DRB-HICOM BERHAD: Potential New MYR 3-Year Bond at 6% What's Happening? Based on the Information We Have Received from Bond Un

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lampiran 1 - Hotline Perintah Kawalan Pergerakan

Lampiran 1 - Hotline Perintah Kawalan Pergerakan No. Company Name Contact Number En. Izham Ab Wahab 013-2936414 En. Rosmawardi Bin Razali @ Ramli 013-3644264 Ms. Vilashini A/P Ananda Rajah 012-7005686 En. Noor Faizal Azman 012-3122404 1 HICOM HOLDINGS BERHAD Pn. Nur Asyati Abdullah (Tina) 012-3159941 Pn. Nor Suriawati Abdullah 012-2965004 En. Raja Reza Affandi Bin Raja Aris 012-6141190 En. Mohd Ashraf Bin Ashari 013-3928123 Pn. Nor Alfareena Mohd Azlee 010-2224550 2 AUTOMOTIVE CORPORATION (M) SDN BHD Pn. Nornaemah Tan 016-2191690 En. Mahazir Ahmad 019-6556169 3 COMPOSITES TECHNOLOGY RESEARCH (M) SDN BHD Pn. Haileena Binti Husin 012-2225402 En. Noor Azizi Bin Ismail 013-3096513 Pn. Siti Rosnani Samsudin 019-2403507 4 DRB-HICOM AUTO SOLUTIONS SDN BHD En. Ahmad Khusairi Sijot 011-65522084 En. Mohd redzuan Bin Yahaya 019-4272628 MOTOSIKAL DAN ENJIN NASIONAL SDN BHD Pn. Rohaida Bt Mohamad 017-5106304 5 EDARAN MODENAS SDN BHD Pn. Fathilah Binti Awang 012-4726864 Pn. Citthana Sengsureeja A/P Tin @ Pin 012-7125206 En. Che Zulhaimee Abdullah 019-6224300 6 HONDA MALAYSIA SDN BHD Ms. Joyce 019-6633871 7 ISUZU MALAYSIA SDN BHD Ms. Sin Sze Wan 012-6936535 8 DRB-HICOM COMMERCIAL VEHICLES SDN BHD Pn. Mega Silfia Mimi 017-3880944 Pn. Rashida Mat Rani 012 218 5672 Pn. Rosmawati Abd Rahman 013 990 0989 9 EDARAN OTOMOBIL NASIONAL BERHAD Pn. Nursyawani binti Mohd Sahril 017 393 1543 Pn. Romaizatul Shaqira binti Mohamad Rom 011 51557147 En. Muhammad Firdaus Saidi 013-7700560 10 HICOM DIECASTINGS SDN BHD Pn. Mariati Maksom 019-2774026 En. -

Estudios De Mercado El Mercado De Los Automóvi- Les En Malasia

Oficina Económica y Comercial de la Embajada de España en Malasia El mercado de los Automóvi- les en Malasia 1 Estudios de Mercado El mercado de los Automóvi- les en Malasia Este estudio ha sido realizado por Joaquín Monreal bajo la supervisión de la Oficina Económica y Co- 2 Estudios de Mercado mercial de la Embajada de España en Kuala Lumpur Agosto de 2006 EL MERCADO DE LOS AUTOMOVILES EN MALASIA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 4 I. INTRODUCCIÓN 5 1. Definición y características del sector y subsectores relacionados 5 2. Situación del sector en españa 8 II. ANÁLISIS DE LA OFERTA 10 1. Análisis cuantitativo 10 1.1. Tamaño de la oferta 10 2. Análisis cualitativo 12 2.1. Producción 12 2.2. Precios 14 2.3. Importaciones 16 2.4. Obstáculos comerciales: La NAP 29 2.5. El sistema de permisos para la matriculación 30 III. ANÁLISIS DEL COMERCIO 31 1. Canales de distribución 31 IV. ANÁLISIS DE LA DEMANDA 33 1. Evaluación del volumen de la demanda 33 1.1. Coyuntura económica. 33 1.2. Infraestucturas 34 1.3. Tendencias del consumo y situación del mercado nacional 34 1.4. Tendencias industriales 39 2. Estructura del mercado 39 3. Percepción del producto español 39 V. ANEXOS 41 1. Ensambladores de automóviles 41 2. Distribuidores y concesionarios 46 3. Informes de ferias 56 Oficina Económica y Comercial de la Embajada de España en Kuala Lumpur 3 EL MERCADO DE LOS AUTOMOVILES EN MALASIA RESUMEN Y PRINCIPALES CONCLUSIONES La industria de la automoción en Malasia es junto con la electrónica la industria más impor- tante en el sector manufacturero de Malasia, y de los más importantes dentro del Sudeste Asiático. -

