Independent Auditor's Limited Assurance Report of Old Mutual Unit Trust Managers (RF) (Pty) Ltd (The “Manager”)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary of Investments by Type

COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY TYPE Cost Market Value Fixed Income Investments $ $ Short-term investments 27,855,310 27,855,310 Bonds 173,219,241 174,637,768 Mortgage-backed securities 29,167,382 28,915,537 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 Total Fixed Income Investments 263,733,583 266,779,691 Equity-Type Investments Mutual funds Domestic 9,284,694 13,089,028 International 18,849,681 21,226,647 Common stocks Domestic 149,981,978 192,057,988 International 225,506,795 259,856,181 Total Equity-Type Investments 403,623,148 486,229,844 Alternative Investments Funds of hedge funds 38,264,990 46,646,700 Real estate trust fund 6,945,440 10,204,969 Total Alternatives Investments 45,210,430 56,851,669 TOTAL INVESTMENTS 712,567,160 809,861,204 Page 1 of 34 COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY FUND Cost Market Value Fixed Income Fund $ $ Short-term investments 6,967,313 6,967,313 Bonds 140,024,544 141,525,710 Mortgage-backed securities 27,878,101 27,642,277 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 208,361,608 211,506,377 Domestic Core Equity Fund Short-term investments 4,856,385 4,856,385 Common stocks 131,222,585 167,989,561 Futures - 19,895 Private placement 4,150 4,150 136,083,120 172,869,991 Small Cap Equity Fund Short-term investments 2,123,629 2,123,629 Mutual funds 9,284,694 13,089,028 Common stocks 18,755,243 -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

Chapter 2 Hon Hai/Foxconn: Which Way Forward ?

Chapter 2 Hon Hai/Foxconn: which way forward ? Gijsbert van Liemt 1 1. Introduction Hon Hai/Foxconn, the world's leading contract manufacturer, assembles consumer electronics products for well-known brand-names. It is also a supplier of parts and components and has strategic alliances with many other such suppliers. Despite its size (over a million employees; ranked 32 in the Fortune Global 500) and client base (Apple, HP, Sony, Nokia), remarkably little information is publicly available on the company. The company does not seek the limelight, a trait that it shares with many others operating in this industry. Quoted on the Taiwan stock exchange, Hon Hai Precision Industry (HHPI) functions as an ‘anchor company’ for a conglomerate of companies. 2 As the case may be, HHPI is the sole, the majority or a minority shareholder in these companies and has full, partial or no control at all. Many subsidiaries use the trade name Foxconn and that is why this chapter refers to the company as Hon Hai/Foxconn. Among its many subsidiaries and affiliates are Ambit Microsystems, Cybermart, FIH Mobile, Fu Taihua Industrial, Hong Fujin Precision and Premier Image. After a near hundredfold increase in sales in the first decade of this century Hon Hai/Foxconn's sales growth slowed down drastically. The company is facing several challenges: slowing demand growth in its core (electronics) business; a weakening link with Apple, its main customer; rising labour costs and a more assertive labour force in China, its main production location; and pressure from its shareholders. 1. Copyright 2015 Gijsbert van Liemt. -

Information Statement 2021

OLD MUTUAL LIMITED (Incorporated in the Republic of South Africa with limited liability under registration number 2017/235138/06) OLD MUTUAL LIFE ASSURANCE COMPANY (SOUTH AFRICA) LIMITED (Incorporated in the Republic of South Africa with limited liability under registration number 1999/004643/06) OLD MUTUAL INSURE LIMITED (Incorporated in the Republic of South Africa with limited liability under registration number 1970/006619/06) INFORMATION STATEMENT in respect of the ZAR25,000,000,000 NOTE PROGRAMME Old Mutual Limited (OML), Old Mutual Life Assurance Company (South Africa) Limited (OMLACSA) and Old Mutual Insure Limited (Old Mutual Insure, together with OML and OMLACSA, the Issuers or relevant Issuer) intend, from time to time to issue notes (the Notes) under the ZAR25,000,000,000 Note Programme (the Programme) on the basis set out in the Programme Memorandum dated 4 March 2020, as amended and restated from time to time (the Programme Memorandum). The Notes may be issued on a continuing basis and be placed by one or more of the Dealers specified in the section headed “Summary of Programme” in the Programme Memorandum and any additional Dealer(s) appointed under the Programme from time to time by the relevant Issuer, which appointment may be for a specific issue or on an ongoing basis. The specific aggregate nominal amount, the status, maturity, interest rate, or interest rate formula and dates of payment of interest, purchase price to be paid to the relevant Issuer, any terms for redemption or other special terms, currency or currencies, -

