04/08/2021 Year Countynumber 31 Number

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Marlboro Mixer

Sept/Oct 2013 Volume 10, Issue 5 The Marlboro Mixer A FREE newsletter for the town of Marlboro, Vermont. 31st Annual Marlboro Community Fair, September 14th!! In this Issue: Marlboro Cares….2 The Fair is almost here! Please join us on Saturday, September 14th. Select Board……….3 This year we are celebrating “The Makers of Marlboro,” all of those Store…………………..3 friends and neighbors who build, create, craft, make, sing, strum, write, Apples………….…….4 repair, harvest, raise, bake, imagine... MES……………………5 Poetry……………..…6 This year we are very glad to have a number of demonstrations of the skill and ingenuity that make Energy……………….6 our Town such a unique place. The Arts & Crafts Tent will host exhibits of wool yarn spinning, toy VPL……………..…….7 making, an oral history, tool sharpening, video productions, and others. Come learn about birds of prey and enjoy a hard cider or maple syrup tasting in the Ag Tent. We encourage everyone to bring flowers, fruits, and vegetables, as well as jams and beers, for display and to enter to win prizes - and entries from all ages are welcome, so please come and bring the best of your harvest. We are glad once again to be hosting a baking contest with prizes donated by King Arthur Flour, with entries being accepted up to 9:30 AM. The stage will be packed with great music all day long, including Rich Grumbine, Singcrony, Michael Hertz, T. Fredric and Lillian Jones, Jesse Lepkoff and friends, the MacArthur Family, Julia Slone, and Red Heart the Ticker. We will have a poetry reading at 3:00 and wrap up the day with A FREE newsletter the Fair Song at 4:00. -

HOW to Eat Crabs!

washingtonFAMILY.com JULY 2019 HOW to Eat Crabs! STUDENT-CENTERED LEARNING AT ONENESS-FAMILY SCHOOL Kenwood School Dedicated to Educational Excellence for over 50 years BEFORE & AFTER SCHOOL CARE KINDERGARTEN THRU 6TH GRADE LEARNING • Small class sizes — allows one-on-one instruction with the teacher • Follows and exceeds Fairfax County curriculum • Standardized testing twice a year to evaluate school ability and achievement; no SOL’s • Integration of reading, writing, oral language, phonics, science, social studies, spelling and math • Extracurricular classes in computers, music, gym and Spanish • Manners and strong social skills are developed in everyday interactions Kindergarten cut o November 30th play • On-site gym for indoor exercise Kindergarten • Daily indoor/outdoor free play cut o • Spacious playground November 30th Extras • Daily interactions with your child’s teacher • Invention Convention, Science Fairs, Fall Festival • Children are able to excel at their own pace • Hot catered lunches and snacks provided • Variety of educational fi eld trips throughout the year • Summer / Holiday Camps • Centrally located — minutes from downtown and major highways 703-256-4711 4955 Sunset Lane Annondale, VA [email protected] www.kenwoodschool.com mommy & me JULY 17TH jokes & WEDNESDAY · 11AM COMMUNITY ROOM juggles Enjoy Mommy’s Lounge while your children play and nurture their magical & creative side. Interactive entertainment provided by Mandy Dalton. Enjoy exclusive discounts from retailers and refreshments provided by Starbucks Coffee and Auntie Anne’s Pretzel Perfect/Planet Smoothie I-95 & I-295 | 6800 Oxon Hill Road | (301) 567-3880 | TangerOutlets.com 51488_NAT_Mommy&Me_PrintAd_7x10_FIN.indd 1 6/19/19 1:24 PM CONTENTS JULY 2019 ON THE COVER STUDENTS AT THE ONENESS-FAMILY SCHOOL Keep your child learning all summer long. -

