2015 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

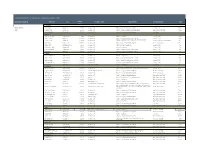

Track Record of Prior Experience of the Senior Cobalt Team

Track Record of Prior Experience of the Senior Cobalt Team Dedicated Executives PROPERTY City Square Property Type Responsibility Company/Client Term Feet COLORADO Richard Taylor Aurora Mall Aurora, CO 1,250,000 Suburban Mall Property Management - New Development DeBartolo Corp 7 Years CEO Westland Center Denver, CO 850,000 Suburban Mall Property Management and $30 million Disposition May Centers/ Centermark 9 Years North Valley Mall Denver, CO 700,000 Suburban Mall Property Management and Redevelopment First Union 3 Years FLORIDA Tyrone Square Mall St Petersburg, FL 1,180,000 Suburban Mall Property Management DeBartolo Corp 3 Years University Mall Tampa, FL 1,300,000 Suburban Mall Property Management and New Development DeBartolo Corp 2 Years Property Management, Asset Management, New Development Altamonte Mall Orlando, FL 1,200,000 Suburban Mall DeBartolo Corp and O'Connor Group 1 Year and $125 million Disposition Edison Mall Ft Meyers, FL 1,000,000 Suburban Mall Property Management and Redevelopment The O'Connor Group 9 Years Volusia Mall Daytona Beach ,FL 950,000 Suburban Mall Property and Asset Management DeBartolo Corp 1 Year DeSoto Square Mall Bradenton, FL 850,000 Suburban Mall Property Management DeBartolo Corp 1 Year Pinellas Square Mall St Petersburg, FL 800,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year EastLake Mall Tampa, FL 850,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year INDIANA Lafayette Square Mall Indianapolis, IN 1,100,000 Suburban Mall Property Management -

2012 FINALISTS ICSC Is Proud to Announce the Finalists of the 2012 U.S

2012 FINALISTS ICSC is proud to announce the finalists of the 2012 U.S. MAXI Awards. The U.S. MAXI Awards honor outstanding marketing campaigns from all over the United States. Chosen by a panel of industry professionals, these finalists represent excellence throughout the industry. The 2012 U.S. Maxi Awards will be presented at ICSC’s first-ever NOI + Conference in Orlando, Florida, September 5, 2012. TRADITIONAL MARKETING - ADVERTISING Single Center Pooches Pose at The Brickyard’s PUParazzi! The Brickyard Shopping Center Chicago, Illinois Owner: Retail Properties of America, Inc. Management Company: RPAI US Management, LLC The Gateway provides Daily Dish The Gateway Salt Lake City, Utah Owner: Retail Properties of America, Inc. Management Company: RPAI, Southwest Management Favorite Label Consumer Campaign Natick Mall Natick, Massachusetts Owner/Management Company: General Growth Properties Home for the Holidays Promotional Campaign Southlake Town Square Southlake, Texas Owner: Retail Properties of America Inc Management Company: RPAI Southwest Management LLC Company 2011 Hillsdale’s South End Renovation Bohannon Development Company San Mateo, California MORE Holiday Advertising CBL & Associates Properties, Inc. Chattanooga, Tennessee Joint Center Club Estrellas E-Magazine The Shops at La Cantera and North Star Mall San Antonio, Texas Management Company: General Growth Properties TRADITIONAL MARKETING - BUSINESS-TO-BUSINESS (B2B) Single Center The Writing’s on the Wall West Acres Shopping Center Fargo, North Dakota Owner/Management Company: West Acres Development, LLP Company Think Retail. Create Value. DDR Corp. Beachwood, Ohio Keep The Dollars In Dallas United Commercial Realty Dallas, Texas TRADITIONAL MARKETING - CAUSE RELATED MARKETING Single Center Queen for a Day Aspen Grove Littleton, Colorado Owner/Management Company: DDR Corp. -

