Banks List (May 2011)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Citigroup Inc. (Exact Name of Registrant As Specified in Its Charter) Delaware 52-1568099 (State Or Other Jurisdiction of (I.R.S

SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 FORM 10-Q QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2007 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________ to _______ Commission file number 1-9924 Citigroup Inc. (Exact name of registrant as specified in its charter) Delaware 52-1568099 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 399 Park Avenue, New York, New York 10043 (Address of principal executive offices) (Zip Code) (212) 559-1000 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer X Accelerated filer Non-accelerated filer Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date: Common stock outstanding as of June 30, 2007: 4,974,552,734 Available on the Web at www.citigroup.com Citigroup Inc. -

Annual Review 2018 About Us Our Purpose Is to Help Britain Prosper

Lloyds Banking Group Annual Review 2018 About us Our purpose is to Help Britain Prosper. We are the largest UK retail financial services provider with around 26 million customers and a presence in nearly every community. We are transforming the business into The Group’s main business activities are retail and commercial banking, general a digitised, simple, low risk, financial insurance and long-term savings, provided under well recognised brands including Lloyds Bank, Halifax, Bank of Scotland and services provider whilst creating a Scottish Widows. Our shares are quoted on the London responsible business that focuses on and New York stock exchanges and we are one of the largest companies in the customers’ needs. This is key to our FTSE 100 index. long-term success and to fulfilling Reporting Just as we operate in an integrated way, our aim to become the best bank for we aim to report in an integrated way. customers, colleagues and shareholders. We have taken further steps towards this goal this year. As well as reporting our Business model on financial results, we also report on our pages 10 to 11 approach to operating responsibly and take into account relevant economic, political, social, regulatory and environmental factors. This Annual Review contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. For further details, reference should be made to the forward looking statements on page 45. This icon appears throughout Inside this year’s Annual Review this report highlighting how we are Helping Britain Prosper. -

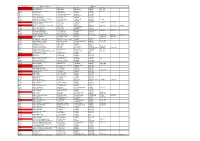

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

Wealth Management & Private Banking

A Meeting of Minds: Wealth Management & Private Banking Thursday 17 November 2016, The Berkeley Hotel, London, SW1 Participant List Sponsors BUSINESS STRATEGY Affinity Private Wealth - Managing Director Bordier & Cie - Chief Executive Officer C & D Partnerships - Managing Partner C Hoare & Co - Head of Front Office, Banking C Hoare & Co - Head of Wealth Front Office Canaccord Genuity Wealth Management - Chief Executive Officer Coombe Advisors Ltd - Managing Director Credit Suisse Private Bank - Chief Operating Officer Credo Group UK Ltd - Chief Executive Officer Deutsche Bank Wealth Management - Managing Director, Global Business Risk Manager Duncan Lawrie Private Banking - Chairman EFG Private Bank Ltd - Head of Private Banking Goldman Sachs - Chief Supervisory Officer Heartwood Wealth Management - Chief Executive Officer HSBC Bank Plc - EMEA Head of RegTech HSBC Bank Plc - Chief of Staff, Corporate and Institutional Digital J.P. Morgan Private Bank - Associate General Counsel Kleinwort Benson - Managing Director, Head of Private Banking Lincoln Private Investment Office - Managing Partner London & Capital - Chief Operating Officer Mirabaud & Cie SA - Co-Head of Private Wealth Management Owl Private Office - Director and Co-Founder Pictet & Cie (Europe) SA - Chief Operating Officer This list is copyright of the Owen James Group and its contents must be kept confidential and may not be passed to any third party for any purpose Santander Wealth Management - Wealth Management Director & Managing Director - Cater -

Giving Private Banking a Stroke of Elegance

PRIVATE BANKER May 2015 Issue 320 www.privatebankerinternational.com On track for digital wellness • Interview: Arbuthnot Latham's James Fleming • PBI London Awards: Preview • Interview: Lombard Odier's Dominic Tremlett • Country survey: France PBI 320.indd 1 22/05/2015 20:11:30 Join thousands of financial services Intelligent Environments, the international professionals who have joined The provider of digital solutions in association with Retail Banker International, Digital Banking Club to understand Cards International, Electronic and discuss the future of mobile and Payments International, Private Banker online financial services International and Motor Finance Membership benefits 10% discount on Delegate passes for Motor Finance and Private Banking UK conferences Annual Subscription to Retail Banker International, Cards International, Electronic Payments International, Motor Finance and Private Banker International publications (new subscribers only) World Market Intelligence Ltd’s archive of over 250 Retail Banking, Private Banking and Cards and Payments research reports (for new report purchasers only) Annual subscription to Retail Banking Intelligence Centre and Wealth Insight Intelligence database (new subscribers only) World Market Intelligence Ltd’s bespoke research and consultancy services For further information please email: [email protected] Join The Club! www.thedigitalbankingclub.com Or For further information please email: [email protected] PBI 320.indd 2 22/05/2015 20:11:30 TDBC-Advert-Dec-2014.indd 1 19/01/2015 09:03:48 Private Banker International EDITOR’S LETTER ANALYSIS CONTENTS London state of mind NEWS Join thousands of financial services Intelligent Environments, the international 2: NEWS BRIEFS hese are exciting times for wealth exposure. provider of digital solutions in association management in the UK. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Annual Report the Bank of N.T. Butterfield & Son Limited

