Van Der Lee 2018 Supplmat Cluster Upgrading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

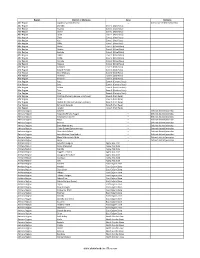

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

Pulses in Ethiopia, Their Taxonomy and Agricultural Significance E.Westphal

Pulses in Ethiopia, their taxonomy andagricultura l significance E.Westphal JN08201,579 E.Westpha l Pulses in Ethiopia, their taxonomy and agricultural significance Proefschrift terverkrijgin g van degraa dva n doctori nd elandbouwwetenschappen , opgeza gva n derecto r magnificus, prof.dr .ir .H .A . Leniger, hoogleraar ind etechnologie , inne t openbaar teverdedige n opvrijda g 15 maart 1974 desnamiddag st evie ruu r ind eaul ava nd eLandbouwhogeschoo lt eWageninge n Centrefor AgriculturalPublishing and Documentation Wageningen- 8February 1974 46° 48° TOWNS AND VILLAGES DEBRE BIRHAN 56 MAJI DEBRE SINA 57 BUTAJIRA KARA KORE 58 HOSAINA KOMBOLCHA 59 DE8RE ZEIT (BISHUFTU) BATI 60 MOJO TENDAHO 61 MAKI SERDO 62 ADAMI TULU 8 ASSAB 63 SHASHAMANE 9 WOLDYA 64 SODDO 10 KOBO 66 BULKI 11 ALAMATA 66 BAKO 12 LALIBELA 67 GIDOLE 13 SOKOTA 68 GIARSO 14 MAICHEW 69 YABELO 15 ENDA MEDHANE ALEM 70 BURJI 16 ABIYAOI 71 AGERE MARIAM 17 AXUM 72 FISHA GENET 16 ADUA 73 YIRGA CHAFFE 19 ADIGRAT 74 DILA 20 SENAFE 75 WONDO 21 ADI KAYEH 76 YIRGA ALEM 22 ADI UGRI 77 AGERE SELAM 23 DEKEMHARE 78 KEBRE MENGIST (ADOLA) 24 MASSAWA 79 NEGELLI 25 KEREN 80 MEGA 26 AGOROAT 81 MOYALE 27 BARENIU 82 DOLO 28 TESENEY 83 EL KERE 29 OM HAJER 84 GINIR 30 DEBAREK 85 ADABA 31 METEMA 86 DODOLA 32 GORGORA 87 BEKOJI 33 ADDIS ZEMEN 88 TICHO 34 DEBRE TABOR 89 NAZRET (ADAMA 35 BAHAR DAR 90 METAHARA 36 DANGLA 91 AWASH 37 INJIBARA 92 MIESO 38 GUBA 93 ASBE TEFERI 39 BURE 94 BEDESSA 40 DEMBECHA 95 GELEMSO 41 FICHE 96 HIRNA 42 AGERE HIWET (AMB3) 97 KOBBO 43 BAKO (SHOA) 98 DIRE DAWA 44 GIMBI 99 ALEMAYA -