Vision One Eyecare Savings Programs

FLORIDA (continued) Vision One Eyecare Savings Program for Blue Cross Miami JCP Miami SEA Port Richey SEA Port Richey WR□ and Blue Shield of Florida Employees International Mall International Mall Gulf View Square Mall Gulf View Square Mall Vision Typical (305) 470-7866 (813) 846-6235 (813) 849-6783 (305) 594-5865 One Cost Savings Miami SEA Miami JCP Sarasota JCP Sarasota SEA Townand Country Mall Cutler Ridge Mall Sarasota Square Mall Sarasota Square Mall FRAMES (305) 270-9255 (305) 252-2798 (813) 923-0178 (813) 921-8278 Up to $54.00 retail $20.00 60% N. Miami Beach BRO Naples SEA St Petersburg WR□ St Petersburg JCP From $55.00 to $74.00 retail $30.00 60% 1333 NE 163rd St Coastland Mall Crossroads S/C Tyrone Square Mall Over $74.00 retail 50% 50% (305) 940-4325 (813) 643-9334 (813) 347-9191 (813) 344-2611 LENSES (uncoated plastic) Ocala JCP Ocala SEA St Petersburg SEA Tallahassee JCP Single vision $30.00 50% Ppddock Mall Paddock Mall TyroneSquare Mall Governor's Square Mall Bifocal $52.00 40% (904) 237-0055 (904) 873-5270 (813) 341-7263 (904) 878-5721 Trifocal $62.00 45% Orange Park JCP Orange Park SEA Tallahassee SEA Tampa JCP Lenticular $97.00 60% Orange Park Mall Orange Park Mall Governor's Square Mall Eastlake Square Mall LENS OPTIONS (904) 264-7070 (904) 269-8239 (904) 671-6278 (813) 621-7551 (add to above lens prices) Orlando BRO Orlando JCP Tampa WR□ Tampa BRO Progressive (no line bifocals) $55.00 20% Fashion Square Mall Fashion Square Mall Eastlake Square Mall Tampa Bay Center Polycarbonate $30.00 40% (407) 896-5398 (407) 896-1006 (813) 621-5290 (813) 872-3185 Scratch resistant coating $15.00 25% Orlando SEA Orlando JCP Tampa SEA Tampa WR□ Ultra-violet coating $12.00 40% Fashion Square Mall Florida Mall Tampa Bay Center Tampa Bay Center Anti-Reflective Coating $38.00 25% (407) 228-6239 (407) 851-9133 (813) 878-9262 (813) 876-0445 Solid tint $ 8.00 33% Orlando SEA Ormond Beach SEA Tampa JCP Tampa SEA Gradient tint $12.00 20% Florida Mall 126 S. -

Alabama Arizona Arkansas California Riverchase Galleria | Hoover, AL

While we are all eager to get back to business as soon as possible, the timing of our reopening plans is subject to federal, state and local regulations, so projected reopening dates are subject to change. Reopening plans and policies will adhere to federal, state, and local regulations and guidance, and be informed by industry best practices, which will vary based on location and other circumstances. Last Updated: May 27, 2020 Open Properties with Restrictions Alabama Arizona Arkansas California Riverchase Galleria | Hoover, AL Park Place | Tucson, AZ Pinnacle Hills Promenade | Rogers, AR Chula Vista Center | Chula Vista, CA The Shoppes at Bel Air | Mobile, AL The Mall at Sierra Vista | Sierra Vista, AZ Fig Garden Village | Fresno, CA Tucson Mall | Tucson, AZ Galleria at Tyler | Riverside, CA Mt. Shasta Mall | Redding, CA Otay Ranch Town Center | Chula Vista, CA Promenade Temecula | Temecula, CA The Shoppes at Carlsbad | Carlsbad, CA Valley Plaza Mall | Bakersfield, CA Victoria Gardens | Rancho Cucamonga, CA Colorado Connecticut Florida Georgia Park Meadows | Lone Tree, CO Brass Mill Center | Waterbury, CT Altamonte Mall | Altamonte Springs, FL Augusta Mall | Augusta, GA The Shoppes at Buckland Hills | Manchester, CT Coastland Center | Naples, FL Cumberland Mall | Atlanta, GA The Shops at Somerset Square | Glastonbury, CT Governor's Square | Tallahassee, FL North Point Mall | Alpharetta, GA The SoNo Collection | Norwalk, CT Lakeland Square Mall | Lakeland, FL Oglethorpe Mall | Savannah, GA Mizner Park | Boca Raton, FL Peachtree Mall | -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Brookfield Properties' Retail Group Overview

