6800000'A1'3hci

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Highlight Der Woche: Überlebt! Episode 1 Am Mittwoch 24.10.2012

DMAX Programm Programmwoche 43, 20.10. bis 26.10.2012 Highlight der Woche: Überlebt! Episode 1 Am Mittwoch 24.10.2012 um 23:45 Uhr Beim Anblick dieser Bilder fragen sich oft auch die behandelten Ärzte: Wie kann ein Mensch das überleben?! Bei "Überlebt!" werden kuriose Unfälle mit Zaunpfählen, Gartenscheren und co. nachgestellt und erklärt In Arizona verliert ein Hobby-Gärtner bei der Arbeit das Gleichgewicht und stürzt in eine Rosenschere. Ihr Griff bohrt sich dabei durch seine Augenhöhle bis tief in den Rachen. Bei der folgenden Notoperation gelingt es einem Chirurgen-Team in der Universitätsklinik von Tuscon nicht nur das Leben des Mannes retten, sondern auch sein Augenlicht. In Neuseeland wird ein 29-jähriger Surfer von seinem eigenen Brett aufgespießt. Auch dieser Fall geht - dank einer fachlichen Meisterleistung der verantwortlichen Ärzte - am Ende glimpflich aus. Diese Dokumentar-Serie berichtet von dramatischen Unfällen und unglaublichen Missgeschicken, die beim Betrachter blankes Entsetzen auslösen. Ärzte und Experten beleuchten die Horror-Szenarien aus medizinischer Sicht und zeigen anhand von Röntgenbildern und Computer-Animationen, wie knapp die Opfer dem Tode entronnen sind. „In meinen Kopf steckte eine Gartenschere!“ – Einen Aufschrei wie diesen vermutet man höchstens in einem Splatter-Film, doch ein Mann aus Arizona musste diesen grauenhaften Unfall am eigenen Leib erfahren. Der 86-jährige Leroy Luetscher stürzt bei der Gartenarbeit so unglücklich in seine Rosenschere, dass sich ihr Griff durch seine Augenhöhle bis tief in den Rachen bohrt. Seine Lebensgefährtin, die Zeugin dieses Horror-Szenarios ist, packt das pure Entsetzen. Sie sieht Leroy bereits tot. Ein Notarztwagen bringt den Hobby-Gärtner in die Universitätsklinik von Tuscon, wo die Chirurgen ein medizinisches Wunder vollbringen: Sie retten nicht nur das Leben ihres Patienten, sondern auch sein Augenlicht. -

TV 2.0 Im Business-Einsatz

Für die Marken- und Unternehmenskommunikation Bewegtbild im Internet nutzen. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Ziele. • Kommunikation von redaktionellen, themenorientierten und unterhaltsamen Verbraucherinformationen • Kundenbindung und –gewinnung • Abverkauf • Umsetzung neuer Businessmodelle • Sendezeit = Werbezeit = Ladenöffnungszeit © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Aber Achtung, das Internet hat andere Gesetze: Aus Push wird Pull. Aus Reklame wird Kommunikation. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Wo der Unterschied zwischen Arbeit ... © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. ...und Privat immer akademischer wird,... © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. ...werden die Optionen für neue Bewegtbildformate immer grösser. „Lean Forward“ und „Lean Back“! Kurze Formate und lange! E-Formate und U-Formate! © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Um zu erahnen, über welche Möglichkeiten wir reden, lassen Sie sich vom TV-Angebot eines Tages inspirieren. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Ein komplettes Programm für das eigene Unternehmen. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Oder für eine Marke. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Corporate Publishing wird Corporate TV: DER Trend in der Unternehmens- kommunikation, siehe auch... BahnTV DouglasTV BMW TV Mercedes TV (Trailer) © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Ein komplettes Programm für ein Unternehmen oder eine Marke, das auch vom Unternehmen alleine bezahlt werden muss. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Ein komplettes Programm für eine eigene Zielgruppe. © Matthias Berg, Horst Klemm, Thor Kunkel. Hamburg, Mai 2008. Ein komplettes Programm für eine eigene Zielgruppe. -

