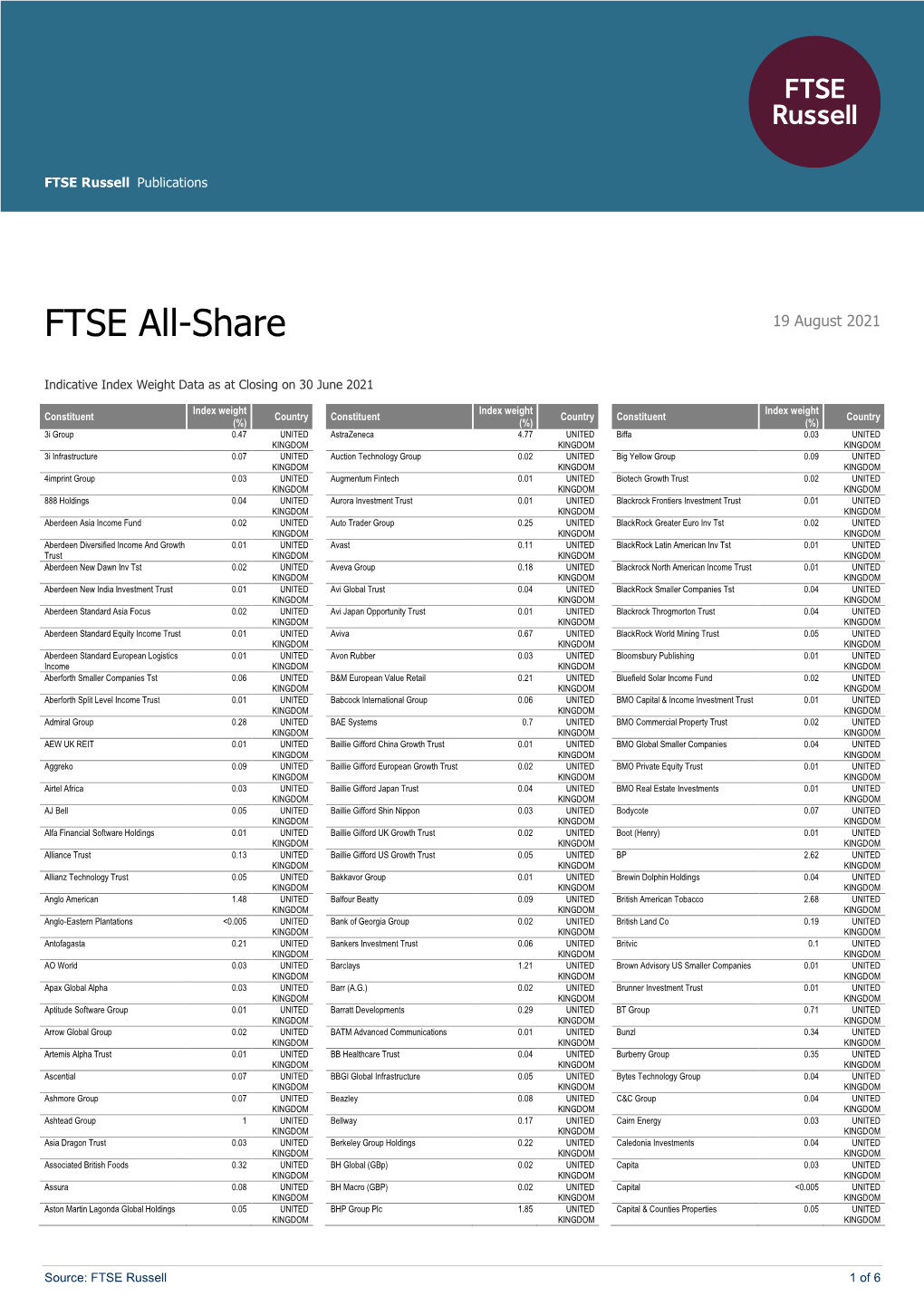

FTSE All-Share

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Kopi Af Aktivlisten 2021-06-30 Ny.Xlsm

