[For Information Purpose Only] August 21, 2015 to All Concerned Parties

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Special Assistance for Project Implementation for Bangkok Mass Transit Development Project in Thailand

MASS RAPID TRANSIT AUTHORITY THAILAND SPECIAL ASSISTANCE FOR PROJECT IMPLEMENTATION FOR BANGKOK MASS TRANSIT DEVELOPMENT PROJECT IN THAILAND FINAL REPORT SEPTEMBER 2010 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS, CO., LTD. EID JR 10-159 MASS RAPID TRANSIT AUTHORITY THAILAND SPECIAL ASSISTANCE FOR PROJECT IMPLEMENTATION FOR BANGKOK MASS TRANSIT DEVELOPMENT PROJECT IN THAILAND FINAL REPORT SEPTEMBER 2010 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS, CO., LTD. Special Assistance for Project Implementation for Mass Transit Development in Bangkok Final Report TABLE OF CONTENTS Page CHAPTER 1 INTRODUCTION ..................................................................................... 1-1 1.1 Background of the Study ..................................................................................... 1-1 1.2 Objective of the Study ......................................................................................... 1-2 1.3 Scope of the Study............................................................................................... 1-2 1.4 Counterpart Agency............................................................................................. 1-3 CHAPTER 2 EXISTING CIRCUMSTANCES AND FUTURE PROSPECTS OF MASS TRANSIT DEVELOPMENT IN BANGKOK .............................. 2-1 2.1 Legal Framework and Government Policy.......................................................... 2-1 2.1.1 Relevant Agencies....................................................................................... 2-1 2.1.2 -

Notice on Formation of Private Fund and Silent Partnership Investment

September 25, 2020 Company name: ES-CON JAPAN Ltd. Representative: Takatoshi Ito, President & Representative Director (TSE 1st Section, code: 8892) Inquiries: Minoru Nakanishi, Senior Managing Director Tel: +81-3-6230-9308 Notice on Formation of Private Fund and Silent Partnership Investment ES-CON JAPAN Ltd. (ES-CON JAPAN) announces that a decision was made to form the GK Kamikitadai Ekimae Development Project and GK Fujisawa Development Project (the “SPCs”) as rental apartment development funds in cooperation with Nisshin Fudosan Company, Limited (Shinjuku-ku, Tokyo; President & Representative Director: Takashi Sakairi) and carry out silent partnership investment in the funds. Details are as follows. 1. Background and Overview of Silent Partnership Investment The SPCs will carry out the Kamikitadai Ekimae Development Project and Fujisawa Development Project (the “Properties”) and operate the Properties as rental apartments after the completion of buildings. The SPCs will grant preferential negotiation rights (the “Preferential Negotiation Rights”) to ES-CON JAPAN to let ES-CON JAPAN or a party designated by ES-CON JAPAN preferentially acquire the Properties during a certain period. In 2021, ES-CON JAPAN Group plans to form and commence operation of a private real estate investment corporation (private REIT (ES-CON Private REIT (tentative name))) with ES-CON Asset Management Ltd. (EAM), a consolidated subsidiary of ES-CON JAPAN, as the party entrusted with asset management, and ES-CON JAPAN is scheduled to exercise the Preferential Negotiation Rights for ES-CON Private REIT (tentative name). The land for the Properties will be acquired by Nisshin Fudosan Company, Limited and then transferred to the SPCs after approval and licenses related to development and construction are obtained. -

