DART Light Rail's Effect on Taxable Property Valuations and Transit-Oriented Development

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bringing Regional Rail Service to the Historic Cotton Belt Corridor DART Current and Future Rail Services

SILVER LINE REGIONAL RAIL GROUNDBREAKING COMMEMORATIVE EDITION Bringing Regional Rail Service to the Historic Cotton Belt Corridor DART Current and Future Rail Services NW PLANO PARK & RIDE PLANO PARKER ROAD To Denton JACK HATCHELL DOWNTOWN PLANO TRANSIT CTR. Preside SHILOH nt G 12TH STREET ROAD e sh Turnpike (future) o r g e Bu Dallas North Tollway CITYLINE/BUSH NORTH CARROLLTON/FRANKFORD UT DALLAS GALATYN PARK TRINITY MILLS CARROLLTON ADDISON KNOLL TRAIL RICHARDSON ARAPAHO CENTER Map Legend DOWNTOWN CARROLLTON ADDISON CYPRESS WATERS TRANSIT CTR. DFW (DALLAS) SPRING VALLEY MapTo FortLegendBlue Worth Line AIRPORT FARMERS NORTH BRANCH Red Line DOWNTOWN Blue Line FARMERS BRANCH GARLAND GARLAND LBJ/CENTRAL Map LegendGreenDFW Line DFW DOWNTOWN Red Line ROWLETT AIRPORT AIRPORT FOREST LANE FOREST/JUPITER OrangeBlueTerminal Line B Line Terminal A Green Line HIDDEN ROYAL LANE LBJ/SKILLMAN Orange Line BELT LINE ROWLETT Red Line RIDGE Map Legend LAKE HIGHLANDS Weekdays Peak Only (future) WALNUT OrangeDFW Line IRVING CONVENTION WALNUT HILL/DENTON HILL TrinityGreen RailwayLine Express CENTER Blue Line (No Sunday Service) PARK LANE Lake Ray Orange Line NORTH LAKE LAS COLINAS S. GARLAND Hubbard Orange Line COLLEGE Red Line TRANSIT CTR. TEXRailWeekdays (Trinity Peak Metro) Only URBAN CENTER UNIVERSITY WHITE ROCK LOVERS A-Train (DCTA) Green Line BACHMAN OrangeTrinity Line Railway Express UNIVERSITY OF DALLAS PARK LANE Weekdays Peak Only (No Sunday Service) LOVE FIELD White Rock M-Line Trolley VIA BUS 524 HIGHLAND LAKE RAY Orange Line Lake TrinityTEXRail Railway (Trinity Express Metro)Inset Map LOOP 12 BURBANK PARK HUBBARD Dallas(No Sunday Streetcar Service) (future) INWOOD/LOVE FIELD SMU/MOCKINGBIRD TRANSIT CTR. -

Doug Allen-Dallas

The DART Perspective Doug Allen Executive Vice President Program Development Dallas Area Rapid Transit Why DART? • Growing Mobility Problems • “World Class” Image • Vision 9 Fixed Guideway 9 Multi-modal 9 Regional Mobility History • DART was created to implement a vision 9 Fixed Guideway 9 Multi-modal • We had some problems along the way 9 Local economy 9 Public input 9 Political support 9 Credibility 9 Failure of Bond Referendum History • 1983 – DART established • 1988 – Bond referendum failure • 1989 – New Directions System Plan campaign • 1992 – Rail construction begins • 1996 – Opening of LRT Starter System • 2000 – Long term debt package passed • 2001-02 – Opening of extensions • 2006 – $700 Million FFGA The Mission To build and operate a safe, efficient and effective transportation system that, within the DART Service Area, provides mobility, improves the quality of life, and stimulates economic development. FY 2006 Ridership by Mode 36.1 Million 18.6 Million 18% 36% 44% 2% 2.4 Million 44.3 Million System Overview THE DART SYSTEM BUS • Provides area-wide coverage 9 700 square miles 9 Over 100 routes • Flexible 9 Local 9 Express 9 Crosstown 9 Feeders 9 Paratransit 9 Innovative services • Carries 44.3 million riders/year (FY ’06) System Overview THE DART SYSTEM Light Rail • Provides high capacity, quality transit within busiest corridors 9 20 mile Starter System 9 Additional 25 miles in 2002-3 9 Another 48 miles in planning & design • Benefits include 9 Service Reliability 9 Consistent time savings 9 Attracts new users 9 Stimulates -

Sounder Commuter Rail (Seattle)

