CHARITABLE ORGANIZATION INITIAL REGISTRATION FORM Website Address INSTRUCTIONS (Pursuant to Minn

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Certificate of Organization (LLC

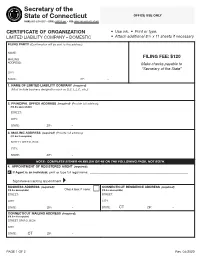

Secretary of the State of Connecticut OFFICE USE ONLY PHONE: 860-509-6003 • EMAIL: [email protected] • WEB: www.concord-sots.ct.gov CERTIFICATE OF ORGANIZATION • Use ink. • Print or type. LIMITED LIABILITY COMPANY – DOMESTIC • Attach additional 8 ½ x 11 sheets if necessary. FILING PARTY (Confirmation will be sent to this address): NAME: FILING FEE: $120 MAILING ADDRESS: Make checks payable to “Secretary of the State” CITY: STATE: ZIP: – 1. NAME OF LIMITED LIABILITY COMPANY (required) (Must include business designation such as LLC, L.L.C., etc.): 2. PRINCIPAL OFFICE ADDRESS (required) (Provide full address): (P.O. Box unacceptable) STREET: CITY: STATE: ZIP: – 3. MAILING ADDRESS (required) (Provide full address): (P.O. Box IS acceptable) STREET OR P.O. BOX: CITY: STATE: ZIP: – NOTE: COMPLETE EITHER 4A BELOW OR 4B ON THE FOLLOWING PAGE, NOT BOTH. 4. APPOINTMENT OF REGISTERED AGENT (required): A. If Agent is an individual, print or type full legal name: _______________________________________________________________ Signature accepting appointment ▸ ____________________________________________________________________________________ BUSINESS ADDRESS (required): CONNECTICUT RESIDENCE ADDRESS (required): (P.O. Box unacceptable) Check box if none: (P.O. Box unacceptable) STREET: STREET: CITY: CITY: STATE: ZIP: – STATE: CT ZIP: – CONNECTICUT MAILING ADDRESS (required): (P.O. Box IS acceptable) STREET OR P.O. BOX: CITY: STATE: CT ZIP: – PAGE 1 OF 2 Rev. 04/2020 Secretary of the State of Connecticut OFFICE USE ONLY PHONE: 860-509-6003 • EMAIL: [email protected] -

Organizational Culture Model

A MODEL of ORGANIZATIONAL CULTURE By Don Arendt – Dec. 2008 In discussions on the subjects of system safety and safety management, we hear a lot about “safety culture,” but less is said about how these concepts relate to things we can observe, test, and manage. The model in the diagram below can be used to illustrate components of the system, psychological elements of the people in the system and their individual and collective behaviors in terms of system performance. This model is based on work started by Stanford psychologist Albert Bandura in the 1970’s. It’s also featured in E. Scott Geller’s text, The Psychology of Safety Handbook. Bandura called the interaction between these elements “reciprocal determinism.” We don’t need to know that but it basically means that the elements in the system can cause each other. One element can affect the others or be affected by the others. System and Environment The first element we should consider is the system/environment element. This is where the processes of the SMS “live.” This is also the most tangible of the elements and the one that can be most directly affected by management actions. The organization’s policy, organizational structure, accountability frameworks, procedures, controls, facilities, equipment, and software that make up the workplace conditions under which employees work all reside in this element. Elements of the operational environment such as markets, industry standards, legal and regulatory frameworks, and business relations such as contracts and alliances also affect the make up part of the system’s environment. These elements together form the vital underpinnings of this thing we call “culture.” Psychology The next element, the psychological element, concerns how the people in the organization think and feel about various aspects of organizational performance, including safety. -