Ichigo Office April 2019 Fiscal Period Corporate Presentation

Ichigo Office (8975) Ichigo Office April 2019 Fiscal Period Corporate Presentation June 14, 2019 Ichigo Office REIT Investment Corporation (8975) Ichigo Investment Advisors Co., Ltd. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. www.ichigo-office.co.jp/english Make The World More Sustainable © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. April 2019 Results Ichigo Office ESG April 2019 Highlights Ichigo Office’s Sustainability Commitment April 2019 Earnings Environmental April 2019 Financial Metrics Social 18 Consecutive Periods of Dividend Growth Governance – No. 1 vs. All J-REITs Growing Shareholder Value: Continued Growth in Base EPS Appendix Growing Shareholder Value: Continued Growth in NAV Financial & Portfolio Data Sustained High Office Occupancy: 99.3% About Ichigo Office Organic Growth: Driving Rental Growth Organic Growth: Existing Tenants at Higher Rents Organic Growth: New Tenants at Higher Rents Acquisition-Driven Growth: April 2019 Acquisitions Ichigo Office Growth Strategy Driving Shareholder Value via Organic Growth & Pro-Active Acquisitions/Sales Sustainable Growth to Maximize Shareholder Value Value-Add Capex (1) Ichigo Uchi Honmachi Building Value-Add Capex (2) Ichigo Uchikanda Building Investing for Long-Term Growth May 2019 Acquisition & Sale Accretive to Shareholders Driving Higher NOI & Harvesting Gains in Strong Market Sustainable Growth with Sponsor Support Access to Ichigo’s Robust Pipeline of Office Assets October 2019 Forecast April 2020 Forecast © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. -

METROS/U-BAHN Worldwide

METROS DER WELT/METROS OF THE WORLD STAND:31.12.2020/STATUS:31.12.2020 ّ :جمهورية مرص العرب ّية/ÄGYPTEN/EGYPT/DSCHUMHŪRIYYAT MISR AL-ʿARABIYYA :القاهرة/CAIRO/AL QAHIRAH ( حلوان)HELWAN-( المرج الجديد)LINE 1:NEW EL-MARG 25.12.2020 https://www.youtube.com/watch?v=jmr5zRlqvHY DAR EL-SALAM-SAAD ZAGHLOUL 11:29 (RECHTES SEITENFENSTER/RIGHT WINDOW!) Altamas Mahmud 06.11.2020 https://www.youtube.com/watch?v=P6xG3hZccyg EL-DEMERDASH-SADAT (LINKES SEITENFENSTER/LEFT WINDOW!) 12:29 Mahmoud Bassam ( المنيب)EL MONIB-( ش ربا)LINE 2:SHUBRA 24.11.2017 https://www.youtube.com/watch?v=-UCJA6bVKQ8 GIZA-FAYSAL (LINKES SEITENFENSTER/LEFT WINDOW!) 02:05 Bassem Nagm ( عتابا)ATTABA-( عدىل منصور)LINE 3:ADLY MANSOUR 21.08.2020 https://www.youtube.com/watch?v=t7m5Z9g39ro EL NOZHA-ADLY MANSOUR (FENSTERBLICKE/WINDOW VIEWS!) 03:49 Hesham Mohamed ALGERIEN/ALGERIA/AL-DSCHUMHŪRĪYA AL-DSCHAZĀ'IRĪYA AD-DĪMŪGRĀTĪYA ASCH- َ /TAGDUDA TAZZAYRIT TAMAGDAYT TAỴERFANT/ الجمهورية الجزائرية الديمقراطيةالشعبية/SCHA'BĪYA ⵜⴰⴳⴷⵓⴷⴰ ⵜⴰⵣⵣⴰⵢⵔⵉⵜ ⵜⴰⵎⴰⴳⴷⴰⵢⵜ ⵜⴰⵖⴻⵔⴼⴰⵏⵜ : /DZAYER TAMANEỴT/ دزاير/DZAYER/مدينة الجزائر/ALGIER/ALGIERS/MADĪNAT AL DSCHAZĀ'IR ⴷⵣⴰⵢⴻⵔ ⵜⴰⵎⴰⵏⴻⵖⵜ PLACE DE MARTYRS-( ع ني نعجة)AÏN NAÂDJA/( مركز الحراش)LINE:EL HARRACH CENTRE ( مكان دي مارت بز) 1 ARGENTINIEN/ARGENTINA/REPÚBLICA ARGENTINA: BUENOS AIRES: LINE:LINEA A:PLACA DE MAYO-SAN PEDRITO(SUBTE) 20.02.2011 https://www.youtube.com/watch?v=jfUmJPEcBd4 PIEDRAS-PLAZA DE MAYO 02:47 Joselitonotion 13.05.2020 https://www.youtube.com/watch?v=4lJAhBo6YlY RIO DE JANEIRO-PUAN 07:27 Así es BUENOS AIRES 4K 04.12.2014 https://www.youtube.com/watch?v=PoUNwMT2DoI -

