CDP Bericht 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Release

CREDIT SUISSE AG Paradeplatz 8 Tel. +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating Overview of Swiss Companies Company CS Rating CS Outlook Changes since June 2009 S&P Moody's ABB Low A Stable A–, Stable A3, Stable Adecco Mid BBB Negative Outlook changed from Stable to Negative BBB–, Stable Baa3, Stable AFG Low BBB Stable Outlook changed from Negative to Stable n.r. n.r. Alpiq High A Stable n.r. n.r. Aryzta High BBB Stable Coverage initiation n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Low A Stable A–, Stable1 n.r. BKW Low AA Stable n.r. n.r. –1 notch, outlook changed from Negative to Bobst Group Low BBB Stable n.r. n.r. Stable Bucher Industries High BBB Stable n.r. n.r. CKW n.r. n.r. Drop coverage Clariant High BB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. –1 notch, outlook changed from Stable to Edipresse High BB Negative n.r. n.r. Negative –1 notch, outlook changed from Negative to EGL Low A Stable n.r. n.r. Stable EMS Chemie Low A Stable Outlook changed from Negative to Stable n.r. n.r. Energiedienst Low A Stable n.r. n.r. EOS n.r. n.r. Drop coverage Flughafen Zurich Mid BBB Stable BBB+, Positive n.r. Forbo Mid BBB Stable n.r. n.r. Geberit High BBB Stable A–, Stable n.r. -

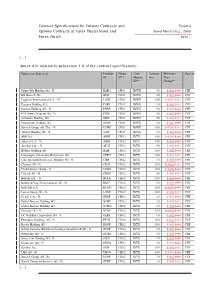

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

2013 Annual Report Swift Code: BCVLCH2L Clearing Number: 767 [email protected] BCV at a Glance

Head Office Place St-François 14 Case postale 300 Rapport 2013 annuel 1001 Lausanne Switzerland Phone: +41 21 212 10 10 2013 Annual Report Swift code: BCVLCH2L Clearing number: 767 www.bcv.ch [email protected] BCV at a glance 2013 highlights Our business remained on firm track in a mixed BCV decided to take part in the US Department of environment Justice’s program aimed at settling the tax dispute • Business volumes in Vaud were up, spurred by a between Switzerland and the USA resilient local economy. • Given the uncertainty surrounding the program • Nevertheless, the low-interest-rate environment and and in keeping with the Bank’s sound approach to the cyclical slowdown in international trade finance risk management, BCV decided to participate in the activities weighed on revenues, which came in at program, for the time being as a category 2 financial CHF 991m. institution. • Firm cost control kept operating profit at CHF 471m We maintained our distribution policy (–3%). • We paid out an ordinary dividend of CHF 22 and BCV’s AA rating was maintained by S&P distributed a further CHF 10 per share out of paid- • Standard & Poor’s confirmed BCV’s long-term rating in reserves, thus returning a total of more than of AA and raised the Bank’s outlook from negative to CHF 275m to our shareholders. stable. We launched stratégie2018 • We achieved virtually all of the goals we had set in our previous strategy, BCVPlus, with concrete results in all targeted areas. • Our new strategy builds on this success and takes its Thanks cue from two key words: onwards and upwards. -

