2017 Palm Oil Buyers Scorecard

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to Sustainable Palm Oil for Singapore Companies: Economic Opportunities and Sourcing Guidelines Acknowledgements

Guide To Sustainable Palm Oil For Singapore Companies: Economic Opportunities And Sourcing Guidelines Acknowledgements Author: Aqeela Samat Programme Executive (WWF-Singapore), Secretariat (SASPO) With contributions from: Jeanne Stampe Head, Asia Sustainable Finance and Commodities (WWF-Singapore) Elizabeth Clarke Global Palm Oil Lead (WWF-Singapore) Maggie Lee Market Transformation Manager (WWF-Singapore), Secretariat (SASPO) Janissa Ng Managing Editor (WWF-Singapore) Fiona Wheatley Sustainable Development Manager for Raw Material Sourcing (Marks and Spencer) Roopali Raghavan Assistant Director, Conservation & Research (Wildlife Reserves Singapore) Hervé Simon Group Marketing Director (Ayam Brand) Published by: Published in February 2018 by SASPO. Any reproduction in full or part of this publication must mention the title and credit the above-mentioned publisher as the copyright owner. For more information, visit saspo.org or contact [email protected] Southeast Asia Alliance for Sustainable Palm Oil Page 02 Acknowledgements Content Page Executive Summary 04 1. Investigating Palm Oil in Singapore’s Supply Chains 06 Introduction: Risks and Opportunities for Singapore Companies 07 Palm Oil and the Singapore Market 08 Sustainability in the Production of Palm Oil Socioenvironmental issues associated with unsustainable palm oil 09 Sustainable palm oil as a solution 12 Supply chain options 13 2. The Business Case and Guidelines for Sustainable Palm Oil 14 The Business Argument Benefits and opportunities for Singapore companies 15 Net economic benefits of RSPO certification 19 Guidelines to Action for Sourcing CSPO Understanding the costs of sourcing CSPO – A case study 20 Understanding palm oil footprint – Restaurants & food manufacturers 21 A checklist guide to sourcing CSPO 22 Case Studies Marks & Spencer 23 Wildlife Reserves Singapore 24 Denis Asia Pacific (Ayam Brand) 25 Supporting Platforms 26 3. -

Summary of Price Comparison for July Week 1 from 01 Until 31 July 2020

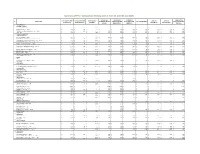

Summary of Price Comparison for July week 1 from 01 until 31 July 2020 SIM KIM HUAT SIM KIM HUAT SIN KIEW HIN UTAMA GRAND HUA HO DEPARTMENT HUA HO DEPARTMENT SIFANA SDN BHD SUPA SAVE SUPA SAVE NO. DESCRIPTIONS TRADING CO SDN BHD TRADING CO SDN BHD DEPARTMENT STORE SUPA SAVE (MABOHAI) SUPERSTORE SDN BHD STORE (KIULAP) STORE (TG BUNUT) (MANGGIS) (MATA-MATA) (ONE RIVER SIDE) (KIULAP) (SENGKURONG) (GADONG) (THE MALL) Butter/Margarine 1 (Mentega / Marjerin) GOLDEN CHURN - 340 g $ 6.65 $ 6.35 $ 6.20 $ 6.59 $ 6.50 $ 6.50 $ 6.95 $ 6.95 $ 6.95 $ 6.90 PLANTA; Margarine - 480 g $ 3.30 $ 3.25 $ 3.29 $ - $ 3.39 $ 3.30 $ 3.50 $ 3.50 $ 3.50 $ 3.30 ANCHOR –Pure New Zealand Butter; tin - 454 g $ 6.50 $ 6.50 $ 6.49 $ 6.50 $ 6.50 $ 6.60 $ 6.80 $ 6.80 $ 6.80 $ 6.60 QBB - 400 g $ 8.00 $ - $ 7.90 $ 7.89 $ 7.39 $ 7.90 $ 8.40 $ 8.40 $ 8.40 $ 7.90 Canned Preserved Food 2 (Makanan dalam tin) REX; Chicken Curry - 160 g $ 1.55 $ - $ 1.50 $ 1.50 $ 1.50 $ 1.50 $ 1.45 $ 1.45 $ 1.45 $ 1.50 AYAM BRAND; Sardine In Tomato Sauce Tall - 230 g $ 2.40 $ 2.40 $ 2.40 $ - $ 2.30 $ - $ 2.40 $ 2.40 $ 2.40 $ 2.50 AYAM BRAND; Sardine In Tomato Sauce Oval - 215 g $ 2.45 $ 2.45 $ 2.35 $ 2.40 $ 2.50 $ 2.50 $ 2.55 $ 2.55 $ 2.55 $ 2.65 SMILING FISH; Fried Baby Clam with Chili - 40 g $ 1.10 $ 1.15 $ 1.15 $ 1.09 $ 1.15 $ 1.15 $ 1.20 $ 1.20 $ 1.20 $ 6.40 KARA; Natural Coconut Extract - 200 ml $ 1.00 $ 1.05 $ 1.00 $ - $ 0.95 $ 1.05 $ 1.10 $ 1.10 $ 1.10 $ 1.00 AYAM BRAND; Coconut Milk Blue Packet - 200 ml $ 1.10 $ 1.10 $ 1.00 $ 1.00 $ 1.10 $ 1.10 $ 1.10 $ 1.10 $ 1.10 $ 1.10 AYAM BRAND; Coconut -

