Meredith Corporation Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Save the World, Eat Insects | Martha Stewart Living

August 14, 2017 To Save the World, Eat Insects Why this Texas company thinks crickets are the future of food. By Bridget Shirvell 125 MORE S H A RE S PHOTOGRAPHY BY: COURTESY OF ASPIRE Find a bowl of slightly roasted crickets as part of the spread at your friend's backyard barbecue and chances are you'll be looking for a new squad. "There's an ick factor, that's people's first impression," said Vincent Vitale, business development manager of Aspire Food Group. Aspire, which is said to be the world's first fully automated cricket farm, is betting on people getting over the ick factor. Based in Texas, the company farms and produces a variety of edible cricket products, sold through its Aketta line. Think cricket protein flour, paleo granola and cricket protein snacks, such as whole roasted crickets and flavored roasted crickets. (Make Your Own Granola -- Whether You Add Cricket Powder is Up to You) PHOTOGRAPHY BY: COURTESY OF ASPIRE This is what an automated cricket farm looks like. WHAT CRICKETS TASTE LIKE Crickets -- I'm taking Vincent's word here -- have a slight sunflower seed-like taste, with a bit of earthy nuttiness and are crispy like chips. WHY THE WORLD NEEDS CRICKETS There's long history of crickets and other insects staring in dishes from cuisines around the globe. Nearly two billion people regularly eat insects, and the U.N. Food and Agriculture Organization would like even more people to give them a shot. That's because insects are an incredible source of protein, 30 grams of crickets is about 20 grams of protein, compared to beef with 8 grams of protein, and farming them is much more sustainable than producing beef, poultry and fish. -

2019 Media Kit Mission Statement

2019 MEDIA KIT MISSION STATEMENT Our mission is to bring enjoyment, fulfillment, and inspiration to our readers by celebrating the best of the Southern lifestyle. We inspire creativity in their homes, their kitchens, their gardens, and their personal style. We are relentless champions of our region, and we set the standard for excellence in Southern content regardless of platform or medium. EDITORIAL Southern Living celebrates the essence of life in the South, covering the best in Southern food, home, travel, and style. EDITORIAL MIX PRINT FOOD TRAVEL & CULTURE 36% 19% FAMILY 2% BEAUTY HOME & & STYLE OTHER GARDEN 4% 10% 29% Source: 2018 MediaRadar Inc. 2019 EDITORIAL CALENDAR PRINT ISSUE CLOSE ON SALE JANUARY 10/29/18 12/21/18 Comfort Food FEBRUARY 11/26/18 1/18/19 Baking Issue MARCH 1/2/19 2/22/19 Homes With Soul APRIL 1/28/19 3/22/19 South’s Best MAY 2/25/19 4/19/19 Hospitality Issue JUNE 4/1/19 5/24/19 Outdoor Entertaining JULY 4/29/19 6/21/19 Food Issue/Best of Summer AUGUST 5/28/19 7/19/19 Idea House SEPTEMBER 7/1/19 8/23/19 The Beautiful Issue OCTOBER 7/29/19 9/20/19 Small Town Fall Weekends NOVEMBER 8/26/19 10/18/19 Thanksgiving DECEMBER 9/24/19 11/15/19 White Cake/Christmas All editorial content and programs subject to change. EDITORIAL MIX DIGITAL NEWS FOOD 40% 20% TRAVEL & CULTURE 20% WEDDINGS, HOME & BEAUTY HOLIDAYS & GARDEN & STYLE OCCASIONS 10% 2% 5% OTHER 3% Source: Meredith Corporation 2018 2019 EDITORIAL CALENDAR DIGITAL JANUARY • Big Batch Family Breakfasts • Party-Perfect Super Bowl Menu • Comfort Food FEBRUARY • Chocolate Lover’s Guide • Romantic Trips • Mardi Gras MARCH • South’s Best Awards • Instant Spring Style • Spring Gardening APRIL • Easter Recipes for a Crowd • Home Renovation Tours • Wedding Etiquette 101 MAY • Kentucky Derby • Sun Care Essentials • Family-Friendly Vacation Planner JUNE • Food Awards • How to Throw a Porch Party • Family Reunions All editorial content and programs subject to change. -

