Good and Bad News for Investors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Sectors Which Recover Quickest from a Sell-Off

VOL 21 / ISSUE 43 / 31 OCTOBER 2019 / £4.49 BOUNCING BACK THE SECTORS WHICH RECOVER QUICKEST FROM A SELL-OFF... AND STAND TALLEST IN A DOWNTURN GLAXOSMITHKLINE WHY ALTERNATIVE FUNDS EXPOSED TRANSFORMED BY ASSETS ARE IN TO HIGH-RISK NEW STRATEGY DEMAND DIVIDENDS EDITOR’S VIEW Why stewardship really matters with investing A new code draws the spotlight on how big investors engage with companies he introduction of a new UK Stewardship in the eyes of the wider public has to be a good Code by the Financial Reporting Council thing, particularly if it opens people’s eyes to the T will look to raise the bar on how big opportunities provided by putting their cash to investors hold the companies in which they invest work in the markets. to account. A lot of the headlines around the news focused DON’T LOSE SIGHT OF UK STRENGTHS on the climate change angle but there is more to In fairness, if it wanted to distract from its own the code than environmental concerns, including shortcomings, the investment world could easily how institutions make their decisions and what point to failures of stewardship among the political they are doing about issues such as governance class in the UK. and diversity. As we write the country remains mired in a Brexit Fundamentally this is about recognising that stalemate with the potential joys of a Christmas investors are part-owners of a business. Even big election. Companies and markets are still denied asset managers are sometimes guilty of buying the clarity on the UK’s future relationship with the shares and seeing their work as done. -

FTSE Factsheet

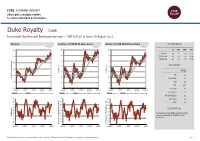

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

2017 Annual Report

Annual Report 2017 Capital and income growth from active global equity investment Witan Investment Trust plc Our objective /RQJWHUPJURZWKLQLQFRPHDQGFDSLWDOWKURXJK 4USBUFHJD3FQPSU 01 3HUIRUPDQFHVQDSVKRW DFWLYHPXOWLPDQDJHULQYHVWPHQWLQJOREDOHTXLWLHV 02 )LQDQFLDOKLJKOLJKWV 04 &KDLUPDQpVUHSRUW 06 &KLHI([HFXWLYHpVUHSRUW 08 6WUDWHJLF5HSRUW :LWDQLVDQLQYHVWPHQWWUXVWZKLFKLVOLVWHGRQWKH 21 ,QYHVWPHQW0DQDJHUV 24 )LIW\/DUJHVW,QYHVWPHQWV /RQGRQ6WRFN([FKDQJHDQGZDVIRXQGHGLQ 25 &ODVVLßFDWLRQRI,QYHVWPHQWV %JSFDUPSTn3FQPSU :LWDQRIIHUVDFWLYHO\PDQDJHGH[SRVXUHWRJOREDO 26 Board of Directors 28 'LUHFWRUVp5HSRUW PDUNHWV SULQFLSDOO\HTXLWLHV XVLQJDPXOWLPDQDJHU $PSQPSBUF(PWFSOBODF DSSURDFK7KHSRUWIROLRLVGLYHUVLßHGE\JHRJUDSKLFDO 32 &RUSRUDWH*RYHUQDQFH6WDWHPHQW 41 5HSRUWRIWKH$XGLW&RPPLWWHH UHJLRQLQGXVWULDOVHFWRUDQGDWWKHLQGLYLGXDOVWRFN 43 'LUHFWRUVp5HPXQHUDWLRQ5HSRUW OHYHO 56 6WDWHPHQWRI'LUHFWRUVp5HVSRQVLELOLWLHV 'JOBODJBMTUBUFNFOUT 57 ,QGHSHQGHQW$XGLWRUpV5HSRUW :LWDQW\SLFDOO\XVHVEHWZHHQDQGLQYHVWPHQW 64&RQVROLGDWHG6WDWHPHQWRI &RPSUHKHQVLYH,QFRPH PDQDJHUV7KHEOHQGRIGLIIHUHQWDFWLYHDSSURDFKHV 65&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\Statement RI&KDQJHVLQ(TXLW\ DQGVW\OHVDLPVWRGHOLYHUDGGHGYDOXHIRU 66&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\%DODQFH VKDUHKROGHUVZKLOHVPRRWKLQJRXWWKHYRODWLOLW\ Sheets 67&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\ QRUPDOO\DVVRFLDWHGZLWKDVLQJOHPDQDJHU &DVK)ORZ6WDWHPHQWV 68 1RWHVWRWKH)LQDQFLDO6WDWHPHQWV 0UIFS*OGPSNBUJPO 94 Other Information 96$OWHUQDWLYH,QYHVWPHQW)XQG0DQDJHUVp 'LUHFWLYH 97 +LVWRULFDOUHFRUG 98 +RZWRLQYHVW 99 6KDUHKROGHULQIRUPDWLRQ and AOWHUQDWLYH 5PßOEPVUNPSF -

