Next Stage for Dairy Development in Ethiopia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

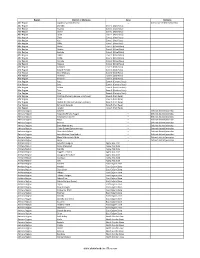

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

The Mid-Term Evaluation of Usaid/Pact/Teach Program Report

THE MID-TERM EVALUATION OF USAID/PACT/TEACH PROGRAM REPORT Ethio-Education Consultants (ETEC) Piluel ABE Center - Itang October 2008 Addis Ababa Ethio-Education Consultants (ETEC) P.O. Box 9184 A.A, Tel: 011-515 30 01, 011-515 58 00 Fax (251-1)553 39 29 E-mail: [email protected] ACKNOWLEDGEMENT Ethio-Education Consultants (ETEC) would like to acknowledge and express its appreciation to USAID/ETHIOPIA for the financial support and guidance provided to carryout the MID-TERM EVALUATION OF USAID/PACT/TEACH PROGRAM, Cooperative Agreement No. 663-A-00-05-00401-00. ETEC would also like to express its appreciation and gratitude: To MoE Department of Educational Planning and those RSEBs that provided information despite their heavy schedule To PACT/TEACH for familiarizing their program of activities and continuous response to any questions asked any time by ETEC consultants To PACT Partners for providing relevant information and data by filling out the questionnaires and forms addressed to them. To WoE staff, facilitators/teachers and members of Center Management Committees (CMCs) for their cooperation to participate in Focus Group Discussion (FDG) ACRONYMS ABEC Alternative Basic Education Center ADA Amhara Development Association ADAA African Development Aid Association AFD Action for Development ANFEAE Adult and Non-Formal Education Association in Ethiopia BES Basic Education Service CMC Center Management Committee CTE College of Teacher Education EDA Emanueal Development Association EFA Education For All EMRDA Ethiopian Muslim's Relief -

Van Der Lee 2018 Supplmat Cluster Upgrading

Supplementary material 1 Basic Data on Study Areas Table A shows basic data on dairy production as compared to crop production and other livestock. Figures A and B give a schematic representation of dairy value chains in both countries. Table A. Basic agricultural sector data for the study areas Ethiopia Kenya (2014 data) (2014–15 ) Nandi Nyandarua Arsi East Shoa Population 753,000 659,848 2,637,657 1,356,342 Arable land (ha) 193,020 201,100 818,132 526,211 Area cropped (ha, excl.tea 1)) 104,916 81,929 631,736 473,124 Livestock (heads) Dairy cattle 251,455 314,810 2) Zebu cattle 45,584 30,620 Cattle 2,454,324 1,116,744 Small ruminants 70,048 426,027 Small ruminants 2,356,854 932,064 Poultry 605,097 445,145 Poultry 2,188,076 1,439,821 Equines n.a. 10,633 Equines 678,711 330,603 Rabbits n.a. 44,670 Pigs 145 879 Milk production 84 226 Milk production 136 44 (Million kg) 2) Agricultural turnover (Million KES) (Million kg) Milk 2,537 7,216 n.a. n.a. Potatoes 400 7,800 Cereals 1,369 877 Maize 2,700 421 Pulses 134 152 Other grains 12 232 Oilseeds 23 0 Beans 1,900 48 Vegetables 12 19 Tea *) n.a -- Root crops 53 36 Other 276 1,769 Permanent crops 11 3 Sources: [39,40] Source: www.csa.gov.et 1) Tea statistics are maintained at national level 2) Data for 2013–2014 The dairy sector in both countries is undergoing significant change. -

Protecting Land Tenure Security of Women in Ethiopia: Evidence from the Land Investment for Transformation Program

PROTECTING LAND TENURE SECURITY OF WOMEN IN ETHIOPIA: EVIDENCE FROM THE LAND INVESTMENT FOR TRANSFORMATION PROGRAM Workwoha Mekonen, Ziade Hailu, John Leckie, and Gladys Savolainen Land Investment for Transformation Programme (LIFT) (DAI Global) This research paper was created with funding and technical support of the Research Consortium on Women’s Land Rights, an initiative of Resource Equity. The Research Consortium on Women’s Land Rights is a community of learning and practice that works to increase the quantity and strengthen the quality of research on interventions to advance women’s land and resource rights. Among other things, the Consortium commissions new research that promotes innovations in practice and addresses gaps in evidence on what works to improve women’s land rights. Learn more about the Research Consortium on Women’s Land Rights by visiting https://consortium.resourceequity.org/ This paper assesses the effectiveness of a specific land tenure intervention to improve the lives of women, by asking new questions of available project data sets. ABSTRACT The purpose of this research is to investigate threats to women’s land rights and explore the effectiveness of land certification interventions using evidence from the Land Investment for Transformation (LIFT) program in Ethiopia. More specifically, the study aims to provide evidence on the extent that LIFT contributed to women’s tenure security. The research used a mixed method approach that integrated quantitative and qualitative data. Quantitative information was analyzed from the profiles of more than seven million parcels to understand how the program had incorporated gender interests into the Second Level Land Certification (SLLC) process. -

