Chimei Innolux Corp. Form CB Filed 2012-09-04

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tainan Rental Market

Tainan Rental Market Setting the Right Expectations PEOPLE FIRST RELOCATION Tainan Rental Market – Setting the Right Expectations Please note, this article is for relocation management companies or human resource professionals relocating people to Tainan. The goal is to build a better understanding of the market norms and better set expectations for the relocating professional. If you like more information on Tainan or Taiwan market conditions, please feel free to contact me. Below is a deep dive into the Tainan rental market. I have broken down the most popular districts of Dongqiao Redevelopment Zone, Shanhua District, and Anping District. I also provided expectations before, during, and pre-departing the rental property. Many of the conditions are unique to the Tainan market and recommend review with your assignee pre-arrival. I would love to hear your experiences, The Top 4 Districts Shanhua District - (medium-high rents) the Tainan Science Park is divided up alphabetically into special administrative zones. The area for housing development is in the “L” and “M” zones. The Park is home to TSMC, ASML, Applied Materials, and many other tech companies. Science Park employees like this area as they are only a 5-10 minutes drive away to their offices. Getting to the high-speed rail station will take 30-40 minutes by car. Residents will also need to drive into Yongkang and Anping Districts to find nightlife and entertainment. For grocery shopping, you will also need to drive to nearby Yongkang District for shops like Carrefour, A-mart, and Majority of the housing consists of semi-to-fully detached townhouses. -

Independent Auditor's Limited Assurance Report of Old Mutual Unit Trust Managers (RF) (Pty) Ltd (The “Manager”)

KPMG Inc 4 Christiaan Barnard Street, Cape Town City Centre, Cape Town, 8000, PO Box 4609, Cape Town, 8001, South Africa Telephone +27 (0)21 408 7000 Fax +27 (0)21 408 7100 Docex 102 Cape Town Web http://www.kpmg.co.za/ Independent Auditor's Limited Assurance Report of Old Mutual Unit Trust Managers (RF) (Pty) Ltd (the “Manager”) To the unitholders of Old Mutual Core Conservative Fund We have undertaken our limited assurance engagement to determine whether the attached Schedule IB ‘Assets of the Fund held in compliance with Regulation 28’ at 31 December 2020 (the “Schedule”) has been prepared in terms of the requirements of Regulation 28 of the Pension Funds Act of South Africa (the “Regulation”) for Old Mutual Core Conservative Fund (the “Portfolio”), as set out on pages 4 to 39. Our engagement arises from our appointment as auditor of the Old Mutual Unit Trust Managers (RF) (Pty) Ltd and is for the purpose of assisting the Portfolio’s unitholders to prepare the unitholder’s Schedule IB ‘Assets of the Fund held in compliance with Regulation 28’ in terms of the requirements of Regulation 28(8)(b)(i). The Responsibility of the Directors of the Manager The Directors of the Manager are responsible for the preparation of the Schedule in terms of the requirements of the Regulation, and for such internal control as the Manager determines is necessary to enable the preparation of the Schedule that is free from material misstatements, whether due to fraud or error. Our Independence and Quality Control We have complied with the independence and other ethical requirements of the Code of Professional Conduct for Registered Auditors issued by the Independent Regulatory Board for Auditors (IRBA Code), which is founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. -

Knowledge Interaction and Spatial Dynamics in Industrial Districts

sustainability Article Knowledge Interaction and Spatial Dynamics in Industrial Districts Hai-Ping Lin 1,2 ID and Tai-Shan Hu 2,* ID 1 Department of Architecture and Urban Planning, Chung Hua University, Hsinchu City 300, Taiwan; [email protected] 2 Department of Urban Planning, National Cheng Kung University, Tainan City 701, Taiwan * Correspondence: [email protected]; Tel.: +886-6-275-7575 (ext. 54224) Received: 31 May 2017; Accepted: 8 August 2017; Published: 11 August 2017 Abstract: The knowledge economy plays a leading role in current socioeconomic development and has changed industrial development. This study addresses whether changes in industrial development have improved the knowledge innovation, technical level, and productive efficiency of industries. Taiwanese industries were typically labor and technology-intensive and policy-oriented manufacturing industries in the past. This study analyzes the change in the spatial distribution of industries in southern Taiwan, and further examines the effect of knowledge interactions between industries and the region on industrial development, as well as the restrictions and opportunities for future development. Industries in southern Taiwan have formed a solid foundation based on policies promoted in the past. Nevertheless, an over-reliance on policy guidance has impeded breakthroughs and motivation to learn. Analytical results indicate that industries with stable and changing clusters achieve sustainable economic growth by creating links for innovative knowledge interactions through collaboration with suppliers and competitors. Accordingly, knowledge sources depend not only on internal research and development but also on external interactions to stimulate innovation. Restated, the input of key knowledge generates a high output, provides opportunities for industry transformation, and decreases resource consumption to achieve environmental sustainability during development. -