American Primacy and the Global Media

City Research Online City, University of London Institutional Repository Citation: Chalaby, J. (2009). Broadcasting in a Post-National Environment: The Rise of Transnational TV Groups. Critical Studies in Television, 4(1), pp. 39-64. doi: 10.7227/CST.4.1.5 This is the accepted version of the paper. This version of the publication may differ from the final published version. Permanent repository link: https://openaccess.city.ac.uk/id/eprint/4508/ Link to published version: http://dx.doi.org/10.7227/CST.4.1.5 Copyright: City Research Online aims to make research outputs of City, University of London available to a wider audience. Copyright and Moral Rights remain with the author(s) and/or copyright holders. URLs from City Research Online may be freely distributed and linked to. Reuse: Copies of full items can be used for personal research or study, educational, or not-for-profit purposes without prior permission or charge. Provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. City Research Online: http://openaccess.city.ac.uk/ [email protected] Broadcasting in a post-national environment: The rise of transnational TV groups Author: Dr Jean K. Chalaby Department of Sociology City University Northampton Square London EC1V 0HB Tel: 020 7040 0151 Fax: 020 7040 8558 Email: [email protected] Jean K. Chalaby is Reader in the Department of Sociology, City University in London. He is the author of The Invention of Journalism (1998), The de Gaulle Presidency and the Media (2002) and Transnational Television in Europe: Reconfiguring Global Communications Networks (2009). -

Liste Des Canaux HD +

Liste des Canaux HD + - Enregistrement & programmation des enregistrements de chaînes (non-fonctionnel sur boîte Android / Smart Tv) - Le seul iptv offrant la fonction marche arrière sur vos canaux préférés - Vidéo sur demande – Films – Séries – Spectacle – Documentaire (Français, Anglais et Espagnole) Liste des canaux FRANÇAIS QUEBEC • TVA • TVA WEST • V TELE • TELE QUEBEC • LCN • MOI & CIE • CANAL D • RADIO CANADA • RADIO CANADA FREE • RDI • RDI FREE • CANAL SAVOIR • AMI TELE • UNIS TV • CANAL VIE • CASA • MUSIQUE PLUS • ZESTE • CANAL INVESTIGATION • CANAL D • ADDICK TV • SERIE + • Z TELE • VRAK • RDS • TVA SPORT • TVA SPORT 2 • RDS 2 • MAX • HISTORIA • PRISE 2 • SUPER ECRAN 1 • SUPER ECRAN 2 • SUPER ECRAN 3 • SUPER ECRAN 4 • ARTV • ICI EXPLORA • CINE-POP • EVASION • YOOPA • TELETOON *** AJOUT DE CANAUX A CHAQUE MOIS *** HORS QUÉBEC • France • TF1 • TFI LOCAL TIME -6 • M6 • M6 LOCAL TIME -6 • FRANCE 2 • FRANCE 3 • FRANCE 3 LOCAL TIME -6 • FRANCE 4 • FRANCE O • FRANCE 5 • ARTE • LCI • TV5 • TV5 MONDE • EURONEWS • BFM • BFM BUSINESS • FRANCE INFO • FRANCE 24 • CNEWS • HD1 • 6TER • W9 • W9 LOCAL TIME -6 • C8 • C8 LOCAL TIME -6 • 13 EIME RUE • PARIS PREMIERE • TEVA • COMEDIE • E! • NUMERO 23 • AB1 • TV BREIZH • NON STOP PEOPLE • NT1 • TCM CINEMA • TMC • CANAL + • CANAL + LOCAL TIME -6 • CANEL + CINEMA • CANAL + SERIES • CANAL + FAMILY • CANAL + DECALE • CINE + PREMIER • CINE + FRISSON • CINE + EMOTION • CINE + CLUB • CINE + CLASSIC • CINE FAMIZ • CINE FX • C STAR • CINE POLAR • OCS CITY • OCS MAX • OCS CHOC • OCS GEANT • GAME ONE • ACTION -

