Banque De Luxembourg Builds a Future-Proof Platform Empowering Relationship Managers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CONVENTUM SICAV with Multiple Sub-Funds Under Luxembourg Law

Annual report including audited financial statements as at 31st December 2020 CONVENTUM SICAV with multiple sub-funds under Luxembourg law R.C.S. Luxembourg B70125 No distribution notices have been submitted for the Sub-Funds named below, which means that shares of these Sub- Funds may not be distributed to investors based within the territorial validity of the German “Kapitalanlagegesetzbuch (KAGB)” (Investment Code): - CONVENTUM - Institutional Fund - CONVENTUM - MultiAssets - CONVENTUM - Fortuna Royale 1 - CONVENTUM - Fortuna Royale 2 - CONVENTUM - Fortuna Royale 3 - CONVENTUM - Echium - CONVENTUM - FensiFund - CONVENTUM - Mekks - CONVENTUM - Prime Selection - CONVENTUM - Createrra Progress World Equities - CONVENTUM - Createrra Multi Assets Index Fund - CONVENTUM - Dynamic Opportunities - CONVENTUM - Income Opportunites - CONVENTUM - Equity Opportunities - CONVENTUM - Waterlily W Flexible Equity Fund - CONVENTUM - Alluvium Global Fund This report is the English translation of the audited annual including audited financial statements respectively unaudited semi- annual report in French. In case of a discrepancy of content and/or meaning between the French and English versions the French one shall prevail. Subscriptions can only be made on the basis of the complete prospectus accompanied by the articles of incorporation and the fact sheets of each of the sub-funds or based on the key investor information document ("KIID"). The complete prospectus may only be distributed if accompanied by the last annual report and the last semi-annual -

ECB and SSM – One Year on SRM – Taking Shape

www.pwc.com ECB and SSM – one year on SRM – taking shape Experiences so far and key priorities for 2016 March 2016 What is the Banking Union? Banking Union Single Supervisory Mechanism Single Resolution Mechanism (SSM) nly (SRM) Aim: Aim: • Ensure that banks comply with the EU banking rules • Ensure an orderly resolution of failing banks with • Be in a position to tackle problems early on minimal costs for the real economy and taxpayers • Key components: Single Resolution Board (SRB) and Eurozone o Eurozone • Direct supervision of ”significant“ banks by ECB; Single Resolution Fund (SRF) for medium-term close cooperation of ECB and National Competent funding Authorities (NCAs) for ”less-significant“ institutions Single Rulebook Aim: To standardise rules within EU area EU Bank Recovery and Resolution Deposit Guarantee Schemes Directive CRD IV/CRR Directive (BRRD) (DGSD) March 2016 PwC 2 SSM and SRM – Status of Luxembourg institutions SSM – ECB list dated 30 December 2015 The list includes: € • Significant entities ECB • Less significant institutions SRM – SRB list dated 1 March 2016 • All significant entities • 16 other cross-border banking groups March 2016 PwC 3 Significant Supervised Entities in Luxembourg 1. Banque et Caisse d’Epargne de l’Etat, Luxembourg 2. J.P. Morgan Bank Luxembourg S.A. 3. Precision Capital S.A. including: - Banque Internationale à Luxembourg S.A. - KBL European Private Bankers S.A. - Banque Puilaetco Dewaay Luxembourg S.A. 4. RBC Investor Services Bank S.A. 5. State Street Bank Luxembourg S.A. 6. UBS (Luxembourg) S.A. March 2016 PwC 4 Luxembourg Subsidiaries of Significant Supervised Entities 1 ABLV Bank Luxembourg S.A. -