Old Mutual Global Investors Series Plc

OLD MUTUAL GLOBAL INVESTORS SERIES PLC An investment company with variable capital incorporated with limited liability in Ireland, established as an umbrella fund with segregated liability between Sub-Funds and authorised pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended, and the Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2015 (Registered Number 271517) Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 Old Mutual Global Investors Series Plc Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 CONTENTS PAGE Directory 4 - 8 GeneralInformation 9-12 Investment Advisers’ Reports: Old Mutual China Equity Fund 13 Old Mutual Global Strategic Bond Fund (IRL) 14 Old Mutual World Equity Fund 15 Old Mutual Pacific Equity Fund 16 Old Mutual European Equity Fund 17 Old Mutual Japanese Equity Fund^ 18 Old Mutual US Equity Income Fund 19 Old Mutual North American Equity Fund 20 Old Mutual Total Return USD Bond Fund 21 Old Mutual Emerging Market Debt Fund 22 OldMutualEuropeanBestIdeasFund 23 Old Mutual Investment Grade Corporate Bond Fund 24 Old Mutual Global Emerging Markets Fund 25 Old Mutual Asian Equity Income Fund 26 Old Mutual Local Currency Emerging Market Debt Fund 27 Old Mutual UK Alpha Fund (IRL) 28 Old Mutual UK Smaller Companies Focus Fund 29 Old Mutual UK Dynamic Equity -

Old Mutual Limited - Climate Change 2020

Old Mutual Limited - Climate Change 2020 C0. Introduction C0.1 CDP Page 1 of 53 (C0.1) Give a general description and introduction to your organization. Old Mutual was started in Africa in 1845, and rapidly developed into a recognised brand across much of Southern Africa. Over the years our business expanded internationally and in 1999 we listed on the London Stock Exchange. In March 2016, it was decided that the best way forward for the Old Mutual Group was to separate its four strong businesses into independent, standalone companies. The foremost aim of this strategy – called Managed Separation – has been to unlock and create value for shareholders. In short, it became clear that the Group’s complex structure and the high running costs of operating in diverse geographies and regulatory environments actually locked in value. To unlock that value, a Managed Separation of the four underlying businesses – Old Mutual Emerging Markets, Nedbank, UK based Old Mutual Wealth and US based Old Mutual Asset Management – was necessary. As part of that Managed Separation, it was agreed that Old Mutual Emerging Markets (OMEM) would strengthen its focus on Africa and move its primary listing to Africa. As Old Mutual Limited, our primary listing is now on the Johannesburg Stock Exchange. We also have a standard listing on the London Stock Exchange and secondary listings on three other stock exchanges in Africa: Namibia, Malawi and Zimbabwe. The growth opportunities in Africa are enormous and exciting – and we are well positioned to make the most of those opportunities, while contributing significantly to the socio-economic progress of the communities we operate in. -

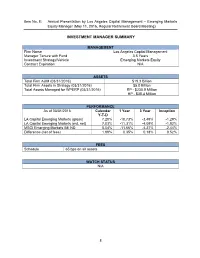

Investment Manager Summary

Item No. 8: Annual Presentation by Los Angeles Capital Management – Emerging Markets Equity Manager (May 11, 2016, Regular Retirement Board Meeting) INVESTMENT MANAGER SUMMARY MANAGEMENT Firm Name Los Angeles Capital Management Manager Tenure with Fund 3.5 Years Investment Strategy/Vehicle Emerging Markets Equity Contract Expiration N/A ASSETS Total Firm AUM (03/31/2016) $19.3 Billion Total Firm Assets in Strategy (03/31/2016) $5.0 Billion Total Assets Managed for WPERP (03/31/2016) RP - $230.9 Million HP - $38.4 Million PERFORMANCE As of 03/31/2016 Calendar 1 Year 3 Year Inception Y-T-D LA Capital Emerging Markets (gross) 7.20% -10.73% -3.49% -1.29% LA Capital Emerging Markets (est. net) 7.03% -11.31% -4.09% -1.92% MSCI Emerging Markets IMI ND 5.04% -11.66% -4.27% -2.44% Difference (net of fees) 1.99% 0.35% 0.18% 0.52% FEES Schedule 65 bps on all assets WATCH STATUS N/A 8 PRESENTATION FOR LOS ANGELES DEPARTMENT OF WATER & POWER EMPLOYEES’ RETIREMENT PLAN AND RETIREE HEALTH BENEFITS FUND LACM Emerging Markets Fund L.P. May 2016 LEGAL DISCLOSURES This presentation is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. Past performance is no guarantee of future results and diversification does not guarantee investment returns or eliminate the risk of loss. The strategies described herein have not been recommended by any Federal or State Securities Commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this presentation. -

