National Automotive Policy 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estudios De Mercado El Mercado De Los Automóvi- Les En Malasia

Oficina Económica y Comercial de la Embajada de España en Malasia El mercado de los Automóvi- les en Malasia 1 Estudios de Mercado El mercado de los Automóvi- les en Malasia Este estudio ha sido realizado por Joaquín Monreal bajo la supervisión de la Oficina Económica y Co- 2 Estudios de Mercado mercial de la Embajada de España en Kuala Lumpur Agosto de 2006 EL MERCADO DE LOS AUTOMOVILES EN MALASIA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 4 I. INTRODUCCIÓN 5 1. Definición y características del sector y subsectores relacionados 5 2. Situación del sector en españa 8 II. ANÁLISIS DE LA OFERTA 10 1. Análisis cuantitativo 10 1.1. Tamaño de la oferta 10 2. Análisis cualitativo 12 2.1. Producción 12 2.2. Precios 14 2.3. Importaciones 16 2.4. Obstáculos comerciales: La NAP 29 2.5. El sistema de permisos para la matriculación 30 III. ANÁLISIS DEL COMERCIO 31 1. Canales de distribución 31 IV. ANÁLISIS DE LA DEMANDA 33 1. Evaluación del volumen de la demanda 33 1.1. Coyuntura económica. 33 1.2. Infraestucturas 34 1.3. Tendencias del consumo y situación del mercado nacional 34 1.4. Tendencias industriales 39 2. Estructura del mercado 39 3. Percepción del producto español 39 V. ANEXOS 41 1. Ensambladores de automóviles 41 2. Distribuidores y concesionarios 46 3. Informes de ferias 56 Oficina Económica y Comercial de la Embajada de España en Kuala Lumpur 3 EL MERCADO DE LOS AUTOMOVILES EN MALASIA RESUMEN Y PRINCIPALES CONCLUSIONES La industria de la automoción en Malasia es junto con la electrónica la industria más impor- tante en el sector manufacturero de Malasia, y de los más importantes dentro del Sudeste Asiático. -

Chapter 1 Introduction

The development of a hybrid knowledge-based Collaborative Lean Manufacturing Management (CLMM) system for an automotive manufacturing environment: The development of a hybrid Knowledge-Based (KB)/ Analytic Hierarchy Process (AHP)/ Gauging Absences of Pre-Requisites (GAP) Approach to the design of a Collaborative Lean Manufacturing Management (CLMM) system for an automotive manufacturing environment. Item Type Thesis Authors Moud Nawawi, Mohd Kamal Rights <a rel="license" href="http://creativecommons.org/licenses/ by-nc-nd/3.0/"><img alt="Creative Commons License" style="border-width:0" src="http://i.creativecommons.org/l/by- nc-nd/3.0/88x31.png" /></a><br />The University of Bradford theses are licenced under a <a rel="license" href="http:// creativecommons.org/licenses/by-nc-nd/3.0/">Creative Commons Licence</a>. Download date 03/10/2021 11:56:12 Link to Item http://hdl.handle.net/10454/3353 CHAPTER 1 INTRODUCTION 1.0 Introduction Lean Manufacturing Management (LMM) is a management system that contains only required resources and materials, manufactures only required quantity of quality products on time that meet customers’ demands. The idea behind LMM is Manufacturing Planning and Control (MPC) system of the materials and information flow which involve both Manufacturing Resources Planning (MRP II), and Just-in-Time (JIT) techniques. In addition, Total Quality Management (TQM) is integrated to ensure the quality of the processes and products of the system. The capabilities of continuously improving the processes by identifying and eliminating manufacturing wastes are essential for effectiveness of LMM. The main benefit of effective LMM is high ratio of quality to cost of the products manufactured which finally contribute to high profitable organisation. -