International Journal of Agriculture and Veterinary Sciences

www.iaard.net IAARD Journals eISSN:2456-009X International Journal of Agriculture And Veterinary Sciences IAARD-International Journal of Agriculture and Veterinary Sciences, 2018, 4(2),11-15 Occurrence and prevalence of Metazoan Parasites in farmed Nile tilapia (Oreochromusniloticus) and Commoncarp (Cyprinuscarpio) in Sebeta fish farm, Sebeta, Ethiopia *Marshet Adugna Mitiku *EthiopianInstitute of Agricultural Research, National Fishery and Aquatic Life Research Center, Sebeta, Ethiopia P. O. Box 64, Sebeta, Ethiopia Email: [email protected] ………………………………………………………………………………………………………………………………………………………….. Abstract: Fish farming is the fastest growing sector of agriculture worldwide but many factors affect its development including fish parasites. A cross sectional study was conducted from November, 2016 to April, 2017 with the objective of identifying and determining the prevalence of internal parasites of fish from Nile tilapia and Common carp in Sebeta fish farm.Parasite identification was done based on the standard protocols and available manuals. The overall prevalence of internal parasites infection in the two species of fish was 46.67%. The risk factors considered in this study including sex and size of fish for the prevalence of internal parasite infestation showed statistically significant difference (P< 0.05). However, there was no statistically significant difference (p>0.05) in the prevalence of the parasite between the two species of fish. The highest prevalent parasite was the trematode Clinostomum species(13.6%) followed by Cestode Botherocephalus species and Nematode Contracaeum species. The lager sized fish are found highly infested than smaller sized fish. It is therefore important to control intermediate host, washing and disinfecting of ponds regularly and keeping good quality water as a means of prevention of the occurrence of internal parasites. -

Pulses in Ethiopia, Their Taxonomy and Agricultural Significance E.Westphal

Pulses in Ethiopia, their taxonomy andagricultura l significance E.Westphal JN08201,579 E.Westpha l Pulses in Ethiopia, their taxonomy and agricultural significance Proefschrift terverkrijgin g van degraa dva n doctori nd elandbouwwetenschappen , opgeza gva n derecto r magnificus, prof.dr .ir .H .A . Leniger, hoogleraar ind etechnologie , inne t openbaar teverdedige n opvrijda g 15 maart 1974 desnamiddag st evie ruu r ind eaul ava nd eLandbouwhogeschoo lt eWageninge n Centrefor AgriculturalPublishing and Documentation Wageningen- 8February 1974 46° 48° TOWNS AND VILLAGES DEBRE BIRHAN 56 MAJI DEBRE SINA 57 BUTAJIRA KARA KORE 58 HOSAINA KOMBOLCHA 59 DE8RE ZEIT (BISHUFTU) BATI 60 MOJO TENDAHO 61 MAKI SERDO 62 ADAMI TULU 8 ASSAB 63 SHASHAMANE 9 WOLDYA 64 SODDO 10 KOBO 66 BULKI 11 ALAMATA 66 BAKO 12 LALIBELA 67 GIDOLE 13 SOKOTA 68 GIARSO 14 MAICHEW 69 YABELO 15 ENDA MEDHANE ALEM 70 BURJI 16 ABIYAOI 71 AGERE MARIAM 17 AXUM 72 FISHA GENET 16 ADUA 73 YIRGA CHAFFE 19 ADIGRAT 74 DILA 20 SENAFE 75 WONDO 21 ADI KAYEH 76 YIRGA ALEM 22 ADI UGRI 77 AGERE SELAM 23 DEKEMHARE 78 KEBRE MENGIST (ADOLA) 24 MASSAWA 79 NEGELLI 25 KEREN 80 MEGA 26 AGOROAT 81 MOYALE 27 BARENIU 82 DOLO 28 TESENEY 83 EL KERE 29 OM HAJER 84 GINIR 30 DEBAREK 85 ADABA 31 METEMA 86 DODOLA 32 GORGORA 87 BEKOJI 33 ADDIS ZEMEN 88 TICHO 34 DEBRE TABOR 89 NAZRET (ADAMA 35 BAHAR DAR 90 METAHARA 36 DANGLA 91 AWASH 37 INJIBARA 92 MIESO 38 GUBA 93 ASBE TEFERI 39 BURE 94 BEDESSA 40 DEMBECHA 95 GELEMSO 41 FICHE 96 HIRNA 42 AGERE HIWET (AMB3) 97 KOBBO 43 BAKO (SHOA) 98 DIRE DAWA 44 GIMBI 99 ALEMAYA -