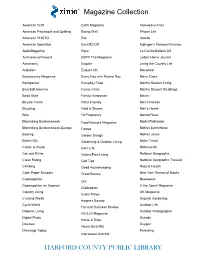

Magazine Collection

Magazine Collection American Craft Earth Magazine Interweave Knits American Patchwork and Quilting Eating Well iPhone Life American PHOTO Elle Islands American Spectator Elle DÉCOR Kiplinger’s Personal Finance AppleMagazine Equs La Cucina Italiana US Architectural Record ESPN The Magazine Ladies Home Journal Astronomy Esquire Living the Country Life Audubon Esquire UK Macworld Backcountry Magazine Every Day with Rachel Ray Marie Claire Backpacker Everyday Food Martha Stewart Living Baseball America Family Circle Martha Stewart Weddings Bead Style Family Handyman Maxim Bicycle Times FIDO Friendly Men’s Fitness Bicycling Field & Stream Men’s Health Bike Fit Pregnancy Mental Floss Bloomberg Businessweek Food Network Magazine Model Railroader Bloomberg Businessweek-Europe Forbes Mother Earth News Boating Garden Design Mother Jones British GQ Gardening & Outdoor Living Motor Trend Canoe & Kayak Girls’ Life Motorcyclist Car and Driver Gluten-Free Living National Geographic Clean Eating Golf Tips National Geographic Traveler Climbing Good Housekeeping Natural Health Cloth Paper Scissors GreenSource New York Review of Books Cosmopolitan Newsweek Grit Cosmopolitan en Espanol O the Oprah Magazine Guideposts Country Living OK Magazine Guitar Player Cruising World Organic Gardening Harper’s Bazaar Cycle World Outdoor Life Harvard Business Review Diabetic Living Outdoor Photographer HELLO! Magazine Digital Photo Outside Horse & Rider Discover Oxygen House Beautiful Dressage Today Parenting Interweave Crochet HARFORD COUNTY PUBLIC LIBRARY Magazine -

State Tourism Offices' Total Marketing Funding (Actual Vs Budget)

State Tourism Offices' Total Marketing Funding (Actual vs Budget) State FY 2016-2017a FY 2017-2018p % Change Alabama $8,115,055.00 $9,199,881.00 13.00% Alaska $2,482,720.00 $4,848,809.00 95.00% Arizona $10,956,969.00 $11,227,720.00 3.00% Arkansas $12,191,546.00 $13,151,494.00 8.00% California $101,394,628.28 $106,339,771.43 5.00% Colorado $18,674,900.00 $18,847,000.00 1.00% Connecticut $6,597,251.00 $6,177,800.00 -6.00% Delaware $735,000.00 $635,000.00 -14.00% Florida $64,539,191.50 $63,859,323.00 -1.00% Georgia $7,642,269.00 $7,642,269.00 0.00% Hawaii $75,262,000.00 $82,372,843.00 9.00% Idaho $4,889,913.00 $5,937,405.00 21.00% Illinois $30,440,862.05 $16,909,167.00 -45.00% Indiana $3,889,326.00 $2,825,231.00 -27.00% Kansas $2,816,279.00 $2,526,048.00 -10.00% Kentucky $7,204,204.34 $9,063,300.00 26.00% Louisiana $8,533,637.00 $11,621,676.00 36.00% Maine $10,983,426.00 $12,424,000.00 13.00% Maryland $5,486,184.00 $5,469,984.00 0.00% Massachusetts $1,460,000.00 $1,460,000.00 0.00% Michigan $29,573,594.00 $31,169,975.00 5.00% Minnesota $9,659,712.00 $9,839,772.00 2.00% Mississippi $3,024,589.55 $2,877,101.09 -5.00% Missouri $16,854,773.37 $7,921,883.10 -53.00% Montana $12,403,057.47 $14,250,920.00 15.00% Nebraska $3,678,389.61 $3,987,503.00 8.00% Nevada $12,141,194.01 $15,192,247.00 25.00% New Jersey $5,119,000.00 $7,910,000.00 55.00% New Mexico $9,449,577.00 $9,423,500.00 0.00% North Carolina $10,799,604.00 $11,253,729.00 4.00% North Dakota $4,660,897.50 $4,006,601.00 -14.00% Ohio $7,409,485.00 $8,566,000.00 16.00% Oklahoma $7,631,357.82 -

