Q U I N T E T Pillar Ill: Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Listing Prospectus Dated 21 October 2020 1 QUINTET PRIVATE BANK

Listing prospectus dated 21 October 2020 QUINTET PRIVATE BANK (EUROPE) S.A. (formerly KBL European Private Bankers S.A.) (Incorporated with limited liability in Luxembourg) €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes The issue price of the €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes (the “Notes”) of Quintet Private Bank (Europe) S.A. (the “Issuer” or “Quintet”) is 100 per cent. of their principal amount. The Notes will, subject to certain interest cancellation provisions described in Condition 3 (Interest Cancellation) in “Terms and Conditions of the Notes” (the “Conditions” and each, a “Condition”), bear interest on their Prevailing Principal Amount (as defined in Condition 17 (Interpretation)) on a non-cumulative basis from (and including) 23 October 2020 (the “Issue Date”) to (but excluding) 23 January 2026 (the “First Reset Date”) at a fixed rate of 7.5 per cent. per annum. Interest will be payable semi-annually in arrear on 23 January and 23 July of each year commencing on 23 January 2021 (each an “Interest Payment Date”). The rate of interest will reset on the First Reset Date and each date which falls five, and each multiple of five, years after the First Reset Date) (each, a “Reset Date”). The Issuer may elect, at its sole and absolute discretion, to cancel (in whole or in part) the payment of interest on the Notes otherwise scheduled to be paid on an Interest Payment Date. Furthermore, interest shall be cancelled (in -

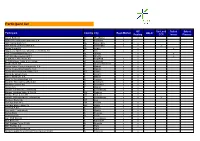

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Uebersicht Der Unterverwahrer.Xlsx

Übersicht der Unterverwahrer der DZ PRIVATBANK S.A. Stand: 28.06.2021 Markt Lagerstelle Unterverwahrer Beziehungsstatus ÄGYPTEN HSBC BANK EGYPT SAE ARGENTINIEN CLEARSTREAM BANKING S.A. LUXEMBOURG AUSTRALIEN BNP PARIBAS SECURITIES SERVICES S.A. AUSTRALIA BRANCH BANGLADESH STANDARD CHARTERED BANK DHAKA BRANCH BELGIEN EUROCLEAR BANK SA/NV BENIN STANDARD CHARTERED BANK COTE D'IVOIRE SA BRASILIEN BANCO BNP PARIBAS BRASIL S.A. BRASILIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Sao Paulo BULGARIEN CLEARSTREAM BANKING S.A. LUXEMBOURG Eurobank EFG Bulgaria AD Sofia BURKINA-FASO STANDARD CHARTERED BANK COTE D'IVOIRE SA CHILE CITIBANK EUROPE PLC LUXEMBOURG BRANCH Banco de Chile DÄNEMARK NORDEA DANMARK, filial af Nordea Bank Abp Finland DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Deutsche WertpapierService Bank AG Muttergesellschaft DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK diverse, abhängig vom Markt Muttergesellschaft DEUTSCHLAND DZ PRIVATBANK S.A. NIEDERLASSUNG STUTTGART DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Niederlassung der DZ PRIVATBANK S.A. ELFENBEINKUESTE STANDARD CHARTERED BANK COTE D'IVOIRE SA ESTLAND CLEARSTREAM BANKING S.A. LUXEMBOURG AS SEB Pank, Tallinn FINNLAND NORDEA BANK ABP FRANKREICH EUROCLEAR BANK SA/NV GHANA STANDARD CHARTERED BANK GHANA PLC GRIECHENLAND CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Europe Plc Athen Branch GROSSBRITANNIEN CITIBANK NA LONDON BRANCH GUINEA BISSAU STANDARD CHARTERED BANK COTE D'IVOIRE SA HONGKONG STANDARD CHARTERED BANK (HK) LTD. INDIEN STANDARD CHARTERED BANK MUMBAI BRANCH INDONESIEN PT BANK HSBC INDONESIA IRLAND REPUBLIK CITIBANK NA LONDON BRANCH IRLAND REPUBLIK EUROCLEAR BANK SA/NV W/ IRLAND ISLAND ISLANDSBANKI HF. ISRAEL BANK HAPOALIM B.M. ITALIEN BNP PARIBAS SECURITIES SERVICES MILANO BRANCH ITALIEN CITIBANK EUROPE PLC JAPAN MUFG BANK LTD JORDANIEN STANDARD CHARTERED BANK AMMAN BRANCH KANADA CITIBANK CANADA KENIA STANDARD CHARTERED BANK KENYA LTD KOLUMBIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Cititrust Colombia S.A. -

