Gmg Fund Swiss Small & Mid Cap A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Release

CREDIT SUISSE AG Paradeplatz 8 Tel. +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating Overview of Swiss Companies Company CS Rating CS Outlook Changes since June 2009 S&P Moody's ABB Low A Stable A–, Stable A3, Stable Adecco Mid BBB Negative Outlook changed from Stable to Negative BBB–, Stable Baa3, Stable AFG Low BBB Stable Outlook changed from Negative to Stable n.r. n.r. Alpiq High A Stable n.r. n.r. Aryzta High BBB Stable Coverage initiation n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Low A Stable A–, Stable1 n.r. BKW Low AA Stable n.r. n.r. –1 notch, outlook changed from Negative to Bobst Group Low BBB Stable n.r. n.r. Stable Bucher Industries High BBB Stable n.r. n.r. CKW n.r. n.r. Drop coverage Clariant High BB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. –1 notch, outlook changed from Stable to Edipresse High BB Negative n.r. n.r. Negative –1 notch, outlook changed from Negative to EGL Low A Stable n.r. n.r. Stable EMS Chemie Low A Stable Outlook changed from Negative to Stable n.r. n.r. Energiedienst Low A Stable n.r. n.r. EOS n.r. n.r. Drop coverage Flughafen Zurich Mid BBB Stable BBB+, Positive n.r. Forbo Mid BBB Stable n.r. n.r. Geberit High BBB Stable A–, Stable n.r. -

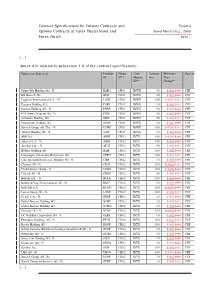

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

Notice N19 2019

UBS MTF Market Notice Swiss Market Removal 28 June 2019 Dear Member, Following the announcement of the Swiss Federal Department of Finance on June 24 (FDF prepared to activate measure to protect Swiss stock exchange infrastructure), and further to our notice of the same date, UBS MTF will remove all instruments issued by companies with registered offices in Switzerland which are listed on Swiss trading venues. This update will take effect from 1 July. Our daily Stock Universe file, published on our website at https://www.ubs.com/global/en/investment- bank/ib/multilateral-trading-facility/reference-data.html and by SFTP, will reflect the removal of these instruments as of this date. Instruments not subject to the Swiss measure are unaffected; a list of affected instruments is attached to this notice. If you have any queries regarding this notice please contact the UBS MTF Supervisors at +44 207 568 2052 or [email protected]. UBS MTF Management Notice N19 2019 UBS MTF Notices and documentation are available at https://www.ubs.com/mtf. If you have any queries regarding this notice, or comments on the above, please contact the UBS MTF Supervisors at +44 20 7568 2052 or [email protected]. UBS MTF is operated by UBS AGLB which is authorised by the Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and Prudential Regulation Authority. UBS AG is a public company incorporated with limited liability in Switzerland domiciled in the Canton of Basel-City and the Canton of Zurich respectively registered at the Commercial Registry offices in those Cantons with Identification No: CHE-101.329.561 as from 18 December 2013 (and prior to 18 December 2013 with Identification No: CH-270.3.004.646-4) and having respective head offices at Aeschenvorstadt 1, 4051 Basel and Bahnhofstrasse 45, 8001 Zurich, Switzerland and is authorised and regulated by the Financial Market Supervisory Authority in Switzerland. -

Zmonthly December 16

Swiss Small & Mid Cap Fund Class A zMonthly December 16 2016 closes on an upbeat note Performance since Launch (as of 30/12/2016) The Swiss equities market moved higher at the end of the year in the wake of US stock markets, with the blue chips in the SMI outperforming for once. In the small and mid cap segment, cy- clical stocks and securities with above-average short-selling po- sitions attracted the strongest demand. The market followed the pattern of ignoring negative news flow – such as the “No” vote in Italy’s referendum on constitutional reform – and focusing in- stead on positive news. The ECB left interest rates at rock bot- tom and extended its bond-purchasing programme at least until December 2017. This move pushed the euro down to a new re- zCapital Swiss Small & Mid Cap Fund A SPI Extra® (indexed) cord low against the US dollar. After months of prevarication, the Fed finally announced a 0.25 percentage point increase in interest rates, long since priced in by the markets, and also sig- Performance (as of 30/12/2016) nalled another three hikes over the course of 2017. There were YTD (Fund / Benchmark) 9.3% / 8.5% several noteworthy company announcements as well. Lonza is 1 year 9.3% / 8.5% acquiring the US capsule manufacturer Capsugel for USD 5.5 3 years p.a. 12.4% / 10.3% billion. Market players felt the acquisition was expensive and 5 years p.a. 16.1% / 14.3% marked down Lonza’s share price. The share price of Leonteq, Since launch p.a. -