Customer Relationship Management and Leadership Sponsorship

Abilene Christian University Digital Commons @ ACU Electronic Theses and Dissertations Electronic Theses and Dissertations Spring 5-2019 Customer Relationship Management and Leadership Sponsorship Jacob Martin [email protected] Follow this and additional works at: https://digitalcommons.acu.edu/etd Recommended Citation Martin, Jacob, "Customer Relationship Management and Leadership Sponsorship" (2019). Digital Commons @ ACU, Electronic Theses and Dissertations. Paper 124. This Dissertation is brought to you for free and open access by the Electronic Theses and Dissertations at Digital Commons @ ACU. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of Digital Commons @ ACU. This dissertation, directed and approved by the candidate’s committee, has been accepted by the College of Graduate and Professional Studies of Abilene Christian University in partial fulfillment of the requirements for the degree Doctor of Education in Organizational Leadership Dr. Joey Cope, Dean of the College of Graduate and Professional Studies Date Dissertation Committee: Dr. First Name Last Name, Chair Dr. First Name Last Name Dr. First Name Last Name Abilene Christian University School of Educational Leadership Customer Relationship Management and Leadership Sponsorship A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Education in Organizational Leadership by Jacob Martin December 2018 i Acknowledgments I would not have been able to complete this journey without the support of my family. My wife, Christal, has especially been supportive, and I greatly appreciate her patience with the many hours this has taken over the last few years. I also owe gratitude for the extra push and timely encouragement from my parents, Joe Don and Janet, and my granddad Dee. -

English Business Organization Law During the Industrial Revolution

Choosing the Partnership: English Business Organization Law During the Industrial Revolution Ryan Bubb* I. INTRODUCTION For most of the period associated with the Industrial Revolution in Britain, English law restricted access to incorporation and the Bubble Act explicitly outlawed the formation of unincorporated joint stock com- panies with transferable shares. Furthermore, firms in the manufacturing industries most closely associated with the Industrial Revolution were overwhelmingly partnerships. These two facts have led some scholars to posit that the antiquated business organization law was a constraint on the structural transformation and growth that characterized the British economy during the period. For example, Professor Ron Harris argues that the limitation on the joint stock form was “less than satisfactory in terms of overall social costs, efficient allocation of resources, and even- 1 tually the rate of growth of the English economy.” * Associate Professor of Law, New York University School of Law. Email: [email protected]. For helpful comments I am grateful to Ed Glaeser, Ron Harris, Eric Hilt, Giacomo Ponzetto, Max Schanzenbach, and participants in the Berle VI Symposium at Seattle University Law School, the NYU Legal History Colloquium, and the Harvard Economic History Tea. I thank Alex Seretakis for superb research assistance. 1. RON HARRIS, INDUSTRIALIZING ENGLISH LAW: ENTREPRENEURSHIP AND BUSINESS ORGANIZATION, 1720–1844, at 167 (2000). There are numerous other examples of this and related arguments in the literature. While acknowledging that, to a large extent, restrictions on the joint stock form could be overcome by alternative arrangements, Nick Crafts nonetheless argues that “institutional weaknesses relating to . company legislation . must have had some inhibiting effects both on savers and on business investment.” Nick Crafts, The Industrial Revolution, in 1 THE ECONOMIC HISTORY OF BRITAIN SINCE 1700, at 44, 52 (Roderick Floud & Donald N. -

A Guide to Nonprofit Board Service in Oregon

A GUIDE TO NONPROFIT BOARD SERVICE IN OREGON Office of the Attorney General A GUIDE TO NONPROFIT BOARD SERVICE Dear Board Member: Thank you for serving as a director of a nonprofit charitable corporation. Oregonians rely heavily on charitable corporations to provide many public benefits, and our quality of life is dependent upon the many volunteer directors who are willing to give of their time and talents. Although charitable corporations vary a great deal in size, structure and mission, there are a number of principles which apply to all such organizations. This guide is provided by the Attorney General’s office to assist board members in performing these important functions. It is only a guide and is not meant to suggest the exact manner that board members must act in all situations. Specific legal questions should be directed to your attorney. Nevertheless, we believe that this guide will help you understand the three “R”s associated with your board participation: your role, your rights, and your responsibilities. Active participation in charitable causes is critical to improving the quality of life for all Oregonians. On behalf of the public, I appreciate your dedicated service. Sincerely, Ellen F. Rosenblum Attorney General 1 UNDERSTANDING YOUR ROLE Board members are recruited for a variety of reasons. Some individuals are talented fundraisers and are sought by charities for that reason. Others bring credibility and prestige to an organization. But whatever the other reasons for service, the principal role of the board member is stewardship. The directors of the corporation are ultimately responsible for the management of the affairs of the charity. -