Next Stage for Dairy Development in Ethiopia

The NEXT STAGE IN DAIRY DEVELOPMENT FOR ETHIOPIA Dairy Value Chains, End Markets and Food Security Cooperative Agreement 663-A-00-05-00431-00 Submitted by Land O'Lakes, Inc. P.O. Box 3099 code 1250, Addis Ababa, Ethiopia November 2010 2 TABLE OF CONTENT Pages ACRONYMNS…………………………………………………………………………………. 5 EXECUTIVE SUMMARY …………………………………………………………………... 6 1. OVERVIEW OF THE DAIRY SUB-SECTOR STUDY………………………………….10 1.1. The Role of the Dairy Sub-Sector in the Economy of Ethiopia 1.1.1. Milk Production and its Allocation 1.1.2 Livestock and Milk in the household economy 1.2. The Challenges 1.3. A Value Chain Approach 1.4. The Tasks and the Study Team 2. DEMAND FOR MILK AND MILK PRODUCTS…………………………………….…. 15 2.1. Milk Consumption 2.1.1. Milk and Milk Product Consumption in Urban Areas 2.1.2. Milk and Milk Product Consumption in Rural Areas 2.1.3. Milk and Milk Product Consumption in Pastoral Areas 2.2. Milk Consumption Compared to Other Countries 2.3. Milk’s Role for Food Security and Household Nutrition 2.4. Consumption of Imported Milk Products by Areas and Product Categories – domestic and imported 2.5. Milk Consumption in 2020 2.5.1.. High Estimate 2.5.2. Middle of the Range Estimate 2.5.3. Low Estimate 2.6. Assessment 3. DAIRY PRODUCTION……………………………………………………………..…… 30 3.1. Current Situation 3.2. Milk Production Areas (waiting on the maps) 3.3. Production systems and Milk Sheds (see zonal data in annex 3.3.1. Commercial Production 3.3.2. Peri-Urban and Urban Production 3.3.3. -

Diversity, Abundance and Distribution of Mammals in Fragmented Remnant Forests Around Asella Town, Ethiopia

MAYFEB Journal of Biology and Medicine Vol 1 (2017) - Pages 1-12 Diversity, Abundance and Distribution of Mammals in Fragmented Remnant Forests around Asella Town, Ethiopia Mohammed Kasso, Dire Dawa University, [email protected] Afework Bekele, Addis Ababa University, [email protected] Abstract- Survey on diversity, relative abundance, and distribution of mammals in fragmented remnant montane forest of Child Care Center and School of Agriculture was conducted from March to July 2013. Trapping, lines transect and indirect survey techniques were used. Information on abundance and species composition of matured trees was collected. Data were organized and analyzed using descriptive statistics. A total of 22 species of mammals belonging to five orders were recorded. From the trapped species of mammals, Stenocephalemys albipes was most abundant while Arvicanthis abyssinicus was least. From non-trapped groups of mammals, the most abundant was Colobus guereza whereas Leptailurus serval and Poecilogale albinucha were least recorded. Most of the species were widely distributed. However, Mus mahomet, Arvicanthis abyssinicus, Redunca redunca and Chlorocebus pygerythrus were recorded only from the School of Agriculture and in the same way Papio anubis was recorded from Child Care Center. The majority of the species (13) belonging to 108 individuals were recorded from thick canopy forest and nine species from grassland habitat. Plantation with secondary growth habitat was the most diversified habitat while grassland was the least. As the area is rich in mammal and other species, urgent conservation action is highly recommended. Keywords: Habitat fragmentation, mammal, montane forest, relative abundance, species composition. I. INTRODUCTION Ethiopia is physically and biologically a diverse country as the result of extensive altitudinal variation [1]. -

Identification and Antimicrobial Susceptibility Profile of Salmonella

ary Scien in ce r te & e T V e f c h o Journal of Veterinary Science & n n l o o a a l l n n o o r r g g u u Beyene, et al., J Veterinar Sci Techno 2016, 7:3 y y o o J J Technology DOI: 10.4172/2157-7579.1000320 ISSN: 2157-7579 Research Article Open Access Identification and Antimicrobial Susceptibility Profile of Salmonella Isolated from Selected Dairy Farms, Abattoir and Humans at Asella Town, Ethiopia Takele Beyene*, Habtie Yibeltie, Bulako Chebo, Fufa Abunna, Ashenafi Feyisa Beyi, Bedaso Mammo, Dinka Ayana and Reta Duguma College of Veterinary Medicine and Agriculture, Addis Ababa University, PO Box 34, Bishoftu, Ethiopia *Corresponding author: Takele Beyene, College of Veterinary Medicine and Agriculture, Addis Ababa University, PO Box 34, Bishoftu, Ethiopia, Tel: +251912828253; E-mail: [email protected] Rec date: Jan 08, 2016; Acc date: Mar 25, 2016; Pub date: Mar 28, 2016 Copyright: © 2016 Beyene T, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract Salmonella is one of the most common causes of food-borne diarrheal disease in human as well as animals. It is leading causes of acute gastroenteritis when ingested in contaminated foods, including meat and dairy products. Moreover, the emergence of multiple-resistant (MDR) isolates is increasing in human and veterinary medicines. Therefore, this cross-sectional study aims at isolation, identification and antibiogram of Salmonella from selected dairy cattle farms, abattoir and in contact humans in both dairy farms and abattoir of Asella, Ethiopia. -