Highlight Der Woche

DMAX Programm Programmwoche 32, 06.08. bis 12.08.2011 Highlight der Woche: DMAX REPORT Mienenunglück in Pennsylvania Donnerstag, 11.08.2011 um 23:15 Uhr auf DMAX Der schlimmste Albtraum für jeden Minenarbeiter: in der Tiefe eingeschlossen zu sein. In Quecreek widerfährt genau dieses Schicksal neun Kumpel unter Tage - können sie gerettet werden? 24. Juli 2002: In der Quecreek-Kohlemine in Pennsylvania werden neun Kumpel von einem plötzlichen Wassereinbruch überrascht und in rund 80 Meter Tiefe eingeschlossen. Ein dramatischer Überlebenskampf unter Tage beginnt. Kurz vor dem Stromausfall in der Mine gelingt es den Verunglückten, einen letzten Notruf abzusetzen. Die Rettungs-Teams und Ingenieure des Bergbauunternehmens beginnen sofort mit der Suche nach den Minenarbeitern, denn ihnen bleibt nur eine Chance: Sie müssen einen Tunnel bis zu den Vermissten bohren, doch die Zeit drängt. Während der Wasserpegel unaufhaltsam steigt, nimmt der Sauerstoffgehalt im Schacht rapide ab! Diese Dokumentation schildert die dramatischen Ereignisse des Unglücks in Quecreek anhand von Interviews mit den Betroffenen, ihren Angehörigen und den Rettungskräften vor Ort. DMAX Programm Programmwoche 32, 06.08. bis 12.08.2011 Samstag, 06.08.2011 06:10 Uhr Die Gebrauchtwagen-Profis - Neuer Glanz für alte Kisten Porsche 944 Teil 1 Zwei waschechte Engländer haben es sich zum Ziel gesetzt, die Gebrauchtwagenwelt neu zu ordnen: Für den Verhandlungs-Experten Mike Brewer und den Profi-Mechaniker Edd China gibt es nämlich nichts Schöneres, als aus scheinbar minderwertigen Kisten ordentlich Profit zu schlagen. Mit einem festgelegten Budget machen sich die beiden Auto-Experten auf die Suche nach besonders rentablen Angeboten. Am besten sind echte Schmuckstücke, die aber schon einige Jahre auf dem Buckel haben: Porsche 924, VW Golf GTI, Mercedes Benz 230E oder Ford Capri sind genau nach dem Geschmack der Auto-Freaks. -

Superbrands Business 2008: Discovery Channer, Il Canale Che

serate ad hoc, filler, eventi sul territorio, cross Promocard premiate con il Media Key Award. A promotion tra un canale e l'altro. Milano e Roma hanno circolato autobus con Ne è un esempio la recente collaborazione con l'immagine della lunghissima macchina sulla Farmina Pet Foods, azienda leader nel settore fiancata. Inoltre, al personale dei centri media è dell'alimentazione di cani e gatti. Dopo la spon- stato regalato il Car-Masutra, un simpatico libro sorizzazione di "Top Dog" - trasmissione di successo con i migliori consigli per mixare al meglio spazio dello scorso giugno di Animal Planet - il progetto è (anche pubblicitario) e auto. proseguito con "Addestriamo il nostro cane", 6 pillole Animal Planet, invece, ha scelto fin dal 2005 di www.discoverychannel.co.uk/int/ da 45 secondi realizzate da Discovery Network in collaborare a fianco del WWF aderendo a iniziative esclusiva per Farmina e in onda sempre su Animal diverse: dalla giornata delle oasi alla tutela dell'Orso Planet, a conferma che Discovery studia il palinsesto marsicano, il progetto di quest'anno. La collaborazione ad hoc con le case di produzione per raggiungere il si è tradotta non solo in un sostegno a favore delle target. È, invece, del febbraio 2008 la partnership di campagne di sensibilizzazione, ma anche in una Discovery Networks con Tattoo Life, rivista di arte e programmazione dedicata. cultura del tatuaggio, sponsor di "LA INK", il Anche Discovery Science ha portato avanti una programma cool con la prorompente tatuatrice Kat collaborazione con il Museo Nazionale della Scienza e Von D, attraverso billboards in apertura e chiusura del della Tecnologia "Leonardo da Vinci" di Milano con un Il canale che racconta autentiche avventure attraverso immagini parole ed emozioni. -