The Wingfoot Clan - August 4, 1966 - Page 3

.... - .......·-· , z <1,; .... I.042,'-•L.,· .042042·042.... - - ./1.- 1·415 -<&2:- ./ I ...... + 2./1 "ING= :•CIT<1••tr:SrA r• LAN 1'' I '4 I ' ..1 '1 t*» ., « Ii U Y,9'* TH" 0/' EAR TIRE & RUBBER COMPANY AKRON EDITION ..»7 *f 44 ** V 01. 5 Akron, Ohio (3.-ti•ip August 4, 1966 No.31 :<fi) -- S THIS THE CLUB? Pam- e Moore ponders as she Teys a big problem - how 'e:...v» . Sales & Earnings Again get this giant ball in the - . .... 4....'::, " Pamela is just one of I + 07:, empl()yes' children to : n a weekly Rolf ..r. - .... e the others and Top All Previous Records /./. 4 2 2 b problems, turn .. ,'. The highest sales and earnings in history Goodyear's record quarterly earnings of •lit . 1- $33,589,000 were equivalent to 93 cents a ..'-34 i: .4/. -- were achieved by Goodyear during the first + - 1 - .- .-1-&44-.00 . I i .-'.*6 9, ..G.-.-'1•.1.•=••'- .... 4**4 42.4.-. six months and the second quarter of 1966, share, based on 35,792,174 shares outstand- ing June 30, 1966. They were 17.4 per cent \ 1.A- Russell DeYoung, chairman and chief ex- ,/). 6-... ecutive officer, announcd. higher than the $28,606,000, or 80 cents a share, recorded in the second quarter of 1965. Spurred by gains in virtually all lines of 1 The previous record for quarterly earnings " .'*V- ........ activity worldwide, the company recorded 41 I. was $31,215,000, achieved in the last three • six-month sales of $1,220,472,000 and net aA months of 1965. -

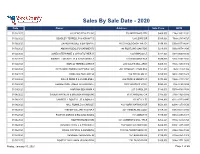

Sales by Date 2020

Sales By Sale Date - 2020 Date Owner Address Sale Price GPIN 01/02/2020 JI CHENG REALTY INC 736 MERRIMAC TRL $465,000 F14d-3352-1091 01/02/2020 BEASLEY TERRELL P & ASHANTI S 124 LEWIS DR $385,000 T08b-2783-4727 01/02/2020 ZAVALA MIGUEL & BARBARA A 115 STAGECOACH WATCH $199,900 S06a-0379-4281 01/02/2020 AMAYA RODOLFO SARMIENTO 146 RUSTLING OAK RDG $210,000 S06a-0074-3540 01/02/2020 JONES STEPHANIE & CHRISTOPHER W 102 MIMADO CT $374,000 S04c-0080-0035 01/02/2020 KIMBRELL MICHAEL R & CASSANDRA A 316 KANAWAH RUN $590,000 V03c-0168-0032 01/02/2020 GARCIA TERESA & ERICK 220 GALTS MILL ARCH $459,990 H14c-1630-1814 01/02/2020 KEYSTONE HOMES CORPORATION 207 WROUGHT IRON BND $151,291 T02d-4740-1352 01/03/2020 MCQUIGG ZACHARY W 106 TRIVALON CT $250,000 S03c-2037-1610 01/03/2020 RALLS DEAN S & CHARLENE J 206 PRINCE HENRY CT $378,000 V02b-4417-3101 01/03/2020 HENDERSON JAMES JR & DONNA J 1003 MARQUIS PKWY $293,490 I13c-0158-0859 01/03/2020 HARRAH BENJAMIN A 217 CAROL DR $186,000 R07b-4566-3538 01/06/2020 SAUER WAYNE M & BRENDA R ROBBINS 513 CAROLINE CIR $385,000 D16c-1925-0946 01/06/2020 CAMPBELL RONEY L JR & SONIA M 105 KELLY ST $249,900 O11a-0270-4907 01/06/2020 HALL RONALD & CAROLE 402 YORK WARWICK DR $521,900 Q09c-1270-0530 01/06/2020 FISHER WILLIAM W & INA F 227 TIMBERLINE LOOP $169,500 S06a-0475-2805 01/06/2020 PAJEVIC ZORAN & BILJANA SOLDO 101 ADELE CT $330,000 S03d-4400-0318 01/06/2020 MOTRENKO MAKSIM 327 CLEMENTS MILL TRCE $255,225 H13a-1679-4769 01/06/2020 WALKER CECIL L & THERESA A 304 YORK WARWICK DR $266,000 Q09c-1485-0803 01/06/2020 -