Collaboration

Partnership, Collaboration: depend on partnerships with local housing Why Form a Partnership? authorities and private development firms to What is the Difference? provide shelter and transitional housing units for With a strong partnership, your organization may their homeless clients. have access to more financial resources, tangible A legal partnership is a contractual relationship resources, people resources, licensed client involving close cooperation between two or more Collaborations are the most immediate, economical services, and professional expertise. Investors, parties having specified and joint rights and way to enhance the services an organization can such as foundations and government grants, will responsibilities. Each party has an equal share of offer homeless veterans. Gaining access to services be more likely to consider your program the risk as well as the reward. that are already provided by community-based proposals because more areas of need are organizations and agencies is critical in containing A collaboration involves cooperation in which addressed and there is less duplication of services. costs while maximizing program benefits. Support parties are not necessarily bound contractually. organizations, in turn, can justify funding requests There is a relationship, but it is usually less formal based on services they offer to homeless veterans. How do you find and select a than a binding, legal contract and responsibilities partner? may not be shared equally. A collaboration exists Where to Find Vital Services when several people pool their common interests, • Define what your clients needs are (both assets and professional skills to promote broader The following is a list of services most homeless current and future). -

10 Benefits of the WTO Trading System

10 benefits of the WTO trading system The world is complex.This booklet highlights some of the benefits of the WTO’s “multilateral” trading system, but it doesn’t claim that everything is perfect—otherwise there would be no need for further negotiations and for the rules to be revised. Nor does it claim that everyone agrees with everything in the WTO. That’s one of the most important reasons for having the system: it’s a forum for countries to thrash out their differences on trade issues. That said,there are many over-riding reasons why we’re better off with the system than we would be without it. Here are 10 of them. The 10 benefits 1. The system helps promote peace 2. Disputes are handled constructively 3. Rules make life easier for all 4. Freer trade cuts the costs of living 5. It provides more choice of products and qualities 6. Trade raises incomes 7. Trade stimulates economic growth 8. The basic principles make life more efficient 9. Governments are shielded from lobbying 10. The system encourages good government 1 1. This sounds like an exaggerated claim, and it would be wrong to make too much of it. Nevertheless, the system does contribute to international peace, and if we understand why, we have a clearer picture of what the system actually does. Peace is partly an outcome of two of expanded—one has become the slide into serious economic trouble for the most fundamental principles of European Union, the other the World all—including the sectors that were the trading system: helping trade to Trade Organization (WTO). -

