Wealthbriefing Awards Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kleinwort Hambros Strengthens UK Regional Presence with Senior Appointments

Kleinwort Hambros strengthens UK regional presence with senior appointments • Leigh Philpot announced as new Head of UK Regions • Chris Thomson new Deputy Head of UK Regions • Richard Brown and Mark Sinclair named Head of Yorkshire and Head of Cambridge Press release London, 14 February 2019 Kleinwort Hambros, one of the leading private bank and wealth manager’s in the UK, has today announced a series of senior appointments to bolster its regional presence across the UK. Leigh Philpot has been appointed the new Head of UK Regions, with immediate effect. In this newly created role, Leigh will be based in London and will report to Andrew Hillery, Head of UK Private Banking. He will be responsible for overseeing and implementing the UK regional strategy outside of London and strengthening its nationwide presence. Kleinwort Hambros currently has four regional offices in Newbury, Cambridge, Leeds and Edinburgh. Leigh previously headed up the Private Banking and Discretionary Fund Management team at Kleinwort Hambros. Most recently, Leigh created the bank’s IFA proposition, working alongside external advisers across the country to offer investment and private banking solutions to their clients. Prior to this, Leigh worked for Ely Fund Managers (now part of Rathbones) and Killik & Co, the advisory stockbrokers. To support Leigh, Chris Thomson has been named Deputy Head of UK Regions. This is in addition to his role as Head of the Edinburgh office, which he founded in 2008. Prior to Kleinwort Hambros, Chris spent twelve years in investment banking, split between London and New York. Richard Brown and Mark Sinclair have also recently been appointed Head of Yorkshire and Head of Cambridge, respectively. -

Banks List (May 2011)

LIST OF BANKS AS COMPILED BY THE FSA ON 31 MAY 2011 This list of banks is intended to be used solely as a guide. The FSA does not warrant, nor accept any responsibility for the accuracy or completeness of the list or for any loss which may arise from reliance by any person on information in the list. (Amendments to the List of Banks since 30 April 2011 can be found on page 6) Banks incorporated in the United Kingdom Abbey National Treasury Services plc DB UK Bank Limited ABC International Bank plc Dunbar Bank plc Access Bank UK Limited, The Duncan Lawrie Ltd Adam & Company plc Ahli United Bank (UK) plc EFG Private Bank Ltd Airdrie Savings Bank Egg Banking plc Aldermore Bank Plc European Islamic Investment Bank Plc Alliance & Leicester plc Europe Arab Bank Plc Alliance Trust Savings Ltd Allied Bank Philippines (UK) plc FBN Bank (UK) Ltd Allied Irish Bank (GB)/First Trust Bank - (AIB Group (UK) plc) FCE Bank plc Alpha Bank London Ltd FIBI Bank (UK) plc AMC Bank Ltd Anglo-Romanian Bank Ltd Gatehouse Bank plc Ansbacher & Co Ltd Ghana International Bank plc ANZ Bank (Europe) Ltd Goldman Sachs International Bank Arbuthnot Latham & Co, Ltd Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Ltd Banc of America Securities Ltd Bank Leumi (UK) plc Habib Allied International Bank plc Bank Mandiri (Europe) Ltd Habibsons Bank Ltd Bank of Beirut (UK) Ltd Hampshire Trust plc Bank of Ceylon (UK) Ltd Harrods Bank Ltd Bank of China (UK) Limited Havin Bank Ltd Bank of Ireland (UK) Plc HFC Bank Ltd Bank of London and The Middle East plc HSBC Bank -