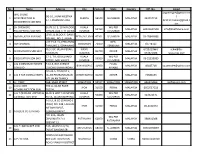

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Trainer Profile

TRAINER PROFILE Biographical Information Name : Nelson Kok Age : 55 Year of Birth : 1963 Nationality : Malaysian Address : 1-2-29, Elit Avenue, Jalan Mayang Pasir 3, 11950, Bayan Lepas, Penang, Malaysia Languages : English, Malay (Written/Verbal) Dialect (Spoken) : Cantonese, Hokkien Personal Contact : +60-12-4922718 (mobile) Email: [email protected] Website: http://www.mytrainingprovider.com Professional Qualifications Qualifications Institution / Year Awarded - Master in Business Administration (MBA) - Universiti Sains Malaysia, 1997 - B.Sc (Hons) in Physics - Universiti Sains Malaysia, 1987 - Certified Trainer - Zenger-Miller Leadership Center, 1993 - Personality I.D. ® Consultant - Crown Financial Ministries, 2014 Work Experience CONSULTANT TRAINER Nelson Kok is a Consultant Trainer who has obtained his Master degree in Business Administration (MBA) and a B.Sc (Hons) degree in Geophysics from the Universiti Sains Malaysia (USM), Malaysia. He is a certified Trainer since 1993 and a Personality I.D ® Consultant. He has over 31 years of work experiences in Multi-nationals, Multi-racial settings, specializing in the area of Learning and Development. He travels widely and enjoys working with all levels of employees, from the Top Management all the way to Operators level. Throughout his career he had held various management positions (General Manager, Human Resources Manager, Training Manager, TQM Manager, and Production Manager) in multi-national Hi-Tech global manufacturing corporations, as well as local Malaysian companies before establishing his own training and consultancy firm. He now serves as a Consultant and Corporate Trainer to several established training providers throughout Malaysia, Indonesia, Singapore, Brunei, Sudan, Oman, Kingdom of Saudi Arabia (K.S.A) and the United Arab Emirates (U.A.E). -

Realising Opportunities Realising (Incorporated (Incorporated in Malaysia)

DRB-HICOM Berhad (203430-W) (Incorporated in Malaysia) Realising Opportunities Annual Report 2010 www.drb-hicom.com www.drb-hicom.com Level 5, Wisma DRB-HICOM, No. 2, Jalan Usahawan U1/8, Seksyen U1, 40150 Shah Alam, Selangor Darul Ehsan. Tel: (03) 2052 8000 • Fax: (03) 2052 8099 Annual Report 2010 (Incorporated in Malaysia) REALISING OPPORTUNITIES DRB-HICOM measures the success of our long-term vision by raising the bar of excellence and scaling greater heights. Our leading position in the industry has enabled DRB-HICOM to reinvigorate its strengths, enhancing performance and deliverables. Akin to the feat of a mountain climber, we scale to new heights of achievements, realising opportunities and creating sustainable environments. Through strategic investments and leading growth streams, leveraging on firm foundations, we continue to grow from strength to strength, enhancing lives of millions and delivering value for generations. contents DRB-HICOM BERHAD • 2010 ANNUAL REPORT HIGHLIGHTS CORPORATE PERFORMANCE LEADERSHIP DISCLOSURE REVIEW 4 NOTICE OF ANNUAL 13 CORPORATE PROFILE 30 GROup’S FIVE YEARS 32 BOARD OF DIRECTORS GENERAL MEETING FINANCIAL HIGHLIGHTS 14 MEDIA HIGHLIGHTS 34 ProFILE OF DIRECTORS 5 STATEMENT 16 CALENDAR OF EVENTS 42 MANAGEMENT TEAM ACCOMPANYING NOTICE OF ANNUAL GENERAL 24 FinanciaL CALENDAR MEETING 25 CORPORATE INFORMATION 6 MILESTONES 1980-2009 26 GROUP CORPORATE STRUCTURE 28 GROUP CORPORATE STRUCTURE BY SECTOR ourvision >> missionstatement > > sharedvalues > > T O be N U mber 1 and T O L ead in the gro W th • EXCELLENCE c o n t i n u o u s l y e x c e l O F the N ation in the • Decorum • TEAmWorK IN ALL THAT WE DO. -

