– with Reopening Possibility – Unconditionally and Ir Revocably

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table of Contents

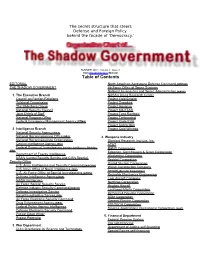

The secret structure that steers Defense and Foreign Policy behind the facade of 'Democracy.' SUMMER 2001 - Volume 1, Issue 3 from TrueDemocracy Website Table of Contents EDITORIAL North American Aerospace Defense Command (NORAD) THE SHADOW GOVERNMENT Air Force Office of Space Systems National Aeronautics and Space Administration (NASA) 1. The Executive Branch NASA's Ames Research Center Council on Foreign Relations Project Cold Empire Trilateral Commission Project Snowbird The Bilderberg Group Project Aquarius National Security Council Project MILSTAR Joint Chiefs of Staff Project Tacit Rainbow National Program Office Project Timberwind Federal Emergency Management Agency (FEMA) Project Code EVA Project Cobra Mist 2. Intelligence Branch Project Cold Witness National Security Agency (NSA) National Reconnaissance Office (NRO) 4. Weapons Industry National Reconnaissance Organization Stanford Research Institute, Inc. Central Intelligence Agency (CIA) AT&T Federal Bureau of Investigation , Counter Intelligence Division RAND Corporation (FBI) Edgerton, Germhausen & Greer Corporation Department of Energy Intelligence Wackenhut Corporation NSA's Central Security Service and CIA's Special Bechtel Corporation Security Office United Nuclear Corporation U.S. Army Intelligence and Security Command (INSCOM) Walsh Construction Company U.S. Navy Office of Naval Intelligence (ONI) Aerojet (Genstar Corporation) U.S. Air Force Office of Special Investigations (AFOSI) Reynolds Electronics Engineering Defense Intelligence Agency (DIA) Lear Aircraft Company NASA Intelligence Northrop Corporation Air Force Special Security Service Hughes Aircraft Defense Industry Security Command (DISCO) Lockheed-Maritn Corporation Defense Investigative Service McDonnell-Douglas Corporation Naval Investigative Service (NIS) BDM Corporation Air Force Electronic Security Command General Electric Corporation Drug Enforcement Agency (DEA) PSI-TECH Corporation Federal Police Agency Intelligence Science Applications International Corporation (SAIC) Defense Electronic Security Command Project Deep Water 5. -

1998 Annual Review and Summary Financial Statement

Annual Review1998 Annual Review 1998 And Summary Financial Statement English Version in Guilders And SummaryFinancialStatement English Version inGuilders English Version U Unilever N.V. Unilever PLC meeting everyday needs of people everywhere Weena 455, PO Box 760 PO Box 68, Unilever House 3000 DK Rotterdam Blackfriars, London EC4P 4BQ Telephone +31 (0)10 217 4000 Telephone +44 (0)171 822 5252 Telefax +31 (0)10 217 4798 Telefax +44 (0)171 822 5951 Produced by: Unilever Corporate Relations Department Design: The Partners Photography: Mike Abrahams, Peter Jordan, Barry Lewis, Tom Main, Bill Prentice & Andrew Ward Editorial Consultants: Wardour Communications U Typesetting & print: Westerham Press Limited, St Ives plc Unilever‘s Corporate Purpose Our purpose in Unilever is to meet the everyday needs of people everywhere – to anticipate the aspirations of our consumers and customers and to respond creatively and competitively with branded products and services which raise the quality of life. Our deep roots in local cultures and markets around the world are our unparalleled inheritance and the foundation for our future growth. We will bring our wealth of knowledge and international expertise to the service of local consumers – a truly multi-local multinational. ENGLISH GUILDERS Our long-term success requires a total commitment to exceptional standards of performance and productivity, to working together effectively and to a willingness to embrace new ideas and learn continuously. We believe that to succeed requires the highest standards of corporate behaviour towards our employees, consumers and the societies and world in which we live. This is Unilever’s road to sustainable, profitable growth for our business and long-term value creation for our shareholders and employees. -