Summary of Investments by Type

COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY TYPE Cost Market Value Fixed Income Investments $ $ Short-term investments 27,855,310 27,855,310 Bonds 173,219,241 174,637,768 Mortgage-backed securities 29,167,382 28,915,537 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 Total Fixed Income Investments 263,733,583 266,779,691 Equity-Type Investments Mutual funds Domestic 9,284,694 13,089,028 International 18,849,681 21,226,647 Common stocks Domestic 149,981,978 192,057,988 International 225,506,795 259,856,181 Total Equity-Type Investments 403,623,148 486,229,844 Alternative Investments Funds of hedge funds 38,264,990 46,646,700 Real estate trust fund 6,945,440 10,204,969 Total Alternatives Investments 45,210,430 56,851,669 TOTAL INVESTMENTS 712,567,160 809,861,204 Page 1 of 34 COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY FUND Cost Market Value Fixed Income Fund $ $ Short-term investments 6,967,313 6,967,313 Bonds 140,024,544 141,525,710 Mortgage-backed securities 27,878,101 27,642,277 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 208,361,608 211,506,377 Domestic Core Equity Fund Short-term investments 4,856,385 4,856,385 Common stocks 131,222,585 167,989,561 Futures - 19,895 Private placement 4,150 4,150 136,083,120 172,869,991 Small Cap Equity Fund Short-term investments 2,123,629 2,123,629 Mutual funds 9,284,694 13,089,028 Common stocks 18,755,243 -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

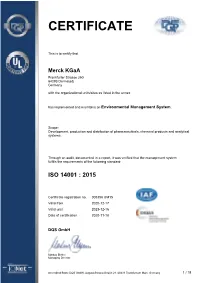

Certificate ISO 14001 From

CERTIFICATE This is to certify that Merck KGaA Frankfurter Strasse 250 64293 Darmstadt Germany with the organizational units/sites as listed in the annex has implemented and maintains an Environmental Management System. Scope: Development, production and distribution of pharmaceuticals, chemical products and analytical systems. Through an audit, documented in a report, it was verified that the management system fulfills the requirements of the following standard: ISO 14001 : 2015 Certificate registration no. 005356 UM15 Valid from 2020-12-17 Valid until 2023-12-16 Date of certification 2020-11-18 DQS GmbH Markus Bleher Managing Director Accredited Body: DQS GmbH, August-Schanz-Straße 21, 60433 Frankfurt am Main, Germany 1 / 19 Annex to certificate Registration No. 005356 UM15 Merck KGaA Frankfurter Strasse 250 64293 Darmstadt Germany Location Scope 005356 Development, production and distribution of Merck KGaA pharmaceuticals, chemical products and Frankfurter Straße 250 analytical systems. 64293 Darmstadt Including: Real Estate GmbH Merck Performance Materials Germany GmbH Merck Healthcare KGaA With regional offices at: Roesslerstrasse 96 64293 Darmstadt Waldstrasse 3 64331 Weiterstadt 450237 Merck S.A. Production and distribution of pharmaceuticals Estrada dos Bandeirantes, 1099 and chemical products. Rio de Janeiro - RJ 22710-571 Brazil 450240 Merck Serono SA Production and distribution of Zone Industrielle de l´Ouriettaz pharmaceuticals. 1170 Aubonne Switzerland 450325 Merck Serono SA Development and production of Corsier-sur-Vevey pharmaceuticals. Rte de Fenil 25 1804 Fenil-sur-Vevey Switzerland This annex (edition: 2020-11-18) is only valid in connection with the above-mentioned certificate. 2 / 19 Annex to certificate Registration No. 005356 UM15 Merck KGaA Frankfurter Strasse 250 64293 Darmstadt Germany Location Scope 450241 Merck & Cie Production of chemical products. -

Chapter 2 Hon Hai/Foxconn: Which Way Forward ?

Chapter 2 Hon Hai/Foxconn: which way forward ? Gijsbert van Liemt 1 1. Introduction Hon Hai/Foxconn, the world's leading contract manufacturer, assembles consumer electronics products for well-known brand-names. It is also a supplier of parts and components and has strategic alliances with many other such suppliers. Despite its size (over a million employees; ranked 32 in the Fortune Global 500) and client base (Apple, HP, Sony, Nokia), remarkably little information is publicly available on the company. The company does not seek the limelight, a trait that it shares with many others operating in this industry. Quoted on the Taiwan stock exchange, Hon Hai Precision Industry (HHPI) functions as an ‘anchor company’ for a conglomerate of companies. 2 As the case may be, HHPI is the sole, the majority or a minority shareholder in these companies and has full, partial or no control at all. Many subsidiaries use the trade name Foxconn and that is why this chapter refers to the company as Hon Hai/Foxconn. Among its many subsidiaries and affiliates are Ambit Microsystems, Cybermart, FIH Mobile, Fu Taihua Industrial, Hong Fujin Precision and Premier Image. After a near hundredfold increase in sales in the first decade of this century Hon Hai/Foxconn's sales growth slowed down drastically. The company is facing several challenges: slowing demand growth in its core (electronics) business; a weakening link with Apple, its main customer; rising labour costs and a more assertive labour force in China, its main production location; and pressure from its shareholders. 1. Copyright 2015 Gijsbert van Liemt. -

