% 1.02% Natwest Group Plc 3.622% 14/08/2030 0.67% 14/08/2025 Corporate Bonds, 23.76% Whitbread Group Plc 3.375% 16/10/2025 1.48% Aviva Plc 5.125% 04/06/2050 0.94% Just Group Plc 9% 26/10/2026 0.82% Legal & General Group Plc 5.625% Perp 1.53% Rothesay Life Plc 3.375% 12/07/2026 1.17% M&G Plc 5.625% 20/10/2051 1.82% High Yield Bonds, 15.31% Sse Plc 3.74% Perp 0.97% High Yield Bonds 15.31% Fce Bank Plc 2.727% 03/06/2022 1.55% Barclays Plc 6.375% Perp 2.41% Permanent Tsb Group Holdings Plc 2.125% 1.26% Rolls-Royce Plc 3.375% 18/06/2026 1.41% Global Equity, 30.92% 26/09/2024 Mpt Operating Partnership Lp / Mpt Finance Sainsbury'S Bank Plc 6% 23/11/2027 1.60% 1.00% Corp 3.692% 05/06/2028 Aa Bond Co Ltd 6.5% 31/01/2026 1.78% Marks & Spencer Plc 4.5% 10/07/2027 2.03% UK Equity, 12.19% Jerrold Finco Plc 5.25% 15/01/2027 1.61% Gkn Holdings Ltd 4.625% 12/05/2032 0.66% Global Equity 30.92% Heineken Nv 1.23% Facebook Inc 1.78% Anheuser-Busch Inbev Sa/Nv 1.19% Microsoft Corp 1.52% Listed Property, 4.08% Bayer Ag 1.39% Akamai Technologies Inc 2.23% Koninklijke Philips -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

JS Journal Nov 1988

si .vis ^ 'im A 'i „3i AWARDS ISSUE P10/11 'iBSl»:- r*^1 *\,« V C^ *^^- -jb U it o ^i ,y '! • i^pilv,,- K^/AWNCI?^ > •JEST ^: :ici % .^ \ii! ^^G-y ^T^^ .^S^ >^ of SEavic|§j fAmrsi Pfopji. 13* SsF"*- ^i *TS '•^^ <t^. oP (ysf CREATIVE EFFECTIVE \iil\t OFADVFRTI&INfc ^^^ JSJOURNAL FRONTLINE FIRST HALF PROFITS up The real glittering prize as we went to press. So, appro is published by 23 per cent. The company's amongst a sparkling array is priately, the Christmas Journal for employees of interim results were announced the Marplan Marketing Week will contain further celeb J Sainsbury pic as the Journal went to press awards in which JS came top, ration. Stamford House and ears are still ringing with as it has indeed for each of the In the meantime, this issue Stamford Street cries of admiration from the three years of the awards. It'? a contains an early gift for London SEI 9LL City of Fleet Street. As The hat trick which represents an readers — a full colour pull- Telephone: 01-921 6660 Times said: 'There seems to be incredible achievement when out guide to the company's no stopping Sainsbury's.' you consider the competition most senior management. Editor The results show we can put includes every big fry company More than an adornment to Yvonne Burke our money where other in Britain. any office or notice board, the Assistant editor people's mouths are, because As many awards as we pull-out puts a face to the Dominic Long this has been a month of crammed into this Journal we names of the people at the top. -

Lessons from FRS17 Disclosures

Is Pension Fund Asset Allocation Really Determined by Fundamentals? Mike Orszag W W W . W A T S O N W Y A T T . C O M Paris, April 2, 2004 Key Question z Do pension funds make asset allocation decisions based on corporate finance risk considerations? z Factors which might matter: – Size of pension scheme relative to company – Size of deficits relative to company – Maturity of scheme Copyright © Watson Wyatt Worldwide. All rights reserved. Data z UK listed companies have had to report pension liabilities on FRS17 basis since late 2001 z Collected roughly 150 data items for FTSE350 on corporate finance from FRS17 disclosures z Matched data to other data on market returns/option price data, betas, etc. Copyright © Watson Wyatt Worldwide. All rights reserved. Accounting Dates z Roughly 48% of FTSE350 (168 companies) use Dec. 31 as end of year, 17% (60 companies) use 31 March, 8% (29 companies) use 30 September, remainder use a variety of dates z Define a panel with two waves: – 2001 Wave = Accounting dates between 30 June 2001 and 29 June 2002 – 2002 Wave = Accounting dates between 30 June 2002 and 29 June 2003 Copyright © Watson Wyatt Worldwide. All rights reserved. Pension Surplus(Deficit)/Pension Liabilities FTSE 350 companies with positive reported pension liabilities 2001 2002 Wave 2002 has 5% -30% -48.1% only 10 10% -24.9% -43.7% companies with 25% -15.2% -34.0% surpluses as 50% -7.7% -27.4% opposed to 81 in 2001. 75% 3.3% -17.3% Among FTSE 90% 15.5% -8.3% 100, wave 2001 95% 21.8% -1.0% has only 4 companies in surplus as N 242 257 opposed to 46 in 2001 Copyright © Watson Wyatt Worldwide.