Download Download

Transnational Corporate Ties: A Synopsis of Theories and Empirical Findings Michael Nollert introduction or sociologists and analysts of the world economy, it is certainly a matter of Ffact that transnational corporations are by no means isolated actors in an economic “war of all against all” (Th omas Hobbes). Rather, transnational cor- porations are frequently members of corporate networks, often of global reach. Although the literature on globalization emphasizes the increasing economic power of these networks and postulates the formation of a transnational capital- ist class, there is still a lack of empirical fi ndings. Th is article starts with a review of theoretical perspectives (resource dependence, social capital, coordination of markets, fi nancial hegemony, class hegemony, inner circle, and transnational capitalist class) which focuses on the functions and structures of corporate inter- locks at the national and the transnational level. Th e subsequent section off ers a synopsis of studies concerning transnational corporate networks. Th ese analyses of corporate ties (interlocking directorates, fi nancial participations and policy group affi liations) suggest the emergence of transnational economic elites whose members, however, have not lost their national identity. In the fi nal section, the theoretical perspectives will be assessed and some prospects are sketched out. Finally, it will be argued that the disintegration of the world society, which is considerably driven by rent-seeking corporate networks, can only be restrained if a potential global regulatory agency will be anchored in a post-Washington consensus. abstract: In general, corporations are not isolated pirical studies concerning transnational cor- actors in an economic “war of all against all” porate networks. -

Adams Adkinson Aeschlimann Aisslinger Akkermann

BUSCAPRONTA www.buscapronta.com ARQUIVO 27 DE PESQUISAS GENEALÓGICAS 189 PÁGINAS – MÉDIA DE 60.800 SOBRENOMES/OCORRÊNCIA Para pesquisar, utilize a ferramenta EDITAR/LOCALIZAR do WORD. A cada vez que você clicar ENTER e aparecer o sobrenome pesquisado GRIFADO (FUNDO PRETO) corresponderá um endereço Internet correspondente que foi pesquisado por nossa equipe. Ao solicitar seus endereços de acesso Internet, informe o SOBRENOME PESQUISADO, o número do ARQUIVO BUSCAPRONTA DIV ou BUSCAPRONTA GEN correspondente e o número de vezes em que encontrou o SOBRENOME PESQUISADO. Número eventualmente existente à direita do sobrenome (e na mesma linha) indica número de pessoas com aquele sobrenome cujas informações genealógicas são apresentadas. O valor de cada endereço Internet solicitado está em nosso site www.buscapronta.com . Para dados especificamente de registros gerais pesquise nos arquivos BUSCAPRONTA DIV. ATENÇÃO: Quando pesquisar em nossos arquivos, ao digitar o sobrenome procurado, faça- o, sempre que julgar necessário, COM E SEM os acentos agudo, grave, circunflexo, crase, til e trema. Sobrenomes com (ç) cedilha, digite também somente com (c) ou com dois esses (ss). Sobrenomes com dois esses (ss), digite com somente um esse (s) e com (ç). (ZZ) digite, também (Z) e vice-versa. (LL) digite, também (L) e vice-versa. Van Wolfgang – pesquise Wolfgang (faça o mesmo com outros complementos: Van der, De la etc) Sobrenomes compostos ( Mendes Caldeira) pesquise separadamente: MENDES e depois CALDEIRA. Tendo dificuldade com caracter Ø HAMMERSHØY – pesquise HAMMERSH HØJBJERG – pesquise JBJERG BUSCAPRONTA não reproduz dados genealógicos das pessoas, sendo necessário acessar os documentos Internet correspondentes para obter tais dados e informações. DESEJAMOS PLENO SUCESSO EM SUA PESQUISA. -

Why Is Knowledge Creation and Transfer So Difficult in Large Multinational Corporations? Evidence from the Business History Of

