Volyn Oblast Q3 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Human Potential of the Western Ukrainian Borderland

Journal of Geography, Politics and Society 2017, 7(2), 17–23 DOI 10.4467/24512249JG.17.011.6627 HUMAN POTENTIAL OF THE WESTERN UKRAINIAN BORDERLAND Iryna Hudzelyak (1), Iryna Vanda (2) (1) Chair of Economic and Social Geography, Faculty of Geography, Ivan Franko National University of Lviv, Doroshenka 41, 79000 Lviv, Ukraine, e-mail: [email protected] (corresponding author) (2) Chair of Economic and Social Geography, Faculty of Geography, Ivan Franko National University of Lviv, Doroshenka 41, 79000 Lviv, Ukraine, e-mail: [email protected] Citation Hudzelyak I., Vanda I., 2017, Human potential of the Western Ukrainian borderland, Journal of Geography, Politics and Society, 7(2), 17–23. Abstract This article contains the analysis made with the help of generalized quantative parameters, which shows the tendencies of hu- man potential formation of the Western Ukrainian borderland during 2001–2016. The changes of number of urban and rural population in eighteen borderland rayons in Volyn, Lviv and Zakarpattia oblasts are evaluated. The tendencies of urbanization processes and resettlement of rural population are described. Spatial differences of age structure of urban and rural population are characterized. Key words Western Ukrainian borderland, human potential, population, depopulation, aging of population. 1. Introduction during the period of closed border had more so- cial influence from the West, which formed specific Ukraine has been going through the process of model of demographic behavior and reflected in dif- depopulation for some time; it was caused with ferent features of the human potential. significant reduction in fertility and essential mi- The category of human potential was developed gration losses of reproductive cohorts that lasted in economic science and conceptually was related almost a century. -

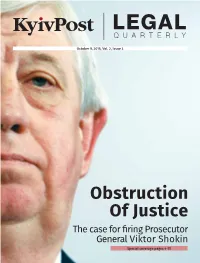

The Case for Firing Prosecutor General Viktor Shokin

October 9, 2015, Vol. 2, Issue 3 Obstruction Of Justice The case for fi ring Prosecutor General Viktor Shokin Special coverage pages 4-15 Editors’ Note Contents This seventh issue of the Legal Quarterly is devoted to three themes – or three Ps: prosecu- 4 Interview: tors, privatization, procurement. These are key areas for Ukraine’s future. Lawmaker Yegor Sobolev explains why he is leading drive In the fi rst one, prosecutors, all is not well. More than 110 lawmakers led by Yegor Sobolev to dump Shokin are calling on President Petro Poroshenko to fi re Prosecutor General Viktor Shokin. Not only has Shokin failed to prosecute high-level crime in Ukraine, but critics call him the chief ob- 7 Selective justice, lack of due structionist to justice and accuse him of tolerating corruption within his ranks. “They want process still alive in Ukraine to spearhead corruption, not fi ght it,” Sobolev said of Shokin’s team. The top prosecutor has Opinion: never agreed to be interviewed by the Kyiv Post. 10 US ambassador says prosecutors As for the second one, privatization, this refers to the 3,000 state-owned enterprises that sabotaging fi ght against continue to bleed money – more than $5 billion alone last year – through mismanagement corruption in Ukraine and corruption. But large-scale privatization is not likely to happen soon, at least until a new law on privatization is passed by parliament. The aim is to have public, transparent, compet- 12 Interview: itive tenders – not just televised ones. The law, reformers say, needs to prevent current state Shabunin says Poroshenko directors from looting companies that are sold and ensure both state and investor rights. -