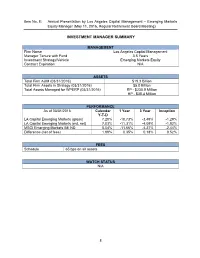

Investment Manager Summary

Item No. 8: Annual Presentation by Los Angeles Capital Management – Emerging Markets Equity Manager (May 11, 2016, Regular Retirement Board Meeting) INVESTMENT MANAGER SUMMARY MANAGEMENT Firm Name Los Angeles Capital Management Manager Tenure with Fund 3.5 Years Investment Strategy/Vehicle Emerging Markets Equity Contract Expiration N/A ASSETS Total Firm AUM (03/31/2016) $19.3 Billion Total Firm Assets in Strategy (03/31/2016) $5.0 Billion Total Assets Managed for WPERP (03/31/2016) RP - $230.9 Million HP - $38.4 Million PERFORMANCE As of 03/31/2016 Calendar 1 Year 3 Year Inception Y-T-D LA Capital Emerging Markets (gross) 7.20% -10.73% -3.49% -1.29% LA Capital Emerging Markets (est. net) 7.03% -11.31% -4.09% -1.92% MSCI Emerging Markets IMI ND 5.04% -11.66% -4.27% -2.44% Difference (net of fees) 1.99% 0.35% 0.18% 0.52% FEES Schedule 65 bps on all assets WATCH STATUS N/A 8 PRESENTATION FOR LOS ANGELES DEPARTMENT OF WATER & POWER EMPLOYEES’ RETIREMENT PLAN AND RETIREE HEALTH BENEFITS FUND LACM Emerging Markets Fund L.P. May 2016 LEGAL DISCLOSURES This presentation is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. Past performance is no guarantee of future results and diversification does not guarantee investment returns or eliminate the risk of loss. The strategies described herein have not been recommended by any Federal or State Securities Commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this presentation. -

List of Insured Financial Institutions (PDF)

401 INSURED FINANCIAL INSTITUTIONS 2021/5/31 39 Insured Domestic Banks 5 Sanchong City Farmers' Association of New Taipei City 62 Hengshan District Farmers' Association of Hsinchu County 1 Bank of Taiwan 13 BNP Paribas 6 Banciao City Farmers' Association of New Taipei City 63 Sinfong Township Farmers' Association of Hsinchu County 2 Land Bank of Taiwan 14 Standard Chartered Bank 7 Danshuei Township Farmers' Association of New Taipei City 64 Miaoli City Farmers' Association of Miaoli County 3 Taiwan Cooperative Bank 15 Oversea-Chinese Banking Corporation 8 Shulin City Farmers' Association of New Taipei City 65 Jhunan Township Farmers' Association of Miaoli County 4 First Commercial Bank 16 Credit Agricole Corporate and Investment Bank 9 Yingge Township Farmers' Association of New Taipei City 66 Tongsiao Township Farmers' Association of Miaoli County 5 Hua Nan Commercial Bank 17 UBS AG 10 Sansia Township Farmers' Association of New Taipei City 67 Yuanli Township Farmers' Association of Miaoli County 6 Chang Hwa Commercial Bank 18 ING BANK, N. V. 11 Sinjhuang City Farmers' Association of New Taipei City 68 Houlong Township Farmers' Association of Miaoli County 7 Citibank Taiwan 19 Australia and New Zealand Bank 12 Sijhih City Farmers' Association of New Taipei City 69 Jhuolan Township Farmers' Association of Miaoli County 8 The Shanghai Commercial & Savings Bank 20 Wells Fargo Bank 13 Tucheng City Farmers' Association of New Taipei City 70 Sihu Township Farmers' Association of Miaoli County 9 Taipei Fubon Commercial Bank 21 MUFG Bank 14 -

