Q2 2020 Wealth Management & Private Banking TABLE of CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banks List (May 2011)

LIST OF BANKS AS COMPILED BY THE FSA ON 31 MAY 2011 This list of banks is intended to be used solely as a guide. The FSA does not warrant, nor accept any responsibility for the accuracy or completeness of the list or for any loss which may arise from reliance by any person on information in the list. (Amendments to the List of Banks since 30 April 2011 can be found on page 6) Banks incorporated in the United Kingdom Abbey National Treasury Services plc DB UK Bank Limited ABC International Bank plc Dunbar Bank plc Access Bank UK Limited, The Duncan Lawrie Ltd Adam & Company plc Ahli United Bank (UK) plc EFG Private Bank Ltd Airdrie Savings Bank Egg Banking plc Aldermore Bank Plc European Islamic Investment Bank Plc Alliance & Leicester plc Europe Arab Bank Plc Alliance Trust Savings Ltd Allied Bank Philippines (UK) plc FBN Bank (UK) Ltd Allied Irish Bank (GB)/First Trust Bank - (AIB Group (UK) plc) FCE Bank plc Alpha Bank London Ltd FIBI Bank (UK) plc AMC Bank Ltd Anglo-Romanian Bank Ltd Gatehouse Bank plc Ansbacher & Co Ltd Ghana International Bank plc ANZ Bank (Europe) Ltd Goldman Sachs International Bank Arbuthnot Latham & Co, Ltd Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Ltd Banc of America Securities Ltd Bank Leumi (UK) plc Habib Allied International Bank plc Bank Mandiri (Europe) Ltd Habibsons Bank Ltd Bank of Beirut (UK) Ltd Hampshire Trust plc Bank of Ceylon (UK) Ltd Harrods Bank Ltd Bank of China (UK) Limited Havin Bank Ltd Bank of Ireland (UK) Plc HFC Bank Ltd Bank of London and The Middle East plc HSBC Bank -

Listing Prospectus Dated 21 October 2020 1 QUINTET PRIVATE BANK

Listing prospectus dated 21 October 2020 QUINTET PRIVATE BANK (EUROPE) S.A. (formerly KBL European Private Bankers S.A.) (Incorporated with limited liability in Luxembourg) €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes The issue price of the €125,000,000 7.5 per cent. Fixed Rate Resettable Callable Perpetual Additional Tier 1 Capital Notes (the “Notes”) of Quintet Private Bank (Europe) S.A. (the “Issuer” or “Quintet”) is 100 per cent. of their principal amount. The Notes will, subject to certain interest cancellation provisions described in Condition 3 (Interest Cancellation) in “Terms and Conditions of the Notes” (the “Conditions” and each, a “Condition”), bear interest on their Prevailing Principal Amount (as defined in Condition 17 (Interpretation)) on a non-cumulative basis from (and including) 23 October 2020 (the “Issue Date”) to (but excluding) 23 January 2026 (the “First Reset Date”) at a fixed rate of 7.5 per cent. per annum. Interest will be payable semi-annually in arrear on 23 January and 23 July of each year commencing on 23 January 2021 (each an “Interest Payment Date”). The rate of interest will reset on the First Reset Date and each date which falls five, and each multiple of five, years after the First Reset Date) (each, a “Reset Date”). The Issuer may elect, at its sole and absolute discretion, to cancel (in whole or in part) the payment of interest on the Notes otherwise scheduled to be paid on an Interest Payment Date. Furthermore, interest shall be cancelled (in -

Annual Review 2018 About Us Our Purpose Is to Help Britain Prosper

Lloyds Banking Group Annual Review 2018 About us Our purpose is to Help Britain Prosper. We are the largest UK retail financial services provider with around 26 million customers and a presence in nearly every community. We are transforming the business into The Group’s main business activities are retail and commercial banking, general a digitised, simple, low risk, financial insurance and long-term savings, provided under well recognised brands including Lloyds Bank, Halifax, Bank of Scotland and services provider whilst creating a Scottish Widows. Our shares are quoted on the London responsible business that focuses on and New York stock exchanges and we are one of the largest companies in the customers’ needs. This is key to our FTSE 100 index. long-term success and to fulfilling Reporting Just as we operate in an integrated way, our aim to become the best bank for we aim to report in an integrated way. customers, colleagues and shareholders. We have taken further steps towards this goal this year. As well as reporting our Business model on financial results, we also report on our pages 10 to 11 approach to operating responsibly and take into account relevant economic, political, social, regulatory and environmental factors. This Annual Review contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. For further details, reference should be made to the forward looking statements on page 45. This icon appears throughout Inside this year’s Annual Review this report highlighting how we are Helping Britain Prosper. -