Ethiopian Agricultural Business Corporation

Ethiopian Agricultural Business Corporation was established in Ethiopian Agricultural December 2015, following the merger of five Ethiopian state-owned enterprises, namely Ethiopian Seed Enterprise, Agricultural Equipment Business Corporation and Technical Services Share Company, Agricultural Inputs Supply Enterprise, Natural Gum Processing and Marketing Enterprise, and Corporate data Headquarters: Addis Ababa, Ethiopia Agricultural Mechanization Service Enterprise. The company is the Ownership type: State-owned largest field crop seed producer and supplier in Ethiopia, in addition to Group revenue (2017): ETB 42,089,070 Seed revenue (2017): ETB 28,002,082 supplying other agricultural inputs. Being state-owned, the company is supervised by the Ministry of Agriculture. Smallholder farmers www.ethioagribusco.com constitute the company’s main clientele. Eastern and Southern Africa Ethiopian Agricultural Business Corporation ranks ninth in the Eastern 9 and Southern Africa Index, significantly improving upon the rank out of 22 performance and score of subsidiary score 2.10 Ethiopian Seed Supply Sector (previously Ethiopian Seed Enterprise) in 2016. The company’s extensive distribution network and close association with farmer groups and cooperatives are reflected in its performance in Marketing & Sales. In Seed Production, the company discloses corporate commitments to engaging smallholder farmers, including women. The company owes its performance in Governance & Strategy to board-level accountability and a diverse range of activities to develop the local seed sector, while its maize breeding program and multiple testing locations contribute to a strong score in Research & Development. The company discloses limited information about its corporate strategies and policies concerning Genetic Resources. Meanwhile, Capacity Building resources are directed toward the company’s smallholder producers rather than customers, limiting its scoring potential. -

Determinants of Mother to Child HIV Transmission (HIV MTCT); a Case

lopmen ve ta e l B D io & l l o l g e y C Cell & Developmental Biology Burusie A et al.,, Cell Dev Biol 2015, 4:2 ISSN: 2168-9296 DOI: 10.4172/2168-9296.1000152 Research Article Open Access Determinants of Mother to Child HIV Transmission (HIV MTCT); A Case Control Study in Assela, Adama and Bishoftu Hospitals, Oromia Regional State, Ethiopia Abay Burusie1* and Negussie Deyessa2 1Adama Science and Technology University, Assela School of Health Sciences, Assela, Ethiopia 2Addis Ababa University, School of Public Health, Addis Ababa, Ethiopia *Corresponding author: Abay Burusie, Adama Science and Technology University, Assela School of Health Sciences, P.O.Box-396, Addis Ababa, Ethiopia, Tel: +251-912-23-93 -90; E-mail: [email protected] Rec date: Feb 22, 2015; Acc date: April 25, 2015; Pub date: May 03, 2015 Copyright: © 2015 Burusie A et al., This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract Background: HIV Mother-to-child transmission is the second most common mode of HIV transmission in sub- Saharan Africa which includes Ethiopia. However; there is little study on determinants of mother-to-child HIV transmission in the country. Objective: To assess determinants of Mother-To-Child HIV Transmission Methods: A case-control study on infants who were born to HIV positive mothers was conducted in Assela, Adama and Bishoftu Hospitals. One hundred and six HIV infected (cases) and 318 not infected infants (controls) were selected by stratified random sampling method. -