Stoxx® Europe Total Market Financial Services Index

STOXX® EUROPE TOTAL MARKET FINANCIAL SERVICES INDEX Components1 Company Supersector Country Weight (%) LONDON STOCK EXCHANGE Financial Services GB 10.21 DEUTSCHE BOERSE Financial Services DE 9.72 INVESTOR B Financial Services SE 8.23 PARTNERS GRP HLDG Financial Services CH 5.46 3I GROUP PLC. Financial Services GB 4.58 STANDARD LIFE ABERDEEN Financial Services GB 3.39 EXOR NV Financial Services IT 2.91 INVESTOR A Financial Services SE 2.82 GRP BRUXELLES LAMBERT Financial Services BE 2.74 M&G Financial Services GB 2.63 HARGREAVES LANSDOWN Financial Services GB 2.32 INTERMEDIATE CAPITAL GRP Financial Services GB 2.01 KINNEVIK B Financial Services SE 1.93 SCHRODERS Financial Services GB 1.68 AMUNDI Financial Services FR 1.54 EURONEXT Financial Services FR 1.41 INDUSTRIVARDEN A Financial Services SE 1.37 INDUSTRIVARDEN C Financial Services SE 1.32 INVESTEC Financial Services GB 1.24 WENDEL Financial Services FR 1.20 QUILTER Financial Services GB 1.17 ACKERMANS & VAN HAAREN Financial Services BE 1.14 SOFINA Financial Services BE 1.09 IG GRP HLDG Financial Services GB 1.08 MAN GRP Financial Services GB 1.04 PARGESA Financial Services CH 1.01 TP ICAP Financial Services GB 0.98 EURAZEO Financial Services FR 0.98 ASHMORE GRP Financial Services GB 0.97 BOLSAS Y MERCADOS ESPANOLES Financial Services ES 0.93 GRENKE N Financial Services DE 0.92 AZIMUT HLDG Financial Services IT 0.84 ONESAVINGS BANK Financial Services GB 0.80 JUPITER FUND MANAGEMENT Financial Services GB 0.79 JOHN LAING GROUP Financial Services GB 0.78 LATOUR INVESTMENT B Financial -

Witan Investment Trust

Witan Investment Trust Adding to its record of outperformance Investment trusts 21 May 2018 Witan Investment Trust (WTAN) has employed an active multi-manager strategy since 2004, offering investors diverse exposure to global equities. Price 1,094.0p In 2017, the trust delivered another year of outperformance versus its Market cap £1,950m composite benchmark, which it has surpassed over the last one, three, five AUM £2,188m and 10 years. WTAN’s investment director, James Hart, believes that equities can continue to offer attractive returns for the patient investor, NAV* 1,110.5p Discount to NAV 1.5% although he notes that stock market volatility is now higher than the NAV** 1,102.9p benign levels experienced in 2017. In this environment, he believes that Discount to NAV 0.8% active stock picking, rather than blanket equity exposure, should produce *Excluding income. **Including income. As at 17 May 2018. better returns for investors. WTAN has a progressive dividend policy; its Yield 2.0% annual distribution has increased for the last 43 consecutive years. Ordinary shares in issue 178.2m Code WTAN 12 months Share price NAV Composite MSCI World FTSE All- FTSE AW North Primary exchange LSE ending (%) (%) benchmark* (%) (%) Share (%) America (%) AIC sector Global 30/04/14 18.9 9.8 7.1 8.1 10.5 10.6 Benchmark Composite benchmark 30/04/15 19.6 17.0 14.3 18.7 7.5 23.0 30/04/16 (7.1) (1.4) (3.6) 1.1 (5.7) 4.8 Share price/discount performance 30/04/17 35.3 30.7 27.2 30.6 20.1 33.1 1,150 2 30/04/18 10.6 8.9 8.8 6.9 8.2 6.3 1,100 0 Discount(%) Source: Thomson Datastream. -

