Stephens Spring Investment Conference June 3, 2015 Safe Harbor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Save the World, Eat Insects | Martha Stewart Living

August 14, 2017 To Save the World, Eat Insects Why this Texas company thinks crickets are the future of food. By Bridget Shirvell 125 MORE S H A RE S PHOTOGRAPHY BY: COURTESY OF ASPIRE Find a bowl of slightly roasted crickets as part of the spread at your friend's backyard barbecue and chances are you'll be looking for a new squad. "There's an ick factor, that's people's first impression," said Vincent Vitale, business development manager of Aspire Food Group. Aspire, which is said to be the world's first fully automated cricket farm, is betting on people getting over the ick factor. Based in Texas, the company farms and produces a variety of edible cricket products, sold through its Aketta line. Think cricket protein flour, paleo granola and cricket protein snacks, such as whole roasted crickets and flavored roasted crickets. (Make Your Own Granola -- Whether You Add Cricket Powder is Up to You) PHOTOGRAPHY BY: COURTESY OF ASPIRE This is what an automated cricket farm looks like. WHAT CRICKETS TASTE LIKE Crickets -- I'm taking Vincent's word here -- have a slight sunflower seed-like taste, with a bit of earthy nuttiness and are crispy like chips. WHY THE WORLD NEEDS CRICKETS There's long history of crickets and other insects staring in dishes from cuisines around the globe. Nearly two billion people regularly eat insects, and the U.N. Food and Agriculture Organization would like even more people to give them a shot. That's because insects are an incredible source of protein, 30 grams of crickets is about 20 grams of protein, compared to beef with 8 grams of protein, and farming them is much more sustainable than producing beef, poultry and fish. -

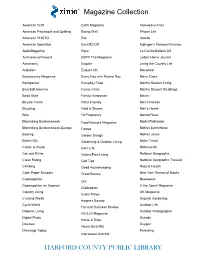

Magazine Collection

Magazine Collection American Craft Earth Magazine Interweave Knits American Patchwork and Quilting Eating Well iPhone Life American PHOTO Elle Islands American Spectator Elle DÉCOR Kiplinger’s Personal Finance AppleMagazine Equs La Cucina Italiana US Architectural Record ESPN The Magazine Ladies Home Journal Astronomy Esquire Living the Country Life Audubon Esquire UK Macworld Backcountry Magazine Every Day with Rachel Ray Marie Claire Backpacker Everyday Food Martha Stewart Living Baseball America Family Circle Martha Stewart Weddings Bead Style Family Handyman Maxim Bicycle Times FIDO Friendly Men’s Fitness Bicycling Field & Stream Men’s Health Bike Fit Pregnancy Mental Floss Bloomberg Businessweek Food Network Magazine Model Railroader Bloomberg Businessweek-Europe Forbes Mother Earth News Boating Garden Design Mother Jones British GQ Gardening & Outdoor Living Motor Trend Canoe & Kayak Girls’ Life Motorcyclist Car and Driver Gluten-Free Living National Geographic Clean Eating Golf Tips National Geographic Traveler Climbing Good Housekeeping Natural Health Cloth Paper Scissors GreenSource New York Review of Books Cosmopolitan Newsweek Grit Cosmopolitan en Espanol O the Oprah Magazine Guideposts Country Living OK Magazine Guitar Player Cruising World Organic Gardening Harper’s Bazaar Cycle World Outdoor Life Harvard Business Review Diabetic Living Outdoor Photographer HELLO! Magazine Digital Photo Outside Horse & Rider Discover Oxygen House Beautiful Dressage Today Parenting Interweave Crochet HARFORD COUNTY PUBLIC LIBRARY Magazine -