Acquisition of Office Asset (Ichigo Tachikawa Building)

Make The World More Sustainable [Provisional Translation Only] This English translation of the original Japanese document is provided solely for information purposes. Should there be any discrepancies between this translation and the Japanese original, the latter shall prevail. December 14, 2020 Issuer Ichigo Office REIT Investment Corporation (“Ichigo Office,” 8975) 1-1-1 Uchisaiwaicho, Chiyoda-ku, Tokyo Representative: Yoshihiro Takatsuka, Executive Director www.ichigo-office.co.jp/en Asset Management Company Ichigo Investment Advisors Co., Ltd. Representative: Hiroshi Iwai, President Inquiries: Sanae Hiraoka, Head of Ichigo Office Tel: +81-3-3502-4891 Acquisition of Office Asset (Ichigo Tachikawa Building) Consistent with its strategy as a specialized office REIT, Ichigo Office decided today to acquire an office asset, the Ichigo Tachikawa Building. 1. Asset Acquisition Summary Asset Number O-96 Asset Name1 Ichigo Tachikawa Building Asset Type Office Date Built December 14, 1992 Form of Ownership Trust beneficiary interest in real estate (juekiken) Appraisal Value2 JPY 4,000 million Acquisition Price3 JPY 3,830 million Seller Tachikawa Holdings GK Contract Date December 14, 2020 Closing Date December 18, 2020 Financing Method Cash-on-hand, Loans Settlement Method Lump-sum payment 1 Ichigo Office will change the building name from the Unizo Tachikawa Building to the Ichigo Tachikawa Building. For purposes of this release, the building is referred to as the Ichigo Tachikawa Building. 2 Appraisal Value is calculated by Daiwa Real Estate Appraisal as of November 1, 2020, and is in compliance with the appraisal guidelines of Ichigo Investment Advisors (“IIA”) as well as the rules of the Investment Trusts Association of Japan. -

Section 2 Facility Plans

Section 2 Facility Plans 1 Transport Facilities (1) Roads a. Urban Planning Road Roads are essential urban facilities to support urban activities and life, and in Tokyo, the Urban Planning Roads of about 3,210km have been approved. On the other hand, the completion ratio remains about 64%, and the implementation plan is formulated every about 10 years. The roads to preferentially develop are selected and systematically and efficiently developed. Regarding the Urban Planning Roads in the wards area in the past, after the City Planning had been approved in 1946 (initial approval), due to changes in social and economic conditions, the review of the entire Urban Planning Roads (re-examination of the Urban Planning Roads) were carried out in 1950, in 1964 (inside Loop 6), in 1966 (outside Loop 6), and in 1981 (the entire wards area). Regarding the Urban Planning Roads in the Tama region, after the plan in the Hachioji City Planning Area had been approved in 1930, as the plan for each City Planning Area has been individually approved, those plans were not the ones integrated for the entire Tama region. Therefore, the Urban Planning Roads were reviewed in consideration of the entire Tama region in 1961 and 1962. After that, the network of the Urban Planning Roads was examined in 1989 due to changes in social and economic conditions. In carrying out the development, the implementation plans to select the roads to develop preferentially were formulated, for the wards area in FY1981, FY1991 and FY2003, and the Tama region in FY1989, FY1995 and FY2006, and systematically and efficiently carried out. -

