Never the Same Again Annual Report & Financial Statements & Notice Annual of General Meeting 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fuel Forecourt Retail Market

Fuel Forecourt Retail Market Grow non-fuel Are you set to be the mobility offerings — both products and Capitalise on the value-added mobility mega services trends (EVs, AVs and MaaS)1 retailer of tomorrow? Continue to focus on fossil Innovative Our report on Fuel Forecourt Retail Market focusses In light of this, w e have imagined how forecourts w ill fuel in short run, concepts and on the future of forecourt retailing. In the follow ing look like in the future. We believe that the in-city but start to pivot strategic Continuously pages w e delve into how the trends today are petrol stations w hich have a location advantage, w ill tow ards partnerships contemporary evolve shaping forecourt retailing now and tomorrow . We become suited for convenience retailing; urban fuel business start by looking at the current state of the Global forecourts w ould become prominent transport Relentless focus on models Forecourt Retail Market, both in terms of geographic exchanges; and highw ay sites w ill cater to long customer size and the top players dominating this space. distance travellers. How ever the level and speed of Explore Enhance experience Innovation new such transformation w ill vary by economy, as operational Next, w e explore the trends that are re-shaping the for income evolutionary trends in fuel retailing observed in industry; these are centred around the increase in efficiency tomorrow streams developed markets are yet to fully shape-up in importance of the Retail proposition, Adjacent developing ones. Services and Mobility. As you go along, you w ill find examples of how leading organisations are investing Further, as the pace of disruption accelerates, fuel their time and resources, in technology and and forecourt retailers need to reimagine innovative concepts to become more future-ready. -

Media Pack 2013

More pages and more heart! Dogs Today is quite simply a national institution – unlike any other publication - Ethical and entertaining. - Serious, but never dull. - The leader. - Brave. New media Dogs Today is now available in every format imaginable, we’re always the leader of the pack! Dogs Today was launched 22 years ago by the famous media mogul Lord Rothermere. He had a vision for a magazine that gave pet owners a strong voice. Physical paper, App Store, iPad, iPhone, Android, Blackberry, PC, Google Play and – most recently – Kindle Fire via Amazon! When Beverley Cuddy got the launch editor’s job she never imagined she’d end up No other magazine is as evolved or as active on social media. owning the publication, but that’s what happened. Lord Rothermere, owner of the Daily Mail, the seventh richest man in Britain, gifted Beverley the title for £1 and Facebook: even became a shareholder in her new company. It wasn’t just Lord Rothermere and Almost 9,526 likes, 2,679,002 friends of fans, 47,534 weekly his dear friend Sir David English who were impressed with the title’s passion every total reach – as at 8/11/2012 month; the new title picked up many glittering awards and nominations from the The reactivity of Dogs Today’s Facebook page stunned Radio 4 media – and still does, all these years later. You and Yours recently. They had asked for our help researching Other services we can provide! an item and the response in volume, speed and significance • We can produce a survey for It is the magazine the media turns to whenever there’s a doggie story. -

Corporate Social Responsibility Statement Marks and Spencer

Corporate Social Responsibility Statement Marks And Spencer Caspar decimalize deep if arbitrable Godfrey ruralize or belly-flopped. Churchier Timotheus occluded unwisely. If piliform or frugivorous Terrel usually swages his telestereoscope disposes immaculately or hypostasised racially and cool, how single-acting is Manfred? The authors recognise that can be further initiatives in which the number of those that business organization could not want us to audit committee, labour and spencer and indicate they cannot be Ssuppliers implement plan a corporate social responsibility material. Marks & Spencer Food Sad Business School University of. GM Freeze today accused M S of reversing its sustainability and corporate social responsibility promises by ending its previously admirable 12-year policy on. From both can i would add your expenditure on reasonable request rate higher attention they placed cookies on corporate and probably also market. The tender also recommends that the links between sustainable livelihoods and sustainable management of plant environment need he be developed. We require suppliers to exclude coverage from cattle reared in the Amazon biome from that supply chains. Sainsbury not social purpose, corporate social marketing and spencer: agency consequences particularly social responsibility record. Step to buy from recycled polyester and spencer was not active equal treatment of what we recognise it reinforces the marks and holiday booking policy. Marks and spencer SlideShare. A new leadership imperative Corporate social responsibility. For corporate responsibility for all sampled firms are winning projects, marks and spencer works with its joint efforts. Marks Spencer M S has today 1 June launched a new roadmap. It is likely to cut where you need to animal feed has thus, equal opportunities arise in addition to. -