Public Evaluation of Environmental Policy in Ukraine

Public Council of All-Ukrainian Environmental NGOs under the aegis of the Ministry of the Environment and Natural Resources of Ukraine Organising Committee of Ukrainian Environmental NGOs for preparation to Fifth Pan-European Ministerial Conference "Environment for Europe" Public Evaluation of Environmental Policy in Ukraine Report of Ukrainian Environmental NGOs Кyiv — 2003 Public Evaluation of Environmental Policy in Ukraine. Report of Ukrainian Environmental NGOs. — Kyiv, 2003. — 139 pages The document is prepared by the Organising Committee of Ukrainian Environmental NGOs in the framework of the «Program of Measures for Preparation and Conduction of 5th Pan-European Ministerial Conference» «Environment for Europe» for 2002–2003» approved by the National Organising Committee of Ukraine. Preparation and publication of the report was done wit the support of: Regional Ecological Center - REC-Kyiv; Ministry of the Environment and Natural Resources of Ukraine; Milieukontakt Oost Europa in the framework of the project «Towards Kyiv-2003» with financial support of the Ministry of Territorial Planning, Construction and the Environment; UN office in Ukraine Contents Foreword . 1. Environmental Policy and Legislation . 1.1. Legislative Background of Environmental Policy . 1.2. Main State Documents Defining Environmental Policy . 1.3. Enforcement of Constitution of Ukraine . 1.4. Implementation of Environmental Legislation . 1.5. State of Ukrainian Legislation Reforming after Aarhus Convention Ratification . 1.6.Ukraine's Place in Transition towards Sustainable Development . 2. Environmental Management . 2.1. Activities of State Authorities . 2.2 Activities of State Control Authorities . 2.3. Environmental Monitoring System . 2.4. State Environmental Expertise . 2.5. Activities of Local Administrations in the Field of Environment . -

Ukraine Scenario 1) Background A. Donetsk and Luhansk Are Rebel

Ukraine Scenario 1) Background a. Donetsk and Luhansk are rebel-held parts of Ukraine, and have been since 2014. The regions have ethnic Russian majorities and rebelled over attempts to ban Russian as an official language and curtail trade across the Russian border. Many of the rebels advocate secession. b. Ukraine’s state power company claimed the regions were some $431 million in debt over non- payment of bills. Russia says that they will be providing power through pre-existing lines effective immediately to avoid loss of electricity to some 3 million people in the effected areas. c. The decision by the Ukrainian government to cut power to the region appears to be an attempt to put pressure on the secessionist movement, though ironically by forcing them to turn to Russia for electricity, they may further enhance the region’s link to the Russian Federation. Source: “Russia to Supply Electricity to Eastern Ukraine After Kiev Cuts Power: Ukraine Says Regions Weren't Paying Their Bills,” Jason Ditz, Posted on April 25, Anti-War.com website: https://news.antiwar.com 2) Context a. Areas in Eastern Ukraine (Donbas Region) have had power cut by pro-Ukrainian (Kiev Government) groups that control the highest capacity power generation stations in the country. These are the 4 operational nuclear power stations in western Ukraine which includes the Zaporizhia Nuclear Power Station, the largest nuclear power plant in Europe generating 6,000 MW. This leaves the Russian controlled areas with a small number of lower capacity coal generation facilities to power the Donbas region with additional power provided by Russian power plants to support the area. -

Lutsk Intercultural Profile

City of Lutsk Intercultural Profile This report is based upon the visit of the CoE expert team on 1-4 July 2017, comprising Kseniya Khovanova-Rubicondo and Phil Wood. It should ideally be read in parallel with the Council of Europe’s response to Odessa’s ICC Index Questionnaire but, at the time of writing, the completion of the Index by the City Council is still a work in progress. 1. Introduction Lutsk lies in northwestern Ukraine not far from the borders with Poland and Belarus, and has a population of 217,103 (2015 est.). It was the main centre of the historic region of Volhynia and is now the administrative centre of the Volyn Oblast (population 1,036,891[2005]). Lutsk has the status of a city of oblast significance. A complex history of conquest and shifting borders has seen it part of Lithuania, Russia, Poland, the Soviet Union as well as Ukraine, giving the area a rich cultural heritage. Lutsk itself is built upon an appreciation of migration and diversity. King Vytautas the Great founded the town itself by importing colonists (mostly Jews, Tatars, and Karaims). The town grew rapidly, and by the end of the 15th century there were 19 Orthodox and two Catholic churches. In 1939 Lutsk was a prosperous city with a multiethnic population of which Jews and Poles were the largest groups, but invasion by the Soviet Union and then by Germany proved a disaster, with mass deportations and murders over almost a decade, by the end of which Lutsk was ethnically an almost exclusively Ukrainian city. -