PRM15-Formele-Discovery

Discovery baut Formel E-Berichterstattung aus und festigt seine Position an der Spitze des elektronischen Motorsports • Discovery setzt komplette Plattformstärke ein, um das Wachstum der ABB FIA Formel-E-Weltmeisterschaft weiter voranzutreiben • Mehrjährige Vereinbarung umfasst Live- und Highlight-Berichterstattung für Sportfans in mehr als 50 Märkten in Europa • Vereinbarung stärkt das umfassende Motorsport-Portfolio von Discovery und Eurosport sowie das Angebot an Elektrorennsport 25. Februar 2021 – Discovery hat seine Rechte für die Live-Berichterstattung der ABB FIA Formel-E-Weltmeisterschaft verlängert und wird dank der neuen Vereinbarung mit der vollelektrischen Rennserie jeden e-Prix zeigen. Bei der Übertragung setzt Discovery auf sein umfangreiches Portfolio an Free-TV- und Pay-TV-Sendern sowie auf die digitalen Plattformen, um das Wachstum der Formel E in Europa zu unterstützen. Die Live- und On-Demand-Berichterstattung wird über die linearen Sender und digitalen Plattformen der führenden Multisport-Marke Eurosport in mehr als 50 Märkten sowie auch auf discovery+*, dem globalen Streaming-Produkt von Discovery, ausgestrahlt, um die Verbreitung der ABB FIA Formel-E-Weltmeisterschaft auf ein möglichst breites Publikum auszuweiten. Die mehrjährige Vereinbarung, die mehr als 50 Märkte umfasst, beinhaltet exklusive Live- und Highlight-Rechte in 27 Märkten** in Europa. Formel-E-Fans können ausgewählte Übertragungen über die frei empfangbaren Kanäle von Discovery in Großbritannien (Quest), Norwegen (MAX), Polen (Metro), Spanien und der Türkei (DMAX), Schweden, Dänemark und Finnland genießen. In Deutschland sind über Discovery die Live-Rennen im Pay-Angebot bei Eurosport 2 zu sehen, inklusive eines 30-minütigen Vorlaufs. Es kommentieren im Wechsel die bekannten Formel-E-Stimmen Oliver Sittler und Patrick Simon. -

Ergebnisse Der 195. Sitzung Der KEK

Sperrfrist 15:30 Uhr (Wenn nicht gewünscht: „_Sperrfrist unsichtbar“) KEK-Pressemitteilung 01/2014 ▪ Berlin, 11.02.2014 Ergebnisse der 195. Sitzung der KEK > Zulassungsantrag National Geographic People Channel / Fox International Channels Germany GmbH > Zulassungsantrag Sky Event / Sky Deutschland Fernsehen GmbH & Co. KG > Zulassungsantrag TLC / Discovery Communications Deutschland GmbH & Co. KG > Zulassungsantrag vfbtv / VfB Stuttgart 1893 e. V. > Zulassungsantrag Deutschland-Regional / TVM/WWTV Lizenz- und Pro- duktions GmbH > Beteiligungsveränderung / N24 Gesellschaft für Nachrichten und Zeitge- schehen mbH > Beteiligungsveränderung / Motor Presse TV GmbH > Relaunch der KEK-Website Zulassungsantrag National Geographic People Channel / Fox International Channels Germany GmbH Zulassungsantrag Sky Event / Sky Deutschland Fernsehen GmbH & Co. KG Die KommissionZulassungsantrag zur Ermittlung TLC / Discovery der Konzentration Communications im Medienbereich Deutschland GmbH (KEK) & hatCo. entschieden,KG dass den folgenden Zulassungen und Beteiligungsveränderungen keine GründeZulassungsantrag der Sicherung vfbtv der / VfB Meinungsvielfalt Stuttgart 1893 entgegenstehen: e. V. Zulassungsantrag Deutschland-Regional / TVM/WWTV Lizenz- und Produkti- Zulassungsantragons GmbH National Geographic People Channel / Fox InternationalBeteiligungsveränderung Channels Germany / N24 Gesellscha GmbHft für Nachrichten und Zeitge- schehenBei dem mbHgeplanten bundesweiten Fernsehspartenprogramm National Geo- Beteiligungsveränderunggraphic People Channel handelt -