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 To

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 to the GTC I. PURPOSE This document defines the Best Execution and Broker Selection Policy of Quintet Private Bank (Europe) S.A. (“the Bank”). The Bank shall take all sufficient steps to obtain the best possible result for its Clients as required by Directive 2014/65/EU of 15 May 2014 on markets in financial Instruments (“hereinafter MiFID II”) when: • executing Client orders; • dealing on own account with Clients; • transmitting Client orders to other entities (brokers) for execution (reception and transmission of Client orders); and • making an investment decision within the framework of discretionary portfolio management and transmitting an order for execution to another entity (brokers). For this purpose, the Bank shall draw up: • A Best Execution Policy (for the execution of orders and dealing on own account with Clients) which includes execution venues where the Bank executes Client orders. • A Best Selection Policy (for RTO and portfolio management) which includes entities (brokers) where the Bank places or transmits client orders for execution. The Best Execution and Broker Selection Policy is appended to the Bank’s GTC and is available on the Bank’s website (www.quintet.com). Where a Client makes reasonable and proportionate requests for information about the Best Execution and Best Selection Policy and how it is reviewed, the Bank shall answer clearly and within a reasonable time. II. SCOPE a. CLIENTS TO WHICH THIS POLICY APPLIES MiFID II distinguishes three categories of Clients: • Private Clients (retail Clients); • Professional Clients are persons who are considered to have the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that they incur; • Eligible counterparties which include regulated financial institutions (e.g. -

General Terms and Conditions Applicable from 1 December 2020

General Terms and Conditions applicable from 1 December 2020 QUINTET PRIVATE BANK (EUROPE) S.A. | R.C.S. LUXEMBOURG B 6395 | SWIFT KBLXLULL 43, boulevard Royal | L-2955 Luxembourg | Grand-Duché de Luxembourg 1 December 2020 T +352 47 97 1 | F +352 47 97 73 900 | W www.quintet.com Contents INTRODUCTION 1. Presentation of the Bank 5 2. Subject of the General Terms and Conditions 5 Part 1 – GENERAL POINTS 3. Relationship of trust 6 4. Authorised bank signatures 6 5. Provisions against money laundering, financing of terrorism and market abuse 6 5.1 Identification of the Client 6 5.1.1. Clients who are natural / legal persons 6 5.1.2. Association or grouping without a legal personality 6 5.1.3. Economic beneficiary 6 5.1.4. Updating of data 7 5.1.5. Inadequate documentation 7 5.2. Client behaviour 7 5.3 Provisions on market abuse 7 5.4 Additional communications 7 6. Banking secrecy 8 7. Obligations specific to the Client 8 8. International cooperation 9 8.1. Cooperation in criminal matters 9 8.2. Cooperation in tax matters 9 8.2.1. Withholding tax 9 8.2.2. Cooperation in the matter of the exchange of information on request 9 8.2.3. Cooperation in the matter of the exchange of information 9 9. Communication with the Bank 10 9.1 Languages of communication 10 9.2. Means of communication 10 10. Correspondence 10 10.1. Sending of correspondence 10 10.2. Domiciliation of correspondence 11 11. Proof 11 12. Complaints 11 13. -