Corporation Limited

Corporation Limited PRESS RELEASE JACKSPEED CORPORATION SECURES NEW CONTRACT TO SUPPLY AUTOMOTIVE LEATHER TRIM TO NAZA AUTOMOTIVE MANUFACTURING SDN BHD AND EXPANDS CAPACITY TO MEET ROBUST DEMAND - Invested in additional new equipment to enhance capacity in Kluang factory - Acquired a 19,035 sq m of land in Kedah, Malaysia to build additional production facility to cater to growing domestic market in Malaysia - Surge in OEM demand and capacity constraint reduced profit margins for FY04 Singapore, March 8, 2004 Jackspeed Corporation Limited ("Jackspeed"), an SGX-Mainboard-listed manufacturer of custom-fitted automotive leather trim for car seats and leather wrapping for automotive interior products, has secured a new contract from Naza Automotive Manufacturing Sdn Bhd (“Naza Automotive”). Naza Automotive is a member of Malaysia’s Naza Group of Companies, which assembles, markets and distributes the Kia range of vehicles, Malaysia’s third national car project. Jackspeed is currently a Tier One supplier of Naza Automotive. Jackspeed will supply a total of 10,000 sets of leather trim for Naza Automotive’s special edition vehicle – the National MPV for the Malaysian market. Delivery will be done over 3 years starting from this financial year. This is the second contract Jackspeed has secured from Naza Automotive in less than a year. Jackspeed has an existing contract to supply 30,000 sets of leather trim over 3 years from July 2003. To meet increased market demand, Jackspeed has expanded its production capacity in Malaysia. It has taken delivery of 69 new sewing machines for a total of about RM$600,000 (estimated S$290,000) for its Kluang factory in January 2004 and will recruit and train new employees to run these machines. -

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13 Penerbit Journal of Advanced Vehicle System Akademia Baru Journal homepage: www.akademiabaru.com/aravs.html ISSN: 2550-2212 Open Towards safer cars in Malaysia Access Z. Mohd Jawi 1, ∗, K.A. Abu Kassim 2, M.H. Md Isa 1,2, A. Hamzah 1, Y. Ghani 1 1 Vehicle Safety & Biomechanics Research Centre, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia 2 ASEAN NCAP Operational Unit, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia ARTICLE INFO ABSTRACT Article history: This article discusses the framework of safer cars in Malaysia based on the Vehicle Type Received 10 October 2016 Approval (VTA) and New Car Assessment Program (NCAP). The new era of automobile Received in revised form 16 November 2016 safety is presumably come at the right time for Malaysia after the two important Accepted 25 November 2016 milestones i.e. local assembly initiative in 1960’s and the national car project in 1980’s. Available online 5 December 2016 The maturity of VTA exercise in Malaysia and the inception of ASEAN NCAP are contributing to direct and indirect pressure to car manufacturers to progressively produce safer cars. Since car pricing is driven by market competitiveness and not affected by safety upgrades, the consumers eventually would enjoy more values for their money through safer cars. In terms of car safety, the automotive ecosystem in Malaysia could as well explain the impact of NCAP in other ASEAN countries’ automotive layout. It is expected that there will be growing demand for safer vehicles and also positive response from OEMs in Malaysia and the region. -