Why is knowledge creation and transfer so difficult in large multinational corporations? Evidence from the business history of Unilever. Geoffrey Jones Harvard Business School A Brief Review of the Literature Alfred Chandler, the doyen of business historians, has stressed the central role of large managerial corporations as the main engine of innovation since the Second Industrial Revolution. These large firms possessed, as Chandler describes in Scale and Scope, “the facilities and skills – the organizational capabilities – that simply were not available to new entrepreneurial entrants into an industry.” The modern industrial enterprise, he concludes, was ‘entrepreneurial and innovative in the Schumpeterian sense’ (Chandler, 1990). In his recent study on the consumer electronics and computer industries, Chandler explores this theme further and has placed great emphasis on the importance of the learned capabilities of large ‘core’ companies who had been first movers, against whom subsequent entrepreneurial start-ups rarely made headway. (Chandler, 2001). This view stands in sharp contrast to the evidence that over the last thirty years large corporations with vast accumulated knowledge experience profound difficulties in new business creation, although it is noteworthy that the world’s 700 largest industrial firms still accounted for around one half of the world’s commercial inventions as measured by patent counts in the early 1990s (Patel and Pavitt, 1991). Still, the problems caused by technological and resource lock-ins, and routine and cultural rigidities have 1 been identified and explored from multiple perspectives in economics and management (Leonard–Brown, 1995; Tushman and O’Reilly, 1997; Christensen 1997). A common theme in the literature is the importance of a firm’s history. -

Der Provinzielle Multi

UNTERNEHMEN UNILEVER Der provinzielle Multi Zu viele Produkte, zu viele Fabriken, zu allem Überfluß auch noch zwei Hauptverwaltungen und zwei Chairmen: Die aus vielen Fürstentümern bestehende Unilever-Gruppe tut sich schwer, mit überkommenen Struk- turen aufzuräumen. Wirklich global arbeitet der Konzern noch längst nicht. 116 managermagazin DEZEMBER 1998 Multinationaler Markenmix, aber kaum weltweit vertriebene Produkte: Unilever-Chairmen FitzGerald und Tabaksblat orris Tabaksblat (61) strahlt. Der niederländische Mana- Mger, einer von zwei Chair- men des Nahrungs- und Reinigungs- mittelkonzerns Unilever, ist sichtlich stolz auf das Erreichte. Kurz vor der Pensionierung meint er, sich zurück- lehnen zu können. In der Tat ist viel geschehen, seit Tabaksblat 1994 ins Amt kam. Unile- ver stieß etliche Randaktivitäten ab, so etwa die Chemiesparte. Der Konzern besann sich auf seine Stärke, das lukra- tive Geschäft mit Markenartikeln. Ferner straffte das Unternehmen seine zersplitterte Produktion. Vor al- DEZEMBER 1998 managermagazin 117 UNTERNEHMEN UNILEVER Klub der Veteranen Im Topmanagement der multikulturellen Gesellschaft Unilever haben Seiteneinsteiger keine Chance Executive Council Executive Committee Niall FitzGerald (53) Antony Burgmans (51) Morris Tabaksblat (61) Chairman Vice Chairman Chairman 31 Dienstjahre 26 Dienstjahre 34 Dienstjahre Ire Niederländer Niederländer Alexander Kemner (59) Clive Butler (52) Hans Eggerstedt (60) Jan Peelen (58) Rudy Markham (52) Category Director Category Director Financial Director Personnel Director -

Tales of Members of the Resistance and Victims of War

Come tell me after all these years your tales about the end of war Tales of members of the resistance and victims of war Ellen Lock Come tell me after all these years your tales about the end of war tell me a thousand times or more and every time I’ll be in tears. by Leo Vroman: Peace Design: Irene de Bruijn, Ellen Lock Cover picture: Leo en Tineke Vroman, photographer: Keke Keukelaar Interviews and pictures: Ellen Lock, unless otherwise stated Translation Dutch-English: Translation Agency SVB: Claire Jordan, Janet Potterton. No part of this book may be reproduced without the written permission of the editors of Aanspraak e-mail: [email protected], website: www.svb.nl/wvo © Sociale Verzekeringsbank / Pensioen- en Uitkeringsraad, december 2014. ISBN 978-90-9030295-9 Tales of members of the resistance and victims of war Sociale Verzekeringsbank & Pensioen- en Uitkeringsraad Leiden 2014 Content Tales of Members of the Resistance and Victims of War 10 Martin van Rijn, State Secretary for Health, Welfare and Sport 70 Years after the Second World War 12 Nicoly Vermeulen, Chair of the Board of Directors of the Sociale Verzekeringsbank (SVB) Speaking for your benefit 14 Hans Dresden, Chair of the Pension and Benefit Board Tales of Europe Real freedom only exists if everyone can be free 17 Working with the resistance in Amsterdam, nursery teacher Sieny Kattenburg saved many Jewish children from deportation from the Hollandsche Schouwburg theatre. Surviving in order to bear witness 25 Psychiatrist Max Hamburger survived the camps at Auschwitz and Buchenwald. We want the world to know what happened 33 in the death camp at Sobibor! Sobibor survivor Jules Schelvis tells his story. -

