Current Pillar III Disclosures December 31, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banks List (May 2011)

LIST OF BANKS AS COMPILED BY THE FSA ON 31 MAY 2011 This list of banks is intended to be used solely as a guide. The FSA does not warrant, nor accept any responsibility for the accuracy or completeness of the list or for any loss which may arise from reliance by any person on information in the list. (Amendments to the List of Banks since 30 April 2011 can be found on page 6) Banks incorporated in the United Kingdom Abbey National Treasury Services plc DB UK Bank Limited ABC International Bank plc Dunbar Bank plc Access Bank UK Limited, The Duncan Lawrie Ltd Adam & Company plc Ahli United Bank (UK) plc EFG Private Bank Ltd Airdrie Savings Bank Egg Banking plc Aldermore Bank Plc European Islamic Investment Bank Plc Alliance & Leicester plc Europe Arab Bank Plc Alliance Trust Savings Ltd Allied Bank Philippines (UK) plc FBN Bank (UK) Ltd Allied Irish Bank (GB)/First Trust Bank - (AIB Group (UK) plc) FCE Bank plc Alpha Bank London Ltd FIBI Bank (UK) plc AMC Bank Ltd Anglo-Romanian Bank Ltd Gatehouse Bank plc Ansbacher & Co Ltd Ghana International Bank plc ANZ Bank (Europe) Ltd Goldman Sachs International Bank Arbuthnot Latham & Co, Ltd Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Ltd Banc of America Securities Ltd Bank Leumi (UK) plc Habib Allied International Bank plc Bank Mandiri (Europe) Ltd Habibsons Bank Ltd Bank of Beirut (UK) Ltd Hampshire Trust plc Bank of Ceylon (UK) Ltd Harrods Bank Ltd Bank of China (UK) Limited Havin Bank Ltd Bank of Ireland (UK) Plc HFC Bank Ltd Bank of London and The Middle East plc HSBC Bank -

Annual Report the Bank of N.T. Butterfield & Son Limited

The Bank of N.T. Butterfield & Son Limited Annual Report 2012 Annual Report Cover 2012_final.indd 1-3 13-03-14 5:12 PM line scope essence In brief focus sight tune Butterfield is committed to environmentally conscious printing. The following savings to our natural resources were realised in the printing of this Annual Report: Energy: 5,874,649 BTUs Air Emissions: 348 kg Trees: 8 Solid Waste: 177 kg 2012 Overview Wastewater: 13,336 liters Cover 2012_final.indd 4-6 13-03-14 5:12 PM As at 31 December 2012 United Kingdom Guernsey In depth Switzerland Find out more at: Bermuda www.butterfieldgroup.com The Bahamas Cayman Islands Two Core Businesses billion $8.9 - Community Banking 1,210 Assets - Wealth Management Employees Efficiency Ratio ROE* Core Earnings improved by 0 281bps 0 45.2% *Core cash return on tangible 479 bps common equity Credit Ratings Fitch Moody’s Standard & Poor’s Short-Term Long-Term Short-Term Long-Term Short-Term Long-Term Senior Senior Senior F1A- P-1 A2 A-2 A- Accolades Six Butterfield employees named to Capital Strength Citywealth International Financial Total Capital Ratio Tier 1 Capital Ratio Centre Leaders List 2012 Euromoney 2012 Global Private Banking Survey Best Private Banking Services Overall (First in Bermuda, Eighth in Caribbean Region) Best Relationship Management (First in Bermuda and Cayman, Fourth in Caribbean Region) Best Range of Investment Products (First in Bermuda) 11.2% 7.5% 10.1% 7.2% 21.6% 15.7% 23.5% 17.7% 24.2% 18.5% Best Net-Worth-Specific Services for 2008 2009 2010 2011 2012 Super-Affluent Clientele (First in Cayman, Third in Caribbean Region) 1 time order sight In review motion brief hand Chairman2 & Chief Executive Officer’s Report to the Shareholders Chairman & Chief Executive Officer’s Report to the Shareholders 2012 was a year of continued recovery for Butterfield. -

