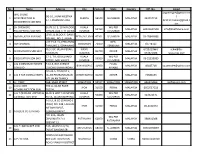

Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lampiran 1 - Hotline Perintah Kawalan Pergerakan

Lampiran 1 - Hotline Perintah Kawalan Pergerakan No. Company Name Contact Number En. Izham Ab Wahab 013-2936414 En. Rosmawardi Bin Razali @ Ramli 013-3644264 Ms. Vilashini A/P Ananda Rajah 012-7005686 En. Noor Faizal Azman 012-3122404 1 HICOM HOLDINGS BERHAD Pn. Nur Asyati Abdullah (Tina) 012-3159941 Pn. Nor Suriawati Abdullah 012-2965004 En. Raja Reza Affandi Bin Raja Aris 012-6141190 En. Mohd Ashraf Bin Ashari 013-3928123 Pn. Nor Alfareena Mohd Azlee 010-2224550 2 AUTOMOTIVE CORPORATION (M) SDN BHD Pn. Nornaemah Tan 016-2191690 En. Mahazir Ahmad 019-6556169 3 COMPOSITES TECHNOLOGY RESEARCH (M) SDN BHD Pn. Haileena Binti Husin 012-2225402 En. Noor Azizi Bin Ismail 013-3096513 Pn. Siti Rosnani Samsudin 019-2403507 4 DRB-HICOM AUTO SOLUTIONS SDN BHD En. Ahmad Khusairi Sijot 011-65522084 En. Mohd redzuan Bin Yahaya 019-4272628 MOTOSIKAL DAN ENJIN NASIONAL SDN BHD Pn. Rohaida Bt Mohamad 017-5106304 5 EDARAN MODENAS SDN BHD Pn. Fathilah Binti Awang 012-4726864 Pn. Citthana Sengsureeja A/P Tin @ Pin 012-7125206 En. Che Zulhaimee Abdullah 019-6224300 6 HONDA MALAYSIA SDN BHD Ms. Joyce 019-6633871 7 ISUZU MALAYSIA SDN BHD Ms. Sin Sze Wan 012-6936535 8 DRB-HICOM COMMERCIAL VEHICLES SDN BHD Pn. Mega Silfia Mimi 017-3880944 Pn. Rashida Mat Rani 012 218 5672 Pn. Rosmawati Abd Rahman 013 990 0989 9 EDARAN OTOMOBIL NASIONAL BERHAD Pn. Nursyawani binti Mohd Sahril 017 393 1543 Pn. Romaizatul Shaqira binti Mohamad Rom 011 51557147 En. Muhammad Firdaus Saidi 013-7700560 10 HICOM DIECASTINGS SDN BHD Pn. Mariati Maksom 019-2774026 En. -

Estudios De Mercado El Mercado De Los Automóvi- Les En Malasia

Oficina Económica y Comercial de la Embajada de España en Malasia El mercado de los Automóvi- les en Malasia 1 Estudios de Mercado El mercado de los Automóvi- les en Malasia Este estudio ha sido realizado por Joaquín Monreal bajo la supervisión de la Oficina Económica y Co- 2 Estudios de Mercado mercial de la Embajada de España en Kuala Lumpur Agosto de 2006 EL MERCADO DE LOS AUTOMOVILES EN MALASIA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 4 I. INTRODUCCIÓN 5 1. Definición y características del sector y subsectores relacionados 5 2. Situación del sector en españa 8 II. ANÁLISIS DE LA OFERTA 10 1. Análisis cuantitativo 10 1.1. Tamaño de la oferta 10 2. Análisis cualitativo 12 2.1. Producción 12 2.2. Precios 14 2.3. Importaciones 16 2.4. Obstáculos comerciales: La NAP 29 2.5. El sistema de permisos para la matriculación 30 III. ANÁLISIS DEL COMERCIO 31 1. Canales de distribución 31 IV. ANÁLISIS DE LA DEMANDA 33 1. Evaluación del volumen de la demanda 33 1.1. Coyuntura económica. 33 1.2. Infraestucturas 34 1.3. Tendencias del consumo y situación del mercado nacional 34 1.4. Tendencias industriales 39 2. Estructura del mercado 39 3. Percepción del producto español 39 V. ANEXOS 41 1. Ensambladores de automóviles 41 2. Distribuidores y concesionarios 46 3. Informes de ferias 56 Oficina Económica y Comercial de la Embajada de España en Kuala Lumpur 3 EL MERCADO DE LOS AUTOMOVILES EN MALASIA RESUMEN Y PRINCIPALES CONCLUSIONES La industria de la automoción en Malasia es junto con la electrónica la industria más impor- tante en el sector manufacturero de Malasia, y de los más importantes dentro del Sudeste Asiático. -