Retail Overview Brookfield Properties’ Retail Group Overview We are Great Gathering Places. We embrace our cultural core values of Humility, Attitude, Do The Right Thing, H Together and Own It. HUMILITY Brookfield Properties’ retail group is a company focused A ATTITUDE exclusively on managing, leasing, and redeveloping high- quality retail properties throughout the United States. D DO THE RIGHT THING T TOGETHER O HEADQUARTERS CHICAGO OWN IT RETAIL PROPERTIES 160+ STATES 42 INLINE & FREESTANDING GLA 68 MILLION SQ FT TOTAL RETAIL GLA 145 MILLION SQ FT PROFORMA EQUITY MARKET CAP $20 BILLION PROFORMA ENTERPRISE VALUE $40 BILLION Portfolio Map 2 7 1 4 3 5 3 6 2 1 2 1 1 2 1 3 3 3 1 1 2 4 1 2 1 3 2 1 1 10 4 2 5 1 4 10 2 3 3 1 48 91 6 5 6 2 7 6 4 5 11 7 4 1 1 1 2 2 2 5 7 1 2 1 2 1 1 1 1 6 1 3 5 3 4 15 19 2 14 11 1 1 3 2 1 2 1 1 3 6 2 1 3 4 18 2 17 3 1 2 1 3 2 2 5 3 6 8 2 1 12 9 7 5 1 4 3 1 2 1 2 16 3 4 13 3 1 2 6 1 7 9 1 10 5 4 2 1 4 6 11 5 3 6 2 Portfolio Properties 1 2 3 3 3 1 7 4 Offices 13 12 2 Atlanta, GA 7 3 1 1 Chicago, IL Baltimore, MD 8 5 2 Dallas, TX 4 Los Angeles, CA 6 New York, NY 8 2 9 5 Property Listings by State ALABAMA 7 The Oaks Mall • Gainesville 3 The Mall in Columbia • Columbia (Baltimore) 9 Brookfield Place • Manhattan WASHINGTON 8 Pembroke Lakes Mall • Pembroke Pines 4 Mondawmin Mall • Baltimore 10 Manhattan West • Manhattan 1 Riverchase Galleria • Hoover (Birmingham) 1 Alderwood • Lynnwood (Seattle) 5 Towson Town Center • Towson (Baltimore) 11 Staten Island Mall • Staten Island 2 The Shoppes at Bel Air • Mobile (Fort Lauderdale) -

BLUE ROUTE Regular

FARES Notifying the Public of Rights Under Title VI VISTA TRANSIT The City of Sierra Vista/Vista Transit operates its programs and services without regard to race, color, national origin, or disability in accordance with Title VI of the Civil Rights Act of 1964, Section 504 of the Rehabilitation Act of 1973, REGULAR FARE INFORMATION and the Americans with Disabilities Act of 1990 (ADA). Any person who believes she or he has been aggrieved by any BLUE ROUTE Regular............................................................$1.25 unlawful discriminatory practice under Title VI may file a complaint with the City of Sierra Vista/Vista Transit. One-Day Pass ..............................................$3.00 For more information on the City of Sierra Vista/Vista Transit’s civil rights program, and the procedures to file Day passes may be purchased in advance. a complaint, contact the Transit Administrator (520) 417-4888; or visit the Transit Center at 2050 E. Wilcox Day passes are not available on the bus and must Avenue, Sierra Vista, AZ 85635. For more information, visit be purchased at the transit center. VistaTransit.org. A separate complaint may be filed with the Federal Transit DISCOUNTED FARE INFORMATION Administration (FTA) by filing a complaint directly with the corresponding offices of Civil Rights: FTA: ATTN: Complaint Passenger must display valid discount card. Team, East Building, 5th Floor-TCR 1200 New Jersey Avenue SE, Washington, DC 20590. Senior Citizen (aged 65 and older) ......$.60 Aviso al Público Sobre los Derechos Bajo el Título VI Disabled Citizen ...........................................$.60 City of Sierra Vista/Vista Transit asegura complir con el Título Children (5 & under) ............................... -

Alabama Arizona Arkansas California Riverchase Galleria

While we are all eager to get back to business as soon as possible, the timing of our reopening plans is subject to federal, state and local regulations, so projected reopening dates are subject to change. Reopening plans and policies will adhere to federal, state, and local regulations and guidance, and be informed by industry best practices, which will vary based on location and other circumstances. Last Updated: July 20, 2020 Open Properties with Restrictions Alabama Arizona Arkansas California Riverchase Galleria | Hoover, AL Park Place | Tucson, AZ Pinnacle Hills Promenade | Rogers, AR Bayshore Mall | Eureka, CA The Shoppes at Bel Air | Mobile, AL The Mall at Sierra Vista | Sierra Vista, AZ Chula Vista Center | Chula Vista, CA Tucson Mall | Tucson, AZ Fig Garden Village | Fresno, CA Mt. Shasta Mall | Redding, CA Otay Ranch Town Center | Chula Vista, CA Valley Plaza Mall | Bakersfield, CA Victoria Gardens | Rancho Cucamonga, CA Colorado Connecticut Delaware Florida Park Meadows | Lone Tree, CO Brass Mill Center | Waterbury, CT Christiana Mall | Newark, DE Altamonte Mall | Altamonte Springs, FL Southwest Plaza | Littleton, CO The Shoppes at Buckland Hills | Manchester, CT Coastland Center | Naples, FL The Shops at Somerset Square | Glastonbury, CT Governor's Square | Tallahassee, FL The SoNo Collection | Norwalk, CT Lakeland Square Mall | Lakeland, FL Mizner Park | Boca Raton, FL The Oaks Mall | Gainesville, FL Pembroke Lakes Mall | Pembroke Pines, FL Shops at Merrick Park | Coral Gables, FL Georgia Hawaii Idaho Illinois Augusta Mall -

