Redstone Private Banking Update Q4 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Listing Prospectus Dated 21 October 2020 1 QUINTET PRIVATE BANK

Listing prospectus dated 21 October 2020 QUINTET PRIVATE BANK (EUROPE) S.A. (formerly KBL European Private Bankers S.A.) (Incorporated with limited liability in Luxembourg) €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes The issue price of the €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes (the “Notes”) of Quintet Private Bank (Europe) S.A. (the “Issuer” or “Quintet”) is 100 per cent. of their principal amount. The Notes will, subject to certain interest cancellation provisions described in Condition 3 (Interest Cancellation) in “Terms and Conditions of the Notes” (the “Conditions” and each, a “Condition”), bear interest on their Prevailing Principal Amount (as defined in Condition 17 (Interpretation)) on a non-cumulative basis from (and including) 23 October 2020 (the “Issue Date”) to (but excluding) 23 January 2026 (the “First Reset Date”) at a fixed rate of 7.5 per cent. per annum. Interest will be payable semi-annually in arrear on 23 January and 23 July of each year commencing on 23 January 2021 (each an “Interest Payment Date”). The rate of interest will reset on the First Reset Date and each date which falls five, and each multiple of five, years after the First Reset Date) (each, a “Reset Date”). The Issuer may elect, at its sole and absolute discretion, to cancel (in whole or in part) the payment of interest on the Notes otherwise scheduled to be paid on an Interest Payment Date. Furthermore, interest shall be cancelled (in -

Q4 Outlook 2020

Q4 2020 OUTLOOK Banque Havilland is a Private Banking Group established in 2009. The Bank is headquartered in Luxembourg with offices in London, Monaco, Liechtenstein, Dubai and Switzerland. The Group provides private banking, asset and wealth management services and institutional banking services to High Net Worth families and individuals from all over the world. TABLE OF CONTENTS MARKET ENVIRONMENT 4 EQUITIES 9 BONDS 12 COMMODITIES AND CURRENCIES 15 MARKET ENVIRONMENT As we move into the final three months of at home’ theme and certain technological what has been a quite extraordinary year, trends were brought forward by the Covid investors are faced with both imminent outbreak, but even since then the Nasdaq and long-term challenges that on the has rallied a further 30% before the recent surface will require perhaps more intricate pull-back. The performance of growth and and thoughtful planning than has been momentum stocks versus so-called value necessary for some time. stocks has also widened to extreme levels, more so than any point in history, with At global level, the rebound of risk assets earnings per share in the value category since the Covid-inspired nadir of March 23rd having declined by 50% year-on-year by has been so furious that we have reached an aggregate compared with a 15% decline inflection point far earlier than could have for growth. Conversely, many other global been anticipated, as unprecedented central indices are still very much in the red and bank and government stimulus has seen many even then with big gaps between the indices financial assets recover or surpass their pre- of neighbouring economies (eg. -

GLOBAL LIST of FGDR MEMBERS Updated on March 24Th, 2021

GLOBAL LIST OF FGDR MEMBERS Updated on March 24th, 2021 Note : to view the guarantee mechanism(s) (deposit, securities, or performance bonds) of which each institution is a member, please use the 'Bank Search engine' on this web site. CIB DENOMINATION 16688 AGENCE FRANCE LOCALE 41829 Al Khaliji France 12240 Allianz banque 19073 ALPHEYS INVEST 19530 Amundi 14758 Amundi ESR 14328 Amundi finance 17273 Amundi Intermédiation 15638 Andbank Monaco S.A.M. 13383 AQUIS EXCHANGE EUROPE 18979 ARAB BANKING CORPORATION SA 17473 Arfinco 16298 Arkéa banking services 18829 Arkéa banque entreprises et institutionnels 15980 Arkéa crédit bail 14518 ARKEA DIRECT BANK 16088 Arkéa Home Loans SFH 16358 Arkéa public sector SCF 23890 Attijariwafa bank europe 45340 Aurel - BGC 16668 Australia and New Zealand banking group limited 13558 Auxifip 16318 AXA BANK EUROPE SCF 12548 Axa banque 25080 Axa banque financement 15573 Axa épargne entreprise 17188 AXA HOME LOAN SFH 17373 Axa Investment Managers IF 11078 BAIL ACTEA IMMOBILIER 14908 Banca popolare di Sondrio (Suisse) 18089 Bank Audi France 14508 Bank Julius Baer (Monaco) S.A.M. 41259 Bank Melli Iran 18769 Bank of China limited 14879 Bank of India 44269 Bank Saderat Iran 17799 Bank Sepah 17579 Bank Tejarat 12579 Banque BCP 12179 Banque BIA 17499 Banque calédonienne d'investissement - B.C.I. 12468 Banque cantonale de Genève (France) S.A. 17519 Banque centrale de compensation 41439 Banque Chaabi du Maroc 24659 Banque Chabrières 10188 Banque Chalus 30087 Banque CIC Est 30027 Banque CIC Nord Ouest 30047 Banque CIC Ouest -