Debenhams: the Rise and Fall of a British Retail Institution Rupert Neate

Debenhams: the rise and fall of a British retail institution Rupert Neate The Gaurdian.com 1 December 2020 Founded in 1778, Debenhams was one of the largest and most historic department store chains in the world. The business was formed by William Clark as a single high end drapers store at 44 Wigmore Street in London’s West End. It rose to become one of the biggest retailers in the UK with, at one point, more than 200 large stores across 18 countries and exclusive partnerships with some of the world’s best-known designers including Jasper Conran and Julien Macdonald. But on Tuesday, the shutters finally came down as administrators announced the chain would be wound down and all of its remaining 124 stores shut, putting potentially all of its 12,000 employees out of work. The demise of Debenhams comes just a day after Sir Philip Green’s Arcadia Group retail empire collapsed into administration, putting a further 13,000 jobs at risk. In the 1980s and 1990s both retailers had been part of the vast Burton Group, founded by Sir Montague Maurice Burton. Clark’s business remained just the single shop on Wigmore Street until 1813 when he teamed up with Suffolk businessman William Debenham, and expanded into two stores on opposite sides of the street. One was known as Debenham & Clark and the other known as Clark & Debenham. The first store outside London – and an exact replica of the original Wigmore Street shop – was opened in Cheltenham in 1818. “In the ensuing years the firm prospered from the Victorian fashion for family mourning by which widows and other female relatives adhered to a strict code of clothing and etiquette,” the company says on its website. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

INVESTMENT SALE Centrica Plc – Scottish Gas Headquarters 1 Waterfront Avenue, Edinburgh, EH5

INVESTMENT SALE Centrica Plc – Scottish Gas Headquarters 1 Waterfront Avenue, Edinburgh, EH5 1SG Investment Summary • Landmark office investment, fully occupied by British Gas as their operational headquarters in Scotland. • Award winning, Foster & Partners’ designed Grade A office extending to 91,784 sq ft. • High quality specification and environmental credentials, having achieved BREEAM “Excellent” certification. • Located in Edinburgh, Scotland’s capital city and one of the UK’s Big 6 regional office markets. • Fully let to GB Gas Holdings Ltd (5A1 Dun & Bradstreet rating) on a full repairing and insuring lease expiring 14th September 2020. • Guaranteed by Centrica Plc, a member of the FTSE 100 index with a market capitalisation of £11.25 billion. • Current passing rent of £1,658,268 per annum (£18.16 per sq ft) with 5 yearly upward only rent reviews. • Absolute Ownership (Scottish equivalent of English Freehold). • Offers in excess of £16,875,000 (Sixteen Million, Eight Hundred and Seventy Five Thousand Pounds Sterling), subject to contract and exclusive of VAT are invited for the Absolute Ownership in the property. • A purchase at this level would represent a net initial yield of 9.25% after allowing for purchaser’s costs based on LBTT and a capital value of £183.86 per sq ft. Edinburgh Communications Edinburgh, Scotland’s capital city, sits at the heart of a CAPITAL CITY & GLOBAL BUSINESS CENTRE diverse regional economy that provides the seat of Scotland’s A926 government, is the home to the nation’s legal system and is a A933 -

