For the Period of Six Months Ending 30 June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Dynamics of FM Frequencies Allotment for the Local Radio Broadcasting

DEVELOPMENT OF LOCAL RADIO BROADCASTING IN UKRAINE: 2015–2018 The Project of the National Council of Television and Radio Broadcasting of Ukraine “Community Broadcasting” NATIONAL COUNCIL MINISTRY OF OF TELEVISION AND RADIO INFORMATION POLICY BROADCASTING OF UKRAINE OF UKRAINE DEVELOPMENT OF LOCAL RADIO BROADCASTING: 2015—2018 Overall indicators As of 14 December 2018 local radio stations local radio stations rate of increase in the launched terrestrial broadcast in 24 regions number of local radio broadcasting in 2015―2018 of Ukraine broadcasters in 2015―2018 The average volume of own broadcasting | 11 hours 15 minutes per 24 hours Type of activity of a TV and radio organization For profit radio stations share in the total number of local radio stations Non-profit (communal companies, community organizations) radio stations share in the total number of local radio stations NATIONAL COUNCIL MINISTRY OF OF TELEVISION AND RADIO INFORMATION POLICY BROADCASTING OF UKRAINE OF UKRAINE DEVELOPMENT OF LOCAL RADIO BROADCASTING: 2015—2018 The competitions held for available FM radio frequencies for local radio broadcasting competitions held by the National Council out of 97 FM frequencies were granted to the on consideration of which local radio stations broadcasters in 4 format competitions, were granted with FM frequencies participated strictly by local radio stations Number of granted Number of general Number of format Practical steps towards implementation of the FM frequencies competitions* competitions** “Community Broadcasting” project The -

Table of Contents

Table of Contents Introduction 2 Oleg Popov, CEO of SCM 2 Maxim Timchenko, CEO of DTEK 4 DTEK Group at a glance 8 15 facts about DTEK Group 10 Mission, vision, values 12 Development Strategy until 2030 13 DTEK Group corporate governance structure 16 Key performance indicators of 2019 17 Location of DTEK Group production enterprises 18 Key Events in 2019 20 Top management of the DTEK Group 24 An overview of Ukraine’s industries and macroeconomic indicators 28 Electricity Market 30 Natural Gas Market 40 Ukraine’s macroeconomic indicators 44 Performance results 48 Production activity 50 Investment projects 62 Analysis of financial results 72 Corporate governance 74 Corporate governance structure 76 Supervisory Boards of the operating holdings companies 77 Risk management system 82 Compliance and corporate ethics 83 Dividend policy 85 Sustainability 86 Sustainability 88 Environmental protection 92 Society 100 Employees 110 Annex 1 122 Annex 2 124 Annex 3 128 2 Integrated report 2019 Integrated report 2019 3 Introduction Dear colleagues and partners, please find hereby the annual report ted itself to achieving the UN Sustainable Development Goals. As of DTEK Group. a result, our actions have remain consistent and our commitment to the principles of ESG (Environmental, Social and corporate Gov- In 2020, DTEK celebrated its 15th anniversary. This year has been a ernance) unwavering, as we strive to support the interests of socie- challenge for all of us because of the global coronavirus pandem- ty. For this purpose, we adopted our ESG Strategy. The 12 UN Sus- ic, which has reignited the discussion about the role and purpose tainable Development Goals were subsequently integrated into this of business for society. -

Luhanska Oblast REFERENCE MAP for Humanitarian Purposes Only As of November 2017 Production Date: 20 November 2017