Industry Experts

Industry Experts http://www.marketresearch.com/Industry‐Experts‐v3766/ Publisher Sample Phone: 800.298.5699 (US) or +1.240.747.3093 or +1.240.747.3093 (Int'l) Hours: Monday - Thursday: 5:30am - 6:30pm EST Fridays: 5:30am - 5:30pm EST Email: [email protected] MarketResearch.com Published: April 2013 Report Code: FB001 Pages: 260 | Charts: 159 Price: Sample “The report reviews, analyzes and projects the global market for Canned Food for the period 2010-2020” © 2013 all rights reserved GLOBAL MARKET PERSPECTIVE INTRODUCTION Though tastes of consumers as regards food are highly varying, there is hardly any difference in the qualities that they value. Topping the list of consumer demands for foods and packaging are freshness, ingredients of superior quality, convenience and eco-friendliness. The humble can is able to provide all of these, though consumer perception regarding the same is very low. For instance, convenience offered by canned foods is highly valued by consumers, but other benefits, such as health and nutritional advantages are often ignored. Today’s consumer is gaining an insight into the role played by nutritious foods to maintain a healthy lifestyle, with health-conscious diets becoming more common and driving the demand for the most nutritious food on offer. For the global canned food industry, “convenience” has been the buzzword that has resulted in increasing demand ever since foods were introduced in cans. Processed foods available in cans have revolutionized the food industry, offering enhanced shelf life and varieties of products, keeping in view the specific requirements of consumers. Global demand for Canned Food is slated to post a CAGR of about x.x% between 2010 and 2020 in terms of value to reach a projected US$xx.x billion by 2020 from an estimated US$xx.x billion in 2013. -

2018 Creative Agencies New Business League

2018 CREATIVE AGENCIES NEW BUSINESS LEAGUE Asia Pacific / June 2018 ESTIMATED ESTIMATED YTD RANK THIS RANK LAST OVERALL YTD No.of AGENCY RECENT WINS WIN REVENUE RECENT LOSSES MONTH MONTH REVENUE Wins (USD $ m) (USD $m) Brita China Project, Wipro India 1 1 Ogilvy 82.9 Amway Artistry China Project 82.6 212 Project, MangoTV China Project Swarovski China, Marster Kong 2 2 Publicis 46.0 MakeMy Trip India 45.7 102 China, Haier China Craveable Brands Australia, 3 4 Leo Burnett Novotown Hong Kong Project, 34.8 34.8 158 Anchor India Foxtel Australia (Brand and Retail), 4 5 DDB AEG China Project, Blue Moon China 34.1 Starhub Singapore 32.1 114 Project 5 3 Isobar SANA Namerakahonpo Thailand 30.9 30.9 168 Jeanswest Australia, British 6 7 J Walter Thompson Amercian Tobacco Indonesia, Sony 36.7 Monte Carlo India 27.2 121 Entertainment (SAB TV) India Grande Asset Thailand, Fujifilm 7 6 Dentsu Thailand, Easy Buy Thailand, 27.4 HP Japan Project 26.4 134 Mandom Thailand Didi Australia, Football Fed 8 8 Saatchi & Saatchi Australia, Haixinsha Exhibition 19.4 19.4 43 China MAC China Project, Da Zhong Dian 9 9 McCann WorldGroup Ping China Project, Krungthai AXA 19.0 Reebok India 18.6 146 Thailand Project Bahlsen Global, UnionPay ASEAN, 10 12 MullenLowe Group Crust Pizza Australia, Tesco 10.8 Macquarie University Australia 10.3 10 Malaysia PepsiCo Beverages Australia, IMAX 11 10 TBWA China, South Australian Tourism 13.9 Foxtel(Brand&Retail) Australia 8.6 12 Australia Bosch China Project, Henkel China 12 13= Digitas 8.4 8.4 39 Project, Huawei China Project Telkomsel -

