Registration Document Dated 30 March 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSBC Bank Argentina SA Casa Central: Florida

HSBC BANK ARGENTINA S.A. ASAMBLEA GENERAL ORDINARIA CELEBRADA EL 22 DE JULIO DE 2021 Acta de la Asamblea General Ordinaria de HSBC Bank Argentina S.A. (en adelante, indistintamente el “Banco” o la “Sociedad”) celebrada el 22 de julio de 2021, por medio del sistema de videoconferencia a través de la plataforma “HSBC Zoom” (https://hsbc.zoom.us/j/95292330739 - ID de Conferencia 952 9233 0739), en virtud de la declaración de pandemia de CORONAVIRUS - COVID 19 emitida por la Organización Mundial de la Salud, la emergencia pública en materia sanitaria decretada por el Decreto de Necesidad y Urgencia N° 260/2020 (en adelante “DECNU”) del Poder Ejecutivo Nacional, y las medidas sanitarias para contener la propagación del coronavirus ordenado por el DECNU N° 297/2020, sus modificaciones y sucesivas prórrogas de alcance similar. El Sr. Gonzalo Javier Fernández Covaro preside la Asamblea, en su carácter de Director Titular y Vicepresidente del Directorio, con facultades suficientes para este acto conforme el Artículo 23° del Estatuto Social, quien manifiesta que se encuentra conectado desde la Provincia de Río Negro, declara abierta la Asamblea siendo las 8:59 horas. Deja constancia que la presente Asamblea cumple con las previsiones de la Resolución General N° 830/2020 (en adelante “RG CNV 830/2020”) emitida por la Comisión Nacional de Valores, publicada en el Boletín Oficial de la República Argentina con fecha 5 de abril de 2020 y que entró en vigencia el 6 de abril de 2020, para ser celebraba bajo la modalidad de reunión a distancia. Agrega que se guardará una copia de respaldo en soporte digital, grabación que será conservada y estará a disposición de todos los asistentes por el término de (5) cinco años, y que la reunión se transcribirá al Libro de Actas de Asambleas, una vez concluidas las medidas sanitarias ordenadas por el DECNU N° 297/2020 precitado, sus modificaciones y sucesivas prórrogas de alcance similar. -

Using Replicated Ledger to Reduce Swift Costs

WHITE PAPER USING REPLICATED LEDGER TO REDUCE SWIFT COSTS Abstract Nientibus et harum la aliquos que dunt harunte nat qui assimin ctincti nimoloratur? Quis sin enim expello rescitis aliberiosam, sumendu cienimil es ab in pelibus antiunt, eatur sit volorec tetur, occus asi suntiss imporer eperis dolupta que quid quatis mo volorit quas maio. Im acest, eos si beat. Ur? Nonseque reribus. Itatium re, nissi nullupietur audis sit adis con non corrum fugias eosae nones nonsenimus Itate esto moluptatur autatis sinctota dolent labo. Sum autem reriossum eos acerestectur rem que et haribus vel etur Introduction This paper proposes an approach to build a payment product that could be deployed across units of same bank or banks which have correspondent relationships, to reduce SWIFT message costs and to conserve liquidity by reducing need for Settlement and Nostro accounts. The paper proposes an outline of a product that implements a replicated, single wrapper around existing ledgers of such bank units to enable quick, irrevocable, tamper-proof approach to managing electronic payments between correspondent bank units. Existing ledgers of the bank would not be replaced or disturbed. Instead a wrapper application would be deployed that tracks specific entries in the ledger and replicates the changes to all members. This enables each member bank to see the same ledger at the same time and also be guaranteed of its accuracy. For this purpose, it is recommended the product be built using Blockchain for established and proven security. Such a replicated ledger would reduce active, recurring costs of using SWIFT network to pass payment messages. This will also reduce the much larger passive cost of holding funds in a non- remunerative settlement a/c with the correspondent bank. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

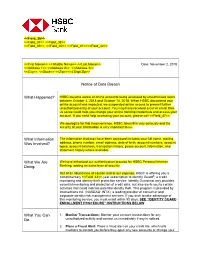

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Unilever Finance Netherlands BV

11 May 2021 Unilever Finance Netherlands B.V. (guaranteed on a joint and several basis by Unilever PLC and Unilever United States, Inc.) and Unilever PLC (guaranteed by Unilever United States, Inc.) U.S.$25,000,000,000 Debt Issuance Programme Application has been made to the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten or the “AFM”) in its capacity as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) to approve this Information Memorandum for the purpose of giving information with regard to the issue of notes by Unilever PLC (“PLC Notes”) and by Unilever Finance Netherlands B.V. (“UFN Notes”, and together with PLC Notes, “Notes”) under the debt issuance programme described herein (the “Programme”) during the period of 12 months after the date hereof. This Information Memorandum is a base prospectus for the purposes of the Prospectus Regulation. This Information Memorandum has been approved by the AFM, as competent authority under the Prospectus Regulation. The AFM only approves this Information Memorandum as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of either the Issuers, the Guarantors or the quality of the securities that are the subject of this Information Memorandum. Investors should make their own assessment as to the suitability of investing in the Notes. The requirement to publish a prospectus under the Prospectus Regulation only applies to Notes which are to be admitted to trading on a regulated market as defined in Directive 2014/65/EU (as amended, “MiFID II”) and/or offered to the public in the European Economic Area (the “EEA”) in circumstances where no exemption is available under the Prospectus Regulation. -