Livestock Production System Characterization in Arsi Zone, Ethiopia

Vol. 9(9), pp. 238-245, September 2018 DOI: 10.5897/IJLP2018.0494 Article Number: 52467D458132 ISSN: 2141-2448 Copyright ©2018 International Journal of Livestock Author(s) retain the copyright of this article http://www.academicjournals.org/IJLP Production Full Length Research Paper Livestock production system characterization in Arsi Zone, Ethiopia Tamrat Gebiso Oromia Agricultural Research Institute, Asella Agricultural Engineering Research Center, Ethiopia. Received 28 May, 2018; Accepted 3 July, 2018 Despite its vital role in the country’s economic activities, livestock sector was considered as poor investment for development in Ethiopia. But currently, it is being given due attention in government policy planning, especially in the last two growth and transformation plans. Arsi zone is known for its own cattle breed known as “Arsi breed” (one of the six local breeds of the country) and has huge livestock population. However, the production system and constraints have not been studied. Therefore, this research was initiated to characterize the production system and prioritize associated production constraints in Arsi zone. In general, the livestock production constraints were studied to be identified and prioritized in order of their importance in each farming system. Overall constraints were categorized into five clusters as feed related constraints, health related constraints, breed related constraints and financial and human power related constraints. Therefore, to solve these constraints, establishment of feed development research program in nearby center (most likely in Asella Agricultural Engineering Research Center) and strong extension system to promote improved forages, better health care and use of improved breeds are suggested as a solution. Provision of credit system in order to enable farmers use all the services like purchase of initial livestock, concentrates and the like must be given due attention. -

Xerox University Microfilms

INFORMATION TO USERS This material was produced from a microfilm copy of the original document. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the original submitted. The following explanation of techniques is provided to help you understand markings or patterns which may appear on this reproduction. 1. The sign or "target" for pages apparently lacking from the document photographed is "Missing Page(s)". If it was possible to obtain the missing page(s) or section, they are spiiced into the film along with adjacent pages. This may have necessitated cutting thru an image and duplicating adjacent pages to insure you complete continuity. 2. When an image on the film is obliterated with a large round black mark, it is an indication that the photographer suspected that the copy may have moved during exposure and thus cause a blurred image. You will find a good image of the page in the adjacent frame. 3. When a map, drawing or chart, etc., was part of the material being photographed the photographer followed a definite method in "sectioning" the material. It is customary to begin photoing at the upper left hand corner of a large sheet and to continue photoing from left to right in equal sections with a small overlap. If necessary, sectioning is continued again — beginning below the first row and continuing on until complete. 4. The majority of users indicate that the textual content is of greatest value, however, a somewhat higher quality reproduction could be made from "photographs" if essential to the understanding of the dissertation. -

Italian Land Policy and Practice in Ethiopia, (1935-1941)

Haile M. Larebo THE MYTH AND REALITY OF EMPIRE BUILDING: ITALIAN LAND POLICY AND PRACTICE IN ETHIOPIA, (1935-1941) A Thesis Submitted To University Of London In Fulfilment Of The Requirements For The Degree Of Doctor Of Philosophy School Of Oriental And African Studies February 1990 ProQuest Number: 11010607 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. uest ProQuest 11010607 Published by ProQuest LLC(2018). Copyright of the Dissertation is held by the Author. All rights reserved. This work is protected against unauthorized copying under Title 17, United States C ode Microform Edition © ProQuest LLC. ProQuest LLC. 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106- 1346 TO ADAMA, IY ANN A, MANITO, PAULINE AND BELOVED PARENTS ABSTRACT Apart from being Italo-centric, the vast majority of scholarly work on the short-lived period of Italian occupation of Ethiopia is mainly preoccupied with political events and particularly with their repercussions on international diploma cy. With the exception of a few pioneering studies, Italian rule and its impact on Ethiopia is given marginal importance. The present thesis confines itself to one specific key area of Italian policy - land. Search for an outlet to settle Italy’s excess population and deploy its surplus capital, had sustained Italian imperialist ambitions from the 19th century and justified the conquest of Ethiopia against quasi universal international opposition. -