A Study of Turnover Rate Among Car Salesman in Pulau Pinang, Malaysia

A STUDY OF TURNOVER RATE AMONG CAR SALESMAN IN PULAU PINANG, MALAYSIA BY LEE KEAT NEE LOH PHUI MANN SOO MOONG YEE TEH YONG YEE WONG PIT CHEE A research project submitted in partial fulfillment of the requirement for the degree of BACHELOR OF BUSINESS ADMINISTRATION (HONS) UNIVERSITI TUNKU ABDUL RAHMAN FACULTY OF BUSINESS AND FINANCE DEPARTMENT OF BUSINESS AUGUST 2013 Copyright @ 2013 ALL RIGHTS RESERVED. No part of this paper may be reproduced, stored in a retrieved system, or transmitted in any form or by any means, graphic, electronic, mechanical, photocopying, recording, scanning, or otherwise, without the prior consent of the authors. ii DECLARATION We hereby declare that: 1) This undergraduate research project is the end result of our own work and that due acknowledgement has been given in the references to ALL sources of information be they printed, electronic, or personal. 2) No portion of this research project has been submitted in support of any application for any other degree or qualification of this or any other university, or other institutes of learning. 3) Equal contribution has been made by each group member in completing the research project. 4) The word count of this research report is 26748 words. Name of Student: Student ID: Signature: 1. LEE KEAT NEE 11ABB00131 ___________ 2. LOH PHUI MANN 11ABB00052 ___________ 3. SOO MOONG YEE 10ABB05392 ___________ 4. TEH YONG YEE 11ABB00130 ___________ 5. WONG PIT CHEE 11ABB00477 ___________ Date: 15 August 2013 iii ACKNOWLEDGEMENT We sincerely appreciate this given opportunity to express our deepest gratitude to those who have made this dissertation possible. -

Australian Journal of Basic and Applied Sciences Processes Of

Australian Journal of Basic and Applied Sciences, 9(13) Special 2015, Pages: 5-11 ISSN:1991-8178 Australian Journal of Basic and Applied Sciences Journal home page: www.ajbasweb.com Processes of Warehouse Management In Automotive Industry – A Study Dr (Mrs.) Muneer Sultana, Mohd Hizam Hashim, Dr Putri Rozita Tahir, Samsudin Shafii Department of Business and Management, International College of Automotive, DRB-HICOM, Automotive Complex, Peramujaya, Industrial Area, Post Box .8,26607, Pekan, Pahang. Malaysia ARTICLE INFO ABSTRACT Article history: Background: Warehouse is very important for achievement or failure of businesses. Received 22 February 2015 Warehouses play a serious intermediate part between supply chain followers, affecting Accepted 20 March 2015 supply chain costs and service to justify supply chain procedures and to manage them Available online 23 April 2015 more efficiently, many corporations have set up centralized production and warehouse services over the previous periods. This has caused in greater warehouses responsible Keywords: for the delivery to a better variety of additional demanding consumers in a massive area Automotive, Industry, Warehouse, and, therefore, with more multifaceted inside logistic processes. Warehouse processes Management, Supply chain, Vehicles, that need to be prearranged and organized include inbound flow handling, product-to- Processes location assignment, product storage, order-to-stock location allocation, order batching Type: Research Paper. and release, order picking, packing, value-added logistics activities, and shipment. The complexity of warehouse processes has increased intensely in the past decade. Warehouse processes have been affected by consumers, demands for quick reply and automation, with its subsequent decrease in enrolment and paperwork. Objective: A study has been conducted to analyze the processes of total output of models of car per day and also per week in warehouse management. -