(Europe) SA (Formerly KBL European Private Bankers

QUINTET Private Bank (Europe) S.A. (Formerly KBL European Private Bankers S.A.) 43, boulevard Royal L-2955 Luxembourg R.C.S. Luxembourg: B 006.395 Consolidated financial statements, Consolidated management report and Report of the independent auditor as at 31 December 2019 Table of contents REPORT OF THE REVISEUR D’ENTREPRISES AGREE ............................................................................... 4 Consolidated statement of profit and loss ........................................................................................................ 10 Consolidated statement of comprehensive income .......................................................................................... 11 Consolidated statement of financial position .................................................................................................... 12 Consolidated statement of changes in equity ................................................................................................... 13 Consolidated statement of cash flows .............................................................................................................. 14 Notes to the consolidated financial statements ................................................................................................ 15 Note 1 – General .............................................................................................................................................. 15 Note 2a – Statement of compliance ................................................................................................................ -

QUINTET Private Bank (Europe) S.A. (Formerly KBL European Private Bankers S.A.) 43, Boulevard Royal L-2955 Luxembourg

QUINTET Private Bank (Europe) S.A. (Formerly KBL European Private Bankers S.A.) 43, boulevard Royal L-2955 Luxembourg R.C.S. Luxembourg: B 006.395 Financial statements, Management report and Report of the independent auditor as at 31 December 2019 Table of contents REPORT OF THE REVISEUR D’ENTREPRISES AGREE ................................................................................................. 3 STATEMENT OF PROFIT AND LOSS ................................................................................................................................ 9 STATEMENT OF COMPREHENSIVE INCOME ............................................................................................................... 10 STATEMENT OF FINANCIAL POSITION ......................................................................................................................... 11 STATEMENT OF CHANGES IN EQUITY ......................................................................................................................... 12 STATEMENT OF CASH FLOWS ...................................................................................................................................... 13 NOTES TO THE FINANCIAL STATEMENTS ................................................................................................................... 14 NOTE 1 – GENERAL ........................................................................................................................................................ 14 NOTE 2A – STATEMENT OF COMPLIANCE .................................................................................................................. -

Wealthbriefing Awards Programme

ACRECOGNISING LEADERS ACCLAIMROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WEALTHBRIEFING AWARDS PROGRAMME EXCLUSIVE FINALISTS OF THE EIGHTH ANNUAL WEALTHBRIEFING EUROPEAN AWARDS 2020 June 2020 ACCLAIM | WealthBriefing Recognises Leaders Across the Global Wealth Management Industry 2 CONTENTS WEALTHBRIEFING EUROPEAN AWARDS JUDGING PANEL .......................................................... 3 WEALTHBRIEFING EUROPEAN AWARDS SHORTLIST ................................................................... 5 FINALIST INTERVIEWS: ABN AMRO Private Banking ......................................... 8 Accuro Trust (Jersey) ..................................................... 8 Alpha ............................................................................. 9 AON ............................................................................... 9 Artorius ........................................................................... 10 Avignon Capital ............................................................. 10 Barclays Private Bank .................................................... 11 Block Asset Management ............................................. 11 BNY Mellon | Pershing .................................................. 12 Bordier Group ................................................................ 12 Brown Shipley ................................................................ 13 Capita Consulting .......................................................... 13 Capitalium Advisors ..................................................... -

Libro De Entidades (1 MB )

REGISTROS DE ENTIDADES 2021 SITUACION A 23 DE SEPTIEMBRE DE 2021 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ...................................................................................................... 7 ORDENADO POR CODIGO B.E. ......................................................................................................... 9 BANCOS ORDENADO ALFABETICAMENTE .................................................................................................... 13 ORDENADO POR CODIGO B.E. ....................................................................................................... 15 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE .................................................................................................... 25 ORDENADO POR CODIGO B.E. ....................................................................................................... 27 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE .................................................................................................... 31 ORDENADO POR CODIGO B.E. ....................................................................................................... 33 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO ALFABETICAMENTE .................................................................................................... 45 ORDENADO POR CODIGO B.E. ....................................................................................................... 47 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ENTIDADES DE PAGO -