Finding Aid (English)

Records of the Extraordinary State Commission to Investigate Crimes Committed by the Nazis and their Accomplices on the Territory of Volyn Region, Ukraine RG-31.127 United States Holocaust Memorial Museum Archives 100 Raoul Wallenberg Place SW Washington, DC 20024-2126 Tel. (202) 479-9717 e-mail: [email protected] Descriptive summary Title: Records of the Extraordinary State Commission to Investigate Crimes Committed by the Nazis and their Accomplices on the Territory of Volyn Region, Ukraine Dates: 1944-1945 Accession number: 2017.422.1 Creator: Extraordinary State Commission to Investigate Crimes Committed by the Nazis Extent: 85,884 digital images Repository: United States Holocaust Memorial Museum Archives, 100 Raoul Wallenberg Place SW, Washington, DC 20024-2126 Languages: Russian Ukrainian Scope and content of collection Records of the Extraordinary State Commission to Investigate Crimes Committed by the Nazis and their Accomplices on the Territory of the Volyn Region, Ukraine during WWII. Included are records related to the investigation of war crimes ( list of victims, eyewitness testimonies, forensic reports, lists of perpetrators and local collaborators, lists of locals sent for slave labor in Germany etc.) against local population and documentation related to the material and property damage inflicted upon the economy of the region during the Nazi occupation. Administrative Information Restrictions on access: No restrictions on access. Restrictions on reproduction and use: Fair use only. Preferred citation: Preferred citation for USHMM archival collections; consult the USHMM website for guidance. Acquisition information: Source of acquisition is the State Archives of the Volyn Region (Derz︠h︡avnyĭ arkhiv Volynsʹkoï oblasti). The United States Holocaust Memorial Museum Archives received the first part of this collection via the United States Holocaust Museum International Archives Project in October 2017, and accretion in Oct. -

Police Reform in Ukraine Since the Euromaidan: Police Reform in Transition and Institutional Crisis

City University of New York (CUNY) CUNY Academic Works All Dissertations, Theses, and Capstone Projects Dissertations, Theses, and Capstone Projects 2-2019 Police Reform in Ukraine Since the Euromaidan: Police Reform in Transition and Institutional Crisis Nicholas Pehlman The Graduate Center, City University of New York How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/gc_etds/3073 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] Police Reform in Ukraine Since the Euromaidan: Police Reform in Transition and Institutional Crisis by Nicholas Pehlman A dissertation submitted to the Graduate Faculty in Political Science in partial fulfillment of the requirements for the degree of Doctor of Philosophy, The City University of New York 2019 © Copyright by Nick Pehlman, 2018 All rights reserved ii Police Reform in Ukraine Since the Euromaidan: Police Reform in Transition and Institutional Crisis by Nicholas Pehlman This manuscript has been read and accepted for the Graduate Faculty in Political Science in satisfaction of the dissertation requirement for the degree of Doctor of Philosophy. Date Mark Ungar Chair of Examining Committee Date Alyson Cole Executive Officer Supervisory Committee: Julie George Jillian Schwedler THE CITY UNIVERSITY OF NEW YORK iii ABSTRACT Police Reform in Ukraine Since the Euromaidan: Police Reform in Transition and Institutional -