REGISTRATION DOCUMENT DATED 28 March 2019

REGISTRATION DOCUMENT DATED 28 March 2019 HSBC HOLDINGS PLC (a company incorporated with limited liability in England with registered number 617987) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority, which is the competent authority in the United Kingdom for the purposes of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive") and relevant implementing measures in the United Kingdom (the "FCA"), as a registration document ("Registration Document") issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by Standard & Poor's Credit Market Services Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. CONTENTS Page RISK FACTORS .......................................................................................................................................... 1 IMPORTANT NOTICES ............................................................................................................................ -

Doing Business in Argentina Contents

This publication is a joint project with Doing business in Argentina Contents Executive summary 4 Disclaimer Foreword 6 This document is issued by HSBC Bank (Argentina) Company Limited Introduction – Doing business in Argentina 8 (the ‘Bank’) in Argentina. It is not intended as an offer or solicitation for business to anyone in any Conducting business in Argentina 13 jurisdiction. It is not intended for distribution to anyone located in or Taxation in Argentina 18 resident in jurisdictions which restrict the distribution of this document. Audit and accountancy 29 It shall not be copied, reproduced, transmitted or further distributed Human Resources and Employment Law 34 by any recipient. Trade 37 The information contained in this document is of a general nature Banking in Argentina 40 only. It is not meant to be comprehensive and does not HSBC in Argentina 43 constitute financial, legal, tax or other professional advice. You Country overview 44 should not act upon the information contained in this publication without Contacts and further information 46 obtaining specific professional advice. This document is produced by the Bank together with PricewaterhouseCoopers (‘PwC’). Whilst every care has been taken in preparing this document, neither the Bank nor PwC makes any guarantee, representation or warranty (express or implied) as to its accuracy or completeness, and under no circumstances will the Bank or PwC be liable for any loss caused by reliance on any opinion or statement made in this document. Except as specifically indicated, the expressions of opinion are those of the Bank and/or PwC only and are subject to change without notice. -

Convenio De Autorización Y Solicitud De Transferencia Electrónica De Fondos En Concepto De Reintegro De Lo Abonado Por Prestaciones Dinerarias

Convenio de Autorización y Solicitud de Transferencia Electrónica de Fondos en concepto de Reintegro de lo abonado por prestaciones dinerarias Razón social Póliza N° CUIT N° Domicilio Constituido Localidad E-mail Tel. DATOS DE LA CUENTA BANCARIA* Denominación de la cuenta: CBU: Bancos adheridos (*) N° ENTIDAD N° ENTIDAD N° ENTIDAD 7 BANCO DE GALICIA 97 BANCO PROVINCIA DEL NEUQUÉN S.A. 309 BANCO RIOJA S.A. 11 BANCO DE LA NACION ARGENTINA 143 BRUBANK S.A.U. 310 BANCO DEL SOL S.A. 14 BANCO DE LA PROVINCIA DE BUENOS AIRES 147 BANCO INTERFINANZAS S.A. 311 NUEVO BANCO DEL CHACO S. A. 15 INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ICBC) 150 HSBC BANK ARGENTINA S.A. 312 BANCO VOII S.A. 16 CITIBANK N.A. 165 JPMORGAN CHASE BANK, NATIONAL ASSOCIATIO 315 BANCO DE FORMOSA S.A. 17 BBVA BANCO FRANCÉS S.A. 191 BANCO CREDICOOP COOPERATIVO LIMITADO 319 BANCO CMF S.A. 20 BANCO DE LA PROVINCIA DE CORDOBA S.A. 198 BANCO DE VALORES S.A. 321 BANCO DE SANTIAGO DEL ESTERO S.A. 27 BANCO SUPERVIELLE S.A. 247 BANCO ROELA S.A. 322 BANCO INDUSTRIAL S.A. 29 BANCO DE LA CIUDAD DE BUENOS AIRES 254 BANCO MARIVA S.A. 330 NUEVO BANCO DE SANTA FE S.A. 34 BANCO PATAGONIA S.A. 259 BANCO ITAU ARGENTINA S.A. 336 BANCO BRADESCO ARGENTINA S.A.U. 44 BANCO HIPOTECARIO S.A. 266 BNP PARIBAS 338 BANCO DE SERVICIOS Y TRANSACCIONES S.A. 45 BANCO DE SAN JUAN S.A. 268 BANCO PROVINCIA DE TIERRA DEL FUEGO 341 BANCO MASVENTAS S.A. -