ADOPTED SEP 0 7 2010 SECONDED BY: C.R~ LOS ANGELES CITY Council

CITY OF LOS ANGELES RESOLUTION MARC MARMARO WHEREAS, Marc Marmaro was born on February 26, 1948, in the Bronx, New York; and, WHEREAS, Marmaro went on to receive a B.A. from George Washington University in 1969 and J.D. cum laude, Order of the Coif, from New York University School of Law in 1972; and, WHEREAS, in 1972, Marmaro clerked for the Honorable John J. Gibbons, U.S. Court of Appeals for the Third Circuit; and, WHEREAS, Marmaro served the U.S. Attorney's Office, Southern District of New York as an assistant U.S. attorney from 1975 to 1978; and, WHEREAS, Marmaro moved to the City of Los Angeles to join Manatt, Phelps & Phillips as a litigation associate and partner until 1981; and, WHEREAS, in 1981, Marmaro helped found the law firm Jeffer, Mangels, Butler, & Marmaro, LLP, which has grown from 11 employees to over 140 in three cities across the United States; and, WHEREAS, Marmaro is a Fellow of the American College of Trial Lawyers; and, WHEREAS, in 2004, he was named California Lawyer of the Year in Intellectual Property by California Lawyer magazine for negotiating the settlement of spinal fusion technology patent disputes for $1.35 billion; and, WHEREAS, on June 30,2010, California Governor Arnold Schwarzenegger appointed him to the Los Angeles County Superior Court; and, WHEREAS, on August 5, 2010, Marc Marmaro was officially sworn into office as a Judge for Los Angeles County Superior Court; and, NOW, THEREFORE, BE IT RESOLVED, that by the adoption of this resolution, the City Council of Los Angeles, the Mayor, and the City Attorney extends their congratulations to Marc Marmaro for his judicial appointment, outstanding achievements, and constant pursuit for justice. -

Susanne Mei, General Manager, People/Entertainment Weekly Network

Susanne Mei, General Manager, People/Entertainment Weekly Network Susanne Mei is the General Manager of People/Entertainment Weekly Network—Time Inc.’s first-ever Over-the-top (OTT) service. When she joined Time Inc. last year, Mei worked across all Time Inc. brands focusing on video distribution partnerships. In her management of the ad supported video on demand (AVOD) platform, she oversees the strategy, operations, revenue and marketing. Mei joins Time Inc. with over 20 years of experience in entertainment business. Prior to joining Time Inc. she was Vice President of Digital Distribution and Business Development at AMC Networks. In this role she was responsible for revenue and strategy on all transactional digital platforms including iTunes, Xbox, Amazon, GooglePlay and others. Additionally, she led the team that launched the SundanceNOW Doc Club subscription video on demand (SVOD) service and ran day-to-day operations. Previously, Mei served as the Vice President of Digital Media for Smithsonian Networks during the initial launch of the network. From 2002 to 2006, Mei was a Director of Business Development at Showtime focusing on mobile, VOD and new channel development. She was part of the team that executed the deal with The Smithsonian Institution to launch the Smithsonian Network. Her start in the strategic world of digital media began as a Strategy Consultant at Concrete Media in 2000. Before that she spent several years at ABC News in production and was a part of the team that developed and launched the original abcnews.com. Mei earned her BA at Tufts University and her MBA at The Stern School of Business at NYU. -

Quick from Scratch Soups & Salad Cookbook

QUICK FROM SCRATCH SOUPS & SALAD COOKBOOK PDF, EPUB, EBOOK Food & Wine Magazine | 192 pages | 07 Feb 2004 | American Express Food & Wine Magazine Corporation | 9780916103903 | English | none Quick from Scratch Soups & Salad Cookbook PDF Book Slow Cooker Cioppino Recipe Simmering the base of this rich stew in the slow cooker allows for ultimate flavor concentration. Item location: Caro, Michigan, United States. There are so many delicious soup recipes! Classic, comforting, and so delicious, this easy potato soup is the ultimate bowl of comfort food. Life more Currently. Email to friends Share on Facebook - opens in a new window or tab Share on Twitter - opens in a new window or tab Share on Pinterest - opens in a new window or tab Add to Watchlist. Trending Topics. Save Pin ellipsis More. It could be just going up for a hike by our home and picking up leaves, riding our bikes, or watching the sunset from our window. Both me and my husband work full time and so having the girls at home is a challenge. This Nut Roast recipe is packed with a deliciously sweet and savory blend of nuts, veggies, lentils, dried fruit and fresh herbs. I see earth in our skin and especially when I paint people. Detailed instructions on unfamiliar things like making yogurt and bread, grilling virtually every food imaginable, preparing and cooking freshly-caught fish and seafood, cutting up and boning meat, cooking in a Thermos and baking on the stove top, as well as lots of tips on how to do things more easily in a tiny, moving kitchen. -