Witan Investment Trust Plc Portfolio Listing As at 29.02.2020

WITAN INVESTMENT TRUST PLC PORTFOLIO LISTING AS AT 29.02.2020 SECURITY % OF TOTAL INVESTMENT SYNCONA ORD NPV 2.39 APAX GBL ALPHA NPV 2.13 TESCO ORD GBP0.05 1.76 ALPHABET A USD0.001 1.40 VONOVIA SE NPV 1.40 BLACKROCK WORLD MINING TST ORD GBP0.05 1.33 CHARTER COMMUNICATIONS -A USD0.001 1.32 BAE SYSTEMS ORD GBP0.025 1.13 BT GRP ORD GBP0.05 1.06 INTL CONSOLIDATED AIRLINE EUR0.5 1.06 LLOYDS BANKING GRP GBP0.1 0.96 DELTA AIR LINES USD0.0001 0.96 SMURFIT KAPPA GRP EUR0.001 0.86 ELECTRA PRIVATE EQTY GBP 0.25 0.83 FACEBOOK A USD0.000006 0.82 PRINCESS PRIVATE EQTY HLDGS ORD EUR0.001 0.79 SCHRODER REAL ESTATE INV TST ORD NPV 0.76 LEG IMMOBILIEN NPV 0.76 TAIWAN SEMICONDUCTOR MANUFACTURING TWD10 0.73 CANADIAN PACIFIC RAILWAY NPV 0.70 DEUTSCHE LUFTHANSA REG NPV 0.70 UNILEVER GBP0.031111 0.69 AIRBUS SE EUR1 0.69 ARCELORMITTAL NPV 0.66 UPM-KYMMENE NPV 0.66 ROYAL BANK OF SCOTLAND GRP GBP1 0.66 UNILEVER EUR0.16 0.64 RIO TINTO ORD GBP0.1 0.64 RECKITT BENCKISER GRP GBP0.1 0.63 MAITLAND INSTL SVC MI SOMERSET EMG MKTS SMALL 0.62 SVENSKA HANDELSBKN A SHS NPV 0.60 DIAGEO GBP28.93518 0.58 UNITED CONTINENTAL HLDGS USD0.01 0.58 APPLIED MATERIALS USD0.01 0.57 LAM RESEARCH CORP COM USD0.001 0.56 RELX GBP0.144397 0.55 LONDON STK EXCHANGE GRP GBP0.06918605 0.55 RAYTHEON CO USD0.01 0.54 INTERCONTINENTAL EXCHANGE GRP USD0.01 0.53 BAXTER INTL COM USD1 0.53 FLUTTER ENT GBP0.09 0.52 ALTICE USA A USD0.01 0.52 INTUIT USD0.01 0.52 PHILIP MORRIS INTL NPV 0.52 KAO CORP NPV 0.51 UNITEDHEALTH GRP USD0.01 0.51 PAYPAL HLDGS W/I USD0.0001 0.51 BRITISH AMER TOBACCO GBP0.25 0.50 HEINEKEN -