Old Mutual at a Glance

OLD MUTUAL AT A GLANCE OUR STRATEGY Contents To drive strategic growth, through leveraging the Introduction 1 strength of our people What we do 2 and through accelerating Where we do it 4 Our business in more detail 5 collaboration between Summary of our strategy to date 10 our businesses: Our focus Our strategy going forward 12 is to expand in South Africa, Responsible business 14 Africa and other selected Our history 16 Group Executive Committee 18 emerging markets; and Old Mutual – On the move 20 to improve and grow Get connected 21 Old Mutual Wealth and our US Asset Management businesses OUR VISION To be our customers’ most trusted partner – passionate about helping them achieve their lifetime financial goals OUR VALUES ■■ Integrity ■■ Respect ■■ Accountability ■■ Pushing beyond boundaries GROUP CHIEF EXECUTIVE’S INTRODUCTION OLD MUTUAL IS AN INTERNATIONAL LONG-TERM SAVINGS, PROTECTION, BANKING AND INVESTMENT GROUP Old Mutual Old Mutual was founded in South Africa in 1845, and today provides life assurance, asset management, general insurance and banking services to more than 14 million customers in Africa, Asia, the Americas and Europe. We are listed on the London and Johannesburg stock exchanges and are members of the FTSE-100 and Fortune 500. Focus on customers We aim to provide affordable financial services to our customers. Our customers are at the heart of everything we do and we know that ultimately our success is governed by our ability to give them the products, outcomes and service levels that they demand. We have spent the past three years ensuring that our business’ primary focus is our Julian Roberts customers and that this ethos is embedded across the Group Chief Executive entire Group. -

International Companies with U.S. Branches

INTERNATIONAL COMPANIES WITH U.S. BRANCHES ® CLEMSON UNIVERSITY MICHELIN CAREER CENTER Company: Home Country: Type of Business: Royal Dutch/Shell Group Netherlands oil & gas Royal Dutch/Shell Group United Kingdom oil & gas BP United Kingdom oil & gas DaimlerChrysler Germany automobile Toyota Motor Japan automobile Mitsubishi Japan trading & distribution Mitsui & Co Japan trading & distribution Allianz Worldwide Germany insurance ING Group Netherlands diversified finance Volkswagen Group Germany automobile Sumitomo Japan trading & distribution Marubeni Japan trading & distribution Hitachi Japan electronic equipment Honda Motor Japan automobile AXA Group France insurance Sony Japan household durables Ahold Netherlands food & drug retail Nestle Switzerland food products Nissan Motor Japan automobile Credit Suisse Group Switzerland diversified finance Deutsche Bank Group Germany diversified finance BNP Paribas France bank Deutsche Telekom Germany telecom services Aviva United Kingdom insurance Generali Group Italy insurance Samsung Electronics South Korea semiconductor equip & prods Vodafone United Kingdom wireless telecom svcs Toshiba Japan electronic equipment ENI Italy oil & gas Unilever Netherlands food products Unilever United Kingdom food products Fortis Netherlands diversified finance France Telecom France telecom services UBS Switzerland diversified finance HSBC Group United Kingdom bank BMW-Bayerische Motor Germany automobile NEC Japan computers & peripherals Fujitsu Japan computers & peripherals Bayer HypoVereinsbank Germany bank -

