Unilever Finance Netherlands BV

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Using Replicated Ledger to Reduce Swift Costs

WHITE PAPER USING REPLICATED LEDGER TO REDUCE SWIFT COSTS Abstract Nientibus et harum la aliquos que dunt harunte nat qui assimin ctincti nimoloratur? Quis sin enim expello rescitis aliberiosam, sumendu cienimil es ab in pelibus antiunt, eatur sit volorec tetur, occus asi suntiss imporer eperis dolupta que quid quatis mo volorit quas maio. Im acest, eos si beat. Ur? Nonseque reribus. Itatium re, nissi nullupietur audis sit adis con non corrum fugias eosae nones nonsenimus Itate esto moluptatur autatis sinctota dolent labo. Sum autem reriossum eos acerestectur rem que et haribus vel etur Introduction This paper proposes an approach to build a payment product that could be deployed across units of same bank or banks which have correspondent relationships, to reduce SWIFT message costs and to conserve liquidity by reducing need for Settlement and Nostro accounts. The paper proposes an outline of a product that implements a replicated, single wrapper around existing ledgers of such bank units to enable quick, irrevocable, tamper-proof approach to managing electronic payments between correspondent bank units. Existing ledgers of the bank would not be replaced or disturbed. Instead a wrapper application would be deployed that tracks specific entries in the ledger and replicates the changes to all members. This enables each member bank to see the same ledger at the same time and also be guaranteed of its accuracy. For this purpose, it is recommended the product be built using Blockchain for established and proven security. Such a replicated ledger would reduce active, recurring costs of using SWIFT network to pass payment messages. This will also reduce the much larger passive cost of holding funds in a non- remunerative settlement a/c with the correspondent bank. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

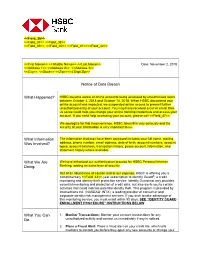

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

REGISTRATION DOCUMENT DATED 28 March 2019

REGISTRATION DOCUMENT DATED 28 March 2019 HSBC HOLDINGS PLC (a company incorporated with limited liability in England with registered number 617987) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority, which is the competent authority in the United Kingdom for the purposes of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive") and relevant implementing measures in the United Kingdom (the "FCA"), as a registration document ("Registration Document") issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by Standard & Poor's Credit Market Services Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. CONTENTS Page RISK FACTORS .......................................................................................................................................... 1 IMPORTANT NOTICES ............................................................................................................................ -

The News, December 29, 1966

Murray State's Digital Commons The eN ws Newspapers 12-29-1966 The ewN s, December 29, 1966 The ewN s Follow this and additional works at: https://digitalcommons.murraystate.edu/tn Recommended Citation The eN ws, "The eN ws, December 29, 1966" (1966). The News. 701. https://digitalcommons.murraystate.edu/tn/701 This Newspaper is brought to you for free and open access by the Newspapers at Murray State's Digital Commons. It has been accepted for inclusion in The eN ws by an authorized administrator of Murray State's Digital Commons. For more information, please contact [email protected]. John W. Greene, Well Known Here, Ond sif Kentucky's TWO SECTIONS To Make State Race For Auditor Better Weakly Papers The News his won 12. PAGES John W. Greene, who has an adult sure that my long experience awards for out- almost me to establish, expedite, standing excellence every year it lifetime of continuous legis- qualifies Margaret I. 1Ge administrative service in conduct an efficient has been submitted in 'wiping con- lative and and properly Periodical I.DDept.eKiag government apd as a auditing all state and Nett. Libra" state leader in system of University of party, today an: Kentucky, the Democratic county funds." Lexington, Ky. 40506 nounced his candidacy in the May Greene is one of the most widely Volume Thirty-Five Fulton, 42041, Fulton County, Kentucky Thursday, December 29, 196E Number 52 primary for State Auditor of Pub- known men In Kentucky and in the lic Accounts. Mr. Green is well Democratic party. Not only has he known and has many friends in gained close acquaintance; and re- Fulton and West Kentucky. -

