Top 200 Companies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

SIXTIETH YEAR No

SIXTIETH YEAR No. 5 VOL. LIX FEBRUARY, 1954 THE PERSONAL REMINISCENCES OF CHOSEN PEOPLE that heepetb Israel Shall neither slumber nor steep.- NE of the most absorbing and revealing books ever published. It Psalm 121:4. o is the autobiography of Joseph Hoffman Cohn, and is entitled "I Have Fought a Good Fight—The Story of Jewish Missionary Pioneering in America." Here is Dr. Cohn's own statement as to how the book came to be written: One day in fellowship, with several members of the Board of Directors, I happened to unravel some of these old-time experiences. They said, "These things you simply must publish as a sort of diary that the world may know a little of what it cost to establish a really worthwhile and dependable Jewish work in America." Since our announcement of the Book in the December issue of THE CHOSEN PEOPLE, we have been deluged with orders. A beloved friend of the Mission for many years, wrote: The Jewish missionary field and the Christian church owe you a sincere vote of thanks ... The great Dr. Neander, church historian, could not have done any better. Another friend of long standing wrote: I read your memoirs with the most intense interest, and I see clearly that the Lord had ... a world-wide field for you, and a world-wide support. Published monthly. October to May of bt as a Have you ordered your copy? The price is only $3.00 postpaid; medium ormksrmaticrn concerning Israel, and the Work of over 300 pages, handsomely bound in cloth. -

Virgin Money UK PLC Full Year 2020 Financial Results Announcement

Virgin Money UK PLC Full Year 2020 Financial Results Announcement BASIS OF PRESENTATION Virgin Money UK PLC (‘Virgin Money’, ‘VMUK’ or ‘the Company’), formerly known as CYBG PLC (‘CYBG’) (the Company was renamed on 30 October 2019), together with its subsidiary undertakings (which together comprise ‘the Group’), operate under the Clydesdale Bank, Yorkshire Bank, B and Virgin Money brands. This results announcement covers the results of the Group for the year ended 30 September 2020. The term ‘Virgin Money’ is used throughout this results announcement either in reference to the Group, or when referring to the acquired business of Virgin Money Holdings (UK) PLC or subsequent integration of the acquired business, within the newly combined Group. Statutory basis Statutory information is set out on page 16 and within the financial statements. Pro forma results: On 15 October 2018, the Company acquired all the voting rights in Virgin Money Holdings (UK) PLC by means of a scheme of arrangement under Part 26 of the UK Companies Act 2006, with the transaction being accounted for as an acquisition of Virgin Money Holdings (UK) PLC. We believe that it is helpful to provide additional information which is more readily comparable with the current year result s of the combined businesses. Therefore we have prepared pro forma comparative results for the Group as if Virgin Money UK PLC and Virgin Money Holdings (UK) PLC had always been a combined group, in order to assist in explaining trends in financial performance. A reconciliation between the results on a comparative pro forma basis and a statutory basis is included on page 17. -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Virgin UK Index Tracking Trust

The Virgin UK Index Tracking Trust Final Report and Financial Statements For the year ended 15 March 2021 2 The Virgin UK Index Tracking Trust Contents Manager's report 3 Management and professional services 3 Manager's investment report 4 Comparative tables 11 Portfolio statement 12 Top purchases and sales of investments 30 Securities Financing Transactions (SFTs) 32 Statement of total return 36 Statement of change in net assets attributable to unitholders 37 Balance sheet 38 Notes to the financial statements 39 Distribution tables 53 Statement of the Manager’s responsibilities 54 Independent auditor’s report to the unitholders of the Virgin UK Index Tracking Trust 55 Manager’s remuneration 58 Statement of the Trustee’s responsibilities in respect of the Scheme and Report of the Trustee to the Unitholders of the Virgin UK Index Tracking Trust 59 The Virgin UK Index Tracking Trust 3 Management and professional services For the year ended 15 March 2021 Manager (the ‘Manager’) Virgin Money Unit Trust Managers Limited Jubilee House Directors: S. Bruce (appointed 29 September 2020) Gosforth J. Byrne (appointed 24 May 2021) Newcastle upon Tyne H. Chater NE3 4PL S. Fennessy (resigned 29 September 2020) F. Murphy (appointed 19 October 2020) M. Phibbs J. Scott (resigned 4 December 2020) I. Smith (resigned 19 October 2020) D. Taylor (appointed 29 September 2020) N. L. Tu (resigned 24 May 2021) S. Wemyss (appointed 8 December 2020) Telephone 03456 10 20 30* Authorised and regulated by the Financial Conduct Authority. Investment adviser Aberdeen Asset Managers Limited 10 Queen’s Terrace Aberdeen Aberdeenshire AB10 1XL Authorised and regulated by the Financial Conduct Authority. -