Local History of Ethiopia : Soba

Local History of Ethiopia Soba - Soquota Li © Bernhard Lindahl (2005) sob- (O) lie HCM55 Soba (mountain peak) 06°51'/39°46' 4161 m 06/39 [Gz] south-west of Goba ?? Soba (in Tigray lowlands) ../.. [Mi] West of the Soba river asbestos outcrops have been indicated. [Mineral 1966] ?? Sobiya (Sobeya, Sobia) wereda ../.. [+ n Yo] (in the 1980s, in Tigray) Early 1991: "Mebratu tells us how twelve fighters came the first time to Sobeya. 'The whole village was in church. Afterwards, they gathered us around the church and told us their aims and what they wanted to do.' -- 'At that time, we were building a new church,' says Desta Kidane. 'The whole community were carrying stones from one kilometre away. The fighters stayed with us a whole day, carrying stones. This impressed us very much.'" "'The enemy was surrounding us,' says Haleqa, 'all coming like rat an cat from four or five directions. So, all the time we were concerned. Where would our fighters sleep? Where would they eat? --' Mebratu adds that he was one of those in Sobeya who collected food for the fighters from house to house." [J Hammond 1999 p 267] In late 1978 peasants held a political meeting in the centre of Sobiya wereda, see Galat. Later there was something of a war between the TPLF and the EPRP. [Young 1997] "Land reform began in Sobeya, a month after the fighters arrived in the village. Ironically, it was also in the interest of the new military government to displace the power of the feudals and to this end they sent agents to the area to distribute the land." "They decided that the measurement of land would be done by the government committee, but that a new committee would work side-by-side with them and be responsible for grading the fertility of the land. -

Assessment of Status of Solid Waste Management in Asella Town, Ethiopia Gorfnesh Lema1* , Million Getachew Mesfun2, Amade Eshete3 and Gizachew Abdeta3

Lema et al. BMC Public Health (2019) 19:1261 https://doi.org/10.1186/s12889-019-7551-1 RESEARCH ARTICLE Open Access Assessment of status of solid waste management in Asella town, Ethiopia Gorfnesh Lema1* , Million Getachew Mesfun2, Amade Eshete3 and Gizachew Abdeta3 Abstract Background: Improper solid waste management (SWM) is a major public health and environmental concern in the urban areas of many developing countries such as Asella Town. The aim of this study was to assess the status of SWM in Asella town. Methods: A community-based cross-sectional study design was used to assess the status of improper SWM and associated factors in Asella town. From the total of eight kebeles (smallest administrative unit in Ethiopia) four kebeles were randomly selected using lottery method. The sample size was 413 households. The households were proportionally allocated to each randomly selected kebeles. The data was collected by pretested questionnaire in the local language. Data was entered using statistical software Epi Info version seven and transferred to SPSS version 21. Descriptive data analysis was done to summarize the socioeconomic status of the respondents. Chi- square was used to show the association between the status of solid waste management and different variables. Binary logistic regression was used to determine the potential factors for improper SWM. Result: 332 (82.8%), had improper solid waste management practice. Lack of adequate knowledge about solid waste management and not having access to door to door solid waste collection could have contributed to the reported improper solid waste practice. Participants who didn’t have access to door to door solid waste collection service were about three times more likely to practice improper solid waste management when compared to those who had access (AOR = 2.873, 95 CI (1.565,5.273) P = 0.001).