Cranfield 100 Women to Watch 2018

The Female FTSE Board Report 2018 - 100 Women to Watch 1 THE FEMALE FTSE BOARD REPORT 2018 100 WOMEN TO WATCH 2018 Dr Patricia Pryce, Director, Beauwest Consultancy Ltd; Visiting Fellow, Cranfield School of Management Jacey Graham, Director, Brook Graham (in association with Pinsent Masons); Visiting Fellow, Cranfield School of Management 2018 is a significant year for women in the UK. It marks 100 years since women (over the age of 30) gained the right to vote, the unveiling of the first statue of a female in Parliament Square (Millicent Fawcett) and the first time a royal princess (Princess Charlotte) gets to keep her position in line to the throne, despite the arrival of a baby brother (Prince Louis). And for the first time women’s representation on FTSE 100/250 boards hits a new high of 29%/23.7%. These figures provide evidence that talented women are increasingly ready to take up Executive and Board positions; however, such women are often not visible to decision-makers who influence shortlists for Non-Executive Director (NED) positions in FTSE 350 companies. In this, our ninth 100 Women to Watch supplement, we continue to showcase the broad and deep female talent pool for ‘UK plc’ to draw on. As always, we acknowledge that it is neither an exhaustive nor definitive list of the only talented women available for board positions; neither is it attempting to represent the best 100 women. Our profiles reflect a broad range of backgrounds and include women who hold senior executive roles in FTSE 350 firms and other significant organisations such as large non-listed companies, major charities, professional services firms, educational institutions and the Civil Service, and from many different disciplines and functions. -

Press Release: Global Finance Names the World's Best Private

Global Finance Names The World’s Best Private Banks 2019 NEW YORK, October 22, 2018 — Global Finance magazine has announced its fourth annual World’s Best Private Banks Awards for 2019. A full report on the selections will appear in the December issue of Global Finance, and winners will be honored at an Awards Dinner at the Harvard Club of New York City on February 5th, 2019. About Global Finance The winners are those banks that best serve the specialized needs of Global Finance, founded in 1987, has a circulation of high-net-worth individuals as they seek to enhance, preserve and pass 50,050 and readers in 188 on their wealth. The winners are not always the biggest institutions, but countries. Global Finance’s rather the best—those with qualities that individuals rate highly when audience includes senior corporate and financial choosing a provider. officers responsible for making investment and strategic Global Finance’s editorial board selected the winners for the Private Bank decisions at multinational companies and financial Awards with input from executives and industry insiders. The editors institutions. Its website — also use information from entries submitted by banks, in addition to GFMag.com — offers analysis independent research, to evaluate a series of objective and subjective and articles that are the legacy of 31 years of experience factors. This year’s ratings were based on performance during the period in international financial covering July 1, 2017 through June 30, 2018. markets. Global Finance is headquartered in New York, with offices around the world. “Recent decades have minted unprecedented new ranks of millionaires Global Finance regularly selects and billionaires around the world, and they bring a new set of beliefs and the top performers among attitudes toward wealth. -

Listing Prospectus Dated 21 October 2020 1 QUINTET PRIVATE BANK

Listing prospectus dated 21 October 2020 QUINTET PRIVATE BANK (EUROPE) S.A. (formerly KBL European Private Bankers S.A.) (Incorporated with limited liability in Luxembourg) €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes The issue price of the €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes (the “Notes”) of Quintet Private Bank (Europe) S.A. (the “Issuer” or “Quintet”) is 100 per cent. of their principal amount. The Notes will, subject to certain interest cancellation provisions described in Condition 3 (Interest Cancellation) in “Terms and Conditions of the Notes” (the “Conditions” and each, a “Condition”), bear interest on their Prevailing Principal Amount (as defined in Condition 17 (Interpretation)) on a non-cumulative basis from (and including) 23 October 2020 (the “Issue Date”) to (but excluding) 23 January 2026 (the “First Reset Date”) at a fixed rate of 7.5 per cent. per annum. Interest will be payable semi-annually in arrear on 23 January and 23 July of each year commencing on 23 January 2021 (each an “Interest Payment Date”). The rate of interest will reset on the First Reset Date and each date which falls five, and each multiple of five, years after the First Reset Date) (each, a “Reset Date”). The Issuer may elect, at its sole and absolute discretion, to cancel (in whole or in part) the payment of interest on the Notes otherwise scheduled to be paid on an Interest Payment Date. Furthermore, interest shall be cancelled (in -