1999 Annual Review and Summary Financial Statement

Unilever Annual Review 1999 And Summary Financial Statement – English Version in Guilders And Summary Financial Statement – English Version Unilever Annual Review 1999 And Summary Financial Statement u English Version in Guilders Unilever N.V. Unilever PLC Weena 455, PO Box 760 PO Box 68, Unilever House 3000 DK Rotterdam Blackfriars, London EC4P 4BQ Telephone +31 (0)10 217 4000 Telephone +44 (0)20 7822 5252 Telefax +31 (0)10 217 4798 Telefax +44 (0)20 7822 5951 Meeting everyday needs of people everywhere u English Guilder Rev Unilever’s Corporate Purpose Our purpose in Unilever is to meet the everyday needs of people everywhere – to anticipate the aspirations of our consumers and customers and to respond creatively and competitively with branded products and services which raise the quality of life. Our deep roots in local cultures and markets around the world are our unparalleled inheritance and the foundation for our future growth. We will bring our wealth of knowledge and international expertise to the service of local consumers – a truly multi-local multinational. Our long-term success requires a total commitment to exceptional standards of performance and productivity, to working together effectively and to a willingness to embrace new ideas and learn continuously. We believe that to succeed requires the highest standards of corporate behaviour towards our employees, consumers and the societies and world in which we live. This is Unilever’s road to sustainable, profitable growth for our business and long-term value creation for our shareholders and employees. A truly multi-local multinational Unilever is dedicated to meeting the everyday needs of people everywhere. -

Unilever Annual Report 1995

E :F c Contents Directors’ Report 2 Chairmen’s Statement 4 Financial Hrghlrghts 5 International Presence 6 Busrness Overview 24 Review of Operations 37 Financial Review 40 Organisation and Corporate Governance 42 Directors 44 Advisory Directors and Board Committees Summary Financial Statement 45 lntroductron 45 Dividends 45 Statement from the Auditors 46 Summary Consolidated Accounts 48 Additional Information The two parent companies, Unilever N.V. (N.V.) and Unilever PLC (PLC), operate as nearly as is practicable as a single entity. This Annual Review therefore deals with the operations and results of the Unilever Group as a whole. Fluctuations in exchange rates can have a significant effect on Unilever’s reported results. In order to highlight the currency impact, key 1995 comparisons are expressed both at the rates of exchange for the current year (current exchange rates) and also at the same exchange rates as were used for 1994 (constant exchange rates). The brand names shown in italics in this Annual Review are trade marks owned by or licensed to companies within the Unilever Group. Our Company The brands we make serve people’s everyday needs, when it comes to what they eat and drink, the way they look and how they keep their clothes and their homes clean. That’s what has turned those brands into household names and made us one of the largest consumer goods companies in the world. We have business customers, too, whose needs are different. Our speciality chemicals and industrial cleaning systems, our professional bakery and catering products are just some of the ways we try to provide specific answers for their specific business needs. -

