6 Cheap Stocks in an Expensive Market We Use Three Methods to Spot Rare Pockets of Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Sectors Which Recover Quickest from a Sell-Off

VOL 21 / ISSUE 43 / 31 OCTOBER 2019 / £4.49 BOUNCING BACK THE SECTORS WHICH RECOVER QUICKEST FROM A SELL-OFF... AND STAND TALLEST IN A DOWNTURN GLAXOSMITHKLINE WHY ALTERNATIVE FUNDS EXPOSED TRANSFORMED BY ASSETS ARE IN TO HIGH-RISK NEW STRATEGY DEMAND DIVIDENDS EDITOR’S VIEW Why stewardship really matters with investing A new code draws the spotlight on how big investors engage with companies he introduction of a new UK Stewardship in the eyes of the wider public has to be a good Code by the Financial Reporting Council thing, particularly if it opens people’s eyes to the T will look to raise the bar on how big opportunities provided by putting their cash to investors hold the companies in which they invest work in the markets. to account. A lot of the headlines around the news focused DON’T LOSE SIGHT OF UK STRENGTHS on the climate change angle but there is more to In fairness, if it wanted to distract from its own the code than environmental concerns, including shortcomings, the investment world could easily how institutions make their decisions and what point to failures of stewardship among the political they are doing about issues such as governance class in the UK. and diversity. As we write the country remains mired in a Brexit Fundamentally this is about recognising that stalemate with the potential joys of a Christmas investors are part-owners of a business. Even big election. Companies and markets are still denied asset managers are sometimes guilty of buying the clarity on the UK’s future relationship with the shares and seeing their work as done. -

FTSE Factsheet

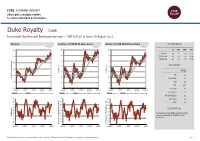

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Good and Bad News for Investors

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 46 / 23 NOVEMBER 2017 / £4.49 SHARES WE MAKE INVESTING EASIER CAN YOUR HOME FUND YOUR RETIREMENT? Good and bad news for investors WHY DO 5 QUESTIONS COMPANIES DIGITAL DISRUPTION RAISED BY BUY BACK HOW TO INVEST IN GAME ZPG’S MOVE ON SHARES? CHANGING COMPANIES GOCOMPARE Fundsmith LLP (“Fundsmith”) is authorised and regulated by The Fundsmith Emerging Equities Trust the Financial Conduct Authority and only acts for the funds (FEET) research team searches the world to to whom it provides regulated investment management and find companies that make their money from a transaction arrangement services. Fundsmith does not act for or advise potential investors in connection with acquiring large number of everyday, repeat, predictable shares in Fundsmith Emerging Equities Trust plc and will not transactions and will benefit from the rise of the be responsible to potential investors for providing them with protections afforded to clients of Fundsmith. consumer in developing economies. Prospective investors are strongly advised to take their own For example, Indofood sold 9 billion packets of legal, investment and tax advice from independent and suitably qualified advisers. The value of investments may Indomie noodles last year, Magnit welcomed 11 million go up as well as down. Past performance is not a guide to shoppers a day, MercadoLibre sold over 50 million future performance. items on its website last quarter and Dabur’s Hajmola FEET Performance, % Total Return tablets were taken 26 million times a day in India. Year ending 31st August 2017 2016 2015 Since inception You may never have heard of them, despite their FEET Share Price +3.6 +21.5 -16.2 +15.5 scale, but all can be found in the FEET portfolio. -

Stoxx® Europe Total Market Financial Services Index

STOXX® EUROPE TOTAL MARKET FINANCIAL SERVICES INDEX Components1 Company Supersector Country Weight (%) LONDON STOCK EXCHANGE Financial Services GB 10.21 DEUTSCHE BOERSE Financial Services DE 9.72 INVESTOR B Financial Services SE 8.23 PARTNERS GRP HLDG Financial Services CH 5.46 3I GROUP PLC. Financial Services GB 4.58 STANDARD LIFE ABERDEEN Financial Services GB 3.39 EXOR NV Financial Services IT 2.91 INVESTOR A Financial Services SE 2.82 GRP BRUXELLES LAMBERT Financial Services BE 2.74 M&G Financial Services GB 2.63 HARGREAVES LANSDOWN Financial Services GB 2.32 INTERMEDIATE CAPITAL GRP Financial Services GB 2.01 KINNEVIK B Financial Services SE 1.93 SCHRODERS Financial Services GB 1.68 AMUNDI Financial Services FR 1.54 EURONEXT Financial Services FR 1.41 INDUSTRIVARDEN A Financial Services SE 1.37 INDUSTRIVARDEN C Financial Services SE 1.32 INVESTEC Financial Services GB 1.24 WENDEL Financial Services FR 1.20 QUILTER Financial Services GB 1.17 ACKERMANS & VAN HAAREN Financial Services BE 1.14 SOFINA Financial Services BE 1.09 IG GRP HLDG Financial Services GB 1.08 MAN GRP Financial Services GB 1.04 PARGESA Financial Services CH 1.01 TP ICAP Financial Services GB 0.98 EURAZEO Financial Services FR 0.98 ASHMORE GRP Financial Services GB 0.97 BOLSAS Y MERCADOS ESPANOLES Financial Services ES 0.93 GRENKE N Financial Services DE 0.92 AZIMUT HLDG Financial Services IT 0.84 ONESAVINGS BANK Financial Services GB 0.80 JUPITER FUND MANAGEMENT Financial Services GB 0.79 JOHN LAING GROUP Financial Services GB 0.78 LATOUR INVESTMENT B Financial -