High Court Judgment Template

Neutral Citation Number: [2021] EWHC 2172 (Comm) Case No: CL-2019-000238 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 30 July 2021 Before : DAVID EDWARDS QC SITTING AS A JUDGE OF THE HIGH COURT - - - - - - - - - - - - - - - - - - - - - Between : THE STATE OF QATAR Claimant - and - (1) BANQUE HAVILLAND SA (a company incorporated under the laws of Luxembourg) (2) VLADIMIR BOLELYY Defendants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - David Mumford QC, Mr Thomas Munby and Mr Hugo Leith (instructed by Macfarlanes LLP) for the Claimant David Quest QC and Mr Philip Hinks (instructed by Reed Smith LLP) for the Defendants Hearing dates: 21 June 2021 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. DAVID EDWARDS QC “Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties’ representatives by email and release to Bailii. The date and time for hand-down is deemed to be 30 July 2021 at 10:30 am” DAVID EDWARDS QC Qatar v Banque Havilland SA & Another SITTING AS A JUDGE OF THE HIGH COURT Approved Judgment David Edwards QC : Introduction 1. On 5 March 2020 a first case management conference (“CMC”) in this action was heard by Cockerill J. Her order gave directions to trial in the usual way. Paragraph 15 provided that there should be a further CMC on the first available date after 9 December 2020 for the determination of any outstanding matters relating to disclosure and expert evidence. -

Q U I N T E T Pillar Ill: Report 2019

Q U I N T E T P R I V A T E B A N K Pillar Ill: Report 2019 Quintet Private Bank (Europe) S.A. – Pillar 3 – 2019 Contents Glossary ................................................................................................................................................................. 5 Note to readers ...................................................................................................................................................... 6 Introduction ........................................................................................................................................................... 7 1. List of Subsidiaries & Associates ........................................................................................................... 9 2. Corporate governance & decision structure ......................................................................................... 9 2.1 Corporate Culture ............................................................................................................................ 9 2.1.1 Board & Executive Committees: structure and key governance principles................................... 9 Risk Management approach at Quintet ............................................................................................................... 12 3. Five lines of defence ........................................................................................................................... 12 4. Risk Control function ......................................................................................................................... -

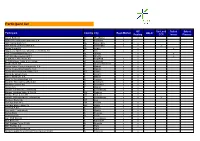

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

UCITS IV Plenum CAT Bond Fund

UCITS IV Trust Agreement Including the fund-specific Appendix and Prospectus July 1st 2016 Plenum CAT Bond Fund UCITS according to Liechtenstein law in the legal form of a trusteeship (hereinafter referred to as “UCITS”) (Single fund) Management Company CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern, www.caiac.li Plenum CAT Bond Fund Trust Agreement & Prospectus Organization of the UCITS at a glance Management Company: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Board of Directors: Dr. Roland Müller Dr. Dietmar Loretz Gerhard Lehner Executive Board: Thomas Jahn Raimond Schuster Asset manager: Plenum Investments AG Brandschenkestrasse 41, CH-8002 Zürich Custodian: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Share register: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Sales Office: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Auditor UCITS: Deloitte (Liechtenstein) AG Landstrasse 123, FL-9495 Triesen Auditor Management Company: ReviTrust Grant Thornton AG Bahnhofstrasse 15, FL-9494 Schaan Representatives and Distributors ACOLIN Fund Services AG in Switzerland: Affolternstrasse 56, CH-8050 Zürich Paying agent in Switzerland: Frankfurter Bankgesellschaft (Switzerland) AG Börsenstrasse 16, P.O. Box, CH-8022 Zurich Paying and information agent DZ BANK AG in Germany: Platz der Republik 60, D-60265 Frankfurt Paying agent in Austria: Erste Bank der österreichischen Sparkassen AG Graben 21, A-1010 Vienna Tax representative in -