Tiffany Cattle Company Wins CAB Feedlot Commitment to Excellence

10-6-15 Sect. 1.qxp:Layout 1 9/30/15 2:02 PM Page 1 High calling – Tiffany Cattle Company wins CAB Feedlot Commitment to Excellence Award By Steve Suther Brothers Shawn and Shane Tiffany grew up in the feedlot business, around a 42-acre yard built on the run- ways of an old Army Air Corps base. Their dad, Steve, was a manager at what was then Black Diamond Feeders near Herington for 14 years, starting in 1988. Only a year apart in school, they were on live- stock judging teams together and earned degrees in animal science at Kansas State Uni- versity. A minor in business foretold Shane’s first career as cattle buyer for Bartlett & After purchasing Black Diamond Feeders in 2007 Co. in the Texas Panhandle. Shane and Shawn Tiffany have worked together to Shawn’s Master’s in repro- grow Tiffany Cattle Company to a 12,000-14,000 head Using performance data to improve the quality of cattle, they strive to build a wider ductive physiology led him operation with a strong focus on customer relation- community for beef by offering a more consistent product for consumers. to manage Chair Rock Land ships. Photos by Steve Suther & Cattle near Kansas City. power for the next ten days. The “boys” try to give “We’re both very Type-A, But from the start, each some uncertainty in the cat- the brand’s annual confer- They learned to be ready for back every day so the next so we have locked horns a wanted to build a legacy. -

Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897

O Comptroller of the Currency Administrator of National Banks Wholesale Washington, D.C. Public Disclosure June 30, 2006 Community Reinvestment Act Performance Evaluation Wells Fargo HSBC Trade Bank, N.A. Charter Number: 22897 1 Front Street – 21st Floor San Francisco, CA 94111 Office of the Comptroller of the Currency Large Bank Supervision 250 E Street SW Washington, D.C. 20219-0001 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number 22897 Institution’s CRA rating: This institution is rated “Outstanding.” The major characteristics that support this rating are: • Wells Fargo HSBC Trade Bank (Trade Bank) demonstrates a high level of qualified investments and, community development loans in its assessment areas. • Trade Bank rarely uses innovative or complex qualified investments or community development loans, in its assessments areas. • Trade Bank demonstrates an excellent level of responsiveness to credit and community economic development needs in its assessment areas. Scope of the Examination In evaluating the bank’s performance under the Community Reinvestment Act (CRA), we reviewed community development (CD) activities from November 18, 2003 through June 30, 2006. We evaluated the level and nature of qualified investments, CD lending, and CD services. -

Consumer Propensity Report by Category

Consumer Propensity Report Marketing and Merchandising Intelligence for Local Business The Consumer Propensity Report (CPR) shows the lifestyle, product, and psychographic likelihood indices for the consumers within the trade area being analyzed. Major retail, restaurant, grocery, and consumer packaged goods firms use this very same information to drive marketing and merchandising decisions. Each analyzed item is assigned a propensity index score with 100 being average. For example, if the consumers within a trade score a 120 for a given analysis item you know that those consumers are 20% more likely to participate in or purchase that item than the average American household. A propensity index score of 80 would indicate that those consumers would be 20% less likely than the average American household to participate in or purchase that item. Information is provided for 32 major categories with over 4,800 total line items. Please note that line items are based upon national‐level purchasing and lifestyle characteristics. These line items are then correlated to the underlying household characteristics of the consumers within the trade area being analyzed. Some line items may not be necessarily relevant or available currently in your market or region. The index score in these situations serves to indicate the degree to which the consumers would participate in or purchase that item if it were relevant and available. Often this is taken as an opportunity for expansion of a similar brand or concept within the category. CPR Categories Apparel -

Citizens' Acquisition of East Coast Branches and National Online

Citizens’ Acquisition of East Coast Branches and National Online Deposits from HSBC Expanding the Footprint in Key Strategic Markets with Significant Opportunity for Growth May 26, 2021 Forward-looking statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This communication contains “forward‐looking statements” —that is, statements related to future, not past, events. In this context, forward‐looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.” Forward‐looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties that could cause our actual results to be materially different than those expressed in our forward‐looking statements include the failure to consummate this transaction or to make or take any filing or other action required to consummate any such transaction on a timely matter or at all. These or other uncertainties may cause our actual future results to be materially different from those expressed in our forward‐looking statements. We caution you, therefore, against relying on any of these forward‐looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. More information about factors that could cause actual results to differ materially from those described in the forward‐looking statements can -