Q U I N T E T Pillar Ill: Report 2019

Q U I N T E T P R I V A T E B A N K Pillar Ill: Report 2019 Quintet Private Bank (Europe) S.A. – Pillar 3 – 2019 Contents Glossary ................................................................................................................................................................. 5 Note to readers ...................................................................................................................................................... 6 Introduction ........................................................................................................................................................... 7 1. List of Subsidiaries & Associates ........................................................................................................... 9 2. Corporate governance & decision structure ......................................................................................... 9 2.1 Corporate Culture ............................................................................................................................ 9 2.1.1 Board & Executive Committees: structure and key governance principles................................... 9 Risk Management approach at Quintet ............................................................................................................... 12 3. Five lines of defence ........................................................................................................................... 12 4. Risk Control function ......................................................................................................................... -

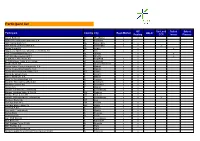

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

List of British Entities That Are No Longer Authorised to Provide Services in Spain As from 1 January 2021

LIST OF BRITISH ENTITIES THAT ARE NO LONGER AUTHORISED TO PROVIDE SERVICES IN SPAIN AS FROM 1 JANUARY 2021 Below is the list of entities and collective investment schemes that are no longer authorised to provide services in Spain as from 1 January 20211 grouped into five categories: Collective Investment Schemes domiciled in the United Kingdom and marketed in Spain Collective Investment Schemes domiciled in the European Union, managed by UK management companies, and marketed in Spain Entities operating from the United Kingdom under the freedom to provide services regime UK entities operating through a branch in Spain UK entities operating through an agent in Spain ---------------------- The list of entities shown below is for information purposes only and includes a non- exhaustive list of entities that are no longer authorised to provide services in accordance with this document. To ascertain whether or not an entity is authorised, consult the "Registration files” section of the CNMV website. 1 Article 13(3) of Spanish Royal Decree-Law 38/2020: "The authorisation or registration initially granted by the competent UK authority to the entities referred to in subparagraph 1 will remain valid on a provisional basis, until 30 June 2021, in order to carry on the necessary activities for an orderly termination or transfer of the contracts, concluded prior to 1 January 2021, to entities duly authorised to provide financial services in Spain, under the contractual terms and conditions envisaged”. List of entities and collective investment -

Order Execution Policy Client Summary

Order Execution Policy Client Summary The information below provides a summary of Brown Shipley’s The relative importance of each factor is determined by taking into Order Execution Policy. The document is designed to provide clients account the following: with a general understanding of Brown Shipley’s typical dealing • The characteristics of the client order arrangements and explains how we at Brown Shipley meet our • The characteristics of the Financial Instrument concerned by the regulatory obligation to take all sufficient steps to obtain the best order possible result when executing orders, otherwise known as ‘best execution’. Brown Shipley’s approach is underpinned by our core • The characteristics of the brokers and /or execution venues to principles to treat clients fairly and act in accordance with the best which that order can be directed. interests of our clients. If specific instructions are provided directly from clients that affect Further details about Brown Shipley’s Order Execution Policy will be Brown Shipley’s application of the above execution factors, the provided upon request. instruction will be respected and in some cases, this may prevent all elements of this policy being followed. Dealing Arrangements for custody clients Where clients have a custody agreement with Brown Shipley, assets Asset types are held to the order of Brown Shipley. As part of that agreement, The dealing processes vary depending on the type of asset being a group wide trading, settlement and custody platform is in place. traded, a summary of the relevant information for each asset type As a result, the execution of all orders for these clients has been is provided below: outsourced to an agency broker, currently Brown Shipley’s parent Equities and exchange traded funds company KBL European Private Bankers (KBL), who route these to Orders for these asset types will be routed to the agency broker. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Masters Finance Guide Example