UKRAINE - Luhanska oblast REFERENCE MAP For Humanitarian Purposes Only Production date: 20 November 2017 As of November 2017 Shevchenkove Hohyne Slyzneve Vilkhuvatka Petropavlivka Novooleksandrivka Prykolotne Kurhanne Dovhenke Hannopillia Malyi Kotivka Malakhove Harbuzivka Yurivka Burluk Milove Mykolaivka Fedorivka Khatnie Berezhne Pohorile Pidserednie Doroshenkove Shevchenkove Ambarne Novoselivka Vovchanskyi Mykhailivka Krasnoiarske Kyrylivka Horiane raion Siryi Buriakivka Velykoburlutskyi Zamist Sonino Seredivka Moskalivka Yar raion Odradne Velykyi Burluk Hryhorivka Bolohivka Didivka Hnylytsia Balka Syrotyne Yaiechne Obukhivka Stroivka Paskivka Hannivka Persha Ploske Zhukiv Demyno-Oleksandrivka Mykilske Novouzhvynivka Yar Dvorichanske Harashkivka Lebedivka Mantsivka Hnylytsia Holubivka Topoli Borshchova Katerynivka Kolodiazne Kupievakha Shatkivka Zelenyi Chervona Rodnychky Hai Khvylia Kamianka Pisky Bahachka Kanivtseve Rohozianka Arkushyne Vesele Novovasylivka Lyman Topoli Pishchanka Rozsypne Sadovod Druhyi Lantrativka Zelenyi Shypuvate Krasne Poltavske Artemivka Nova Andriivka Mytrofanivka Hai Nova Vodiane Pershe Dzherelne Maslivka Oleksandrivka Shypuvate Petrivka Pavlivka Babycheve Oleksandrivka Petro-Ivanivka Nezhdanivka Zaitseve Voievodske Pechenizkyi Ridkodub Mykolaivka Nesterivka Pryliutove Dvorichanskyi Troitske Maksymivka Zahiria raion Stetskivka Putnykove Shevchenkove Serednii Fyholivka raion Solontsi Berezivka Prosianka Krasne Burluk Mykolaivka Kasianivka Dovhenke Bohdanivske Maltsivka Polkovnyche Shyshkivka Novomlynsk Terny -

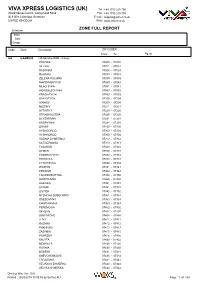

Viva Xpress Logistics (Uk)

VIVA XPRESS LOGISTICS (UK) Tel : +44 1753 210 700 World Xpress Centre, Galleymead Road Fax : +44 1753 210 709 SL3 0EN Colnbrook, Berkshire E-mail : [email protected] UNITED KINGDOM Web : www.vxlnet.co.uk Selection ZONE FULL REPORT Filter : Sort : Group : Code Zone Description ZIP CODES From To Agent UA UAAOD00 UA-Ukraine AOD - 4 days POLISKE 07000 - 07004 VILCHA 07011 - 07012 RADYNKA 07024 - 07024 RAHIVKA 07033 - 07033 ZELENA POLIANA 07035 - 07035 MAKSYMOVYCHI 07040 - 07040 MLACHIVKA 07041 - 07041 HORODESCHYNA 07053 - 07053 KRASIATYCHI 07053 - 07053 SLAVUTYCH 07100 - 07199 IVANKIV 07200 - 07204 MUSIIKY 07211 - 07211 DYTIATKY 07220 - 07220 STRAKHOLISSIA 07225 - 07225 OLYZARIVKA 07231 - 07231 KROPYVNIA 07234 - 07234 ORANE 07250 - 07250 VYSHGOROD 07300 - 07304 VYSHHOROD 07300 - 07304 RUDNIA DYMERSKA 07312 - 07312 KATIUZHANKA 07313 - 07313 TOLOKUN 07323 - 07323 DYMER 07330 - 07331 KOZAROVYCHI 07332 - 07332 HLIBOVKA 07333 - 07333 LYTVYNIVKA 07334 - 07334 ZHUKYN 07341 - 07341 PIRNOVE 07342 - 07342 TARASIVSCHYNA 07350 - 07350 HAVRYLIVKA 07350 - 07350 RAKIVKA 07351 - 07351 SYNIAK 07351 - 07351 LIUTIZH 07352 - 07352 NYZHCHA DUBECHNIA 07361 - 07361 OSESCHYNA 07363 - 07363 KHOTIANIVKA 07363 - 07363 PEREMOGA 07402 - 07402 SKYBYN 07407 - 07407 DIMYTROVE 07408 - 07408 LITKY 07411 - 07411 ROZHNY 07412 - 07412 PUKHIVKA 07413 - 07413 ZAZYMIA 07415 - 07415 POHREBY 07416 - 07416 KALYTA 07420 - 07422 MOKRETS 07425 - 07425 RUDNIA 07430 - 07430 BOBRYK 07431 - 07431 SHEVCHENKOVE 07434 - 07434 TARASIVKA 07441 - 07441 VELIKAYA DYMERKA 07442 - 07442 VELYKA -

