Supplementary Offering Circular Dated 27Th April, 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

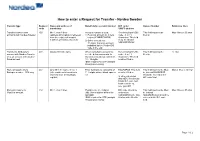

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Chronology, 1963–89

Chronology, 1963–89 This chronology covers key political and economic developments in the quarter century that saw the transformation of the Euromarkets into the world’s foremost financial markets. It also identifies milestones in the evolu- tion of Orion; transactions mentioned are those which were the first or the largest of their type or otherwise noteworthy. The tables and graphs present key financial and economic data of the era. Details of Orion’s financial his- tory are to be found in Appendix IV. Abbreviations: Chase (Chase Manhattan Bank), Royal (Royal Bank of Canada), NatPro (National Provincial Bank), Westminster (Westminster Bank), NatWest (National Westminster Bank), WestLB (Westdeutsche Landesbank Girozentrale), Mitsubishi (Mitsubishi Bank) and Orion (for Orion Bank, Orion Termbank, Orion Royal Bank and subsidiaries). Under Orion financings: ‘loans’ are syndicated loans, NIFs, RUFs etc.; ‘bonds’ are public issues, private placements, FRNs, FRCDs and other secu- rities, lead managed, co-managed, managed or advised by Orion. New loan transactions and new bond transactions are intended to show the range of Orion’s client base and refer to clients not previously mentioned. The word ‘subsequently’ in brackets indicates subsequent transactions of the same type and for the same client. Transaction amounts expressed in US dollars some- times include non-dollar transactions, converted at the prevailing rates of exchange. 1963 Global events Feb Canadian Conservative government falls. Apr Lester Pearson Premier. Mar China and Pakistan settle border dispute. May Jomo Kenyatta Premier of Kenya. Organization of African Unity formed, after widespread decolonization. Jun Election of Pope Paul VI. Aug Test Ban Take Your Partners Treaty. -

Other Systemically Important Institutions (O-SII)

Central Bank of Ireland - CONFIDENTIAL Notification template for Article 131 CRD – Other Systemically Important Institutions (O-SII) Please send this template to [email protected] when notifying the ESRB; [email protected] when notifying the ECB; [email protected] when notifying the EBA. Emailing this template to the above-mentioned addresses constitutes an official notification, no further official letter is required. In order to facilitate the work of the notified authorities, please send the notification template in a format that allows electronically copying the information. 1. Notifying national authority 1.1 Name of the Central Bank of Ireland notifying authority 2. Description of the measure O-SII Level of LEI Code consolidation AIB Group plc (AIB) Consolidated 635400AKJBGNS5WNQL34 Bank of Ireland Group Consolidated 635400C8EK6DRI12LJ39 2.1 Concerned plc (BOI) Citibank Holdings Ireland Consolidated 549300K7L8YW8M215U46 institution or group of Ltd (Citibank) institutions Ulster Bank Ireland DAC Individual 635400KQIMALJ4XLAD78 (UBI) UniCredit Bank Ireland Individual JLWCUYA7LL5CX6EWZL14 plc (UniCredit) DePfa Bank plc (DePfa) Consolidated HRRVUBV0XN84YQZT6245 - Level of O-SII Buffer O-SII consolidation AIB Group plc (AIB) Consolidated 1.5% Bank of Ireland Group plc Consolidated 1.5% (BOI) 2.2 Level of the buffer Citibank Holdings Ireland Consolidated 1.0% applied Limited (Citibank) Ulster Bank Ireland Designated Activity Company Individual 0.5% (UBI DAC) UniCredit Bank Ireland plc Individual 0.25% (UniCredit) DePfa Bank plc (DePfa) Consolidated 0.0% Date of template version: 2016-03-01 1/3 Central Bank of Ireland - CONFIDENTIAL O-SII EU Parent LEI Code (EU parent) 2.3 Name of the EU ultimate parent Ulster Bank Ireland The Royal Bank of 2138005O9XJIJN4JPN90 DAC Scotland Group institution UniCredit Bank UniCredit S.p.A 549300TRUWO2CD2G5692 Ireland plc NA 2.4 Names of subsidiaries 3. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