MASTERS Banking, Finance and Investment Companies – April 2020 Recruitment Guide Company Index CLICK on the company name to be taken to the appropriate document. Societe Generale Mediobanca Banking Standard Chartered M.M. Warburg ABN AMRO Holding NV Standard Life Moelis & Co. ANZ Banking The Bank of Tokyo- Mitsubishi UFJ Morgan Stanley Banco Santander Ltd Needham & Company LLC Bank of America NA The Royal Bank of Scotland Nomura Bank of China Limited UBS Oppenheimer Bank for International Settlements UniCredit SpA Perella Weinburg Partners Bank of Nova Scotia Wells Fargo Bank NA Piper Jaffray Bank of Scotland Investment Banks Robert W Baird Barclays Rothschild APP Securities BayernLB Torreya Partners B. Riley FBR Inc. BNP Paribas Vermilion Bank of America Merrill Lynch China Construction Bank WR. Hambrecht & Co. Barclays Capital Citibank Blackstone Group Clydesdale Bank Private Equity Firms Brown Shipley Commerzbank AG 3i Group Cain Brothers Commonwealth Bank Abraaj Group Capstone Partners Co-operative Banking Group Advent International CIBC Credit Agricole AlpInvest Partners Close Brothers Credit Suisse Group Apax Partners CLSA Danske Bank A/S Apollo Cowen Group Deutsche Bank AG AXA Investment Managers Evercore Partners Dexia Group Bain Capital Foros HSBC Bank plc Bridgepoint Capital Goldman Sachs HypoVereinsbank Charterhouse Capital Partners Greenhill Industrial & Commercial Bank of Cerberus Capital Management Houlihan Lokey China Limited Cinven Investec ING Bank NV CVC Capital Partners ITG Itaú Unibanco Fortress Janney Intesa Sanpaolo Spa General Atlantic Jefferies J.P. Morgan Oaktree Keefe, Bruyette & Woods Lloyds Banking Group Permira Lazard Rabobank Terra Firma Capital Partners Lincoln International Royal Bank of Canada The Carlyle Group Marathon Capital Sberbank of Russia TPG Capital Workmaze Limited Office B, Business Centre West, Avenue 1, Letchworth, Hertfordshire, SG6 2HB, UK Registered in England: Company Registration No. -

Uebersicht Der Unterverwahrer.Xlsx

Übersicht der Unterverwahrer der DZ PRIVATBANK S.A. Stand: 28.06.2021 Markt Lagerstelle Unterverwahrer Beziehungsstatus ÄGYPTEN HSBC BANK EGYPT SAE ARGENTINIEN CLEARSTREAM BANKING S.A. LUXEMBOURG AUSTRALIEN BNP PARIBAS SECURITIES SERVICES S.A. AUSTRALIA BRANCH BANGLADESH STANDARD CHARTERED BANK DHAKA BRANCH BELGIEN EUROCLEAR BANK SA/NV BENIN STANDARD CHARTERED BANK COTE D'IVOIRE SA BRASILIEN BANCO BNP PARIBAS BRASIL S.A. BRASILIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Sao Paulo BULGARIEN CLEARSTREAM BANKING S.A. LUXEMBOURG Eurobank EFG Bulgaria AD Sofia BURKINA-FASO STANDARD CHARTERED BANK COTE D'IVOIRE SA CHILE CITIBANK EUROPE PLC LUXEMBOURG BRANCH Banco de Chile DÄNEMARK NORDEA DANMARK, filial af Nordea Bank Abp Finland DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Deutsche WertpapierService Bank AG Muttergesellschaft DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK diverse, abhängig vom Markt Muttergesellschaft DEUTSCHLAND DZ PRIVATBANK S.A. NIEDERLASSUNG STUTTGART DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Niederlassung der DZ PRIVATBANK S.A. ELFENBEINKUESTE STANDARD CHARTERED BANK COTE D'IVOIRE SA ESTLAND CLEARSTREAM BANKING S.A. LUXEMBOURG AS SEB Pank, Tallinn FINNLAND NORDEA BANK ABP FRANKREICH EUROCLEAR BANK SA/NV GHANA STANDARD CHARTERED BANK GHANA PLC GRIECHENLAND CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Europe Plc Athen Branch GROSSBRITANNIEN CITIBANK NA LONDON BRANCH GUINEA BISSAU STANDARD CHARTERED BANK COTE D'IVOIRE SA HONGKONG STANDARD CHARTERED BANK (HK) LTD. INDIEN STANDARD CHARTERED BANK MUMBAI BRANCH INDONESIEN PT BANK HSBC INDONESIA IRLAND REPUBLIK CITIBANK NA LONDON BRANCH IRLAND REPUBLIK EUROCLEAR BANK SA/NV W/ IRLAND ISLAND ISLANDSBANKI HF. ISRAEL BANK HAPOALIM B.M. ITALIEN BNP PARIBAS SECURITIES SERVICES MILANO BRANCH ITALIEN CITIBANK EUROPE PLC JAPAN MUFG BANK LTD JORDANIEN STANDARD CHARTERED BANK AMMAN BRANCH KANADA CITIBANK CANADA KENIA STANDARD CHARTERED BANK KENYA LTD KOLUMBIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Cititrust Colombia S.A. -