55 the Commission Received Two Reports, One from the Flemish

BELGIUM The Commission received two reports, one from the Flemish Community (BE-FL – Vlaamse Gemeenschap) and one from the French Community of Belgium (BE-FR – Communauté française de Belgique). No report was received from the German-speaking Community. Number of identified channels Reference period BE-VL = 48 2007/2008 BE-FR = 25 BELGIUM FLEMISH COMMUNITY PART 1 - Statistical data Number of channels identified: 48 Reference period: 2007/2008 EW (%TQT) IP (%TQT) RW(%IP) Broadcaster Channel 2007 2008 2007 2008 2007 2008 ACTUA - TV Actua TV EX EX EX EX EX EX BELGIAN BUSINESS TELEVISION Kanaal Z 100,0%100,0% 26,6% 27,3% 100,0%100,0% BOX ENTERTAINMENT Kinepolis TV 1 NC NO NC NO NC NO BOX ENTERTAINMENT Kinepolis TV 2 NC NO NC NO NC NO EURO 1080 Euro 1080 NO 100,0% NO 64,0% NO 100,0% EURO 1080 Exqi / Exqi VL. 95,0% 98,0% 38,0% 32,0% 100,0%100,0% EURO 1080 Exqi Culture NC 98,0% NC 32,0% NC 100,0% EURO 1080 Exqi Sport NC 100,0% NC 69,0% NC 100,0% EURO 1080 HD NL NC NC NC NC NC NC EURO 1080 HD1 100,0% NC 56,0% NC 100,0% NC EURO 1080 HD2 NC NC NC NC NC NC EbS Europe by Satellite (version in EUROPEAN COMMISSION EX EX EX EX EX EX Dutch) EVENT TV VLAANDEREN Liberty TV Vlaanderen 89,3% 87,4% 10,7% 12,6% 89,2% 92,6% KUST TELEVISIE VZW Kust Televisie 100,0%100,0% NC NC NC NC LIFE ! TV BROADCASTING COMPANY NV Life! TV 100,0%100,0% 13,0% 13,0% 100,0%100,0% MEDIA AD INFINITUM Vitaliteit 81,0% 76,0% 97,0% 94,0% 100,0%100,0% MEDIA AD INFINITUM Vitaya 55,0% 71,0% 85,0% 94,0% 100,0% 92,0% MTV NETWORKS BELGIUM TMF Live HD NC 98,0% NC 11,8% NC 100,0% MTV NETWORKS -

Video on Demand

Video on Demand Video on Demand ist wie eine Videothek zu Hause, die einfache Lösung für Ihre Filmabende. “Tele vun der Post” bietet Ihnen ein reichhaltiges Angebot an Filmen aller Genres und verschiedener Länder, die sie bequem vom Sessel aus abrufen können. Und noch weitere Filme... Un coeur invaincu (vom 17/06/08 bis 16/09/08 in FR Version und vom 06/08/08 bis 05/11/08 in DE Version) TM, ® & Copyright © 2008 by Paramount Pictures. Mit 10 thematischen Senderpaketen All Rights Reserved. The Water Horse : Legend of the Deep (vom 15/09/08 bis 14/12/09 in FR Version und vom 10/09/08 bis 09/12/08 in DE Version) © 2007 Revolution Studios Distribution Company, LLC, Walden Media, LLC and Holding Pictures Distribution Co., LLC. All Rights Reserved. Good Luck Chuck (vom 07/10/08 bis 05/01/09 in FR Version und vom 28/08/08 bis 25/11/08 in DE Version) © Sony Pictures Releasing. All rights reserved. No Country for Old Men (vom 26/11/08 bis 25/02/09 in FR Version und vom 10/12/08 bis 09/03/09 in DE Version) TM, ® & Copyright © 2008 by Paramount Pictures. All Rights Reserved. D’TELE VUN DER POST Fernsehen und noch viel mehr. American Gangster (vom 20/08/08 bis 17/11/08 ausschliesslich in FR Version) © Universal Pictures - Imagine Entertainment - Relativity Media - Scott Free Productions. All rights reserved. Cloverfield (vom 06/11/08 bis 05/02/09 in FR Version und vom 24/09/08 bis 23/12/08 in DE Version) TM, ® & Copyright © 2008 by Paramount Pictures. -

Zulassungsantrag Der DMAX TV Gmbh & Co. KG Für Die

Zulassungsantrag der DMAX TV GmbH & Co. KG für die Fernsehprogramme „Animal Planet”, „Discovery Channel”, „Discovery Geschichte” und „Discovery HD” Aktenzeichen: KEK 528 Beschluss In der Rundfunkangelegenheit der DMAX TV GmbH & Co. KG, vertreten durch die DMAX TV Verwaltungsgesell- schaft mbH, diese ihrerseits vertreten durch die Geschäftsführer Katja Hofem-Best und Magnus Kastner, Maximilianstraße 13, 80539 München, – Antragstellerin – Verfahrensbevollmächtigte: XXX... w e g e n Zulassung zur Veranstaltung der bundesweiten Fernsehspartenprogramme Animal Planet, Discovery Channel, Discovery Geschichte und Discovery HD hat die Kommission zur Ermittlung der Konzentration im Medienbereich (KEK) auf Vorlage der Bayerischen Landeszentrale für neue Medien (BLM) vom 03.11.2008 am 14.04.2009 unter Mitwirkung ihrer Mitglieder Prof. Dr. Sjurts (Vorsitzende), Prof. Dr. Huber (stv. Vorsit- zender), Albert, Dr. Bauer, Prof. Dr. Dörr, Prof. Dr. Gounalakis, Dr. Hege, Dr. Hornauer, Langheinrich, Dr. Lübbert und Prof. Dr. Schneider entschieden: Der von der DMAX TV GmbH & Co. KG mit Schreiben vom 20.10.2008 bei der Bayerischen Landeszentrale für neue Medien (BLM) beantragten Zulassung zur Veranstaltung der bundesweit verbreiteten Fernsehspartenprogramme Animal Planet, Discovery Channel, Discovery Geschichte und Discovery HD stehen Gründe der Sicherung der Meinungsvielfalt im Fernsehen nicht entgegen. 2 Begründung I Sachverhalt 1 Gegenstand der Anzeige Mit Schreiben vom 20.10.2008 haben die anwaltlichen Vertreter der Discovery Communications Deutschland GmbH („Discovery Communications Deutschland“) bei der BLM angezeigt, dass die Discovery Communications Deutschland auf Grundlage des Verschmelzungsvertrags vom 27.08.2008 und der Beschlüsse der Gesellschafterversammlung vom selben Tag auf die DMAX TV GmbH & Co. KG („DMAX TV“) verschmolzen wurde. Die Verschmelzung wurde am 06.10.2008 in das Handelsregister eingetragen. -

