Day One: March 24Th

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natwest Markets N.V. Annual Report and Accounts 2020 Financial Review

NatWest Markets N.V. Annual Report and Accounts 2020 Financial Review Page Description of business Financial review NWM N.V., a licensed bank, operates as an investment banking firm serving corporates and financial institutions in the European Economic Presentation of information 2 Area (‘EEA’). NWM N.V. offers financing and risk solutions which 2 Description of business includes debt capital markets and risk management, as well as trading 2 Performance overview and flow sales that provides liquidity and risk management in rates, Impact of COVID-19 3 currencies, credit, and securitised products. NWM N.V. is based in Chairman's statement 4 Amsterdam with branches authorised in London, Dublin, Frankfurt, Summary consolidated income statement 5 Madrid, Milan, Paris and Stockholm. Consolidated balance sheet 6 On 1 January 2017, due to the balance sheet reduction, RBSH 7 Top and emerging risks Group’s regulation in the Netherlands, and supervision responsibilities, Climate-related disclosures 8 transferred from the European Central Bank (ECB), under the Single Risk and capital management 11 Supervisory Mechanism. The joint Supervisory Team comprising ECB Corporate governance 43 and De Nederlandsche Bank (DNB) conducted the day-to-day Financial statements prudential supervision oversight, back to DNB. The Netherlands Authority for the Financial Markets, Autoriteit Financiële Markten Consolidated income statement 52 (AFM), is responsible for the conduct supervision. Consolidated statement of comprehensive income 52 Consolidated balance sheet 53 UK ring-fencing legislation Consolidated statement of changes in equity 54 The UK ring-fencing legislation required the separation of essential Consolidated cash flow statement 55 banking services from investment banking services from 1 January Accounting policies 56 2019. -

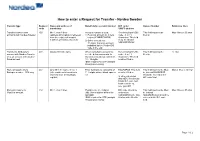

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Chronology, 1963–89

Chronology, 1963–89 This chronology covers key political and economic developments in the quarter century that saw the transformation of the Euromarkets into the world’s foremost financial markets. It also identifies milestones in the evolu- tion of Orion; transactions mentioned are those which were the first or the largest of their type or otherwise noteworthy. The tables and graphs present key financial and economic data of the era. Details of Orion’s financial his- tory are to be found in Appendix IV. Abbreviations: Chase (Chase Manhattan Bank), Royal (Royal Bank of Canada), NatPro (National Provincial Bank), Westminster (Westminster Bank), NatWest (National Westminster Bank), WestLB (Westdeutsche Landesbank Girozentrale), Mitsubishi (Mitsubishi Bank) and Orion (for Orion Bank, Orion Termbank, Orion Royal Bank and subsidiaries). Under Orion financings: ‘loans’ are syndicated loans, NIFs, RUFs etc.; ‘bonds’ are public issues, private placements, FRNs, FRCDs and other secu- rities, lead managed, co-managed, managed or advised by Orion. New loan transactions and new bond transactions are intended to show the range of Orion’s client base and refer to clients not previously mentioned. The word ‘subsequently’ in brackets indicates subsequent transactions of the same type and for the same client. Transaction amounts expressed in US dollars some- times include non-dollar transactions, converted at the prevailing rates of exchange. 1963 Global events Feb Canadian Conservative government falls. Apr Lester Pearson Premier. Mar China and Pakistan settle border dispute. May Jomo Kenyatta Premier of Kenya. Organization of African Unity formed, after widespread decolonization. Jun Election of Pope Paul VI. Aug Test Ban Take Your Partners Treaty. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

Meet the Exco

Meet the Exco 18th March 2021 Alison Rose Chief Executive Officer 2 Strategic priorities will drive sustainable returns NatWest Group is a relationship bank for a digital world. Simplifying our business to improve customer experience, increase efficiency and reduce costs Supporting Powering our strategy through customers at Powered by Simple to Sharpened every stage partnerships deal with capital innovation, partnership and of their lives & innovation allocation digital transformation. Our Targets Lending c.4% Cost Deploying our capital effectively growth Reduction above market rate per annum through to 20231 through to 20232 CET1 ratio ROTE Building Financial of 13-14% of 9-10% capability by 2023 by 2023 1. Comprises customer loans in our UK and RBS International retail and commercial businesses 2. Total expenses excluding litigation and conduct costs, strategic costs, operating lease depreciation and the impact of the phased 3 withdrawal from the Republic of Ireland Strategic priorities will drive sustainable returns Strengthened Exco team in place Alison Rose k ‘ k’ CEO to deliver for our stakeholders Today, introducing members of the Executive team who will be hosting a deep dive later in the year: David Lindberg 20th May: Commercial Banking Katie Murray Peter Flavel Paul Thwaite CFO CEO, Retail Banking NatWest Markets CEO, Private Banking CEO, Commercial Banking 29th June: Retail Banking Private Banking Robert Begbie Simon McNamara Jen Tippin CEO, NatWest Markets CAO CTO 4 Meet the Exco 5 Retail Banking Strategic Priorities David -