Reaching Beyond Boundaries, If Turning Ideas We Set Our Into Value, Crafting Solutions and Establishing New Markets Through Unprecedented Opportunities

DRB-HICOM Berhad DRB-HICOM DEFINITION: REACHING Borders, Frontiers, Edge, BOUNDARIES Limits, Margin Periphery. (Incorporated in Malaysia) BEYOND That which indicates or fixes a limit of extent, (203430-W) (Incorporated in Malaysia) (203430-W) (Incorporated BOUNDARIES or marks a bound, as of a territory, a bounding 365 DAYS or separating line; a real or imaginary limit. 24 HOURS RE A Rationale CHING BEYOND A dramatic moment on earth, seen from the glimpse of an all emerging sun on the horizon, brings forth the light and surging energy of a new day and its dawning. Earth’s constant rotation (Incorporated in Malaysia) encompasses time, distance and space that in effect, has much influence on our surrounding environment, our lives and the relationship of our existence to everything that we do. B O U ND Drawing parallel to a world demarcated by boundaries, the infinite perimeters of unabated depth lie in the realm of the imagination. AR Stirring and fostering creativity, imagination is the catalyst of all IE S innovation that permeates every sphere of our business operations. DRB-HICOM is what and where we are today because of the spark that equates to our edge in the way we run our businesses. Annual Report This cover holds the promise of DRB-HICOM’s strategic step it takes to consistently strike a balance of its diversity, reaffirmed in Level 5, Wisma DRB-HICOM, No. 2, Jalan Usahawan U1/8, Seksyen U1, 40150 Shah Alam, Selangor Darul Ehsan a belief that there are no limits to our imagination, if we set our 603 2052 8000 603 2052 8099 minds to it. -

“Business Opportunities in Malaysia”

“Business Opportunities in Malaysia” 1 Ahmad Tajudin Omar Director MIDA Munich 14th June, 2012, Thursday Prague 2 CONTENTContent OutlineOUTLINE • Functions • Malaysian Economy • Investment Trends • Investment Opportunities in Malaysia • Investment Policies & Incentives • Development Corridors • International Rankings MIDA’s Function in The Promotion of The Manufacturing and Services Sectors in Malaysia Milestones Established in 1967 under Act of Parliament, 1965 The principal Malaysian Government agency responsible for the promotion and coordination of industrial development in the country First point of contact for investors who intend to set up projects in the manufacturing and services sectors in Malaysia On 27 March 2004, the Government mandated MIDA to promote investments in the services sector Functions of MIDA . Foreign Direct Investment . Domestic Investment Promotion . Business matching through E-Connect . Manufacturing Services . Manufacturing licenses . Tax incentives Evaluation . Expatriate posts . Duty exemption . OHQ, RDC, IPC and R&D status . Planning for industrial development . Recommend policies and strategies on industrial Planning promotion and development . Formulation of strategies, programmes and initiatives for international economic cooperation . Assist companies in the implementation and operation of their projects Follow-up / . Facilitate exchange & co-ordination among institutions engaged Monitoring in or connected with industrial development . Advisory Services MIDA “One Stop Centre” Based outside of MIDA • -