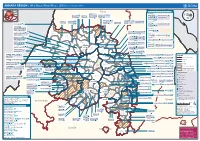

AMHARA REGION : Who Does What Where (3W) (As of 13 February 2013)

AMHARA REGION : Who Does What Where (3W) (as of 13 February 2013) Tigray Tigray Interventions/Projects at Woreda Level Afar Amhara ERCS: Lay Gayint: Beneshangul Gumu / Dire Dawa Plan Int.: Addis Ababa Hareri Save the fk Save the Save the df d/k/ CARE:f k Save the Children:f Gambela Save the Oromia Children: Children:f Children: Somali FHI: Welthungerhilfe: SNNPR j j Children:l lf/k / Oxfam GB:af ACF: ACF: Save the Save the af/k af/k Save the df Save the Save the Tach Gayint: Children:f Children: Children:fj Children:l Children: l FHI:l/k MSF Holand:f/ ! kj CARE: k Save the Children:f ! FHI:lf/k Oxfam GB: a Tselemt Save the Childrenf: j Addi Dessie Zuria: WVE: Arekay dlfk Tsegede ! Beyeda Concern:î l/ Mirab ! Concern:/ Welthungerhilfe:k Save the Children: Armacho f/k Debark Save the Children:fj Kelela: Welthungerhilfe: ! / Tach Abergele CRS: ak Save the Children:fj ! Armacho ! FHI: Save the l/k Save thef Dabat Janamora Legambo: Children:dfkj Children: ! Plan Int.:d/ j WVE: Concern: GOAL: Save the Children: dlfk Sahla k/ a / f ! ! Save the ! Lay Metema North Ziquala Children:fkj Armacho Wegera ACF: Save the Children: Tenta: ! k f Gonder ! Wag WVE: Plan Int.: / Concern: Save the dlfk Himra d k/ a WVE: ! Children: f Sekota GOAL: dlf Save the Children: Concern: Save the / ! Save: f/k Chilga ! a/ j East Children:f West ! Belesa FHI:l Save the Children:/ /k ! Gonder Belesa Dehana ! CRS: Welthungerhilfe:/ Dembia Zuria ! î Save thedf Gaz GOAL: Children: Quara ! / j CARE: WVE: Gibla ! l ! Save the Children: Welthungerhilfe: k d k/ Takusa dlfj k -