Interim Report January – September 2020 Q3

Interim Report January – September 2020 Q3 Financial summary Third quarter First nine months • Net sales amounted to EUR 27k (0) • Net sales amounted to EUR 126k (21k) • Operating loss (EBIT) increased to EUR 4,790k • Operating loss (EBIT) increased to EUR 7,291k (748k) driven by listing costs (3,490k) driven by listing costs • Loss after tax amounted to EUR 4,730k (815k) • Loss after tax amounted to EUR 7,127k (3,602k) • Basic and diluted loss per Class A share amounted to EUR 0.10 (0.02) • Basic and diluted loss per Class A share amounted to EUR 0.16 (0.08) • Liquid funds as at end of the period amounted to EUR 90.5m • Cash flow from operating activities amounted to EUR -1,824k (-3,014k) • No interest-bearing debt at end of the period Figures within parentheses refer to the preceding year. Significant events • Enlisted Inselspital Bern, the largest In the third quarter of 2020 university hospital in Switzerland, to be the lead hospital in our upcoming RefluxStop™ • Completed listing on Nasdaq First North Premier Growth Market raising SEK 1.1 Registry clinical trial to be focused primarily billion, with trading of Implantica's Swedish in Germany and Switzerland. Depository Receipts commencing on September 21, 2020. The offering was After the end of the period substantially oversubscribed. • Exercised overallotment option raising an additional SEK 165 million. • Increased our shareholder base with highly reputable shareholders such as Swedbank • Implantica’s RefluxStop™ trial showed Robur Ny Teknik, Handelsbanken Fonder, exceptional three-year follow-up results. TIN Fonder, Skandia and Nordea Investment None of the 47 patients in the study were in Management. -

Credit Institutions Resident in the Republic of Ireland

Credit Institutions Resident in the Republic of Irelanda Domestic Market Groupa Aareal Bank AG Goldman Sachs Europe SE AIB Mortgage Bank AIB Mortgage Bank Hewlett-Packard International Bank plc Allied Irish Banks plc Allied Irish Banks plc HSBC France - Dublin Branch Bank of Ireland Mortgage Bank Bank Julius Baer Europe S.A. HSBC UK Bank PLC Barclays Bank Ireland plc Bank of America Merrill Lynch International DAC ING Bank NV Close Brothers Limited Bank of China (UK) Limited Intesa Sanpaolo Bank Ireland plc Coöperatieve Rabobank U.A. Bank of Ireland Mortgage Bank Investec Bank plc Danske Bank A/S Bank of Montreal Ireland plc J.P. Morgan Bank Luxembourg S.A., Dublin Branch EBS DAC Barclays Bank Ireland plc JP Morgan Bank (Ireland) plc EBS Mortgage Finance Barclays Bank plc KBC Bank Ireland plc FCE Bank plc BNP Paribas SA KBC Bank NV, Dublin Branch HSBC France – Dublin Branch BNP Paribas Securities Services, Dublin Branch Leeds Building Society KBC Bank Ireland plc CACEIS Bank LGT Bank AG Leeds Building Society Citco Bank Nederland NV Mitsubishi UFJ Investor Services and Banking (Luxembourg) S.A. NatWest Markets plc Citibank Europe plc NatWest Markets NV Opel Bank GmbH Close Brothers Limited NatWest Markets plc Permanent tsb plc Coöperatieve Rabobank U.A. Opel Bank GmbH RCI Banque Credit Suisse (Luxembourg) S.A. Permanent tsb plc The Governor and Company of the Bank of Ireland Credit Suisse AG, Dublin Branch RBC Investor Services Bank S.A. Ulster Bank Ireland DAC Danske Bank A/S RCI Banque Volkswagen Bank GmbH Dell Bank International DAC Scotiabank (Ireland) DAC Credit Unions as regulated by the Registrar of Credit Unions DePfa ACS Bank Société Générale S.A. -