The Bank of N.T. Butterfield & Son Limited Annual Report 2012 Annual Report Cover 2012_final.indd 1-3 13-03-14 5:12 PM line scope essence In brief focus sight tune Butterfield is committed to environmentally conscious printing. The following savings to our natural resources were realised in the printing of this Annual Report: Energy: 5,874,649 BTUs Air Emissions: 348 kg Trees: 8 Solid Waste: 177 kg 2012 Overview Wastewater: 13,336 liters Cover 2012_final.indd 4-6 13-03-14 5:12 PM As at 31 December 2012 United Kingdom Guernsey In depth Switzerland Find out more at: Bermuda www.butterfieldgroup.com The Bahamas Cayman Islands Two Core Businesses billion $8.9 - Community Banking 1,210 Assets - Wealth Management Employees Efficiency Ratio ROE* Core Earnings improved by 0 281bps 0 45.2% *Core cash return on tangible 479 bps common equity Credit Ratings Fitch Moody’s Standard & Poor’s Short-Term Long-Term Short-Term Long-Term Short-Term Long-Term Senior Senior Senior F1A- P-1 A2 A-2 A- Accolades Six Butterfield employees named to Capital Strength Citywealth International Financial Total Capital Ratio Tier 1 Capital Ratio Centre Leaders List 2012 Euromoney 2012 Global Private Banking Survey Best Private Banking Services Overall (First in Bermuda, Eighth in Caribbean Region) Best Relationship Management (First in Bermuda and Cayman, Fourth in Caribbean Region) Best Range of Investment Products (First in Bermuda) 11.2% 7.5% 10.1% 7.2% 21.6% 15.7% 23.5% 17.7% 24.2% 18.5% Best Net-Worth-Specific Services for 2008 2009 2010 2011 2012 Super-Affluent Clientele (First in Cayman, Third in Caribbean Region) 1 time order sight In review motion brief hand Chairman2 & Chief Executive Officer’s Report to the Shareholders Chairman & Chief Executive Officer’s Report to the Shareholders 2012 was a year of continued recovery for Butterfield. -

Bank of England List of Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 31 October 2017 (Amendments to the List of Banks since 30 September 2017 can be found on page 5) Banks incorporated in the United Kingdom Abbey National Treasury Services Plc DB UK Bank Limited ABC International Bank Plc Diamond Bank (UK) Plc Access Bank UK Limited, The Duncan Lawrie Limited (Applied to cancel) Adam & Company Plc ADIB (UK) Ltd EFG Private Bank Limited Agricultural Bank of China (UK) Limited Europe Arab Bank plc Ahli United Bank (UK) PLC AIB Group (UK) Plc FBN Bank (UK) Ltd Airdrie Savings Bank FCE Bank Plc Al Rayan Bank PLC FCMB Bank (UK) Limited Aldermore Bank Plc Alliance Trust Savings Limited Gatehouse Bank Plc Alpha Bank London Limited Ghana International Bank Plc ANZ Bank (Europe) Limited Goldman Sachs International Bank Arbuthnot Latham & Co Limited Guaranty Trust Bank (UK) Limited Atom Bank PLC Gulf International Bank (UK) Limited Axis Bank UK Limited Habib Bank Zurich Plc Bank and Clients PLC Habibsons Bank Limited Bank Leumi (UK) plc Hampden & Co Plc Bank Mandiri (Europe) Limited Hampshire Trust Bank Plc Bank Of America Merrill Lynch International Limited Harrods Bank Ltd Bank of Beirut (UK) Ltd Havin Bank Ltd Bank of Ceylon (UK) Ltd HSBC Bank Plc Bank of China (UK) Ltd HSBC Private Bank (UK) Limited Bank of Cyprus UK Limited HSBC Trust Company (UK) Ltd Bank of Ireland (UK) Plc HSBC UK RFB Limited Bank of London and The Middle East plc Bank of New York Mellon (International) Limited, The ICBC (London) plc Bank of Scotland plc ICBC Standard Bank Plc Bank of the Philippine Islands (Europe) PLC ICICI Bank UK Plc Bank Saderat Plc Investec Bank PLC Bank Sepah International Plc Itau BBA International PLC Barclays Bank Plc Barclays Bank UK PLC J.P. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