Seritage Growth Properties

ANNUAL REPORT 2019 ANNUAL REPORT 2019 Our Mission Create and own revitalized shopping, dining, entertainment and mixed-use destinations that provide enriched experiences for consumers and local communities, and that generate long-term value for our shareholders. Seritage Growth Properties is a publicly-traded, self-administered and self-managed REIT with 180 wholly-owned properties and 28 joint venture properties totaling approximately 30 million square feet of space across 44 states and Puerto Rico. ANNUAL REPORT 2019 Dear Fellow Shareholders We will get through this. We are focused on preserving the medium and long-term value of our assets and platform, balanced with the need to make immediate changes in response to the current environment. As this letter goes to print, we are in the midst of the COVID-19 pandemic, which has created significant uncertainty and volatility and put a pause on normal daily life. Our number one priority is the health and safety of our team, our families and loved ones, our communities and our partners, including our tenants, contractors, and other stakeholders. To you, our shareholders, we hope this letter finds that all is well with each of you and your families. I am very proud of our team. In the face of intense disruption, our team has met our business challenges head on while also balancing responsibilities at home. On the civic front, we want to widely broadcast that over 180 of our properties (certain full buildings and many of our parking lots) are available to governmental and community organizations for relief efforts. Please visit www.seritage.com/civic or email us at [email protected] to utilize these facilities at no cost. -

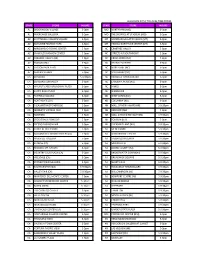

Opticianry Employers - USA

www.Jobcorpsbook.org - Opticianry Employers - USA Company Business Street City State Zip Phone Fax Web Page Anchorage Opticians 600 E Northern Lights Boulevard, # 175 Anchorage AK 99503 (907) 277-8431 (907) 277-8724 LensCrafters - Anchorage Fifth Avenue Mall 320 West Fifth Avenue Ste, #174 Anchorage AK 99501 (907) 272-1102 (907) 272-1104 LensCrafters - Dimond Center 800 East Dimond Boulevard, #3-138 Anchorage AK 99515 (907) 344-5366 (907) 344-6607 http://www.lenscrafters.com LensCrafters - Sears Mall 600 E Northern Lights Boulevard Anchorage AK 99503 (907) 258-6920 (907) 278-7325 http://www.lenscrafters.com Sears Optical - Sears Mall 700 E Northern Lght Anchorage AK 99503 (907) 272-1622 Vista Optical Centers 12001 Business Boulevard Eagle River AK 99577 (907) 694-4743 Sears Optical - Fairbanks (Airport Way) 3115 Airportway Fairbanks AK 99709 (907) 474-4480 http://www.searsoptical.com Wal-Mart Vision Center 537 Johansen Expressway Fairbanks AK 99701 (907) 451-9938 Optical Shoppe 1501 E Parks Hy Wasilla AK 99654 (907) 357-1455 Sears Optical - Wasilla 1000 Seward Meridian Wasilla AK 99654 (907) 357-7620 Wal-Mart Vision Center 2643 Highway 280 West Alexander City AL 35010 (256) 234-3962 Wal-Mart Vision Center 973 Gilbert Ferry Road Southeast Attalla AL 35954 (256) 538-7902 Beckum Opticians 1805 Lakeside Circle Auburn AL 36830 (334) 466-0453 Wal-Mart Vision Center 750 Academy Drive Bessemer AL 35022 (205) 424-5810 Jim Clay Optician 1705 10th Avenue South Birmingham AL 35205 (205) 933-8615 John Sasser Opticians 1009 Montgomery Highway, # 101 -