No. Name Department Address City Postcode State Country Contact Off

No. Name Department Address City Postcode State Country Contact Off. No. H/P No. Fax No. Email LEVEL 8, BLOCK F, OASIS SQUARE, NO. 2, 1 3M MALAYSIA SDN BHD HUMAN RESOURCE JALAN PJU 1A/7A ARA DAMANSARA PETALING JAYA 47301 SELANGOR MALAYSIA AMRAN NORDIN 03-78842888 2 A A DESIGN COMMUNICATION SDN BHD 390-A, JALAN PASIR PUTEH, IPOH 31650 PERAK MALAYSIA - 6052537518 6052415528 NO 18 & 19, PERSIARAN VENICE SUTERA 1 3 AANS TECHNICAL & SERVICES SDN BHD DESA MANJUNG RAYA LUMUT 32200 PERAK MALAYSIA ENCIK MOHD NAIMI BIN ABDUL HAKIM 56883211 56883121 lumut @aans.my 2-11A,TINGKAT KIKIK 7 TAMAN 4 ABA JURUTERA PERUNDING INDERAWASIH PRAI 13600 PULAU PINANG MALAYSIA ENCIK AZMAN BIN AKOB 43989901 43999902 [email protected] NO.78, JALAN IDAMAN 1/3, SENAI 5 AC MECA (M) SDN BHD INDUSTRIAL PARK, SENAI 81400 JOHOR MALAYSIA MS CHONG 07-5990168 07-5990268 5B, JALAN PERINDUSTRIAN BERINGIN 6 ACA VISION TECHNOLOGY SDN BHD TAMAN PERINDUSTRIAN BERINGIN JURU SIMPANG AMPAT 14100 PULAU PINANG MALAYSIA CHEW BENG YIH 45011010 124948039 LEVEL 35, THE GARDENS NORTH TOWER, 7 ACCENTURE SOLUTIONS SDN BHD ACCENTURE TECHNOLOGY CONSULTING MID VALLEY CITY LINGKARAN SYED PUTRA, KUALA LUMPUR 59200 WIL PER K.LUMPUR MALAYSIA TEH LY SHA 60327314698 [email protected] LEVEL 35, THE GARDENS NORTH TOWER, 8 ACCENTURE SOLUTIONS SDN BHD MID VALLEY CITY LINGKARAN SYED PUTRA, KUALA LUMPUR 59200 WIL PER K.LUMPUR MALAYSIA CHUA CHAI PING 320884000 NO. 302C, MELAWATI SQUARE BUSS 9 ACICC MALAYSIA SDN BHD CENTRE, TAMAN MELAWATI KUALA LUMPUR 53100 WIL PER K.LUMPUR MALAYSIA NOR ZAILAM BINTI HASAN 03-41062475 03-41075539 G-01, BLOCK E, JALAN JELATANG 4 TAMAN 10 ACTUAL BUILDER SDN BHD CAHAYA KOTA PUTERI MASAI 81750 JOHOR MALAYSIA TN HJ ZAINAL ABIDIN BIN SANUDIN 73866624 73886624 14, JALAN 14/55, TAMAN PERINDUSTRIAN 11 AD CONCEPTS INC. -

Corporation Limited

Corporation Limited PRESS RELEASE Jackspeed Corporation Limited Wins RM55 million Contract from Naza Automotive Manufacturing Sdn Bhd • Jackspeed's Malaysian subsidiary will supply leather trims for Naza’s New MPV project for three years Singapore, September 13, 2004 – SGX Mainboard-listed Jackspeed Corporation Limited (“Jackspeed””), a manufacturer of custom-fitted automotive leather trim for car seats and leather wrapping for automotive interior products, has secured a RM 55 million contract from Naza Automotive Manufacturing Sdn Bhd (“Naza Automotive”). This is its third and also single largest contract that Naza Automotive has awarded to Jackspeed. The contract is for the company’s Malaysian subsidiary to supply leather trims for Naza’s new MPV project for three years, starting on November 2004. Naza Automotive assembles, markets and distributes the Naza range of vehicles for its third national car project. Jackspeed is currently a Tier One supplier of Naza Automotive. Commenting on the new contract win, Mr Jackson Liew, Jackspeed’s Group Chairman and CEO said, "This latest contract with Naza Automotive is a strong testament to their trust and confidence in our high standards of quality and delivery. We see tremendous potential in the automotive industry in Malaysia. With the implementation of AFTA and reduction of tariffs, the region’s automotive industry is expected to enjoy robust growth. This will also drive further growth in the automotive manufacturing sector in Malaysia. Jackspeed, which already has an established presence in Malaysia, is well-poised to take advantage of new opportunities in the auto sector and ride on its vibrant growth. Mr Liew said that this major contract win will further reinforce its relationship with Naza Automotive and strengthen its stronghold in the Malaysian automotive industry. -