No. Name Department Address City Postcode State Country Contact Off

No. Name Department Address City Postcode State Country Contact Off. No. H/P No. Fax No. Email LEVEL 8, BLOCK F, OASIS SQUARE, NO. 2, 1 3M MALAYSIA SDN BHD HUMAN RESOURCE JALAN PJU 1A/7A ARA DAMANSARA PETALING JAYA 47301 SELANGOR MALAYSIA AMRAN NORDIN 03-78842888 2 A A DESIGN COMMUNICATION SDN BHD 390-A, JALAN PASIR PUTEH, IPOH 31650 PERAK MALAYSIA - 6052537518 6052415528 NO 18 & 19, PERSIARAN VENICE SUTERA 1 3 AANS TECHNICAL & SERVICES SDN BHD DESA MANJUNG RAYA LUMUT 32200 PERAK MALAYSIA ENCIK MOHD NAIMI BIN ABDUL HAKIM 56883211 56883121 lumut @aans.my 2-11A,TINGKAT KIKIK 7 TAMAN 4 ABA JURUTERA PERUNDING INDERAWASIH PRAI 13600 PULAU PINANG MALAYSIA ENCIK AZMAN BIN AKOB 43989901 43999902 [email protected] NO.78, JALAN IDAMAN 1/3, SENAI 5 AC MECA (M) SDN BHD INDUSTRIAL PARK, SENAI 81400 JOHOR MALAYSIA MS CHONG 07-5990168 07-5990268 5B, JALAN PERINDUSTRIAN BERINGIN 6 ACA VISION TECHNOLOGY SDN BHD TAMAN PERINDUSTRIAN BERINGIN JURU SIMPANG AMPAT 14100 PULAU PINANG MALAYSIA CHEW BENG YIH 45011010 124948039 LEVEL 35, THE GARDENS NORTH TOWER, 7 ACCENTURE SOLUTIONS SDN BHD ACCENTURE TECHNOLOGY CONSULTING MID VALLEY CITY LINGKARAN SYED PUTRA, KUALA LUMPUR 59200 WIL PER K.LUMPUR MALAYSIA TEH LY SHA 60327314698 [email protected] LEVEL 35, THE GARDENS NORTH TOWER, 8 ACCENTURE SOLUTIONS SDN BHD MID VALLEY CITY LINGKARAN SYED PUTRA, KUALA LUMPUR 59200 WIL PER K.LUMPUR MALAYSIA CHUA CHAI PING 320884000 NO. 302C, MELAWATI SQUARE BUSS 9 ACICC MALAYSIA SDN BHD CENTRE, TAMAN MELAWATI KUALA LUMPUR 53100 WIL PER K.LUMPUR MALAYSIA NOR ZAILAM BINTI HASAN 03-41062475 03-41075539 G-01, BLOCK E, JALAN JELATANG 4 TAMAN 10 ACTUAL BUILDER SDN BHD CAHAYA KOTA PUTERI MASAI 81750 JOHOR MALAYSIA TN HJ ZAINAL ABIDIN BIN SANUDIN 73866624 73886624 14, JALAN 14/55, TAMAN PERINDUSTRIAN 11 AD CONCEPTS INC. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Hand-In-Hand 2008