The Bermuda Society Newsletter

The Bermuda Society Winter 2013 / Spring 2014 Newsletter - Issue 18 IN THIS ISSUE In Memoriam Summary of Company Results y/e 2013 Summary of Company Results 1Q2014 Aon Benfield Aggregate (ABA) Report 2013 ABIR 2013 year-end figures Bermuda Monetary Authority (BMA) – Captive Insurers Lloyd’s FY2013 Results Society Events ➣ 2014 Calendar ➣ Bermudian Students – Dinner 2013 ➣ BFIS Students – London Visit – July 2014 ➣ Bermudian Students Internship Programme ➣ BNT-UK and NMB event – September 2013 ➣ David Burns Speech - Guildhall – October 2013 ➣ Brendan McDonagh Speech - House of Lords – November 2013 ➣ Matthew Elderfield Speech – Guildhall – February 2014 Masterworks Museum of Bermuda Art ➣ The Charman Prize 2013 ➣ The Masterworks Collection Prize 2013 The Bermuda Institute of Ocean Sciences (BIOS) ➣ Deepgliders: The Next Frontier in Ocean Exploration In Memoriam Sir Richard Ground, OBE The Hon. Sir David Gibbons, KBE, JP 17 December 1949 – 22 February 2014 15 June 1927 – 30 March 2014 Sir Richard was born in Stamford, England and educated Sir David was Premier of Bermuda from 1977 to 1982 at Oakham School in Rutland, Lincoln College, Oxford, and Finance Minister of Bermuda from 1975 to 1984. and the Inns of Court School of Law. During his stewardship, the legislative foundations were He was called to the Bar in Gray’s Inn, in 1975; was laid for Bermuda’s reinsurance industry and modern appointed Queen’s Counsel (Cayman Islands) in 1987; international business sector. and was elected a Bencher of his Inn in 2011. Sir David presided over a tumultuous period in Bermuda’s He began his legal career in private practice at 1 Brick history and commissioned a social review of Bermuda by Court, Middle Temple from 1976 to 1983 and specialised the renowned social psychologist and African American in media law. -

Annual Report 2020 the Bank of N.T

ANNUAL REPORT 2020 THE BANK OF N.T. BUTTERFIELD & SON LIMITED ANNUAL REPORT 2020 REPORT ANNUAL Banking, trust, investments, by . Established as Bermuda’s first bank in 1858, Butterfield today offers a range of community banking and bespoke financial services from eight leading international financial centers, supported by centralized service centers in Canada and Mauritius. The Butterfield team comprises 1,314 employees working together to help our clients manage their wealth and protect it for future generations, while creating sustainable, long-term value for our shareholders. Vision Mission To be the leading independent offshore bank To build relationships and wealth. and trust company. Values APPROACHABLE COLLABORATIVE EMPOWERED IMPACTFUL We commit to We collaborate for We foster We celebrate personal service. effective teamwork. individual initiative. collective success. Locations The Bahamas Bermuda Jersey United Kingdom Cayman Islands Canada* Switzerland Mauritius* Singapore Guernsey *Non-client-facing service center. Results Core Net Income* (millions) Core Return on Average Tangible Total Assets (millions) $250 Common Equity* 30.0% $16,000 $13,922 $14,739 $197.0 $197.9 25.6% $14,000 $200 25.0% 22.4% 23.4% 20.5% $12,000 $11,103 $10,779 $10,773 $158.9 $154.5 20.0% $150 17.3% $10,000 $123.0 15.0% $8,000 $100 $6,000 10.0% $4,000 $50 5.0% $2,000 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Capital** 25.0% 22.4% 19.9% 19.6% 19.6% 19.8% 20.0% 19.4% 17.6% 18.2% 18.2% 17.3% 17.3% 16.1% 16.1% 15.3% 15.3% 15.0% -

The Bermuda Society

The Bermuda Society Winter 2009 Newsletter – Issue 11 IN THIS ISSUE O Obituaries The Hon. Nelson Bascome, JP, MP Julian Hall Derek R. Brightwell O Aon Benfield Research Lloyd’s Update – ‘Evolution’ Lloyd’s Update – Interim Management Statements O Company Financial Results O UK Market Impact Statement – ABIR O Society Events Mr. Graham White’s Speech Dr. Anthony Knap’s Speech Dinner 2009 Photostory O 2009 – Royal Visit to Bermuda The Hon. Nelson Bascome, JP, MP Company Financial Results 1955 – 2009 July 3, 2009 Royal Gazette An MP for two decades who – at the time of his death on Argus Group July 14th in the United States – held the Health Ministry Bermuda insurance group, Argus Group Holdings Ltd has portfolio. announced its first ever annual loss – $115.7 million for the year ending March 31, 2009. The net loss compares to a net income amount of $15.48 million for the year before. The Julian Hall vast majority of the loss came from a $116.1 million fall in 1950 – 2009 the fair value of its investments. These losses were unrealised and the company believes the investments could Prominent barrister and former politician died in Bermuda start to recover value as financial markets stabilise. After the on July 18th. announcement, rating agency, AM Best downgraded the financial strength of the company to “A-” from “A”. July 22, 2009 Derek R. Brightwell Royal Gazette 1936 – 2009 Platinum time Platinum Underwriters Holdings Ltd posted 2Q2009 net A long-serving supporter of Bermuda and Bermuda Tourism income of $98.1 million, comfortably beating analyst’s – he was Tourism’s public relations consultant in the UK for expectations. -