80 Investors: Longevity in Switzerland 3Wventures

80 Investors: Longevity in Switzerland 3wVentures 3wVentures provides seed money and venture capital to international internet startups. As 3wVentures' clients focus on early stage projects and prototypes, the company's investments and co-investments target a volume of up to USD 250,000. 3wVentures is located in Switzerland and backed by Yves Latour and Arvin Zuberbuehler. 3wVentures has invested early stage venture capital in these startup companies: forAtable.com, Lunchgate, UEPAA! etc. Web site: 3wventures.com Number of Investments: 44 Total Investments: $23.3M Founded in: 2007 Based in: Herisau, Switzerland Sector: P3, AgeTech Investment in Switzerland companies: Pregnolia, Abionic Stages: Early Stage Venture, Seed 231 Aescap Venture Aescap 2.0 is an open-end fund that invests in publicly listed biotech / life sciences companies. It invests in highly innovative companies that develop and market new medicines and to a lesser extent diagnostics and/or medical devices. Entry into and exit from the fund is possible twice per month. The life sciences market is a large and fast-growing market where breakthrough innovations can be harnessed in a global and profitable manner. Aescap 2.0 has a focused portfolio, investing in approximately 18 companies. Within this focus it will ensure that the portfolio is diversified over different diseases and company development phases. The Fund’s objective is to make an annual net return (after deduction of costs) of 20% over the mid-term (4-5 years). Web site: aescap.com Number of Investments: 26 Total Investments: $30.5M Founded in: 2005 Based in: Amsterdam, The Netherlands Sector: Regenerative Medicine Investment in Switzerland companies: Vivendy Therapeutics Stages: Early Stage Venture, Late Stage Venture 2 Angel Investment Network Angel Investment Network is a London-based investment company founded in 2004 whose aim is to connect entrepreneurs and investors. -

No Place Left to Hide – Swiss Banks Under Scrutiny from US Regulators Author: Alexander Troller, Simone Nadelhofer and Nicolas Ollivier

No place left to hide – Swiss banks under scrutiny from US regulators Author: Alexander Troller, Simone Nadelhofer and Nicolas Ollivier 20 Sep 2013 | 00:00 | Tags: Banking & finance, Regulatory Alexander Troller, Simone Nadelhofer and Nicolas Ollivier say the Wegelin case shows that the US is willing to target senior managers, lawyers and trustees On 28 August, the Swiss Government and the US Department of Justice (DOJ) issued a joint statement announcing an 'accord' over a unilateral program launched by the DOJ and allowing most Swiss banks to seek a non-prosecution agreement (NPA) from the DOJ and pay heavy fines. This would allow them to avoid or defer prosecution in relation to the custody of undeclared assets of former or existing US customers, or – subject to demonstrating the bank's US tax compliance in relation to each and any former and existing customers – a non-target letter (the "Program"). The Program will be available to any of Switzerland's 300 banks, save for those 14 institutions already prosecuted by the DOJ, among which are Credit Suisse, Julius Baer, Zurich Cantonal Bank and Pictet to name only a few. The decision whether or not to join the Program lies with each bank. Participating banks will be split into four categories, depending on their degree of responsibility in relation to tax offences committed by their US customers. The categories explained Category 1 includes the 14 banks already under investigation and to which the Program does not apply. Category 2 covers those banks who believe they may have committed a US tax offence in the way they handled assets of US persons, and Categories 3 and 4 includes those banks who can show a clean bill of (tax) health in relation to US customers or demonstrate having an exclusively non-US client base only. -

Zurich Cantonal Bank to Go Live on Reuters Trading for Foreign Exchange Service

Zurich Cantonal Bank to go live on Reuters Trading for Foreign Exchange service February 20, 2006 Zurich – Reuters (LSE: RTR, NASDAQ: RTRSY) today announced that Zurich Cantonal Bank is the latest bank to go live on Reuters Trading for Foreign Exchange. Zurich Cantonal Bank, the first Swiss bank to join RTFX, has also signed up for Reuters Electronic Trading – Automated Dealing to support its e-commerce needs. Zurich Cantonal Bank, one of the leading FX liquidity providers in Switzerland and central Europe with an AAA rating, brings its core strength in Swiss franc and the other major currencies to the Reuters Trading for Foreign Exchange (RTFX) platform. Initially, Zurich Cantonal Bank will target inter-bank customers in Europe, Middle East and Asia and buy-side customers in Europe. Zurich Cantonal Bank's prices will be fed to the RTFX platform using the Reuters Electronic Trading – Automated Dealing pricing engine. Daniel Corbaz, Director and Head of FX at Zurich Cantonal Bank, commented: “Reuters Trading for Foreign Exchange allows us to offer our clients additional access to our FX services and leverage the global Reuters footprint to serve our customer base in the German speaking part of Europe, Middle East and Asia with attractive FX pricing and extend it globally. These will be provided by the Reuters Electronic Trading rate engine from Reuters and will give us the best in class prices to compete successfully in the FX e-trading markets.” RTFX allows banks and their customers to trade foreign exchange from their Reuters desktop. Zurich Cantonal Bank will go live in March and bring banks, corporate and other financial participants using Reuters desktops the ability to trade 13 currency pairs 24- hours a day with the triple A rated bank. -