Velliv noterede aktier i alt pr. 30-06-2021 ISIN Udstedelsesland Navn Markedsværdi (i DKK) US0378331005 US APPLE INC 1.677.392.695 US5949181045 US MICROSOFT CORP 1.463.792.732 US0231351067 US AMAZON.COM INC 1.383.643.996 DK0060534915 DK NOVO NORDISK A/S-B 1.195.448.146 US30303M1027 US FACEBOOK INC-CLASS A 1.169.094.867 US02079K3059 US ALPHABET INC-CL A 867.740.769 DK0010274414 DK DANSKE BANK A/S 761.684.457 DK0060079531 DK DSV PANALPINA A/S 629.313.827 US02079K1079 US ALPHABET INC-CL C 589.305.120 US90138F1021 US TWILIO INC - A 514.807.852 US57636Q1040 US MASTERCARD INC - A 490.766.560 US4781601046 US JOHNSON & JOHNSON 478.682.981 US70450Y1038 US PAYPAL HOLDINGS INC 471.592.728 DK0061539921 DK VESTAS WIND SYSTEMS A/S 441.187.698 US79466L3024 US SALESFORCE.COM INC 439.114.061 US01609W1027 US ALIBABA GROUP HOLDING-SP ADR 432.325.255 US8835561023 US THERMO FISHER SCIENTIFIC INC 430.036.612 US22788C1053 US CROWDSTRIKE HOLDINGS INC - A 400.408.622 KYG875721634 HK TENCENT HOLDINGS LTD 397.054.685 KR7005930003 KR SAMSUNG ELECTRONICS CO LTD 389.413.700 DK0060094928 DK ORSTED A/S 378.578.374 ES0109067019 ES AMADEUS IT GROUP SA 375.824.429 US46625H1005 US JPMORGAN CHASE & CO 375.282.618 US67066G1040 US NVIDIA CORP 357.034.119 US17275R1023 US CISCO SYSTEMS INC 348.160.692 DK0010244508 DK AP MOLLER-MAERSK A/S-B 339.783.859 US20030N1019 US COMCAST CORP-CLASS A 337.806.502 NL0010273215 NL ASML HOLDING NV 334.040.559 CH0012032048 CH ROCHE HOLDING AG-GENUSSCHEIN 325.008.200 KYG970081173 HK WUXI BIOLOGICS CAYMAN INC 321.300.236 US4370761029 US HOME DEPOT INC 317.083.124 US58933Y1055 US MERCK & CO. -

Alliance Trust Portfolio

Alliance Trust Portfolio University of St Andrews Month Ending 31/07/2013 No Of Equity Description Shares ALEXION PHARMACEUTICALS INC 10,900 AMAZON.COM 4,500 AMER INTERNATIONAL GROUP 21,514 AMGEN INC 9,600 ANGIE'S LIST 22,900 ANHEUSER-BUSCH INBEV 6,876 ARM HOLDINGS PLC 77,323 BANCA GENERALI SPA 35,206 BANGKOK BANK 122,600 BG GROUP 45,404 BORG WARNER INC 11,300 BROOKDALE SENIOR LIVING 24,370 CHECK POINT SOFTWARE TECHNOLOGIES LTD 17,200 CITIGROUP INC 20,650 CLEAN HARBORS INC 18,200 COMPUTERSHARE LTD 87,337 CONTINENTAL AG 4,935 CSL LTD 11,335 DENTSU INC 42,100 DNB ASA 50,402 ECOLAB INC 16,206 EMC CORP 49,000 ENN ENERGY HOLDINGS LTD 138,000 EQUINIX INC 5,300 ESSILOR INTERNATIONAL 7,186 FAST RETAILING CO LTD 2,100 GOOGLE INC CL'A' 1,600 KENMARE RESOURCES PLC 1,071,478 MACY'S 20,061 MILLICOM 8,604 MITSUI FUDOSAN CO LTD 26,979 NOVATEK 4,660 NOVO NORDISK A/S 6,724 OIL SEARCH LTD 175,993 OMNICOM GROUP INC 12,200 PNC FINANCIAL SERVICES INC 12,786 PRAXAIR INC 13,287 PRUDENTIAL PLC 41,841 RENEWABLES INFRASTRUCTURE GROUP LTD 357,100 ROCHE HOLDING AG 5,037 ROCKWELL AUTOMATION INC 10,100 ROPER TECHNOLOGIES INC 10,700 SPX CORPORATION 7,200 STARWOOD HOTELS & RESORTS WORLDWIDE 14,100 TERADATA 11,800 TRACTOR SUPPLY COMPANY 6,944 TRIMBLE NAVIGATION 21,000 UNILEVER PLC 25,446 VARIAN MEDICAL SYSTEMS 14,094 VISA INC 5,800 W. W. GRAINGER INC 4,643 WATERS CORP 11,300 Buckley Muething Portfolio University of St Andrews Month Ending 31/07/2013 No Of Fund Description Shares Value Bonds ALPHA NATURAL RESOURCES INC 100,000 ARCH COAL INC 100,000 BEAZER HOMES USA INC -