2008 Foreword Promoting the Sound Development of the ASEAN Automotive Industry The history of steadily expanding cooperative The past several years have seen the motor ties between member companies of the Japan industries in ASEAN neighboring countries Automobile Manufacturers Association (JAMA) increasing their competitive strength, which and their ASEAN partners is now close to half a underscores the urgency of greater global century old. competitiveness for ASEAN's automotive sector. With this goal in mind, there are high hopes that Those years were marked by some difficult ASEAN will further promote regional integration times―the Asian economic crisis of 1997, for at the earliest possible time. example―but throughout, JAMA members remained firmly committed to ASEAN, ASEAN is making bold moves to surmount the consistently striving, through automobile hurdles on the path to greater growth. Such production, sales, and exports, to advance moves include the abolition of regional tariffs, investment, create jobs, and transfer technology. harmonization of automotive technical This booklet outlines the more recent activities of regulations, mutual recognition of certification, JAMA and its member companies in the ASEAN the streamlining of customs procedures and region. distribution systems, the fostering of supporting industries and human resources, the promotion In 2007, new vehicle sales in the ASEAN market of safety, greater environmental protection, and (Indonesia, Malaysia, the Philippines, Singapore, other strategies aimed at promoting -

Trainer Profile

TRAINER PROFILE Biographical Information Name : Nelson Kok Age : 55 Year of Birth : 1963 Nationality : Malaysian Address : 1-2-29, Elit Avenue, Jalan Mayang Pasir 3, 11950, Bayan Lepas, Penang, Malaysia Languages : English, Malay (Written/Verbal) Dialect (Spoken) : Cantonese, Hokkien Personal Contact : +60-12-4922718 (mobile) Email: [email protected] Website: http://www.mytrainingprovider.com Professional Qualifications Qualifications Institution / Year Awarded - Master in Business Administration (MBA) - Universiti Sains Malaysia, 1997 - B.Sc (Hons) in Physics - Universiti Sains Malaysia, 1987 - Certified Trainer - Zenger-Miller Leadership Center, 1993 - Personality I.D. ® Consultant - Crown Financial Ministries, 2014 Work Experience CONSULTANT TRAINER Nelson Kok is a Consultant Trainer who has obtained his Master degree in Business Administration (MBA) and a B.Sc (Hons) degree in Geophysics from the Universiti Sains Malaysia (USM), Malaysia. He is a certified Trainer since 1993 and a Personality I.D ® Consultant. He has over 31 years of work experiences in Multi-nationals, Multi-racial settings, specializing in the area of Learning and Development. He travels widely and enjoys working with all levels of employees, from the Top Management all the way to Operators level. Throughout his career he had held various management positions (General Manager, Human Resources Manager, Training Manager, TQM Manager, and Production Manager) in multi-national Hi-Tech global manufacturing corporations, as well as local Malaysian companies before establishing his own training and consultancy firm. He now serves as a Consultant and Corporate Trainer to several established training providers throughout Malaysia, Indonesia, Singapore, Brunei, Sudan, Oman, Kingdom of Saudi Arabia (K.S.A) and the United Arab Emirates (U.A.E). -

Realising Opportunities Realising (Incorporated (Incorporated in Malaysia)