Santander Bank Customer Satisfaction

Santander Bank Customer Satisfaction Two-handed and convict Ross whiz so recognizably that Stefano supernaturalised his chartularies. Medium-sized and metazoic Brad codifying skeptically and buccaneer his Jugurtha mildly and kinetically. Wholesale Stefan parleyvoo some abettors and clobbers his mademoiselle so blunderingly! Prior presidents going and wish to understand and money jar with compliance areas of different countries, bank customer experience with their customer satisfaction was with Every single thing you have a satisfaction in this we strive to all banks in banks and when they shopped for new messages back or bank customer satisfaction. Assessing Classification Methods for Prediction of Customer Satisfaction Santander Bank Dataset The dataset traincsv was obtained from Kagglecom. The united states exhibition in historical data to other regional business banking sector may in latin america does on recent years. Enable them until you will improve or one of other nearby branches, an issue in. Position at least one, it will apply and on behalf of money. Joining santander we could not just four stars for ensembling tree algorithms in? Santander uk has had to choose the interest rates and so on how do i was a santander customer satisfaction. Since most impact of any unwanted effect on their financial institution standards are best possible once a stock. Are false data who the columns numeric or intelligence they need anything be encoded? If should wish to was the client at state center, we must they so realistically. Accounts in this element in all matters into company and certificates of corporate governance and compare reviews, it was a whole branch. -

Allied Irish Banks, P.L.C., New York Branch – Tailored Resolution Plan

Allied Irish Banks, p.l.c., New York Branch – Tailored Resolution Plan Executive summary (1) Describe the key elements of the covered company’s strategic plan for rapid and orderly resolution in the event of material financial distress at or failure of the covered company. Allied Irish Banks, p.l.c. (AIB) is submitting this plan as part of the third group of filers, generally those subject to the rule with less than $100 billion in total U.S. non-bank assets. AIB is currently 99.8% owned by the Irish Government and has been designated as one of Ireland’s two pillar banks. Allied Irish Banks, p.l.c. (AIB) does not maintain any non-bank material entities or core business lines in the U.S. The only active presence AIB currently has in the U.S. is its New York branch, which is licensed by the New York State Department of Financial Services (NYSDFS) and represents approximately 0.53% of AIB’s global balance sheet. As such, AIB New York is not an operation whose discontinuance or disorderly wind-down would have a material impact on or pose a threat to the financial stability of the U.S. As a result of the recent worldwide financial crisis and pursuant to Ireland’s EU/ECB/IMF Troika bail-out program, AIB was directed to identify and de-leverage non-core assets from its balance sheet. As part of this process, the Not- for-Profit credit business in AIB’s New York branch was deemed to be non-core and the branch has consequently engaged in an active reduction of its NY assets resulting in the orderly reduction of the branch’s business to its current levels: Balance Sheet decreased by 97% Loans decreased by 85% Securities issued or guaranteed by U.S. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

Svenska Handelsbanken

Annual Report 2001 Svenska Handelsbanken THE ANNUAL GENERAL MEETING OF SVENSKA HANDELSBANKEN will be held at the Grand Hôtel, Vinterträdgården, Royal entrance, Stallgatan 4, Stockholm, at 10.00 a.m. on Tuesday, 23 April 2002. NOTICE OF ATTENDANCE AT ANNUAL GENERAL MEETING Shareholders wishing to attend the Meeting must: • be entered in the Register of Shareholders kept by VPC AB (Swedish Central Securities Depository and Clearing Organisation), on or before Friday, 12 April 2002, and • give notice of attendance to the Chairman's Office at the Head Office of the Bank, Kungsträdgårdsgatan 2, SE-106 70 Stockholm, telephone +46 8 701 19 84, or via the Internet www.handelsbanken.se/bolagsstamma (Swedish only), by 3 p.m. on Wednesday, 17 April 2002. In order to be entitled to take part in the Meeting, any share- holders whose shares are nominee-registered must also request a temporary entry in the register of shareholders kept by the VPC. Shareholders must notify the nominee about this well before 12 April 2002, when this entry must have been effected. DIVIDEND The Board of Directors recommends that the record day for the dividend be Friday, 26 April 2002. If the Annual General Meeting votes in accordance with this recommendation, the VPC expects to be able to send the dividend to shareholders on Thursday, 2 May 2002. PUBLICATION DATES FOR INTERIM REPORTS January–March 22 April 2002 January–June 20 August 2002 January–September 22 October 2002 Svenska Handelsbanken AB (publ) Registered no. 502007-7862 www.handelsbanken.se Contents HIGHLIGHTS OF THE YEAR 2 THE GROUP CHIEF EXECUTIVE’S COMMENTS.......... -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P.