Issue Country of Domicile GICS Sector Portfolio Weight (%) AJ BELL United

Issue Country of domicile GICS sector Portfolio weight (%) AJ BELL United Kingdom Financials 3.35% AVAST United Kingdom Information Technology 2.45% CAPITAL FOR COLLEAGUES United Kingdom Financials 0.03% CERES POWER HOLDINGS United Kingdom Industrials 0.76% COMPASS GROUP United Kingdom Consumer Discretionary 1.73% COUNTRYSIDE PROPERTIES United Kingdom Consumer Discretionary 3.84% CREST NICHOLSON HOLDINGS United Kingdom Consumer Discretionary 1.84% DFS FURNITURE United Kingdom Consumer Discretionary 3.08% DISTRIBUTION FINANCE CAPITAL United Kingdom Financials 0.70% ETHICAL PROPERTY CO United Kingdom Real Estate 0.06% FIRST DERIVATIVES United Kingdom Information Technology 2.00% GB GROUP United Kingdom Information Technology 2.58% GENUIT GROUP United Kingdom Industrials 1.04% GREENCOAT UK WIND United Kingdom Utilities 0.96% GYM GROUP United Kingdom Consumer Discretionary 2.75% HALMA United Kingdom Information Technology 2.74% HARGREAVES LANSDOWN United Kingdom Financials 3.53% HELIOS TOWERS United Kingdom Communication Services 2.93% HOME REIT United Kingdom Consumer Discretionary 0.88% INTERTEK GROUP United Kingdom Industrials 3.23% KINGSPAN GROUP Ireland Industrials 2.52% LEARNING TECHNOLOGIES GROUP United Kingdom Information Technology 4.01% LEGAL & GENERAL GROUP United Kingdom Financials 3.72% LONDON STOCK EXCHANGE GROUP United Kingdom Financials 3.78% MORTGAGE ADVICE BUREAU HOLDINGS United Kingdom Financials 1.57% NATIONAL EXPRESS GROUP United Kingdom Industrials 3.35% NATIONAL GRID United Kingdom Utilities 1.30% OXFORD INSTRUMENTS -

28447 R Witan AR Cover (With Spine).Indd

Witan plc Investment Trust Annual Report 2016 ANNUAL REPORT 2016 Capital and income growth from active global equity investment Printed by Park Communications on FSC® certified paper. Park is an EMAS certified company and its Environmental Management System is certified to ISO 14001. 100% of the inks used are vegetable oil based, 95% of press chemicals are recycled for further use and, on average 99% of any waste associated with this production will be recycled. This document is printed on Cocoon 50% Silk and Cocoon 50% Offset paper. The fibres are sourced from well-managed, responsible, FSC® certified forests. The pulp used in this product is bleached using an Elemental Chlorine Free (ECF) process. Job No: 28447 Proof Event: 25 Black Line Level: 1 Park Communications Ltd Alpine Way London E6 6LA Customer: Witan Project Title: Annual Report T: 0207 055 6500 F: 020 7055 6600 WITAN’S OBJECTIVE OUR RELATIONSHIP WITH THE RHS Long-term growth in income and capital through active multi-manager investment in global equities Witan is an investment trust which is listed on the London Stock Exchange and was founded in 1909. Witan offers diversified exposure to global markets (principally equities) using a multi-manager approach. The portfolio is diversified by geographical region, industrial sector and at the individual stock level. Witan typically uses between 10 and 15 investment managers. The blend of different active approaches and styles aims to deliver added value for shareholders while smoothing out the volatility normally associated Witan Investment Trust plc has enjoyed a long and fruitful relationship with the Royal with a single manager. -

6 Cheap Stocks in an Expensive Market We Use Three Methods to Spot Rare Pockets of Value

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 44 / 09 NOVEMBER 2017 / £4.49 SHARES WE MAKE INVESTING EASIER 6 CHEAP STOCKS IN AN EXPENSIVE MARKET WE USE THREE METHODS TO SPOT RARE POCKETS OF VALUE RETAIL INVESTORS LOSE OUT BIG TIME WITH IPOS SCOTTISH MORTGAGE PLEADS FOR PATIENCE INTEREST RATE HIKE: WHY EXPERTS DON’T EXPECT ANOTHER ONE SOON TO KNOW LOCAL COMPANIES, KEEP LOCAL COMPANY. LET’STALKHOW. FIDELITYCHINA That’s whyDaleNicholls, managerofFidelity ChinaSpecialSituations, andhis team of SPECIALSITUATIONSPLC researchersare basedinHongKongand Chinaischanging, presenting significantinvestment Shanghai. Theirlocal knowledgeand opportunitiesfor thosewho knowwhere to look. connectionsmakethemwell-placed to identifyand benefit fromvaluation anomalies Why? Well,the spendingpowerofagrowingand affluent as they arise. middle class is increasingly driving theeconomy. And governmentreforms supportthisshift to afocus on the So,ifyou’relooking forlocal knowledge-basedinvestment new consumer. in amarketthat’s toobig to ignore, take acloserlookat theUK’slargest Chinainvestmenttrust. In suchavastand complexmarket, youneed on-the- groundexpertise to take fulladvantage of thesechanges Please note thatpastperformanceisnot aguideto andthe resultingundervaluations, particularly of small and thefuture. Thevalue of investments cangodownaswell medium-sized companies,which can occur. as up andyou maynot get back theamountinvested. Overseas investments are subject to currency fluctuations. PAST PERFORMANCE Investments in small and emergingmarkets -