Ichigo Office October 2019 Fiscal Period Corporate Presentation

Ichigo Office (8975) Ichigo Office October 2019 Fiscal Period Corporate Presentation December 13, 2019 Ichigo Office REIT Investment Corporation (8975) Ichigo Investment Advisors Co., Ltd. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. www.ichigo-office.co.jp/english Make The World More Sustainable © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. October 2019 Results Ichigo Office ESG October 2019 Highlights Ichigo Office’s Sustainability Commitment October 2019 Earnings Environmental October 2019 Financial Metrics Social Strong Record of Sustainable & Enduring Dividend Growth Governance Growing Shareholder Value: Continued Growth in Base EPS Appendix Growing Shareholder Value: Continued Growth in NAV Financial & Portfolio Data Sustained High Office Occupancy: 99.3% About Ichigo Office Organic Growth: Driving Rental Growth Organic Growth: Existing Tenants at Higher Rents Organic Growth: New Tenants at Higher Rents Acquisition-Driven Growth: October 2019 Acquisitions Launch of Ichigo J.League Shareholder Program Ichigo Office Growth Strategy Sustainable Growth to Maximize Shareholder Value Rent Gap Offers Further NOI Upside Value-Add Capex: Ichigo Nogizaka Building Driving Earnings with New Leases: Ebisu Green Glass Driving Higher NOI & Harvesting Gains in Strong Market Sustainable Growth via Sponsor Support Access to Ichigo’s Robust Pipeline of Office Assets April 2020 Forecast October 2020 Forecast © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. 5 October 2019 Results © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. -

Ichigo Office April 2021 Fiscal Period Corporate Presentation

Ichigo Office (8975) Ichigo Office April 2021 Fiscal Period Corporate Presentation June 14, 2021 Ichigo Office REIT Investment Corporation (8975) Ichigo Investment Advisors Co., Ltd. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. www.ichigo-office.co.jp/english We would like to express our deepest condolences to all those across the world affected by the Covid pandemic and our wishes for the earliest and fullest possible recovery. Take care, be safe. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. 2 Make The World More Sustainable © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. April 2021 Results Ichigo Office ESG April 2021 Highlights Ichigo Office’s Sustainability Commitment April 2021 Earnings Environmental April 2021 Financial Metrics Social Occupancy & Average Rent per Tsubo (3.3m2) Governance Mid-Size Office Market Recovery Appendix Organic Growth: NOI Upside Despite Smaller Rent Gap Ichigo Office ESG Organic Growth: Rent Renewals of Existing Tenants Financial & Portfolio Data Organic Growth: New Tenants at Higher Rents Mid-Size Office Investment Opportunity Organic Growth: Driving Growth via Value-Add Capex About Ichigo Office Acquisition-Driven Growth: April 2021 Acquisition Other Access to Sponsor Ichigo’s Robust Pipeline of Office Assets Maximizing Shareholder Value via Share Buyback/Cancellation Ichigo Office Growth Strategy Growth Strategy Roadmap Revised to Reflect Covid Impact Transition to Renewable Energy October 2021 Forecast April 2022 Forecast © Ichigo Investment Advisors Co., Ltd. -

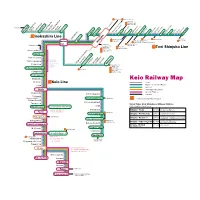

Keio Railway

Oedo Line Marunouchi Line Chuo Line Yurakucho Line Namboku Line Chuo Line Keio New Line Inokashira-koen Mitakadai FujimigaokaTakaidoHamadayamaNishi- Kichijoji eifuku Kugayama Eifukucho Shinjuku-sanchomeAkebonobashi Kudanshita OgawamachiIwamotocho Hamacho KikukawaSumiyoshiNishi-ojima Higashi-ojima Ichinoe Mizue Shinozaki bocho Ojima Ichigaya m Inokashira Line Hatagaya Hatsudai Ji Bakuroyokoyama Morishita Funabori Motoyawata Daitabashi Hanzomon Line Oedo Line Hanzomon Line Sobu Line Tozai Line Sobu Line (Bakurocho) Keisei Line Meidai Sasazuka Shinjuku Asakusa Line (Higashi-nihombashi) mae Chuo Line Marunouchi Line Setagaya Line Yamanote Line Chiyoda Line Saikyo Line Mita Line Toei Shinjuku Line Odakyu Line Hanzomon Line Shimo-takaido Marunouchi Line Keio Line Oedo Line Sakurajosui Kami-kitazawa Commuter Hachimanyama Rapid Train does not stop Higashi-matsubaraShindaita Ikenoue Komaba- Shinsen todaimae Shibuya Roka-koen at these Shimo-kitazawa Yamanote Line stations Saikyo Line Chitose-karasuyama Toyoko Line Odakyu Line Den-en-toshi Line Ginza Line Sengawa Hanzomon Line Tsutsujigaoka Shibasaki Keio Railway Map Kokuryo Keio Line Local Fuda Rapid / Commuter Rapid Express Chofu Semi-Special Express Special Express Nishi-chofu Keio-tamagawa Transfer Tobitakyu Ajinomoto Stadium Keio-inadazutsumi Nambu Line Lines accepting Passnet Card Musashinodai Keio-yomiuri-land Tama-reien Travel Times from Shinjuku or Shibuya Stations Higashi-fuchu Fuchukeiba-seimonmae Inagi (fastest daytime travel times) Express (Inbound) runs Wakabadai Shinjuku - Fuchu 19 -