Horticultural Studies 1998 John R

University of Arkansas, Fayetteville ScholarWorks@UARK Research Series Arkansas Agricultural Experiment Station 5-1-1999 Horticultural Studies 1998 John R. Clark University of Arkansas, Fayetteville Michael D. Richardson University of Arkansas, Fayetteville Follow this and additional works at: https://scholarworks.uark.edu/aaesser Part of the Agronomy and Crop Sciences Commons, and the Horticulture Commons Recommended Citation Clark, John R. and Richardson, Michael D., "Horticultural Studies 1998" (1999). Research Series. 137. https://scholarworks.uark.edu/aaesser/137 This Report is brought to you for free and open access by the Arkansas Agricultural Experiment Station at ScholarWorks@UARK. It has been accepted for inclusion in Research Series by an authorized administrator of ScholarWorks@UARK. For more information, please contact [email protected], [email protected]. HORTICULTURAL STUDIES 1998 Edited by John R. Clark and Michael D. Richardson ARKANSAS AGRICULTURAL EXPERIMENT STATION Division of Agriculture University of Arkansas May 1999 Research Series 466 Editing and cover design by Karen Eskew Arkansas Agricultural Experiment Station, University of Arkansas Division of Agriculture, Fayetteville. Milo J. Shult, Vice President for Agriculture and Director; Charles J. Scifres, Associate Vice President for Agriculture. PS1.20599PM65.The Arkansas Agricultural Experiment Station follows a nondiscriminatory policy in programs and employment. ISSN:0099-5010 CODEN:AKAMA6 HORTICULTURAL STUDIES 1998 John R. Clark, editor Associate Professor Horticulture University of Arkansas Michael D. Richardson, editor Assistant Professor Horticulture University of Arkansas Arkansas Agricultural Experiment Station Fayetteville, Arkansas 72701 PREFACE This initial volume of Horticultural Studies reports results of numerous investiga- tions on a range of horticultural crops in Arkansas. This publication is intended to give the reader increased information on current activities underway in the Division of Ag- riculture in the area of horticulture and its many related disciplines. -

Annual Progress/Final Progress Report Format

Annual Report 2011: Hard Cider Carol Miles, Jonathan Roozen, Andrew Zimmerman, Karen Hasenoehrl, and Jacqueline King WSU Mount Vernon NWREC 16650 State Route 536, Mount Vernon, WA 98273 Tel. 360-848-6150 Email [email protected] http://maritimefruit.wsu.edu/ TITLE : Evaluation of Apple Varieties for Hard Cider Production PERSONNEL: Carol A. Miles, Vegetable Extension Specialist, WSU Mount Vernon NWREC Jonathan Roozen, Associate in Research, WSU Mount Vernon NWREC Jacqueline King, Technical Assistant, WSU Mount Vernon NWREC Karen Hasenoehrl, Technical Assistant, WSU Mount Vernon NWREC Andrew (Drew) Zimmerman, Tulip Valley Vineyard and Orchard, 16163 State Route 536, Mount Vernon, WA 98273 OBJECTIVES: 1. To evaluate certain hard cider apple varieties and determine bloom dates, fruit set, and juice characteristics (brix, pH, percent acid, percent tannin) in northwest Washington. 2. To test mechanical harvest of cider apples with a berry harvester and evaluate impact on fruit yield and quality. SUMMARY: Bottling of 2 cider apples harvested in 2010 was done in January 2011, and 9 cider apple varieties were harvested and pressed for cider making in 2011; they will be bottled Spring 2012. Observations of bloom time and bloom density of 62 cultivars were recorded in April-May 2011. At harvest, juice samples were collected from 59 cider apple varieties grown at WSU Mount Vernon NWREC, and analyzed for percent tannin, brix, pH and titratable acid. A replicated trial comparing machine harvest of cider apples with hand harvest was conducted on October 25, 2011. Cider School courses were conducted at WSU Mount Vernon NWREC by the Northwest Agriculture Business Center; introductory courses were held June 27-July 1 and December 12-16, 2011. -