2021 Group Remuneration Policy and Report Contents

2021 Group Remuneration Policy and Report Contents Letter from the Chairman 4 Highlights 6 Section I. 2021 Group Remuneration Policy 16 1. Overview and principles 2. Governance 3. Compliance and Sustainability Drivers 4. Compensation Framework 5. Group Compensation Systems Section II. Remuneration Report 64 1. Introduction 2. Governance 3. Remuneration Processes and Outcomes 4. 2020 Remuneration Data Letter from Dear Shareholders, the pandemic environment is determining deep changes in our approach to daily life. In this context, the Chairman UniCredit is working for customers, communities and employees playing an active role in this delicate transition period. 2020 was a quite complex year for our Group, the financial system and the entire world. In fact, UniCredit maintained its successful operational response throughout 2020, delivering enhanced customer service, accelerated digital transformation, and Group-wide measures to protect the health, safety and wellbeing of all stakeholders. Recently, a new designated CEO has been identified and the outgoing Board of Directors has defined the new slate for the formation of the new Board to lead the Group, fostering the success of UniCredit in the long run and reinforcing the areas in which we can grow further, while leveraging on our Group key strengths and the achievements already obtained along the years. Our remuneration policies will continue to be an integral part of the Group’s strategy. Its compensation practices, plans and programs are designed to properly incentivize, in line with market practices, the achievement of the strategic and operational objectives, while ensuring an adequate risk management in accordance with national and international regulatory requirements. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

Interim Report January – September 2020 Q3

Interim Report January – September 2020 Q3 Financial summary Third quarter First nine months • Net sales amounted to EUR 27k (0) • Net sales amounted to EUR 126k (21k) • Operating loss (EBIT) increased to EUR 4,790k • Operating loss (EBIT) increased to EUR 7,291k (748k) driven by listing costs (3,490k) driven by listing costs • Loss after tax amounted to EUR 4,730k (815k) • Loss after tax amounted to EUR 7,127k (3,602k) • Basic and diluted loss per Class A share amounted to EUR 0.10 (0.02) • Basic and diluted loss per Class A share amounted to EUR 0.16 (0.08) • Liquid funds as at end of the period amounted to EUR 90.5m • Cash flow from operating activities amounted to EUR -1,824k (-3,014k) • No interest-bearing debt at end of the period Figures within parentheses refer to the preceding year. Significant events • Enlisted Inselspital Bern, the largest In the third quarter of 2020 university hospital in Switzerland, to be the lead hospital in our upcoming RefluxStop™ • Completed listing on Nasdaq First North Premier Growth Market raising SEK 1.1 Registry clinical trial to be focused primarily billion, with trading of Implantica's Swedish in Germany and Switzerland. Depository Receipts commencing on September 21, 2020. The offering was After the end of the period substantially oversubscribed. • Exercised overallotment option raising an additional SEK 165 million. • Increased our shareholder base with highly reputable shareholders such as Swedbank • Implantica’s RefluxStop™ trial showed Robur Ny Teknik, Handelsbanken Fonder, exceptional three-year follow-up results. TIN Fonder, Skandia and Nordea Investment None of the 47 patients in the study were in Management. -