Vontobel Fund (CH) - Vescore Swiss Equity Multi Factor A

Asset Management / Monthly Factsheet as at 30/11/2020 Vontobel Fund (CH) - Vescore Swiss Equity Multi Factor A Approved for Wholesale/Retail investors in: CH. Investment objective Fund Data This equity fund aims to achieve attractive long-term returns compared Investment manager Vontobel Asset Management AG to traditional Swiss equity market indices weighted by market capitaliza- Custodian RBC Investor Services Bank S.A. tion. Management company Vontobel Fonds Services AG Fund domicile Switzerland Key features The fund actively invests in around 50 of the largest equities listed in Fund currency CHF Switzerland, measured by market capitalization. Based on quantitative Share class currency CHF models, the fund tactically adjusts the weights of its positions to maintain Swinging Single Pricing Yes adequate exposure to the fundamental factor premia driving equity re- Net asset value 152.95 turns, such as Value, Momentum, Quality, and Minimum Volatility. Fund volume in mln 722.44 CHF Management fee 1.000% Approach TER (per 31/08/2020) 1.01% Vescore's proven investment process amalgamates outstanding propriet- Launch date 26/01/2016 ary models, cutting-edge technology, and active management. For this Launch price 100.00 fund, the highly experienced investment team uses their models to con- tinuingly assess the attractiveness of each fundamental factor premium End of fiscal year 28. February and make the corresponding investment decisions without emotional bi- Last distribution 2.00 / June ases, while ensuring systematic risk control at all times. ISIN CH0311188863 Valor 31118886 Bloomberg VESEMFA SW Distribution policy Distributing As of 31.10.2020 Net Performance of A Share (in CHF and %)** Net Performance of A Share in CHF** 3 y. -

Zmonthly October 20

Swiss Small & Mid Cap Fund Class A zMonthly October 20 Second wave takes markets by surprise Performance since Launch (as of 30/10/2020) Equity markets enjoyed a healthy start to the closing quarter of the year. However, US President Donald Trump caused market jitters following his stay in hospital with COVID-19 when he in- structed the Republicans with a tweet to break off talks on an- other fiscal package. A short while later, he stated that he was once again open to a swift conclusion. The US elections subse- quently became one of the dominant themes, as the possibility of a “blue sweep” – with the Democrats taking control of the White House, Senate and House of Representatives – fuelled hopes for more aggressive fiscal policy and led share prices to zCapital Swiss Small & Mid Cap Fund A SPI Extra® (indexed) rally. From the middle of the month, the second wave of the pandemic began to spread across Europe. Tighter restrictions Performance (as of 30/10/2020) on movement and fresh lockdowns are now in force in several countries. The economic recovery is therefore likely to be MTD (Fund / Benchmark) -4.0% / -4.7% weaker than expected in the fourth quarter. European markets YTD -2.5% / -5.4% consequently slipped back to their June levels. As in spring, 1 year 2.4% / 0.3% this also dragged US markets lower. Logitech shares climbed to 3 years p.a. 2.8% / 1.3% a new all-time high on the back of the company’s quarterly re- 5 years p.a. -

Rating Overview of Swiss Companies

CREDIT SUISSE AG Paradeplatz 8 Telephone +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating overview of Swiss companies Rating overview of Swiss corporate issuers Company CS rating CS outlook Changes since September 2013 S&P Moody’s ABB Low A Stable A, Stable A2, Stable Adecco Mid BBB Stable BBB+, Stable Baa3, Positive Aduno Holding Mid A Stable n.r. n.r. Alpiq Mid BBB Stable n.r. n.r. Arbonia Forster Group Low BBB Negative Outlook changed from Stable to Negative n.r. n.r. Aryzta Low BBB Stable - 1 notch, outlook changed from Negative to Stable n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Insurance Low A1 Stable A, Stable1 n.r. Bell Mid BBB Stable n.r. n.r. BKW Mid A Negative - 1 notch n.r. n.r. Bobst Group High BB Stable Outlook changed from Negative to Stable n.r. n.r. Bucher Industries High BBB Stable n.r. n.r. CFT High BB Stable Coverage Initiation n.r. n.r. Clariant Low BBB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. Emmi Low A Stable Coverage Initiation n.r. n.r. Flughafen Zurich Low A Stable A, Stable n.r. Galenica High BBB Stable + 1 notch, outlook changed from Positive to Stable n.r. n.r. Georg Fischer Mid BBB Stable + 1 notch n.r. n.r. Givaudan Low A Stable n.r. n.r. GlencoreXstrata Mid BBB Stable BBB, Stable Baa2, Stable Helvetia Low A2 Stable A, Stable2 n.r. -

