Case No COMP/M.3464 - KESKO / ICA / JV

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail of Food Products in the Baltic States

RETAIL OF FOOD PRODUCTS IN THE BALTIC STATES FLANDERS INVESTMENT & TRADE MARKET SURVEY Retail of food products in the Baltic States December 2019 Flanders Investment & Trade Vilnius Retail of Food Products in the Baltic States| December 2019 1 Content Executive summary ................................................................................................................................. 3 Overview of the consumption market Baltic States ................................................................................ 4 Economic forecasts for the Baltic States ............................................................................................. 4 Lithuania .......................................................................................................................................... 4 Latvia ............................................................................................................................................... 5 Estonia ............................................................................................................................................. 6 Structure of distribution and market entry in the Baltic States ............................................................ 13 Structure ............................................................................................................................................ 13 Market entry ..................................................................................................................................... 14 Key -

S Group and Responsibility 2016 Owned by You – S Group and Responsibility 2016

Owned by you – S GROUP AND RESPONSIBILITY 2016 OWNED BY YOU – S GROUP AND RESPONSIBILITY 2016 2 CONTENTS Contents ...............................................................................................................................................................................5 From the management .......................................................................................................................................................5 Benefits and convenience for co-op members’ daily life..................................................................................................5 Let’s make Finland the Best Place to Live .......................................................................................................................6 S Group in brief ..................................................................................................................................................................7 Business areas .................................................................................................................................................................11 Supermarket trade .......................................................................................................................................................11 Department stores and speciality stores .......................................................................................................................13 Service station store and fuel sales ...............................................................................................................................15 -

Abc Autopesupaikat

ABC AUTOPESUPAIKAT Bonusta saa seuraavista autopesupaikoista. ABC CarWash -pesupaikoissa käy myös S- Business -kortti, poikkeuksina Porissa ABC Prisma Mikkolan sekä ABC Tikkulan yhteydessä olevat autopesupaikat. Espoo, ABC Espoonlahti Espoo, Nöykkiönkatu 2, 02300 Espoo Espoo, ABC Mikkelä Espoo, Mikkelänkallio 1, 02770 Espoo Espoo, ABC Nihtisilta pesukatu, Nihtisilta 4, 02630 Espoo Espoo, ABC Niittykumpu Espoo, Niittymaantie 4, 02200 Espoo Forssa, ABC Carwash Prisma Forssa, Tapulikuja 6, 30100 Forssa Haapajärvi, ABC Haapajärvi, Puistokatu 40, 85800 Haapajärvi Haapavesi, ABC Carwash Haapavesi, Mieluskyläntie, 86600 Haapavesi Hamina, ABC Kippari Hamina, Satamakatu 2, 49400 Hamina Helsinki, ABC Käpylä Helsinki, Vähänkyröntie 2, 00610 Helsinki Helsinki, ABC Malmi Helsinki, Kirkonkyläntie 39, 00780 Helsinki Helsinki, ABC Pitäjänmäki Helsinki, Vanha Viertotie 31, 00380 Helsinki Helsinki, ABC Porttipuisto Pesukatu Vantaa, Tatti 19, 00760 Helsinki Helsinki, ABC Prisma Kaari pesukatu Helsinki, Kantelettarentie 1 D, 00420 Helsinki Helsinki, ABC Vuosaari Helsinki, Vuotie 4, 00980 Helsinki Hollola, ABC Carwash Hollola, Kansankatu 8, 15870 Hollola Hyvinkää, ABC Carwash Hyvinkää, Peltokuumolantie 2, 05800 Hyvinkää Hämeenlinna, ABC Carwash S-market Idänpää, Laaniitynkatu 2, 13210 Hämeenlinna Hämeenlinna, ABC Pesukatu Tiiriö, Pitkätanhuankatu 2, 13130 Hämeenlinna Iitti, ABC Kausala Iitti, Hallitie 1, 47400 Kausala Imatra, ABC CarWash Imatra, Karhumäenkatu 6, 55120 Imatra Isokyrö, ABC Carwash Isokyrö, Marttilantie 1, 61500 Isokyrö Joensuu, ABC Siihtala -