Market Overview Q3 2019 Wealth Management & Private Banking Market Overview L Wealth Management & Private Banking

Market Overview Q3 2019 Wealth Management & Private Banking Market Overview l Wealth Management & Private Banking ANNUAL ASSEMBLY 2019 UNINTENDED CONSEQUENCE Impact of AI on our future workforce Thursday, 14th November - London The Partners of Boyden UK request the pleasure of your company for an evening of drinks, canapes and thought leadership! This year we will have the opportunity to listen to the very latest thinking on how AI will impact our organisations' human capital and how organisations are preparing for the impact on the future workforce. Guest speakers include: Michael Priddis CEO, Faethm AI Faethm is an AI company with more data about the impact of the Fourth Industrial Revolution and the Future of Work than any company globally. One of the first companies globally to be invited to join the World Economic Forum - Centre for the Fourth Industrial Revolution, Michael has recently been invited to be an inaugural member of the WEF Global AI Council. Formerly a Partner and Managing Director of Boston Consulting Group’s Digital Ventures, Michael is also a member of the Science & Innovation Group of BHP. Isabel Fernandez-Mateo Professor of Strategy and Entrepreneurship; Chair, PhD Programme Isabel is the Adecco Professor of Strategy and Entrepreneurship and Chair of the PhD Programme at London Business School. She is an expert on how relationships influence career outcomes – particularly in hiring, job transitions, and career advancement. She also studies gender diversity in the executive labour market. Professor Fernandez-Mateo teaches in various degree and executive programmes at London Business School, including an elective course on “Building your Career Strategy.” She also teaches People Analytics, where she examines the challenges and opportunities of a data driven approach to people- related issues in organisations. -

The Bank of N.T. Butterfield & Son Limited

The Bank of N.T. Butterfield & Son Limited Butterfield is a diversified financial services company operating in nine jurisdictions. We have total assets of $9.6 billion and $60.7 billion of client assets under administration. We employ 1,606 people around the world. Butterfield is a publicly traded company with a primary share listing on the Bermuda Stock Exchange and a secondary listing on the Cayman Islands Stock Exchange. CHAIRMAN’S LETTER TO THE SHAREHOLDERS Butterfield is in the midst of the most important transition in its 152-year history. Over the past two years, we have realised significant losses on investments and felt the negative impact of the global financial crisis on our revenues. At year-end 2009, the Board decided that it was in the best interests of our shareholders for the Bank to take proactive steps to substantially de-risk the Balance Sheet. This action ended a protracted period of ongoing losses and the adverse effects this had on our share price and reputation in the market. Concurrently with this decision, the Board sought and secured new sources of capital to help offset the impact of the losses. Unfortunately, this capital raise was highly dilutive to shareholders. My objective with this letter is to provide a summary of the circumstances that led the Board to its decision, along with more details of the capital raising transaction. Prior to taking the actions we did, your Board considered several alternatives for increasing capital, and although we are aware that many shareholders are disappointed with our decision, we are confident that it was the best alternative for preserving the long-term value of the Butterfield franchise. -