2017 Palm Oil Buyers Scorecard

REPORT MY & SG 2017 PALM OIL BUYERS SCORECARD – MALAYSIA AND SINGAPORE 2017 ACKNOWLEDGEMENTS On the cover Aerial view of small oil palm plantation in the rainforest of Southeastern Cameroon © WWF / Carlos Drews Authors: Gregory Bardies, Manager, Market Transformation, WWF-Singapore Denise Westerhout, Lead for Sustainable Markets Programme, WWF-Malaysia With contributions from: WWF Singapore and Malaysia Benjamin Loh, Sustainable Palm Oil Manager, WWF-Malaysia Nadia Hasbi, Corporate Engagement, Market Transformation Initiative, Malaysia, WWF-Malaysia WWF International Carrie Carrie Svingen, Manager, Markets and Communications, Palm Oil and Soy, WWF-International Stephen Watson, Global Palm Oil Lead, WWF-International Acknowledgements: Published in August 2017 by WWF-Singapore and WWF-Malaysia. Any reproduction in full or part of this publication must mention the title and credit the above mentioned publisher as the copyright owner. Text © WWF-Singapore 2017 CONTENTS PALM OIL IN SOUTHEAST ASIA 4 EXECUTIVE SUMMARY 6 How did the companies perform? 7 Are regional companies ready for sustainability? 7 What barriers do companies face? 8 How can companies act on these results? 8 FROM PLANTATION TO SHOPPING CART 10 Understanding the popularity of palm 10 Negative impacts of palm oil 11 RSPO-certified palm oil: Growing global prominence 14 Supporting sustainable palm oil 14 SUSTAINABLE SUPPLY CHAINS 15 RESULTS: TRANSPARENCY A KEY STEP TO TRANSFORMING A REGION 19 How does the Scorecard work? 19 Results 23 Regional companies lag behind global peers 24 Report scores 26 SCORECARD OUTCOMES 29 Understanding challenges faced by companies 31 Recommendations 33 What can consumers do? 36 APPENDIX 1: SUPPORTING PLATFORMS 37 Palm oil is arguably one of the most promising yet controversial growth PALM OIL IN drivers in Southeast Asia. -

Guide to Sustainable Palm Oil for Singapore Companies: Economic Opportunities and Sourcing Guidelines Acknowledgements

Guide To Sustainable Palm Oil For Singapore Companies: Economic Opportunities And Sourcing Guidelines Acknowledgements Author: Aqeela Samat Programme Executive (WWF-Singapore), Secretariat (SASPO) With contributions from: Jeanne Stampe Head, Asia Sustainable Finance and Commodities (WWF-Singapore) Elizabeth Clarke Global Palm Oil Lead (WWF-Singapore) Maggie Lee Market Transformation Manager (WWF-Singapore), Secretariat (SASPO) Janissa Ng Managing Editor (WWF-Singapore) Fiona Wheatley Sustainable Development Manager for Raw Material Sourcing (Marks and Spencer) Roopali Raghavan Assistant Director, Conservation & Research (Wildlife Reserves Singapore) Hervé Simon Group Marketing Director (Ayam Brand) Published by: Published in February 2018 by SASPO. Any reproduction in full or part of this publication must mention the title and credit the above-mentioned publisher as the copyright owner. Southeast Asia Alliance for Sustainable Palm Oil Page 02 Acknowledgements Content Page Executive Summary 04 1. Investigating Palm Oil in Singapore’s Supply Chains 06 Introduction: Risks and Opportunities for Singapore Companies 07 Palm Oil and the Singapore Market 08 Sustainability in the Production of Palm Oil Socioenvironmental issues associated with unsustainable palm oil 09 Sustainable palm oil as a solution 12 Supply chain options 13 2. The Business Case and Guidelines for Sustainable Palm Oil 14 The Business Argument Benefits and opportunities for Singapore companies 15 Net economic benefits of RSPO certification 19 Guidelines to Action for Sourcing CSPO Understanding the costs of sourcing CSPO – A case study 20 Understanding palm oil footprint – Restaurants & food manufacturers 21 A checklist guide to sourcing CSPO 22 Case Studies Marks & Spencer 23 Wildlife Reserves Singapore 24 Denis Asia Pacific (Ayam Brand) 25 Supporting Platforms 26 3. -