DRB-HICOM Berhad (203430-W) (Incorporated in Malaysia) Realising Opportunities Annual Report 2010 www.drb-hicom.com www.drb-hicom.com Level 5, Wisma DRB-HICOM, No. 2, Jalan Usahawan U1/8, Seksyen U1, 40150 Shah Alam, Selangor Darul Ehsan. Tel: (03) 2052 8000 • Fax: (03) 2052 8099 Annual Report 2010 (Incorporated in Malaysia) REALISING OPPORTUNITIES DRB-HICOM measures the success of our long-term vision by raising the bar of excellence and scaling greater heights. Our leading position in the industry has enabled DRB-HICOM to reinvigorate its strengths, enhancing performance and deliverables. Akin to the feat of a mountain climber, we scale to new heights of achievements, realising opportunities and creating sustainable environments. Through strategic investments and leading growth streams, leveraging on firm foundations, we continue to grow from strength to strength, enhancing lives of millions and delivering value for generations. contents DRB-HICOM BERHAD • 2010 ANNUAL REPORT HIGHLIGHTS CORPORATE PERFORMANCE LEADERSHIP DISCLOSURE REVIEW 4 NOTICE OF ANNUAL 13 CORPORATE PROFILE 30 GROup’S FIVE YEARS 32 BOARD OF DIRECTORS GENERAL MEETING FINANCIAL HIGHLIGHTS 14 MEDIA HIGHLIGHTS 34 ProFILE OF DIRECTORS 5 STATEMENT 16 CALENDAR OF EVENTS 42 MANAGEMENT TEAM ACCOMPANYING NOTICE OF ANNUAL GENERAL 24 FinanciaL CALENDAR MEETING 25 CORPORATE INFORMATION 6 MILESTONES 1980-2009 26 GROUP CORPORATE STRUCTURE 28 GROUP CORPORATE STRUCTURE BY SECTOR ourvision >> missionstatement > > sharedvalues > > T O be N U mber 1 and T O L ead in the gro W th • EXCELLENCE c o n t i n u o u s l y e x c e l O F the N ation in the • Decorum • TEAmWorK IN ALL THAT WE DO. -

A Study of Turnover Rate Among Car Salesman in Pulau Pinang, Malaysia

A STUDY OF TURNOVER RATE AMONG CAR SALESMAN IN PULAU PINANG, MALAYSIA BY LEE KEAT NEE LOH PHUI MANN SOO MOONG YEE TEH YONG YEE WONG PIT CHEE A research project submitted in partial fulfillment of the requirement for the degree of BACHELOR OF BUSINESS ADMINISTRATION (HONS) UNIVERSITI TUNKU ABDUL RAHMAN FACULTY OF BUSINESS AND FINANCE DEPARTMENT OF BUSINESS AUGUST 2013 Copyright @ 2013 ALL RIGHTS RESERVED. No part of this paper may be reproduced, stored in a retrieved system, or transmitted in any form or by any means, graphic, electronic, mechanical, photocopying, recording, scanning, or otherwise, without the prior consent of the authors. ii DECLARATION We hereby declare that: 1) This undergraduate research project is the end result of our own work and that due acknowledgement has been given in the references to ALL sources of information be they printed, electronic, or personal. 2) No portion of this research project has been submitted in support of any application for any other degree or qualification of this or any other university, or other institutes of learning. 3) Equal contribution has been made by each group member in completing the research project. 4) The word count of this research report is 26748 words. Name of Student: Student ID: Signature: 1. LEE KEAT NEE 11ABB00131 ___________ 2. LOH PHUI MANN 11ABB00052 ___________ 3. SOO MOONG YEE 10ABB05392 ___________ 4. TEH YONG YEE 11ABB00130 ___________ 5. WONG PIT CHEE 11ABB00477 ___________ Date: 15 August 2013 iii ACKNOWLEDGEMENT We sincerely appreciate this given opportunity to express our deepest gratitude to those who have made this dissertation possible. -