Tama City Map

TAMA CITY MAP たまっ ぷ 歴史と文化の散歩道 木造随身椅像 水と緑と都 市 機 能 。 京王線 聖 蹟 桜ヶ丘 駅 多摩川 Keio Line 市内を歩いてココチヨイを感じてみませんか? Seiseki-sakuragaoka st. Water, nature, and city functions. Explore the city and find your comfort spots. 市 役 所 聖 蹟 桜ヶ丘 駅 出 張 所 市立健康センター 関戸公民館 桜ぽるぼろん 大栗川 桜の塩漬けのしょっぱさと、ほろっと した口どけがポイント。口の中で溶 川崎街道 けないうちに「ポルボロン」と3回唱 市立総合体育館 いろは坂通り えると 幸 せ が 訪 れ るそう。 Sakura Polvoron (sweet) 霞ノ関南木戸柵跡 Oragamachino Umeshu Shirakaga (Plum Wine of My Town) 野猿街道 市の花「ヤマザクラ」 市の木「イチョウ」 市の鳥「ヤマバト (別名キジバト)」 おらがまちの しらかが 梅酒「白加賀」 明治天皇がしばしば行幸されたこと 多 摩 ニュータウンの 開 発 に 伴 い 、 市内の丘陵地は鳥や生き物が多く 稲荷塚古墳 を記念して建てられた、旧多摩聖蹟 街路樹などとして多く植樹。秋の色 生 息 し 、ヤ マ バ ト も よ く 見 る こ と が で 多摩市役所 記念館の周辺や向ノ岡は古くから づきも 見 事 です 。 きたといいます 。 旧多摩聖蹟記念館 多摩の地酒 Tama City Hall 桜の名所として知られています。 「原峰のいずみ」 Flower of the city Tree of the city Bird of the city Yamazakura (Mountain Cherry) Ginkgo Turtledove 市の花・木・鳥:昭和47年11月1日制定 Haramineno-izumi (Local Sake of Tama) 乞田川 多摩都市モノレール線 京王永山駅 多摩ニュータウン通り Keio Nagayama st. Tama Toshi Monorail Line 多摩市子育て Tama newtown street 小田急永山駅 総合センター「たまっこ」 Odakyu Nagayama st. 共同アンテナショップ「Ponte」 多摩の味噌 京王相模原線 永山公民館 「原峰のかおり」 Keio Sagamihara Line ビジネススクエア多摩 小田急多摩線 地場産の農産物を使用した特産 京王多摩センター駅 Odakyu Tama Line 品 。伝統を受け継ぐうま味をぜひ堪 Haramineno-kaori 多 摩 市 コミュニティ・アイデ ンティティ Keio Tama Center st. 多摩センター南通り 鎌倉街道 市立武道館 市 章 市役所多摩センター駅出張 所 能して み てください 。 (Miso of Tama) シンボルマークとスローガン 小田急多摩センター駅 Odakyu Tama Center st. サンリオピューロランド 市立陸上競技場 多 摩 市 の「 多 」を ハ ト が 羽 ば た い 市 のより良 いイメージ 形 成を目 的とし 多摩 都 市モノレール 線 ベネッセ・スター・ドーム パルテノン て飛 び 立 つ 姿 にたとえて 表した て昭 和 6 2 年 5月決 定 。人と人との 触 多摩センター駅 かけはし ポ ン テ 大通り 多摩センター東通り もので、特に真ん中の線は未来 れ合い、自然と人の触れ合いを強調 Tama Toshi Monorail Line (諏訪複合教育施設) 共同アンテナショップ「Ponte」 Tama Center st. -