Tourist Guide 2017

tourist guide 2017 Distances to Rauma From Pori 49 km From Turku 94 km From Tampere 145 km From Helsinki 242 km From Vaasa 242 km From Jyväskylä 293 km From Oulu 548 km tampere Rauma turku Helsinki Welcome to rauma! Make yourself at home! old rauma ................ 4 shopping ............... 14 sammallahdenmäki.. 8 Cafés, CONTENTS restaurants and Art and culture ...... 10 accommodation .... 16 Lace ....................... 12 Families with children ................. 18 Winter and the sea .................. 20 Christmas.............. 26 Maps ...................... 30 the archipelago .... 22 events .................... 28 service directory....32 Hiking and hobbies .................. 24 About this brochure: rauma tourist guide 2017. Publisher: City of rauma, Communications and tourism services. Layout: Princeps oy. Printed by: rauman Painopiste oy. Printed on PeFC-certified paper.Print run: 27,000. Photos: City of rauma image Bank. the information was compiled in November 2016. the publisher is not responsible for changes to or the accuracy of the contact information, opening hours, prices and other similar information. 2 Welcome to rauma! Make yourself at home! it is easy to fall in love with rauma – it is one of Finland's oldest cities and known for its lace and unique dialect. rauma is a city of culture with a rich history, fascinating museums and a diverse range of events. rauma was established in 1442. the 575-year-old city possesses long traditions as a significant centre of industry and trade where history meets the present, making the city cosy and lively. rauma is the location of two uNesCo World Heritage sites, old rauma and sammallahdenmäki Bronze Age burial cairns area. rauma, a sea and archipelago city, has developed from a small village into a lively industrial and harbour city with approximately 40,000 residents. -

Finnish Grocery Trade 2009–2010 CONTENTS

Finnish Grocery Trade 2009–2010 CONTENTS For the reader. ...................................................................... 3 Grocery trade market in Finland, 2008.......................... 5 Grocery trade as part of society ...................................... 6 Key indicators for 2008 ...................................................... 8 Finnish Grocery Trade Association ...............................10 Deregulation for the benefit of the consumer .........11 Responsible supply chain benefits the consumer .....................................................................12 Best operating practices of the store ..........................13 FGTA supports its member companies in environmental affairs ..................................................14 Retail chains more dominant, procurement more centralised .....................................16 HoReCa wholesales as part of comprehensive service ....................................................22 HoReCa wholesalers prosper alongside their customers ..............................................23 Private labels ......................................................................24 Structural change in grocery trade ..............................27 Store types and definitions ...........................................30 Village grocery stores ......................................................32 Kiosk trade ..........................................................................33 Department store sales ...................................................34 Clothing -

Commission Decision of 20 11 1996 Declaring a Concentration to Be Incompatible with the Common Market (Case No IV/M.784 -Kesko

Commission Decision of 20 11 1996 declaring a concentration to be incompatible with the common market (Case No IV/M.784 -Kesko/Tuko) Council Regulation (EEC) N/ 4064/89 (Only the English text is authentic) (Text with EEA relevance) THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Community, Having regard to the Agreement on the European Economic Area and in particular Article 57(2)a thereof, Having regard to Council Regulation (EEC) N/ 4064/89 of 21 December 1989 on the control of concentrations between undertakings1, as amended by the Act of Accession of Austria, Finland and Sweden, and in particular Articles 8(3) and 22 thereof, Having regard to the Commission decision of 26 July 1996 to initiate proceedings in this case, Having given the undertakings concerned the opportunity to make known their views on the objections raised by the Commission, Having regard to the opinion of the Advisory Committee on Concentrations2, WHEREAS : 1 OJ N0 L 395, 30.12.1989, p1; corrected version OJ N/ L 257, 21.09.1990, p. 13. 2 OJ N/ C ...,...199. , p.... 2 1 The procedure under consideration concerns a request from the Finnish Office of Free Competition pursuant to Article 22 of Regulation 4064/89 (the Merger Regulation) to examine the acquisition of Tuko Oy by Kesko Oy. The request was received by the Commission on 26 June 1996. The operation was made known to the Office of Free Competition on 27 May 1996 by means of a press release sent from Kesko Oy. The request pursuant to Article 22 has therefore been made within the one month period provided for in Article 22(4). -