Public Use of Rail Right-of-Way in Urban Areas Final Report PRC 14-12 F Public Use of Rail Right-of-Way in Urban Areas Texas A&M Transportation Institute PRC 14-12 F December 2014 Authors Jolanda Prozzi Rydell Walthall Megan Kenney Jeff Warner Curtis Morgan Table of Contents List of Figures ................................................................................................................................ 8 List of Tables ................................................................................................................................. 9 Executive Summary .................................................................................................................... 10 Sharing Rail Infrastructure ........................................................................................................ 10 Three Scenarios for Sharing Rail Infrastructure ................................................................... 10 Shared-Use Agreement Components .................................................................................... 12 Freight Railroad Company Perspectives ............................................................................... 12 Keys to Negotiating Successful Shared-Use Agreements .................................................... 13 Rail Infrastructure Relocation ................................................................................................... 15 Benefits of Infrastructure Relocation ................................................................................... -

Bus Rapid Transit (BRT) and Light Rail Transit

Bus Rapid Transit (BRT) and Light Rail Transit (LRT) Performance Characteristics Stations Mixed Traffic Lanes* Service Characteristics Newest Corridor End‐to‐End Travel Departures Every 'X' Travel Speed (MPH) City Corridor Segment Open length (mi) # Spacing (mi) Miles % Time Minutes BRT Systems Boston Silver Line Washington Street ‐ SL5 2002 2.40 13 0.18 1.03 42.93% 19 7 7.58 Oakland San Pablo Rapid ‐ 72R 2003 14.79 52 0.28 14.79 100.00% 60 12 14.79 Albuquerque The Red Line (766) 2004 11.00 17 0.65 10.32 93.79% 44 18 15.00 Kansas City Main Street ‐ MAX "Orange Line" 2005 8.95 22 0.41 4.29 47.92% 40 10 13.42 Eugene Green Line 2007 3.98 10 0.40 1.59 40.00% 29 10 8.23 New York Bx12 SBS (Fordham Road ‐ Pelham Pkwy) 2008 9.00 18 0.50 5.20 57.73% 52 3 10.38 Cleveland HealthLine 2008 6.80 39 0.17 2.33 34.19% 38 8 10.74 Snohomish County Swift BRT ‐ Blue Line 2009 16.72 31 0.54 6.77 40.52% 43 12 23.33 Eugene Gateway Line 2011 7.76 14 0.55 2.59 33.33% 29 10 16.05 Kansas City Troost Avenue ‐ "Green Line" 2011 12.93 22 0.59 12.93 100.00% 50 10 15.51 New York M34 SBS (34th Street) 2011 2.00 13 0.15 2.00 100.00% 23 9 5.22 Stockton Route #44 ‐ Airport Corridor 2011 5.50 8 0.69 5.50 100.00% 23 20 14.35 Stockton Route #43 ‐ Hammer Corridor 2012 5.30 14 0.38 5.30 100.00% 28 12 11.35 Alexandria ‐ Arlington Metroway 2014 6.80 15 0.45 6.12 89.95% 24 12 17.00 Fort Collins Mason Corridor 2014 4.97 12 0.41 1.99 40.00% 24 10 12.43 San Bernardino sbX ‐ "Green Line" 2014 15.70 16 0.98 9.86 62.79% 56 10 16.82 Minneapolis A Line 2016 9.90 20 0.50 9.90 100.00% 28 10 21.21 Minneapolis Red Line 2013 13.00 5 2.60 2.00 15.38% 55 15 14.18 Chapel Hill N‐S Corridor Proposed 8.20 16 0.51 1.34 16.34% 30 7.5 16.40 LRT Systems St. -

Trinity Mills Station Market Overview

Report Trinity Mills Station Market Overview Prepared for: City of Carrollton, Texas and Dallas Area Rapid Transit Prepared by: Economic & Planning Systems, Inc. April 24, 2013 EPS #20842 Table of Contents 1. INTRODUCTION AND PROPERTY DESCRIPTION ................................................................. 1 Trinity Mills Station Properties .................................................................................... 1 Surrounding Land Use ............................................................................................... 3 Transportation and Access ......................................................................................... 4 Planning and Land Use Policy Context .......................................................................... 4 2. REGIONAL MARKET FRAMEWORK ................................................................................ 7 Employment Trends .................................................................................................. 7 Population Growth .................................................................................................. 12 Subject Property Demographics ................................................................................ 15 Conclusions – Regional Growth Trends ...................................................................... 17 3. TRANSIT ORIENTED DEVELOPMENT ON THE DART SYSTEM ............................................... 18 Red and Blue Lines, Northeast Dallas ....................................................................... -

Free to Ride!