Reed Elsevier Capital Inc

O Electronic Proof This proof may not fit on letter-sized (8.5 x 11 inch) paper. If copy is cut off, please print to larger, e.g., legal-sized (8.5 x 14 inch) paper. Accuracy of proof is guaranteed ONLY if printed to a PostScript printer using the correct PostScript driver for that printer make and model. PROSPECTUS SUPPLEMENT (To Prospectus dated April 17, 2001) Reed Elsevier Capital Inc. $550,000,000 6.125% Notes due 2006 $550,000,000 6.750% Notes due 2011 4500,000,000 5.750% Notes due 2008 Fully and Unconditionally Guaranteed Jointly and Severally by Reed International P.L.C. and Elsevier NV This is an oÅering by Reed Elsevier Capital Inc. of an aggregate of $550,000,000 6.125% notes due 2006 (the ""U.S. Dollar 6.125% Notes''), an aggregate of $550,000,000 6.750% notes due 2011 (the ""U.S. Dollar 6.750% Notes,'' and together with the U.S. Dollar 6.125% Notes, the ""U.S. Dollar Notes'') and an aggregate of 4500,000,000 5.750% notes due 2008 (the ""Euro Notes,'' and together with the U.S. Dollar Notes, the ""Notes''). The Notes will be unsecured senior obligations of Reed Elsevier Capital Inc. and will be fully and unconditionally guaranteed jointly and severally by Reed International P.L.C. and Elsevier NV (the ""Guarantees''). Interest on the U.S. Dollar 6.125% Notes and the U.S. Dollar 6.750% Notes will be payable semi-annually on February 1 and August 1 of each year, beginning on February 1, 2002. -

Fl-Gvd OCT 2 01009

fL-Gvd OCT 2 01009 Unilever United States, Inc 800 Sylvan Avenue Andrew Shakalis, Esq. Englewood Qiffs, NJ 07632 Associate General Counsel - USA Environmental & Safety Tel: 201894 2763 Fax: 201 894 2727 [email protected] VIA FEDERAL EXPRESS Brian Carr, Esq. Assistant Regional Counsel New York/Caribbean Superfund Branch Office of Regional Counsel U.S. Environmental Protection Agency, Region II 290 Broadway, 17th Floor New York, NY 10007-1866 Re: Unilever United States, Inc. ("Unilever"): Response to USEPA's Gowanus Canal Superfund Site Section 104(e) Information Request Dear Brian: As a follow-up to our various conversations and, consistent with the granted extension of time within which to respond, attached please find Unilever's response to the USEPA's July 10, 2009 Information Request. As we have discussed, due to the fact that Chesebrough-Pond's Inc. sold the shares of the Stauffer Chemical Company to Imperial Chemicals Industries PLC in 1987, I have not been able to ascertain or locate any responsive information or documentation other than the attached Purchase Agreement. To the extent any additional information is discovered, I will forward it to your attention. If you have any questions, please give me a call. Andrew Shakalis encl. 106386.01 10119/09 REQUEST FOR INFORMATION 1. Please provide the following information on your Company: · a. Identify the state and date of incorporation of the Company and the Company's agents for service of process in the state of incorporation and in New York State. b. Please identify the Chief Executive Officer or other presiding officer of the Company. -

The Great Fight by Jeroen Smit

Sample translation from The Great Fight by Jeroen Smit Amsterdam: Prometheus, 2019 translated by Vivien D. Glass JEROEN SMIT – THE GREAT FIGHT 2 Contents A Near-Death Experience - 10 February 2017 11 MAKING MONEY & Doing Good - 1994-2007 1. Mea Culpa, We’ve Been Wrong 25 Food & healthcare, Dutch & British, NV & PLC, local & global. Large but hopelessly divided Unilever launches the ecologically friendly Omo Power in an attempt to finally get a step ahead of its successful American competitor Procter & Gamble. 2. Two Captains Jostling for Position at the Helm 46 How can so many talented people achieve such mediocre results? Desperate for trust, transparency and clear responsibility, the board of Unilever goes in search of itself. But the two chairmen don’t understand each other at all. 3. Mutinous Men; It Can’t Go on like This 68 The men running Unilever have managed to keep their world and their hierarchy intact for a long time. They speak the same language, one of the criteria for their selection. And after all, as long as people need to eat and wash, Unilever will be fine. Until the board’s lack of diversity becomes embarrassingly plain. 4. French Accountant Focuses on Share Price 91 Some say he has saved Unilever, others that he is all but driving it into the ground. Patrick Cescau is proud of how he has managed costs and steadily improved earnings per share. But so much energy is still wasted on internal strife that the hoped-for growth is not achieved. 5. Power to the Public 108 Yet another reorganisation, yet more structural change.