Arles 2021 Les Rencontres De La Photographie 4 July → 26

ARLES 2021 MINISTÈRE DE LA CULTURE MINISTÈRE DE DE L’ÉDUCATION NATIONALE, DE LA JEUNESSE ET DES SPORTS DIRECTION RÉGIONALE DES AFFAIRES CULTURELLES PACA LES RENCONTRES RÉGION PROVENCE-ALPES-CÔTE D’AZUR DÉPARTEMENT DES BOUCHES-DU-RHÔNE VILLE D’ARLES PHOTOGRAPH (DETAIL): SMITH, DESIDERATION, 2000-2021. COURTESY LES FILLES DU CALVAIRE GALLERY. DE LA PHOTOGRAPHIE DESIGN ABM STUDIO 4 JULY → 26 SEPTEMBER ARLES 2021 LES RENCONTRES DE LA PHOTOGRAPHIE JULY 4 → SEPTEMBER 26 PRESS RELEASE – JULY 2021 PRESS RELATIONS LES RENCONTRES CLAUDINE COLIN D’ARLES COMMUNICATION 34 RUE DU DOCTEUR FANTON MARINE MAUFRAS DU CHATELLIER 13200 ARLES & ALEXIS GREGORAT 3 RUE DE TURBIGO INFO@ 75001 PARIS RENCONTRES-ARLES.COM RENCONTRES-ARLES.COM RENCONTRESARLES@ TÉL. +33 (0)4 90 96 76 06 CLAUDINECOLIN.COM CLAUDINECOLIN.COM TÉL. +33 (0)1 42 72 60 01 INSTITUTIONAL PARTNERS MAIN PARTNERS MEDIA PARTNERS THE RENCONTRES D'ARLES IS ALSO ORGANIZED WITH AND THE ACTIVE COLLABORATION OF BARBICAN CENTRE, APERTURE, INA, INSTITUT POUR LA PHOTOGRAPHIE, SPECIAL SUPPORT FROM ÉCOLE NATIONALE SUPÉRIEURE DE LA PHOTOGRAPHIE, ASSOCIATION PRIX PICTET, FONDATION JAN MICHALSKI POUR DU MÉJAN, MONOPRIX ARLES, MUSEON ARLATEN – MUSÉE DE PROVENCE, L’ÉCRITURE ET LA LITTÉRATURE, LËT’Z ARLES (LUXEMBOURG), FONDATION ABBAYE DE MONTMAJOUR, MUSÉE RÉATTU, MUSÉE DE LA CAMARGUE, LOUIS ROEDERER, TECTONA, ACTES SUD, ADAGP, SAIF, FNAC, LUMA FONDATION MANUEL RIVERA-ORTIZ, CARRÉ D’ART – MUSÉE D’ART ARLES, COMMUNAUTÉ D’AGGLOMÉRATION ARLES CRAU CAMARGUE CONTEMPORAIN DE NÎMES, CARRÉ D’ART – BIBLIOTHÈQUE DE NÎMES, MONTAGNETTE. COLLECTION LAMBERT AVIGNON, FRAC PACA, MUCEM, CENTRE PHOTOGRAPHIQUE MARSEILLE, MUSÉE ESTRINE, CENTRE DE SUPPORT FROM LA PHOTOGRAPHIE DE MOUGINS, ASSOCIATION JEAN VILAR. -