FREE TO RIDE! NO SUNDAY SERVICE UPTOWN PEARL ST OLIVE & E McKINNEY 722 OLIVE ST 21 K WOODALL D-LINK RODGERS FWY PEARL/ARTS B 20 D 21 FLORA ST DISTRICT STATION CEDAR RD SPRINGS 19 MAP NOT TO SCALE DALLAS ARTS 20 Pearl/Arts District DISTRICT 18 17 LEGEND 19 East Transfer D-Link Route & Stop Center MCKINNEY AVE Dallas Streetcar & Stop FIELD ST Victory DART Light Rail and Station FEDERAL ST. BROOM ST PEARL ST M-Line Trolley West Transfer St.HARWOOD Paul Trinity Railway Express Center CESAR CHAVEZ BLVD MAIN & Commuter Rail and Station ST. PAUL ST Akard ST. PAUL C 12 LAMAR ST 11 15 13 ELM ST 14 WEST END MAIN ST HISTORIC MAIN STREET YOUNG ST DISTRICTRECORD DISTRICT 16 West End LAMAR ST G ROSS AVE FIELD ST TRINITY RIVER DALLAS FARMERS G ST 10 MARKET ST MARKET DISTRICT PACIFIC AVE ELM ST 4 BC HOUSTON & HOUSTON ST MAIN ST 3 MARILLA ELM 9 2 COMMERCE ST 5 1 CONVENTION CENTER E A WOOD ST B STATION 8 Union Convention Center Station 6 YOUNG ST LAMAR ST 7 Cedars 2 MIN-WALK REUNION DALLAS STREETCAR 5 MIN-WALK DISTRICT TO BISHOP ARTS DISTRICT Route 722 Serves All Local Bus Stops POWHATTAN STBELLEVIEW ST Stop Numbers and Places of Interest 620 NO SUNDAY SERVICE 1. Convention Center Station 8. Dealey Plaza 15. Main Street Garden No Holiday Service on days observed for Memorial Day, 2. Kay Bailey Hutchison 9. Sixth Floor Museum at 16. Dallas Farmers Market July 4, Labor Day, Thanksgiving DALLAS TRINITY RIVER HOUSTON ST Convention Center Dealey Plaza Day, Christmas Day and New Year’s Day. -

Highland Park Carrollton Farmers Branch Addison

LAKE LEWISVILLE 346 348 EXCHANGE PKWY 348 LEGACY DR PARKWOOD SH 121 SHOPS AT 452 348 452 LEGACY 346346 LEGACY DR TENNYSON 347 P 183 451 208 NORTH PLANO NORTHWEST PLANO DART ON-CALL ZONE PARK AND RIDE 183, 208, 346, 347, PRESTON RD 348, 451, 452 SPRING CREEK PKWY 452 SPRING CREEK PKWY 829 LAKESIDE US-75 N. CENTRAL EXPWY. COLLIN COUNTY MARKET COMMUNITY 350 COLLEGE JUPITER RD 350 TEXAS HEALTH 451 PLANO RD PRESBYTERIAN HOSPITAL PLANO PARKER RD 452 R RD COMMUNICATIONS 347 PARKER RD PARKER ROAD STATION PARKE 350, 410, 452 183 PRESTON RD. DART ON-CALL, TI Shuttle, Texoma Express 410 CUSTER RD SHOPS AT RD COIT PARK BLVD INDEPENDENCE PARK BLVD CREEK WILLOWBEND 410 ALMA ARBOR 531 347 PARK BLVD PARK BLVD CHEYENNE 870 451 BAYLOR MEDICAL CTR. 18TH 870 AT CARROLLTON HEBRON PLANO DOWNTOWN PLANO STATION MEDICAL CENTER 870 FLEX 208 OF PLANO 15TH 15TH OHIO 14TH IN T PARKWOOD E 350 R 13TH 870 N A PLANO PKWY TI 210 COLLIN CREEK MALL ON JACK HATCHELL TRANSIT CENTER FM 544 AL P KWY 841 210, 350, 451, 452, 841 FLEX SH-121 347 210 BAYLOR REGIONAL 870 843 AVE K AVE 843 841 MEDICAL CTR. ROSEMEADE PKWY 534 841 PLANO PKWY PLANO PKWY HEBRON to Denton (operated by DCTA) 531 347 841 MARSH LUNA 350 841 410 WAL-MART 883 Fri/Sun 841 ROUND GROVE NPIKE NORTH STAR RD TIMBERGREEN H TUR NORTH CARROLLTON/FRANKFORD STATION P S BUSH TURNPIKE STATION 333 U 883 UTD Shuttle, 841-843 FLEX PEAR RIDGE PEAR B IH-35E STEMMONS FRWY. -