ADOPTED SEP 0 7 2010 SECONDED BY: C.R~ LOS ANGELES CITY Council

CITY OF LOS ANGELES RESOLUTION MARC MARMARO WHEREAS, Marc Marmaro was born on February 26, 1948, in the Bronx, New York; and, WHEREAS, Marmaro went on to receive a B.A. from George Washington University in 1969 and J.D. cum laude, Order of the Coif, from New York University School of Law in 1972; and, WHEREAS, in 1972, Marmaro clerked for the Honorable John J. Gibbons, U.S. Court of Appeals for the Third Circuit; and, WHEREAS, Marmaro served the U.S. Attorney's Office, Southern District of New York as an assistant U.S. attorney from 1975 to 1978; and, WHEREAS, Marmaro moved to the City of Los Angeles to join Manatt, Phelps & Phillips as a litigation associate and partner until 1981; and, WHEREAS, in 1981, Marmaro helped found the law firm Jeffer, Mangels, Butler, & Marmaro, LLP, which has grown from 11 employees to over 140 in three cities across the United States; and, WHEREAS, Marmaro is a Fellow of the American College of Trial Lawyers; and, WHEREAS, in 2004, he was named California Lawyer of the Year in Intellectual Property by California Lawyer magazine for negotiating the settlement of spinal fusion technology patent disputes for $1.35 billion; and, WHEREAS, on June 30,2010, California Governor Arnold Schwarzenegger appointed him to the Los Angeles County Superior Court; and, WHEREAS, on August 5, 2010, Marc Marmaro was officially sworn into office as a Judge for Los Angeles County Superior Court; and, NOW, THEREFORE, BE IT RESOLVED, that by the adoption of this resolution, the City Council of Los Angeles, the Mayor, and the City Attorney extends their congratulations to Marc Marmaro for his judicial appointment, outstanding achievements, and constant pursuit for justice. -

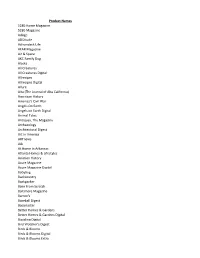

Product Names 5280 Home Magazine 5280 Magazine Adage Additude

Product Names 5280 Home Magazine 5280 Magazine AdAge ADDitude Adirondack Life AFAR Magazine Air & Space AKC Family Dog Alaska All Creatures All Creatures Digital Allrecipes Allrecipes Digital Allure Alta (The Journal of Alta California) American History America's Civil War Angels On Earth Angels on Earth Digital Animal Tales Antiques, The Magazine Archaeology Architectural Digest Art In America ARTnews Ask At Home In Arkansas Atlanta Homes & Lifestyles Aviation History Azure Magazine Azure Magazine Digital Babybug Backcountry Backpacker Bake From Scratch Baltimore Magazine Barron's Baseball Digest Bassmaster Better Homes & Gardens Better Homes & Gardens Digital Bicycling Digital Bird Watcher's Digest Birds & Blooms Birds & Blooms Digital Birds & Blooms Extra Blue Ridge Country Blue Ridge Motorcycling Magazine Boating Boating Digital Bon Appetit Boston Magazine Bowhunter Bowhunting Boys' Life Bridal Guide Buddhadharma Buffalo Spree BYOU Digital Car and Driver Car and Driver Digital Catster Magazine Charisma Chicago Magazine Chickadee Chirp Christian Retailing Christianity Today Civil War Monitor Civil War Times Classic Motorsports Clean Eating Clean Eating Digital Cleveland Magazine Click Magazine for Kids Cobblestone Colorado Homes & Lifestyles Consumer Reports Consumer Reports On Health Cook's Country Cook's Illustrated Coral Magazine Cosmopolitan Cosmopolitan Digital Cottage Journal, The Country Country Digital Country Extra Country Living Country Living Digital Country Sampler Country Woman Country Woman Digital Cowboys & Indians Creative -

Case Studies on the Downside of Transactional and Authoratitative Organizational Leadership Styles During Crisis Management