Uebersicht Der Unterverwahrer.Xlsx

Übersicht der Unterverwahrer der DZ PRIVATBANK S.A. Stand: 28.06.2021 Markt Lagerstelle Unterverwahrer Beziehungsstatus ÄGYPTEN HSBC BANK EGYPT SAE ARGENTINIEN CLEARSTREAM BANKING S.A. LUXEMBOURG AUSTRALIEN BNP PARIBAS SECURITIES SERVICES S.A. AUSTRALIA BRANCH BANGLADESH STANDARD CHARTERED BANK DHAKA BRANCH BELGIEN EUROCLEAR BANK SA/NV BENIN STANDARD CHARTERED BANK COTE D'IVOIRE SA BRASILIEN BANCO BNP PARIBAS BRASIL S.A. BRASILIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Sao Paulo BULGARIEN CLEARSTREAM BANKING S.A. LUXEMBOURG Eurobank EFG Bulgaria AD Sofia BURKINA-FASO STANDARD CHARTERED BANK COTE D'IVOIRE SA CHILE CITIBANK EUROPE PLC LUXEMBOURG BRANCH Banco de Chile DÄNEMARK NORDEA DANMARK, filial af Nordea Bank Abp Finland DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Deutsche WertpapierService Bank AG Muttergesellschaft DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK diverse, abhängig vom Markt Muttergesellschaft DEUTSCHLAND DZ PRIVATBANK S.A. NIEDERLASSUNG STUTTGART DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Niederlassung der DZ PRIVATBANK S.A. ELFENBEINKUESTE STANDARD CHARTERED BANK COTE D'IVOIRE SA ESTLAND CLEARSTREAM BANKING S.A. LUXEMBOURG AS SEB Pank, Tallinn FINNLAND NORDEA BANK ABP FRANKREICH EUROCLEAR BANK SA/NV GHANA STANDARD CHARTERED BANK GHANA PLC GRIECHENLAND CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Europe Plc Athen Branch GROSSBRITANNIEN CITIBANK NA LONDON BRANCH GUINEA BISSAU STANDARD CHARTERED BANK COTE D'IVOIRE SA HONGKONG STANDARD CHARTERED BANK (HK) LTD. INDIEN STANDARD CHARTERED BANK MUMBAI BRANCH INDONESIEN PT BANK HSBC INDONESIA IRLAND REPUBLIK CITIBANK NA LONDON BRANCH IRLAND REPUBLIK EUROCLEAR BANK SA/NV W/ IRLAND ISLAND ISLANDSBANKI HF. ISRAEL BANK HAPOALIM B.M. ITALIEN BNP PARIBAS SECURITIES SERVICES MILANO BRANCH ITALIEN CITIBANK EUROPE PLC JAPAN MUFG BANK LTD JORDANIEN STANDARD CHARTERED BANK AMMAN BRANCH KANADA CITIBANK CANADA KENIA STANDARD CHARTERED BANK KENYA LTD KOLUMBIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Cititrust Colombia S.A. -