Supply Chain Integration Strategy Best Practices

NUMBER TWO IN SUPPLY CHAIN INTEGRATION STRATEGY THE SUPPLY CHAIN BEST PRACTICES STRATEGY SERIES REDEFINING THE VALUE DERIVED FROM END-TO-END, INTEGRATED SUPPLY CHAINS NOVEMBER 2018 A WHITE PAPER BY THE GLOBAL SUPPLY CHAIN INSTITUTE 310 STOKELY MANAGEMENT CENTER KNOXVILLE, TN 37996 865.974.9413 GLOBALSUPPLYCHAININSTITUTE.UTK.EDU Sponsored by GSCI END-TO-END, INTEGRATED SUPPLY CHAIN PLANNING, SERVICE, & INFORMATION FLOWS SUPPLY DEMAND NETWORK NETWORK INTEGRATED SUPPLY/DEMAND Integrated Planning Consumers Procurement Logistics Operations Resources < RETURNS PRODUCT FLOWS CASH Collaboration SUPPLY CHAIN INTEGRATION STRATEGY BEST PRACTICES TABLE OF CONTENTS Executive Summary 3 Introduction 6 Integration Concepts 11 Best Practices 22 Case Studies 36 Summary 40 How to Start 42 SUPPLY CHAIN INTEGRATION STRATEGY BEST PRACTICES REDEFINING THE VALUE DERIVED FROM END-TO-END, INTEGRATED SUPPLY CHAINS NUMBER TWO IN THE SUPPLY CHAIN STRATEGY SERIES OF UT’S GLOBAL SUPPLY CHAIN INSTITUTE WHITE PAPERS NOVEMBER 2018 AUTHORS: DAN PELLATHY, PhD MIKE BURNETTE SCOTT MELINE CONTRIBUTING EDITORS: TED STANK, PhD PAUL DITTMANN, PhD MANAGING RISK IN THE GLOBAL SUPPLY CHAIN 1 THE GLOBAL SUPPLY CHAIN INSTITUTE WHITE PAPERS THE TECHNOLOGY IN THE SUPPLY CHAIN SERIES New Supply Chain Technology Best Practices A SAVVY Guide to the Digital Supply Chain THE INNOVATIONS SERIES Platform Lifecycle Best Practices Selecting and Managing a Third Party Logistics Provider Best Practices Creating a Transparent Supply Chain Best Practices Transportation 2025 Megatrends and Current -

How to Analyze Non-Profit Financial Statements

Reading 5 NASAA Training 09/10/2008 How to Assess Nonprofit Financial Performance Elizabeth K. Keating, CPA Assistant Professor of Accounting and Information Systems Kellogg Graduate School of Management Northwestern University 2001 Sheridan Drive, Room 6226 Evanston, IL 60208-2002 Tel: (847) 467-3343 Fax: (847) 467-1202 E-Mail: [email protected] Peter Frumkin Assistant Professor of Public Policy Kennedy School of Government Harvard University 79 JFK Street Cambridge, MA 02138 Tel: (617) 495-8057 E-Mail: [email protected] With research assistance from: Robert Caton [email protected] Michelle Sinclair Colman [email protected] October 2001 IV. UNDERSTANDING FINANCIAL STATEMENTS A. Overview This section will describe the structure underlying the financial statements and explain how the statements stated in the Form 990 differ from those in audited financial statements. Sample financial statements are included in this section, while sample 990 Tax returns are presented in Appendix 1.7 8 The accounting system for nonprofits is designed to capture the economic activities of the firm and its financial position. The financial statements are constructed based on the “Accounting Equation” in which: Assets = Liabilities + Net Assets This equation states that the things of value that the nonprofit organization owns (assets) are equal to its outstanding debt (liabilities) plus the portion of assets funded by the nonprofit’s own resources (net assets). In a for-profit setting, net assets are labeled equity or net worth. Until the mid-1990s, nonprofits labeled this account fund balance. The accounting equation is the basis of one of the four financial statements called the Statement of Financial Position, Statement of Financial Condition or Balance Sheet. -