Mountain View Room AARP Magazine Advocate American Spirit

Mountain View Room Mother Earth News Newspapers AARP Magazine Motocross Action (Mountain View Room, Advocate Magazine near Arizona Collection) American Spirit Motor Home Apache Junction Arizona Highways Motor Trend Independent Arizona Wildlife Views Mystery Scene Apache Junction News Artist's National Geographic Arizona Business Gazette Backpacker New Yorker Arizona Republic Bats O - Oprah Barrons Better Homes & Gardens Out Phoenix Business Journal Bicycling Outdoor Life Trade-A-Plane Catster formerly Cat Fancy Outdoor Photographer USA Today Newspaper China/Africa Parents Wall Street Journal Consumer Reports PC Gamer Newspaper Cooking Light People Cosmopolitan People En Espanol Youth Area Craft Ideas formerly Crafts 'N Phoenix Home & Garden American Girl Things Phoenix Magazine Boys' Life Creative Knitting Plane & pilot Cricket Cycle World Popular Mechanics Disney Junior Dirt Bike Popular Science Fun for Kidz Dirt Wheels Practical Homeschooling Disney Princess Discover Prevention Highlights Dogster formerly Dog Fancy Quilting Arts formerly Quilters National Geographic Kids Ebony Magazine New Moon Girls Entertainment Weekly Rachael Ray Every Day OWL Family Fun formerly Disney's Reader's Digest Ranger Rick Family Fun Reader's Digest Large Ranger Rick Jr. formerly Family Handyman Print Your Big Backyard Family Tree Real Simple Spider Fortune Reminisce Sports Illustrated for Kids Forum Rolling Stone Golf Magazine Saturday Evening Post Good Housekeeping Sew News Harper's Bazaar Shape Harper's Magazine Sky & Telescope Health Southern Living Hemmings Motor News Southwest Art Home Business Sports Illustrated Horse Illustrated Sunset Hot Rod Teen Vogue Jewelry Artist/Lapidary Time Weekly Journal Traditional Home Kiplinger's Personal Trailer Life Finance Travel 50 and Beyond Liberty Treasures formerly Antiques & LivAbility Collecting Mad Vanity Fair Martha Stewart Living WebMD Men's Health Week Money Wired . -

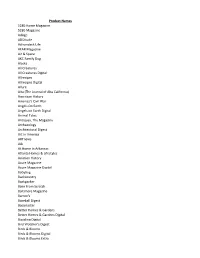

Product Names 5280 Home Magazine 5280 Magazine Adage Additude

Product Names 5280 Home Magazine 5280 Magazine AdAge ADDitude Adirondack Life AFAR Magazine Air & Space AKC Family Dog Alaska All Creatures All Creatures Digital Allrecipes Allrecipes Digital Allure Alta (The Journal of Alta California) American History America's Civil War Angels On Earth Angels on Earth Digital Animal Tales Antiques, The Magazine Archaeology Architectural Digest Art In America ARTnews Ask At Home In Arkansas Atlanta Homes & Lifestyles Aviation History Azure Magazine Azure Magazine Digital Babybug Backcountry Backpacker Bake From Scratch Baltimore Magazine Barron's Baseball Digest Bassmaster Better Homes & Gardens Better Homes & Gardens Digital Bicycling Digital Bird Watcher's Digest Birds & Blooms Birds & Blooms Digital Birds & Blooms Extra Blue Ridge Country Blue Ridge Motorcycling Magazine Boating Boating Digital Bon Appetit Boston Magazine Bowhunter Bowhunting Boys' Life Bridal Guide Buddhadharma Buffalo Spree BYOU Digital Car and Driver Car and Driver Digital Catster Magazine Charisma Chicago Magazine Chickadee Chirp Christian Retailing Christianity Today Civil War Monitor Civil War Times Classic Motorsports Clean Eating Clean Eating Digital Cleveland Magazine Click Magazine for Kids Cobblestone Colorado Homes & Lifestyles Consumer Reports Consumer Reports On Health Cook's Country Cook's Illustrated Coral Magazine Cosmopolitan Cosmopolitan Digital Cottage Journal, The Country Country Digital Country Extra Country Living Country Living Digital Country Sampler Country Woman Country Woman Digital Cowboys & Indians Creative -