Annual Report and Audited Financial Statements

Annual report and audited financial statements BlackRock Charities Funds • BlackRock Armed Forces Charities Growth & Income Fund • BlackRock Catholic Charities Growth & Income Fund • BlackRock Charities Growth & Income Fund • BlackRock Charities UK Bond Fund • BlackRock Charities UK Equity ESG Fund • BlackRock Charities UK Equity Fund • BlackRock Charities UK Equity Index Fund For the financial period ended 30 June 2020 Contents General Information 2 About the Trust 3 Charity Authorised Investment Fund 4 Charity Trustees’ Investment Responsibilities 4 Fund Manager 4 Significant Events 4 Investment Report 5 Report on Remuneration 15 Accounting and Distribution Policies 21 Financial Instruments and Risks 24 BlackRock Armed Forces Charities Growth & Income Fund 37 BlackRock Catholic Charities Growth & Income Fund 56 BlackRock Charities Growth & Income Fund 74 BlackRock Charities UK Bond Fund 95 BlackRock Charities UK Equity ESG Fund 111 BlackRock Charities UK Equity Fund 125 BlackRock Charities UK Equity Index Fund 138 Statement of Manager’s and Trustee’s Responsibilities 162 Independent Auditor’s Report 165 Supplementary Information 169 1 General Information Advisory Committee Members - BlackRock manager of the Funds, each of which is an alternative Armed Forces Charities Growth & Income investment fund for the purpose of the Alternative Fund: Investment Fund Managers Directive. Mr Michael Baines (Chairman) Mr Guy Davies Directors of the Manager Major General A Lyons CBE G D Bamping* Major General Ashley Truluck CB, CBE M B Cook Colonel -

Blackrock UK Smaller Companies PDF Factsheet

Adventurous 31 August 2021 Life Fund SW BlackRock UK Smaller Companies Life Asset Allocation (as at 31/07/2021) This document is provided for the purpose of UK Small Cap Companies 99.8% information only. This factsheet is intended for individuals who are familiar with investment Money Market 0.2% terminology. Please contact your financial adviser if you need an explanation of the terms used. This material should not be relied upon as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim The fund aims for long-term growth by investing in UK smaller companies which the Fund Manager considers to have above average long-term growth prospects. The fund Sector Breakdown (as at 31/07/2021) invests solely through the BlackRock UK Consumer Discretionary 27.7% Smaller Companies Unit Trust. Industrials 25.1% Basic Fund Information Financials 12.2% Fund Launch Date 19/09/2001 Technology 11.3% Fund Size £5.3m Basic Materials 5.1% Sector ABI UK Smaller Other 4.9% Companies Energy 3.8% ISIN GB0030873565 Consumer Staples 3.8% MEX ID SWMUL Health Care 3.7% SEDOL 3087356 Telecommunications 2.5% Manager Name Roland Arnold Regional Breakdown (as at 31/07/2021) Manager Since 26/03/2015 Top Ten Holdings (as at 31/07/2021) WATCHES OF SWITZERLAND 2.9% GROUP PLC IMPAX ASSET MANAGEMENT 2.4% GROUP PLC TREATT PLC 2.2% The composition of asset mix and asset allocation may change at any time and exclude cash CVS GROUP PLC 2.1% unless otherwise stated BREEDON GROUP PLC 2.0% OXFORD INSTRUMENTS PLC 1.8% INTEGRAFIN HOLDINGS PLC 1.8% AUCTION TECHNOLOGY GROUP 1.7% PLC ERGOMED PLC 1.7% LEARNING TECHNOLOGIES GROUP 1.7% PL TOTAL 20.3% Page 1 Past Performance Fund Rating Information 100% Overall Morningstar **** Rating Morningstar Analyst Rating 50% FE fundinfo Crown Rating The FE fundinfo Crown Rating relates to this fund. -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

FT UK 500 2011 A-Z Company UK Rank 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 A

FT UK 500 2011 A-Z UK rank Company 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 Advanced Medical Solutions 488 Aegis Group 127 Afren 138 African Barrick Gold 118 African Minerals 131 Aggreko 69 Albemarle & Bond 460 Allied Gold 306 Amec 75 Amerisur Resources 426 Amlin 124 Anglo American 11 Anglo Pacific Group 327 Anglo-Eastern Plantations 370 Anite 445 Antofagasta 29 Aquarius Platinum 136 Archipelago Resources 346 Arm Holdings 42 Ashley (Laura) 476 Ashmore 112 Ashtead Group 206 Asian Citrus 263 Asos 171 Associated British Foods 41 Assura 449 Astrazeneca 12 Atkins (WS) 240 Aurelian Oil & Gas 334 Autonomy 76 Avanti Communications 324 Aveva 192 Avis Europe 326 Aviva 31 Avocet Mining 287 Axis-Shield 469 AZ Electronic Materials 199 Babcock International 117 Bae Systems 35 Bahamas Petroleum 397 Balfour Beatty 111 Barclays 16 Barr (AG) 289 Barratt Developments 197 BBA Aviation 209 Beazley 257 Bellway 216 Bellzone Mining 292 Berendsen 222 Berkeley 160 Betfair Group 202 BG Group 8 BHP Billiton 7 Big Yellow Group 308 Blinkx 344 Bodycote 259 Booker 213 Boot (Henry) 478 Borders & Southern Petroleum 378 Bovis Homes Group 268 Bowleven 220 BP 4 Brammer 351 Brewin Dolphin 319 British American Tobacco 9 British Land 61 British Sky Broadcasting 27 Britvic 210 Brown (N) 237 BT Group 28 BTG 235 Bunzl 107 Burberry 59 Bwin Party Digital Entertainment 223 Cable & Wireless Communications 181 Cable & Wireless Worldwide 158 Cairn Energy 49 Caledon Resources 380 Camellia 389 Cape 270 Capita 66 Capital & Counties Properties -