GREATER CLEVELAND REGIONAL TRANSIT AUTHORITY Transit Oriented Development Best Practices February 2007

FEBRUARY GREATER CLEVELAND 2007 REGIONAL TRANSIT AUTHORITY TOD in Practice San Francisco, CA Dallas, TX Boston, MA Baltimore, MD St.Louis, MO Portland, OR Washington DC Lessons Learned Establishing Roles Developing the Development Using Regional Strengths 1240 West 6th Street Cleveland, OH 44113 216.566-5100 TRANSIT ORIENTED www.gcrta.org DEVELOPMENT BEST PRACTICES 2007 Greater Cleveland Regional Transit Authority 1240 West 6th Street, Cleveland, OH 44113 216.566.5100 www.gcrta.org Best Practices Manual GREATER CLEVELAND REGIONAL TRANSIT AUTHORITY Table of Contents PAGE Introduction .......................................................................................................................1 TOD in Practice .................................................................................................................3 Bay Area Rapid Transit (BART) and Santa Clara County Valley Transportation Authority (VTA): San Francisco Bay Area, CA................................................................................5 Dallas Area Rapid Transit (DART): Dallas, TX..............................................................15 Massachusetts Bay Transportation Authority (MBTA): Boston, MA................................23 Metro: Baltimore, MD ..................................................................................................32 Metro: St. Louis, MO....................................................................................................36 Tri-County Metropolitan Transportation District of Oregon (Tri-Met): -

REFERENCE BOOK March 2019

DALLAS AREA RAPID TRANSIT REFERENCE BOOK March 2019 Version 10.0 WHAT The Dallas Area Rapid Transit (DART) Reference Book is a convenient and easy to use compilation of information on the DART system. It provides staff with key data, maps and contacts. The objective is to allow staff to respond to inquiries, with consistent, accurate information in a timely manner. WHO The DART Reference Book was compiled by the Capital Planning Division of the Growth/Regional Development Department. Numerous DART departments provide input and assist Capital Planning with annual updates. WHEN DART Capital Planning coordinates an update after each fiscal year ending September 30. Because some financial information does not become immediately available, the Reference Book update is completed by the second quarter (March) of the following fiscal year. AVAILABILITY A limited number of printed copies are made for senior management. A PDF version of the Reference Book is available for DART staff on DART InfoStation, and also on www.DART.org under About DART. VERSION CONTROL VERSION NUMBER VERSION DATE DESCRIPTION OF CHANGES 1 8.2010 DRAFT 2 3.2011 FY10 Actual/FY11 Budget Update 3 4.2012 FY11 Actual/FY12 Budget Update 4 4.2013 FY12 Actual/FY13 Budget Update 5 3.2014 FY13 Actual/FY14 Budget Update New Board Member committee 5.1 5.2014 assignments/minor edits 6 3.2015 FY14 Actual/FY15 Budget Update Corrected LRT on-time performance for 6.1 7.2015 PDF version only. 7 3.2016 FY15 Actual/FY16 Budget Update 8 3.2017 FY16 Actual/FY17 Budget Update 9 3.2018 FY17 Actual/FY18 Budget Update 10 3.2019 FY18 Actual/FY19 Budget Update II DART REFERENCE BOOK – MARCH 2019 DART POINTS-OF-CONTACT ADMINISTRATIVE OFFICES DART MAILING/PHYSICAL ADDRESS 214-749-3278 DALLAS AREA RAPID TRANSIT P.O. -