Cost and Benefit Analysis of Dairy Farms in the Central Highlands of Ethiopia

Ethiop. J. Agric. Sci. 29(3)29-47 (2019) Cost and Benefit Analysis of Dairy Farms in the Central Highlands of Ethiopia Samuel Diro1, Wudineh Getahun1, Abiy Alemu1, Mesay Yami2, Tadele Mamo1 and Takele Mebratu1 1 Holetta Agricultural Research Center; 2Sebeta National Fishery Research አህፅሮት ይህ ጥናት የወተት ላም የወጪ-ገቢ ትንተና ለማድረግ የታቀደ ነዉ፡፡ ጥናቱ ከ35 ትናንሽ እና 25 ትላልቅ የወተት ፋርሞች ላይ የተደረገ ነዉ፡፡ መረጃዉ ከአራት እስከ ስድስት ተከታታይ ወራት የተሰበሰበ ስሆን ይህን መረጃ ለማጠናከር የወተት ፋርሞች መልካም አጋጣሚዎችና ተግዳሮቶች ተሰብስቧል፡፡ መረጃዉ የተሰበሰበዉ ፋርሙ ዉስጥ ካሉት ሁሉም የዲቃላ የወተት ላሞች ነዉ፡፡ የዚህ ምርምር ግኝት እንደሚያመለክተዉ 80 ፐርሰንት የሚሆነዉ የወተተወ ላሞች ወጪ ምግብ ነዉ፡፡ ትናንሽ ፋርሞች ከትላልቅ ፋርሞች 35 ፐርሰንት የበለጠ ወጪ ያወጣሉ፤ ነገር ግን ትላልቅ ፋርሞች ከትናንሽ ፋርሞች በ55 ፐርሰንት የበለጠ ዓመታዉ ትቅም ያገኛሉ፡፡ ትልቁ የወተት ላሞች ገቢ ከወተት ስሆን የጥጃ ገቢም በተከታይነት ትልቅ ቦታ የሚሰጠዉ ነዉ፡፡ በዚህ ጥናት ግኝት መሰረት የትላልቅ ፋርሞች ያልተጣራ ማርጂን ከትናንሽ ፋርሞች በሦስት እጥፍ እንደሚበልጥ ተረጋግጧል፡፡ የጥቅም-ወጪ ንፅፅር 1.43 እና 2.24 ለትናንሽና ለትላልቅ የወተት ፋርሞች በቅድመ ተከተል እንደሆነ ጥናቱ ያመለክታል፡፡ ይህም ትላልቅ ፋርሞች ከትናንሽ ፋርሞች የበለጠ ትርፋማ እንደሆኑ ያሚያሳይ ነዉ፡፡ የማስፋፍያ መሬት እጥረት፣ የብድር አገልግሎት አለመኖር፣ የሞያዊ ድጋፍ አለመኖር፣ የመኖና የመድሃኒት ዋጋ ንረት፣ ከፍተኛ የወት ዋጋ መለያየት፣ የማዳቀል አገልግሎት ዉጤታማ ያለመሆን፣ የጽንስ መጨናገፍ በፋርሞቹ ባለቤቶች የተነሱ ተግዳሮቶች ናቸዉ፡፡ በዚህ መሰረት ምርታማነታቸዉ ዝቅተኛ የሆኑትን ላሞች ማስወገድ፤ የላሞች ቁጥር ማብዛት፣ በስልጠና የፋርሞቹን ባለቤቶችና የማዳቀል አገልግሎት የሚሰጡትን አካላት ማብቃትና የገብያ ትስስር ማጠናከር፣ አርሶ-አደሩን በመደራጀት የመኖ ማቀነባበርያ መትከል አስፈላጊ እንደሆነ ይህ ጥናት ምክረሃሳብ ያቀርባል፡፡ Abstract This study was conducted to estimate costs and gross profits of dairy farms under small and large diary management in central highlands of Ethiopia. -

11 HS 000 ETH 013013 A4.Pdf (English)

ETHIOPIA:Humanitarian Concern Areas Map (as of 04 February 2013) Eritrea > !ª !ª> Note: The following newly created woreda boundaries are not Tahtay !ª E available in the geo-database; hence not represented in this Nutrition Hotspot Priority Laelay Erob R R !ª Adiyabo Mereb Ahferom !ª Tahtay Gulomekeda !ª I E map regardless of their nutrition hot spot priority 1 & 2: Adiyabo Leke T D Adiyabo Adwa Saesie Dalul Priority one Asgede Tahtay R S Kafta Werei Tsaedaemba E E Priority 1: Dawa Sarar (Bale zone), Goro Dola (Guji zone), Abichu Tsimbila Maychew !ª A Humera Leke Hawzen Berahle A Niya( North Showa zone) and Burka Dintu (West Hararge Priority two > T I GR AY > Koneba Central Berahle zone) of Oromia region, Mekoy (Nuer zone) of Gambella Western Naeder Kola Ke>lete Awelallo Priority three Tselemti Adet Temben region, Kersadula and Raso (Afder zone), Ararso, Birkod, Tanqua > Enderta !ª Daror and Yo'ale (Degahabour zone), Kubi (Fik zone), Addi Tselemt Zone 2 No Priority given Arekay Abergele Southern Ab Ala Afdera Mersin (Korahe zone), Dhekasuftu and Mubarek (Liben Beyeda Saharti Erebti Debark Hintalo !ª zone), Hadigala (Shinille zone) and Daratole (Warder Abergele Samre > Megale Erebti Bidu Wejirat zone) of Somali region. Dabat Janamora > Bidu International Boundary Alaje Raya North Lay Sahla Azebo > Wegera Endamehoni > > Priority 2: Saba Boru (Guji zone) of Oromia region and Ber'ano Regional Boundary Gonder Armacho Ziquala > A FA R !ª East Sekota Raya Yalo Teru (Gode zone) and Tulu Guled (Jijiga zone) of Somali region. Ofla Kurri Belesa -