Ichigo Office April 2021 Fiscal Period Corporate Presentation

Ichigo Office (8975) Ichigo Office April 2021 Fiscal Period Corporate Presentation June 14, 2021 Ichigo Office REIT Investment Corporation (8975) Ichigo Investment Advisors Co., Ltd. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. www.ichigo-office.co.jp/en We would like to express our deepest condolences to all those across the world affected by the Covid pandemic and our wishes for the earliest and fullest possible recovery. Take care, be safe. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. 2 Make The World More Sustainable © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. © Ichigo Investment Advisors Co., Ltd. Ichigo Office REIT Investment Corporation All rights reserved. April 2021 Results Ichigo Office ESG April 2021 Highlights Ichigo Office’s Sustainability Commitment April 2021 Earnings Environmental April 2021 Financial Metrics Social Occupancy & Average Rent per Tsubo (3.3m2) Governance Mid-Size Office Market Recovery Appendix Organic Growth: NOI Upside Despite Smaller Rent Gap Ichigo Office ESG Organic Growth: Rent Renewals of Existing Tenants Financial & Portfolio Data Organic Growth: New Tenants at Higher Rents Mid-Size Office Investment Opportunity Organic Growth: Driving Growth via Value-Add Capex About Ichigo Office Acquisition-Driven Growth: April 2021 Acquisition Other Access to Sponsor Ichigo’s Robust Pipeline of Office Assets Maximizing Shareholder Value via Share Buyback/Cancellation Ichigo Office Growth Strategy Growth Strategy Roadmap Revised to Reflect Covid Impact Transition to Renewable Energy October 2021 Forecast April 2022 Forecast © Ichigo Investment Advisors Co., Ltd. -

Let's Visit Tama New Town!

w Town! w Ne visit a s Tam Let' a fascinating area in an expanse of hills Town Ne Tama Tama Zoological Park Hino City Minami-Tama Sta. JR Chuo Line Tamagawa River Tama-Dobutsukoen Sta. Tama-Dobutsukoen Sta. Seiseki-sakuragaoka Sta. JR Nambu Line Asakawa River Hirayamajoshi-koen Sta. Chuo-Daigaku Meisei-Daigaku Sta. Inaginaganuma Sta. Naganuma Sta. Chuo Univ. Tama Monorail Otsuka Teikyo-Daigaku Sta. Inagi Sta. Tama City Keio-nagayama Sta. Hachioji City Matsugaya Sta. Odakyu Nagayama Sta. Tama Univ. Tama Center Sta. Sanrio Puroland Keio-horinouchi Sta. Keio-tama-center Sta. Tokyo Metropolitan Univ. Yaen-kaido Ave. Odakyu Tama Center Sta. Keio Sagamihara Line Tokyo Asobimare Wakabadai Sta. Haruhino Sta. Mitsui Outlet Park Karakida Sta. Tama Minami Osawa Inagi City Minami-osawa Sta. Kurokawa Sta. Minami-Tama One Kansen Road Kamakura-kaido Ave. Kurihira Sta. Odakyu Tama Line Tamasakai Sta. Tama-Newtown-dori Ave. Kawasaki City Machida-kaido Ave. Satsukidai Sta. Odawara Line Odakyu Machida City *Unless otherwise noted, the contents published in Published in October 2020 Registration No. (31)95 Tama New Town—a fascinating area in an expanse of hills this magazine are as of October 2020. Details may change after publication. Please check websites or Tama New Town Project Office, Urban Redevelopment. Section,Bureau Edited and produced by C&Z Communication Co., Ltd other sources for up-to-date information before your of Urban Development Tokyo Metropolitan Government Printed by C&Z Communication Co., Ltd visit. Also, please be aware that we will take no 8-1, Nishi Shinjuku 2-chome, Shinjuku-ku, Tokyo, 163-8001 responsibility for any liability for any damage arising TEL (direct): 03-5320-5479 from the use of information in this magazine.