Form DSCB: 15-8821

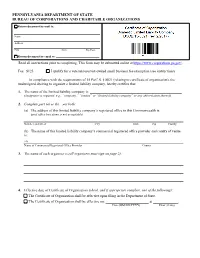

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS Return document by mail to: Name Address City State Zip Code Return document by email to: _________________________________ Read all instructions prior to completing. This form may be submitted online at https://www.corporations.pa.gov/. Fee: $125 I qualify for a veteran/reservist-owned small business fee exemption (see instructions) In compliance with the requirements of 15 Pa.C.S. § 8821 (relating to certificate of organization), the undersigned desiring to organize a limited liability company, hereby certifies that: 1. The name of the limited liability company is: ___________________________________________________ (designator is required, e.g., “company,” “limited” or “limited liability company” or any abbreviation thereof) 2. Complete part (a) or (b) – not both: (a) The address of this limited liability company’s registered office in this Commonwealth is: (post office box alone is not acceptable) Number and Street City State Zip County (b) The name of this limited liability company’s commercial registered office provider and county of venue is: c/o: Name of Commercial Registered Office Provider County 3. The name of each organizer is (all organizers must sign on page 2): 4. Effective date of Certificate of Organization (check, and if appropriate complete, one of the following): The Certificate of Organization shall be effective upon filing in the Department of State. The Certificate of Organization shall be effective on: ________________________ at ______________. Date (MM/DD/YYYY) Hour (if any) DSCB:15-8821-2 5. Restricted professional companies only. Check the box if the limited liability company is organized to render a restricted professional service and check the type of restricted professional service(s). -

How to Start a Cooperative Cooperative Information Report 45, Section 14

Understanding Cooperatives: How to Start a Cooperative Cooperative Information Report 45, Section 14 Discussion topics should include: When Should a Cooperative be u What information about the perceived United States need is readily available? Department of Organized? Cooperatives are formed u Could a cooperative effort address this Agriculture need? Rural Development in response to an economic need, u What information about cooperatives is Cooperative such as providing marketing, pro- available? Programs cessing, bargaining, manufacturing, u Who can serve as an adviser to the group? September 1995 and purchasing services not current- u Who should be invited to a meeting of Revised potential users? April 2011 ly available, or available only at u How should potential users be contact- excessive cost. ed? If a cooperative seems to offer a solu- tion, a larger meeting of interested potential If interested in forming a cooperative, learn users may be planned. all you can about the legal, economic, and financial aspects of a cooperative Hold Initial Exploratory Meeting business. Careful planning increases the A meeting of potential member-users chances of success. should be called to decide if interest is suf- ficient to support a cooperative. The meet- Why Groups Organize ing date, time, and place should be pub- Cooperatives: licized in advance. The leadership group u To improve bargaining power; should select a chairperson to conduct a u To reduce costs; meeting and develop an agenda. These u To obtain products or services; items should be discussed: u To create new and expand existing mar- u What is the need; ket opportunities; u Possible solutions; u To improve the quality of products or u Cooperative principles and terms; Stage 1 services; u Advantages and disadvantages of a u To increase income. -

Nonprofit Organization Expanded Loan Facility

Nonprofit Organization Expanded Loan Facility Effective July 28, 20201 Program: The Nonprofit Organization Expanded Loan Facility (“Facility”), which has been authorized under section 13(3) of the Federal Reserve Act, is intended to facilitate lending to Nonprofit Organizations by Eligible Lenders. Under the Main Street Lending Program, including the Facility, the Nonprofit Organization New Loan Facility (“NONLF”), the Main Street New Loan Facility (“MSNLF”), the Main Street Expanded Loan Facility (“MSELF”), and the Main Street Priority Loan Facility (“MSPLF”), the Federal Reserve Bank of Boston (“Reserve Bank”) will commit to lend to a single common special purpose vehicle (“SPV”) on a recourse basis. The SPV will purchase 95% participations in the upsized tranche of Eligible Loans from Eligible Lenders. Eligible Lenders will retain 5% of the upsized tranche of each Eligible Loan. The Department of the Treasury, using funds appropriated to the Exchange Stabilization Fund under section 4027 of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), will make a $75 billion equity investment in the single common SPV in connection with the Facility, the NONLF, the MSELF, the MSPLF, and the MSNLF. The combined size of the Facility, the NONLF, the MSELF, the MSPLF, and the MSNLF will be up to $600 billion. Eligible Lenders: An Eligible Lender is a U.S. federally insured depository institution (including a bank, savings association, or credit union), a U.S. branch or agency of a foreign bank, a U.S. bank holding company, a U.S. savings and loan holding company, a U.S. intermediate holding company of a foreign banking organization, or a U.S.