(RCAP) Assessment of Basel III LCR Regulations – Argentina

Basel Committee on Banking Supervision Regulatory Consistency Assessment Programme (RCAP) Assessment of Basel III LCR regulations – Argentina This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2016. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISBN 978-92-9197-658-4 (online) Contents Preface ................................................................................................................................................................................................ 2 Executive summary ........................................................................................................................................................................... 4 Response from the Central Bank of Argentina ...................................................................................................................... 5 1 Assessment context and main findings ................................................................................................................. 6 1.1 Context ................................................................................................................................................................................ 6 Status of implementation ............................................................................................................................................ 6 Regulatory system and model of supervision .................................................................................................... -

SSA Sector and ESG Fixed Income - Rates

26 May 2021 Free to View SSA sector and ESG Fixed Income - Rates More social, more green Global Social, green and sustainability issuance is the fastest growing Frank Will Global Head of Covered Bond Research segment in the SSA sector HSBC Trinkaus & Burkhardt AG Chris Attfield EUR remains the dominant currency but USD volumes are Strategist rising HSBC Bank plc Dominic Kini S&A supply in social bond format currently dominates but Credit and Green Bond Strategist HSBC Bank plc green issuance to rise in light of EU recovery fund volumes Fighting climate change and tackling the COVID-19 pandemic are currently two of the biggest challenges facing governments around the world. But thanks to growing investor interest in the ESG space, the huge financing required for both battles is proving easier to access than might otherwise be the case. Few parts of the financial markets are being left untouched by these developments, and that includes the Sovereigns, Supranationals and Agencies section of the bond market. Indeed, issuance of green, social and sustainability (GSS) bonds is currently the fastest growing part of the SSA market. Issuers are finding strong demand for their bonds, but also ways to broaden their investor bases. KfW, the German state-owned development bank, recently noted that its green bonds have attracted 100 new investors since 2014 ie buyers who had not previously subscribed to its new issues. The GSS sovereign market is growing very fast. According to Bloomberg, since 2018 the size of the sovereign GSS bond market has almost doubled each year to reach a total outstanding amount equivalent to USD142bn. -

Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897

O Comptroller of the Currency Administrator of National Banks Wholesale Washington, D.C. Public Disclosure June 30, 2006 Community Reinvestment Act Performance Evaluation Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897 1 Front Street – 21st Floor San Francisco, CA 94111 Office of the Comptroller of the Currency Large Bank Supervision 250 E Street SW Washington, D.C. 20219-0001 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number 22897 Institution’s CRA rating: This institution is rated “Outstanding.” The major characteristics that support this rating are: • Wells Fargo HSBC Trade Bank (Trade Bank) demonstrates a high level of qualified investments and, community development loans in its assessment areas. • Trade Bank rarely uses innovative or complex qualified investments or community development loans, in its assessments areas. • Trade Bank demonstrates an excellent level of responsiveness to credit and community economic development needs in its assessment areas. Scope of the Examination In evaluating the bank’s performance under the Community Reinvestment Act (CRA), we reviewed community development (CD) activities from November 18, 2003 through June 30, 2006. We evaluated the level and nature of qualified investments, CD lending, and CD services. -

Plan De Marketing: Banco General De Panamá

Universidad de San Andrés Escuela de Negocios Maestría en Marketing y Comunicación Plan de Marketing: Banco General de Panamá Autor: Fernando Agustín D’Acunto DNI: 31529206 Mentora de Tesis: Mercedes Gerding Ciudad Autónoma de Buenos Aires, 2019 Universidad de San Andrés Departamento de Administración / Escuela de Negocios Magister en Marketing y Comunicación Plan de Marketing: Banco General de Panamá Autor: Fernando Agustín D’Acunto DNI: 31.529.206 Mentor: Mercedes Gerding Ciudad Autónoma de Buenos Aires Fernando Agustín D’Acunto 1 Resumen ejecutivo El Banco General de Panamá, nacido en 1950, es el banco privado más grande del país. El presente plan de marketing tiene como objetivo desarrollar una estrategia de comunicación digital que posicione al Banco General de forma coherente con sus valores de mercado dentro de una audiencia joven y con pleno crecimiento en Panamá. Para lograr este objetivo, primero se llevó adelante un análisis PEST, en el cual se analizaron los factores externos que pueden influir en el desempeño de la marca. Se realizó un análisis FODA, del cual se tomaron oportunidades y se utilizaron para elaborar una estrategia de marca fuerte y sostenible en el tiempo. Para desarrollar la estrategia de marca, se analizaron los insights 1 más relevantes de nuestro público joven y se tomaron algunos de ellos para incorporar, en la estrategia de comunicación de la marca. La implementación de la estrategia de comunicación digital se lleva adelante con una herramienta de mapeo que nos permite definir los medios más pertinentes y afines con la audiencia, como los contenidos que mejor ayuden a lograr los objetivos esperados por el banco.