To Download the Full Programme

ASEAN RESPONSIBLE BUSINESS FORUM Towards Inclusive, Resilient and Sustainable ASEAN: The Role of Responsible and Inclusive Business 27 – 28 August 2018, Concorde Hotel, Singapore Agenda Day 1 (Monday, 27 August 2018) Time Programme 08:00 – 09:00 Registration 09:00 – 09:30 OPENING CEREMONY • Welcoming Remarks by Ms Yanti Triwadiantini, Chair, ASEAN CSR Network • Speech by Guest of Honour Mr Liang Eng Hwa, Member of Parliament for Holland- Bukit Timah GRC; Chairman of Government Parliamentary Committee for Finance and Trade, Singapore Parliament 09:30 – 10:00 Coffee Break 10:00 – 12:00 SESSION 1: Investing for an Inclusive, Resilient and Sustainable Future: Advancing Responsible and Inclusive Business in ASEAN Private sector engagement is integral to the achievement of the ASEAN aspiration for inclusive and sustainable growth which is in line with the SDGs. Businesses create jobs, provide income, goods, services, and innovation. Responsible and inclusive business enhances equality among people and society – it ensures people, especially the marginalized, to have equitable access to the opportunities for economic and human development, for enhancing his/her well-being and dignity, contributing to the poverty alleviation. Responsible and inclusive business also provides innovative solutions to manage risks that help in reducing vulnerability and building resilience in the long term. This session seeks to discuss the following: • What is responsible and inclusive business? In what ways, does responsible and inclusive business offer business solutions to development problems faced by those who are at the base of the pyramid (BOP)? • Leading businesses are experimenting with ways to create social, environmental and economic value by addressing these gaps through responsible and inclusive business. -

Celebrating CBI Member Success in China

Celebrating CBI Member Success in China CBI Beijing May 2015 Executive summary (*Access full sector-specific updates: architecture and design (1), automotive (1), aviation (1), banking and financial services (2), beverage (1), education (3), energy (2), fashion (1), insurance (1), legal (3), media (1), printing (1), professional services (2), retail (2), and telecommunications (1)) Airbus exhibited an ACJ319, operated by Comlux on VVIP charters, at the Asian Business Aviation Conference and Exhibition in Shanghai, highlighting the trend toward larger cabins in the business jet market. (April) Read more here. Benoy announced that Chengdu IFS and iAPM, Shanghai were recognised at the inaugural International Council of Shopping Centres China Awards this year. (April) Benoy built a 5,350-can Temple of Heaven for Canstruction Hong Kong. (April) Read more here. BP and Sinopec Fuel Oil announced the formation of a 50:50 marine fuels bunkering joint venture, BP Sinopec Marine Fuels Pte. Ltd. (May) Read more here. BT announced a five-year contract with GNET, China’s largest independent domestic provider of conferencing solutions, to provide BT’s audio conferencing solutions in China. (April) Read more here. Burberry released its preliminary results for the year ended on 31 March 2015, reporting a strong performance in China. (May) Read more here. Deloitte announced that its Tianjin office had signed a Memorandum of Understanding and Investment and Financing System Innovation Advisory Service Agreement with the Management Committee of Tianjin Economic-Technological Development Area (TEDA). (April) Read more here. Guy Dru Drury – Chief Representative – Beijing Office DL: 00 86 10 85253100 DF: 00 86 10 85253116 E: [email protected] 1006B, 10F, China Life Tower, 16 Chaoyangmenwai Ave, Beijing 100020 CHINA www.cbi.org.uk Director-General:John Cridland President: Sir Mike Rake CBI BEIJING: CELEBRATING CBI MEMBER SUCCESS IN CHINA MAY 2015 Fuji Xerox attended PRINT CHINA 2015, where it brought multiple new technologies and innovative applications. -

The Food and Beverage Market Entry Handbook: Singapore

The Food and Beverage Market Entry Handbook: Singapore a practical guide to the market in Singapore for European agri-food products Prepared by: October 2016 Agriculture and Rural Development 2 | P a g e Tastes of Europe S i n g a p o r e – Market Entry H a n d b o o k EUROPEAN COMMISSION Consumers, Health, Agriculture and Food Executive Agency 3 | P a g e Tastes of Europe S i n g a p o r e – Market Entry H a n d b o o k Promotion of Agricultural Products Unit E-mail: [email protected] Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). This document has been prepared for the Consumers, Health, Agriculture and Food Executive Agency (Chafea) acting under the mandate from the European Commission. It reflects the views only of the authors, and the Commission / Chafea cannot be held responsible for any use which may be made of the information contained therein. More information on the European Union is available on the Internet (http://europa.eu). Luxembourg: Publications Office of the European Union, 2017 PDF/Volume ISBN doi: 10.2818/068090 © European Union, 2017 Reproduction for commercial purposes is not authorised. 4 | P a g e Tastes of Europe S i n g a p o r e – Market Entry H a n d b o o k Table of Contents List of Figures .................................................................................................................................................................... -

A Preliminary Investigation of Radiation Level and Some Radionuclides in Imported Food and Food Products