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report TO OUR SHAREHOLDERS WE’VE COME A LONG WAY… So, we have come a long way. Which gives us an opportunity to put this company - now in its 35th year - When we meet people from outside Logitech, we often into a broader perspective as we look ahead. For both hear, “Wow, you really had a terrific year!”, or “What a of us, it’s an anniversary of sorts this year. Guerrino turnaround this past year or two!”. celebrates 20 years at Logitech in a few months and Bracken celebrates his first five. Let’s step back and think The truth is we started down this road five years ago. about the world in which we now play. After all, you’re That was Fiscal Year 2013, when retail sales in constant reading this because you’re interested in what’s ahead. currency fell -7% year on year. TOOLS ENHANCE OUR LIVES We made changes to our strategy, our culture and our team. And since then we’ve systematically and Let’s step way back to the dawn of humanity; even before Letter to Shareholders passionately worked toward our goal to become a design history was recorded. Our earliest tools were knives, company. A design company is not one focused on spears, the wheel, jugs and more. They enabled us to do fashion or beautiful products (although our products are things we couldn’t do on our own and became stepping beautiful). It’s a company that puts the consumer at the stones for new advances. -

2004 Annual Report

2004 ANNUAL REPORT Our commitment: your trust 2004 ANNUAL REPORT BCV AT A GLANCE BCV AT A GLANCE KEY FIGURES (in CHF millions) 2003 2004 Change (as %) Total assets 34 252 32 295 –5.7 Total income 943 944 +0.1 Gross profit 389 399 +2.5 Net profit 157 337 +114.1 Assets under management 60 248 64 071 +6.3 Ratios (%) Cost / income ratio (C / I)* 71 67 Return on equity (ROE) 6.5 12.4 BIS Tier I capital-adequacy ratio 13.4 16.5 BIS Tier II capital-adequacy ratio 15.1 17.4 * Excluding goodwill amortization and goodwill write-downs Highlights in 2004: The Bank confirmed the turnaround in its financial performance: – Net profit jumped 114.1% to CHF 336.6 million. – Capital adequacy, calculated according to rules set out by Switzerland’s Implementing Ordinance on Banks and Savings Institutions, improved from 156.3% to 184.6%. – S&P raised its credit rating on BCV from A– with negative outlook to A– with stable outlook. The strategic realignment on core businesses was completed: – BCV withdrew fully from ship financing and oil-trading financing. – BCV Finance (France) was sold, bringing strategic withdrawals from foreign subsidiaries to an end. – The Yverdon-based retail subsidiary CEPY was integrated within the parent company (effective January 2005). The Bank drew up a statement of its core values: responsibility, performance and close ties to cus- tomers and the community at large. The Bank developed a buyback plan for its participation certificates. The plan was jointly proposed by BCV and the Cantonal Government for approval by the Cantonal Parliament. -