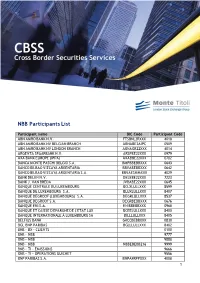

NBB Participants List

NBB Participants List Participant name BIC Code Participant Code ABN AMRO BANK N.V. FTSBNL2RXXX 4018 ABN AMRO BANK NV BELGIAN BRANCH ABNABE2AIPC 0509 ABN AMRO BANK NV LONDON BRANCH ABNAGB22XXX 4014 ARGENTA SPAARBANK N.V. ARSPBE22XXX 0979 AXA BANK EUROPE (IPPA) AXABBE22XXX 0702 BANCA MONTE PASCHI BELGIO S.A. BMPBBEBBXXX 0643 BANCO BILBAO VIZCAYA ARGENTARIA BBVABEBBXXX 0642 BANCO BILBAO VIZCAYA ARGENTARIA S.A. BBVAESMMXXX 4029 BANK DELEN N.V. DELEBE22XXX 7223 BANK J. VAN BREDA JVBABE22XXX 0645 BANQUE CENTRALE DU LUXEMBOURG BCLXLULLXXX 8599 BANQUE DE LUXEMBOURG S.A. BLUXLULLXXX 8407 BANQUE DEGROOF (LUXEMBOURG) S.A. DEGRLULLXXX 8537 BANQUE DEGROOF S.A. DEGRBEBBXXX 0676 BANQUE ENI S.A. ENIBBEBBXXX 0968 BANQUE ET CAISSE D'EPARGNE DE L'ETAT LUX BCEELULLXXX 8400 BANQUE INTERNATIONALE À LUXEMBOURG SA BILLLULLXXX 8405 BELFIUS BANK GKCCBEBBXXX 0830 BGL BNP PARIBAS BGLLLULLXXX 8402 BNB - BX - CLIENTS 0100 BNB - NBB 9777 BNB - NBB 9888 BNB - NBB NBBEBEBB216 9999 BNB - TI - EMISSIONS 9666 BNB - TI - OPERATIONS GUICHET 9556 BNP PARIBAS S.A. BNPAFRPPXXX 4008 1 BNP PARIBAS SECURITIES SERVICES PARIS PARBFRPPXXX 4017 BNP PARIBAS SECURITIES SERVICES(GCM) PARBFRPPBEC 4028 CBC BANK NV (klanten)-KBC BANK VCD8255 CREGBEBBNBB 4190 CBC BANQUE S.A. CREGBEBBXXX 0190 CENTEA SPAABE22XXX 0850 CITIBANK BELGIUM S.A. CTBKBEBXXXX 0595 CITIBANK INTERNATIONAL CITIBEBXXXX 0570 CITIBANK INTERNATIONAL PLC CITTGB2LXXX 4012 CLEARSTREAM BANKING S.A. CEDELULLXXX 0301 COMMERZBANK AG COBADEFFXXX 4026 CREDIT AGRICOLE NICABEBBXXX 0103 CREDIT AGRICOLE CORPORATE & INVEST.BANK BSUIFRPPXXX 4005 CREDIT PROFESSIONNEL BKCPBEBBXXX 0110 DELTA LLOYD BANK S.A. BNAGBEBBXXX 0635 DEUTSCHE BANK AG FRANKFURT DEUTDEFFDSO 4003 DEUTSCHE BANK AG LONDON DEUTGB2LGLO 4001 DEUTSCHE BK FRANKFURT CLIENTS/DB AMSTERD DEUTNL2AXXX 4015 DIERICKX, LEYS & CIE N.V. -

List of Supervised Entities January 2021

List of supervised entities Cut-off date for changes in group structures: 1 January 2021 Number of significant entities directly supervised by the ECB: 115 This list displays the significant supervised entities, which are directly supervised by the ECB (part A) and the less significant supervised entities which are indirectly supervised by the ECB (Part B). Based on Article 2(20) of Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014 establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (OJ L 141, 14.5.2014, p. 1 - SSM Framework Regulation) a ‘supervised entity’ means any of the following: (a) a credit institution established in a participating Member State; (b) a financial holding company established in a participating Member State; (c) a mixed financial holding company established in a participating Member State, provided that the coordinator of the financial conglomerate is an authority competent for the supervision of credit institutions and is also the coordinator in its function as supervisor of credit institutions (d) a branch established in a participating Member State by a credit institution which is established in a non-participating Member State. The list is compiled on the basis of significance decisions which have been adopted and notified by the ECB to the supervised entity and that have become effective up to the cut-off date. A. List of significant entities directly -

Luxembourg Annual Report (ABBL)