State Store Hours State Store Hours Al Brookwood

ALL HOURS APPLY TO LOCAL TIME ZONES STATE STORE HOURS STATE STORE HOURS AL BROOKWOOD VILLAGE 5-9pm MO NORTHPARK (MO) 5-9pm AL RIVERCHASE GALLERIA 5-9pm MO THE SHOPPES AT STADIUM (MO) 5-9pm AZ SCOTTSDALE FASHION SQUARE 5-9pm MT BOZEMAN GALLATIN VALLEY (MT) 5-9pm AZ BILTMORE FASHION PARK 5-9pm MT HELENA NORTHSIDE CENTER (MT) 5-9pm AZ ARROWHEAD TOWNE CENTER 5-9pm NC CRABTREE VALLEY 5-9pm AZ CHANDLER FASHION CENTER 5-9pm NC STREETS AT SOUTHPOINT 5-9pm AZ PARADISE VALLEY (AZ) 5-9pm NC CROSS CREEK (NC) 5-9pm AZ TUCSON MALL 5-9pm NC FRIENDLY CENTER 5-9pm AZ TUCSON PARK PLACE 5-9pm NC NORTHLAKE (NC) 5-9pm AZ SANTAN VILLAGE 5-9pm NC SOUTHPARK (NC) 5-9pm CA CONCORD 5-9:30pm NC TRIANGLE TOWN CENTER 5-9pm CA CONCORD SUNVALLEY 5-9pm NC CAROLINA PLACE (NC) 5-9pm CA WALNUT CREEK BROADWAY PLAZA 5-9pm NC HANES 5-9pm CA SANTA ROSA PLAZA 5-9pm NC WENDOVER 5-9pm CA FAIRFIELD SOLANO 5-9pm ND WEST ACRES (ND) 5-9pm CA NORTHGATE (CA) 5-9pm ND COLUMBIA (ND) 5-9pm CA PLEASANTON STONERIDGE 5-9pm NH MALL OF NEW HAMPSHIRE 5-9:30pm CA MODESTO VINTAGE FAIR 5-9pm NH BEDFORD (NH) 5-9pm CA NEWPARK 5-9pm NH MALL AT ROCKINGHAM PARK 5-9:30pm CA STOCKTON SHERWOOD 5-9pm NH FOX RUN (NH) 5-9pm CA FRESNO FASHION FAIR 5-9pm NH PHEASANT LANE (NH) 5-9:30pm CA SHOPS AT RIVER PARK 5-9pm NJ MENLO PARK 5-9:30pm CA SACRAMENTO DOWNTOWN PLAZA 5-9pm NJ WOODBRIDGE CENTER 5-9:30pm CA ROSEVILLE GALLERIA 5-9pm NJ FREEHOLD RACEWAY 5-9:30pm CA SUNRISE (CA) 5-9pm NJ MONMOUTH 5-9:30pm CA REDDING MT. -

Mall at Sierra Vista 2200 El Mercado Loop Sierra Vista, Az 85635

MALL AT SIERRA VISTA 2200 EL MERCADO LOOP SIERRA VISTA, AZ 85635 THE MALL AT SIERRA VISTA serves as the regional shopping, dining, and entertainment destination for Southeast Arizona and the neighboring Mexican border towns of Agua Prieta and Naco. Situated seventy miles southeast of Tucson, and 15 miles north of Mexico, Sierra Vista enjoys a diverse customer base which includes over 17,000 military personnel and related contractors, high-income aeronautical/defense employees, and over 40,000 non-duplicated Mexican national shoppers each year. Our customers enjoy the only first run theater in the area (Cinemark), a collection of dining options (Texas Roadhouse, Applebee’s, food court), and the most diverse assortment Mall at Sierra Vista SIERRA VISTA, ARIZONA of national retailers in the region. Acting as the main commercial, cultural and recreational hub of the southeastern area of Arizona, one of the fastest growing communities in the state. [email protected] (212) 608-5108 5 5 WEST Properties EAST Properties 1114 AVENUE OF THE AMERICAS NEW YORK, NY 10036-7703 ROUSEPROPERTIES.COM | NYSE : RSE TRADE AREA MALL 20-MILE MALL AT SIERRA VISTA PROFILE INFORMATION RADIUS* RAPID GROWTH | EXCELLENT ACCESSIBILITY | STRONG MILITARY PRESENCE Market Sierra Vista 2010 Population 75,170 2010 Population 104,680 2015 Projected 80,793 Description Single-level, enclosed, • A large tech industry, including companies 2015 Projected 111,222 regional such as Northrop Grumman and Lockheed 2010 Households 29,186 Martin, employ highly-educated local CATER