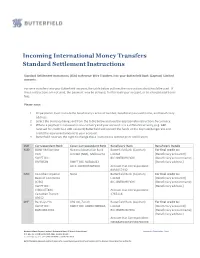

Incoming International Money Transfers Standard Settlement Instructions

Incoming International Money Transfers Standard Settlement Instructions Standard Settlement Instructions (SSIs) to Receive Wire Transfers into your Butterfield Bank (Cayman) Limited accounts. For wire transfers into your Butterfield account, the table below outlines the instructions that should be used. If these instructions are not used, the payment may be delayed, fail to reach your account, or be charged additional fees. Please note: 1. All payments must include the beneficiary's account number, beneficiary account name, and beneficiary address. 2. Select the currency being sent from the table below and use the appropriate instructions by currency. 3. Where a payment is received in one currency and your account is in a different currency, (e.g. GBP received for credit to a USD account) Butterfield will convert the funds at the day’s exchange rate and credit the equivalent amount to your account. 4. Butterfield reserves the right to change these instructions without prior notification. CUR Correspondent Bank Cover Correspondent Bank Beneficiary Bank Beneficiary Details AUD Westpac, Sydney, None Butterfield Bank (Cayman) For final credit to: Australia Limited [Beneficiary account #] SWIFT BIC: BIC: BNTBKYKYXXX [Beneficiary account name] WPACAU2SXXX [Beneficiary address] Account # at Correspondent: BUU0001978 CAD Canadian Imperial None Butterfield Bank (Cayman) For final credit to: Bank of Commerce Limited [Beneficiary account #] (CIBC) BIC: BNTBKYKYXXX [Beneficiary account name] SWIFT BIC: [Beneficiary address] CIBCCATTXXX Account # at Correspondent: Canadian Transit: 1765116 09602 CHF Barclays PLC UBS AG, Zurich Butterfield Bank (Cayman) For final credit to: SWIFT BIC: SWIFT BIC: UBSWCHZH80A Limited [Beneficiary account #] BARCGB22XXX BIC: BNTBKYKYXXX [Beneficiary account name] [Beneficiary address] Account # at Correspondent: GB66BARC20325369740099 Butterfield Bank (Cayman) Limited | Butterfield Place, 12 Albert Panton Street Information Classification: Public P.O. -

Butterfield Announces Covid-19 Customer Relief Initiatives

Butterfield Bank (Cayman) Limited 12 Albert Panton Street George Town, Grand Cayman Tel: (345) 949 7055 www.butterfieldgroup.com BUTTERFIELD ANNOUNCES COVID-19 CUSTOMER RELIEF INITIATIVES George Town, Grand Cayman—18 March 2020: In addition to lower personal lending and mortgage rates which will become effective on 23 March, Butterfield today announced measures to provide customers in the Cayman Islands with temporary assistance from financial difficulties caused by the COVID-19 health crisis. Butterfield will introduce a three-month automatic payment deferral programme on all residential mortgages and personal loans in good standing, meaning customers will not be making principal and interest payments for the next three months and any penalties will be waived. This will assist customers who may be facing lower incomes or cash inflow at this time. The Bank will also introduce a payment deferral on credit cards for two months beginning in May, meaning customers can skip May and June monthly payments without incurring any late fees. In addition, business customers with remaining loan principal of up to $2 million who are facing difficulties can pay interest only on their next three monthly loan payments with no penalties. Business and corporate clients with loan values greater than $2 million who wish to discuss credit and payment arrangements should contact their relationship managers, as these arrangements are typically more complex. Mike McWatt, Butterfield’s Managing Director - Cayman, said “The impact of the COVID-19 crisis on tourism and hospitality, and its knock-on effect on employment has been sudden and significant. We understand that the situation will make it difficult for some of our customers to service their outstanding debts. -