Annual Report 2015 4 Strategy Report > This Is How We Operate > Our Strategy

Strategy report 2015 THIS IS HOW WE OPERATE Our strategy 5 Our operating environment 11 The customer in everything we do 24 Quality as the basis of our work 36 Welfare for society 48 YEAR 2015 Review by the President and CEO 60 Kesko in brief 64 Board of Directors 70 Group Management Board 77 DIVISIONS Divisions in brief 87 Grocery trade 89 Home improvement and speciality goods trade 105 Car trade 120 Store sites 126 GRI report 2015 RESPONSIBILITY MANAGEMENT Management model 138 Responsibility programme 143 Responsibility monitoring and steering 170 Materiality assessment 188 We listen to our stakeholders 193 Contact information 197 GRI INDEX 199 PERFORMANCE INDICATORS Economic impacts 218 Environmental impacts 232 Social impacts 253 GRI REPORT PROFILE 282 ASSURANCE REPORT 283 Financial statements 2015 REPORT BY THE BOARD OF DIRECTORS Note 26. Trade payables and other current non- 387 AND KEY PERFORMANCE INDICATORS interest-bearing liabilities Note 27. Jointly controlled assets 388 Report by the Board of Directors 287 Note 28. Commitments 389 Group's key performance indicators 302 Note 29. Operating leases 390 Calculation of performance indicators 308 Note 30. Share-based payment 391 Analysis of shareholding 310 Note 31. Notes related to the statement of cash flows 394 CONSOLIDATED FINANCIAL Note 32. Financial risk management 396 STATEMENTS (IFRS) Note 33. Related party transactions 410 Consolidated income statement 316 Note 34. Legal disputes and possible legal 414 Consolidated statement of financial position 318 proceedings Consolidated statement of cash flows 320 Note 35. Other notes 415 Consolidated statement of changes in equity 322 Note 36. Group composition 416 Notes to the consolidated financial statements Note 37. -

Finnish Grocery Trade 2020

CONTENTS The Finnish Grocery Trade Association ..................2 Statistics ................................................................................3 Member Companies .......................................................9 Finnish Grocery Trade Association The Finnish Grocery Trade Association (PTY) is a lobbyist for the grocery trade and foodservice wholesale trade in industrial and social policy-making processes. The objective is that the grocery trade acts in an environment of free competition and is known as a responsible sector and an operator that takes the consumers’ interest into account. Trade is a significant employer and investor in Finland and it is important to pay attention to its perspectives in social decision-making processes. The Finnish Grocery Trade Association also actively co-operates with the Finnish Commerce Federation in its lobbying operations. In addition to industrial lobbying, the Finnish Grocery Trade Association also develops sector- wide, non-competitive operational models promoting efficiency and the realisation of social responsibility as well as co-operation throughout the value chain. Organisation Board of Directors Working Groups 2020 Retail Group | Foodservice Wholesale Group | Local Grocery Store Group Resource Efficiency Group | Product Safety Group | Self-monitoring Group Communications Group | Steering group regarding issues related to GS1 Personnel Business policy – Managing Director Kari Luoto Product safety, foodservice wholesale legislation – Senior Advisor, LL.M. Merja Söderström Supply -

KUOPION PÄIVITTÄISTA- VARAKAUPAN VETOVOIMA- TEKIJÄT Case: Osuuskauppa Peeässä, Prisma Kuopio

OPINNÄYTETYÖ - AMMATTIKORKEAKOULUTUTKINTO YHTEISKUNTATIETEIDEN, LIIKETALOUDEN JA HALLINNON ALA KUOPION PÄIVITTÄISTA- VARAKAUPAN VETOVOIMA- TEKIJÄT Case: Osuuskauppa PeeÄssä, Prisma Kuopio TEKIJÄ T: Henriikka Asikainen Wilhelmina Penttinen 2 (84) SAVONIA-AMMATTIKORKEAKOULU OPINNÄYTETYÖ Tiivistelmä Koulutusala Yhteiskuntatieteiden, liiketalouden ja hallinnon ala Koulutusohjelma/Tutkinto-ohjelma Liiketalouden tutkinto-ohjelma Työn tekijät Henriikka Asikainen ja Wilhelmina Penttinen Työn nimi Kuopion päivittäistavarakaupan vetovoimatekijät Päiväys 22.3.2018 Sivumäärä/Liitteet 72/12 Ohjaaja Virpi Oksanen Toimeksiantaja Osuuskauppa PeeÄssä, Prisma Kuopio, Jouni Ruotsalainen Tiivistelmä Tämän opinnäytetyön aiheena oli Kuopion päivittäistavarakauppojen vetovoimatekijät. Työn toimeksiantajana toimi Prisma Kuopion johtaja Jouni Ruotsalainen. Toimeksiantaja valikoitui muun muassa sen perusteella, että toinen opinnäytetyön tekijöistä työskentelee kyseisessä päivittäistavarakaupassa. Työn aihe valittiin opinnäyte- työn tekijöiden mielenkiinnosta asiakaskäyttäytymiseen, tutkimiseen ja kehittämiseen. Aiheen valintaan vaikutti myös se, että samasta aiheesta ei ole ennen tehty opinnäytetyötä. Työn tarkoituksena oli antaa toimeksiantajalle tietoa siitä, mitkä päivittäistavarakaupan vetovoimatekijöistä ovat merkittävimpiä asiakkaan näkökulmasta. Lisäksi työn tarkoituksena oli tuoda esille ne asiat, mihin päivittäistava- rakaupoissa tulisi eniten kiinnittää huomiota. Tällaiselle tutkimukselle oli tarvetta, koska Prisma Kuopiota uudis- tettiin ennen tutkimuksen -