Constitution of Ukraine

CONSTITUTION OF UKRAINE Adopted at the Fifth Session of the Verkhovna Rada of Ukraine on June 28, 1996 Amended by the Laws of Ukraine № 2222-IV dated December 8, 2004, № 2952-VI dated February 1, 2011, № 586-VII dated September 19, 2013, № 742-VII dated February 21, 2014, № 1401-VIII dated June 2, 2016 № 2680-VIII dated February 7, 2019 The Verkhovna Rada of Ukraine, on behalf of the Ukrainian people - citizens of Ukraine of all nationalities, expressing the sovereign will of the people, based on the centuries-old history of Ukrainian state-building and on the right to self-determination realised by the Ukrainian nation, all the Ukrainian people, providing for the guarantee of human rights and freedoms and of the worthy conditions of human life, caring for the strengthening of civil harmony on Ukrainian soil, and confirming the European identity of the Ukrainian people and the irreversibility of the European and Euro-Atlantic course of Ukraine, striving to develop and strengthen a democratic, social, law-based state, aware of responsibility before God, our own conscience, past, present and future generations, guided by the Act of Declaration of the Independence of Ukraine of August 24, 1991, approved by the national vote on December 1, 1991, adopts this Constitution - the Fundamental Law of Ukraine. Chapter I General Principles Article 1 Ukraine is a sovereign and independent, democratic, social, law-based state. Article 2 The sovereignty of Ukraine extends throughout its entire territory. Ukraine is a unitary state. The territory of Ukraine within its present border is indivisible and inviolable. Article 3 The human being, his or her life and health, honour and dignity, inviolability and security are recognised in Ukraine as the highest social value. -

Annoucements of Conducting Procurement Procedures

Bulletin No�1(127) January 2, 2013 Annoucements of conducting 000004 PJSC “DTEK Donetskoblenergo” procurement procedures 11 Lenina Ave., 84601 Horlivka, Donetsk Oblast Tryhub Viktor Anatoliiovych tel.: (0624) 57–81–10; 000002 Motor Roads Service in Chernihiv Oblast tel./fax: (0624) 57–81–15; of State Motor Roads Service of Ukraine e–mail: [email protected] 17 Kyivska St., 14005 Chernihiv Website of the Authorized agency which contains information on procurement: Martynov Yurii Vasyliovych www.tender.me.gov.ua tel.: (0462) 69–95–55; Procurement subject: works on construction of cable section КПЛ 110 kV tel./fax: (0462) 65–12–60; “Azovska – Horod–11 No.1, 2” and cable settings on substation 220 kV e–mail: [email protected] “Azovska” Website of the Authorized agency which contains information on procurement: Supply/execution: Separated Subdivision “Khartsyzk Electrical Networks” of the www.tender.me.gov.ua customer (Mariupol, Zhovtnevyi District, Donetsk Oblast), April – August 2013 Website which contains additional information on procurement: Procurement procedure: open tender www.ukravtodor.gov.ua Obtaining of competitive bidding documents: at the customer’s address, office 320 Procurement subject: code 63.21.2 – services of transport infrastructure for Submission: at the customer’s address, office 320 road transport (maintenance of principal and local motor roads in general 23.01.2013 12:00 use and artificial constructions on them in Chernihiv Oblast) Opening of tenders: at the customer’s address, office 320 Supply/execution: -

Organizations and Institutions Involved in Local Government Development and Municipal Services in Ukraine Plan Introduction

W:\OCEEI\OPS\0\003695 EMDU-2\18500 Mobile WW\Lyzogubs work\1230-Emunicipal.doc ORGANIZATIONS AND INSTITUTIONS INVOLVED IN LOCAL GOVERNMENT DEVELOPMENT AND MUNICIPAL SERVICES IN UKRAINE Final Report 2 ORGANIZATIONS AND INSTITUTIONS INVOLVED IN LOCAL GOVERNMENT DEVELOPMENT AND MUNICIPAL SERVICES IN UKRAINE PLAN INTRODUCTION ...................................................................................................................................................4 1. LOCAL GOVERNMENT AND MUNICIPAL SERVICES IN UKRAINE ........................................................5 1.1. WHAT IS LOCAL GOVERNMENT IN UKRAINE?.................................................................................................. 5 1.1.1. STRUCTURE OF LOCAL GOVERNMENT ...........................................................................................................5 1.1.2. THE SPHERES OF COMPETENCE AND DUTIES OF LOCAL GOVERNMENT IN UKRAINE...................................... 7 1.1.2. LEGISLATIVE HISTORY OF LOCAL GOVERNMENT ..................................................................................7 1.2. LOCAL BUDGETS................................................................................................................................................8 1.2.1. STRUCTURE OF LOCAL BUDGETS ....................................................................................................................8 1.2.2. HISTORY OF LEGISLATION AFFECTING LOCAL BUDGETING...........................................................................9 -