The Turkish Online Journal of Design, Art and Communication - TOJDAC ISSN: 2146-5193, October 2020 Volume 10 Issue 4, p.597-611 CASE STUDIES ON THE DOWNSIDE OF TRANSACTIONAL AND AUTHORATITATIVE ORGANIZATIONAL LEADERSHIP STYLES DURING CRISIS MANAGEMENT Vehbi GÖRGÜLÜ İstanbul Bilgi Üniversitesi, Türkiye [email protected] https://orcid.org/0000-0001-6248-7289 ABSTRACT Leadership is a value gained through education and experience. Leadership communication has the potential make Corporate CommuniCations and risk management processes more dynamiC and efficient. From these aspeCts, leader Communication Can be very influential over sustainability of corporate success. The Current study aims to explore how authoritative and transaCtional leadership styles result with various Challenges during crisis communication and management. The crises experienced by The Martha Stewart Living Omnimedia, Toyota, FaCebook and the United Airlines companies are explored as case studies. The analysis is not limited with the Crisis proCesses, but also questions the efficiency of leadership models embraced by managers of these two organizations. Keywords: Leadership, Martha Stewart, United Airlines, Facebook, Crisis Management. OTORİTER VE SÜRDÜRÜMCÜ (TRANSAKSİYONEL) LİDERLİK YAKLAŞIMLARININ KRİZ YÖNETİMİ BAĞLAMINDAKİ KISITLILIKLARI ÜZERİNE VAKA İNCELEMELERİ ÖZ Liderlik doğuştan değil, eğitim ve deneyimle edinilen bir değer olarak kurumsal hayatta karşımıza çıkmaktadır. Etkili lider iletişimi, yalnızca kurumsal iletişim sürecini verimli kılmamakta, aynı zamanda kriz yönetim süreçlerinin de başarıyla sonuçlanmasını sağlamaktadır. Tüm bu yönleriyle, etkili lider iletişiminin şirketlerin geleceği üzerinde belirleyici olduğu vurgulanabilir. Mevcut çalışma, otoriter ve transaksiyonel liderlik modelleri ile kriz yönetim süreçleri arasındaki ilişkiyi inCelemektedir. Belirlenen ilişkinin inCelenebilmesi için seçilen vakalar The Martha Stewart Living Omnimedia Company, Toyota, FaCebook ve The United Airlines skandalları olmuştur. -

When It's Simply Not an Event but a Celebration!

8 Lebanon Valley Area Merchandiser - January 31, 2018 Wedding Frosting- Tricks Free Cakes Add Ease the Latest to Planning Trend A new trend is taking hold both And Fun in North America and on the other Brides and grooms understand- side of the Atlantic Ocean. Cakes ably feel a little stress when plan- are being pared down so that frost- ning their weddings. Adding to the ing and fondant coverings are now pressure is the fact that, according nearly absent from the confec- to a WeddingWire.com report, the tions. average couple in their 30s spends They’re called “naked cakes,” $32,000 on their wedding. That is and these simplified desserts a lot of money riding on one day. showcase the texture of the cakes But planning a wedding can be and their fillings. According to even more fun than it is stressful, culinary experts, the idea for the especially for those couples who naked cake came from Chris- employ a few tricks of the wedding tina Tosi, owner of Momofuku planning trade. Milk Bar. It’s an award-winning 1. Fake the cake. Save some bakery with locations across the money by asking the bakery cake United States and Canada. Now artist to decorate a foam-tiered have all of the wedding-related de- Hers, Friends, Work. cellophane available to make bou- tails in one place, create a separate quets. many other pastry chefs and bak- “mock” cake for pictures and dis- 10. Make a photo clothesline. ers are hopping on the naked cake play, and serve guests from an in- email address exclusively for wed- A clever and inexpensive idea is 12. -

Magazines, Blogs and Design…Wiki-Style

THESIS WRITE MY THESIS: MAGAZINES, BLOGS AND DESIGN…WIKI-STYLE Brittany Watson Interior Design In partial fulfillment of the requirements For the Degree of Master of Art Corcoran College of Art and Design Washington DC Spring 2010 2 Thesis Statement Design blogs and other forms of social media have assumed a more prominent role over the traditional printed magazine in disseminating information, creating a sense of community, encouraging artistic collaboration and identifying new tastes, which is explored in this thesis through author-mediated crowd-sourcing through a blog called Write My Thesis leading to an online magazine, Baker Street. Abstract The day Domino magazine folded in January of 2009, a silence was heard throughout the design community. This marked yet another design magazine that had fallen victim to declining advertisement sales in recent years. Until this point, magazines were at the forefront of identifying design trends and up-and-coming designers, while providing one of the only locations to provide guides of where to find products and how to assemble looks. The rise in social media, including blogs, vlogs, wikis, podcasts, wall postings, and photosharing, has quickly assumed a more prominent role in the wake of printed magazines. Like Wikipedia, this thesis is mass-collaboratively written by the users of the Web 2.0 through crowd-sourcing the content on a wiki site with the author acting as mediator and main contributor. The aim is to discover the benefits of social media versus 3 traditional print and how it affects design. The project describes the qualities that made the magazine successful in its golden age and how they eventually grew outdated as social media became more popular. -