The 2008 Icelandic Bank Collapse: Foreign Factors

The 2008 Icelandic Bank Collapse: Foreign Factors A Report for the Ministry of Finance and Economic Affairs Centre for Political and Economic Research at the Social Science Research Institute University of Iceland Reykjavik 19 September 2018 1 Summary 1. An international financial crisis started in August 2007, greatly intensifying in 2008. 2. In early 2008, European central banks apparently reached a quiet consensus that the Icelandic banking sector was too big, that it threatened financial stability with its aggressive deposit collection and that it should not be rescued. An additional reason the Bank of England rejected a currency swap deal with the CBI was that it did not want a financial centre in Iceland. 3. While the US had protected and assisted Iceland in the Cold War, now she was no longer considered strategically important. In September, the US Fed refused a dollar swap deal to the CBI similar to what it had made with the three Scandinavian central banks. 4. Despite repeated warnings from the CBI, little was done to prepare for the possible failure of the banks, both because many hoped for the best and because public opinion in Iceland was strongly in favour of the banks and of businessmen controlling them. 5. Hedge funds were active in betting against the krona and the banks and probably also in spreading rumours about Iceland’s vulnerability. In late September 2008, when Glitnir Bank was in trouble, the government decided to inject capital into it. But Glitnir’s major shareholder, a media magnate, started a campaign against this trust-building measure, and a bank run started. -

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 To

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 to the GTC I. PURPOSE This document defines the Best Execution and Broker Selection Policy of Quintet Private Bank (Europe) S.A. (“the Bank”). The Bank shall take all sufficient steps to obtain the best possible result for its Clients as required by Directive 2014/65/EU of 15 May 2014 on markets in financial Instruments (“hereinafter MiFID II”) when: • executing Client orders; • dealing on own account with Clients; • transmitting Client orders to other entities (brokers) for execution (reception and transmission of Client orders); and • making an investment decision within the framework of discretionary portfolio management and transmitting an order for execution to another entity (brokers). For this purpose, the Bank shall draw up: • A Best Execution Policy (for the execution of orders and dealing on own account with Clients) which includes execution venues where the Bank executes Client orders. • A Best Selection Policy (for RTO and portfolio management) which includes entities (brokers) where the Bank places or transmits client orders for execution. The Best Execution and Broker Selection Policy is appended to the Bank’s GTC and is available on the Bank’s website (www.quintet.com). Where a Client makes reasonable and proportionate requests for information about the Best Execution and Best Selection Policy and how it is reviewed, the Bank shall answer clearly and within a reasonable time. II. SCOPE a. CLIENTS TO WHICH THIS POLICY APPLIES MiFID II distinguishes three categories of Clients: • Private Clients (retail Clients); • Professional Clients are persons who are considered to have the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that they incur; • Eligible counterparties which include regulated financial institutions (e.g. -

CONVENTUM SICAV with Multiple Sub-Funds Under Luxembourg Law

Annual report including audited financial statements as at 31st December 2020 CONVENTUM SICAV with multiple sub-funds under Luxembourg law R.C.S. Luxembourg B70125 No distribution notices have been submitted for the Sub-Funds named below, which means that shares of these Sub- Funds may not be distributed to investors based within the territorial validity of the German “Kapitalanlagegesetzbuch (KAGB)” (Investment Code): - CONVENTUM - Institutional Fund - CONVENTUM - MultiAssets - CONVENTUM - Fortuna Royale 1 - CONVENTUM - Fortuna Royale 2 - CONVENTUM - Fortuna Royale 3 - CONVENTUM - Echium - CONVENTUM - FensiFund - CONVENTUM - Mekks - CONVENTUM - Prime Selection - CONVENTUM - Createrra Progress World Equities - CONVENTUM - Createrra Multi Assets Index Fund - CONVENTUM - Dynamic Opportunities - CONVENTUM - Income Opportunites - CONVENTUM - Equity Opportunities - CONVENTUM - Waterlily W Flexible Equity Fund - CONVENTUM - Alluvium Global Fund This report is the English translation of the audited annual including audited financial statements respectively unaudited semi- annual report in French. In case of a discrepancy of content and/or meaning between the French and English versions the French one shall prevail. Subscriptions can only be made on the basis of the complete prospectus accompanied by the articles of incorporation and the fact sheets of each of the sub-funds or based on the key investor information document ("KIID"). The complete prospectus may only be distributed if accompanied by the last annual report and the last semi-annual