2003 Annual Report

2003 Annual Report Our commitment: your trust contentsContents Key Figures 3 Letter from the Chairman 4 Letter from the CEO 5 Executive Board (photo) 6 Business Report: Divisions and Subsidiaries in 2003 8 Significant Events in 2003 22 Extraordinary General Meeting of 5 February 22 General Meeting of 22 May 23 Participation-certificate capital 23 Ongoing proceedings 23 Mortgage rate 24 Rating 24 Structural realignment 24 Risk Management 26 Compliance Office 29 Comments on the Consolidated Financial Statements for 2003 31 Consolidated Financial Statements 38 Balance Sheet, Income Statement, Cash Flow Statement 38 Accounting principles 42 Risk management 47 Scope of consolidation 51 Notes to the Consolidated Financial Statements 54 Report of the Group Auditors 68 Company Financial Statements 69 Proposals of the Board of Directors 76 Report of the Statutory Auditors 77 Corporate Governance 78 Group structure and shareholder base 78 Group operational structure 79 Capital structure 80 Governing bodies 82 Compensation, shareholdings and loans 90 Shareholders’ rights 92 Takeovers and defensive measures 93 Auditors 93 Information policy 95 Organizational Structure 96 BCV Group 99 1 keyKey figures Figures 1999 2000 2001 2002 2003 Balance sheet (in CHF millions) Total assets 34 978 37 963 36 104 35 138 34 252 Advances to customers 25 678 26 038 25 985 25 026 23 208 Customer deposits and bonds 26 244 27 700 27 499 27 208 25 683 Shareholders’ equity 2 627 2 664 1 499 1 167 2 563 Income Net interest income 367 413 436 429 419 Net fee and commission -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

Swiss Leader Index Price Index Index

BLUE-CHIP INDICES 1 SWISS LEADER INDEX PRICE INDEX INDEX Index description Key facts The SLI Swiss Leader Index includes the 30 most liquid stocks traded in the » "In order to achieve the stated index objective SIX Swiss Ex-change defines Swiss equity market, the developments of which are reflected by the SPI® the general principles that govern the index methodology. SIX Swiss Family. Consequently, the index weighting of a given issue is limited by Exchange publishes the index objective and rules for all indices. means of a 9/4,5 capping model. In other words, the weighting of each of the four companies with the largest market capitalisation is capped at a » Representative: the development of the market is represented by the maximum of 9 %. The weightings of all lower-ranked companies are if index necessary capped at 4.5 %. This limitation will be calculated by applying a » Tradable: the index components are tradable in terms of company size capping factor, which as a general rule will remain constant for a three- and market month period. The SLI offers a number of advantages: for investors, the capping feature improves their stock- and sector specific diversification and, » Replicable: the development of the index can be replicated in practise with because the new index fulfils Swiss, EU and US regulatory requirements, a portfolio new markets can be opened with products based on the SLI. That, in turn, generates liquidity for the stocks included in the basket. » Stable: high index continuity » Rules-based: index changes and calculations -

Results Zrating Study 2019 on Corporate Governance

Zurich, 12 September 2019 Media release Results zRating Study 2019 on Corporate Governance Zürich, 12 September 2019 – Sunrise once again scores highest in this year’s corporate governance ranking followed by Swisscom (81 points) and Lonza (78 points). Due to amendments to the Articles of Association, also induced by activist shareholders, and changes in practices, companies have improved their corporate governance. For the eleventh time since 2009, the zRating Study on corporate governance in Swiss public companies has been published. zRating summarizes the situation regarding shareholders' rights in a company and draws attention to possible conflicts between shareholders and managers. zRating evaluates corporate governance holistically based on 62 criteria from the categories «Shareholders and Capital Structure», «Shareholders' Rights», «Composition Board of Directors/Management and Information Policy», and «Compensation and participation models». The criteria are weighted in a scoring model and evaluated with points. The total maximum of points is 100. 174 listed Swiss companies are analyzed based on Annual Reports 2018 and decisions at General Meetings 2019. Further improvements through amendments to the Articles of Association Once again Sunrise takes first place with 86 points. They had already gained a large lead thanks to amendments to the Articles of Association at the annual general meetings (AGM) in 2017 and 2018, and in 2019 Sunrise was also able to score in the new criteria. Second place went to Swisscom with 81 points and third place to Lonza with 78 points. This year, the boards of directors of Mobilezone, Peach Property and Starrag in particular proposed amendments to the Articles of Association that strengthened shareholders' participation rights.