Instrument ID ISIN Code Description Market ID Yzai CH0043238366 ARYZTA AG XDUB Notd CH0012005267 NOVARTIS AG-REG XETR O5hd CH002

Instrument ID ISIN Code Description Market ID YZAi CH0043238366 ARYZTA AG XDUB NOTd CH0012005267 NOVARTIS AG-REG XETR O5Hd CH0022237009 OPENLIMIT HOLDING AG XETR HLGd CH0006539198 HIGHLIGHT COMMUNICATIONS-BR XETR NESRd CH0038863350 NESTLE SA-REG XETR BBZAd CH0038389992 BB BIOTECH AG-REG XETR CCHl CH0198251305 COCA-COLA HBC AG-DI XLON TVRBp CH0008175645 TELEVERBIER XPAR AGTAp CH0008853209 AGTA RECORD LTD XPAR GNROp CH0308403085 GENEURO SA XPAR LHNp CH0012214059 LAFARGEHOLCIM LTD-REG XPAR CCCs CH0136071542 CAVOTEC SA XSTO ORIs CH0256424794 ORIFLAME HOLDING AG XSTO FOIBs CH0242214887 FENIX OUTDOOR INTERNATIONAL XSTO ABBs CH0012221716 ABB LTD-REG XSTO MIKNz CH0003390066 MIKRON HOLDING AG-REG NEW XSWX PSPNz CH0018294154 PSP SWISS PROPERTY AG-REG XSWX SFZNz CH0014284498 SIEGFRIED HOLDING AG-REG XSWX SWTQz CH0010754924 SCHWEITER TECHNOLOGIES AG-BR XSWX GRKPz CH0001340204 GRAUBUENDNER KANTONALBANK-PC XSWX GMIz CH0012949464 GROUPE MINOTERIES SA-REG XSWX BPDGz CH0473243506 BANQUE PROFIL DE GESTION-BR XSWX UHRNz CH0012255144 SWATCH GROUP AG/THE-REG XSWX TIBNz CH0214706357 BERGBAHNEN ENGELB. TRUEB-REG XSWX TAMNz CH0011178255 TAMEDIA AG-REG XSWX ZWMz CH0002661731 ZWAHLEN & MAYR SA-BR XSWX ZUGNz CH0148052126 ZUG ESTATES HOLDING AG-B SHR XSWX ZUBNz CH0312309682 ZUEBLIN IMMOBILIEN HOLDI-REG XSWX ALPHz CH0034389707 ALPIQ HOLDING AG-REG XSWX AEVSz CH0478634105 AEVIS VICTORIA SA XSWX HRENz CH0025607331 ROMANDE ENERGIE HOLDING-REG XSWX HLEEz CH0003583256 HIGHLIGHT EVENT AND ENTERTAI XSWX HBMNz CH0012627250 HBM HEALTHCARE IVST-A XSWX ZGz CH0001308904 ZUGER -

