Handelsbanken UK Risks Low Costs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

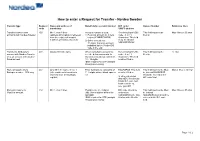

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Chronology, 1963–89

Chronology, 1963–89 This chronology covers key political and economic developments in the quarter century that saw the transformation of the Euromarkets into the world’s foremost financial markets. It also identifies milestones in the evolu- tion of Orion; transactions mentioned are those which were the first or the largest of their type or otherwise noteworthy. The tables and graphs present key financial and economic data of the era. Details of Orion’s financial his- tory are to be found in Appendix IV. Abbreviations: Chase (Chase Manhattan Bank), Royal (Royal Bank of Canada), NatPro (National Provincial Bank), Westminster (Westminster Bank), NatWest (National Westminster Bank), WestLB (Westdeutsche Landesbank Girozentrale), Mitsubishi (Mitsubishi Bank) and Orion (for Orion Bank, Orion Termbank, Orion Royal Bank and subsidiaries). Under Orion financings: ‘loans’ are syndicated loans, NIFs, RUFs etc.; ‘bonds’ are public issues, private placements, FRNs, FRCDs and other secu- rities, lead managed, co-managed, managed or advised by Orion. New loan transactions and new bond transactions are intended to show the range of Orion’s client base and refer to clients not previously mentioned. The word ‘subsequently’ in brackets indicates subsequent transactions of the same type and for the same client. Transaction amounts expressed in US dollars some- times include non-dollar transactions, converted at the prevailing rates of exchange. 1963 Global events Feb Canadian Conservative government falls. Apr Lester Pearson Premier. Mar China and Pakistan settle border dispute. May Jomo Kenyatta Premier of Kenya. Organization of African Unity formed, after widespread decolonization. Jun Election of Pope Paul VI. Aug Test Ban Take Your Partners Treaty. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

Web Updation FAQ's Version 3

FAQ’S for Barclaycard customers 1. Customer: How do I know when my Standard Chartered Bank Credit Card will become active? There is an Instructions letter with your new card that instructs the date on which your new Standard Chartered Bank Credit Card will become active and your Barclaycard will become inactive. A sms will also be sent to you before the activation of your new Standard Chartered Bank Credit Card. 2. Customer: I not received any card from Standard Chartered Bank after I received the Welcome Letter at the end of February 2012? We are dispatching cards in batches. You will receive an SMS from Standard Chartered Bank when your card is dispatched to you. The SMS will contain details of the Airway Bill No. of the courier which you can use to track your card. In case, you do not receive this SMS or your card by the 1st week of June, please write to Customer Care at [email protected] or call Standard Chartered Bank phone banking at the following numbers http://www.standardchartered.co.in/personal/ways-to-bank/en/phone-banking12.html 3. Customer: Do I need to give details about my account again or will it be transferred automatically? You do not need to do anything as all the information that is currently with Barclays bank will be transferred to Standard Chartered Bank in order to have your new card account set up. However if you have set up ECS/SI instructions on your current Barclaycard, then once you have received the new Standard Chartered Bank Credit Card please call the number at the back of your new Standard Chartered Bank Credit Card to provide ECS/SI instructions. -

Interim Report January – September 2020 Q3

Interim Report January – September 2020 Q3 Financial summary Third quarter First nine months • Net sales amounted to EUR 27k (0) • Net sales amounted to EUR 126k (21k) • Operating loss (EBIT) increased to EUR 4,790k • Operating loss (EBIT) increased to EUR 7,291k (748k) driven by listing costs (3,490k) driven by listing costs • Loss after tax amounted to EUR 4,730k (815k) • Loss after tax amounted to EUR 7,127k (3,602k) • Basic and diluted loss per Class A share amounted to EUR 0.10 (0.02) • Basic and diluted loss per Class A share amounted to EUR 0.16 (0.08) • Liquid funds as at end of the period amounted to EUR 90.5m • Cash flow from operating activities amounted to EUR -1,824k (-3,014k) • No interest-bearing debt at end of the period Figures within parentheses refer to the preceding year. Significant events • Enlisted Inselspital Bern, the largest In the third quarter of 2020 university hospital in Switzerland, to be the lead hospital in our upcoming RefluxStop™ • Completed listing on Nasdaq First North Premier Growth Market raising SEK 1.1 Registry clinical trial to be focused primarily billion, with trading of Implantica's Swedish in Germany and Switzerland. Depository Receipts commencing on September 21, 2020. The offering was After the end of the period substantially oversubscribed. • Exercised overallotment option raising an additional SEK 165 million. • Increased our shareholder base with highly reputable shareholders such as Swedbank • Implantica’s RefluxStop™ trial showed Robur Ny Teknik, Handelsbanken Fonder, exceptional three-year follow-up results. TIN Fonder, Skandia and Nordea Investment None of the 47 patients in the study were in Management. -