Prioritization of Shelter/NFI Needs

Prioritization of Shelter/NFI needs Date: 31st May 2018 Shelter and NFI Needs As of 18 May 2018, the overall number of displaced people is 345,000 households. This figure is based on DTM round 10, partner’s assessments, government requests, as well as the total of HH supported since July 2017. The S/NFI updated its prioritisation in early May and SNFI Cluster partners agreed on several criteria to guide prioritisation which include: - 1) type of emergency, 2) duration of displacement, and 3) sub-standard shelter conditions including IDPS hosted in collective centres and open-air sites and 4) % of vulnerable HH at IDP sites. Thresholds for the criteria were also agreed and in the subsequent analysis the cluster identified 193 IDP hosting woredas mostly in Oromia and Somali regions, as well as Tigray, Gambella and Addis Ababa municipality. A total of 261,830 HH are in need of urgent shelter and NFI assistance. At present the Cluster has a total of 57,000 kits in stocks and pipeline. The Cluster requires urgent funding to address the needs of 204,830 HHs that are living in desperate displacement conditions across the country. This caseload is predicted to increase as the flooding continues in the coming months. Shelter and NFI Priority Activities In terms of priority activities, the SNFI Cluster is in need of ES/NFI support for 140,259 HH displaced mainly due to flood and conflict under Pillar 2, primarily in Oromia and Somali Regions. In addition, the Shelter and NFI Cluster requires immediate funding for recovery activities to support 14,000 HH (8,000 rebuild and 6,000 repair) with transitional shelter support and shelter repair activities under Pillar 3. -

Role of Female and Male Headed Households in Dairy Production, Processing and Marketing in Walmera District of Central High Lands of Ethiopia

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by International Institute for Science, Technology and Education (IISTE): E-Journals Journal of Biology, Agriculture and Healthcare www.iiste.org ISSN 2224-3208 (Paper) ISSN 2225-093X (Online) Vol.6, No.23, 2016 Role of Female and Male Headed Households in Dairy Production, Processing and Marketing in Walmera District of Central High Lands of Ethiopia Alganesh Tola 1* Abdi Kaba 1 Mebrat Hailu 1 Zerihun Asefa 1 Kasahun Melesse 2 1.Holeta Agricultural Research Center 2.Debre Ziet Agricultural Research Center Ethiopian Institute of Agricultural Research P. O. Box 2003, Addis Ababa, Ethiopia Abstract A formal survey was conducted in Rob Gebeya women dairy producers of Walmera districts of West Shewa in central highlands of Ethiopia. The objective of the study was to identify constraints of female headed households (FHH) in comparison with male headed households (MHH) in dairy production, handling, processing and marketing. A total of 66 dairy producer households were randomly selected from a women dairy producer association in Rob Gebeya ‘kebele’ of Walmera district. The average family size (Mean ± SE) in the FHHs in Rob Gebeya was 4.8 ± 0.7 persons per household whereas the MHHs was 6.0 ± 0.3 persons. FHHs had less access to education than MHHs in Rob Gebeya. Dairy and food crop based farming enterprises were identified as major sources of livelihood. Record keeping is not common in more than half of the respondents both in female and male headed households. The situation is more aggravated in FHH where more than 80% of the FHHs do not keep any type of farm record. -

Ethiopia COI Compilation

BEREICH | EVENTL. ABTEILUNG | WWW.ROTESKREUZ.AT ACCORD - Austrian Centre for Country of Origin & Asylum Research and Documentation Ethiopia: COI Compilation November 2019 This report serves the specific purpose of collating legally relevant information on conditions in countries of origin pertinent to the assessment of claims for asylum. It is not intended to be a general report on human rights conditions. The report is prepared within a specified time frame on the basis of publicly available documents as well as information provided by experts. All sources are cited and fully referenced. This report is not, and does not purport to be, either exhaustive with regard to conditions in the country surveyed, or conclusive as to the merits of any particular claim to refugee status or asylum. Every effort has been made to compile information from reliable sources; users should refer to the full text of documents cited and assess the credibility, relevance and timeliness of source material with reference to the specific research concerns arising from individual applications. © Austrian Red Cross/ACCORD An electronic version of this report is available on www.ecoi.net. Austrian Red Cross/ACCORD Wiedner Hauptstraße 32 A- 1040 Vienna, Austria Phone: +43 1 58 900 – 582 E-Mail: [email protected] Web: http://www.redcross.at/accord This report was commissioned by the United Nations High Commissioner for Refugees (UNHCR), Division of International Protection. UNHCR is not responsible for, nor does it endorse, its content. TABLE OF CONTENTS List of abbreviations ........................................................................................................................ 4 1 Background information ......................................................................................................... 6 1.1 Geographical information .................................................................................................... 6 1.1.1 Map of Ethiopia ...........................................................................................................