OAEP รมา^ A PRELIMINARY INVESTIGATION OF RADIATION LEVEL AND SOME RADIONUCLIDES IN IMPORTED FOOD AND FOOD PRODUCTS by FUKIAT SINAKHOM AND SUCHAT MONGKOLPHANTA library LOAN MATERIAL Please return to the Loan Ides*K F0145 เมษายน 2523 OFFICE OF ATOMIC ENERGY rOI APRIL 1980 BANGKOK , THAILAND We regret that some of the pages in the microfiche copy of this report may not be up to the proper legibility standards, even though the best possible copy was used for preparing the master fiche การrfารวVวเกราะหเของทนทงฟ่รนาพรํงสืน8ะขนศของ ใอโชโฟในอาใเทรนอะข«»ฬผ์,พอง อาหารห!โงทททางประเห!! * A PRELIMINARY INVESTIGATION OF RADIATION LEVEL AND SOKE RADIONUCLIDES IN IMPORTED FOOD AND FOOD-PRODUCTS " ฟเกยรก สิไทกน U9ะ แขาก มงกพํนธุ กองช'fกกากกํมม้นกรง!! fi านํก์งานหล้งงานปรนาผเ*๗นกิ FUKIAT SINAKHOM AND SUCHAT MONGKOLPHANTHA WASTE DISPOSAL DIVISION OFFICE OF ATOMIC ENERGY FOR PEACE เมษายน 2523 APRIL 1980 ส'าน่ก์งานหล*งงานปรมาผู๗นก OFFICE OF ATOMIC ENERGY FOR PEACE ทยงานนเปึน!เวนพนึ๋งของวหยานแนขของ นางijเกยรก สินากม (fmitiงาน) กามหiก์สืกราศวกรรมแาแกรมหาบ่ผทิก ชุ*ไaงกรผมหาาหขาสํย With the rorrpl?Tents of Office of Atomic Fnergy 11.r Peace Thailand This report was prepared as an account of work sponsored by the Office of Atomic Siergy for Peace. Neither the Office of Atomic Energy for Peace, nor any of their employees, or any of their contractors, sub- contractors, or their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, com- pleteness or usefulness of any information, apparatus, product or process disclosed, or represents that its use would not infringe privately owned rights. เอก*ทรชJข์น ^Mh ขึ้นโทย rflนกงานฑจ็งงานปรมา^*อรํนค ส์าน้กงานห®']งาน- ป!มา^เไ!อiนก ไมประ1พ้ทวามmiwอบหางกฎหมายในเรอง!ทามนนนอน ทวามรม^ทน ห?® ประโยขนชองขณพ เทรองมอ ฃลคขล หรอกระบวนการใศ ๆ หึ่เปีคเขยในเอกรารน. -

Recommitting to Sustainable Growth CONFERENCE HIGHLIGHTS Friday, 15 April 2016 • the Ritz-Carlton, Millenia Singapore

3RDRD SINGAPORIINGAPORENGAPOR DIALOGUE LOGUELOGUE ONON SustainableSustainable WorldWorld ResourceSResourceS Global Consensus, Regional Actions: Recommitting to Sustainable Growth CONFERENCE HIGHLIGHTS Friday, 15 April 2016 • The Ritz-Carlton, Millenia Singapore 3RDRD SINGAPOREIINNNGGAGAPPOPORPOREOREORE DIALOGUEIIAAALLOLOGUE ONN SustainableSSuussttaiinanablble WWoWorldorrlld RReResourceSessoouurrcceeS KEYNOTE SPEAKER: Mr Masagos Zulkifli Bin Masagos Mohamad Global Consensus, Regionali l AcƟons: Minister for the Environment and Water Resources, Singapore Recommiƫng to Sustainable Growth PANEL KEYNOTES: Mr Nazir Foead The case for sustainable business is now clearer than ever. Le Head, Peatland Restoraon Agency, Indonesia unchecked, the exploitaon of resources will have profoundly Dr Muliaman Hadad negave impacts on the environment and vulnerable communies Chairman, Financial Services Authority (OJK), Indonesia across ASEAN. PANELLISTS: Mr Bian Zhenhu In 2015, the Paris climate conference saw 195 countries adopng President, China Chamber of Commerce for Import the first-ever universal, legally binding global climate deal. At the & Export of Foodstuffs, Nave Produce and Animal By-Products same me, ASEAN countries experienced one of the worst Professor Wang Yao transboundary haze episodes since 1997. Forest and peat fires Deputy Secretary General, across Indonesia led to months of smoke haze and affected at least China Green Finance Commiee, China Finance Society six of the ten ASEAN countries, extending even to southern Thailand Dato’ Dr Makhdzir