Minder Initiative a Review of the Popular Initiative That Revolutionised Swiss Governance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Release

CREDIT SUISSE AG Paradeplatz 8 Tel. +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating Overview of Swiss Companies Company CS Rating CS Outlook Changes since June 2009 S&P Moody's ABB Low A Stable A–, Stable A3, Stable Adecco Mid BBB Negative Outlook changed from Stable to Negative BBB–, Stable Baa3, Stable AFG Low BBB Stable Outlook changed from Negative to Stable n.r. n.r. Alpiq High A Stable n.r. n.r. Aryzta High BBB Stable Coverage initiation n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Low A Stable A–, Stable1 n.r. BKW Low AA Stable n.r. n.r. –1 notch, outlook changed from Negative to Bobst Group Low BBB Stable n.r. n.r. Stable Bucher Industries High BBB Stable n.r. n.r. CKW n.r. n.r. Drop coverage Clariant High BB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. –1 notch, outlook changed from Stable to Edipresse High BB Negative n.r. n.r. Negative –1 notch, outlook changed from Negative to EGL Low A Stable n.r. n.r. Stable EMS Chemie Low A Stable Outlook changed from Negative to Stable n.r. n.r. Energiedienst Low A Stable n.r. n.r. EOS n.r. n.r. Drop coverage Flughafen Zurich Mid BBB Stable BBB+, Positive n.r. Forbo Mid BBB Stable n.r. n.r. Geberit High BBB Stable A–, Stable n.r. -

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

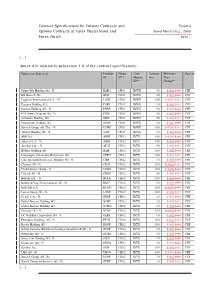

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Marktbericht Aktien Schweiz Small Mid Cap 01 2017

BERICHT AKTIEN SCHWEIZ SMALL & MID CAP Albin Kistler Aktien Small & Mid Cap Schweiz Quartalsbericht 1/2017 Benjamin Ginesta Als Aktienanalyst ist Benjamin Ginesta seit 2012 Die periodisch erscheinenden Markteinschätzun- bei Albin Kistler tätig und ist zuständig für die gen & Anlageberichte stehen auf der Website von Investitionen im Bereich Gesundheit. In der Funk- Albin Kistler als PDF-Download zur Verfügung: tion als Berater im Bereich Asset Management ist www.albinkistler.ch/markteinschaetzung er zudem verantwortlich für Mandate von Institu- tionellen Kunden. Marktbericht Albin Kistler Aktien Small & Mid Cap Schweiz Breite Hausse in Schweizer Aktien bei den Small & Mid Cap Aktien sind hingegen- Der Schweizer Aktienmarkt stieg im ersten Quar- breiter verteilt. Den grössten Einfluss (Kontributi- tal 2017 auf breiter Front. Der Swiss Performance on +1.09%) hatte das Chemieunternehmen Si- Index (SPI) erzielte eine Rendite von +7.50%. Die ka(+23.9%). Ebenfalls beachtlich sind die Einflüsse Small & Mid Cap Aktien, gemessen am SPI Extra, der beiden Index-Leichtgewichte AMS und Lo- stiegen sogar um +9.76%. Mit einer Mehrendite gitech aus dem Technologiesektor. Obwohl die von +2.26% übertrafen die Schweizer Small & Mid Gewichtungen im SPI Extra-Index bei 1.1% bzw. Cap Aktien ein weiteres Mal den Gesamtmarkt. 1.9% lagen, wirkten sich die Anstiege von +87% bzw. +24% dieser Aktien substantiell auf die Ge- samtperformance des SPI Extra aus. In der Sek- torbetrachtung erzielten die Industriefirmen den grössten Beitrag zur Indexrendite. Nebst dem -

Ishares SMIM® ETF (CH)