CAYMAN Standard Settlement Instructions March 8.Pdf

Incoming International Money Transfers Standard Settlement Instructions Standard Settlement Instructions (SSIs) to Receive Wire Transfers into your Butterfield Bank (Cayman) Limited accounts. For wire transfers into your Butterfield account, the table below outlines the instructions that should be used. If these instructions are not used, the payment may be delayed, fail to reach your account, or be charged additional fees. Please note: 1. All payments must include the beneficiary's account number, beneficiary account name, and beneficiary address. 2. Select the currency being sent from the table below and use the appropriate instructions by currency. 3. Where a payment is received in one currency and your account is in a different currency, (e.g. GBP received for credit to a USD account) Butterfield will convert the funds at the day’s exchange rate and credit the equivalent amount to your account. 4. Butterfield reserves the right to change these instructions without prior notification. CUR Correspondent Bank Cover Correspondent Bank Beneficiary Bank Beneficiary Details AUD BONY Mellon New National Australian Bank Butterfield Bank (Cayman) For final credit to: York Limited (NAB), Melbourne Limited [Beneficiary account #] SWIFT BIC: BIC: BNTBKYKYXXX [Beneficiary account name] IRVTUS3N SWIFT BIC: NATAAU33 [Beneficiary address] Acct: 1803007285500 Account # at Correspondent: 8033057432 CAD Canadian Imperial None Butterfield Bank (Cayman) For final credit to: Bank of Commerce Limited [Beneficiary account #] (CIBC) BIC: BNTBKYKYXXX [Beneficiary account name] SWIFT BIC: [Beneficiary address] CIBCCATTXXX Account # at Correspondent: Canadian Transit: 1765116 09602 CHF Barclays PLC UBS AG, Zurich Butterfield Bank (Cayman) For final credit to: SWIFT BIC: SWIFT BIC: UBSWCHZH80A Limited [Beneficiary account #] BARCGB22XXX BIC: BNTBKYKYXXX [Beneficiary account name] [Beneficiary address] Account # at Correspondent: GB66BARC20325369740099 Butterfield Bank (Cayman) Limited | Butterfield Place, 12 Albert Panton Street Information Classification: Public P.O. -

Butterfield to Acquire ABN AMRO (Channel Islands) Limited Apr 25 2019 Combines Two Leading Banking Operations in Channel Islands

Butterfield to Acquire ABN AMRO (Channel Islands) Limited Apr 25 2019 Combines Two Leading Banking Operations in Channel Islands HAMILTON, Bermuda‐‐(BUSINESS WIRE)‐‐ The Bank of N.T. Butterfield & Son Limited (“Butterfield”) (NYSE: NTB) (BSX: NTB.BH), a leading offshore bank and trust company headquartered in Bermuda with significant operations in the Cayman Islands and Channel Islands, today announced that it has entered into a definitive agreement to acquire ABN AMRO (Channel Islands) Limited (“ABN AMRO Channel Islands”), the Channel Islands‐based banking business of ABN AMRO Bank N.V. through its wholly owned subsidiary, Butterfield Bank (Guernsey) Limited, a company incorporated in Guernsey (“Butterfield Guernsey”). The aggregate purchase price is approximately £161 million in cash (US$208 million), subject to certain purchase price adjustments. The transaction combines two leading banking operations in the Channel Islands to create an organization with a widened and diversified offering, as well as the ability to service a broader array of clients around the globe. With the acquisition of ABN AMRO Channel Islands, Butterfield will significantly expand its presence in Guernsey and Jersey. For ABN AMRO Channel Islands, the transaction will bring the benefits of a more extensive loan product offering, as well as the opportunity to extend its service offering to the private equity and insurance industries. Michael Collins, Butterfield’s Chairman and Chief Executive Officer, said, “In ABN AMRO Channel Islands, we have found an ideal partner through which to expand our core Channel Islands banking business. This acquisition is another important step in our strategy to grow through acquisitions in the highest quality offshore markets where we have scale and expertise. -

Global Finance Announces the Winners' Circle a Ranking of the Top

Global Finance announces The Winners' Circle The reach of Global Finance A ranking of the Top Winners of our Annual Awards Global Finance, founded in over the magazine's 25-year history 1987, has a circulation of 50,050 and readers in 163 countries. Its circulation is audited by BPA. Global NEW YORK, June 4, 2012 – Global Finance magazine is proud to announce The Winners' Circle – the Top Winners from 25 years of the magazine's annual awards Finance’s audience includes program. chairmen, presidents, CEOs, CFOs, treasurers and other “The world has changed dramatically since Global Finance first appeared in 1987. Global senior financial officers respon- financial markets have undergone a seismic shift, and the firms and individuals that made sible for making investment it into our Winners' Circle are those that have shown their true mettle and transformed and strategic decisions at themselves to meet the demands of a changing environment," says Global Finance’s publisher, Joseph D. Giarraputo. “We recognize these firms and individuals for their multinational companies and outstanding accomplishments over the past 25 years.” Global Finance’s annual awards financial institutions. Global program is a recognized and trusted standard for the entire financial world. Finance also targets the 8,000 international portfolio investors A full report on the winners will appear in the Special Commemorative 25th Anniversary responsible for more than Issue, released on June 25th, 2012. Award tallies are calculated to June 2012 issue. To compile the winners, we tallied winners/those taking first place over all of the years that a 80% of all global assets under particular award was given.