Rating Action, Barclays Bank UK

Rating Action: Moody's takes rating actions on Barclays, Lloyds, Santander UK, Nationwide and Close Brothers, following update to banks methodology 13 Jul 2021 London, 13 July 2021 -- Moody's Investors Service (Moody's) has today taken rating actions on Barclays, Lloyds, Santander UK and Close Brothers banking groups and on Nationwide Building Society, including the upgrade of the long-term senior ratings of Lloyds Banking Group plc and Close Brothers Group plc. The rating actions were driven by revisions to Moody's Advanced Loss Given Failure (Advanced LGF) framework, which is applied to banks operating in jurisdictions with Operational Resolution Regimes, following the publication of Moody's updated Banks Methodology on 9 July 2021. This methodology is available at this link: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1269625 . A full list of affected ratings and assessments can be found at the end of this Press Release. RATINGS RATIONALE Today's rating actions were driven by revisions to the Advanced Loss Given Failure framework within Moody's updated Banks Methodology: a revised notching guidance table, with thresholds at lower levels of subordination and volume in the liability structure have been applied to the UK banks and Additional Tier 1 (AT1) securities issued by banks domiciled in the UK have been included in the Advanced LGF framework, eliminating the previous analytical distinction between those high trigger instruments that were deemed to provide equity-like absorption of losses before the point of failure and other AT1 securities. Moody's removal of equity credit for high trigger Additional Tier 1 (AT1) instruments from banks' going concern capital means that affected banks have reduced capacity to absorb unexpected losses before the point of failure, everything else being equal. -

Svenska Handelsbanken

Annual Report 2001 Svenska Handelsbanken THE ANNUAL GENERAL MEETING OF SVENSKA HANDELSBANKEN will be held at the Grand Hôtel, Vinterträdgården, Royal entrance, Stallgatan 4, Stockholm, at 10.00 a.m. on Tuesday, 23 April 2002. NOTICE OF ATTENDANCE AT ANNUAL GENERAL MEETING Shareholders wishing to attend the Meeting must: • be entered in the Register of Shareholders kept by VPC AB (Swedish Central Securities Depository and Clearing Organisation), on or before Friday, 12 April 2002, and • give notice of attendance to the Chairman's Office at the Head Office of the Bank, Kungsträdgårdsgatan 2, SE-106 70 Stockholm, telephone +46 8 701 19 84, or via the Internet www.handelsbanken.se/bolagsstamma (Swedish only), by 3 p.m. on Wednesday, 17 April 2002. In order to be entitled to take part in the Meeting, any share- holders whose shares are nominee-registered must also request a temporary entry in the register of shareholders kept by the VPC. Shareholders must notify the nominee about this well before 12 April 2002, when this entry must have been effected. DIVIDEND The Board of Directors recommends that the record day for the dividend be Friday, 26 April 2002. If the Annual General Meeting votes in accordance with this recommendation, the VPC expects to be able to send the dividend to shareholders on Thursday, 2 May 2002. PUBLICATION DATES FOR INTERIM REPORTS January–March 22 April 2002 January–June 20 August 2002 January–September 22 October 2002 Svenska Handelsbanken AB (publ) Registered no. 502007-7862 www.handelsbanken.se Contents HIGHLIGHTS OF THE YEAR 2 THE GROUP CHIEF EXECUTIVE’S COMMENTS.......... -

