Asset Allocation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

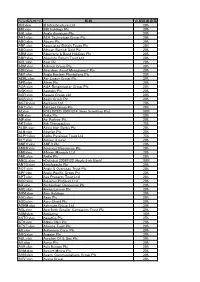

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Annual Report and Accounts 2018 01 Overview Performance Highlights for the Year to 31 March 2018

3i Group plc Overview Governance Introduction 01 Chairman’s introduction 58 Performance highlights 02 Board of Directors and Executive Committee 60 Chairman’s statement 02 Nominations Committee report 65 Chief Executive’s statement 04 Audit and Compliance Committee report 66 Action 08 Valuations Committee report 70 Directors’ remuneration report 73 Our business Relations with shareholders 83 Our business at a glance 10 Additional statutory and corporate governance information 84 Our business model 12 Our strategic objectives 14 Audited financial statements Key performance indicators 16 Private Equity 18 Consolidated statement of comprehensive income 92 Infrastructure 25 Consolidated statement of financial position 93 Performance, risk and sustainability Consolidated statement of changes in equity 94 Consolidated cash flow statement 95 Financial review 29 Company statement of financial position 96 Investment basis 35 Company statement of changes in equity 97 Reconciliation of Investment basis and IFRS 39 Company cash flow statement 98 Alternative Performance Measures 43 Significant accounting policies 99 Risk management 44 Notes to the accounts 104 Principal risks and mitigations 47 Independent Auditor’s report 139 Sustainability 52 Portfolio and other information 20 Large investments 148 Strategic report: Portfolio valuation – an explanation 150 pages 2 to 56. Information for shareholders 152 Directors’ report: pages Glossary 154 58 to 72 and 83 to 90. For definitions of our financial terms, used throughout this report, please see Directors’ remuneration our glossary on pages 154 to 156. report: pages 73 to 82. Consistent with our approach since the introduction of IFRS 10 in 2014, the financial data presented in the Overview and Strategic report is taken from the Investment basis financial statements. -

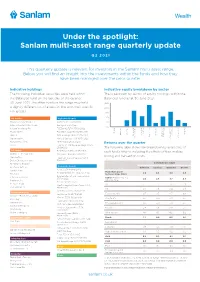

Sanlam Multi-Asset Range Quarterly Update

Under the spotlight: Sanlam multi-asset range quarterly update Q2 2021 This quarterly update is relevant for investors in the Sanlam multi-asset range. Below you will find an insight into the investments within the funds and how they have been managed over the prior quarter. Indicative holdings Indicative equity breakdown by sector The following individual securities were held within The breakdown by sector of equity holdings within the the Balanced fund on the last day of the quarter, Balanced fund as at 30 June 2021. 30 June 2021. The other funds in the range may hold 25% a slightly different list of assets, in line with their specific 20% risk grades. 15% 10% UK equity High yield bonds Howden Joinery Group Plc AA Bond 6.5% 31/01/2026 5% Intercontinental Hotels Group Barclays 6.375% Perp 0% s s s s s e y re Integrafin Holdings Plc FCE Bank 2.727% 03/06/2022 ty gy on ion ti rial rial Ca vice umer umer aple onar Prudential Plc Fidelidade SA 4.25% 04/09/2031 te oper ti Ener ructur St rmat Ser Ma alth Pr re chnology fo Financial Indust Cons Relx Plc GKN Holdings 4.625% 12/05/2032 Cons sc In He Te frast Di Rightmove Plc Marks & Spencer 4.5% 10/07/2027 In Communica Taylor Wimpey Plc MPT 3.692% 05/06/2028 Returns over the quarter Unilever Plc Permanent TSB Group Holdings 2.125% 26/09/2024 The following table shows the breakdown by asset class of US equity Rolls-Royce 3.375% 18/06/2026 each fund’s returns, including the effects of fees, midday Akamai Technologies Inc Sainsbury’s Bank 6% 23/11/2027 pricing and transaction costs. -

Electronic Transmission Disclaimer

ELECTRONIC TRANSMISSION DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before continuing. This electronic transmission applies to the attached document and you are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached document relating to 3i Infrastructure plc (the “Company”) accessed from this page or otherwise received as a result of such access and you are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached document. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce or publish this electronic transmission or the attached document to any other person. The attached document has been prepared solely in connection with the open offer, placing, intermediaries offer (the “Offer”) and (if applicable) an additional issue (the “Additional Issue”) of new ordinary shares (“New Ordinary Shares”) of the Company. The New Ordinary Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws in the United States. Subject to certain exceptions, the New Ordinary Shares may not be offered or sold within the United States or to (or by) any national, resident or citizen of the United States. -