Creatiedatum 26 sep 2021 iShares SMIM® ETF (CH) Morningstar Analyst Rating™ Morningstar Categorie Index Benchmark van het fonds Morningstar Rating™ Morningstar Categorie™ MSCI Switzerland Small Cap NR SIX SMI Mid TR CHF QQQ Aandelen Zwitserland Small/Mid CHF Cap Wordt gebruikt in dit rapport als index 22.5 Beleggingsdoelstelling Groei van 10000 (EUR) 20.0 Fonds The Fund aims to achieve a return on your investment 17.5 Index which reflects the return of the Swiss Market Index Mid 15.0 Categorie (SMIM®), the Fund's benchmark index. The benchmark 12.5 is weighted in accordance with the free-float value of 10.0K Swiss equities with an average market capitalization. 2016 2017 2018 2019 2020 08/21 Rendement It comprises the 30 largest, most liquid stocks on the Swiss equity market that are not included in the SMI®. 7.80 20.94 -14.18 39.86 5.73 24.44 Fonds The index is calculated on a real-time basis in CHF. -4.88 -3.57 8.55 6.10 -7.41 1.49 +/- Index -5.01 2.62 1.22 7.68 -4.43 0.43 +/- Categorie - - - - - - Percentiel Score Risicomaatstaven Rendementen (24 sep 2021) Rend % +/-Idx +/-Cat Kwartaalrendementen 1e kw 2e kw 3e kw 4e kw Alpha 0.64 Sharpe Ratio 0.81 3 Maanden 2.82 -5.79 -2.87 2021 6.42 10.54 - - Beta 0.97 Std Deviatie 17.18 6 Maanden 15.68 -1.12 -2.47 2020 -18.87 13.98 4.79 9.11 R-kwadraat 90.70 3-jr Risico Bov gem 1 jaar 36.75 -0.79 0.35 2019 16.62 7.47 4.33 6.96 Informatie Ratio 0.03 5-jr Risico Bov gem 3 jr gean. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

Swiss Leader Index Price Index Index

BLUE-CHIP INDICES 1 SWISS LEADER INDEX PRICE INDEX INDEX Index description Key facts The SLI Swiss Leader Index includes the 30 most liquid stocks traded in the » "In order to achieve the stated index objective SIX Swiss Ex-change defines Swiss equity market, the developments of which are reflected by the SPI® the general principles that govern the index methodology. SIX Swiss Family. Consequently, the index weighting of a given issue is limited by Exchange publishes the index objective and rules for all indices. means of a 9/4,5 capping model. In other words, the weighting of each of the four companies with the largest market capitalisation is capped at a » Representative: the development of the market is represented by the maximum of 9 %. The weightings of all lower-ranked companies are if index necessary capped at 4.5 %. This limitation will be calculated by applying a » Tradable: the index components are tradable in terms of company size capping factor, which as a general rule will remain constant for a three- and market month period. The SLI offers a number of advantages: for investors, the capping feature improves their stock- and sector specific diversification and, » Replicable: the development of the index can be replicated in practise with because the new index fulfils Swiss, EU and US regulatory requirements, a portfolio new markets can be opened with products based on the SLI. That, in turn, generates liquidity for the stocks included in the basket. » Stable: high index continuity » Rules-based: index changes and calculations -