Company Response Status and Score Company Response Status and Score

2017 Company response status and score Company response status and score Key to response status: AQ Answered questionnaire AQ (NP) Answered questionnaire but response not made public AQ (SA) Company is either a subsidiary or has merged during the reporting process; see Company in parenthesis for further information AQ (L) Answered questionnaire after submission deadline DP Declined to participate NR No response RV Responded voluntarily 1 Score levels: The levels build consecutively from Disclosure to Leadership. A threshold of 75% in a lower level has to be passed before a company is scored for the next level. For more information, please see our Introduction to Scoring. A Leadership A- B Management B- C Awareness C- D Disclosure D- F: Failure to provide sufficient information to CDP to be evaluated for this purpose 2 Company Response Status Ticker Country HQ CDP Band and Score Consumer Discretionary ABC-Mart, Inc. NR 2670 JP Japan Failure to disclose (F) AccorHotels DP AC FP France Failure to disclose (F) Adastria Co., Ltd. NR 2685 JP Japan Failure to disclose (F) adidas AG AQ ADS GR Germany Leadership (A-) Advance Auto Parts Inc NR AAP US USA Failure to disclose (F) Aisin Seiki Co., Ltd. AQ (NP) 7259 JP Japan Awareness (C) AKSA AKRILIK KIMYA SANAYII A.S. DP AKSA TI Turkey Failure to disclose (F) Anta Sports Products Ltd NR 2020 HK Hong Kong Failure to disclose (F) Aoyama Trading Co., Ltd. NR 8219 JP Japan Failure to disclose (F) 1 Companies that respond voluntarily to CDP are not scored unless they request this service. -

China Steel Corporation and Subsidiaries

China Steel Corporation and Subsidiaries Consolidated Financial Statements for the Three Months Ended March 31, 2021 and 2020 and Independent Auditors’ Review Report The engagement partners on the reviews resulting in this independent auditors’ review report are Jui-Hsuan Hsu and Cheng-Hung Kuo. Deloitte & Touche Taipei, Taiwan Republic of China May 7, 2021 Notice to Readers The accompanying consolidated financial statements are intended only to present the consolidated financial position, financial performance and cash flows in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards, procedures and practices to review such consolidated financial statements are those generally applied in the Republic of China. For the convenience of readers, the independent auditors’ review report and the accompanying consolidated financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language independent auditors’ review report and consolidated financial statements shall prevail. - 2 - CHINA STEEL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thousands of New Taiwan Dollars) March 31, 2021 (Reviewed) December 31, 2020 (Audited) March 31, 2020 (Reviewed) ASSETS Amount % Amount % Amount % CURRENT ASSETS Cash and -

台灣鄉鎮名中英對照 2 Page 7 Pt Bilingual Taiwantwnship Names__For Church Data Maps

台灣鄉鎮名中英對照 2 page 7 pt Bilingual TaiwanTwnship Names__For Church Data Maps Bilingual Names For 46. Taishan District 泰山區 93. Cholan Town 卓蘭鎮 142. Fenyuan Twnship 芬園鄉 Taiwan Cities, Districts, 47. Linkou District 林口區 94. Sanyi Township 三義鄉 143. Huatan Township 花壇鄉 Towns, and Townships 48. Pali District 八里區 95. Yuanli Town 苑裏鎮 144. Lukang Town 鹿港鎮 For Church Distribution Maps 145. Hsiushui Twnship 秀水鄉 Taoyuan City 桃園市 Taichung City 台中市 146. Tatsun Township 大村鄉 49. Luchu Township 蘆竹區 96. Central District 中區 147. Yuanlin Town 員林鎮 Taipei City 台北市 50. Kueishan Twnship 龜山區 97. North District 北區 148. Shetou Township 社頭鄉 1. Neihu District 內湖區 51. Taoyuan City 桃園區 98. West District 西區 149. YungchingTnshp 永靖鄉 2. Shihlin District 士林區 52. Pate City 八德區 99. South District 南區 150. Puhsin Township 埔心鄉 3. Peitou District 北投區 53. Tahsi Town 大溪區 100. East District 東區 151. Hsihu Town 溪湖鎮 4. Sungshan District 松山區 54. Fuhsing Township 復興區 101. Peitun District 北屯區 152. Puyen Township 埔鹽鄉 5. Hsinyi District 信義區 55. Lungtan Township 龍潭區 102. Hsitun District 西屯區 153. Fuhsing Twnship 福興鄉 6. Taan District 大安區 56. Pingchen City 平鎮區 103. Nantun District 南屯區 154. FangyuanTwnshp 芳苑鄉 7. Wanhua District 萬華區 57. Chungli City 中壢區 104. Taan District 大安區 155. Erhlin Town 二林鎮 8. Wenshan District 文山區 58. Tayuan District 大園區 105. Tachia District 大甲區 156. Pitou Township 埤頭鄉 9. Nankang District 南港區 59. Kuanyin District 觀音區 106. Waipu District 外埔區 157. Tienwei Township 田尾鄉 10. Chungshan District 中山區 60. Hsinwu Township 新屋區 107. Houli District 后里區 158. Peitou Town 北斗鎮 11.