Virtual Swiss Equities Conference 2021 - Program 13 January 2021

Virtual Swiss Equities Conference 2021 - Program 13 January 2021 Timeline presentations 13 January 2021 13:00 - 13:40 Track 1 Track 2 Track 3 (CET) Molecular Partners Achiko Dr. Patrick Amstutz (CEO), Steven Goh (Founder & Board Member) Andreas Emmenegger (CFO) 13:50 - 14:30 Track 1 Track 2 Track 3 (CET) Newron Pharmaceuticals Implenia Compagnie Financière Tradition Stefan Weber (CEO) Marco Dirren (CFO) Patrick Combes (CEO), François Brisebois (Group CFO) 14:30 Break 14:50 - 15:30 Track 1 Track 2 Track 3 (CET) Addex Therapeutics CPH Chemie + Papier ASMALLWORLD Tim Dyer (CEO) Richard Unterhuber Jan Luescher (CEO) (CFO/Member of the Group Management Team) 15:40 - 16:20 Track 1 Track 2 Track 3 (CET) Sonova CALIDA GROUP Meyer Burger Arnd Kaldowski (CEO) Reiner Pichler (CEO), Dr. Gunter Erfurt (CEO) Sacha Gerber (CFO) 16:30 - 17:10 Track 1 Track 2 Track 3 (CET) Basilea mobilezone Rieter Management David Veitch (CEO), Markus Bernhard (CEO) Kurt Ledermann (CFO) Adesh Kaul (CFO) 17:10 End As of 14 January 2021 The conference language is English. * Virtual participation ** Hybrid participation Wednesday, 13 January 2021 Overview one-on-one only meetings (sorted by market cap) ⁄ Bossard Dr. Daniel Bossard (CEO), Stephan Zehnder (Group CFO) ⁄ ARBONIA Alexander von Witzleben (CEO), Daniel Wüest (CFO) 14 January 2021 Timeline presentations 14 January 2021 08:30 - 09:10 Track 1 Track 2 Track 3 (CET) Siegfried Holding Conzzeta COLTENE Dr. Reto Suter (CFO) Michael Willome (Group CEO), Alex Waser Martin Schaufelberger (CEO), (CEO of Bystronic & Member of Conzzeta Gerhard Mahrle (CFO) Executive Committee) 09:20 - 10:00 Track 1 Track 2 Track 3 (CET) Givaudan SFS Group VZ Holding Gilles Andrier (CEO) Jens Breu (CEO) Matthias Reinhart (CEO) 10:00 Break 10:20 - 11:00 Track 1 Track 2 Track 3 (CET) Clariant Sulzer HBM Healthcare Investments AG Stephan Lynen (CFO) Greg Poux-Guillaume (CEO) Erwin Troxler (CFO) 11:10 - 11:50 Track 1 Track 2 Track 3 (CET) Galenica Bossard ORIOR Felix Burkhard (CFO) Dr. -

Minder Initiative a Review of the Popular Initiative That Revolutionised Swiss Governance

Minder Initiative A Review of the Popular Initiative that Revolutionised Swiss Governance 1 Table of Contents BACKGROUND TO THE MINDER INITIATIVE ...............................................................1 Amendments to Articles ........................................................................................................................................................................ 1 THE IMPLEMENTATION PROCESS ................................................................................ 3 Prospective vs. Retrospective Compensation Approval .......................................................................................................... 3 Binding Compensation Votes ............................................................................................................................................................. 3 Advisory Compensation Votes ...........................................................................................................................................................4 Common Practice: Overboarding Thresholds Confirmed ........................................................................................................4 Board Compensation.............................................................................................................................................................................. 5 VOTING RESULTS: 2015 SWISS COMPENSATION PROPOSALS .............................. 6 Executive Compensation ......................................................................................................................................................................6 -

High AA, Positive Daniel Rupli

Swiss Credit Handbook Canton of Basel-Stadt – High AA, Positive Daniel Rupli Rating rationale Degree of self-financing / self-financing ratio The rating of the Canton of Basel-Stadt is supported by sound financial statements over past years that were dominated by increasing capitalization, a lower debt burden, excess revenues CHF m 750 400% and self-financing ratios that came in clearly above 100%, with the exception of last year due to a disproportionately high net investment as a result of the disincorporation of the hospitals, 600 320% which reduced the canton's assets substantially. Excluding this effect, the canton would have 450 240% been able to fully self-finance its net investments. We highlight the canton's high debt per 300 160% capital reading at end-December 2012, reflecting its status as a "city canton." From a quality 150 80% perspective, Basel-Stadt benefits from a strong CS locational quality index reading, which is supported by strong transportational accessibility and good availability of highly qualified labor, 0 0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 partially offset by the below-average tax regime. We also highlight the strong resource index 2013B reading. These factors position the canton to benefit from an above-average population and the Degree of self-financing Self-financing ratio (r.h.s.) ability to increase taxable income in the future. Financial ratios (CHF m) 2009 2010 2011 2012 2013B Total debt and interest expense Operating account CHF m Total expenditure operating account 4,365.3 4,903.0