Issue Country of Domicile GICS Sector Portfolio Weight (%) AJ BELL United

Issue Country of domicile GICS sector Portfolio weight (%) AJ BELL United Kingdom Financials 3.35% AVAST United Kingdom Information Technology 2.45% CAPITAL FOR COLLEAGUES United Kingdom Financials 0.03% CERES POWER HOLDINGS United Kingdom Industrials 0.76% COMPASS GROUP United Kingdom Consumer Discretionary 1.73% COUNTRYSIDE PROPERTIES United Kingdom Consumer Discretionary 3.84% CREST NICHOLSON HOLDINGS United Kingdom Consumer Discretionary 1.84% DFS FURNITURE United Kingdom Consumer Discretionary 3.08% DISTRIBUTION FINANCE CAPITAL United Kingdom Financials 0.70% ETHICAL PROPERTY CO United Kingdom Real Estate 0.06% FIRST DERIVATIVES United Kingdom Information Technology 2.00% GB GROUP United Kingdom Information Technology 2.58% GENUIT GROUP United Kingdom Industrials 1.04% GREENCOAT UK WIND United Kingdom Utilities 0.96% GYM GROUP United Kingdom Consumer Discretionary 2.75% HALMA United Kingdom Information Technology 2.74% HARGREAVES LANSDOWN United Kingdom Financials 3.53% HELIOS TOWERS United Kingdom Communication Services 2.93% HOME REIT United Kingdom Consumer Discretionary 0.88% INTERTEK GROUP United Kingdom Industrials 3.23% KINGSPAN GROUP Ireland Industrials 2.52% LEARNING TECHNOLOGIES GROUP United Kingdom Information Technology 4.01% LEGAL & GENERAL GROUP United Kingdom Financials 3.72% LONDON STOCK EXCHANGE GROUP United Kingdom Financials 3.78% MORTGAGE ADVICE BUREAU HOLDINGS United Kingdom Financials 1.57% NATIONAL EXPRESS GROUP United Kingdom Industrials 3.35% NATIONAL GRID United Kingdom Utilities 1.30% OXFORD INSTRUMENTS -

FOR SMALL CAP VALUE Why Fund Managers Are Cashing out of Star Performers Like Fevertree to Reinvest in Better Opportunities

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 28 / 20 JULY 2017 / £4.49 SHARES WE MAKE INVESTING EASIER SEARCHING FOR SMALL CAP VALUE Why fund managers are cashing out of star performers like Fevertree to reinvest in better opportunities OUR GREAT ALL CHANGE IDEAS ARE at the top BEATING THE for EasyJet MARKET and ITV 14% AVERAGE GAIN CARILLION OVER 12 bounces back MONTHS from share price collapse FIVE WAYS TO BOOST YOUR RETIREMENT INCOME EDITOR’S VIEW Do the rewards compensate for the risks taken? We look at performance for investors risking their money in the mining sector hareholders in miner Rio Tinto (RIO) have for half of the year; sustaining that trend for enjoyed a 12.3% total return so far this year. the rest of 2017 would imply a 24% return on S While more than twice the total return an annualised basis. Therefore you are being from the FTSE 100 index (5.6%), is such a reward adequately compensated in this situation for the adequate to compensate for the risks involved with risk of investing in mining, in my opinion. investing in such a volatile sector? Just remember that past performance doesn’t Investors should always think about the ‘equity always equate to future performance – you aren’t risk premium’ when establishing the desired return guaranteed to make that extra 12% in the second from putting money in a certain sector. That is the half of the year. extra return you hope to generate on top of the ‘risk-free’ rate, which in the UK is benchmarked WHY INVEST IN RIO? against the UK 10-year government bond (aka gilt). -