ANNUAL REPORT 2020 THE LUXEMBOURG BANKERS’ ASSOCIATION 01 Foreword from our Chairman p.3 02 The banking sector in numbers p.6 03 The priorities of the ABBL p.13 1 Shaping and representing the voice of our industry p.14 2 Fostering collaboration with and amongst our members p.21 3 Providing industry and regulatory expertise p.26 4 Offering research, thought leadership and financial education p.32 5 Collaborating with other economic actors and relevant authorities p.33 6 Representing members for the purpose of collective employment relations p.37 04 Our members p.38 05 About the ABBL p.41 06 Become a member of the ABBL p.49 Table of contents ABBL - ANNUAL REPORT 2020 3 01Foreword from our Chairman When I took on the role of Chair of the ABBL in 2018, I had a + Secondly, we were able to come together to agree a concerted clear vision. In addition to the increasingly complex regulatory approach to supporting small and medium-sized businesses flow through which our mission is to help our members navigate, throughout the period of confinement, when many I identified three major challenges that were to mark my companies were experiencing a complete suspension of mandate: climate change and the role of banks for a transition to income streams. This we did with a series of measures, a sustainable economy, Brexit and the desire to maintain strong including moratoria, special ‘covid’ loans, with state-backed links with London, and the digital transformation of banks. loans providing a safety net for local businesses affected by the COVID-19 pandemic. -

Luxembourg Banks Insights 2008

Luxembourg Banks Insights 2008 FINANCIAL SERVICES Message by Mr Luc Frieden, Minister of the Treasury 2 Contents Introduction by Mr John Li, Chairman, KPMG Luxembourg 4 Interview of Mr Jean-Nicolas Schaus, Director General CSSF 6 Approach 10 Executive Summary 11 Insights 2008 14 Doing business in Luxembourg 34 Evolution of bank business models 36 Human Resources 48 Information Technology 51 Regulatory developments 54 Tax environment 59 Bank ranking 2007 - Tables 69 - Overview 70 - Total assets 74 - Amounts owed to customers 76 - Net interest income 78 - Net fee and commission income 80 - Profit for the financial year 82 - Own funds 84 - Staff 86 2 Luxembourg Banks - Insights 2008 Banking institutions worldwide have experienced turbulent times recently. Message by The global financial crisis, initially triggered by the subprime mortgage crisis in the United States, has caused significant losses, both socially and Mr Luc Frieden economically. Fortunately, the Luxembourg financial institutions have so far been less hit than some other banks elsewhere. The “fight against financial crises” has since become a priority topic in international economic and financial fora. Indeed, in times of globalisation, even isolated bank failures have rapid spill-over effects, whether cross-border or cross-market. The European Union has been particularly swift to acknowledge the need to improve financial stability arrangements accordingly. As soon as October 2007, the Ecofin Council designed a “road map” aiming at achieving sustainable financial stability on the continent through concrete action in four main areas: increase transparency for investors markets and the regulators; improve valuation of financial products; strengthen prudential requirements and risk management; and make the markets function better. -

Redstone Private Banking Update Q4 2020

The Redstone Private Banking Update Welcome to the Redstone Private Banking Update: Q4 2020 The total number of moves reported this quarter has remained fairly consistent with those reported in Q3, this is unusual insofar as we normally see a Q4 slowdown but must be taken in the context of an overall muted year recruitment wise. One of the trends we have noticed throughout the year and especially within Q4 2020 is the acceleration of market consolidation, this is especially prominent within the Swiss market which has seen a flurry of mergers and acquisitions. Companies are increasingly starting to pick and choose which parts of the business to share, rather than wholesale takeovers. Another theme throughout 2020 has been the rush by many private banks, EAM’s and boutiques to expand their digital coverage, although analysis suggests the quality of many private banks digital offerings are not in line with hopes and expectations, a problem seen throughout other sectors too as the availability of face-to-face meetings are hindered via various lockdown protocols and restrictions globally. With the positive news of vaccine rollouts globally, there is a hope for a return to some semblance of normality within the medium term. The seniority of hires has unusually followed different trends globally, where we normally see some sort of global pattern – this quarter has been different in that Europe has adopted a notably different recruitment strategy than seen within APAC or the Americas. In terms of volume, Europe and Asia are level pegging with the Americas showing lower levels of recruitment appetite within Q4. -