J.P. Morgan Private Bank Privacy Notice for U.S. Clients

The Private Bank Respecting and protecting client privacy have always been vital to our relationships with clients. The attached Privacy Notice, in a format recommended by federal regulators, describes how J.P. Morgan Private Bank keeps client information private and secure and uses it to serve you better. As shown, the J.P. Morgan companies that provide private banking services do not use client information for purposes not related to the Private Bank. Additionally, we keep your information under physical, electronic and procedural controls, and authorize our agents and contractors to get information about you only when they need it to do their work for us. The Private Bank uses information we have about you in order to make private banking products and services available to you through the Private Bank, including loans, deposits and investments, to meet your private banking needs. Using your information in this way, through the authorization you provided as part of your private banking application, may qualify you for account upgrades, improved client services and new service offerings based on our more complete knowledge of your relationship with the Private Bank. The Private Bank is a part of J.P. Morgan Asset & Wealth Management (the brand name for the asset and wealth management businesses of JPMorgan Chase & Co.) and provides private banking services for Private Bank clients. The Private Bank includes those units of JPMorgan Chase Bank, N.A., J.P. Morgan Trust Company of Delaware and J.P. Morgan Securities LLC dedicated to the Private Bank, as well as alternative investment funds offered through the Private Bank. -

Annual Review 2018 About Us Our Purpose Is to Help Britain Prosper

Lloyds Banking Group Annual Review 2018 About us Our purpose is to Help Britain Prosper. We are the largest UK retail financial services provider with around 26 million customers and a presence in nearly every community. We are transforming the business into The Group’s main business activities are retail and commercial banking, general a digitised, simple, low risk, financial insurance and long-term savings, provided under well recognised brands including Lloyds Bank, Halifax, Bank of Scotland and services provider whilst creating a Scottish Widows. Our shares are quoted on the London responsible business that focuses on and New York stock exchanges and we are one of the largest companies in the customers’ needs. This is key to our FTSE 100 index. long-term success and to fulfilling Reporting Just as we operate in an integrated way, our aim to become the best bank for we aim to report in an integrated way. customers, colleagues and shareholders. We have taken further steps towards this goal this year. As well as reporting our Business model on financial results, we also report on our pages 10 to 11 approach to operating responsibly and take into account relevant economic, political, social, regulatory and environmental factors. This Annual Review contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. For further details, reference should be made to the forward looking statements on page 45. This icon appears throughout Inside this year’s Annual Review this report highlighting how we are Helping Britain Prosper. -

Giving Private Banking a Stroke of Elegance

PRIVATE BANKER May 2015 Issue 320 www.privatebankerinternational.com On track for digital wellness • Interview: Arbuthnot Latham's James Fleming • PBI London Awards: Preview • Interview: Lombard Odier's Dominic Tremlett • Country survey: France PBI 320.indd 1 22/05/2015 20:11:30 Join thousands of financial services Intelligent Environments, the international professionals who have joined The provider of digital solutions in association with Retail Banker International, Digital Banking Club to understand Cards International, Electronic and discuss the future of mobile and Payments International, Private Banker online financial services International and Motor Finance Membership benefits 10% discount on Delegate passes for Motor Finance and Private Banking UK conferences Annual Subscription to Retail Banker International, Cards International, Electronic Payments International, Motor Finance and Private Banker International publications (new subscribers only) World Market Intelligence Ltd’s archive of over 250 Retail Banking, Private Banking and Cards and Payments research reports (for new report purchasers only) Annual subscription to Retail Banking Intelligence Centre and Wealth Insight Intelligence database (new subscribers only) World Market Intelligence Ltd’s bespoke research and consultancy services For further information please email: [email protected] Join The Club! www.thedigitalbankingclub.com Or For further information please email: [email protected] PBI 320.indd 2 22/05/2015 20:11:30 TDBC-Advert-Dec-2014.indd 1 19/01/2015 09:03:48 Private Banker International EDITOR’S LETTER ANALYSIS CONTENTS London state of mind NEWS Join thousands of financial services Intelligent Environments, the international 2: NEWS BRIEFS hese are exciting times for wealth exposure. provider of digital solutions in association management in the UK. -