2017 Creative Agencies New Business League

2017 CREATIVE AGENCIES NEW BUSINESS LEAGUE Global / Oct 2017 ESTIMATED ESTIMATED YTD RANK THIS RANK LAST OVERALL YTD No.of AGENCY RECENT WINS WIN REVENUE RECENT LOSSES MONTH MONTH REVENUE Wins (USD $ m) (USD $m) Ulta Beauty US, National 1 1 McCann WorldGroup Geographic US Brand Marketing , 162.3 Office Depot US 151.3 402 Flybe US Kohl's US, Mercedes Benz Service 2 4 BBDO 151.4 Belvedere vodka US 140.6 237 Germany, EA Madden US CFA Institute Global, British 3 2 Ogilvy Airways(Loyalty) US, Mondelez 132.0 American Express US 105.9 326 Cadbury UK & Australia Lafayette 148 US (Digital), Titan 4 5 Isobar Company (Digital) Global, Canon 86.8 Innisfree Malaysia 86.7 337 Thailand Le Monde France, Church's Chicken 5 3 J Walter Thompson US, Qatar Financial Centre Global, 111.6 Kellogg's US 84.0 513 Tunisie Telecom Europe Radox Global, Sol Beer US, ConAgra 6 6 DDB US, Miller Lite US, Center Parcs 95.2 Electrolux Global 73.2 273 Europe Liberty Mutual US, PepsiCo US, NFL 7 9 GS&P Network US Project, Gradifi US 87.7 Princess Cruises US 72.3 4 Project McDelivery Global, McDonald's UK, 8 11 Leo Burnett 68.1 Coty (Max Factor) Global 54.4 236 Kellogg's US, Serta Mattresses US The Hershey Company US, Carnival 9 7 Anomaly Cruises US, Electrolux Global, Coca- 57.0 Diesel Global 53.5 11 Cola Minute Maid US 10 8 WPP(Team WBA) Walgreens Boots Alliance US 50.0 50.0 1 Peroni Nastro Azzurro UK, Mattress 11 10 Droga5 47.0 Air Wick, Clearasil Global 37.0 12 Firm US, Tencent Gaming US Whole Foods Market US, Nuveen 12 12 MullenLowe Group 43.3 Cash Converters Australia -

Airtel Africa Plc Results for the Nine-Month Period Ended 31 December 2020 29 January 2021

Airtel Africa plc Results for the nine-month period ended 31 December 2020 29 January 2021 Another quarter of double-digit growth, with continued improvement in revenue growth and EBITDA profitability Highlights • Reported revenue increased by 13.8% to $2,870m with Q3’21 reported revenue growth of 19.5%. • Constant currency underlying revenue growth was 18.6%, with Q3’21 growth of 22.8%. Growth for the nine months was recorded across all regions: Nigeria up 21.6%, East Africa up 23.4% and Francophone Africa up 8.0%; and across all services, with voice revenue up 10.4%, data up 31.1% and mobile money up 34.2%. • Underlying EBITDA for the nine months was $1,297m, up 16% in reported currency while constant currency underlying EBITDA growth was 22.5%. • Underlying EBITDA margin for the nine months was 45.5%, up by 118 bps (up 144 bps in constant currency). Q3’21 underlying EBITDA margin was 46.9%. • Operating profit increased by 21.8% to $800m in reported currency, and by 29.9% in constant currency. • Free cash flow was $466m, up 20% compared to the same period last year. • Basic EPS was 5.5 cents, down 36.5%, largely due to prior year exceptional items and a one-off derivative gain. Excluding these, basic EPS rose by 19.8%. EPS before exceptional items was 5.0 cents. • Customer base up 11.0% to 118.9 million, with increased penetration across mobile data (customer base up 23.5%) and mobile money services (customer base up 29.0%). -