Pioneer1939.Pdf

* * * * Member 1938-39 * :\ r i:::vl.BER S OUTll ER:-1 f NTERSCllOLASTIC * Piu:ss : \ ss<KIATIOX * * * * * * * * * * Clay Model by \ .AN GnvER * Photograph by \Vooo EX * L BR IS * * .. ,. .. ~ '5> ..... PYJU<.;llT , . co , C u EWNINt. Sui::AH AN H1; 1. i:::-r Editor KJ::ISTER GREJ::R . Busmns. Ma11age1 . 0 1195 03350934 if{,> l . r. The 1939 ;onE-E~ * * * * * * EDICftTIOn T o the student of the past who helped to make the traditions of our school what ther are today; to the student of the present who is pro udly loyal to those ideals, e,·er seeking to maintain and ath·ancc them; to the student of the future who will con tinue to carry o n in t he same trustwo rthy manner, we wish to pay tribute by dedicating this 1939 Edition of T11~ ProNEER. Clo\' .\/odt'ls by \·Ax GELDER · Pliutogropli by \\'oou * * * * * * * * * * * * * * * ... _ _ O~EWOfZD M ASTERPif.CES of art in sculpture and painting ha,·c been produced throughout the :igcs which perpetuate for the world great moments - moments of glory or moments of suffering which s tir the human soul. \·erses ha,·e been written and melodics created "·hich inspire the sou l of man to noble thoughts an<l actions. Books ha,·e been written which immortalize great mo ments in the histo ry of mankind. \\·c, TIII·: PIO>.:"EER STAFF, have sought to capture and record for you, the students of Andrew Lewis High School, t h e rapture o f such a moment a moment which you yourseh·es have made as you went on "striving, seeking, finding," each day. -

Southern Plant Lists

Southern Plant Lists Southern Garden History Society A Joint Project With The Colonial Williamsburg Foundation September 2000 1 INTRODUCTION Plants are the major component of any garden, and it is paramount to understanding the history of gardens and gardening to know the history of plants. For those interested in the garden history of the American south, the provenance of plants in our gardens is a continuing challenge. A number of years ago the Southern Garden History Society set out to create a ‘southern plant list’ featuring the dates of introduction of plants into horticulture in the South. This proved to be a daunting task, as the date of introduction of a plant into gardens along the eastern seaboard of the Middle Atlantic States was different than the date of introduction along the Gulf Coast, or the Southern Highlands. To complicate maters, a plant native to the Mississippi River valley might be brought in to a New Orleans gardens many years before it found its way into a Virginia garden. A more logical project seemed to be to assemble a broad array plant lists, with lists from each geographic region and across the spectrum of time. The project’s purpose is to bring together in one place a base of information, a data base, if you will, that will allow those interested in old gardens to determine the plants available and popular in the different regions at certain times. This manual is the fruition of a joint undertaking between the Southern Garden History Society and the Colonial Williamsburg Foundation. In choosing lists to be included, I have been rather ruthless in expecting that the lists be specific to a place and a time. -

Cider Apples at Mount Vernon: Planting History Carol Miles, Drew

Cider Apples at Mount Vernon: Planting History Carol Miles, Drew Zimmerman, and Jacqueline King WSU Mount Vernon NWREC 16650 State Route 536, Mount Vernon, WA 98273 Tel. 360-848-6150 Email [email protected] http://maritimefruit.wsu.edu/ Cider Apples at WSU Mount Vernon NWREC: Planting History A small collection of traditional English and French cider apple varieties was planted in a preliminary trial from 1977 to 1998, evaluating only the trees’ potential productivity and disease resistance. In 1994 a larger, replicated planting was established to provide enough fruit for cider making, and expanded in 1999. New varieties from France and England were added in 2001– 2008, including some old American cider varieties. The most recent addition was in 2013. Beginning In 2002, varietal ciders have been produced on-station using fruit from the trial, with the advice of an expert cider maker. The ciders are then sampled and evaluated for quality and marketability. The trial has included some 90 varieties including preliminary trials, replicated plots and screening test plots. Table 1. Cider apple varieties at WSU Mount Vernon NWREC from 1977 to present (* indicates currently planted 2014). Cv. Dates planted Notes Amere de Berthcourt 1977-1998, 2003, cider made 2007; evaluated 2009; transplant added 2013* 2013 American Forestier 2003* Ashmead's Kernel 1977* dual purpose: cider, fresh eating; heirloom Bedan de Parts 1977-1995, 2006* Bellflower 1977-1998 AKA Yellow Bellflower, heirloom variety; not evaluated for cider Blanc Mollet 2003* cider evaluated -