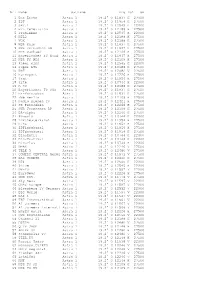

Tvbox Channel List

Nr. Name Satname Frq Pol SR 1 Das Erste Astra 1 19.2° O 11837 H 27500 2 ZDF Astra 1 19.2° O 11954 H 27500 3 SAT.1 Astra 1 19.2° O 12545 H 22000 4 RTL Television Astra 1 19.2° O 12188 H 27500 5 ProSieben Astra 1 19.2° O 12545 H 22000 6 RTL2 Astra 1 19.2° O 12188 H 27500 7 VOX Astra 1 19.2° O 12188 H 27500 8 WDR Köln Astra 1 19.2° O 11837 H 27500 9 SWR Fernsehen BW Astra 1 19.2° O 11837 H 27500 10 MDR Sachsen Astra 1 19.2° O 12109 H 27500 11 Bayerisches FS Nord Astra 1 19.2° O 11837 H 27500 12 NDR FS NDS Astra 1 19.2° O 12109 H 27500 13 kabel eins Astra 1 19.2° O 12545 H 22000 14 Super RTL Astra 1 19.2° O 12188 H 27500 15 DSF Astra 1 19.2° O 12480 V 27500 16 Eurosport Astra 1 19.2° O 12226 H 27500 17 3sat Astra 1 19.2° O 11954 H 27500 18 arte Astra 1 19.2° O 10744 H 22000 19 n-tv Astra 1 19.2° O 12188 H 27500 20 Bayerisches FS Süd Astra 1 19.2° O 11837 H 27500 21 hr-fernsehen Astra 1 19.2° O 11837 H 27500 22 rbb Berlin Astra 1 19.2° O 12109 H 27500 23 Radio Bremen TV Astra 1 19.2° O 12421 H 27500 24 SR Fernsehen Astra 1 19.2° O 12266 H 27500 25 SWR Fernsehen RP Astra 1 19.2° O 12109 H 27500 26 BR-alpha Astra 1 19.2° O 12266 H 27500 27 Phoenix Astra 1 19.2° O 10744 H 22000 28 ZDFtheaterkanal Astra 1 19.2° O 11954 H 27500 29 KiKa Astra 1 19.2° O 11954 H 27500 30 ZDFinfokanal Astra 1 19.2° O 11954 H 27500 31 ZDFdokukanal Astra 1 19.2° O 11954 H 27500 32 EinsExtra Astra 1 19.2° O 10744 H 22000 33 EinsFestival Astra 1 19.2° O 10744 H 22000 34 EinsPlus Astra 1 19.2° O 10744 H 22000 35 DMAX Astra 1 19.2° O 12246 V 27500 36 TELE 5 Astra 1 19.2° O 12480 V 27500 37 COMEDY CENTRAL Germa Astra 1 19.2° O 11973 V 27500 38 DAS VIERTE Astra 1 19.2° O 12460 H 27500 39 N24 Astra 1 19.2° O 12545 H 22000 40 9Live Astra 1 19.2° O 12545 H 22000 41 DW-TV Astra 1 19.2° O 11597 V 22000 42 EuroNews Astra 1 19.2° O 12226 H 27500 43 CNN Int.