Brown Brothers Harriman Global Custody Network Listing

BROWN BROTHERS HARRIMAN GLOBAL CUSTODY NETWORK LISTING Brown Brothers Harriman (Luxembourg) S.C.A. has delegated safekeeping duties to each of the entities listed below in the specified markets by appointing them as local correspondents. The below list includes multiple subcustodians/correspondents in certain markets. Confirmation of which subcustodian/correspondent is holding assets in each of those markets with respect to a client is available upon request. The list does not include prime brokers, third party collateral agents or other third parties who may be appointed from time to time as a delegate pursuant to the request of one or more clients (subject to BBH's approval). Confirmations of such appointments are also available upon request. COUNTRY SUBCUSTODIAN ARGENTINA CITIBANK, N.A. BUENOS AIRES BRANCH AUSTRALIA CITIGROUP PTY LIMITED FOR CITIBANK, N.A AUSTRALIA HSBC BANK AUSTRALIA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) AUSTRIA DEUTSCHE BANK AG AUSTRIA UNICREDIT BANK AUSTRIA AG BAHRAIN* HSBC BANK MIDDLE EAST LIMITED, BAHRAIN BRANCH FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BANGLADESH* STANDARD CHARTERED BANK, BANGLADESH BRANCH BELGIUM BNP PARIBAS SECURITIES SERVICES BELGIUM DEUTSCHE BANK AG, AMSTERDAM BRANCH BERMUDA* HSBC BANK BERMUDA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BOSNIA* UNICREDIT BANK D.D. FOR UNICREDIT BANK AUSTRIA AG BOTSWANA* STANDARD CHARTERED BANK BOTSWANA LIMITED FOR STANDARD CHARTERED BANK BRAZIL* CITIBANK, N.A. SÃO PAULO BRAZIL* ITAÚ UNIBANCO S.A. BULGARIA* CITIBANK EUROPE PLC, BULGARIA BRANCH FOR CITIBANK N.A. CANADA CIBC MELLON TRUST COMPANY FOR CIBC MELLON TRUST COMPANY, CANADIAN IMPERIAL BANK OF COMMERCE AND BANK OF NEW YORK MELLON CANADA RBC INVESTOR SERVICES TRUST FOR ROYAL BANK OF CANADA (RBC) CHILE* BANCO DE CHILE FOR CITIBANK, N.A. -

CLASSIFIED & 66 Inch Buffet; Set of Sire to Sell As a Package

I I 1 \ I I I 1 I V \ Mll.ll Page B-iO DINING ROOM SET— HUMMEL-«GU RIN ES - MOVING-MUST SELL- STEREO- Back to TIRES- (2) Unlroyal. WOLFF- TANNING Mahogany,, table 60X40 (28) displayed in dark Dinette,. hutch, coffee & school spoclall Sansul with 12 Inch leaf, 6 chairs enc steel belted radlals, P215/ BEDS Commercial-Home wood Curio Cabinet. De- * tables, TV, rocker, rack system with' cas- 75R15. $40/both. Call Units From $199.00. CLASSIFIED & 66 Inch buffet; Set of sire to sell as a package. chatrs"; raTfTBs7~b'IK*e, seller CD & turn table, 725-7615. •• aluminum cookware, Asking $3000! Call 874- kitchen, items & more. Ex- Sounds greatl Must sell, Lamps-Lotions- $200,396-8985. " . eel cond. 234-2367. $450. Call 722-4831. TIRES- P205 75R15 Accessories. Monthly 8142 after 6PM, anytime .Eayjnents.lQW as $18.00, X-fLJ_JL E C T,:l.Q N -rims-&-tl«»-llk»-n8w.-Al!-4- CHIL,DCRAFT CRIB & 66 DS 80- for $160. Couch. S love CalFToday FREE Color ANTIQUE PUMP OR- ental. Inlaid teak table, HUTCH— Dark pine, 70mm rriacro zoom, SB20 Many new pparts, runs catalog 1-800-228-6292. DRESSER CHANGER- lighted hutch, server, 6 seat neutral color $500.. GAN— Sleigh coffee tar • Light oak, excellent cond.. $250, Maytag washer, T -TTL, auto flash, Nikon great. Very fastt , GGood Bo- Call 985-5531. 310 ble; 2 small cocktail ta- $350. Black sleeper chairs, excellent condi- yr, old, $375. 2 Konmoro skyllght,' $425. All excel- glnnog r bike. $0$5007B.O7 . bles. All are ' dark pine. tion. -

Registration Document Dated 30 March 2021

REGISTRATION DOCUMENT DATED 30 MARCH 2021 HSBC HOLDINGS PLC (a company incorporated in England with registered number 617987; the liability of its members is limited) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority (the "FCA") as a registration document ("Registration Document") for the purposes of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended ("EUWA") (the "UK Prospectus Regulation") for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. The FCA has only approved this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation Rules sourcebook in the FCA Handbook. Such an approval should not be considered an endorsement of the Issuer that is the subject of the Registration Document. This Registration Document is valid for a period of twelve months from the date of approval. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by S&P Global Ratings UK Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the United Kingdom and registered under Regulation (EU) No 1060/2009 on credit rating agencies as it forms part of the domestic law of the United Kingdom by virtue of EUWA (the "UK CRA Regulation").