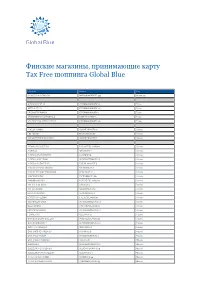

Global Lists Alpha.Indd

Финские магазины, принимающие карту Tax Free шоппинга Global Blue Merchant Address City DISAS FISH AHVENKOSKI MARKKINAMÄENTIE 476 Ahvenkoski ALEKSI 13 OY SELLO LEPPÄVAARANKATU 3-9 Espoo ANTTILA SELLO LEPPÄVAARANKATU 3-9 Espoo PRISMA LEPPÄVAARA LEPPÄVAARANKATU 5 Espoo STOCKMANN OYJ ABP TAPIOLA LÄNSITUULENTIE 5 Espoo VELJEKSET HALONEN OY SELLO LEPPÄVAARANKATU 3-9 Espoo ALKO OY HAMINA ISOYMPYRÄKATU 15 Hamina LIDL HAMINA MAARIANKATU 16 Hamina S-MARKET/EMOTION HAMINA ISOYMPYRÄKATU 15 Hamina AARIKKA POHJOISESPA POHJOISESPLANADI 27 Helsinki AJATAR OY SIMONKATU 2 Helsinki ALEKSI 13 OY CITYCENTER KAIVOKATU 6 Helsinki ALEKSI 13 OY HELSINKI ALEKSANTERINKATU 13 Helsinki ALEKSI 13 OY ITÄKESKUS TURUNLINNANTIE 6 Helsinki ALKO OY HELSINKI ARKADIA SALOMONKATU 1 Helsinki ALKO OY HELSINKI STOCKMANN KESKUSKATU 1 Helsinki ANNENSOPPI TMI FREDRIKINKATU 68 Helsinki ANNIKKI KARVINEN POHJOISESPLANADI 23 Helsinki ANTTILA ITÄKESKUS ITÄKATU 3-5 Helsinki ANTTILA KAMPPI SALOMONKATU 13 Helsinki BILTEMA HELSINKI ILTARUSKONTIE 2 Helsinki BOSS SHOP HELSINKI ETELÄESPLANADI 24 Helsinki CALVIN KLEIN JEANS URHO KEKKOSEN KATU 1 Helsinki DELLA MARGA POHJOISESPLANADI 33 Helsinki ECCO-SHOP KAMPPI URHO KEKKOSEN KATU 1 Helsinki FEMINETT OY KLUUVIKATU 1 Helsinki GANT STORE KÄMP GALLERIA POHJOISESPLANADI 33 Helsinki GANT STORE KAMPPI URHO KEKKOSEN KATU 1 Helsinki GIGANTTI ITÄKESKUS VISBYNKUJA 2 Helsinki GINA TRICOT CITY-CENTER KAIVOKATU 6 Helsinki GINA TRICOT FORUM MANNERHEIMINTIE 14 Helsinki GINA TRICOT ITÄKESKUS ITÄKATU 1 B Helsinki GUESS SHOP URHO KEKKOSEN KATU 1 Helsinki GUESS -