28415 NDR Credits

28415 NDR Credits Billing Primary Liable party name Full Property Address Primary Liable Party Contact Add Outstanding Debt Period British Airways Plc - (5), Edinburgh Airport, Edinburgh, EH12 9DN Cbre Ltd, Henrietta House, Henrietta Place, London, W1G 0NB 2019 -5,292.00 Building 320, (54), Edinburgh Airport, Edinburgh, Building 319, World Cargo Centre, Manchester Airport, Manchester, Alpha Lsg Ltd 2017 -18,696.00 EH12 9DN M90 5EX Building 320, (54), Edinburgh Airport, Edinburgh, Building 319, World Cargo Centre, Manchester Airport, Manchester, Alpha Lsg Ltd 2018 -19,228.00 EH12 9DN M90 5EX Building 320, (54), Edinburgh Airport, Edinburgh, Building 319, World Cargo Centre, Manchester Airport, Manchester, Alpha Lsg Ltd 2019 -19,608.00 EH12 9DN M90 5EX The Maitland Social Club Per The 70a, Main Street, Kirkliston, EH29 9AB 70 Main Street, Kirkliston, West Lothian, EH29 9AB 2003 -9.00 Secretary/Treasurer 30, Old Liston Road, Newbridge, Midlothian, EH28 The Royal Bank Of Scotland Plc C/O Gva , Po Box 6079, Wolverhampton, WV1 9RA 2019 -519.00 8SS 194a, Lanark Road West, Currie, Midlothian, Martin Bone Associates Ltd (194a) Lanark Road West, Currie, Midlothian, EH14 5NX 2003 -25.20 EH14 5NX C/O Cbre - Corporate Outsourcing, 55 Temple Row, Birmingham, Lloyds Banking Group 564, Queensferry Road, Edinburgh, EH4 6AT 2019 -2,721.60 B2 5LS Unit 3, 38c, West Shore Road, Edinburgh, EH5 House Of Fraser (Stores) Ltd Granite House, 31 Stockwell Street, Glasgow, G1 4RZ 2008 -354.00 1QD Tsb Bank Plc 210, Boswall Parkway, Edinburgh, EH5 2LX C/O Cbre, 55 Temple -

GOLDMAN SACHS PRIVATE BANK SELECT a Digital Lending Solution

GOLDMAN SACHS PRIVATE BANK SELECT® A digital lending solution INTRODUCING GOLDMAN SACHS PRIVATE BANK SELECT Goldman Sachs Private Bank Select® (“GS Select”) is a securities-based lending solution that uses diversified, non- POTENTIAL USES retirement investment assets as collateral for your loan. Our digital platform allows you to quickly and seamlessly PERSONAL establish a revolving line of credit, providing easy access to liquidity. Our high-tech, high-touch servicing ensures easy Education mangement of your loan. Home renovations Tax obligations LOAN FEATURES BUSINESS SIZE: From $75,000 to $25 million, with an initial minimum loan advance requirement of $75,000 and subsequent drawdowns Acquisitions starting at $2,500 Liquidity USE: Any purpose other than purchasing or carrying margin stock Seed/startup capital TYPE: Revolving line of credit; you can borrow, repay, and re-borrow as needed BORROWER: Individuals and joint; irrevocable and revocable trusts POTENTIAL BENEFITS COLLATERAL: Non-retirement investment assets, including stocks, bonds, mutual funds, and exchange-traded funds Immediate and ongoing access to cash INTEREST RATE: 1-month LIBOR plus a spread determined by loan amount; LIBOR resets monthly Expedited loan processing, often within REPAYMENT: Interest only, payable monthly; principal can be 24 hours repaid at any time without penalty TERM: No maturity date; repayment can be demanded at any time High-tech, high-touch servicing and support by FEES: No application, origination, or annual fees phone, in person, and online DOCUMENTS: No personal financial statements, tax returns, paper applications, or other documents; trust documents not required in most states Securities-based loans may not be suitable for all borrowers/pledgors and carry a number of risks, including but not limited to the risk of a market downturn, tax implications if pledged securities are liquidated, and an increase in interest rates. -

Q U I N T E T Pillar Ill: Report 2019

Q U I N T E T P R I V A T E B A N K Pillar Ill: Report 2019 Quintet Private Bank (Europe) S.A. – Pillar 3 – 2019 Contents Glossary ................................................................................................................................................................. 5 Note to readers ...................................................................................................................................................... 6 Introduction ........................................................................................................................................................... 7 1. List of Subsidiaries & Associates ........................................................................................................... 9 2. Corporate governance & decision structure ......................................................................................... 9 2.1 Corporate Culture ............................................................................................................................ 9 2.1.1 Board & Executive Committees: structure and key governance principles................................... 9 Risk Management approach at Quintet ............................................................................................................... 12 3. Five lines of defence ........................................................................................................................... 12 4. Risk Control function ......................................................................................................................... -

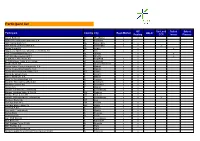

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A.