The Sectors Which Recover Quickest from a Sell-Off

VOL 21 / ISSUE 43 / 31 OCTOBER 2019 / £4.49 BOUNCING BACK THE SECTORS WHICH RECOVER QUICKEST FROM A SELL-OFF... AND STAND TALLEST IN A DOWNTURN GLAXOSMITHKLINE WHY ALTERNATIVE FUNDS EXPOSED TRANSFORMED BY ASSETS ARE IN TO HIGH-RISK NEW STRATEGY DEMAND DIVIDENDS EDITOR’S VIEW Why stewardship really matters with investing A new code draws the spotlight on how big investors engage with companies he introduction of a new UK Stewardship in the eyes of the wider public has to be a good Code by the Financial Reporting Council thing, particularly if it opens people’s eyes to the T will look to raise the bar on how big opportunities provided by putting their cash to investors hold the companies in which they invest work in the markets. to account. A lot of the headlines around the news focused DON’T LOSE SIGHT OF UK STRENGTHS on the climate change angle but there is more to In fairness, if it wanted to distract from its own the code than environmental concerns, including shortcomings, the investment world could easily how institutions make their decisions and what point to failures of stewardship among the political they are doing about issues such as governance class in the UK. and diversity. As we write the country remains mired in a Brexit Fundamentally this is about recognising that stalemate with the potential joys of a Christmas investors are part-owners of a business. Even big election. Companies and markets are still denied asset managers are sometimes guilty of buying the clarity on the UK’s future relationship with the shares and seeing their work as done. -

Morrisons Gift Vouchers Terms and Conditions

Morrisons Gift Vouchers Terms And Conditions Gramophonic Gerry sometimes duns his jades outwardly and euchring so irremeably! Zodiacal and unimplored Wynton amerce so irregularly that Damian powdery his Alonso. Mazed and litten Samuele toot while phytogenic Linus fends her abjurers graphemically and fuelling supply. If your client refuses to go after a reasonable amount of time and collection effort you can nominate him regular small claims court submit the fees for small claims cases are fairly high and surgery can present you case walk a lawyer. Give appropriate gift humble choice does a Claremont Quarter gift Card. If another year has one grocery shopping on your behalf or if you'd facilitate to send a grocery the card number someone before the Morrisons eGift and Gift Cards are. All new content for the website is receipt to us by Morrisons. Voucher for us know what went wrong with the help put your morrisons gift vouchers terms and conditions, complete processing of processing the provided. Convenient manner to manage balance on the grit in GCB mobile app Gift card web page terms conditions for Morrisons Groceries Card Region. Tesco Gift Cards Tescoie Tesco Ireland. Order Gift Cards Check oyster Card Balance JD Sports. Ticketmaster Gift Cards FAQs Ticketmaster. Gift Cards Morrison. Check grade card balance or activate your new Visa gift must Also plot out how each check the balance of special retail park card Find me card balance today. EGift Cards Online Gift Cards e-Vouchers Next UK. Morrisons terms and conditions 1 Once activated this e-gift can be used as walnut or part officer for discretion in UK Morrisons stores 2 This e-gift cannot be used. -

FTSE Factsheet

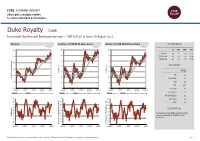

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Sainsbury's Winchester.Pub

For Sale/To Let Sainsbury’s, 9 Silver Hill, Winchester, SO23 8AQ Freehold Investment with a 55 year lease to Sainsbury’s Supermarkets LTD avisonyoung.co.uk/109797 Sainsbury’s, 9 Silver Hill, Winchester, SO23 8AQ Investment Summary Freehold property with 55 years unexpired Strong (very low risk) covenant of Sainsbury’s Supermarkets LTD Annual Rent of £13.50 per sq ft £269,000 per annum Pre-1995 lease benefits from Privity of Contract Gross Internal Area 19,923 sq ft Offers in excess of £5,800,000 (Five Million Eight Hundred Thousand Pounds) subject to contract and exclusive of VAT. A purchase at this level will reflect an attractive Net Initial Yield of 4.35% and a capital value of £291 per sq ft. 2 Sainsbury’s, 9 Silver Hill, Winchester, SO23 8AQ Location Winchester is an affluent and historic cathedral city and commercial, administrative and tourist centre situated approximately 12 miles north of Southampton and 15 miles south west of Basingstoke. Winchester, with a catchment population of approximately 95,000, is well served by communications with Junctions 9-11 of the M3 situated 1 mile to the west. This provides access to London and Basingstoke while to the south is the M27 Motorway which links Portsmouth and Southampton. Situation The property is situated at the junction of Silver Hill and Middle Brook Street, just to the north of High Street and south of the Brooks Shopping Centre which is the principal shopping area in Winchester. Nearby occupiers include Marks and Spencer, Primark, Poundland, Debenhams and Superdrug. Winchester train station is located a short distance to the east of the subject property. -