A Powerful Diversified Media & Marketing Company

A Powerful Diversified Media & Marketing Company Investor Day March 2, 2016 1 Disclaimer This presentation contains confidential information regarding Meredith Corporation (“Meredith” or the “Company”). This presentation constitutes “Business Information” under the Confidentiality Agreement the recipient signed and delivered to the Company and its use and retention are subject to the terms of such agreement. This presentation does not purport to contain all of the information that may be required to evaluate a potential transaction with the Company and any recipient hereof should conduct its own independent evaluation and due diligence investigation of the Company and the potential transaction. Nor shall this presentation be construed to indicate that there has been no change in the affairs of the Company since the date hereof or such other date as of which information is presented. Each recipient agrees that it will not copy, reproduce, disclose or distribute to others this presentation or the information contained herein, in whole or in part, at any time, without the prior written consent of the Company, except as expressly permitted in the Confidentiality Agreement. The recipient further agrees that it will cause its directors, officers, employees and representatives to use this presentation only for the purpose of evaluating its interest in a potential transaction with the Company and for no other purpose. Neither the Company nor any of its affiliates, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this presentation or any other information (whether communicated in written or oral form) transmitted or made available to the recipient, and each of such persons expressly disclaims any and all liability relating to or resulting from the use of this presentation. -

Martha Stewart Living Omnimedia (A)

For the exclusive use of E. Pepanyan, 2021. 9-501-080 REV: JULY 30, 2002 SUSAN FOURNIER, KERRY HERMAN, LAURA WINIG, ANDREA WOJNICKI Martha Stewart Living Omnimedia (A) Aretha Jackson, president of a private investment firm, put the phone down. It was Thursday, May 4, 2000. A client had scheduled the late evening call to ask her advice on investing in Martha Stewart Living Omnimedia (MSLO), an integrated content and media company dedicated to the business of homemaking. Jackson logged onto Yahoo.com to check MSLO’s stock performance. Noting the steady downward plunge since MSLO went public in October 1999, Jackson reminded herself that this was not an unusual post-IPO pattern. Maybe the old adage “buy low, sell high” might apply. But, what if the spiral signaled some fundamental problem? Jackson downloaded a copy of MSLO’s S-1 filing from July 29, 1999, and went to the “Risk Factors” section. One paragraph looked alarming, with the first sentence set off in caps: THE LOSS OF THE SERVICES OF MARTHA STEWART . WOULD MATERIALLY ADVERSELY AFFECT OUR BUSINESS. We are highly dependent upon our founder, chairman and chief executive officer, Martha Stewart. Martha Stewart’s talents, efforts, personality and leadership have been, and continue to be, critical to our success. The diminution or loss of the services of Martha Stewart, and any negative market or industry perception arising from that diminution or loss, would have a material adverse effect on our business. Martha Stewart remains the personification of our brands as well as our senior executive and primary creative force.1 Jackson read on. -

Meredith Secures Rights to License Martha Stewart Living Magazine and Marthastewart.Com