Acronimos Automotriz

ACRONIMOS AUTOMOTRIZ 0LEV 1AX 1BBL 1BC 1DOF 1HP 1MR 1OHC 1SR 1STR 1TT 1WD 1ZYL 12HOS 2AT 2AV 2AX 2BBL 2BC 2CAM 2CE 2CEO 2CO 2CT 2CV 2CVC 2CW 2DFB 2DH 2DOF 2DP 2DR 2DS 2DV 2DW 2F2F 2GR 2K1 2LH 2LR 2MH 2MHEV 2NH 2OHC 2OHV 2RA 2RM 2RV 2SE 2SF 2SLB 2SO 2SPD 2SR 2SRB 2STR 2TBO 2TP 2TT 2VPC 2WB 2WD 2WLTL 2WS 2WTL 2WV 2ZYL 24HLM 24HN 24HOD 24HRS 3AV 3AX 3BL 3CC 3CE 3CV 3DCC 3DD 3DHB 3DOF 3DR 3DS 3DV 3DW 3GR 3GT 3LH 3LR 3MA 3PB 3PH 3PSB 3PT 3SK 3ST 3STR 3TBO 3VPC 3WC 3WCC 3WD 3WEV 3WH 3WP 3WS 3WT 3WV 3ZYL 4ABS 4ADT 4AT 4AV 4AX 4BBL 4CE 4CL 4CLT 4CV 4DC 4DH 4DR 4DS 4DSC 4DV 4DW 4EAT 4ECT 4ETC 4ETS 4EW 4FV 4GA 4GR 4HLC 4LF 4LH 4LLC 4LR 4LS 4MT 4RA 4RD 4RM 4RT 4SE 4SLB 4SPD 4SRB 4SS 4ST 4STR 4TB 4VPC 4WA 4WABS 4WAL 4WAS 4WB 4WC 4WD 4WDA 4WDB 4WDC 4WDO 4WDR 4WIS 4WOTY 4WS 4WV 4WW 4X2 4X4 4ZYL 5AT 5DHB 5DR 5DS 5DSB 5DV 5DW 5GA 5GR 5MAN 5MT 5SS 5ST 5STR 5VPC 5WC 5WD 5WH 5ZYL 6AT 6CE 6CL 6CM 6DOF 6DR 6GA 6HSP 6MAN 6MT 6RDS 6SS 6ST 6STR 6WD 6WH 6WV 6X6 6ZYL 7SS 7STR 8CL 8CLT 8CM 8CTF 8WD 8X8 8ZYL 9STR A&E A&F A&J A1GP A4K A4WD A5K A7C AAA AAAA AAAFTS AAAM AAAS AAB AABC AABS AAC AACA AACC AACET AACF AACN AAD AADA AADF AADT AADTT AAE AAF AAFEA AAFLS AAFRSR AAG AAGT AAHF AAI AAIA AAITF AAIW AAK AAL AALA AALM AAM AAMA AAMVA AAN AAOL AAP AAPAC AAPC AAPEC AAPEX AAPS AAPTS AAR AARA AARDA AARN AARS AAS AASA AASHTO AASP AASRV AAT AATA AATC AAV AAV8 AAW AAWDC AAWF AAWT AAZ ABA ABAG ABAN ABARS ABB ABC ABCA ABCV ABD ABDC ABE ABEIVA ABFD ABG ABH ABHP ABI ABIAUTO ABK ABL ABLS ABM ABN ABO ABOT ABP ABPV ABR ABRAVE ABRN ABRS ABS ABSA ABSBSC ABSL ABSS ABSSL ABSV ABT ABTT -

Australian Journal of Basic and Applied Sciences Processes Of

Australian Journal of Basic and Applied Sciences, 9(13) Special 2015, Pages: 5-11 ISSN:1991-8178 Australian Journal of Basic and Applied Sciences Journal home page: www.ajbasweb.com Processes of Warehouse Management In Automotive Industry – A Study Dr (Mrs.) Muneer Sultana, Mohd Hizam Hashim, Dr Putri Rozita Tahir, Samsudin Shafii Department of Business and Management, International College of Automotive, DRB-HICOM, Automotive Complex, Peramujaya, Industrial Area, Post Box .8,26607, Pekan, Pahang. Malaysia ARTICLE INFO ABSTRACT Article history: Background: Warehouse is very important for achievement or failure of businesses. Received 22 February 2015 Warehouses play a serious intermediate part between supply chain followers, affecting Accepted 20 March 2015 supply chain costs and service to justify supply chain procedures and to manage them Available online 23 April 2015 more efficiently, many corporations have set up centralized production and warehouse services over the previous periods. This has caused in greater warehouses responsible Keywords: for the delivery to a better variety of additional demanding consumers in a massive area Automotive, Industry, Warehouse, and, therefore, with more multifaceted inside logistic processes. Warehouse processes Management, Supply chain, Vehicles, that need to be prearranged and organized include inbound flow handling, product-to- Processes location assignment, product storage, order-to-stock location allocation, order batching Type: Research Paper. and release, order picking, packing, value-added logistics activities, and shipment. The complexity of warehouse processes has increased intensely in the past decade. Warehouse processes have been affected by consumers, demands for quick reply and automation, with its subsequent decrease in enrolment and paperwork. Objective: A study has been conducted to analyze the processes of total output of models of car per day and also per week in warehouse management. -