Of the Public Purchasing Announcernº40 (62) October 04, 2011

Bulletin ISSN: 2078–5178 of the public purchasing AnnouncerNº40 (62) October 04, 2011 Announcements of conducting procurement procedures � � � � � � � � � 2 Announcements of procurement procedures results � � � � � � � � � � � � 38 Urgently for publication � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 73 Bulletin No�40 (62) October 04, 2011 Annoucements of conducting 17707 Subsidiary Company “Luhansk oblavtodor”, procurement procedures OJSC “SJSC “Motor Roads of Ukraine” 9 Liniia zaliznytsi St., 91000 Luhansk Koval Oleh Viktorovych, Fomenko Oleksandr Mykolaiovych, Makhukova Kateryna Ivanivna 17705 SOE “Starokostiantyniv Plant of Reinforced tel.: (0642) 931–170; Concrete Ties” tel./fax: (0642) 533–436, 931–164; 22 Voroshylova St., 31100 Starokostiantyniv, Khmelnytska Oblast e–mail: [email protected], [email protected] Horban Oleksandr Vasyliovych Procurement subject: code 34.10.5 – special and specialized cars (salt tel.: (03854) 3–17–52, 3–31–67; spreader mounted on truck with hopper capacity 12 m³), 1 unit e–mail: [email protected] Supply/execution: at the customer’s address, November 2011 – March 2012 Procurement subject: code 29.22.1 – lifting and rigging equipment (gantry Procurement procedure: open tender crane of 100–10 t freight capacity, span – 26 m), 1 unit Obtaining of competitive bidding documents: at the customer’s address, office 404 Supply/execution: at the customer’s address, during 2011 Submission: at the customer’s address, office 404 Procurement procedure: open tender 20.10.2011 10:00 Obtaining of competitive bidding documents: at the customer’s address, Opening of tenders: at the customer’s address, 5th floor, assembly hall office of the planning–economic department, personally or by mail 20.10.2011 11:00 Submission: at the customer’s address, office of the planning–economic Tender security: not required department or reception room, by mail Additional information: Qualification criteria are established in accordance with 02.11.2011 09:00 article 16 of the Law on Public Procurement. -

For the Period of Three Months Ending 31 March 2021 Overview

INTERIM REPORT for the period of three months ending 31 March 2021 Overview ASTARTA’s consolidated revenues amounted to EUR83m in 1Q21, 18% down y-o-y, mainly due to lower sales in the Agricultural segment which generated 18% of consolidated revenues. Revenues in the Agricultural segment declined by 63% to EUR15m on lower sales volumes of corn. Revenues in the Sugar segment were flat at EUR29m, or 35% of the total consolidated revenues. The Soybean Processing and the Cattle Farming segments generated EUR29m and EUR9m of revenues, correspondingly, vis-à-vis EUR22m and EUR10m in 1Q20. Gross profit decreased by 34% y-o-y to EUR20m and Gross margin from 29% to 24% as changes in biological assets per IAS41 were lower due to the later start of the planting season. Accordingly, EBITDA declined by 30% y-o-y to EUR19m and EBITDA margin from 27% to 23%. Excluding the impact of IAS41, Gross margin improved from 28% to 31% and EBITDA margin – from 26% to 31%. Summary P&L EURk 1Q20 1Q21 Revenues, including 101 344 82 835 Agriculture 39 170 14 626 Sugar production 28 755 28 756 Soybean processing 22 348 29 301 Cattle farming 10 042 9 159 Cost of sales, including (81 948) (62 276) Effect of FV remeasurement of AP (9 316) (5 491) Changes in FV of BA and AP* 10 469 (888) Gross profit 29 865 19 671 Gross profit margin 29% 24% EBIT 11 955 7 684 Depreciation & Amortisation 15 820 11 733 EBITDA, including 27 775 19 417 Agriculture 20 401 7 233 Sugar production 3 408 9 711 Soybean processing 2 891 3 189 Cattle farming 1 955 (454) EBITDA margin 27% 23% Interest -

The Vinnytsia Mass Graves and Some Other Soviet Sites of Execution

TABLE OF CONTENTS Preface by L.R. Wynar...................................................... vii Acknowledgements ......................................................... xii Editorial Policy ............................................................... xv I. INTRODUCTION by lhor Kamenetsky Humanitarian and Anti-Humanitarian Trends in Modern History ............................................................1 The Vinnytsia Case and the Yezhovshchyna Era.. ................ .15 The Role of the Local Ukrainian Population and of the German Occupation Forces in the Vinnytsia Case .....................................................22 The Vinnytsia Mass Graves and Some Other Soviet Sites of Execution ........................ 31 Conclusion.. ................................................................... .35 11. TESTIMONIES AND HEARINGS M. Seleshko, Vinnystsia - The Katyn of Ukraine (A Report by an Eyewitness) ............................41 Petro Pavloyvch, I Saw Hell: Fragment of Reminiscences........................................................... .52 Bishop Sylvester, The Vynnytsya Tragedy.. ........................ .54 Archbishop Hyhoriy, P. Pavlovych, K. Sybirsky, Testimony on the Crime in Vynnytsya ............................................................ .56 lhor Kamenetsky, Interview with an Eyewitness in August 1987 .......................................... .60 Archbishop Hyhoriy, Funeral Eulogy Delivered at Vinnytsia, October 3, 1943.. ....................... .63 Congressional Hearings, The Crimes of Khrushchev, Part -