Redstone Private Banking Update Q1 2020

The Redstone Private Banking Update Welcome to the Redstone Private Banking Update 2020: Q1 Most of the moves reported this quarter fall heavily into January and February as to be expected when considering the immediate fallout of social distancing in response to Covid-19. At this stage I would like to thank all the companies supporting the recruitment industry by deciding to continue with their urgent recruitment projects at this time. For those companies who are deciding to press the pause button, we completely understand and remain ready to assist you when we finally beat this thing. There was strong hiring appetite early in 2020 following a good year end with the Chinese and Americans getting to the phase one trade deal and enhanced political certainty elsewhere. With the markets currently in freefall, we are hearing of significant investors standing ready to provide much needed liquidity to the global markets, as well as some very significant government interventions globally, with many countries providing record levels of peacetime support to their respective economies and populace. When the world and markets can move on from the Covid-19 threat, it likely that 2020 will provide unparalleled opportunity for significant investment returns, a bright light at the end of the tunnel. It is in preparation for this that we see some companies preparing significant strategic planning and resourcing efforts. With many wealthy clients sitting at home, it seems that private banking wealth managers are in high demand right now. Noteworthy Talent Moves in EMEA The share of Swiss and UK hiring in the first quarter fell behind that of the wider European market (16%, 25% and 34% respectively), with many London based firms now seeking to plant seeds in Europe as the reality of Brexit following the UK’s December election takes hold. -

To Download 2020 Special Report

2020 SPECIAL REPORT Meet the executives and institutions pioneering innovation in the private banking sector. www.pbigws.verdict.co.uk 1 Editor's Note These awards never fail to surprise me and this year is no exception. The fact that there is an increasingly large amount of talent in this region is no surprise, but the level at which this accelerates is. DBS Bank took the coveted Outstanding Global Private Bank – Global award, as well as being recognised for North Asia. This shows how the behemoth is not willing to rest on its laurels and continues to evolve and adapt. Part of this is down to its tremendous investment in talent and people. The bank also won 20 awards for Outstanding Young Private Bankers and Rising Stars for Asia Pacific. An overwhelming achievement and with this level of personnel, it seems unlikely that DBS will be absent of more awards in the near future. Commendations to Hana Bank and Equirus Wealth Private Limited, both of whom were recognised for their rising stars. DBS won a further award for Outstanding Private Banker – Regional Player. Ahli United Bank, Hana Bank, and Deutsche Bank were also commended in this category. Standard Bank received an award for Outstanding RM Training and Development Programme. Talent pools are a huge area for discussion in private banking across the globe. As many seemingly glamourous sectors, such as tech, are very happy to poach employees with the promise of the future, how can banking compete? As shown by these awards, there is clearly a scheme in place to keep good people and this can only make the sector and the region stronger. -

Authorised Banks and Securities Firms

Authorised banks and securities firms Name City Licensing Bank type Securities firms type no activity as securities firm non-account-holding securities firms Category Aargauische Kantonalbank Aarau Bank Cantonal banks Swiss securities firm 3 ABANCA CORPORACION BANCARIA S.A., Betanzos, Genève 1 Foreign bank branch office First branch office of a foreign bank X 5 succursale de Genève acrevis Bank AG St. Gallen Bank Regional banks and savings banks Swiss securities firm 4 AEK BANK 1826 Genossenschaft Thun Bank Regional banks and savings banks Swiss securities firm 4 AFS Equity & Derivatives B.V., Amsterdam, Regensdorf Foreign securities firm branch office Securities firm First branch office of a foreign X 5 Zweigniederlassung Regensdorf securities firm Allfunds Bank International S.A., Luxembourg, Zurich Zürich Foreign bank branch office First branch office of a foreign bank First branch office of a foreign 5 Branch securities firm Alpha RHEINTAL Bank AG Heerbrugg Bank Regional banks and savings banks Swiss securities firm 4 Alternative Bank Schweiz AG Olten Bank Other banks Swiss securities firm 4 Appenzeller Kantonalbank Appenzell Bank Cantonal banks Swiss securities firm 4 Aquila AG Zürich Bank Other banks Swiss securities firm 5 Arab Bank (Switzerland) Ltd. Genève 3 Bank Foreign-controlled banks Foreign-controlled securities 4 firm AXION SWISS BANK SA Lugano Bank Banks specialised in exchange, Swiss securities firm 4 securities and asset management business Baader Helvea AG Zürich Securities firm Securities firm Foreign-controlled securities