FOR SMALL CAP VALUE Why Fund Managers Are Cashing out of Star Performers Like Fevertree to Reinvest in Better Opportunities

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 28 / 20 JULY 2017 / £4.49 SHARES WE MAKE INVESTING EASIER SEARCHING FOR SMALL CAP VALUE Why fund managers are cashing out of star performers like Fevertree to reinvest in better opportunities OUR GREAT ALL CHANGE IDEAS ARE at the top BEATING THE for EasyJet MARKET and ITV 14% AVERAGE GAIN CARILLION OVER 12 bounces back MONTHS from share price collapse FIVE WAYS TO BOOST YOUR RETIREMENT INCOME EDITOR’S VIEW Do the rewards compensate for the risks taken? We look at performance for investors risking their money in the mining sector hareholders in miner Rio Tinto (RIO) have for half of the year; sustaining that trend for enjoyed a 12.3% total return so far this year. the rest of 2017 would imply a 24% return on S While more than twice the total return an annualised basis. Therefore you are being from the FTSE 100 index (5.6%), is such a reward adequately compensated in this situation for the adequate to compensate for the risks involved with risk of investing in mining, in my opinion. investing in such a volatile sector? Just remember that past performance doesn’t Investors should always think about the ‘equity always equate to future performance – you aren’t risk premium’ when establishing the desired return guaranteed to make that extra 12% in the second from putting money in a certain sector. That is the half of the year. extra return you hope to generate on top of the ‘risk-free’ rate, which in the UK is benchmarked WHY INVEST IN RIO? against the UK 10-year government bond (aka gilt). -

Collective Wisdom Annual Report 2018 Report Annual

Witan Investment Trust plc Trust Investment Witan Collective Wisdom Annual Report 2018 Witan Investment Trust plc Annual Report 2018 Our purpose STRATEGIC REPORT FINANCIAL STATEMENTS 01 Company overview 58 Independent Auditor’s Report is to achieve significant 06 Key performance indicators to the members of Witan 08 Business model Investment Trust plc 10 Our strategy 64 Consolidated Statement of growth in our investors’ 12 Chairman’s statement Comprehensive Income 14 CEO’s review of the year 65 Consolidated and Individual wealth by investing in 19 Costs Statement of Changes in Equity 20 Corporate and 66 Consolidated and Individual operational structure Balance Sheet global equity markets, 21 Principal risks and uncertainties 67 Consolidated and Individual 23 Viability statement Cash Flow Statements using a multi-manager 24 Meet the managers 68 Notes to the Financial 30 Fifty largest investments Statements 31 Classification of investments 89 Other Financial Information approach. (unaudited) CORPORATE GOVERNANCE 91 Additional Shareholder Information 32 Board of directors 94 Contacts 34 Corporate Governance Our objective 40 Report of the Audit Committee 42 Directors’ Remuneration Report 53 Directors’ Report is to achieve an investment 57 Statement of Directors’ total return exceeding Responsibilities that of the Company’s The annual report is intended to help shareholders assess benchmark over the long the Company’s strategy. It contains certain forward-looking statements. These are made by the directors in good faith term, together with based on information available to them up to the time of their approval of this report. Such statements should be growth in the dividend treated with caution due to the inherent uncertainties, including economic and business risks, underlying ahead of inflation.