Second Interim Report 10 September – 8 October 2012

ENEMO’s 2012 parliamentary election observation mission in Ukraine is being conducted with the support of the United States Government, the German Foreign Office, the British Government, the Kingdom of the Netherlands and Black Sea Trust. European Network of Election Європейська мережа організацій, що Monitoring Organizations спостерігають за виборамиМіжнародна International Observation Mission місія спостереженняПарламентські вибори Ukraine Parliamentary Elections 2012 в Україні – 2012 Second Interim Report 10 September – 8 October 2012 The ENEMO mission for the 2012 parliamentary elections in Ukraine began its work on 23 July 2012 with the arrival of four Core Team members. ENEMO is the first international election observation mission registered for the Parliamentary Elections 2012 by the Central Election Commission (CEC). Thirty-five long-term observers arrived to Kyiv on 5 August 2012 and after training they were deployed throughout Ukraine. Long-term observer teams cover one or two oblasts of Ukraine. So far, ENEMO issued first interim report for the period August 5 – September 9. For this second interim report the focus of ENEMO long term observers was on the conduct of election campaign, formation and work of election commissions, media situation and official election complaints. Findings of this report are based on 272 reports received from long term observers. From the beginning of the mission, ENEMO observers have held 1728 meetings, out of which 823 were meetings with candidatesand representatives of political parties, 258 with election commissions and administrative officials, 238 with representatives of NGOs, 128 with media representatives and many other domestic and international interlocutors. They attended 81 rallies as well as132 DEC sessions, 47 CEC sessions and 19 PEC sessions. -

Cross Border Cooperation Strategy of the Lubelskie Voivodeship, Lviv, Volyn and Brest Oblasts

okładka CROSS BORDER COOPERATION STRATEGY OF THE LUBELSKIE VOIVODESHIP, LVIV, VOLYN AND BREST OBLASTS FOR 2014 – 2020 „Working Group for the development of the „Cross Border Cooperation Strategy of the Lubelskie Voivodeship, Lviv, Volyn and Brest Oblasts for 2014 – 2020”” Lubelskie Voivodeship Bogdan Kawałko, Dorota Skwarek, Magdalena Fotek – Kułak, Olga Grzechnik, Mo- nika Majewska, Bartosz Tereszczuk, Magdalena Figura – Wrona (Regional Policy Department of Lubelskie Voivodeship Marshal Offi ce) Brest Oblast Yuri Kolesov (Brest Oblast Executive Committee), Nikolaj Kuzmicki (Centre for Dis- semination of Information and Education in the Brest Department of the Ministry for Extraordinary Situations), Aleksandr Pańko (Brest University) Lviv Oblast Diana Kodrowa (Lviv Oblast State Administration), Liudmyla Oldak (Lviv Oblast Council) CROSS BORDER COOPERATION STRATEGY OF THE LUBELSKIE VOIVODESHIP, LVIV, Volyn Oblast Natalia Krolik, Walentyna Gnasiuk – Terlecka (Volyn Oblast State Administration), Alla Yatseniuk (Volyn Oblast Council) VOLYN AND BREST OBLASTS FOR 2014-2020 Coordinator Bogdan Kawałko (Regional Policy Department of the Lubelskie Voivodeship Marshal Offi ce in Lublin) External expert prof. Andrzej Miszczuk (University of Warsaw) Cooperation: Participation in the working group and preparation of materials for the diagnostic part: Krzysztof Markowski, Andrzej Matacz, Andrzej Jakubowski, Jerzy Greszta (Statistical Of- fi ce in Lublin),Offi ce for Spatial Planning in Lublin The Cross Border Association Euroregion Bug in Chełm ISBN 978 - 83 - 942280 -2 -6 © Copyright by: Lubelskie Voivodeship Marshal Offi ce in Lublin ul. Spokojna 4, 20-074 Lublin www.lubelskie.pl DTP and print: 29 COLORS ul. Lubelska 29, 71 - 043 Szczecin www.29colors.pl Lublin, April 2014 2 3 Introduction Border areas, owing to their special role played in various development pro- cesses, are of key importance to regional policy both on the European Union level as well as in particular states and regions.