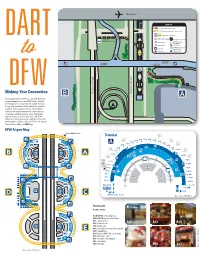

Making Your Connection

DART Rail System Map DOWNTOWN ROWLETT DFW AIRPORT STATION Open 2014 Irving Convention Center Belt Line Making Your Connection During peak times (4:30-7 a.m. and 2:15-5:30 p.m. weekday departures from DFW Airport Station), the Orange Line travels from the station through Irving, into downtown Dallas and to the northern terminus of the system at Parker Road Station in Plano. Off-peak, it follows the same path but terminates at LBJ/Central Station. Select late- night Orange Line trains will travel from DFW Exploring Airport Station to downtown; from there they will Popular Destinations go through Deep Ellum and end at Fair Park Station. Check out schedules at DART.org. DART DFW Airport Map Convention Center District. One of the largest in the nation, the Kay Bailey Hutchison (Dallas) Convention Center hosts major national and international conventions, meetings, antique and Exit to DART Station Terminal auto shows, and other events. The Omni Dallas Hotel is connected to it via sky bridge. Convention Center Station Fair Park. The largest collection of Art Deco exhibit buildings in the U.S., Fair Park is a historical treasure that plays host to the State Fair of Texas®. Other attractions include the Heart of Dallas Bowl football game and year-round museums. Fair Park Station Dallas Arts District. The Dallas Arts District is the largest arts district in the nation, spanning 68 acres and comprising Entry numerous venues of cultural as well as architectural from distinction. Pearl/Arts District Station DART Omni Dallas Hotel Station NorthPark Center. Shoppers from all over the world are drawn to NorthPark’s one-of-a-kind collection of luxury and fashion-forward retailers. -

History of Mass Transit

A NEW WAY TO CONNECT TO TRAVEL Ryan Quast Figure 1.1 A NEW WAY TO CONNECT TO TRAVEL A Design Thesis Submitted to the Department of Architecture and Landscape Architecture of North Dakota State University By Ryan Quast In Partial Fulfillment of the Requirements for the Degree of Master of Architecture Primary Thesis Advisor Thesis Committee Chair May 2015 Fargo, North Dakota List of Tables and Figures Table of Contents Figure 1.1 Train entering COR station 1 Cover Page................................................................................................1 Taken by author Signature Page....................................................................................... ...3 Figure 1.2 Northstar commuter train 13 Table of Contents......................................................................................4 www.northstartrain.org Tables and Figures....................................................................................5 Thesis Proposal.....................................................................................10 Figure 2.1 Render of The COR 15 Thesis Abstract............................................................................11 coratramsey.com/node/23 Narrative of the Theoretical Aspect of the Thesis..................12 Figure 2.2 Development plan for COR 15 Project Typology.........................................................................13 coratramsey.com/sites/default/files/COR-Development-Plan-6.0.pdf Typological Research (Case Studies)...................................................14 -

The Predicted and Actual Impacts of New Starts Projects - 2007

US Department of Transportation Federal Transit Administration THE PREDICTED AND ACTUAL IMPACTS OF NEW STARTS PROJECTS - 2007 CAPITAL COST AND RIDERSHIP Prepared by: Federal Transit Administration Office of Planning and Environment with support from Vanasse Hangen Brustlin, Inc. April 2008 Acknowledgements This report was primarily authored by Mr. Steven Lewis-Workman of the Federal Transit Administration and Mr. Bryon White of VHB, Inc. Portions of this report were also written and edited by Ms. Stephanie McVey of the Federal Transit Administration and Mr. Frank Spielberg of VHB, Inc. The authors would like to thank all of the project sponsors and FTA Regional Office staff who took the time to review and ensure the accuracy of the information contained in this study. Table of Contents 1. OVERVIEW 1 1.1. REVIEW OF PAST STUDIES 2 1.2. METHODOLOGY 2 1.3. FINDINGS FOR CAPITAL COSTS 3 1.4. FINDINGS FOR RIDERSHIP 4 1.5. ORGANIZATION OF THIS REPORT 4 2. CAPITAL COSTS 7 2.1. CAPITAL COST ANALYSIS APPROACH 7 2.2. CAPITAL COST ANALYSIS RESULTS 8 2.3. COMPARISON TO NEW STARTS PROJECTS FROM PRIOR STUDIES 14 2.4. DURATION OF PROJECT DEVELOPMENT 15 3. RIDERSHIP 17 3.1. RIDERSHIP ANALYSIS APPROACH 17 3.2. FORECAST AND ACTUAL RIDERSHIP 18 3.2.1. AVERAGE WEEKDAY BOARDINGS 18 3.2.2. AVERAGE WEEKDAY BOARDINGS ADJUSTED TO FORECAST YEAR 19 3.3. COMPARISON TO NEW STARTS PROJECTS FROM PRIOR STUDIES 21 3.3.1. PREDICTED VS. ACTUAL – 2003 UPDATE 21 3.3.2. URBAN RAIL TRANSIT PROJECTS – 1990 UPDATE 22 3.4.