Of the Public Purchasing Announcernº33 (55) August 16, 2011

Bulletin ISSN: 2078–5178 of the public purchasing AnnouncerNº33 (55) August 16, 2011 Announcements of conducting procurement procedures � � � � � � � � � 2 Announcements of procurement procedures results � � � � � � � � � � � � 52 Urgently for publication � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 92 Bulletin No�33 (55) August 16, 2011 Annoucements of conducting 14768 SOE “Mariupol Commercial Sea Port” procurement procedures 99 Admirala Lunina Ave., 87510 Mariupol, Donetsk Oblast Potaienko Serhii Volodymyrovych tel.: (0629) 40–02–30 14766 SOE “Mariupol Commercial Sea Port” Procurement subject: code 29.52.2 – excavating machines, 1 unit 99 Admirala Lunina Ave., 87510 Mariupol, Donetsk Oblast Supply/execution: at the customer’s address, during 2011 Bilodid Ivan Vasyliovych Procurement procedure: open tender tel.: (0629) 40–86–48 Obtaining of competitive bidding documents: at the customer’s address, office 303 Procurement subject: code 29.22.1 – hoisting crane, 2 units Submission: at the customer’s address, administrative office Supply/execution: at the customer’s address, during 2012–2013 15.09.2011 11:30 Procurement procedure: open tender Opening of tenders: at the customer’s address, chief engineer’s office Obtaining of competitive bidding documents: at the customer’s address, office 303 15.09.2011 15:00 Submission: at the customer’s address, administrative office Tender security: bank guarantee, UAH 191 000.00 01.09.2011 11:30 Additional information: Customer’s registration account: 2600800016056. Website Opening of tenders: at the customer’s address, chief engineer’s office of the Authorized agency, which contains information on the procurement: 01.09.2011 15:05 www.tender.me.gov.ua. Tender security is not returned in cases specified in part Tender security: bank guarantee, UAH 2 600 000.00 3, article 24 of the Law on Public Procurement. -

Of the Board of Directors for the Nine Months Period Ended 30 September 2020 OVERVIEW

INTERIM REPORT of the Board of Directors for the nine months period ended 30 September 2020 OVERVIEW ASTARTA’s consolidated revenues amounted to EUR291m in 9M20, 11% down y-o-y, on lower sales volumes of grains and soybean products. Revenues in the Agricultural segment stood at EUR 121m (18% lower y-o-y), or 42% of the total. Revenues in the Sugar segment were flat at EUR87m.The Soybean Processing and the Cattle Farming segments generated EUR54m and EUR25m of revenues, correspondingly, vis-à-vis EUR62m and EUR25m in 9M19. Exports contributed EUR146m, or half of the total revenues. Gross profit increased by 38% y-o-y to EUR82m as Cost of sales reduction by 18% y-o-y to EUR242m offset the revenue decline. Accordingly, EBITDA grew by 53% y-o-y to EUR82m. Excluding the impact of IAS41, Gross Margin improved from 24% to 26% and EBITDA Margin – from 22% to 26%. ASTARTA reported Operating Cash Flows of EUR106m versus EUR134m in 9M19. Operating Cash Flows before Working Capital changes increased from EUR26m to EUR49m (excluding IAS41 – EUR83m versus EUR53m). Capex tightly controlled at EUR10m in 9M20. These measures allowed the Company to pay down a further EUR47m of bank debt on a Cash Flow Basis. As a result, Net Debt reduced to EUR175m corresponding to Net debt/EBITDA (LTM) of 1.6x at the end of 9M20. As at the end of 9M20 ASTARTA complied with financial covenants. Summary P&L EURk 9M19 9M20 Revenues, including 325 711 290 548 Agriculture 147 522 121 287 Sugar production 86 809 87 093 Soybean processing 61 545 53 555 Cattle farming 24 947 -