Transactions of the Massachusetts Horticultural Society

TRANSACTIONS MASSACHUSETTS HORTICULTURAL SOCIETY FOR THE YEARS 1843-4-5-6 TO WHICH IS ADDED THE ADDRESS DELIVERED BEFORE THE SOCIETY ON 15TH MAY, 1845, AT THE DEDICATION OF THEIR HALL. BOSTON: DUTTON AND WENTWORTH'S PRINT 1847. {,52 .OG CHAPEL i B^ At a meeting of the Massachusetts Horticultural Society, on the 25th day of October, 1S45, " Voted, That Messrs. Samuel Walker, Joseph Breck, Henry W. Dut- TON, Charles K. Dillaway, and Ebenezer Wight, be a Committee to pub- lish the Transactions of the Society for 1S43-4-5-6, to which shall be added the Address delivered before the Society at the dedication of their Hall." The Committee have attended to the duty assigned to them by the above vote, to which they have added, the Act of Incorporation of the Massachusetts Horti- cultural Society, passed June 12th, 1829 ; also, an Additional Act, passed Febru- ary 5th, 1344, and a part of an Act, incorporating the proprietors of Mount Auburn Cemetery, with a List of the Members of the Society, and a Catalogue of the Books in the Library. All which is respectfully submitted. By order of the Committee, SAMUEL WALKER, Chairman. Boston, February 23, 1847. ACT OF INCORPORATION. (KommonUjealti) of li^assacijusetts In the Year of Our Lord One Thousand Eight Hundred and Twenty-nine. AN ACT TO INCORPORATE THE MASSACHUSETTS HORTICULTURAL SOCIETY. Section 1. Be it enacted by the Senate and House of Representatives in General Court assembled, and by the authority of the same : That Zebedee Cook, Jr., Robert L. Emmons, William Worthington, B. V. -

Scale and Regionality of Nonelectric Markets for U.S. Nuclear Light Water Reactors

INL/EXT-20-57885 Revision 0 Scale and Regionality of Nonelectric Markets for U.S. Nuclear Light Water Reactors L. Todd Knighton, Daniel Wendt, Abdalla Jaoude, Cristian Rabiti, and Richard Boardman (INL), Amgad Elgowainy, Krishna Reddi, and Adarsh Bafana (ANL), Brian D. James, Brian Murphy, Julia Scheerer, and Fred Peterson (Strategic Analysis) March 2020 The INL is a U.S. Department of Energy National Laboratory operated by Battelle Energy Alliance DISCLAIMER This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their employees, makes any warranty, expressed or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness, of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. References herein to any specific commercial product, process, or service by trade name, trade mark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by the U.S. Government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the U.S. Government or any agency thereof. INL/EXT-20-57885 Scale and Regionality of Nonelectric Markets for U.S. Nuclear Light Water Reactors L. Todd Knighton, Daniel Wendt, Abdalla Jaoude, Cristian Rabiti, and Richard Boardman (INL), Amgad Elgowainy, Krishna Reddi, and Adarsh Bafana (ANL), Brian D. James, Brian Murphy, Julia Scheerer, and Fred Peterson (Strategic Analysis) March 2020 Idaho National Laboratory Idaho Falls, Idaho 83415 http://www.inl.gov Prepared Under DOE Idaho Operations Office Contract DE-AC07-05ID14517 EXECUTIVE SUMMARY Nuclear energy is increasingly being recognized as a valuable low-carbon, low-emissions energy source that can help meet clean energy targets being set by states, commissions, and utilities in the United States. -

Summary of Research and Extension Activities Hudson Valley Research Laboratory 2016 – 2017

Summary of Research and Extension Activities Hudson Valley Research Laboratory 2016 – 2017 Peter Jentsch, Entomologist, HVRL Director Srdan Acimovic, Plant Pathologist Dana Acimovic, Horticulturist Albert Woelfersheim, Facilities Coordinator ENY Commercial Horticulture Program: Dan Donahue: Tree Fruit Specialist Teresa Rusinek: Vegetable Specialist: Jim Meyers: Viticulture Specialist Elizabeth Higgins: Business Management Specialist Highland, NY Released February 2018 Table of Contents Page Plant Pathology Program ........................................................................................ 3 Horticulture Program………................................................................................... 14 Entomology Program ............................................................................................. 27 Facility Report ........................................................................................................ 34 Extension Activities by Extension Educators housed at the Lab ............................ 36 Publications and Extension/Outreach by Scientist ………….................................. 40 Peter Jentsch………….................................. 40 Dan Donahue………….................................. 50 Srdan Avimovic………….................................. 51 Support Staff, 2016-2017 Without the focused efforts of those listed below, very little would have been accomplished! Without the diversity and humor they brought to the lab, life would have been dull! Albert Woelfersheim Facilities Coordinator 1992 to