COMPANIES We Explain How to Filter the Market Using a Well-Established Formula

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 47 / 30 NOVEMBER 2017 / £4.49 SHARES WE MAKE INVESTING EASIER HOW EXPERTS FIND THE BEST COMPANIES We explain how to filter the market using a well-established formula PROPERTY AND INFRASTRUCTURE FLOATS WITH A DIFFERENCE THE LOWER RISK WAY OF GETTING OVERSEAS EXPOSURE BUMPER EDITION: FREE SMALLER COMPANIES ‘SPOTLIGHT’ REPORT INSIDE HOW TO INVEST IF YOU HAVE A FLUCTUATING INCOME EDITOR’S VIEW Don’t rule out a UK general election in 2018 Investment bank Morgan Stanley says the risk of Labour getting into power isn’t fully priced in to the market e’re approaching the point sector and away from outsourcing firms where investment experts give and defence companies. W their predictions for big themes Morgan Stanley believes there is more in the year ahead. We will publish our than a 50% chance of another UK general analysis of the key issues facing investors election in the second half of 2018. Secker in 2018 in a fortnight’s time (14 Dec). says investors should already be aware Ahead of that article, it is worth of the Labour-related risk to parts of the touching on one issue which has the UK stock market as many stocks have potential to be a much bigger concern for already had this risk discounted into their investors if Brexit negotiations don’t go smoothly. valuation. However, he doesn’t believe the risk is That issue is the potential for Labour to get fully discounted yet. into power and what that would mean for a large number of companies on the UK stock market. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance AJ Bell AJB Investment Banking and Brokerage Services — GBP 4.3 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 4.8 115 120 1D WTD MTD YTD Absolute 0.2 -1.0 1.4 -0.8 4.6 110 115 Rel.Sector 2.1 1.7 2.4 -2.8 Rel.Market 2.0 0.6 1.7 -8.9 4.4 105 110 VALUATION 4.2 100 105 Trailing Relative Price Relative Price Relative 4 95 100 PE 44.8 Absolute Price (local currency) (local Price Absolute EV/EBITDA 32.1 3.8 90 95 PB 15.9 PCF 44.6 3.6 85 90 Div Yield 1.4 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 13.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 90 100 Div Payout 64.9 90 80 90 ROE 39.7 80 80 70 Share Index) Share Share Sector) Share - 70 - 70 DESCRIPTION 60 60 60 50 The Company is a public limited company that 50 50 RSI RSI (Absolute) provides online investment platforms and stockbroker 40 services. -

BP and SHELL Chinas RESULTS Internet BAIDU, ALIBABA and TENCENT - WHO THEY ARE, WHAT THEY DO Stars and HOW to INVEST

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 30 / 3 AUGUST 2017 / £4.49 SHARES WE MAKE INVESTING EASIER OUR TAKE ON BP AND SHELL Chinas RESULTS Internet BAIDU, ALIBABA AND TENCENT - WHO THEY ARE, WHAT THEY DO Stars AND HOW TO INVEST BIG DEALS PAYMENTS FIRMS IN DEMAND FOUR WAYS PENSIONS TO USE IMPACT OF INVESTMENT FREEDOMS TRUSTS OVERDONE? DIVIDEND DANGER: ASTRAZENECA TO CUT AFTER TRIAL FAILURE? MONKS INVESTMENT TRUST LAUNCHED IN 1929, MONKS HAS OVER £1.4BN IN NET ASSETS UNDER MANAGEMENT, WHILE ITS ONGOING CHARGE IS A MODEST 0.59%*. A HEAVYWEIGHT STRATEGY THAT AIMS TO DELIVER LONG-TERM GROWTH. Monks Investment Trust, we believe, could be a core investment for anyone seeking long-term growth. It is managed by Baillie Gifford’s Global Alpha team who are also responsible for looking after some £31bn on behalf of clients across the globe. As a result, Monks takes a highly active approach to investment and its portfolio looks nothing like the index. The managers like to pick from what they believe are the best ideas available at Baillie Gifford and take a measured approach to portfolio construction. They invest in around 100 stocks, which allows for excellent diversification, and offers the chance to unearth some of the more interesting companies listed on global stock markets. Please remember that changing stock market conditions and currency exchange rates will affect the value of your investment in the fund and any income from it. You may not get back the amount invested. If in doubt, please seek financial advice. -

Never the Same Again Annual Report & Financial Statements & Notice Annual of General Meeting 2021