Policies What Banks Say About Financing Nuclear Weapons

Chapter 6 Policies What Banks Say about Financing Nuclear Weapons any financial institutions apply ethical standards – such as the UN Principles for Responsible Investment – when deciding how to invest their funds. These Mstandards take into account environmental, social and corporate governance factors. This chapter examines selected institutions’ policies on financing nuclear weapons. Investing in companies that manufacture and arms, they must adopt more stringent policies that modernize nuclear weapons is a grave breach of exclude the financing of nuclear weapons companies ethical investment norms, as nuclear weapons are altogether. The existing policies of some financial illegal to use and cause catastrophic humanitarian and institutions have little if any practical effect. environmental harm. Some financial institutions, in addition to maintaining general policies on ethical or Policies Examined sustainable investment, specifically state that they will In this chapter, we examine the nuclear weapons not invest in nuclear armaments. policies of 14 mainstream banks, asset managers However, as this chapter shows, their policies and pension funds in nine countries. Only two of on nuclear weapons investments often fall short of them – Rabobank and PGGM – were found not to imposing a blanket ban on the financing of nuclear invest substantively in any of the 20 nuclear weapons weapons companies. For example, some banks rule companies studied. The policies here provide a out providing loans specifically for nuclear weapons snapshot of financial institutions’ nuclear weapons projects, but they are willing to provide loans to stances, not an exhaustive list. Selection of the nuclear arms makers for general purposes. financial institutions was based on a desire to show a All nuclear weapons companies are engaged diversity of institutions from a diversity of nations. -

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 To

BEST EXECUTION & BROKER SELECTION POLICY Appendix 2 to the GTC I. PURPOSE This document defines the Best Execution and Broker Selection Policy of Quintet Private Bank (Europe) S.A. (“the Bank”). The Bank shall take all sufficient steps to obtain the best possible result for its Clients as required by Directive 2014/65/EU of 15 May 2014 on markets in financial Instruments (“hereinafter MiFID II”) when: • executing Client orders; • dealing on own account with Clients; • transmitting Client orders to other entities (brokers) for execution (reception and transmission of Client orders); and • making an investment decision within the framework of discretionary portfolio management and transmitting an order for execution to another entity (brokers). For this purpose, the Bank shall draw up: • A Best Execution Policy (for the execution of orders and dealing on own account with Clients) which includes execution venues where the Bank executes Client orders. • A Best Selection Policy (for RTO and portfolio management) which includes entities (brokers) where the Bank places or transmits client orders for execution. The Best Execution and Broker Selection Policy is appended to the Bank’s GTC and is available on the Bank’s website (www.quintet.com). Where a Client makes reasonable and proportionate requests for information about the Best Execution and Best Selection Policy and how it is reviewed, the Bank shall answer clearly and within a reasonable time. II. SCOPE a. CLIENTS TO WHICH THIS POLICY APPLIES MiFID II distinguishes three categories of Clients: • Private Clients (retail Clients); • Professional Clients are persons who are considered to have the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that they incur; • Eligible counterparties which include regulated financial institutions (e.g.