Vontobel Swiss Small Companies A

Asset Management / Monthly Factsheet as at 31/08/2020 Vontobel Swiss Small Companies A Approved for Wholesale/Retail investors in: CH. Investment objective Net Performance of A Share (in CHF and %) This equity fund aims to generate long-term capital growth while re- 1 mth. YTD 2019 2018 2017 3 y. 5 y. since specting risk diversification. p.a. p.a. inception Fund 6.6 4.2 21.6 -21.3 23.0 2.5 7.2 1206.0 Key features Index 7.4 6.2 20.1 -19.1 26.3 4.0 9.4 1184.8 The fund invests in a concentrated portfolio mainly including stocks of smaller, innovative Swiss companies which are among the leaders in their 09.15 – 08.16 09.16 – 08.17 09.17 – 08.18 09.18 – 08.19 09.19 – 08.20 industry, offer interesting profitability growth potential, and whose stock Fund 14.3 15.2 8.0 -13.6 15.5 prices have attractive upside potential versus the estimated enterprise Index 15.6 20.5 6.3 -10.0 17.4 values at the time of the investment. Benchmark: ZKB Swiss Small Cap Index Source: Vontobel Asset Management AG. Past performance is not a guide to current or future Approach performance. The performance data do not take account of the commissions and costs incurred The specialized and seasoned investment team takes long-term high- on issue and redemption. The return of the fund can be a result of currency fluctuations rise or fall. conviction investment decisions based on in-depth research. -

Stoxx® Europe Low Risk Weighted 100 Index

STOXX® EUROPE LOW RISK WEIGHTED 100 INDEX Components1 Company Supersector Country Weight (%) BARRY CALLEBAUT Food, Beverage & Tobacco CH 1.40 KUEHNE + NAGEL Industrial Goods & Services CH 1.35 ALLREAL HLDG Real Estate CH 1.35 NESTLE Food, Beverage & Tobacco CH 1.33 SCHINDLER P Industrial Goods & Services CH 1.31 BANQUE CANTONALE VAUDOISE Banks CH 1.20 EMS-CHEMIE HLDG Chemicals CH 1.16 NOVO NORDISK B Health Care DK 1.16 GALENICA SANTE AG Personal Care, Drug & Grocery Stores CH 1.16 SWISSCOM Telecommunications CH 1.15 AHOLD DELHAIZE Personal Care, Drug & Grocery Stores NL 1.14 KONE B Industrial Goods & Services FI 1.14 DANONE Food, Beverage & Tobacco FR 1.13 HERMES INTERNATIONAL Consumer Products & Services FR 1.12 NOVOZYMES Health Care DK 1.11 GEBERIT Construction & Materials CH 1.11 SWISS PRIME SITE Real Estate CH 1.11 NOVARTIS Health Care CH 1.10 SGS Industrial Goods & Services CH 1.10 AXFOOD Personal Care, Drug & Grocery Stores SE 1.09 STADLER RAIL AG Industrial Goods & Services CH 1.08 WOLTERS KLUWER Media NL 1.08 SANOFI Health Care FR 1.07 KONINKLIJKE DSM Chemicals NL 1.07 DEUTSCHE TELEKOM Telecommunications DE 1.06 GIVAUDAN Chemicals CH 1.05 PERNOD RICARD Food, Beverage & Tobacco FR 1.05 ACKERMANS & VAN HAAREN Financial Services BE 1.05 UNIPER Utilities DE 1.05 SAINSBURY (J) Personal Care, Drug & Grocery Stores GB 1.04 ELISA CORPORATION Telecommunications FI 1.04 ADMIRAL GRP Insurance GB 1.04 HENKEL PREF Consumer Products & Services DE 1.04 IMCD Chemicals NL 1.04 JDE PEET S Food, Beverage & Tobacco NL 1.04 VOPAK Industrial Goods -

2018 Switzerland Spencer Stuart Board Index

2018 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. At Spencer Stuart, we know how much leadership matters. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning 57 offices, 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2019 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword 4 HigHligHtS 6 In tHe SpotligHt: in tHe new erA For boArdS, culture iS key 10 our Survey ApproAcH 11 BoArd Size And compoSition 22 BoArd governAnce 26 remunerAtion 29 compAriSon tAbleS 30 International comparison 36 Board composition 40 Board remuneration in 2017 44 Spencer StuArt in SwitzerlAnd 2018 Switzerland Spencer Stuart board index 1 Foreword The Spencer Stuart Board Index is an annual study that analyses aspects of board governance among major listed companies, including composition, committees and remuneration.