Hampton-Alexander Review Press Release

13th November 2019 The Hampton-Alexander Review, 1Victoria Street, London SW1H 0ET Hampton-Alexander Review Press Release STRONGEST YEAR OF PROGRESS FOR WOMEN ON BOARDS BUT STEP- CHANGE NEEDED FOR WOMEN IN SENIOR LEADERSHIP ROLES • Strongest year of progress since targets were first set in 2011: o FTSE 100 on track to reach the 33% target for women on boards ahead of the 2020 deadline o FTSE 250 made strong gains during the year and with sustained effort, will also meet the 2020 deadline • Last year’s challenge to “One & Done” boards is having an impact: there are 39 “this year, down from 74 with only 2 All-Male boards remaining • A step-change is needed for senior leadership roles below board level: 50% of all appointments next year need to go to women, or the 2020 target will not be met Women on Boards 2019 Today we are pleased to publish the 2019 Hampton-Alexander report which shows that women now hold 32.4% of all FTSE 100 board positions, up from 30.2% last year and up from only 12.5% in 2011. The FTSE 100 is very close to meeting the 33% target for Women on Boards and will do so ahead of the 2020 deadline. Today’s report also shows that women hold 29.6% of all FTSE 250 board positions, up from 24.9% last year and only 7.8% in 2011. The FTSE 250 has had its strongest year yet and if the same rate of progress continues next year, the FTSE 350 will be on track to meet the 33% target by the end of 2020 deadline. -

シンボルコード 銘柄 必要証拠金率 3IN:Xlon 3I Infrastructure Ltd 20

シンボルコード 銘柄 必要証拠金率 3IN:xlon 3I Infrastructure Ltd 20% 888:xlon 888 Holdings Plc 20% AAL:xlon Anglo American Plc 20% AAT:xlon AEA Technology Group Plc 20% ABC:xlon Abcam Plc 20% ABF:xlon Associated British Foods Plc 20% ABG:xlon African Barrick Gold Plc 20% ABM:xlon Albemarle & Bond Holdings Plc 20% ABR:xlon Absolute Return Trust Ltd 20% ACL:xlon Acal Plc 20% ADM:xlon Admiral Group Plc 20% ADN:xlon Aberdeen Asset Management Plc 20% AEP:xlon Anglo Eastern Plantations Plc 20% AERL:xlon Aer Lingus Group Plc 20% AFR:xlon Afren Plc 20% AGA:xlon AGA Rangemaster Group Plc 20% AGK:xlon Aggreko Plc 20% AGR:xlon Assura Group Ltd 20% AGS:xlon Aegis Group Plc 20% AGTA:xlon Agriterra Ltd 20% AHT:xlon Ashtead Group Plc 20% AI:xlon *DELISTED 20091214 (Aero Inventory Plc) 100% AIE:xlon Anite Plc 20% AIP:xlon Air Partner Plc 20% AKT:xlon Ark Therapeutics 75% ALBK:xlon Allied Irish Banks Plc 20% ALN:xlon Alterian Plc 20% ALPH:xlon Alpha Pyrenees Trust Ltd 75% ALY:xlon Ashley (Laura) 20% AMEC:xlon AMEC Plc 20% AMER:xlon Amerisur Resources Plc 20% AMI:xlon African Minerals Ltd 20% AML:xlon Amlin Plc 20% ANGL:xlon *Delisted 20090122 (Anglo Irish Bank) 100% ANTO:xlon Antofagasta Plc 20% AOT:xlon Anglo & Overseas Trust Plc 20% APF:xlon Anglo Pacific Group Plc 20% APT:xlon Axa Property Trust Ltd 20% AQP:xlon Aquarius Platinum Ltd 20% AR:xlon Archipelago Resources Plc 20% ARE:xlon Arena Leisure Plc 20% ARM:xlon Arm Holdings 20% ASC:xlon Asos Plc 20% ASD:xlon Axis-Shield Plc 20% ASHM:xlon Ashmore Group Ltd 20% ASL:xlon Aberforth Smaller Companies Trust Plc 20% ASM:xlon Antisoma 100% ASTO:xlon AssetCo Plc 25% ATK:xlon Atkins (Ws) Plc 20% ATST:xlon Alliance Trust Plc 20% AU:xlon Autonomy Corp. -

FTSE Russell Publications

FTSE Russell Publications 19 November 2018 FTSE 250 Indicative Index Weight Data as at Closing on 28 September 2018 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.34 UNITED Capital & Counties Properties 0.51 UNITED Esure Group 0.21 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.13 UNITED Card Factory 0.16 UNITED Euromoney Institutional Investor 0.19 UNITED KINGDOM KINGDOM KINGDOM AA 0.15 UNITED Centamin 0.3 UNITED F&C Commercial Property Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.32 UNITED Charter Court Financial Services Group 0.12 UNITED F&C Global Smaller Companies 0.22 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.54 UNITED Cineworld Group 0.82 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.68 UNITED City of London Investment Trust 0.39 UNITED Ferrexpo 0.15 UNITED KINGDOM KINGDOM KINGDOM Amigo Holdings 0.09 UNITED Clarkson 0.17 UNITED Fidelity China Special Situations 0.21 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.43 UNITED Close Brothers Group 0.62 UNITED Fidelity European Values 0.25 UNITED KINGDOM KINGDOM KINGDOM Ashmore Group 0.36 UNITED CLS Holdings 0.09 UNITED Fidelity Special Values 0.13 UNITED KINGDOM KINGDOM KINGDOM Assura 0.33 UNITED Coats Group 0.3 UNITED Finsbury Growth & Income Trust 0.36 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.07 UNITED Cobham 0.72 UNITED FirstGroup 0.29 UNITED KINGDOM KINGDOM KINGDOM Avast 0.18 UNITED Computacenter 0.23 UNITED Fisher (James) & Sons -