Of the Public Purchasing Announcernº11 (85) March 13, 2012

Bulletin ISSN: 2078–5178 of the public purchasing AnnouncerNº11 (85) March 13, 2012 Announcements of conducting procurement procedures � � � � � � � � � 2 Announcements of procurement procedures results � � � � � � � � � � � � 69 Urgently for publication � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 141 Bulletin No�11 (85) March 13, 2012 Annoucements of conducting 06566 SOE “Donetsk Oblast Directorate on Liquidation procurement procedures of Unprofitable Coal–Mining Enterprises and Coal Refineries” (SOE “Donvuhlerestrukturyzatsiia”) Uspenskoho St., 86102 Makiivka, Donetsk Oblast 06541 SOE “Donetsk Coal and Energy Company” Nikulin Hryhorii Volodymyrovych 63 Artema St., 83001 Donetsk tel.: (06232) 9–33–02; Taran Viktor Mykolaiovych, Ahatii Volodymyr Valeriiovych, Martemianov Oleksandr tel./fax: (062) 302–81–61; Pavlovych, Tupchii Maryna Oleksandrivna e–mail: [email protected] tel.: (062) 345–79–68, 345–79–35, 382–61–67; Website of the Authorized agency which contains information on procurement: tel./fax: (062) 382–67–94; www.tender.me.gov.ua e–mail: [email protected] Procurement subject: physical liquidation of buildings and constructions Website of the Authorized agency which contains information on procurement: of mine “Petrovska” according to project on liquidation of www.tender.me.gov.ua “Petrovska” mine Website which contains additional information on procurement: www.duеk.dn.ua Supply/execution: Donetsk, mine “Petrovska”, May – August 2012 Procurement subject: code 02.01.1 – timber products (softwood mine prop), -

Of the Public Purchasing Announcernº12 (191) March 25, 2014

Bulletin ISSN: 2078–5178 of the public purchasing AnnouncerNº12 (191) March 25, 2014 Urgently for publication (procurement procedures) � � � � � � � � � � � � � � 2 Announcements of conducting procurement procedures � � � � � � � � � 3 Urgently for publication (procurement procedures results) � � � � � � � 24 Announcements of procurement procedures results � � � � � � � � � � � � 24 Other purchases � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 63 Bulletin No�12(191) March 25, 2014 Urgently for publication 003674 Main Administration of Veterinary Medicine (procurement procedures) in Donetsk Oblast 74 Artema St., 83001 Donetsk Khoziaienko Genadii Mykhailovych 003598 State Enterprise “National Nuclear Energy tel.: 3524003009108; Generating Company “Energoatom” tel./fax: (062) 305–44–48; 3 Vietrova St., 01032 Kyiv e–mail: [email protected] Chebrov Viktor Dmytrovych Website of the Authorized agency which contains information on procurement: tel.: (044) 206–97–56, 206–97–67; www.tender.me.gov.ua tel./fax: (044) 206–97–56, 206–97–67; Procurement subject: code 21.20.2 – miscellaneous pharmaceuticals e–mail: [email protected] (antirabic vaccine for oral immunization of carnivores Brovarabies V–RG) – Website of the Authorized agency which contains information on procurement: 600000 doses www.tender.me.gov.ua Supply/execution: Donetsk, Main Administration of Veterinary Medicine in Procurement subject: code 20.13.2 – chemical elements, not included into Donetsk Oblast; during 2014 other groups; inorganic -

Eastern Ukraine)

International Dragonfly Fund - Report 31 (2010): 1-41 1 The Odonata fauna of the basin of the river Severskyi Donets in its middle current (Eastern Ukraine) Alexander V. Martynov Entomology Department, Schmalhausen Institute of Zoology NAS of Ukraine, Kyiv, Ukraine. Email: [email protected], [email protected] Abstract A list of 57 Odonata species from 108 localities recorded in the basin of the river Severskyi Donets in its middle range (Eastern Ukraine) is provided. This compilation includes literature and museum data as well as results from field surveys realized between 2001 and 2009. Annotations to the history of regional odonate research are made. Brief descriptions of typical dragonfly habitats in the floodplain of Severskyi Donets are presented. Locality wise notes on the reproductive status for most of the species are made. Introduction Odonata from the territory of Ukraine were first mentioned in the ‘70s of the 18th century. Pallas (1771) lists Onychogomphus forcipatus from the rivers Don and Dnieper, and Lestes barbarus from the Crimean peninsula. Eichwald (1830) reports Leucorrhinia rubicunda from the Volhynia. Selys-Longchamps & Hagen (1850) note for the Crimea Calopteryx splendens and L. barbarus. The investigation of Severskyi Donets’ Odonata fauna in its middle range started in the 19th century. First odonatological studies in this region were realized by Ivanov (1876), Yaroshevsky (1881), and Rodzyanko (1889, 1895). Solodovnikov (1929) and Zakharenko (1974) are the only papers for a period of nearly 80 years that list any information about Odonata fauna of the region. However, these are fragmentary data sets about the basin of Severskyi Donets that do not add new species for Ukraine.