Marks and Spencer Group plc Annual Report & Financial Statements 2021 Never the Same Again Forging a reshaped M&S Marks and Spencer Group plc Annual Report & Financial Statements & Notice of Annual General Meeting 2021 AT A GLANCE M&S IS A BRITISH VALUE FOR MONEY RETAILER focused on own label businesses, including Food, Clothing & Home and Bank & Services in the UK and internationally. Today, we operate a family of businesses, selling high-quality, great-value own-brand products in the UK and internationally, from 1,509 stores and over 100 websites globally. Together our 70,000 colleagues across our stores, support centres, warehouses and supply chain serve nearly 30 million customers each year. The objective of our transformation programme is to restore the M&S business and brand, to deliver long-term, sustainable, profitable growth for our investors, colleagues and wider communities. In a year defined by the pandemic, through ourNever the Same Again programme, we have accelerated our transformation and forged a reshaped business as we emerge from the crisis. GROUP OVERVIEW £9.0bn -11.8% £(201.2)m (19/20: £67.2m) 50.5% (19/20: 22.5%) Group revenue Group loss before tax Percentage of UK Clothing & Home sales online ( 19/20: 1.3p) -89.7% (9.8)p £41.6m (19/20: 63%) Basic loss per share APM Profit before tax and 67% adjusting items Food: Value for money perception -20.1% (19/20: 68) No dividend paid for 20/21 £1.11bn 81 APM Net debt excluding lease liabilities Stores: Net promoter score1 1.1p (19/20: 16.7p) 51(19/20: 57) APM Adjusted earnings per share M&S.com: Net promoter score1 Cover APM Alternative performance measures Our colleagues, The report provides alternative performance measures (“APMs”) which are not defined or specified including Vicky in under the requirements of International Financial Reporting Standards as adopted by the EU. -

Why Now Discover

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 13 / 06 APRIL 2017 / £4.49 SHARES WE MAKE INVESTING EASIER WHY NOW IS THE PERFECT TIME TO INVEST IN SAGA FTSE 100 DISCOVER DIVIDEND THE FUND WITH SWEET A REFRESHING SPOTS ATTITUDE USE AIM STOCKS TO AVOID 40% INHERITANCE TAX Adventurous Moderately adventurous Appetite for risk varies. Appetite for charges doesn’t. AJ Bell Passive funds range in risk from ‘Cautious’ to ‘Adventurous’, but with a 0.5% capped annual charge, the risk of unexpected costs is always zero. Also, until January 2019 we will waive our custody charge for these funds. Balanced youinvest.co.uk Full details of the capped annual charge are outlined in the Key Investor Information Document for each fund. The value of investments can go down as well as up and you may get back less Moderately cautious than you originally invested. Cautious AJ Bell includes AJ Bell Holdings Limited and its wholly owned subsidiaries. AJ Bell Management Limited and AJ Bell Securities Limited are authorised and regulated by the Financial Conduct Authority. All companies are registered in England and Wales at Traff ord House, Chester Road, Manchester M32 0RS EDITOR’S VIEW Don’t lose sight of what stocks can deliver Dividend reinvestment unlocks the wealth generating potential of equities he old Chinese curse ‘may you those offered by cash on deposit. live in interesting times’ has T rarely felt more apt than it does SPIRIT OF ADVENTURE in 2017. Amid all the noise about Trump, In our main feature this week we Brexit, European elections and the rest make the case for including some high it can be useful to take a step back and conviction stocks in your portfolio. -

Success Doesn't Always Last Forever

VOL 21 / ISSUE 28 / 18 JULY 2019 / £4.49 STAR FUND MANAGERS SUCCESS DOESN’T ALWAYS LAST FOREVER BT COULD THE KEY REASONS THE DIFFERENT SLASH ITS WHY YOU NEED WAYS TO PLAY DIVIDEND TO INVEST IN THE US MARKETS BY 30% MICROSOFT VIA ETFS EDITOR’S VIEW Thomas Cook investors in a spin as they brace for debt-for-equity pain It is important to understand the impact of lenders deciding to take new shares instead of getting their cash back ebt-for-equity swaps are rarely good to shareholders in the form of dividends. If the news for shareholders despite potentially pool of shares has got much bigger as a result of D keeping the lights on in a business. the debt-for-equity swap, it means any dividend That matters for anyone owning stock in payments have to be spread across a greater holiday seller Thomas Cook (TCG) as they are number of people and each investor’s share now facing this situation and therefore need to could be tiny. understand what debt-for-equity really means. Thomas Cook suspended dividends last year Shares in Thomas Cook halved in value and it is hard to see it paying them again in the on 12 July when the company outlined a near future, although the lenders accepting new £750m refinancing plan that would see major shares will inevitably hope for such payments shareholder Fosun, a Chinese tourist group, gain down the line. a controlling stake in the package holiday part Debt-for-equity swaps can also impact voting of Thomas Cook and a minority interest in its rights.