Capital Analytics UK Registrars Benchmarking Survey 2009

Capital Analytics UK Registrars Benchmarking Survey 2009 CAPITAL ANALYTICS UK REGISTRARS BENCHMARKING SURVEY 2009 September 2009 © Copyright, 2009 Capital Analytics Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission from Capital Analytics Limited. No advertising or other promotional use can be made of the information in this report without the express prior written consent of Capital Analytics Limited. Capital Analytics UK Registrars Benchmarking Survey 2009 CONTENTS SURVEY PURPOSE AND METHODOLOGY ................................................................................... 4 Purpose ................................................................................................................................................ 4 Methodology ........................................................................................................................................ 4 COMPANY SATISFACTION INDEX 2009 ........................................................................................ 6 INDUSTRY ANNUAL OVERALL COMPARISON 2005 - 2009 ...................................................... 7 OVERALL SATISFACTION WITH SERVICES .............................................................................. 8 Comments on Overall Satisfaction with Services ................................................................................ 8 Overall Satisfaction with Registrar .................................................................................................. -

The Sectors Which Recover Quickest from a Sell-Off

VOL 21 / ISSUE 43 / 31 OCTOBER 2019 / £4.49 BOUNCING BACK THE SECTORS WHICH RECOVER QUICKEST FROM A SELL-OFF... AND STAND TALLEST IN A DOWNTURN GLAXOSMITHKLINE WHY ALTERNATIVE FUNDS EXPOSED TRANSFORMED BY ASSETS ARE IN TO HIGH-RISK NEW STRATEGY DEMAND DIVIDENDS EDITOR’S VIEW Why stewardship really matters with investing A new code draws the spotlight on how big investors engage with companies he introduction of a new UK Stewardship in the eyes of the wider public has to be a good Code by the Financial Reporting Council thing, particularly if it opens people’s eyes to the T will look to raise the bar on how big opportunities provided by putting their cash to investors hold the companies in which they invest work in the markets. to account. A lot of the headlines around the news focused DON’T LOSE SIGHT OF UK STRENGTHS on the climate change angle but there is more to In fairness, if it wanted to distract from its own the code than environmental concerns, including shortcomings, the investment world could easily how institutions make their decisions and what point to failures of stewardship among the political they are doing about issues such as governance class in the UK. and diversity. As we write the country remains mired in a Brexit Fundamentally this is about recognising that stalemate with the potential joys of a Christmas investors are part-owners of a business. Even big election. Companies and markets are still denied asset managers are sometimes guilty of buying the clarity on the UK’s future relationship with the shares and seeing their work as done. -

The Art of Investing in Smaller Companies – P 30

www.whatinvestment.co.ukWhat FOR Investment A WEALTHIER FUTURE Issue 424 July 2018 £4.50 The art of investing in smaller companies – P 30 Emerging Profit from Wine Markets How looking beyond the China and India are catching blockbuster vintages can the US, but are they worth deliver corking returns investing in? – Page 36 – Page 50 WI.JULY.2018.Cover.indd 1 21/06/2018 16:07 NEED INVESTMENT GUIDANCE? Why not join thousands of investors and benefi t from all our independent analysis and insight? Subscribe www.whatinvestment.co.ukWhat FOR Investment A WEALTHIER FUTURE Issue 423 June 2018 £4.50 and get Britain’s Buffetts issues How can you profit 12 from the UK managers inspired by the legendary American investor for the price – P 14 of 10 > Unit Trusts 1 | >| The Last Word | Peter Elston behaviour of, say, numbers or Hubris is the greatest challenge planets or elementary particles or rocks or plants or people. Our new columnist argues that being a non- Successful investing, on the other conformist and not following the crowd can be hand, necessitates disagreement. The Aging bull The Empire Trust For me to give myself a chance uncomfortable but can also produce good returns of beating my competitors, and thus the market, the last thing I should do is agree with them. I The bull market might be The British Empire Trust I am not exactly sure how I have one was just lucky. Probably seek out where they are huddled ended up as a chief investment best to assume you were lucky.