On Screen Presentation

Bob Diamond Chief Executive, Barclays PLC UBS Global Financial Services Conference, New York May 2012 Balanced performance across Barclays in Q1 Barclays Q1 2012 Total Income: £8,138m * Corporate Banking Retail and Business Banking £824m Investment Banking £1,077m UK £243m Europe £3,464m £3,140m £830m Africa £990m Barclaycard £451m Head Office & Other: £259m Wealth * Total Income net of Insurance and excluding own credit and gains on debt buybacks UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Basel 3 Core Tier 1 ratio pro forma Core Tier 1 ratio under Basel 3 / CRD4 RWA effect Consensus from Basel 3 retained incl. mitigating Capacity for earnings Basel 2.5 actions £47bn RWA 1.6% 12.6% (1.6%) Basel 3 growth above Outstanding pre RWA a 10% CT 1 Basel 2.5 warrants growth ratio 10.9% 0.2% 11% (1%) 10.0% Mar 11 Dec 13 Dec 13 UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Adjusted Return on Equity (RoE) by business 2011 FY RoE by business Q1 2012 RoE by business 14.9% UK RBB 15.0% (6.0)% Europe RBB (6.0)% 10.0% Africa RBB 10.2% 17.4% Barclaycard 19.6% 10.4% Investment Bank 17.0% 1.3% Corporate Banking 9.0% 10.9% Wealth & Investment 9.6% Management UBS Global Financial Services Conference, New York | May 2012 Income growth Examples: Barclaycard Africa Wealth and Investment Management Investment Banking UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Bob Diamond Chief Executive, Barclays PLC UBS Global Financial Services Conference, New York May 2012 . -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Handelsbanken Ulf Riese, CFO

Handelsbanken Ulf Riese, CFO Morgan Stanley European Financials Conference 2 April 2009 Handelsbanken Financial target – focus on profitability Handelsbanken’s financial goal is to have a higher return on equity than a weighted average of comparable listed Nordic and British banks This should be achieved through: More satisfied clients Lower costs than peers The financial goal has been reached for 37 consecutive years 2 Handelsbanken Higher profitability than the average for comparable banks Return on shareholder’s equity, 1973 - 2008 % Handelsbanken Other Comparable banks* 30 25 20 15 10 5 0 -5 1973 1978 1983 1988 1993 1998 2003 2008 Return on shareholder's equity after standard tax. * Since 2003 the comparable banks are: SEB, Nordea, Swedbank, Danske Bank samt DnB NOR. 3 Handelsbanken Business model Decentralisation Nonnegotiable Credit policy No central No bonus Business control system marketing Responsibility and Accountability Customer The branch No budget is the bank 4 Handelsbanken We have more satisfied customers Customer satisfaction – private customers Handelsbanken Sector average, weighted Index Sweden Index Denmark 80 85 75 80 70 75 70 65 65 60 60 55 55 50 50 2001 2002 2003 2004 2005 2006 2007 2008 2001 2002 2003 2004 2005 2006 2007 2008 Index Finland Index Norway 85 75 80 70 75 70 65 65 60 60 55 55 50 50 2001 2002 2003 2004 2005 2006 2007 2008 2002 / 2004 2005 2006 2007 2008 Source: SKI, Dansk KundeIndex, EPSI Rating and EPSI Norway. 2003 5 In Sweden, the sector average comprises SEB, Nordea and Swedbank. Handelsbanken We are the most cost-effective bank Cost/income-ratio before loan losses, Jan – Dec 2008 Weighted average % excl. -

Barclays Bespoke Disclosure Commodity Futures Trading Commission Rule 1.55(K)

BARCLAYS BESPOKE DISCLOSURE COMMODITY FUTURES TRADING COMMISSION RULE 1.55(K) Barclays Bespoke Disclosure – v2.0 February 2021 COMMODITY FUTURES TRADING COMMISSION RULE 1.55(K): FCM-SPECIFIC DISCLOSURE DOCUMENT The Commodity Futures Trading Commission (Commission) requires each futures commission merchant (FCM), including Barclays Capital Inc. (BCI), to provide the following information to a customer prior to the time the customer first enters into an account agreement with the FCM or deposits money or securities (funds) with the FCM. Except as otherwise noted below, the information set out is as of December 31, 2019. BCI will update this information annually and as necessary to take account of any material change to its business operations, financial condition or other factors that BCI believes may be material to a customer’s decision to do business with BCI. Nonetheless, BCI’s business activities and financial data are not static and will change in non-material ways frequently throughout any 12-month period. NOTE: BCI is a subsidiary of Barclays Group US Inc. (BGUS), which is a subsidiary of Barclays US LLC (IHC LLC). The IHC LLC is an indirect parent entity of BCI and is a wholly-owned subsidiary of Barclays Bank, PLC (BBPLC and together with its subsidiaries Barclays or the Group). BCI’s FCM business forms part of the Investment Banking division of Barclays Group (together with Barclays). Barclays is an international financial services provider engaged in personal banking, credit cards, corporate and investment banking and wealth management. Information that may be material with respect to BCI for purposes of the Commission’s disclosure requirements may not be material to BGUS, IHC LLC or BBPLC for purposes of applicable securities laws.