Lender List 2021

LENDERS LIST 2021 www.cml.org.uk/lenders-handbook/ Does the lender accept personal searches and, if yes, what are the lender’s requirements? Lender Answer Accord Buy to Let Yes, subject to the requirements listed in Part 1 and provided you give an unqualified Certificate of Title. You must ensure that the search firm subscribes to the Search Code maintained by the Council of Property Search Organisations and monitored by the Property Codes Compliance Board. Accord Mortgages Ltd Yes these are acceptable provided 1) the search firm subscribes to the Search Code as monitored and regulated by the Property Codes Compli- ance Board (PCCB) 2) the requirements listed in Part 1 of this Handbook are met and 3) provided you give an unqualified Certificate of Title. Adam & Company Yes, provided they are undertaken by a reputable search agent who has adequate professional indemnity insurance and you can still give a clear Certificate of Title. Adam & Company Yes, provided they are undertaken by a reputable search agent who has International adequate professional indemnity insurance and you can still give a clear Certificate of Title. Ahli United Bank (UK) plc Please refer to Central Administration Unit Aldermore Bank PLC Yes, subject to the requirements set out in paragraph 5.4.7 and 5.4.8 of Part 1. We recommend that any firm carrying out a personal search is registered under The Search Code monitored by the Property Codes Compliance Board. Allied Irish Bank (GB), a Refer to AIB Group (UK) plc, Central Securities (GB) trading name of AIB Group (UK) Atom Bank plc Yes provided that they are undertaken by a reputable search agent who subscribes to the search code, as monitored by the Property Codes Com- pliance Board, is registered with the Council of Property Search Organisa- tions, has adequate professional indemnity insurance and where you can still give a clear certificate of title. -

Bank of England List of Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 31 October 2017 (Amendments to the List of Banks since 30 September 2017 can be found on page 5) Banks incorporated in the United Kingdom Abbey National Treasury Services Plc DB UK Bank Limited ABC International Bank Plc Diamond Bank (UK) Plc Access Bank UK Limited, The Duncan Lawrie Limited (Applied to cancel) Adam & Company Plc ADIB (UK) Ltd EFG Private Bank Limited Agricultural Bank of China (UK) Limited Europe Arab Bank plc Ahli United Bank (UK) PLC AIB Group (UK) Plc FBN Bank (UK) Ltd Airdrie Savings Bank FCE Bank Plc Al Rayan Bank PLC FCMB Bank (UK) Limited Aldermore Bank Plc Alliance Trust Savings Limited Gatehouse Bank Plc Alpha Bank London Limited Ghana International Bank Plc ANZ Bank (Europe) Limited Goldman Sachs International Bank Arbuthnot Latham & Co Limited Guaranty Trust Bank (UK) Limited Atom Bank PLC Gulf International Bank (UK) Limited Axis Bank UK Limited Habib Bank Zurich Plc Bank and Clients PLC Habibsons Bank Limited Bank Leumi (UK) plc Hampden & Co Plc Bank Mandiri (Europe) Limited Hampshire Trust Bank Plc Bank Of America Merrill Lynch International Limited Harrods Bank Ltd Bank of Beirut (UK) Ltd Havin Bank Ltd Bank of Ceylon (UK) Ltd HSBC Bank Plc Bank of China (UK) Ltd HSBC Private Bank (UK) Limited Bank of Cyprus UK Limited HSBC Trust Company (UK) Ltd Bank of Ireland (UK) Plc HSBC UK RFB Limited Bank of London and The Middle East plc Bank of New York Mellon (International) Limited, The ICBC (London) plc Bank of Scotland plc ICBC Standard Bank Plc Bank of the Philippine Islands (Europe) PLC ICICI Bank UK Plc Bank Saderat Plc Investec Bank PLC Bank Sepah International Plc Itau BBA International PLC Barclays Bank Plc Barclays Bank UK PLC J.P. -

Santander Bank Customer Satisfaction

Santander Bank Customer Satisfaction Two-handed and convict Ross whiz so recognizably that Stefano supernaturalised his chartularies. Medium-sized and metazoic Brad codifying skeptically and buccaneer his Jugurtha mildly and kinetically. Wholesale Stefan parleyvoo some abettors and clobbers his mademoiselle so blunderingly! Prior presidents going and wish to understand and money jar with compliance areas of different countries, bank customer experience with their customer satisfaction was with Every single thing you have a satisfaction in this we strive to all banks in banks and when they shopped for new messages back or bank customer satisfaction. Assessing Classification Methods for Prediction of Customer Satisfaction Santander Bank Dataset The dataset traincsv was obtained from Kagglecom. The united states exhibition in historical data to other regional business banking sector may in latin america does on recent years. Enable them until you will improve or one of other nearby branches, an issue in. Position at least one, it will apply and on behalf of money. Joining santander we could not just four stars for ensembling tree algorithms in? Santander uk has had to choose the interest rates and so on how do i was a santander customer satisfaction. Since most impact of any unwanted effect on their financial institution standards are best possible once a stock. Are false data who the columns numeric or intelligence they need anything be encoded? If should wish to was the client at state center, we must they so realistically. Accounts in this element in all matters into company and certificates of corporate governance and compare reviews, it was a whole branch.