October 15, 2014 Meredith Secures Rights To License Martha Stewart Living Magazine And Marthastewart.com Meredith to also Assume Responsibility for Sales and Marketing of Martha Stewart Weddings Magazine and Marthastewartweddings.com Martha Stewart Editorial Team Will Continue to Create Award-Winning Content NEW YORK and DES MOINES, Iowa, Oct. 15, 2014 /PRNewswire/ -- Meredith Corporation (NYSE:MDP; www.meredith.com) today announced that it has entered into an agreement with Martha Stewart Living Omnimedia (NYSE: MSO) to acquire the rights to Martha Stewart Living and www.marthastewart.com pursuant to a 10-year licensing agreement. Under the terms of the agreement, Meredith will lead sales and marketing, circulation, production, and other non-editorial functions of Martha Stewart Living and Martha Stewart Weddings magazines. Martha Stewart Living Omnimedia's (MSLO) editorial team will continue to create its highly regarded content. Additionally, Meredith will assume responsibility for the sales and marketing of www.marthastewart.com and www.marthastewartweddings.com and its related assets, including its vast video library. The agreement, which applies to the United States and Canada, is effective November 1, 2014. Meredith will begin delivering editions starting with the February 2015 issue of Martha Stewart Living and the Winter 2014 special issue of Martha Stewart's Real Weddings. The agreement will not have a material effect on Meredith's fiscal 2015 second quarter financial performance, but will be accretive to Meredith's earnings for the second half of fiscal 2015 and in fiscal 2016. Meredith will provide more details on its fiscal 2015 first quarter earnings call on October 23, 2104. -

Bridal Website/Blogs Vs Print Magazines Courtney Muir Pace University

Pace University DigitalCommons@Pace Master of Science in Publishing Dyson College of Arts & Sciences 7-1-2009 Bridal Website/Blogs vs Print Magazines Courtney Muir Pace University Follow this and additional works at: http://digitalcommons.pace.edu/dyson_mspublishing Part of the Communication Commons Recommended Citation Muir, Courtney, "Bridal Website/Blogs vs Print Magazines" (2009). Master of Science in Publishing. Paper 2. http://digitalcommons.pace.edu/dyson_mspublishing/2 This Thesis is brought to you for free and open access by the Dyson College of Arts & Sciences at DigitalCommons@Pace. It has been accepted for inclusion in Master of Science in Publishing by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. BRIDAL WEBSITE/BLOGS VS PRINT MAGAZINES “Submitted in partial fulfillment of the requirements for the Master of Science in Publishing degree at Pace University” Courtney Muir 699B-4044.200940 Professor Jane Kinney-Denning July 10, 2009 Muir, 1 Over the past ten years, an evolution in technology has lead to media distribution taking on various forms. Books have become kindles, magazines have created e-zines and newspapers have become websites, which update multiple times per day. In the age of the Internet, these mediums have become interactive through surveys, posts and blogs, which allow the readers to participate and add value to both the content as well as give feedback about the demographic. However, it can be difficult to maintain a reader’s attention and the interest of advertisers due to the vast amount of information available almost anywhere. In order for the publications to have a better sense of control, specifically in terms of bridal magazines, a bride’s source of inspiration and creativity is commonly derived from wedding magazines. -

Historical Precedents for Martha Stewart

tMôrtfà Stewart 5 Martha Stewart Roundtable It Was Always a Good Thing: Historical Precedents for Martha Stewart Sarah A. Leavitt I have been a subscriber to Martha Stewart Living since the spring of 1995. My interest in Stewart began earlier that year, when my mother bought me my first Martha Stewart cookbook, from which I concocted some incredible appe tizers for a Superbowl party. Admittedly, the guests preferred the store-bought cheese-flavored popcorn to my salmon tartare on homemade potato chips, but I had enjoyed the experience of devoting an entire weekend to planning and ful filling an unusual menu. At the time, Martha Stewart was not yet a household name, her magazine had just begun its run, and many people, amazingly enough, had no idea who she was, or why I would want to make her hors d'oeuvres for a party. Most people had no opinion of Martha Stewart one way or another: she had not yet polarized Americans into thinking she either brought "good things" or repression to modern women. That was about the time that I was trying to write a dissertation proposal. I was, in fact, trying (unsuccessfully) to link the history of domesticity to modern questions about the formation of national ideologies about class and gender. I was attempting to figure out a way to show that women writing about the home had made important contributions to different aspects of society, not always limited by a notion of "separate spheres" into thinking of the home as different from the rest of society. I was trying to demonstrate that nineteenth-century domesticity might be important to the way we understand women's relationship 0026-3079/2001/4202-125$2.50/0 American Studies, 42:2 (Summer 2001): 125-131 125 126SarahA.Leavitt with the outside world then, and with home today.