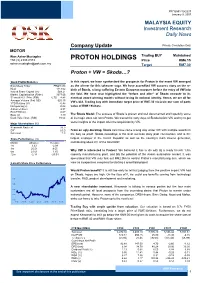

PROTON HOLDINGS Price RM6.15 [email protected] Target RM7.30

PP/10551/10/2007 January 9, 2007 MALAYSIA EQUITY Investment Research Daily News Private Circulation Only Company Update MOTOR Wan Azhar Mustapha Trading BUY Maintained +60 (3) 2333 8373 PROTON HOLDINGS Price RM6.15 [email protected] Target RM7.30 Proton + VW = Skoda…? Stock Profile/Statistics In this report, we have synthesized the prospects for Proton in the event VW emerged Bloomberg Ticker PROH MK as the winner for this takeover saga. We have accredited VW success story on the re- KLCI 1113.02 birth of Škoda, a long suffering Eastern European marques before the entry of VW into Issued Share Capital (m) 549.21 Market Capitalisation (RMm) 3377.66 the fold. We have also highlighted the “before and after” of Škoda en-route to its 52 week H | L Price (RM) 6.75 4.48 eventual award winning models without losing its national identity. Hence, we are all for Average Volume (3m) ‘000 625.15 VW’s bid. Trading buy with immediate target price of RM7.30 vis-à-vis our sum of parts YTD Returns (%) -0.45 Net gearing (x) -0.02 value of RM9.19/share. Altman Z-Score 2.97 ROCE/WACC -0.07 Beta (x) 1.49 The Škoda Model. The success of Škoda is proven and well documented and hopefully some Book Value/share (RM) 10.64 of its magic does rub onto Proton. We traced the early days of Škoda before VW and try to get some insights of the impact after the acquisition by VW. Major Shareholders (%) Khazanah Nasional 38.3 EPF 10.5 From an ugly duckling. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

The Mediating Effects of Organisational Culture on Job Performance of Automotive Salespersons in a Large Automotive Sales Company in Malaysia

International Journal of Recent Technology and Engineering (IJRTE) ISSN: 2277-3878, Volume-9 Issue-1, May 2020 The Mediating Effects of Organisational Culture on Job Performance of Automotive salespersons in a Large Automotive Sales Company in Malaysia Muhammad Iqbal Shaharom, K. Kuperan Viswanathan, Nor Azman Ali Abstract: The purpose of this paper was to examine the This translates to a rather high employment of employees mediating effects that organisational culture would have, on the within the country’s automotive industry, where statistics has work performance of those automotive sales persons, specifically shown that the total employment numbers stand at 550,000 in within a case study of a large automotive sales organisation within the year 2014 (Statistics Employment, 2014). With such a the country of Malaysia. The findings were then detailed from the high number of employees within the automotive sector, it is perceptions of the studies automotive salespersons, along with the correlating implications that could affect the automotive retaining vital that their job performances are sustained in order to also industry in Malaysia. It was known that the work and job sustain the growth of the overall automotive manufacturing performance of automotive salespersons were greatly influenced sector in the country. Having a high number of employed by the kind of organisational culture that they were residing staff but with low productivity will negatively affect the within. The organisational culture theories were used to overall performance and growth of the automotive industry. investigate the social cognitive theory, via literature reviews This will then involve the role of organisation culture in conducted. -

JD Power Asia Pacific Reports

J.D. Power Asia Pacific Reports: After-Sales Service Standards Improve Notably at Authorized Service Centres of National Makes BMW Ranks Highest in Customer Service Satisfaction in Malaysia for a Second Consecutive Year SINGAPORE: 17 August 2012 — Satisfaction with authorized service centres among new-vehicle owners of national makes has increased from 2011 due to the implementation of higher service standards at dealerships, according to the J.D. Power Asia Pacific 2012 Malaysia Customer Service Index (CSI) Study.SM The study, now in its 10 th year, measures overall customer satisfaction among vehicle owners who took their vehicle to their authorized service centre for maintenance or repair work during the first 12 to 24 months of ownership. The study evaluates new-vehicle owner satisfaction with the after-sales service experience by examining dealership performance in five factors (in order of importance): service quality; vehicle pickup; service initiation; service advisor; and service facility. Overall customer satisfaction averages 740 index points on a 1,000-point scale in 2012, an improvement of 22 points from 2011. Of the 22 service standards examined in the study, authorized service centres of national makes implement 17.7 per visit, on average, an increase from 17.1 in 2011. Service standard implementation among non- national makes remains higher, with an average of 18.4, which is unchanged from 2011. Improvements cited by owners of national makes—Malaysia-branded vehicles—include essential customer-centric activities, such as explanations of work and physical inspection of vehicle both before and after service. “Gaps in service satisfaction remain, but are narrowing between national and non-national makes in Malaysia,” said Mohit Arora, executive director at J.D. -

