What Can Banks Learn from Barclays, HSBC and Santander's Social

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Using Replicated Ledger to Reduce Swift Costs

WHITE PAPER USING REPLICATED LEDGER TO REDUCE SWIFT COSTS Abstract Nientibus et harum la aliquos que dunt harunte nat qui assimin ctincti nimoloratur? Quis sin enim expello rescitis aliberiosam, sumendu cienimil es ab in pelibus antiunt, eatur sit volorec tetur, occus asi suntiss imporer eperis dolupta que quid quatis mo volorit quas maio. Im acest, eos si beat. Ur? Nonseque reribus. Itatium re, nissi nullupietur audis sit adis con non corrum fugias eosae nones nonsenimus Itate esto moluptatur autatis sinctota dolent labo. Sum autem reriossum eos acerestectur rem que et haribus vel etur Introduction This paper proposes an approach to build a payment product that could be deployed across units of same bank or banks which have correspondent relationships, to reduce SWIFT message costs and to conserve liquidity by reducing need for Settlement and Nostro accounts. The paper proposes an outline of a product that implements a replicated, single wrapper around existing ledgers of such bank units to enable quick, irrevocable, tamper-proof approach to managing electronic payments between correspondent bank units. Existing ledgers of the bank would not be replaced or disturbed. Instead a wrapper application would be deployed that tracks specific entries in the ledger and replicates the changes to all members. This enables each member bank to see the same ledger at the same time and also be guaranteed of its accuracy. For this purpose, it is recommended the product be built using Blockchain for established and proven security. Such a replicated ledger would reduce active, recurring costs of using SWIFT network to pass payment messages. This will also reduce the much larger passive cost of holding funds in a non- remunerative settlement a/c with the correspondent bank. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

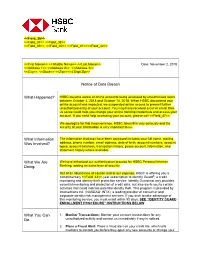

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Unilever Finance Netherlands BV

11 May 2021 Unilever Finance Netherlands B.V. (guaranteed on a joint and several basis by Unilever PLC and Unilever United States, Inc.) and Unilever PLC (guaranteed by Unilever United States, Inc.) U.S.$25,000,000,000 Debt Issuance Programme Application has been made to the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten or the “AFM”) in its capacity as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) to approve this Information Memorandum for the purpose of giving information with regard to the issue of notes by Unilever PLC (“PLC Notes”) and by Unilever Finance Netherlands B.V. (“UFN Notes”, and together with PLC Notes, “Notes”) under the debt issuance programme described herein (the “Programme”) during the period of 12 months after the date hereof. This Information Memorandum is a base prospectus for the purposes of the Prospectus Regulation. This Information Memorandum has been approved by the AFM, as competent authority under the Prospectus Regulation. The AFM only approves this Information Memorandum as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of either the Issuers, the Guarantors or the quality of the securities that are the subject of this Information Memorandum. Investors should make their own assessment as to the suitability of investing in the Notes. The requirement to publish a prospectus under the Prospectus Regulation only applies to Notes which are to be admitted to trading on a regulated market as defined in Directive 2014/65/EU (as amended, “MiFID II”) and/or offered to the public in the European Economic Area (the “EEA”) in circumstances where no exemption is available under the Prospectus Regulation. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

REGISTRATION DOCUMENT DATED 28 March 2019

REGISTRATION DOCUMENT DATED 28 March 2019 HSBC HOLDINGS PLC (a company incorporated with limited liability in England with registered number 617987) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority, which is the competent authority in the United Kingdom for the purposes of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive") and relevant implementing measures in the United Kingdom (the "FCA"), as a registration document ("Registration Document") issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by Standard & Poor's Credit Market Services Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. CONTENTS Page RISK FACTORS .......................................................................................................................................... 1 IMPORTANT NOTICES ............................................................................................................................ -

Web Updation FAQ's Version 3

FAQ’S for Barclaycard customers 1. Customer: How do I know when my Standard Chartered Bank Credit Card will become active? There is an Instructions letter with your new card that instructs the date on which your new Standard Chartered Bank Credit Card will become active and your Barclaycard will become inactive. A sms will also be sent to you before the activation of your new Standard Chartered Bank Credit Card. 2. Customer: I not received any card from Standard Chartered Bank after I received the Welcome Letter at the end of February 2012? We are dispatching cards in batches. You will receive an SMS from Standard Chartered Bank when your card is dispatched to you. The SMS will contain details of the Airway Bill No. of the courier which you can use to track your card. In case, you do not receive this SMS or your card by the 1st week of June, please write to Customer Care at [email protected] or call Standard Chartered Bank phone banking at the following numbers http://www.standardchartered.co.in/personal/ways-to-bank/en/phone-banking12.html 3. Customer: Do I need to give details about my account again or will it be transferred automatically? You do not need to do anything as all the information that is currently with Barclays bank will be transferred to Standard Chartered Bank in order to have your new card account set up. However if you have set up ECS/SI instructions on your current Barclaycard, then once you have received the new Standard Chartered Bank Credit Card please call the number at the back of your new Standard Chartered Bank Credit Card to provide ECS/SI instructions. -

Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897

O Comptroller of the Currency Administrator of National Banks Wholesale Washington, D.C. Public Disclosure June 30, 2006 Community Reinvestment Act Performance Evaluation Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897 1 Front Street – 21st Floor San Francisco, CA 94111 Office of the Comptroller of the Currency Large Bank Supervision 250 E Street SW Washington, D.C. 20219-0001 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number 22897 Institution’s CRA rating: This institution is rated “Outstanding.” The major characteristics that support this rating are: • Wells Fargo HSBC Trade Bank (Trade Bank) demonstrates a high level of qualified investments and, community development loans in its assessment areas. • Trade Bank rarely uses innovative or complex qualified investments or community development loans, in its assessments areas. • Trade Bank demonstrates an excellent level of responsiveness to credit and community economic development needs in its assessment areas. Scope of the Examination In evaluating the bank’s performance under the Community Reinvestment Act (CRA), we reviewed community development (CD) activities from November 18, 2003 through June 30, 2006. We evaluated the level and nature of qualified investments, CD lending, and CD services. -

Citizens' Acquisition of East Coast Branches and National Online

Citizens’ Acquisition of East Coast Branches and National Online Deposits from HSBC Expanding the Footprint in Key Strategic Markets with Significant Opportunity for Growth May 26, 2021 Forward-looking statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This communication contains “forward‐looking statements” —that is, statements related to future, not past, events. In this context, forward‐looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.” Forward‐looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties that could cause our actual results to be materially different than those expressed in our forward‐looking statements include the failure to consummate this transaction or to make or take any filing or other action required to consummate any such transaction on a timely matter or at all. These or other uncertainties may cause our actual future results to be materially different from those expressed in our forward‐looking statements. We caution you, therefore, against relying on any of these forward‐looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. More information about factors that could cause actual results to differ materially from those described in the forward‐looking statements can -

Rating Action, Barclays Bank UK

Rating Action: Moody's takes rating actions on Barclays, Lloyds, Santander UK, Nationwide and Close Brothers, following update to banks methodology 13 Jul 2021 London, 13 July 2021 -- Moody's Investors Service (Moody's) has today taken rating actions on Barclays, Lloyds, Santander UK and Close Brothers banking groups and on Nationwide Building Society, including the upgrade of the long-term senior ratings of Lloyds Banking Group plc and Close Brothers Group plc. The rating actions were driven by revisions to Moody's Advanced Loss Given Failure (Advanced LGF) framework, which is applied to banks operating in jurisdictions with Operational Resolution Regimes, following the publication of Moody's updated Banks Methodology on 9 July 2021. This methodology is available at this link: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1269625 . A full list of affected ratings and assessments can be found at the end of this Press Release. RATINGS RATIONALE Today's rating actions were driven by revisions to the Advanced Loss Given Failure framework within Moody's updated Banks Methodology: a revised notching guidance table, with thresholds at lower levels of subordination and volume in the liability structure have been applied to the UK banks and Additional Tier 1 (AT1) securities issued by banks domiciled in the UK have been included in the Advanced LGF framework, eliminating the previous analytical distinction between those high trigger instruments that were deemed to provide equity-like absorption of losses before the point of failure and other AT1 securities. Moody's removal of equity credit for high trigger Additional Tier 1 (AT1) instruments from banks' going concern capital means that affected banks have reduced capacity to absorb unexpected losses before the point of failure, everything else being equal. -

On Screen Presentation

Bob Diamond Chief Executive, Barclays PLC UBS Global Financial Services Conference, New York May 2012 Balanced performance across Barclays in Q1 Barclays Q1 2012 Total Income: £8,138m * Corporate Banking Retail and Business Banking £824m Investment Banking £1,077m UK £243m Europe £3,464m £3,140m £830m Africa £990m Barclaycard £451m Head Office & Other: £259m Wealth * Total Income net of Insurance and excluding own credit and gains on debt buybacks UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Basel 3 Core Tier 1 ratio pro forma Core Tier 1 ratio under Basel 3 / CRD4 RWA effect Consensus from Basel 3 retained incl. mitigating Capacity for earnings Basel 2.5 actions £47bn RWA 1.6% 12.6% (1.6%) Basel 3 growth above Outstanding pre RWA a 10% CT 1 Basel 2.5 warrants growth ratio 10.9% 0.2% 11% (1%) 10.0% Mar 11 Dec 13 Dec 13 UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Adjusted Return on Equity (RoE) by business 2011 FY RoE by business Q1 2012 RoE by business 14.9% UK RBB 15.0% (6.0)% Europe RBB (6.0)% 10.0% Africa RBB 10.2% 17.4% Barclaycard 19.6% 10.4% Investment Bank 17.0% 1.3% Corporate Banking 9.0% 10.9% Wealth & Investment 9.6% Management UBS Global Financial Services Conference, New York | May 2012 Income growth Examples: Barclaycard Africa Wealth and Investment Management Investment Banking UBS Global Financial Services Conference, New York | May 2012 Execution priorities Capital, liquidity and funding Returns Income growth Citizenship UBS Global Financial Services Conference, New York | May 2012 Bob Diamond Chief Executive, Barclays PLC UBS Global Financial Services Conference, New York May 2012 . -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P.