List of British Entities That Are No Longer Authorised to Provide Services in Spain As from 1 January 2021

LIST OF BRITISH ENTITIES THAT ARE NO LONGER AUTHORISED TO PROVIDE SERVICES IN SPAIN AS FROM 1 JANUARY 2021 Below is the list of entities and collective investment schemes that are no longer authorised to provide services in Spain as from 1 January 20211 grouped into five categories: Collective Investment Schemes domiciled in the United Kingdom and marketed in Spain Collective Investment Schemes domiciled in the European Union, managed by UK management companies, and marketed in Spain Entities operating from the United Kingdom under the freedom to provide services regime UK entities operating through a branch in Spain UK entities operating through an agent in Spain ---------------------- The list of entities shown below is for information purposes only and includes a non- exhaustive list of entities that are no longer authorised to provide services in accordance with this document. To ascertain whether or not an entity is authorised, consult the "Registration files” section of the CNMV website. 1 Article 13(3) of Spanish Royal Decree-Law 38/2020: "The authorisation or registration initially granted by the competent UK authority to the entities referred to in subparagraph 1 will remain valid on a provisional basis, until 30 June 2021, in order to carry on the necessary activities for an orderly termination or transfer of the contracts, concluded prior to 1 January 2021, to entities duly authorised to provide financial services in Spain, under the contractual terms and conditions envisaged”. List of entities and collective investment -

Current Pillar III Disclosures December 31, 2020

Capital and Risk Management Pillar 3 Disclosures for the period ended December 31, 2020 Contents Page 1. Overview 3 1.1. Background 1.2. Basis of disclosures 1.3. Scope of applications 1.4. Location and verification 2. Risk Management Objectives and Policies 5 2.1. Risk governance 2.2. Risk management 3. Prudential Metrics 7 4. Capital Adequacy 9 4.1. Capital management 4.2. Regulatory capital framework 4.3. Capital structure 4.4. Linkages between financial statements and regulatory exposures 4.5. Minimum capital requirement: Pillar 1 4.6. Leverage ratio 5. Credit Risk Measurement, Mitigation and Reporting 16 5.1. Credit risk overview 5.2. Credit risk - retail and private banking 5.3. Credit risk - commercial banking 5.4. Credit risk - treasury 5.5. Exposures 5.6. Impairment provisions 5.7. Credit risk concentrations 5.8. Credit risk mitigation 5.9. Securitization 6. Market and Liquidity Risk 28 6.1. Market risk overview 6.2. Interest rate risk 6.3. Foreign exchange risk 6.4. Liquidity risk 7. Operational Risk 33 8. Other Information 34 8.1. Abbreviations 8.2. Cautionary statements regarding forward-looking statements Page 2 Capital and Risk Management Pillar 3 Disclosures for the period ended December 31, 2020 1. Overview 1.1 Background Effective January 1, 2015, the BMA implemented the capital reforms proposed by the BCBS and referred to as the Basel III regulatory framework. Basel III aims to strengthen the regulation, supervision and risk management of banks. Basel III adopts CET1 capital as the predominant form of regulatory capital with the CET1 ratio as a new metric. -

Order Execution Policy Client Summary

Order Execution Policy Client Summary The information below provides a summary of Brown Shipley’s The relative importance of each factor is determined by taking into Order Execution Policy. The document is designed to provide clients account the following: with a general understanding of Brown Shipley’s typical dealing • The characteristics of the client order arrangements and explains how we at Brown Shipley meet our • The characteristics of the Financial Instrument concerned by the regulatory obligation to take all sufficient steps to obtain the best order possible result when executing orders, otherwise known as ‘best execution’. Brown Shipley’s approach is underpinned by our core • The characteristics of the brokers and /or execution venues to principles to treat clients fairly and act in accordance with the best which that order can be directed. interests of our clients. If specific instructions are provided directly from clients that affect Further details about Brown Shipley’s Order Execution Policy will be Brown Shipley’s application of the above execution factors, the provided upon request. instruction will be respected and in some cases, this may prevent all elements of this policy being followed. Dealing Arrangements for custody clients Where clients have a custody agreement with Brown Shipley, assets Asset types are held to the order of Brown Shipley. As part of that agreement, The dealing processes vary depending on the type of asset being a group wide trading, settlement and custody platform is in place. traded, a summary of the relevant information for each asset type As a result, the execution of all orders for these clients has been is provided below: outsourced to an agency broker, currently Brown Shipley’s parent Equities and exchange traded funds company KBL European Private Bankers (KBL), who route these to Orders for these asset types will be routed to the agency broker.