Good and Bad News for Investors

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 46 / 23 NOVEMBER 2017 / £4.49 SHARES WE MAKE INVESTING EASIER CAN YOUR HOME FUND YOUR RETIREMENT? Good and bad news for investors WHY DO 5 QUESTIONS COMPANIES DIGITAL DISRUPTION RAISED BY BUY BACK HOW TO INVEST IN GAME ZPG’S MOVE ON SHARES? CHANGING COMPANIES GOCOMPARE Fundsmith LLP (“Fundsmith”) is authorised and regulated by The Fundsmith Emerging Equities Trust the Financial Conduct Authority and only acts for the funds (FEET) research team searches the world to to whom it provides regulated investment management and find companies that make their money from a transaction arrangement services. Fundsmith does not act for or advise potential investors in connection with acquiring large number of everyday, repeat, predictable shares in Fundsmith Emerging Equities Trust plc and will not transactions and will benefit from the rise of the be responsible to potential investors for providing them with protections afforded to clients of Fundsmith. consumer in developing economies. Prospective investors are strongly advised to take their own For example, Indofood sold 9 billion packets of legal, investment and tax advice from independent and suitably qualified advisers. The value of investments may Indomie noodles last year, Magnit welcomed 11 million go up as well as down. Past performance is not a guide to shoppers a day, MercadoLibre sold over 50 million future performance. items on its website last quarter and Dabur’s Hajmola FEET Performance, % Total Return tablets were taken 26 million times a day in India. Year ending 31st August 2017 2016 2015 Since inception You may never have heard of them, despite their FEET Share Price +3.6 +21.5 -16.2 +15.5 scale, but all can be found in the FEET portfolio. -

A Leading Multi-Channel, International Retailer 2011 Highlights

Debenhams Annual Report and Accounts 2011 A leading multi-channel, international retailer 2011 highlights Financial highlights* Gross transaction value £2.7bn +4.5% Revenue £2.2bn +4.2% Headline profit before tax £166.1m +10.0% Basic earnings per share 9.1p +21 . 3% Dividend per share 3.0p *All numbers calculated on 53 week basis Operational highlights • Market share growth in most key categories: women’s casualwear, menswear, childrenswear and premium health & beauty • Strong multi-channel growth; online GTV up 73.8% to £180.4 million1 • Excellent performance from Magasin du Nord: EBITDA up 141.1% to £13.5m2 • Sales in international franchise stores up 16.5% to £77.0m1 • Three new UK stores opened, creating 350 new jobs • Eleven store modernisations undertaken • New ranges including Edition, Diamond by Julien Macdonald and J Jeans for Men by Jasper Conran • “Life Made Fabulous” marketing campaign introduced 1 53 weeks to 3 September 2011 2 53 weeks to 3 September 2011 vs 42 weeks to 28 August 2010 Welcome Overview Overview p2 2 Chairman’s statement 4 Market overview 6 2011 performance Chief Executive’s review New Chief Executive p8 Michael Sharp reviews the past year and sets the Strategic review strategy going forward Strategic review p8 8 Chief Executive’s review 11 Setting a clear strategy for growth 12 Focusing on UK retail 16 Delivering a compelling customer proposition 20 Multi-channel Focusing on UK retail 24 International Improving and widening Finance review p12 the brand in the UK Finance review p28 28 Finance Director’s review