200130 GCP Initiation MC

M A R T E N & C O Initiation | Investment companies 30 January 2020 GCP Infrastructure Sector Infrastructure Stable income, uncertain times Ticker GCP LN Base currency GBP For almost 10 years, GCP Infrastructure (GCP) has met Price 128.0p its objective of delivering high and stable income with NAV 109.6p low volatility of returns, while preserving investors’ Premium/(discount) 16.8% Yield 5.9% capital. The mix of assets that it lends against has evolved as the investment adviser has sought out Share price and premium alternative sources of public sector-backed cash flow. Time period 31/12/2014 to 29/01/2020 A debate is under way about the future of infrastructure finance in the 140 40 UK. No one seems to doubt that the investment is needed – the 130 30 question is: what role will private capital play? Until this is resolved, 120 20 while there is still some opportunity to invest in new assets (we explore some of these in this note), the investment adviser has been 110 10 reinvesting free cash in secondary market opportunities, without 100 0 2014 2015 2016 2017 2018 2019 compromising on asset quality or returns. Price (LHS) Premium (RHS) Source: Morningstar, Marten & Co Public sector-backed, long-term cashflows from loans used to fund UK infrastructure Performance over five years GCP aims to provide shareholders with regular, sustained, long-term Time period 31/12/2014 to 31/12/2019 distributions and to preserve capital over the long term by generating 160 exposure primarily to UK infrastructure debt and related and/or similar 140 assets which provide regular and predictable long-term cashflows. -

Ftse Publications

FTSE PUBLICATIONS 19 November 2016 FTSE 250 Indicative Index Weight Data as at Closing on 30 September 2016 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.38 UNITED Cairn Energy 0.31 UNITED Esure Group 0.24 UNITED KINGDOM KINGDOM KINGDOM AA 0.51 UNITED Caledonia Investments 0.23 UNITED Euromoney Institutional Investor 0.12 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Asset Management 0.91 UNITED Capital & Counties Properties 0.6 UNITED Evraz 0.22 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.28 UNITED Card Factory 0.2 UNITED F&C Commercial Property Trust 0.18 UNITED KINGDOM KINGDOM KINGDOM Acacia Mining 0.21 UNITED Carillion 0.3 UNITED Fidelity China Special Situations 0.19 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.65 UNITED Centamin 0.45 UNITED Fidelity European Values 0.21 UNITED KINGDOM KINGDOM KINGDOM Aldermore Group 0.09 UNITED Cineworld Group 0.32 UNITED Fidessa Group 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.84 UNITED City of London Investment Trust 0.37 UNITED Finsbury Growth & Income Trust 0.26 UNITED KINGDOM KINGDOM KINGDOM Allied Minds 0.12 UNITED Clarkson 0.15 UNITED FirstGroup 0.36 UNITED KINGDOM KINGDOM KINGDOM Amec Foster Wheeler 0.63 UNITED Close Brothers Group 0.58 UNITED Fisher (James) & Sons 0.19 UNITED KINGDOM KINGDOM KINGDOM AO World 0.08 UNITED CLS Holdings 0.07 UNITED Foreign & Col Invest Trust 0.78 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.19 UNITED CMC Markets 0.05 UNITED G4S 1 UNITED KINGDOM KINGDOM KINGDOM -

200601 GCP Update QD

Update | Investment companies 1 June 2020 GCP Infrastructure Sector Infrastructure Rebased dividend Ticker GCP LN Base currency GBP GCP Infrastructure will be 10 years old in a few weeks. Price 119.0p Since 2012, it has paid a stable 7.6p per year dividend NAV 107.9p backed largely by UK public sector cashflows and Premium/(discount) 10.3% Yield 6.4%1 achieved modest growth in net asset value (NAV). The Note 1) based on 7.6p dividend for current financial year yield premium that GCP delivers relative to UK government debt securities has increased significantly Share price and premium Time period 30/04/2015 to 28/05/2020 over the past decade (see page 2). 30 135 20 GCP’s board wants to ensure that the company’s next 125 115 10 decade is as successful as the last. That has meant 105 0 reassessing the fund’s objectives and risk tolerances. 95 -10 85 -20 The board has determined that, following an extensive 75 -30 2015 2016 2017 2018 2019 2020 review of the sustainability of the dividend, the company Price (LHS) Premium (RHS) will target a dividend of 7.0p from 1 October 2020. Source: Morningstar, Marten & Co Public sector-backed, long-term cashflows from loans used to fund UK infrastructure Performance over five years Time period 30/04/2015 to 30/04/2020 GCP aims to provide shareholders with regular, sustained, long-term 160 distributions and to preserve capital over the long term by generating 140 exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.