Registration Document and Annual Financial Report

2014 Registration document and annual financial report This registration document was filed with the Autorité des Marchés Financiers (AMF) on April 21, 2015, pursuant to Article 212-13 of the AMF’s General Regulations. It may be used in support of a financial transaction if it is accompanied by a memorandum approved by the AMF. This document was prepared by the issuer and is binding on its signatories. In 2014, CIC maintained its growth momentum… Michel Lucas and Nicolas Théry In 2014, CIC maintained its growth momentum to serve its 4.8 million customers and reconfirmed its active participation in the real economy. Thanks to the motivation of its 20,000 employees, CIC was able to provide solid support for its customers’ needs, whether private individuals, associations, self-employed professionals, or corporates. This commitment and this professionalism are reflected in the figures: net income was €1,124 million, up 32.4%*; customer loans and deposits rose by a respective 7.3% and 8%; and insurance, remote banking, telephony and remote surveillance also grew significantly. With its responsive organizational structure and network of more than 2,000 points of sale, CIC’s top priorities are retail banking and customer satisfaction. Its diverse business lines and cutting-edge technology enable it to tailor its offerings to every need. As banker to one in three businesses in France, it supports job-creating companies and is an active partner in the regions’ economies. CIC benefits from the strength and solidity of its parent company, Crédit Mutuel, a powerful group with a European reach. With €43.9 billion in equity (up 9.1%), the Crédit Mutuel group posted a CET1 ratio of 15.5% and has one of the soundest balance sheets in Europe. -

Mfi Id Name Address Postal City Head Office Res* Luxembourg

MFI ID NAME ADDRESS POSTAL CITY HEAD OFFICE RES* LUXEMBOURG Central Banks LUB00000 Banque centrale du Luxembourg 2, boulevard Royal 2983 Luxembourg No Total number of Central Banks : 1 Credit Institutions LUB00162 ABN Amro Bank (Luxembourg) S.A. 46, avenue J.F. Kennedy 1855 LUXEMBOURG Yes LUB00340 ABN AMRO Mellon Global Securities 46A, avenue John F. Kennedy 1855 Luxembourg Yes Services, Luxembourg Branch LUB00344 Advanzia Bank S.A. 9, Parc d'activités Syrdall 5365 Munsbach Yes LUB00213 Argentabank Luxembourg S.A. 27, boulevard Prince Henri 1724 LUXEMBOURG Yes LUB00280 Banca Antoniana - Popolare Veneta, 62, avenue Guillaume 1650 LUXEMBOURG IT Banca Antoniana Popolare Yes succursale de Luxembourg Veneta Spa LUB00301 Banca Lombarda International S.A. 47, boulevard Prince Henri 1724 LUXEMBOURG Yes LUB00091 Banca Nazionale del Lavoro International S.A. 51, rue des Glacis 1628 LUXEMBOURG Yes LUB00298 Banca Popolare dell'Emilia Romagna 30, boulevard Royal 2449 LUXEMBOURG Yes (Europe) International S.A. LUB00133 Banco Bradesco Luxembourg S.A. 3b, boulevard du Prince Henri 1724 LUXEMBOURG Yes LUB00260 Banco di Brescia S.p.A., succursale de 47, boulevard du Prince Henri 1724 LUXEMBOURG IT Banco di Brescia San Yes Luxembourg Paolo Cab Spa LUB00291 Banco Itaú Europa Luxembourg S.A. 29, avenue de la Porte-Neuve 2227 LUXEMBOURG Yes LUB00284 Banco Popolare di Verona e Novara 26, boulevard Royal 2449 LUXEMBOURG Yes (Luxembourg) S.A. LUB00237 Banco Santander Totta S.A., succursale de 27, avenue de la Liberté 1931 LUXEMBOURG PT Banco Santander Totta, SAYes Luxembourg LUB00288 Bank Leumi (Luxembourg) S.A. 6D, route de Trèves 2633 SENNINGERBE Yes RG LUB00222 Bank of China (Luxembourg) S.A. -