Level 5, Wisma DRB-HICOM, No

DRB-HICOM Berhad DRB-HICOM DRB-HICOM Berhad (203430-W) (203430-W) Annual Report 2005 DRB-HICOM Berhad (203430-W) www.drb-hicom.com Level 5, Wisma DRB-HICOM, No. 2, Jalan Usahawan U1/8 Strategically Positioned Seksyen U1, 40150 Shah Alam, Selangor Darul Ehsan Strategically Positioned Annual Report 2005 Strategically Positioned DRB-HICOM BERHAD (203430-W) 2005 ANNUAL REPORT VALUES VISION Excellence • Teamwork • Innovation To be a leading regional conglomerate • Integrity through the provision of competitive world-class products and services. MISSION • We are committed to the creation of • We are committed to being socially and brand name recognition by adding value environmentally responsible corporate and exceeding customers’ expectation. citizens, improving the lives of the community we live in. • We are committed to the development of a knowledgeable, dynamic and motivated • We are committed to continue to lead the workforce. growth of Malaysia’s industrialisation. • We are committed to the creation and application of innovative technology through strategic alliances. COVER RATIONALE In every evolving business environment, it is important to understand the terrain and to adapt to its unwavering demands. The challenges faced are opportunities waiting to be realised if we are able to identify its value. Being proactive in our pursuit to be strategically positioned is our primary focus to succeed at the highest level. The image of the blue marble featured on the cover design is a conceptual representation of our confidence to be placed in a competitive environment and succeed whilst staying steadfast to our intrinsic value of consistently re-innovating and re-engineering our products and services to meet the demands of our customers. -

Financial Statements

92 DRB-HICOM ANNUAL REPORT | FINANCIAL PERIOD ENDED 31 DECEMBER 2019 MANAGEMENT DISCUSSION & ANALYSIS Despite yet another challenging year, DRB-HICOM Berhad (“DRB-HICOM” or “the Group”) once again proved its resilience by pooling their resources and leveraging expertise to present a set of commendable results. This performance was greatly enhanced by PROTON Holdings Berhad (“PROTON”), which catapulted to second position in the domestic automotive sales rankings, once again becoming the market’s darling in the sedan segment while completely dominating the sport ultility vechicle (“SUV") space, a new niche for the nation’s first car-maker. PROTON’s performance did not just boost the Group’s performance; it also boosted the nation’s total industry volume (“TIV”). MACROENVIRONMENT The global economy contracted from 3.6% in 2018 to 2.9%1 in 2019 amid were 31,092 unsold residential units at end of September 2019, ongoing US-China trade tensions and uncertainties over Brexit, among compared with 30,115 units in the previous corresponding period. This others. Both developed and developing countries were affected, was despite the year-long Home Ownership Campaign launched by the Malaysia notwithstanding. The country recorded a drop in gross Government which spurred sales of 29,461 units worth RM17.99 billion domestic product GDP from 4.7% in 2018 to 4.3%, the lowest since comprising completed units and those still under construction2. The the financial crisis of 2008/9. industrial sector fared better as a result of undersupply of quality property together with relatively higher returns, longer lease tenures and Within this environment, the domestic market still saw a slight expansion lower maintenance costs. -

Nap 2020 Released 2020 Incentives to Be Menu-Based

ISSUE #02/2020 (MAY) KDN NO. PP 5666/04/2013 (032548) MAA HOPES NAP NAP 2020 RELEASED 2020 INCENTIVES TO BE MENU-BASED THE MAA President The NAP 2020 will YBhg. Datuk Aishah continue to promote Ahmad was quoted in an interview with participation of The Edge Malaysia local companies in and published on the domestic and 24th February 2020 global supply chain, as saying – “To make Malaysia’s automotive encourage R&D industry more competitive, the government and engineering must attract auto investors to the country activities, build by having long-term policies and attractive incentives in place. MAA had requested for capabilities and menu-based incentives to be implemented capacity of local to ensure certainty for investors to know workforce, support what will be approved, but the government is still insisting on continuing customised national car projects incentives.” However, she was quoted as well as enhancing as agreeing to some of the NAP 2020 exports, investments guidelines such as Next Generation Vehicle and local production (NxGV), Mobility-as-a-Service (MaaS) and Industry Revolution 4.0 (IR 4.0). volume.” She told The Star that to attract —YAB Tun Dr. Mahathir investors, the government must come Mohamad, Prime Minister of up with good incentives like other Asean countries. “Currently, the customised Malaysia (21st February 2020) incentives are dependent on proposed potential like export and production plans. Our concern is that the customised incentives mechanism is not clear. NAP 2020 encourages new growth areas through integration of Investors need clarity on incentives technology such as Next Generation Vehicle (NxGV), Mobility as a before committing to investments.