Yla-Anttila.Pdf

Kimmo Ylä-Anttila Verkosto kaupunkirakenteen analyysin ja suunnittelun välineenä Tekniikan tohtorin arvon saavuttamiseksi tehty väitöskirja, joka julkaistavaksi hyväksyttynä esitetään julkisesti tarkastettavaksi Tampereen teknilli- sen yliopiston Rakennustalon auditoriossa RG202 maaliskuun 26. päivänä 2010 kello 12. Thesis for the degree of Doctor of Technology to be presented with due permission for public examination and criticism in Rakennustalo, Audito- rium RG202, at Tampere University of Technology, on the 26th of March 2010, at 12 noon. Tampereen teknillinen yliopisto Tampere University of Technology Tampere 2010 Arkkitehtuurin laitos School of Architecture ISBN 978-952-15-2322-9 (nid.) ISBN 978-952-15-2558-2 (PDF) SISÄLLYSLUETTELO 9 1 VERKOSTOT JA METAPOLISAATIO 11 1.1 JOHDANTO 20 1.2 TRIANGULAATIO TUTKIMUSMENETELMÄNÄ 29 1.3 UUSI KAUPUNKIKEHITYSVAIHE: METAPOLISAATIO 45 1.4 METAPOLISAATION TULKINTA-AVAIMIA 53 1.5 KAUPUNKIRAKENTEEN MORFOLOGINEN TUTKIMUSPERINNE 65 2 VERKOSTOTEORIA JA TOPOMORFOLOGISEN ANALYYSIKOKONAISUUDEN MUODOSTAMINEN 67 2.1 VERKOSTOAJATTELUN TEORIA 71 2.2 VERKOSTOAJATTELU TILATIETEISSÄ 89 2.3 TOPOMORFOLOGISEN ANALYYSIKOKONAISUUDEN MUODOSTAMINEN 111 3 VERKOSTOANALYYSIN MENETELMÄT 114 3.1 VERKOSTO GRAAFINA 116 3.2 FYYSISTEN VERKOSTOJEN ANALYYSIMENETELMÄT 127 3.3 SUHTEELLISEN SIJAINNIN ANALYYSIMENETELMÄT 134 3.4 TILA–AIKA-VERKOSTOJEN ANALYYSI 143 3.5 YHTEENVETO VERKOSTOLUENNAN MENETELMISTÄ 147 4 VERKOSTOANALYYSIN TESTAUS 149 4.1 CASE TAMPERE 158 4.2 TOPOMORFOLOGINEN MONITASOANALYYSI 174 4.3 TOPOMORFOLOGISEN ANALYYSIMENETELMÄN ARVIOINTI 179 5 VERKOSTONÄKÖKULMA KAUPUNKISUUNNITTELUSSA 182 5.1 KAUPUNKISUUNNITTELUN KEHITTÄMISEN LÄHTÖKOHDAT 190 5.2 INTEGROIVA SUUNNITTELU 205 6 YHTEENVETO JA DISKUSSIO 1 METAPOLISAATIO JA VERKOSTOT city? An old word. See ’m.city (or multicity).’ Metapolis Dictionary of Advanced Architecture (Gausa ym. 2003, s. 111) ”But the equipment we have for making sense of what is happening to our cities has lagged far behind these changes.” (Sudjic 1992, s. -

Suomen Osuuskauppojen Keskuskunta SOK Corporation

Suomen Osuuskauppojen Keskuskunta SOK Corporation Annual Report 2005 Suomen Osuuskauppojen Keskuskunta SOK Corporation Annual Report 2005 1 Contents 4 CEO’s Review 7 The S Group 13 SOK Corporation 19 Business-by-business review 19 Market trade 21 Service station stores and fuel sales 22 Department store and speciality store trade 24 Hotel and restaurant business 26 Motor trade and accessories 28 Agricultural trade 29 Procurements and logistics 31 Neighbouring countries 32 Corporate governance within SOK Corporation 38 Accountability 38 Personnel 43 Environment 46 Sponsorship and international contacts 48 Financial Statements 2005 48 Executive Board Report on Operations 54 Consolidated Income Statement 55 Consolidated Balance Sheet 56 Consolidated Cash Flow Statement 57 SOK Income Statement 58 SOK Balance Sheet 59 SOK Cash Flow Statement 60 Accounting Policies 63 Notes to the Consolidated and SOK Income Statement and Balance Sheet 77 Key Ratios and their Method of Calculation 78 Executive Board’s Proposal for the Disposal of SOK’s Profi t for the Year 79 Auditors’ Report 79 Statement of the Supervisory Board 3 CEO’s Review The S Group’s cooperative enterprises Increasing patronage by our – customer-owners’ own store customer-owners Th e S Group’s task is to provide services and benefi ts for its Th e S Group succeeded well in carrying out its mission last year. members, its customer-owners. Th is mission guides both strategic Bonus sales targeted at customer-owners outstripped the development and practical operations, and it underlies day-to-day S Group’s overall sales growth. Customer-owners thus showed their service for customer-owners at all our S Group locations.