Hand-In-Hand 2008

2008 Foreword Promoting the Sound Development of the ASEAN Automotive Industry The history of steadily expanding cooperative The past several years have seen the motor ties between member companies of the Japan industries in ASEAN neighboring countries Automobile Manufacturers Association (JAMA) increasing their competitive strength, which and their ASEAN partners is now close to half a underscores the urgency of greater global century old. competitiveness for ASEAN's automotive sector. With this goal in mind, there are high hopes that Those years were marked by some difficult ASEAN will further promote regional integration times―the Asian economic crisis of 1997, for at the earliest possible time. example―but throughout, JAMA members remained firmly committed to ASEAN, ASEAN is making bold moves to surmount the consistently striving, through automobile hurdles on the path to greater growth. Such production, sales, and exports, to advance moves include the abolition of regional tariffs, investment, create jobs, and transfer technology. harmonization of automotive technical This booklet outlines the more recent activities of regulations, mutual recognition of certification, JAMA and its member companies in the ASEAN the streamlining of customs procedures and region. distribution systems, the fostering of supporting industries and human resources, the promotion In 2007, new vehicle sales in the ASEAN market of safety, greater environmental protection, and (Indonesia, Malaysia, the Philippines, Singapore, other strategies aimed at promoting -

Realising Opportunities Realising (Incorporated (Incorporated in Malaysia)

DRB-HICOM Berhad (203430-W) (Incorporated in Malaysia) Realising Opportunities Annual Report 2010 www.drb-hicom.com www.drb-hicom.com Level 5, Wisma DRB-HICOM, No. 2, Jalan Usahawan U1/8, Seksyen U1, 40150 Shah Alam, Selangor Darul Ehsan. Tel: (03) 2052 8000 • Fax: (03) 2052 8099 Annual Report 2010 (Incorporated in Malaysia) REALISING OPPORTUNITIES DRB-HICOM measures the success of our long-term vision by raising the bar of excellence and scaling greater heights. Our leading position in the industry has enabled DRB-HICOM to reinvigorate its strengths, enhancing performance and deliverables. Akin to the feat of a mountain climber, we scale to new heights of achievements, realising opportunities and creating sustainable environments. Through strategic investments and leading growth streams, leveraging on firm foundations, we continue to grow from strength to strength, enhancing lives of millions and delivering value for generations. contents DRB-HICOM BERHAD • 2010 ANNUAL REPORT HIGHLIGHTS CORPORATE PERFORMANCE LEADERSHIP DISCLOSURE REVIEW 4 NOTICE OF ANNUAL 13 CORPORATE PROFILE 30 GROup’S FIVE YEARS 32 BOARD OF DIRECTORS GENERAL MEETING FINANCIAL HIGHLIGHTS 14 MEDIA HIGHLIGHTS 34 ProFILE OF DIRECTORS 5 STATEMENT 16 CALENDAR OF EVENTS 42 MANAGEMENT TEAM ACCOMPANYING NOTICE OF ANNUAL GENERAL 24 FinanciaL CALENDAR MEETING 25 CORPORATE INFORMATION 6 MILESTONES 1980-2009 26 GROUP CORPORATE STRUCTURE 28 GROUP CORPORATE STRUCTURE BY SECTOR ourvision >> missionstatement > > sharedvalues > > T O be N U mber 1 and T O L ead in the gro W th • EXCELLENCE c o n t i n u o u s l y e x c e l O F the N ation in the • Decorum • TEAmWorK IN ALL THAT WE DO.