![POSITIVE [Unchanged]](https://docslib.b-cdn.net/cover/5879/positive-unchanged-4145879.webp)

POSITIVE [Unchanged]

February 8, 2021 Malaysia Automotive POSITIVE [Unchanged] Porsche picks MY? Analyst Excellent, if it crystalizes Porsche AG is in an advanced talk to setting up an assembly plant in Liaw Thong Jung Malaysia for its ASEAN market, identifying Inokom as its partner. Sime (603) 2297 8688 and BAuto are the key beneficiaries through their equity stake in Inokom. [email protected] We have BUYs on these two stocks. Identifies Inokom as its partner According to media sources, German luxury sports car maker Porsche AG is said to be setting up an assembly plant in Kulim, Kedah, in what would be its first outside Germany. Porsche will partner Inokom for this Automotive venture, making Malaysia its ASEAN hub. The latter will construct a new plant specifically for Porsche in Kulim. That said, the size (capacity) and value of this investment cannot be ascertained at the moment. Targets to CKD 2 SUV models We are positive but not entirely surprised by this development, for we have highlighted this possibility in the past. Inokom is involved in the assembly of passenger cars, multi utility vehicles, sports utility vehicles, Malaysia multi-purpose vehicles and light commercial vehicles for Hyundai, BMW, Mazda and MINI cars there. We understand that this will be Porsche’s assembly plant for the ASEAN market with the prospect of CKD-ing 2 models, namely the SUV Cayenne and Macan. Sime Darby and BAuto to benefit Inokom is owned by a consortium of shareholders, namely Sime Darby Motors S/B (51%), BAuto (29%), Hyundai Motor Company of South Korea (15%) and Sime Darby Hyundai S/B (5%). -

RCAPS Working Paper Series

RCAPS Working Paper Series RWP-12002 Globalisation and the Malaysian Automotive Industry: Industrial Nationalism, Liberalisation, and the Role of Japan April 24, 2012 Kaoru NATSUDA College of International Management Ritsumeikan Asia Pacific University, Japan Noriyuki SEGAWA Faculty of International Studies Osaka Gakuin University, Japan John THOBURN School of International Development University of East Anglia, UK and Graduate School of Asia Pacific Studies Ritsumeikan Asia Pacific University, Japan Ritsumeikan Center for Asia Pacific Studies (RCAPS) Ritsumeikan Asia Pacific University (APU) URL: http://www.apu.ac.jp/rcaps/ Globalisation and the Malaysian Automotive Industry: Industrial Nationalism, Liberalisation, and the Role of Japan Kaoru NATSUDA College of International Management Ritsumeikan Asia Pacific University, Japan Noriyuki SEGAWA Faculty of International Studies Osaka Gakuin University, Japan John THOBURN School of International Development University of East Anglia, UK and Graduate School of Asia Pacific Studies Ritsumeikan Asia Pacific University, Japan 1 Globalisation and the Malaysian Automotive Industry: Industrial Nationalism, Liberalisation, and the Role of Japan ABSTRACT This paper examines the attempts by Malaysia to foster production by national automotive producers in a global industry dominated by a small number of major multinationals. Despite the use of a wide range of industrial policies, both standard import substituting ones and more targeted policies, the main national producer, Proton, has been unable successfully to enter the global automotive value chain. We argue that Malaysia is probably faced with a choice of accepting foreign majority ownership, as in its second national producer, Perodua, or reconciling itself to Proton lagging in both technology and marketing. One hopeful sign is the intensified assistance being provided by Japanese motor firms to Malaysian producers under the current Malaysia-Japan Economic Partnership Agreement.