Annual Report and Accounts 2018 01 Overview Performance Highlights for the Year to 31 March 2018

3i Group plc Overview Governance Introduction 01 Chairman’s introduction 58 Performance highlights 02 Board of Directors and Executive Committee 60 Chairman’s statement 02 Nominations Committee report 65 Chief Executive’s statement 04 Audit and Compliance Committee report 66 Action 08 Valuations Committee report 70 Directors’ remuneration report 73 Our business Relations with shareholders 83 Our business at a glance 10 Additional statutory and corporate governance information 84 Our business model 12 Our strategic objectives 14 Audited financial statements Key performance indicators 16 Private Equity 18 Consolidated statement of comprehensive income 92 Infrastructure 25 Consolidated statement of financial position 93 Performance, risk and sustainability Consolidated statement of changes in equity 94 Consolidated cash flow statement 95 Financial review 29 Company statement of financial position 96 Investment basis 35 Company statement of changes in equity 97 Reconciliation of Investment basis and IFRS 39 Company cash flow statement 98 Alternative Performance Measures 43 Significant accounting policies 99 Risk management 44 Notes to the accounts 104 Principal risks and mitigations 47 Independent Auditor’s report 139 Sustainability 52 Portfolio and other information 20 Large investments 148 Strategic report: Portfolio valuation – an explanation 150 pages 2 to 56. Information for shareholders 152 Directors’ report: pages Glossary 154 58 to 72 and 83 to 90. For definitions of our financial terms, used throughout this report, please see Directors’ remuneration our glossary on pages 154 to 156. report: pages 73 to 82. Consistent with our approach since the introduction of IFRS 10 in 2014, the financial data presented in the Overview and Strategic report is taken from the Investment basis financial statements. -

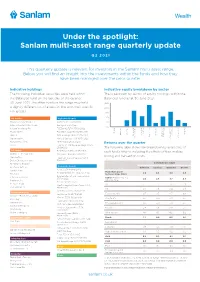

Sanlam Multi-Asset Range Quarterly Update

Under the spotlight: Sanlam multi-asset range quarterly update Q2 2021 This quarterly update is relevant for investors in the Sanlam multi-asset range. Below you will find an insight into the investments within the funds and how they have been managed over the prior quarter. Indicative holdings Indicative equity breakdown by sector The following individual securities were held within The breakdown by sector of equity holdings within the the Balanced fund on the last day of the quarter, Balanced fund as at 30 June 2021. 30 June 2021. The other funds in the range may hold 25% a slightly different list of assets, in line with their specific 20% risk grades. 15% 10% UK equity High yield bonds Howden Joinery Group Plc AA Bond 6.5% 31/01/2026 5% Intercontinental Hotels Group Barclays 6.375% Perp 0% s s s s s e y re Integrafin Holdings Plc FCE Bank 2.727% 03/06/2022 ty gy on ion ti rial rial Ca vice umer umer aple onar Prudential Plc Fidelidade SA 4.25% 04/09/2031 te oper ti Ener ructur St rmat Ser Ma alth Pr re chnology fo Financial Indust Cons Relx Plc GKN Holdings 4.625% 12/05/2032 Cons sc In He Te frast Di Rightmove Plc Marks & Spencer 4.5% 10/07/2027 In Communica Taylor Wimpey Plc MPT 3.692% 05/06/2028 Returns over the quarter Unilever Plc Permanent TSB Group Holdings 2.125% 26/09/2024 The following table shows the breakdown by asset class of US equity Rolls-Royce 3.375% 18/06/2026 each fund’s returns, including the effects of fees, midday Akamai Technologies Inc Sainsbury’s Bank 6% 23/11/2027 pricing and transaction costs.