Luxembourg Banking Insights 2018

Luxembourg Banking Insights 2018 Financial Services kpmg.lu IN A CHANGING WORLD A GROWING ESTATE IS THE FRUIT OF SOUND ADVICE WEALTH MANAGEMENT AND STRUCTURING You can count on the comprehensive expertise of BGL BNP Paribas, established in Luxembourg since 1919. Our private bankers work with you to find the best solution for your wealth. We’ll be pleased to advise you: (+352) 42 42-25 25 and bgl.lu/privatebanking The bank for a changing world Contact our Private Banking service for the terms and conditions, subject to approval of your application. BGL BNP PARIBAS S.A. (50, avenue J.F. Kennedy, L-2951 Luxembourg, R.C.S. Luxembourg: B 6481) Marketing Communication June 2018 BGL2293_Campagne Banque Privé_Luxembourg_banking_insights_20Juin_210x297_EN_HD.indd 1 11/06/2018 16:41 IN A CHANGING WORLD A GROWING ESTATE IS THE FRUIT OF SOUND ADVICE Contents Foreword 02 04 Message from Pierre Gramegna 06 Interview with Guy Hoffmann 08 Interview with Nasir Zubairi 10 Introduction from Stanislas Chambourdon and Anne-Sophie Minaldo Insights 12 14 Executive summary 18 Infographics 20 Assets 26 Profitability Megatrends 34 34 Megatrends 40 Interview with Bernard Coucke, Edmond de Rothschild (Europe) 52 Interview with Yves Baguet and Serge Munten, BIL WEALTH MANAGEMENT AND STRUCTURING You can count on the comprehensive expertise Bank rankings 2017 of BGL BNP Paribas, established in Luxembourg 56 since 1919. Our private bankers work with you to find the best solution for your wealth. We’ll be pleased to advise you: (+352) 42 42-25 25 and bgl.lu/privatebanking The bank for a changing world Contact our Private Banking service for the terms and conditions, subject to approval of your application. -

Convention Collective De Travail Des Salaries De Banque 2021

CONVENTION COLLECTIVE DE TRAVAIL DES SALARIES DE BANQUE 2021 – 2023 1 Table de matières Art. 1. - Préambule ..................................................................................................................... 8 Art. 2. - Champ d’application ..................................................................................................... 8 Art. 3. - Durée - Dénonciation .................................................................................................... 9 Art. 4. - Engagement................................................................................................................... 9 Art. 5. - Période d’essai ............................................................................................................ 10 Art. 6. - Résiliation du contrat .................................................................................................. 10 Art. 7. - Mesures disciplinaires ................................................................................................. 11 Art. 8. - Activité en dehors de celle de la banque .................................................................... 11 Art. 9. - Commission Paritaire .................................................................................................. 12 Art. 10. - Informations à fournir à la délégation du personnel ................................................ 12 Art. 11. - Whistleblowing et protection des personnes concernées ....................................... 12 Art. 12. - Mesures de sécurité ................................................................................................. -

Banque De Luxembourg Deutsche Bank Bank Central European 46 Unicredit Academic Council

bulletin 2021 eabh (The European Association for Banking and Financial History e.V.) Photograph: EC President Delors meets with students in Brussells during 1985 © European Central Bank Contents Bank for International Settlements 03 Banque de Luxembourg 04 Deutsche Bank 08 European Central Bank 11 Mediobanca 16 Metzler Bank 20 Banco de México 26 eabh National Bank of Moldova 29 bulletin Nationale-Nederlanden Group 32 Bank of Russia 34 Národná banka Slovenska 41 UniCredit 46 Academic Council 55 KEY TITLE DESIGN WEBSITE eabh bulletin Richard McBurney, grand-creative.com bankinghistory.org eabh - The European Association for SUBMISSIONS ISSN Banking and Financial History e.V. All submissions by email 2219-0643 EDITORS EMAIL LICENSE Carmen Hofmann, eabh [email protected] CC BY NC ND Gabriella Massaglia, eabh Hanauer Landstrasse 126-128, D-60314, TEL © eabh, Frankfurt am Main, 2021. Frankfurt am Main, Germany +49(0)69 36 50 84 650 All rights reserved. 2 Bank for International Settlements Opened its doors on 17 May 1930 Promoting Global Monetary and Financial Stability A new publication on the recent history of the BIS was released in May 2020: Borio Claudio, Stijn Claessens, Piet Clement, Robert N. McCauley and Hyun Song Shin (eds.), Promoting Global Monetary and Financial Stabil- ity, The Bank for International Settlements after Bretton Woods, 1973-2020, Cambridge University Press, 2020. eabh bulletin Piet Clement On the occasion of its 90th anniversary BIS launched the book via its social media channels: Twitter and LinkedIn. Piet Clement, historian at the BIS, did a podcast on the origins and functions of the BIS, which is accessible via LinkedIn/Twitter and via the BIS website.