Chimei Innolux Corp. Form CB Filed 2012-09-04

SECURITIES AND EXCHANGE COMMISSION FORM CB Notification form filed in connection with certain tender offers, business combinations and rights offerings, in which the subject company is a foreign private issuer of which less than 10% of its securities are held by U.S. persons Filing Date: 2012-09-04 SEC Accession No. 0001486620-12-000015 (HTML Version on secdatabase.com) SUBJECT COMPANY Chimei Innolux Corp. Mailing Address Business Address NO. 160, KESYUE RD. NO. 160, KESYUE RD. CIK:1392387| IRS No.: 000000000 | State of Incorp.:D8 | Fiscal Year End: 1231 JHUNAN SCIENCE PARK JHUNAN SCIENCE PARK Type: CB | Act: 34 | File No.: 005-86971 | Film No.: 121069645 MIAOLI COUNTY 350 F5 MIAOLI COUNTY 350 F5 00000 00000 886-6-5051888 FILED BY Chimei Innolux Corp. Mailing Address Business Address NO. 160, KESYUE RD. NO. 160, KESYUE RD. CIK:1392387| IRS No.: 000000000 | State of Incorp.:D8 | Fiscal Year End: 1231 JHUNAN SCIENCE PARK JHUNAN SCIENCE PARK Type: CB MIAOLI COUNTY 350 F5 MIAOLI COUNTY 350 F5 00000 00000 886-6-5051888 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form CB TENDER OFFER/RIGHTS OFFERING NOTIFICATION FORM (AMENDMENT NO. ______) Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to file this Form: Securities Act Rule 801 (Rights Offering) x Securities Act Rule 802 (Exchange Offer) o Exchange Act Rule 13e-4(h)(8) (Issuer Tender Offer) o Exchange Act Rule 14d-1(c) (Third Party Tender o Offer) Exchange Act Rule 14e-2(d) (Subject Company o Response) Filed or submitted in paper if permitted by Regulation S-T Rule 101(b)(8) o Note: Regulation S-T Rule 101(b)(8) only permits the filing or submission of a Form CB in paper by a party that is not subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act. -

Company Response Status and Score Company Response Status and Score

2017 Company response status and score Company response status and score Key to response status: AQ Answered questionnaire AQ (NP) Answered questionnaire but response not made public AQ (SA) Company is either a subsidiary or has merged during the reporting process; see Company in parenthesis for further information AQ (L) Answered questionnaire after submission deadline DP Declined to participate NR No response RV Responded voluntarily 1 Score levels: The levels build consecutively from Disclosure to Leadership. A threshold of 75% in a lower level has to be passed before a company is scored for the next level. For more information, please see our Introduction to Scoring. A Leadership A- B Management B- C Awareness C- D Disclosure D- F: Failure to provide sufficient information to CDP to be evaluated for this purpose 2 Company Response Status Ticker Country HQ CDP Band and Score Consumer Discretionary ABC-Mart, Inc. NR 2670 JP Japan Failure to disclose (F) AccorHotels DP AC FP France Failure to disclose (F) Adastria Co., Ltd. NR 2685 JP Japan Failure to disclose (F) adidas AG AQ ADS GR Germany Leadership (A-) Advance Auto Parts Inc NR AAP US USA Failure to disclose (F) Aisin Seiki Co., Ltd. AQ (NP) 7259 JP Japan Awareness (C) AKSA AKRILIK KIMYA SANAYII A.S. DP AKSA TI Turkey Failure to disclose (F) Anta Sports Products Ltd NR 2020 HK Hong Kong Failure to disclose (F) Aoyama Trading Co., Ltd. NR 8219 JP Japan Failure to disclose (F) 1 Companies that respond voluntarily to CDP are not scored unless they request this service. -

South African Insurers: Simran Parmar Ali Karakuyu Sustained Capital Resilience, Amid Grey Clouds Liesl Saldanha

Trevor Barsdorf South African Insurers: Simran Parmar Ali Karakuyu Sustained Capital Resilience, Amid Grey Clouds Liesl Saldanha March 16, 2021 Key Takeaways – SouthSouth AfricanAfrican insurersinsurers havehave demonstrateddemonstrated resilientresilient creditworthinesscreditworthiness basedbased onon theirtheir strongstrong capitalcapital metrics,metrics, despitedespite aa weakweak operatingoperating environmentenvironment andand thethe ongoingongoing pandemic.pandemic. AlthoughAlthough earningsearnings generationgeneration hashas weakened,weakened, wewe seesee thethe pandemicpandemic asas anan earningsearnings event.event. – EconomicEconomic recoveryrecovery prospectsprospects andand debtdebt consolidationconsolidation overover thethe mediummedium termterm dependdepend onon macroeconomicmacroeconomic conditions.conditions. TheseThese affectaffect thethe overalloverall operatingoperating environmentenvironment andand assetasset qualityquality withinwithin thethe sector.sector. – WeakWeak economiceconomic growthgrowth prospectsprospects andand thethe riskrisk ofof aa slowerslower recoveryrecovery willwill depressimpact the the sector’s sector’s performance performance in in 2021 2021.. WeWe expectexpect GDPGDP growthgrowth willwill reboundrebound toto 3.6%3.6% inin 20212021 afterafter aa sharpsharp recessionrecession estimatedestimated atat 7.0%7.0% inin 2020.2020. TheThe technicaltechnical recoveryrecovery withinwithin thethe insuranceinsurance sectorsector isis likelylikely toto bebe similar,similar, butbut growthgrowth isis likelylikely