Available Titles

Available Titles American Spectator Motor Trend Beadwork National Geographic BirdWatching National Geographic Boating Traveler Car & Driver Newsweek Clean Eating O The Oprah Magazine Downloadable Consumer Reports Organic Gardening Cosmopolitan Outdoor Life Country Living Outside Magazines Digital Photo Pro Parenting Early Years Discover Parenting School Dwell Years EatingWell PC Magazine Elle Popular Science Elle Décor Prevention ESPN Reader’s Digest Esquire Redbook Every Day with Rolling Stone Rachel Ray Scholastic Parent & Family Handyman Child Field & Stream Seventeen Food Network Shape Magazine ShopSmart Download Magazines from the Library! Forbes Smithsonian Magazine Girls’ Life Sound & Vision The following devices are compatible with House Beautiful Taste of Home Zinio: iPhone Life Taste of Home Holiday PC, Mac, iPhone, iPad, Android, Knitter’s Magazine Traditional Home Kindle Fire, Blackberry Playbook Ladies Home Journal US Weekly MacWorld Vegetarian Times NOTE: Zinio is not compatible with Nook Martha Stewart VIV Magazine devices Weddings Weight Watchers Men’s Fitness Woman’s Day Men’s Health Women’s Health Getting Started You will need: Your Library Card Number An Email Address PC or mobile device Internet Access Fairport Public Library Zinio account Zinio.com account 1 Fairport Village Landing Fairport, NY 14450 Updated 4/29/13 kg-fpl 585-223-9091 First Time User? Start Here Returning User? Start Here Go to www.fairportlibrary.org and click on the link for Digital Books & Magazines Go to www.fairportlibrary.org and click on the link for Digital Books & Magazines Click on the Zinio icon Click on the Zinio icon Select the Purple “Create Account” button. At the login page, enter your email address Enter your library card number and click the and password and select Log In. -

Letha Yurko Griffin January 31, 2015

Letha Yurko Griffin January 31, 2015 Universities Attended: West Virginia University, summer school Ohio State University Degree: B.S., College of Biological Sciences Major: Microbiology Status: summa cum laude Ohio State University Degree: M.Sc., Department of Microbiology Field: Immunology Status: summa cum laude Ohio State University Degree: Ph.D., Academic Faculty of Microbial and Cellular Biology Field: Immunology Status: summa cum laude Ohio State University Degree: M.D., College of Medicine Status: summa cum laude Post Graduate Medical Training Intern, General Surgery, University of Michigan Hospital. Resident, Orthopaedic Surgery, University of Michigan Hospital. Certification: Certification, American Board of Orthopaedic Surgery, July, 1982 Recertification, American Board of Orthopaedic Surgery, July, 1994; July 2003; July 2014 Added Qualification in Sports Medicine, American Board of Orthopaedic Surgery, November 2011 Employment: July, 1978-September, 1979. Instructor, Department of Surgery, University of Michigan. September, 1979-August, 1981. Assistant Professor, Department of Orthopaedics, Division of Sports Medicine, University of Washington. September, 1979-August, 1981. Team Physician to Varsity Athletes, University of Washington. August, 1981-present. Clinical Staff, Peachtree Orthopaedic Clinic, P.A., Atlanta, Georgia. January, 1982-1984. Clinical Staff, Scottish Rite Sports Medicine Clinic, Atlanta, Georgia. 1 January, 1984-1993. Clinical Instructor, Emory University School of Medicine, Atlanta, Georgia. September, -

Flipster Magazines

Flipster Magazines Cricket AARP the Magazine Crochet! Advocate (the) Cruising World AllRecipes Current Biography Allure Curve Alternative Medicine Delight Gluten Free Amateur Gardening Diabetic Self-Management Animal Tales Discover Architectural Digest DIVERSEability Art in America Do It Yourself Artist's Magazine (the) Dogster Ask Dr. Oz: The Good Life Ask Teachers Guide Dwell Astronomy Eating Well Atlantic (the) Entertainment Weekly Audiofile Equus Audobon Faces BabyBug Faces Teachers Guide Baseball Digest FIDO Friendly Bazoof Fine Cooking BBC Easy Cook Fine Gardening BBC Good Food Magazine First for Women Beadwork Food Network Magazine Birds and Blooms Food + Wine Bloomberg Businessweek Foreward Reviews Bon Appetit Gay and Lesbian Review Worldwide Book Links Girlfriend Booklist Golf Magazine BuddhaDharma Good Housekeeping Catster GQ Chess Life Harvard Health Letter Chess Life for Kids Harvard Women's Health Watch Chickadee Health Chirp High Five Bilingue Christianity Today Highlights Cinema Scope Highlights High Five Clean Eating History Magazine Click Horn Book Magazine COINage In Touch Weekly Commonweal Information Today Computers in Libraries Inked Craft Beer and Brewing InStyle J-14 LadyBug Sailing World LadyBug Teachers Guide School Library Journal Library Journal Simply Gluten Free Lion's Roar Soccer 360 Martha Stewart Living Spider Men's Journal Spider Teachers Guide Mindful Spirituality & Health Modern Cat Sports Illustrated Modern Dog Sports Illustrated Kids Muse Taste of Home Muse Teachers Guide Teen Graffiti Magazine National